WSR 14-15-154

PROPOSED RULES

DEPARTMENT OF HEALTH

[Filed July 23, 2014, 11:21 a.m.]

Original Notice.

Preproposal statement of inquiry was filed as WSR 13-24-103.

Title of Rule and Other Identifying Information: Chapter 246-790 WAC, Special supplemental nutrition program for women, infants, and children (WIC), proposed amendments to authorizing retailer rules to reflect changes in federal requirements and agency policy.

Hearing Location(s): Department of Health, 310 Israel Road S.E., Point Plaza East Room 251, Tumwater, WA 98504, on September 16, 2014, at 1:30 p.m.

Date of Intended Adoption: September 16, 2014.

Submit Written Comments to: Daniel O'Neill, P.O. Box 47886, Olympia, WA 98504-7886, e-mail Daniel.O'Neill@doh.wa.gov, fax (360) 236-2345, by September 12, 2014.

Assistance for Persons with Disabilities: Contact Jane Basler by September 12, 2014, TTY (800) 833-6388 or 711.

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: The proposed rule amends chapter 246-790 WAC which regulates the department's food delivery system within the WIC program. The proposal provides support for the operation of the WIC nutrition program, assists in recontracting with retail partners, and maximizes agency options for determining participant access. Proposed changes will allow for necessary clarifications and consistency with federal rules and directives, including expanding the proposed definition of "full line grocery store" and updating definitions. The proposed rule also provides a solid foundation for WIC modernization, including fulfilling federal directives to implement an electronic benefit transfer system for WIC.

Reasons Supporting Proposal: Stakeholder and contractor transparency, increased accountability, and reduced costs related to the appeals process. Also, in order to continue to receive federal funding the rules need to be in compliance with federal recontracting regulations.

Statutory Authority for Adoption: RCW 43.70.120.

Statute Being Implemented: RCW 43.70.120.

Rule is not necessitated by federal law, federal or state court decision.

Name of Proponent: Department of health, governmental.

Name of Agency Personnel Responsible for Drafting and Implementation: Daniel O'Neill, 310 Israel Road S.E., Tumwater, WA 98501, (360) 236-3681; and Enforcement: Janet Charles, 310 Israel Road S.E., Tumwater, WA 98501, (360) 236-3697.

A small business economic impact statement has been prepared under chapter 19.85 RCW.

Small Business Economic Impact Statement

Describe the proposed rule, including: A brief history of the issue; an explanation of why the proposed rule is needed; and a brief description of the probable compliance requirements and the kinds of professional services that a small business is likely to need in order to comply with the proposed rule.

The proposed rule amends chapter 246-790 WAC which regulates the department's food delivery system within the WIC program. The proposal will assure support for the operation of the WIC nutrition program, assist in recontracting with our retail partners, and maximize agency options for determining participant access and applying sanctions. Proposed changes will allow for necessary clarifications and consistency with C.F.R. and FNS rules and directives, including expanding the proposed definition of "full line grocery store," updating definitions, and including a sanction table. Although 7 C.F.R. 246 describes the WIC program's purpose and scope in greater detail, there are operational areas where the state has discretion. This will also provide a solid foundation for WIC modernization, including fulfilling federal directives to implement an electronic benefit transfer system for WIC.

Identify which businesses are required to comply with the proposed rule using the North American Industry Classification System (NAICS) codes and what the minor cost thresholds are.

Table A:

NAICS Code (4, 5 or 6 digit) |

NAICS Business Description |

# of businesses in WA |

Minor Cost Threshold = 1% of Average Annual Payroll |

Minor Cost Threshold = .3% of Average Annual Receipts |

445110 |

Washington Grocery Stores |

1486 |

9,190 |

26,117 |

Analyze the probable cost of compliance. Identify the probable costs to comply with the proposed rule, including: Cost of equipment, supplies, labor, professional services and increased administrative costs; and whether compliance with the proposed rule will cause businesses to lose sales or review [revenue].

The WIC program consists of the two hundred twenty-five contractors representing approximately eight hundred individual grocery stores and supermarket chains, which is a subset of the approximate 1,486 grocery stores in Washington state.

The department used the survey to get input from retailers on the potential impact of proposed changes to what constitutes a "full line grocery store." This includes four main components. The first is the minimum number of items (e.g., cans, packages, gallons of milk) for the existing required food categories. The second component is a minimum number of fresh or perishable items. The third component is having at least five linear feet of refrigerated shelf space for produce. The fourth component is having a cash register on premises that is capable of printing receipts.

Table 1 - Summary of Survey Responses

# |

Potential cost category |

Will impact operations? |

Estimated impact1 |

1 |

Ten varieties2 of frozen food |

Yes: 2/77 (2.6%) No: 75/77 (97.4 %) |

One cost estimate: $500.00 |

2 |

Six varieties of meat |

Yes: 4/77 (5.19%) No: 73/77 (94.81%) |

Two cost estimates: $60.00 and $100.00 |

3 |

Ten varieties of whole grains |

Yes: 1/76 (1.32%) No: 75/76 (98.68%) |

One cost estimate: $200.00 |

4 |

Five linear feet of refrigerated display for produce |

Yes: 4/73 (5.48%) No: 69/73 (94.52%) |

Department obtained costs for five linear feet of refrigerated unit, the price ranged from $1,806 - $3,1243 |

5 |

At least one cash register capable of printing receipts4 |

Yes: 9/73 (12.33%) No: 64/73 (87.67%) |

Nine respondents indicated that they will need to purchase at least one cash machine to be in compliance. |

Department obtained costs for one cash register ranged $169.99 - $372.79 |

The complete survey results are attached as Appendix 2

1 | The first three rows of the table are upfront costs that the retailer will need to pay their distributor to purchase the minimum required items. The retailer will recoup these costs when they sell the item(s). |

2 | The department defines "variety" as "similar, but not identical, foods and products that may include different brands, sizes or flavors of similar foods or products." |

3 | The department did a price search for 60" refrigeration units on the internet. The five cost estimates ranged from $1,806 to $3,124. |

4 | Of these nine respondents, some indicated that they would elect to purchase more than the one register required by the department. |

Analyze whether compliance with the proposed rule will cause businesses to lose sales or revenue.

The department's assumption is that the proposed rule will not cause businesses to lose sales [or] revenue.

Analyze whether the proposed rule may impose more than minor costs on businesses in the industry.

Over ninety percent of the stores that responded to the survey indicated that they already comply with proposed rules. There were, however, a few grocery stores that indicated they would incur costs to comply with the proposed rule. For these few stores, collectively, the potential cost of the rule is significantly lower than the $9,190.00 minor cost threshold. Although not required, the department is electing to complete this analysis.

Determine whether the proposed rule may have a disproportionate impact on small businesses as compared to the ten percent of businesses that are the largest businesses required to comply with the proposed rule.

The proposed rules set consistent requirements for all sizes of full line grocery stores. Consistent requirements were needed to assure that applicant grocery stores are aware of program requirements for authorization, which facilitates a consistent shopping experience for WIC clients.

Given that some of the estimated costs will be incurred by small grocery stores, these costs will have a disproportionate impact, largely because the costs are consistent (e.g., cost for minimum inventory, refrigeration, fresh/perishable produce and cash machines).

Describe how small businesses were involved in the development of the proposed rule.

The department facilitates a WIC retailer advisory committee. The committee has representatives from the Washington Food Industry Association, and retailers representing a wide range of both size and types of retailers (see Appendix 1 - Full list of Peer Groups). The department created a draft rule and forwarded the draft to the retailer advisory committee in March for review and comment. The committee submitted comments and met with program staff to recommend changes to the draft rules. The department incorporated many of their recommendations. To further gauge the potential impact of the proposed rules on WIC authorized vendors, the department elected to send a survey to all WIC vendors, which included all small businesses that are currently WIC authorized.

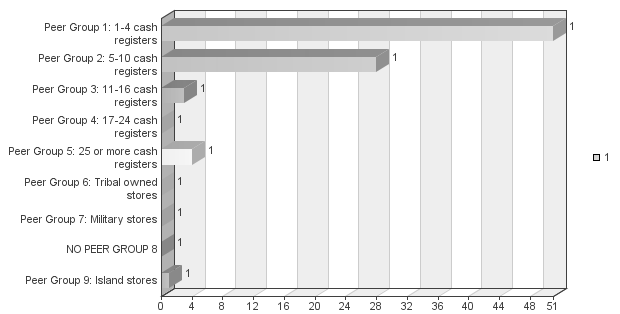

In May 2014, the department sent all two hundred twenty-five contractors an opinio [opinion] survey request via e-mail with a response window of ten days. Eighty-seven respondents submitted responses, representing a 38.6 percent response rate. This included fifty-one respondents from Peer Group 1, which are retailers with 1-4 cash registers, which the department assumes are small businesses (i.e., grocery stores with fifty or fewer employees).

Identify the estimated number of jobs that will be created or lost as the result of compliance with the proposed rule.

The department's assumption is that the proposed rule will not impact the number of jobs in this industry. Grocery stores will not have to hire of [or] fire any employees because of this rule.

Appendix 1

Special Supplemental Nutrition Program for Women, Infant and Children (WIC)

WIC Authorized Vendor Peer Groups in Washington State

Peer Group 1 1-4 Cash Registers

Peer Group 2 5-10 Cash Registers

Peer Group 3 11-16 Cash Registers

Peer Group 4 17-24 Cash Registers

Peer Group 5 25 or more Cash Registers

Peer Group 6 Tribal Owned Stores

Peer Group 7 Military Stores

Peer Group 8 (No Peer Group 8)

Peer Group 9 Island Stores

Appendix 2

Comment Report

Lists all the questions in the survey and displays all the comments made to these questions, if applicable.

Table of Contents

Report info. . . .

Question 1: Please indicate your peer group or the number of cash registers in your store. . . .

Question 2: My store stocks at least 20 varieties of

canned foods. . . .

Question 3: My store stocks at least 10 varieties of

frozen foods. . . .

Question 4: My store stocks at least 10 varieties of dairy products. . . .

Question 5: My store stocks at least 6 varieties of fresh and frozen meats. . . .

Question 6: My store stocks at least 20 varieties of fresh fruits and vegetables. . . .

Question 7: My store stocks at least 10 varieties of breads and tortillas. . . .

Question 8: My store stocks at least 10 varieties of grains, pasta and dried beans. . . .

Question 9: My store stocks at least 10 varieties of baby products. . . .

Question 10: My store stocks at least 10 varieties of household cleaners. . . .

Question 11: My store stocks at least 20 varieties of healthcare products. . . .

Question 12: With the proposed minimum varieties for perishable items (dairy products, fresh fruits and vegetables). . . .

Question 13: Does your store currently have a minimum of five linear feet of refrigerated display space. . . .

Question 14: Are your electronic cash registers capable of producing receipts that include a description of. . . .

Report Info |

|

Report date: |

Tuesday, June 10, 2014 1:39:26 PM PDT |

Start date: |

Wednesday, May 7, 2014 10:43:00 AM PDT |

Stop date: |

Sunday, June 8, 2014 11:59:00 PM PDT |

Stored responses: |

94 |

Number of completed responses: |

73 |

Question 1

Please indicate your peer group or the number of cash register in your store. My store is in (check the appropriate row below):

|

1 |

Sum |

|

Peer Group 1: 1-4 cash registers |

51 100% 58.62% |

51 100% 58.62% |

Peer Group 2: 5-10 cash registers |

28 100% 32.18% |

28 100% 32.18% |

Peer Group 3: 11-16 cash registers |

3 100% 3.45% |

3 100% 3.45% |

Peer Group 4: 17-24 cash registers |

0 0% 0% |

0 0% 0% |

Peer Group 5: 25 or more cash registers |

4 100% 4.6% |

4 100% 4.6% |

Peer Group 6: Tribal owned stores |

0 0% 0% |

0 0% 0% |

Peer Group 7: Military stores |

0 0% 0% |

0 0% 0% |

NO PEER GROUP 8 |

0 0% 0% |

|

Peer Group 9: Island stores |

1 100% 1.15% |

1 100% 1.15% |

Sum |

87 - 100% |

87 - 100% |

* Sequence of numbers in a cell |

||

Absolute frequency |

||

Relative frequency row |

||

Relative frequency |

||

Question 2

My store stocks at least 20 varieties of canned foods.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

74 |

78.72% |

96.1% |

No |

3 |

3.19% |

3.9% |

Sum: |

77 |

81.91% |

100% |

Not answered: |

17 |

18.09% |

- |

Total answered: 77 |

|||

Text input |

Canned beans,vegetable, chili, sauce, dates. |

7 |

We do not stock twenty varieties of canned [foods]. We have less than ten varieties of canned foods and drinks altogether. |

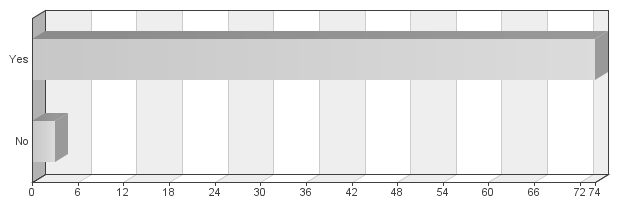

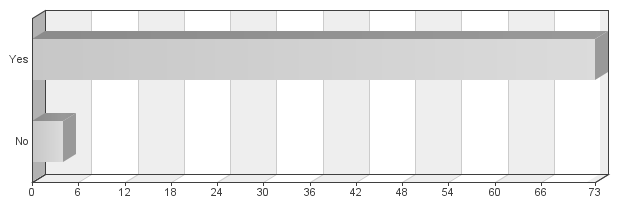

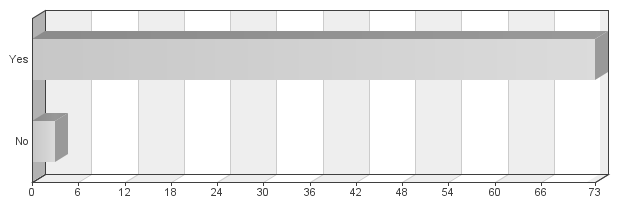

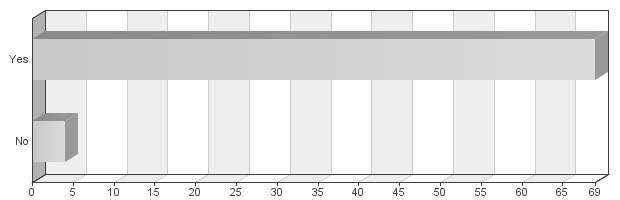

Question 3

My store stocks at least 10 varieties of frozen foods.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

75 |

79.79% |

97.4% |

No |

2 |

2.13% |

2.6% |

Sum: |

77 |

81.91% |

100% |

Not answered: |

17 |

18.09% |

- |

Total answered: 77 |

|||

Text input |

500.00 |

Hot dog, chicken parties [parts], gyro bread and green vegetable. |

Only frozen fruits and vegetables. |

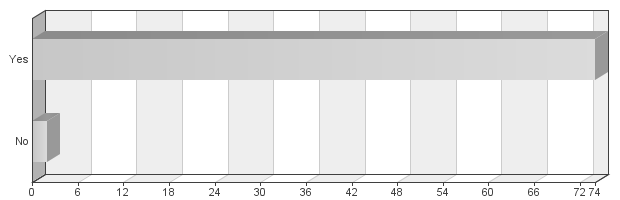

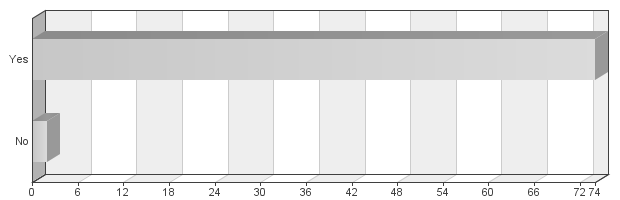

Question 4

My store stocks at least 10 varieties of dairy products.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

75 |

79.79% |

97.4% |

No |

2 |

2.13% |

2.6% |

Sum: |

77 |

81.91% |

100% |

Not answered: |

17 |

18.09% |

- |

Total answered: 77 |

|||

Text input |

Yogurt, cream cheese. |

6 |

We stock at least one case of yogurt or whipped cream or sour cream. |

Question 5

My store stocks at least 6 varieties of fresh and frozen meats.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

73 |

77.66% |

94.81% |

No |

4 |

4.26% |

5.19% |

Sum: |

77 |

81.91% |

100% |

Not answered: |

17 |

18.09% |

- |

Total answered: 77 |

|||

Text input |

Hot dog, chicken parties [parts], gyro bread, goat meat, chicken legs, chicken breast. |

Two varieties cost $60 |

Goat, lamb, beef, thigh and breast chicken, chicken drums, tilapia and salmon fish. |

Stock three cost $100.00 +/- |

Question 6

My store stocks at least 20 varieties of fresh fruits and vegetables.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

74 |

78.72% |

97.37% |

No |

2 |

2.13% |

2.63% |

Sum: |

76 |

80.85% |

100% |

Not answered: |

18 |

19.15% |

- |

Total answered: 76 |

|||

Text input |

Banana, apple, tomato, onion, cabbage, green pepper, orange, mango, lettuce, lemon. ten total varieties based on seasonal availability. |

We stock fresh fruits include [including]: Banana, mango, lemons, limes, strawberries, etc. Vegetables: Lettuce, onions, tomatoes, garlic, cucumber, green peppers, hot peppers, etc. |

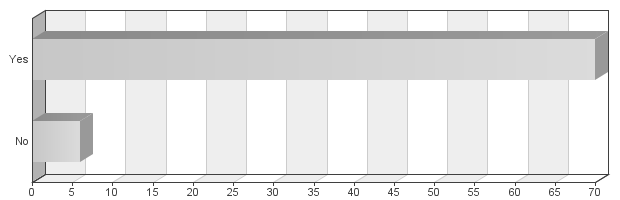

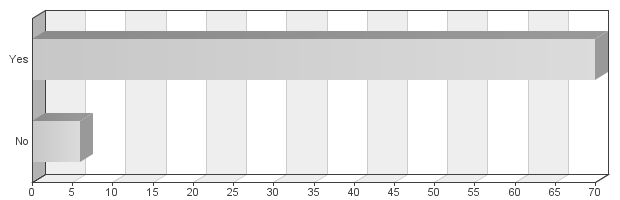

Question 7

My store stocks at least 10 varieties of breads and tortillas.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

70 |

74.47% |

92.11% |

No |

6 |

6.38% |

7.89% |

Sum: |

76 |

80.85% |

100% |

Not answered: |

18 |

19.15% |

- |

Total answered: 76 |

|||

Text input |

100% wheat sliced bread, flour bread. |

Only one brand of whole wheat bread, and some tortillas. |

6 |

We carry at least three types sliced bread and three types of tortillas. |

Question 8

My store stocks at least 10 varieties of grains, pasta and dried beans.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

75 |

79.79% |

98.68% |

No |

1 |

1.06% |

1.32% |

Sum: |

76 |

80.85% |

100% |

Not answered: |

18 |

19.15% |

- |

Total answered: 76 |

|||

Text input |

200.00 |

Question 9

My store stocks at least 10 varieties of baby products.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

73 |

77.66% |

96.05% |

No |

3 |

3.19% |

3.95% |

Sum: |

76 |

80.85% |

100% |

Not answered: |

18 |

19.15% |

- |

Total answered: 76 |

|||

Text input |

Diapers, baby wipes, baby shampoo, baby lotion. |

6 |

Question 10

My store stocks at least 10 varieties of household cleaners.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

74 |

78.72% |

97.37% |

No |

2 |

2.13% |

2.63% |

Sum: |

76 |

80.85% |

100% |

Not answered: |

18 |

19.15% |

- |

Total answered: 76 |

|||

Text input |

Dish detergent, bleach, window cleaner, laundry product. |

3 |

Question 11

My store stocks at least 20 varieties of healthcare products.

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

70 |

74.47% |

92.11% |

No |

6 |

6.38% |

7.89% |

Sum: |

76 |

80.85% |

100% |

Not answered: |

18 |

19.15% |

- |

Total answered: 76 |

|||

Text input |

No medications, several varieties of toilet paper, tissues. Not sure if each sku of toilet paper counts toward the twenty, if so we have twenty. |

Toothbase [toothpaste], and toilet paper. |

5 |

N/A |

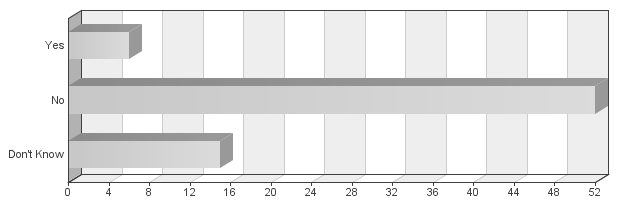

Question 12

With the proposed minimum varieties for perishable items (dairy products, fresh fruits and vegetables), do you anticipate this will increase the total weekly spoilage for your store?

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

6 |

6.38% |

8.22% |

No |

52 |

55.32% |

71.23% |

Don't Know |

15 |

15.96% |

20.55% |

Sum: |

73 |

77.66% |

100% |

Not answered: |

21 |

22.34% |

- |

Total answered: 73 |

|||

Text input |

[$]90.00 |

$120-$180 pre [per] week |

$90/week |

$50-$100 |

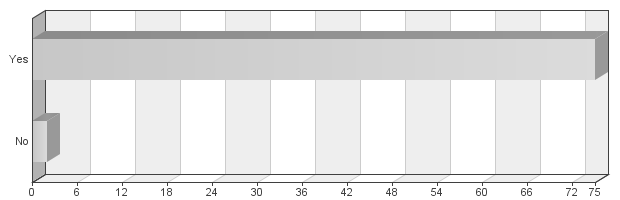

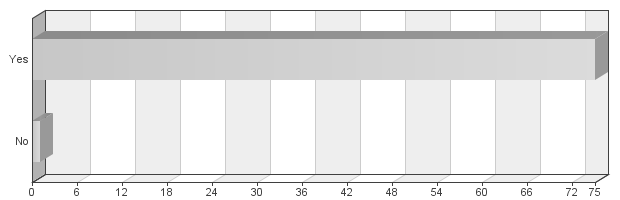

Question 13

Does your store currently have a minimum of five linear feet of refrigerated display space that may be used for fresh fruits and vegetables?

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

69 |

73.4% |

94.52% |

No |

4 |

4.26% |

5.48% |

Sum: |

73 |

77.66% |

100% |

Not answered: |

21 |

22.34% |

- |

Total answered: 73 |

|||

Text input |

Four linear feet. Three shelves available. |

Approximately three feet for one location. |

Three feet. Yes I do have fresh fruits and vegetables. |

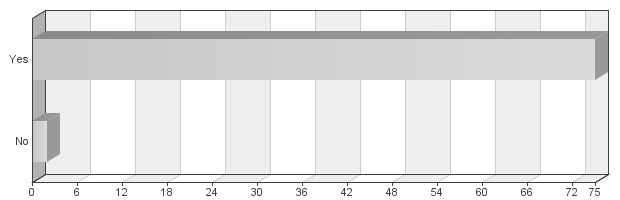

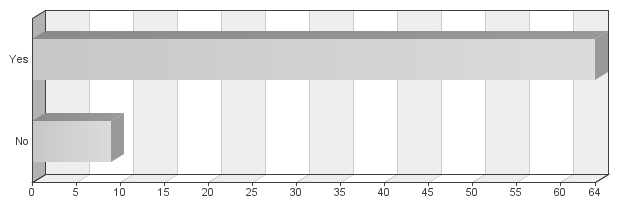

Question 14

Are your electronic case [cash] registers capable of producing receipts that include a description of the food product, and the total actual purchase price in addition to the already required information?

|

Frequency Table |

|||

Choices |

Absolute frequency |

Relative frequency |

Adjusted relative frequency |

Yes |

64 |

68.09% |

87.67% |

No |

9 |

9.57% |

12.33% |

Sum: |

73 |

77.66% |

100% |

Not answered: |

21 |

22.34% |

- |

Total answered: 73 |

|||

Text input |

2 |

Not programmed for that. |

1 |

7 |

3 |

I may need one. |

2 |

Main till does backup does not. |

2 |

A copy of the statement may be obtained by contacting Daniel O'Neill, 310 Israel Road S.E., Tumwater, WA 98501, phone (360) 236-3681, fax (360) 236-2345, e-mail daniel.o'neill@doh.wa.gov.

A cost-benefit analysis is required under RCW 34.05.328. A preliminary cost-benefit analysis may be obtained by contacting Daniel O'Neill, 310 Israel Road S.E., Tumwater, WA 98501, phone (360) 236-3681, fax (360) 236-2345, e-mail daniel.o'neill@doh.wa.gov

July 22, 2014

John Wiesman, DrPH, MPH

Secretary

NEW SECTION

WAC 246-790-001 Purpose.

(1) The federal Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) provides supplemental foods and nutrition education to pregnant, postpartum and breastfeeding women, infants and young children from families with inadequate income through payment of cash grants to states that operate WIC food delivery systems. The department operates a WIC retail food delivery system in which WIC participants obtain authorized supplemental foods by submitting a food instrument to a retail business that has entered into a contract with the department to provide such service. The department's WIC operations comply with the most current version of 7 C.F.R. 246. Copies are available from the Department of Health, P.O. Box 47886, Olympia, WA 98504-7886, or by calling the WIC nutrition program at 800-841-1410.

(2) The purpose of this chapter is to establish:

(a) Qualifications a store must meet before the department will consider its application to be a WIC authorized vendor;

(b) Requirements of all WIC authorized vendors;

(c) A sanction table;

(d) Administrative appeal processes; and

(e) An advisory committee.

AMENDATORY SECTION (Amending WSR 11-23-125, filed 11/21/11, effective 12/22/11)

WAC 246-790-010 Definitions.

The definitions in this section apply throughout this chapter unless the context clearly ((requires)) indicates otherwise.

(((1) "C.F.R." means Code of Federal Regulations.

(2) "Contract" means a written legal document binding the contractor and the department to designated terms and conditions. Terms and conditions include those stated in 7 C.F.R. 246.12 (h)(3) under "Retail food delivery systems: Vendor agreements, Vendor agreement provisions."

(3) "Department" means the Washington state department of health.

(4) "Retailer" means "vendor" as defined in 7 C.F.R. 246.2.

(5) "Wholesale supplier" means a business licensed to sell food and other goods at prices lower than retail to a retail vendor for resale to customers.

(6) "WIC" means the federally funded special supplemental nutrition program for women, infants, and children as described in 7 C.F.R. 246 and defined in 7 C.F.R. 246.2.

(7) "WIC check" means "food instrument" and "cash-value voucher" as defined in 7 C.F.R. 246.2.)) (1) "Administrative appeal" means a formal proceeding where a vendor who has received a notice of violation from the department has the opportunity to present his or her case in an impartial setting and be heard by the department.

(2) "Applicant" means any vendor, or person representing a vendor, requesting authorization to participate in the WIC program by submitting a completed application for authorization and all corresponding documentation.

(3) "Approved infant formula wholesaler" means the document created, maintained and supplied by the department that lists the infant formula wholesale providers that are approved by the department.

(4) "Authorized vendor" means a vendor who has met the vendor selection criteria as required by the United States Department of Agriculture (USDA) and the department, received training on WIC program requirements, and entered into a fully executed contract with the department.

(5) "Business integrity" means the store's uncompromising commitment and adherence to honesty, truthfulness, and accuracy in interactions with customers, creditors, suppliers, associates, and the public at large.

(6) "C.F.R." means Code of Federal Regulations.

(7) "Cash value voucher" means a WIC food instrument used by a participant to obtain fresh fruits and vegetables.

(8) "Civil monetary penalty" means a sum of money imposed by the WIC program for noncompliance with program requirements.

(9) "Contract" means the department's standard WIC contract form that, once completed and signed by both parties, becomes the written legal document binding a vendor and the department to designated terms and conditions and authorizes the vendor to transact food instruments.

(10) "Cost containment" means the process of controlling expenses required to operate the WIC program.

(11) "Department" means the Washington state department of health.

(12) "Disqualification" means the act of revoking the authorization and terminating the contract of an authorized vendor for a specific period of time or permanently for noncompliance with WIC program requirements.

(13) "EBT (electronic benefits transfer)" means the electronic system that allows a participant to authorize transfer of their government food benefits from a federal account to a vendor account to pay for products they buy.

(14) "Food instrument" means the method of payment used by a participant to obtain WIC approved foods. This method may include WIC checks, cash value vouchers, or EBT payment.

(15) "Minimum inventory requirements" means the document created, maintained and supplied by the department that lists the required minimum stock levels of department authorized foods a store must maintain on premises at all times.

(16) "Notice of violation" means a written document given to a vendor when the department determines the vendor has not complied with program requirements, federal WIC regulations, this chapter, or the contract.

(17) "Participant" means a woman, infant or child receiving WIC benefits.

(18) "Participant access" means the ability of WIC participants to purchase authorized WIC foods, with consideration made to factors including, but not limited to, geography, population density and participant dietary needs, as determined by the department.

(19) "Peer group" means a group of authorized vendors which share certain characteristics and can be expected to have similar business practices and prices. Peer group criteria and assignments are determined by the department. Vendors in the same peer group are subject to the same WIC maximum reimbursement levels. Peer group criteria include, but are not limited to, characteristics such as geography or size.

(20) "SNAP" means the federal supplemental nutrition assistance program. SNAP was previously known as the food stamp program.

(21) "Variety" means a collection of similar, but not identical, foods and products. This may include different brands, sizes or flavors of similar foods and products.

(22) "Vendor," also known as "retailer" means a sole proprietorship, partnership, cooperative association, corporation, or other business entity operating one or more stores authorized by the state WIC program to provide WIC approved foods to WIC participants.

(23) "Vendor selection criteria" means the federally approved standards the department uses to select vendors for WIC authorization.

(24) "Wholesale supplier" means a business licensed to sell food and other goods at prices lower than retail to a retail vendor for resale to customers.

(25) "WIC" means the federally funded special supplemental nutrition program for women, infants, and children as described in 7 C.F.R. 246.

NEW SECTION

WAC 246-790-061 Contract procedure.

(1) To become an authorized vendor and receive a contract, a retail business must apply to the department as provided under WAC 246-790-075.

(2) The department shall make available to the applicant vendor copies of the contract and all applicable regulations, policies, and guidelines current at the time of application.

(3) The department will consider an application only if the applicant complies with WAC 246-790-075 and 246-790-077.

(4) If the applicant vendor meets the qualifications or the department has determined that including the applicant vendor's store in the program is necessary to assure participant access, the department may offer a contract to the applicant vendor. An applicant vendor that has an application declined may appeal the department's decision as provided in WAC 246-790-125.

(5) The authorized vendor will be assigned to the department's vendor peer group system as appropriate. That assignment establishes the vendor's maximum allowable reimbursement level.

(6) If authorized, the applicant vendor will become an authorized vendor for the term of the contract, provided the authorized vendor continues to comply with requirements in WAC 246-790-086.

(7) Vendors can request an administrative appeal for certain adverse actions by the department in connection with the contract as specified in the contract and provided in WAC 246-790-125.

(8) The department may temporarily suspend acceptance of applications when in the best interest of program administration.

AMENDATORY SECTION (Amending WSR 11-23-125, filed 11/21/11, effective 12/22/11)

WAC 246-790-075 ((Requirements to become an authorized retailer.)) Vendor application.

(1) To ((become authorized in the WIC program)) be considered for WIC vendor authorization an applicant must:

(a) Be a food ((retailer)) vendor that meets or exceeds all selection criteria listed in WAC 246-790-077;

(b) Apply ((for authorization)) to the department using department forms;

(c) Provide complete and truthful information in the application;

(d) ((Meet all the retailer selection criteria stated in WAC 246-790-077;

(e))) Allow the department to inspect the store; and

(((f))) (e) Participate in training on WIC program requirements((; and

(g) Agree to follow WIC program requirements stated in the contract)).

(2) ((The effective date of authorization is the date on which the last party to sign the contract signs it. The department and the retailer are the parties to the contract.)) If the department declines an application, the applicant may reapply no sooner than six months afterwards.

(3) Before declining an application, the department shall give an applicant thirty days notice to ((correct their application when it is incomplete or insufficient in any manner before the department denies authorization.

(4) The department may not accept a new application sooner than six months after an applicant's denial)) submit missing materials or information.

(((5))) (4) An applicant ((or an authorized retailer)) may request an exemption to the ((retailer)) vendor selection criteria in WAC 246-790-077.

(a) The request must:

(i) Be in writing, dated, and signed by the applicant;

(ii) ((Identify the specific retailer selection criterion or criteria for which the retailer is seeking an exemption and)) Explain the reasons for the request in detail; ((and))

(iii) Demonstrate how the requested exemption is consistent with the requirements, purpose and objectives of the program; and

(iv) List, in the body of the request, the physical address of the applicant.

(b) The department may grant ((an)) the request exemption ((from retailer selection criteria if the applicant submits a request that satisfies)) if the applicant's request conforms to (a) of this subsection and the department determines that allowing the exemption is consistent with the requirements, purpose, and objectives of the program and is necessary to assure participant access.

(c) The department shall respond in writing to a request for exemption with its decision to grant or deny the request.

AMENDATORY SECTION (Amending WSR 11-23-125, filed 11/21/11, effective 12/22/11)

WAC 246-790-077 ((Retailer)) Vendor selection criteria.

((An applicant and an authorized retailer shall meet all the following retailer selection criteria to be authorized.

(1) Business license, permit, and certification requirements.

(a) A current master business license and unified business identifier number issued by the Washington state department of revenue as required under chapter 19.02 RCW with a major operation category that includes the retail sale of foods, such as grocery store.

(b) A current reseller's permit issued by the Washington state department of revenue as required under chapter 82.32 RCW.

(c) A current food establishment permit issued by the local health jurisdiction as required by the Washington state board of health under chapter 246-215 WAC.

(d) A current weighing and measuring device registration issued by the Washington state department of agriculture as required under chapter 16-674 WAC.

(e) A current authorization as a vendor in the supplemental nutrition assistance program (SNAP).

(f) Comply with all other applicable federal, state, county, and city required licenses, permits and certifications.

(2) Business model requirements.

(a) Be primarily engaged in retail sales of a variety of food products and general merchandise as a full line grocery store. A full line grocery store stocks on a continuous basis, multiple varieties of the following product categories:

(i) Canned foods;

(ii) Frozen foods;

(iii) Dairy products;

(iv) Fresh and frozen meat, fish, and poultry;

(v) Fresh fruits;

(vi) Fresh vegetables;

(vii) Juices;

(viii) Bakery goods including, but not limited to, breads, pastries, and tortillas;

(ix) Dried grains and beans;

(x) Baby products;

(xi) Household cleaners;

(xii) Laundry products; and

(xiii) Health care products.

(b) Purchase WIC approved foods directly from a wholesale supplier or other nonretail supplier, such as a food manufacturer or a fresh produce supplier.

(c) Purchase WIC approved infant formula directly from an infant formula manufacturer or supplier named on the WIC approved infant formula supplier list.

(d) Not use the WIC program name, acronym, or logo in the store name or advertisement, advertise primarily to WIC customers, offer incentives primarily to WIC customers, or otherwise focus primarily on serving WIC customers.

(e) Not receive or expect to receive more than fifty percent of annual food sales revenue from WIC transactions.

(f) Maintain on store shelves at all times the minimum quantities and varieties of WIC approved foods, including infant formula, required by the contract. Expired foods are not counted as inventory.

(g) Maintain shelf prices for WIC approved foods that are competitive with retailers in the same WIC retailer peer group. A "peer group" means a group of retailers who share similar characteristics established by the department.

(h) Operate from a fixed, permanent location where all WIC transactions take place in the store.

(i) Maintain business hours of at least eight hours per day, six days per week.

(j) Accept various types of tender including cash and SNAP electronic benefit transfer (EBT).

(k) Post WIC food price on the item, on the shelf next to the item, or other means that is clearly visible to customers.

(l) Maintain sanitary conditions that meet food service rules in chapter 246-215 WAC.

(m) Keep fresh fruit and vegetable display areas free of spoiled produce.

(3) Recordkeeping.

(a) Maintain a recordkeeping system that meets the Washington state department of revenue requirements in WAC 458-20-254 including the following:

(i) The recordkeeping system must have original documents and records organized in a logical way that conforms to acceptable accounting methods and procedures.

(ii) Documents and records must be retrievable and in a readable format.

(b) The recordkeeping system must include original, dated documents and records that contain enough detail to prove the purchase, inventory, and sale of WIC approved foods, including infant formula, by brand name, container size and quantity. These documents and records must be kept for a period of six years following the date of final payment.

(c) Submit to the department upon request documents and records showing food is purchased from a wholesale supplier or other nonretail supplier, such as a food manufacturer or a fresh produce supplier.

(d) Submit to the department upon request documents and records showing infant formula is purchased from an infant formula manufacturer or supplier named on the WIC approved infant formula supplier list.

(e) Submit to the department upon request itemized sales receipts for WIC purchases using an electronic cash register or a manual system. Sales receipts must include the store name, food product name, quantity sold, price of each item, and the date of sale.

(f) Submit to the department upon request annual sales information including gross sales and tax exempt food sales by payment type including cash, SNAP EBT, WIC and credit/debit card.

(g) Submit to the department upon request shelf price and stock level information.

(4) Additional requirements.

(a) Allow access to facilities, including nonpublic storage areas, by the department during normal business hours.

(b) Maintain an active e-mail account that is capable of receiving WIC contract and program information.

(c) Comply with WIC training requirements stated in the contract.

(d) Maintain in-store records documenting employee training on WIC requirements.

(e) Demonstrate business integrity.

(f) Comply with all applicable federal and state laws.

(5) Exemptions.

(a) Oregon and Idaho retailers located on the Washington border and that serve Washington residents are exempt from Washington state business license, permit, and certification requirements. They shall meet all applicable business license, permit and certification requirements for their respective state.

(b) A retailer authorized as an "infant formula only provider" is exempt from the full line grocery store requirement. "Infant formula only provider" means a retailer for whom WIC authorization is limited to the redemption of WIC checks issued for infant formula.)) At the time of application, applicants must meet the following criteria; all authorized vendors must continue to meet the following criteria throughout the period of authorization:

(1) Purchase WIC approved infant formula directly from an infant formula manufacturer or supplier named on the "WIC approved infant formula suppliers" document.

(2) Purchase WIC approved foods directly from a wholesale supplier or other nonretail supplier, such as a food manufacturer, wholesaler, dairy, or fresh produce supplier.

(3) Maintain in store at all times the minimum quantities and varieties of WIC approved foods, including infant formula, as required by the "WIC minimum inventory requirements" document. Expired or spoiled foods do not count as inventory.

(4) Maintain an active electronic mailing address to be used for department communications.

(5) Be primarily engaged in the retail sale of food products and general merchandise as a full line grocery store. A full line grocery store carries the designated products in the following categories on a continuous basis. These requirements are separate from the "minimum inventory requirements."

(a) Canned foods: At least twenty total varieties of canned foods such as fruit, vegetables, beans, meat, poultry, chili, soup, stew, broth or sauce (excluding canned infant formula, fish, juice or other beverages).

(b) Frozen foods: At least ten total varieties of frozen foods such as dinners, pizza, fruit, or vegetables (excluding frozen juice, meat, seafood, poultry, desserts, snacks or novelties).

(c) Dairy products: At least ten total varieties of refrigerated dairy products such as butter, yogurt, cottage cheese, string cheese, cream cheese, whipped cream, sour cream or ice cream (excluding milk, WIC approved cheeses, infant formula or individual serving size packages).

(d) Frozen and unfrozen meat, seafood, and poultry: At least six total varieties (all unbreaded) of frozen meat, unfrozen meat, frozen seafood, unfrozen seafood, frozen poultry, or unfrozen poultry including at least two varieties of meat and at least two varieties of poultry (excluding precooked and deli style products).

(e) Fresh fruit and vegetables: At least twenty total varieties of fresh fruits or fresh vegetables including at least five varieties of fruits and at least five varieties of vegetables. The store must have a minimum of five linear feet of refrigerated display space for its produce.

(f) Bread and tortillas: At least ten total varieties of bread products such as bread, rolls, bagels, and tortillas. Breads and tortillas exclude muffins, pastries, cookies, cakes, crackers, or other snack foods.

(g) Grains, pasta, and dried beans: At least ten total varieties of grains, pasta, or beans such as oatmeal, rice, bulgur, pasta, beans, peas, or lentils (excluding bread, canned products or other breakfast cereals).

(h) Baby products: At least ten total varieties of baby products such as diapers, baby bottles, baby wipes, baby shampoo, baby lotion, or baby bottles (excluding infant formula).

(i) Household cleaners and laundry products: At least ten total varieties of household cleaning or laundry products used for cleaning kitchens, dishes, bathrooms, windows, floors, furniture, clothes, or fabrics.

(j) Health care products: At least twenty total varieties of health care products such as pain relievers, cold/cough/allergy products, digestive aids, dental care products, feminine hygiene products, or toilet paper.

(6) Maintain prices for WIC approved foods that are at or below the limits established by the WIC nutrition program's current price management system.

(7) Be currently authorized and participating as a vendor in the supplemental nutrition assistance program (SNAP).

(8) Receive or expect to receive less than fifty percent in annual food sales revenue from WIC transactions.

(9) Be open for business at least eight hours per day, six days per week.

(10) Submit to the department, upon request, sales information including gross sales and tax exempt food sales.

(11) Have electronic cash registers capable of producing receipts that include:

(a) The store name;

(b) Food product name and description;

(c) Quantity sold, price of each item;

(d) Total actual purchase price; and

(e) The date of sale.

(12) Post food prices for all foods, including fresh fruits and vegetables, on each item, or on the shelf next to the item.

(13) Maintain a business model that promotes business integrity. In its determination of business integrity, the department's consideration will include, but is not limited to, the following:

(a) Providing complete and truthful information in the application, correspondence, and other documents requested by the department.

(b) Ensuring all current owners, officers, managers, or representatives have had no criminal convictions or civil judgments entered against them in the last six years for fraud, antitrust violations, embezzlement, theft, forgery, bribery, falsification or destruction of records, making false statements, receiving stolen property, making false claims, and obstruction of justice.

(c) Having no uncorrected violation from a previous contracting period, current disqualification, or outstanding claims owed to the department.

(d) Not being currently disqualified from the SNAP or having a civil money penalty levied instead of SNAP disqualification.

(e) Disclosure of any third party, agent or broker involved in any part of the application process.

(f) Where a store has an outstanding WIC or SNAP sanction or claim, not attempting to avoid sanction or claim by reapplying after:

(i) Conveying any legal interest in a store to a relative or other person with whom the owner or owners have a financial relationship.

(ii) Accepting any legal interest in a store from a relative by blood or marriage or other person with whom the owner or owners have a financial relationship.

(iii) Reorganizing the business to another form, such as, but not limited to, corporation, general partnership, limited partnership, sole proprietorship, and limited liability company.

(14) When evaluating business integrity, the department may take into account whether a store subject to a sanction or claim has been sold for less than fair market value.

(15) Not own, have previously owned, or have a legal interest in a business that has a WIC sanction currently in effect. This includes any business for which a vendor may be applying.

(16) Maintain a recordkeeping system that meets the Washington state department of revenue requirements and the following criteria:

(a) A vendor must retain inventory records used for federal tax reporting and other records the WIC nutrition program may require for the period of six years following the date of final payment.

(b) The recordkeeping system must include original, dated documents, invoices, and records that contain enough detail to prove the purchase, inventory, and sale of WIC approved foods, including infant formula, by brand name and description, container size, and quantity.

(c) Sales receipts must come from a wholesale supplier or other nonretail supplier, such as a food manufacturer or a fresh produce supplier. The sales receipts must include the supplier's business name and address, your business name, food product name, quantity sold, price of each item, and the date of sale.

(d) The recordkeeping system must consist of original documents and records organized in a logical, orderly, readable, and retrievable way that conforms to acceptable accounting methods and procedures.

(e) Upon request, a vendor must make available to representatives of the WIC nutrition program, USDA Food and Nutrition Services, and the Comptroller General at any reasonable time and place for inspection and audit, all food instruments and cash value vouchers in the vendor's possession.

(f) Upon request, a vendor must make available to representatives of WIC nutrition program, USDA Food and Nutrition Services, and the Comptroller General at any reasonable time and place for inspection and audit, all WIC program-related records, which may include tax identification numbers, bills of sale, lease agreements, or bank statements.

(17) Comply with all federal and state nondiscrimination laws, regulations, and policies. This includes, but is not limited to, 7 C.F.R. Parts 15, 15a, and 15b and RCW 49.60.030.

(18) Comply with the Americans with Disabilities Act (ADA) of 1990, Public Law 101-336.

(19) Comply with all other federal, state, county, and city required licenses, permits and certifications.

(20) Exemptions.

(a) Oregon and Idaho vendors located on the Washington border and that serve Washington residents are exempt from Washington state business license, permit, and certification requirements. They shall meet all applicable business license, permit and certification requirements for their respective state.

(b) An "infant formula only provider" is exempt from the full line grocery store requirement. Infant formula only provider means an authorized vendor or pharmacy for whom WIC authorization is limited to the redemption of WIC checks issued for infant formula.

AMENDATORY SECTION (Amending WSR 11-23-125, filed 11/21/11, effective 12/22/11)

WAC 246-790-086 Requirements of an authorized ((retailer)) vendor.

(1) ((An)) Authorized ((retailer)) vendors shall:

(a) Comply with the terms and conditions of their contracts;

(b) Continue to meet the ((retailer)) vendor selection criteria in WAC 246-790-077 throughout the term of the contract;

(c) Notify the department prior to ownership changes; ((and))

(d) Notify the department prior to store closures;

(e) Notify the department prior to changing telephone numbers or electronic mailing addresses;

(f) Safeguard WIC client-related data; and

(g) Comply with corrective action requested by the department or the United States Department of Agriculture (USDA).

(2) An authorized ((retailer)) vendor may reapply at the time of contract expiration; however, neither the department nor the ((retailer)) vendor has an obligation to enter into a subsequent contract.

AMENDATORY SECTION (Amending WSR 11-23-125, filed 11/21/11, effective 12/22/11)

WAC 246-790-105 Failure to meet WIC program requirements.

(1) When ((a retailer)) an authorized vendor is out of compliance with the requirements of 7 C.F.R. 246.12, this chapter, or the contract, the department ((may)) will initiate appropriate enforcement action which may include notices of violation, unless the department determines that ((notifying the retailer)) notification would compromise the investigation; claims for reimbursement; and disqualification.

(((2) The department shall disqualify an authorized retailer for violations stated in 7 C.F.R. 246.12(l).

(3) For violations of the requirements of this chapter, not specified in 7 C.F.R. 246.12(l), the department may take enforcement action based on a pattern of violations. Department actions may include:

(a) Notice of violation and offer of technical assistance for the first incident;

(b) Notice of violation and warning of disqualification for the second incident of the same type of violation;

(c) One year disqualification for the third incident of the same type of violation.

(4) A "pattern" of violations means more than one documented incident of the same type of violation within a thirty-six month period.

(5) An authorized retailer's contract is terminated on the effective date of a disqualification.

(6) An authorized retailer who has been disqualified may reapply at the end of the disqualification period.)) (2) Where a violation requires disqualification, the department may determine to impose a civil penalty in lieu of disqualification if the department determines, in its sole discretion and in accordance with the department's participant access criteria, that the continued operation of the store is necessary to assure adequate participant access.

(3) An authorized vendor's contract is terminated on the effective date of a disqualification.

(4) A "pattern" of violations means more than one documented incident of the same type of violation within a contract period.

(5) A disqualified vendor may reapply at the end of the disqualification period.

(6) The department will document complaints against authorized vendors and any resulting corrective action.

(7) The effective date of all sanctions is twenty-eight days after authorized vendor receives notice of the department's decision to impose sanctions, unless otherwise specified in this chapter, the contract, or in the department's notice. The department, in its sole discretion, may temporarily suspend the contract in lieu of termination to resolve any uncertain matters including appeals.

(8) Federal sanctions: In compliance with 7 C.F.R. 246.12(I), the WIC program must sanction a vendor as follows:

Violation |

Mandatory Federal Sanction |

1. Conviction for trafficking WIC food instruments or cash value vouchers or selling firearms, ammunition, explosives, or controlled substances in exchange for WIC food instruments or cash value vouchers. |

Termination of contract, permanent disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). Termination of the contract shall be effective upon authorized vendor's receipt of termination notice. |

2. One incidence of selling firearms, ammunition, explosives or controlled substances (as defined in section 21 of the Controlled Substances Act (U.S.C.) 802) in exchange for WIC food instruments or cash value vouchers. |

Termination of contract, six-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

3. One incidence of buying or selling WIC food instruments or cash value vouchers for cash (trafficking). Trafficking includes some of the violations included in the definition of redeeming WIC food instruments or cash value vouchers outside of authorized channels. |

Termination of contract, six-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

4. Failure to comply fully with the applicable provisions of 7 C.F.R. 278—SNAP. (Authorized vendor is disqualified from SNAP, or chooses not to participate in SNAP.) |

Termination of contract and disqualification for time period corresponding to the SNAP disqualification term, or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). No administrative review allowed. |

5. One incidence of sale of alcohol or alcoholic beverages or tobacco products in exchange for WIC food instruments or cash value vouchers. |

Termination of contract, three-year disqualification or, at the discretion of the department, civil monetary penalty. |

6. A pattern of providing credit or nonfood items, other than alcohol, alcoholic beverages, tobacco products, cash, firearms, ammunition, explosives, or controlled substances as defined in 21 U.S.C. 802, in exchange for food instruments or cash value vouchers. |

Termination of contract, three-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

7. A pattern charging for food not received by a participant. |

Termination of contract, three-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

8. A pattern of receiving, transacting, or redeeming a food instrument outside of authorized channels, including the use of an unauthorized store or person. |

Termination of contract, three-year disqualification or, at the discretion of the department, civil monetary penalty. |

9. A pattern of claiming reimbursement for the sale of an amount of a specific supplemental food item which exceeds the authorized vendor's documented inventory of that supplemental food item for a specific period of time. |

Termination of contract, three-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

10. A pattern of authorized vendor overcharges. |

Termination of contract, three-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

11. A pattern of charging for supplemental foods provided in excess of those listed on the food instrument. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

12. A pattern of selling unauthorized food items in exchange for food instruments or cash value vouchers. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

13. A pattern of an above-fifty-percent vendor providing prohibited incentive items to customers as set forth in paragraph (g)(3)(iv) of this section, in accordance with the state agency's policies and procedures required by paragraph (h)(8) of this section. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

14. Providing false information on its application for authorization. |

Termination of contract upon minimum fifteen day notice. |

15. The existence of a conflict of interest between the authorized vendor and the department or local agency as defined by state law, regulations or policies. |

Termination of contract upon minimum fifteen day notice and disqualification from the WIC program until the conflict of interest no longer exists. |

Second Mandatory Sanction |

|

If a vendor has been assessed a sanction for any of the violations in this table, then receives another sanction for any of the same violations, the department must double the second sanction. If a civil monetary penalty is assessed in lieu of disqualification, the amount may be doubled up to the limits specified in Federal WIC Regulations at 7 C.F.R. 3.91(b)(3)(v). |

|

Third or Subsequent Mandatory Sanction |

|

If a vendor, previously assessed two or more sanctions for any of the above sanctions, then receives another sanction for any of the same violations, the department must double the third sanction and all subsequent sanctions. Civil monetary penalties may not be imposed in lieu of disqualification for third or subsequent sanctions. |

|

(9) State sanctions: For violations of the contract, not specified in 7 C.F.R. 246.12(I), the department may take enforcement action based on a pattern of violations. At the department's discretion and for violations not involving a pattern, the department actions may include:

(a) Notice of violation and offer of technical assistance for the first incident;

(b) Technical assistance or notice of violation and warning of disqualification for the second incident of the same type of violation;

(c) One year disqualification for the third incident of the same type of violation in a contract period.

Violation |

Sanction |

16. A pattern of adding sales tax or a fee or surcharge to the purchase amount charged to the WIC program (military commissaries may levy a surcharge). |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

17. A pattern of charging a participant for WIC foods. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

18. A pattern of exceeding food instruments costs based upon the state price assessment tool. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

19. A pattern of failing to process each food instrument separately (except cash value vouchers for fruits and vegetables which can be combined). |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

20. A pattern of failing to write the total amount of the purchase amount on the food instrument or cash value voucher. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

21. A pattern of vendor having the participant sign the food instrument or cash value voucher before the purchase price is entered on the food instrument or cash value voucher. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

22. A pattern of not getting a participant's signature on a WIC food instrument or cash value voucher. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

23. A pattern of failing to show program participants, parents or caretakers or infant of child participants, and proxies the same courtesies offered to other customers. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

24. A pattern of failing to allow a participant to buy all the foods in the amounts listed on the food instruments or cash value vouchers. This violation also includes refusal to sell WIC foods to a participant. If refusal to sell WIC foods is based on discrimination, use discrimination follow-up procedures. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

25. A pattern of giving free items or discounts to participants that are not offered to other customers. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

26. A pattern of not meeting the WIC minimum inventory requirements. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

27. A pattern of not complying with the vendor selection criteria. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

28. A pattern of using the acronym "WIC" without permission in advertising, or for foods identification. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

29. A pattern of WIC approved foods when they are defective, spoiled, or have exceeded their "sell by," "best if used by," or other date limiting the sale or use of an item. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

30. A pattern of failing to allow exchange of an identical approved food obtained with WIC food instruments or cash value vouchers when the original approved food item is defective, spoiled, or has exceeded its "sell by," "best if used by," or other date limiting the sale or use of the food item. An identical approved food item means the exact brand and size as the original approved food item obtained and returned by the participant. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

31. A pattern of failing to train store staff on WIC requirements annually by participating in annual training in the prescribed manner. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

32. A pattern of failing to post prices where participants can see them. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

33. A pattern of failing to keep training records. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

34. A pattern of failing to provide training records upon request. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

35. A pattern of failing to participate in the food price survey conducted by the department twice a year. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

36. A pattern of failing to keep or submit inventory receipts upon request. |

Termination of contract, one-year disqualification or, at the discretion of the department, civil monetary penalty (based upon participant access criteria). |

37. Any incidence of refusal to allow the participant to use the WIC appointment and ID folder as identification. |

Technical assistance provided. |

38. Any incidence of requiring the participant to buy all the food on the food instrument or cash value voucher. |

Technical assistance provided. |

39. Any incidence of failing to print clearly and carefully on the food instrument or cash value voucher using a black or dark blue ink pen. |

Technical assistance provided. |

40. Any incidence of accepting WIC food instruments or cash value vouchers that were not signed in the presence of the checker. |

Technical assistance provided. |

41. Any incidence of failing to treat participants with courtesy or being rude. |

Technical assistance provided. |

42. Any incidence of failing to attend or assure a representative attends any training identified as mandatory by the department. |

Technical assistance provided, may be subject to other penalties as prescribed by department policy. |

43. Failure to have a representative from the store attend required WIC training once in a three-year contract period. |

Technical assistance provided, may not be eligible for reauthorization in new contract period. |

Second Sanction |

|

If an authorized vendor has been assessed a sanction for any of the violations in this table, then receives another sanction for any of the same violations all in the same contract period, the department must double the second sanction. If a civil monetary penalty is assessed in lieu of disqualification, the amount may be doubled up to the limits specified in Federal WIC Regulations at 7 C.F.R. 3.91(b)(3)(v). |

|

Third or Subsequent Sanction |

|

If an authorized vendor, previously assessed two or more sanctions for any of the above sanctions, then receives another sanction for any of the same violations all in the same contract period, the department must double the third sanction and all subsequent sanctions. Civil monetary penalties may not be imposed in lieu of disqualification for third or subsequent sanctions. |

|

AMENDATORY SECTION (Amending WSR 11-23-125, filed 11/21/11, effective 12/22/11)

WAC 246-790-125 ((Retailer)) Vendor appeal process.

(((1) The retailer may request an administrative appeal of certain adverse actions as provided in 7 C.F.R. 246.18. Actions that the retailer may not appeal are described in 7 C.F.R. 246.18 (a)(1)(iii).

(2) A request for appeal must:

(a) Be in writing, state the issue, and contain a summary of the retailer's position on the issue;

(b) Be filed with the Department of Health, Adjudicative Service Unit, P.O. Box 47879, Olympia, WA 98504-7879, with a copy sent to the WIC Nutrition Program at P.O. Box 47886, Olympia, WA 98504-7886; and

(c) Be received by the department of health, adjudicative services unit within twenty-eight days of the date the retailer receives the notice unless otherwise specified in the program's notification of adverse action.

(3) The administrative hearing procedures of chapter 246-10 WAC apply to retailer administrative appeals. If a provision of chapter 246-10 WAC conflicts with a provision of 7 C.F.R. 246.18, the federal regulation shall prevail.)) (1) The following department actions may not be appealed:

(a) The validity or appropriateness of the department's limiting criteria or the vendor selection criteria for minimum variety and quantity of WIC approved foods, business integrity, and current SNAP disqualification or civil monetary penalty instead of disqualification;

(b) The validity or appropriateness of the department's selection criteria for competitive price including, but not limited to, the peer group criteria and the criteria used to identify above fifty percent vendors;

(c) The validity or appropriateness of the department's participant access criteria and the department's participant access determinations;

(d) The department's determination whether or not to include an infant formula manufacturer, wholesaler, or distributor on the approved infant formula provider list;

(e) The validity or appropriateness of the department's prohibition of incentive items;

(f) The department's determination whether to notify an authorized vendor in writing when an investigation reveals an initial violation for which a pattern of violations must be established;

(g) The department's determination whether the authorized vendor had an effective policy and program in effect to prevent trafficking and that the ownership of the authorized vendor was not aware of, did not approve of, and was not involved in the violation;

(h) The expiration of the authorized vendor contract;

(i) Disputes regarding food instrument payments and claims (other than the opportunity to justify or correct an overcharge or other error);

(j) Disqualification as a result of a disqualification from SNAP.

(2) Except as provided in WAC 246-790-125(1), applicant or authorized vendor may file an appeal for the department's decision to decline an application, terminate a contract, impose a sanction, or other adverse action.

(3) The request for appeal must be filed in conformance with the following:

(a) A request for appeal must be filed with the Department of Health, Adjudicative Service Unit (ASU), P.O. Box 47879, Olympia, WA 98504-7879, with a copy sent to the department's WIC Nutrition Program at P.O. Box 47886, Olympia, WA 98504-7886;

(b) The request must be in writing, state the issue, contain a summary of the applicant or authorized vendor's position on the issue, and include a copy of the department's notice of adverse action;

(c) If applicable, a notice of appearance by the applicant or authorized vendor's attorney;

(d) The request must be filed no later than twenty-eight days from the date the applicant or authorized vendor receives the notice unless otherwise specified in the department's notification of adverse action.

(4) Proceedings under this chapter shall be in accordance with chapter 246-10 WAC as modified by the following:

(a) Within thirty days from the date ASU receives the request for appeal, the ASU or other designee of the secretary shall approve or deny the request. The notice of approval shall include a scheduling order setting forth a date, time, and place for a prehearing conference and the hearing.

(b) Without discovery request by the appellant, the program shall deliver its record of the decision to the appellant within thirty days from the issuance of the scheduling order.

(c) At the time provided in the scheduling order, the presiding officer shall conduct a telephonic prehearing conference. Following the prehearing conference, the presiding officer will issue a prehearing order defining conduct at hearing, which will establish the procedure for the hearing.

(d) At the time provided in the scheduling order, the presiding officer will conduct an in-person hearing in which the appellant and program will each have an opportunity to present its case and cross-examine adverse witnesses.

(e) The presiding officer shall decide the case based solely on whether the program has correctly applied federal and state statutes, regulations, policies, and procedures governing the WIC program, according to the evidence presented at the review.

(5) If a provision of chapter 246-10 WAC conflicts with a provision of 7 C.F.R. 246.18, the federal regulation shall prevail.

AMENDATORY SECTION (Amending WSR 11-23-125, filed 11/21/11, effective 12/22/11)

WAC 246-790-127 ((Retailer)) Vendor advisory committee.

(1) The department shall facilitate a WIC ((retailer)) vendor advisory committee.

(2) The committee shall function in an advisory capacity.

(3) Participation is voluntary and there is no compensation.

(4) Invitations for participation may include authorized WIC ((retailers)) vendors, retail grocer associations, food manufacturers, wholesale suppliers, and retail checker labor unions.

REPEALER

The following section of the Washington Administrative Code is repealed:

WAC 246-790-055 |

Adoption by reference. |