WSR 14-21-174

PROPOSED RULES

PUBLIC DISCLOSURE COMMISSION

[Filed October 22, 2014, 9:52 a.m.]

Original Notice.

Preproposal statement of inquiry was filed as WSR 14-10-062.

Title of Rule and Other Identifying Information: WAC 390-20-020 Forms for lobbyist report of expenditures and 390-20-020A L-2 reporting guide for entertainment, receptions, travel and educational expenditures.

Hearing Location(s): 711 Capitol Way, Room 206, Olympia, WA 98504, on December 4, 2014, at 9:30 a.m.

Date of Intended Adoption: December 4, 2014.

Submit Written Comments to: Lori Anderson, (mail) P.O. Box 40908, Olympia, WA 98504-0908, (physical address) 711 Capitol Way, Room 206, Olympia, WA, e-mail lori.anderson@pdc.wa.gov, fax (360) 753-1112 by November 26, 2014.

Assistance for Persons with Disabilities: Contact Jana Greer by e-mail jana.greer@pdc.wa.gov or phone (360) 753-1980.

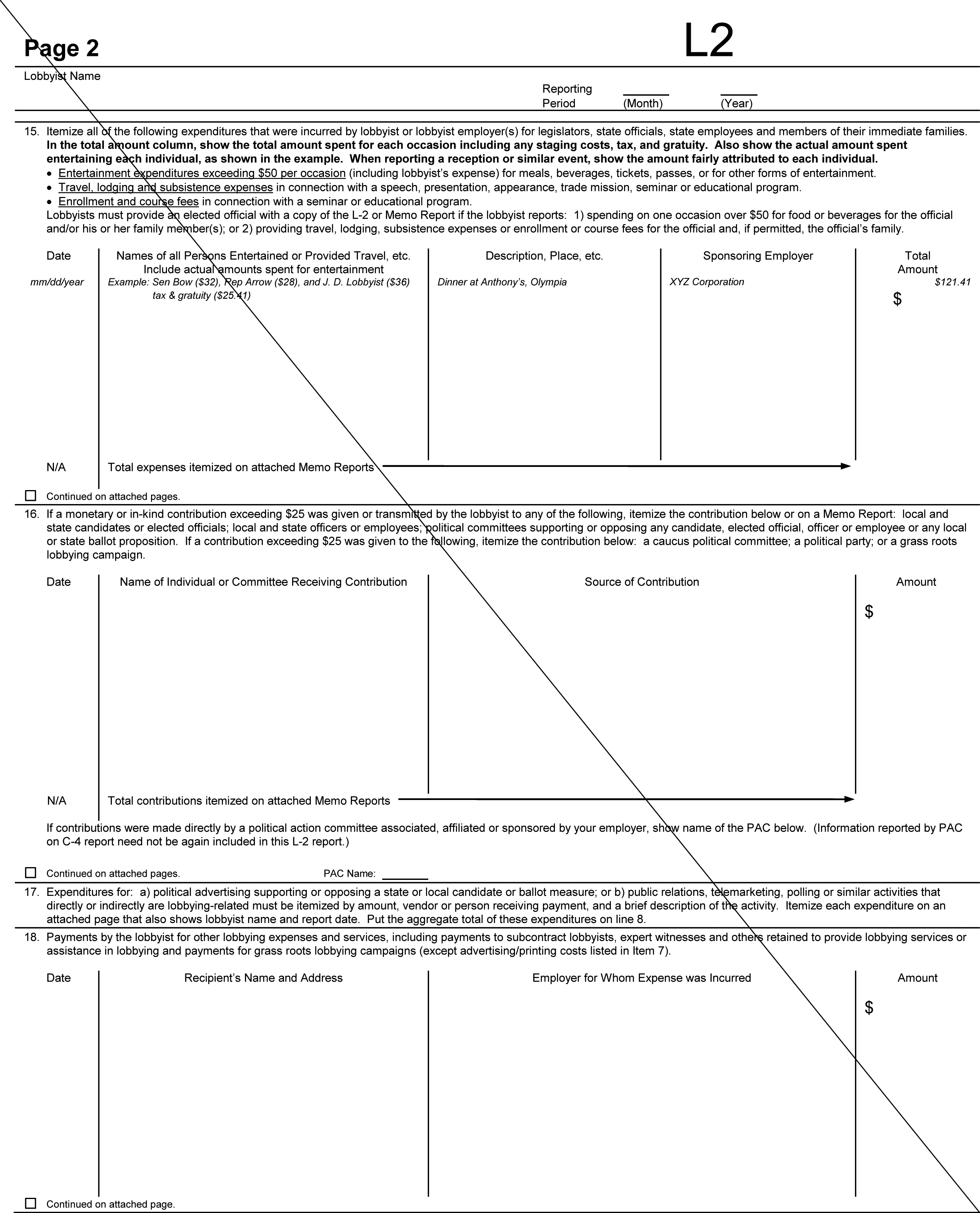

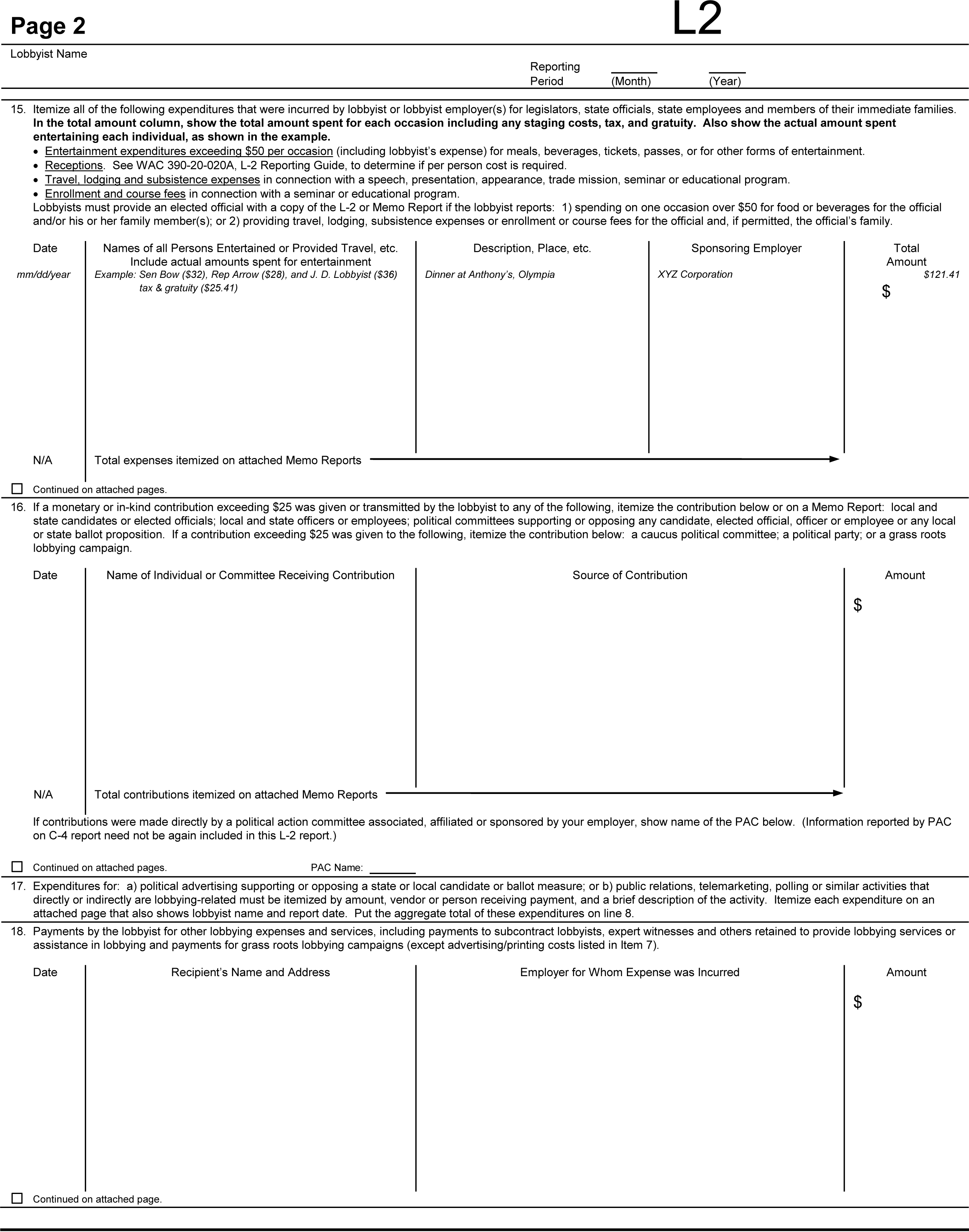

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: Interpretive Statement 96-03, L-2 Reporting Guide for Entertainment, Travel and Educational Expenditures is being converted to rule. Related instructions pertaining to disclosing costs of certain legislative receptions are being inserted on PDC Form L-2. Additionally, the instructions contained in PDC Forms F-1 and F-1 [F-1A] are similarly updated under separate notice published in Washington State Register Issue 14-21.*

* Under separate notice, a December 4, 2014, hearing is scheduled to consider amendments to WAC 390-20-010 and 390-20-020 to adjust for inflation, the dollar amounts used for candidates', elected officials', and executive state officers' personal financial affairs disclosure (PDC Forms F-1 and F-1A) pursuant to RCW 42.17A.700 - [42.17A].710. These forms are also used to disclose gifts of food and beverage in excess of $50, as required by RCW 42.52.150(5). Proposed amendments to WAC 390-20-010 and 390-20-020 will insert instructions on the F-1 and F-1A forms explaining that disclosing the cost of food and beverage served at a qualifying legislative reception is not required.

Proposed new WAC 390-20-020A explains how typical lobbying expenditures for gifts, entertainment, travel, and educational expenses are disclosed on lobbyists' monthly reports and whether notice needs to be provided to the recipient. The proposed new rule differs from the interpretation in that it allows an alternative method for disclosing legislative receptions. The change relieves lobbyists from disclosing the per person cost of legislative receptions, provided that the entire legislature, all members of a chamber, or any of the two largest caucuses recognized in each chamber are invited and the reception is sponsored by a person other than a lobbyist; attended by individuals other than legislators, lobbyists, and lobbyist employers; is a social event; and does not include a sit-down meal. Proposed amendment to WAC 390-20-020 inserts instructions on the monthly lobbyist expenditure report (PDC Form L-2) explaining that disclosing the per-person cost for legislative receptions as defined in (proposed) WAC 390-20-020A is not required.

Reasons Supporting Proposal: The interpretation has served as useful guidance for many years. Converting it to rule better informs the public of lobbyist disclosure requirements. Reception costs are currently disclosed in the same manner as entertainment, which requires disclosing a per person cost. Stakeholders have encouraged the commission to develop an alternative disclosure method for receptions, stating that organizers have difficulty monitoring what food and beverage attendees consume. The commission has recently determined that receptions are not entertainment, but rather an opportunity for legislators to meet with constituents, an obligation or customary duty of holding office. Furthermore, the proposed amendments conform to the disclosure requirements set out in the Ethics Act at RCW 42.52.150. Finally, the commission believes the proposal will promote compliance and consistent reporting without depriving the public of significant data.

Statutory Authority for Adoption: RCW 42.17A.110 and 42.17A.615(4).

Statute Being Implemented: RCW 42.17A.615.

Rule is not necessitated by federal law, federal or state court decision.

Name of Proponent: Public disclosure commission (PDC), governmental.

Name of Agency Personnel Responsible for Drafting and Implementation: Lori Anderson, 711 Capitol Way, Room 206, Olympia, WA 98504, (360) 664-2737; and Enforcement: Andrea Doyle, 711 Capitol Way, Room 206, Olympia, WA 98504, (360) 664-2735.

No small business economic impact statement has been prepared under chapter 19.85 RCW. The implementation of these rule amendments has minimal impact on small business. The PDC is not subject to the requirement to prepare a school district fiscal impact statement, per RCW 28A.305.135 and 34.05.320.

A cost-benefit analysis is not required under RCW 34.05.328. The PDC is not an agency listed in subsection (5)(a)(i) of RCW 34.05.328. Further, the PDC does not voluntarily make the section applicable to the adoption of these rules pursuant to subsection (5)(a)(ii) and, to date, the joint administrative rules review committee has not made the section applicable to the adoption of these rules.

October 22, 2014

Lori Anderson

Communications and

Training Officer

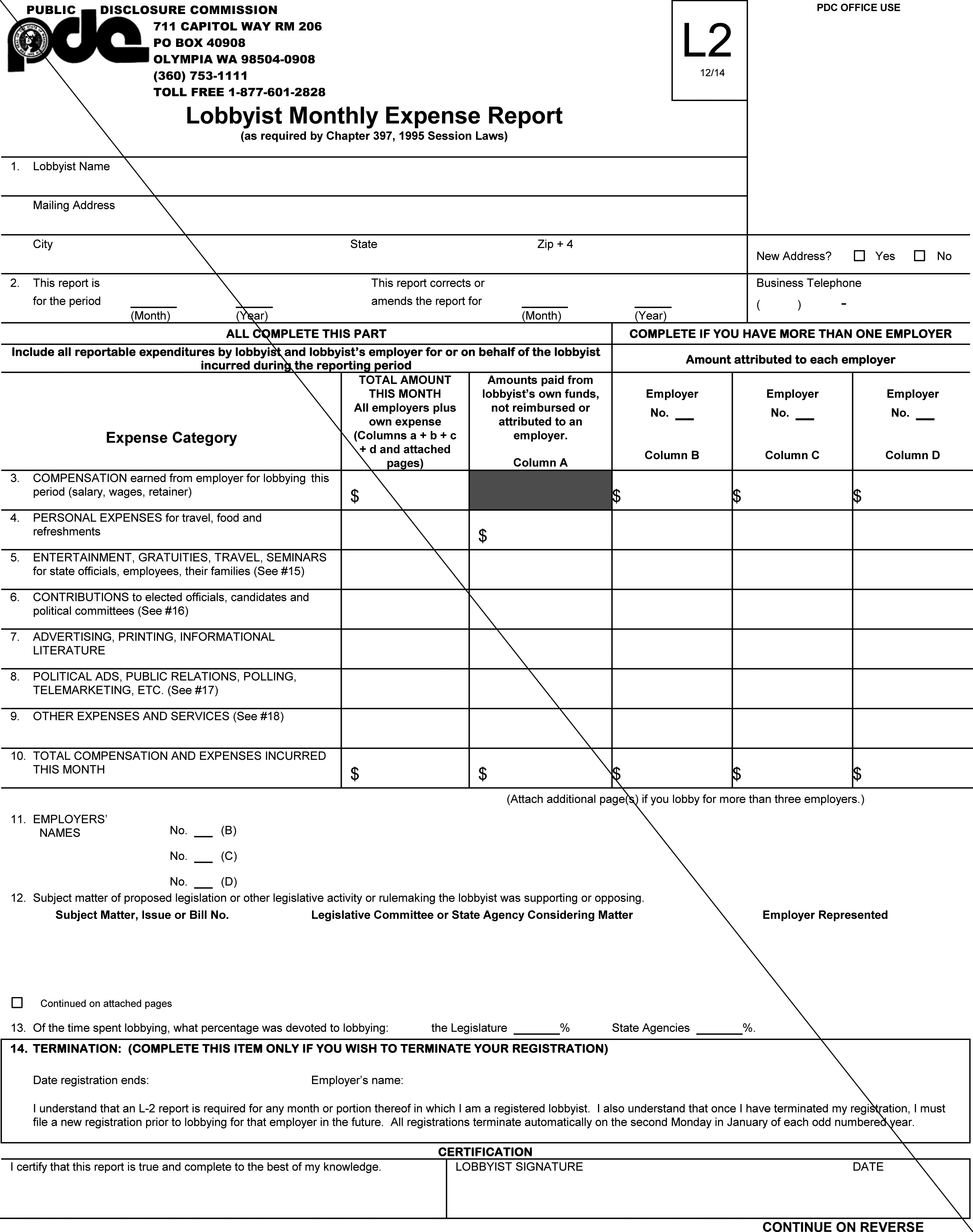

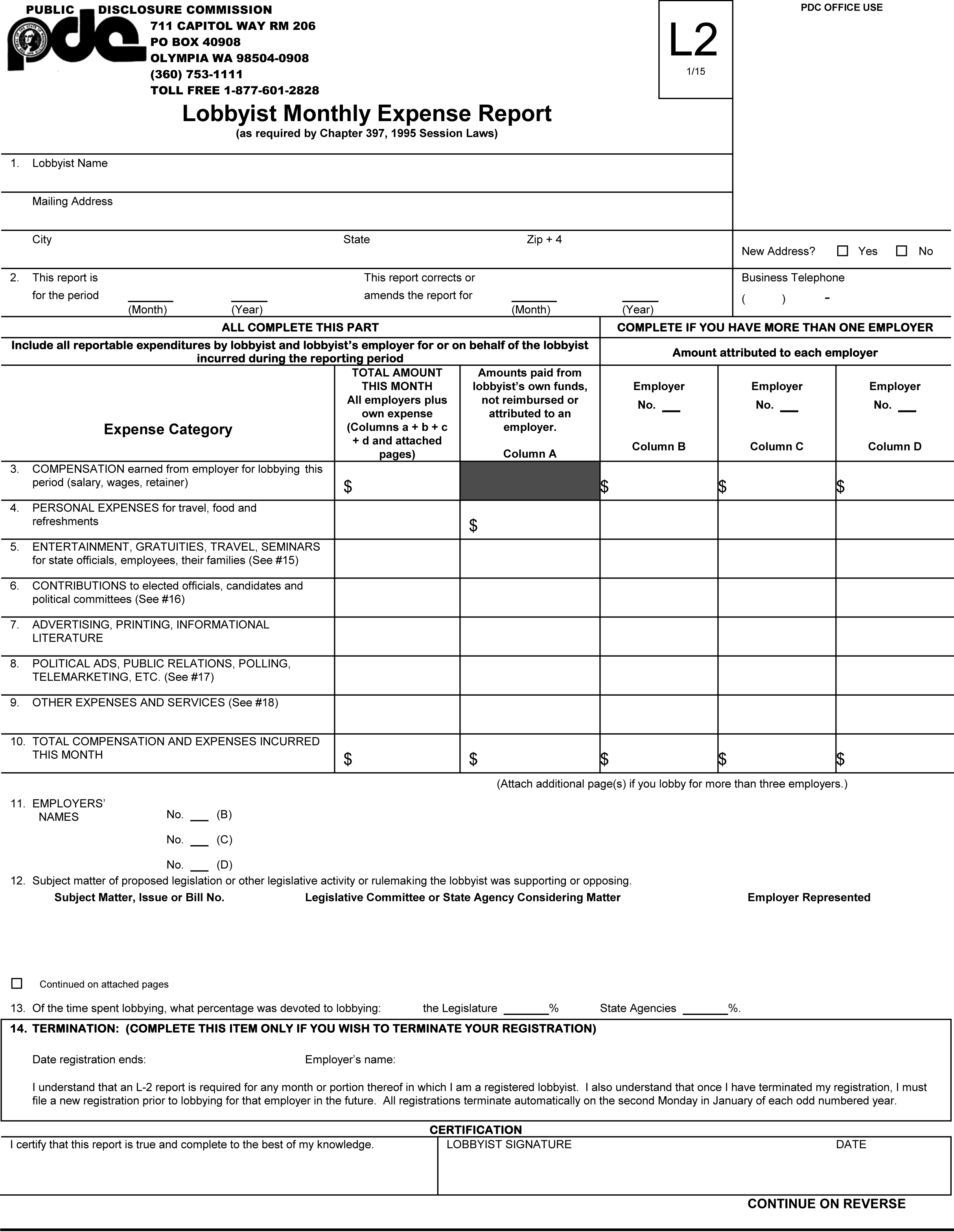

AMENDATORY SECTION (Amending WSR 14-15-015, filed 7/3/14, effective 12/1/14)

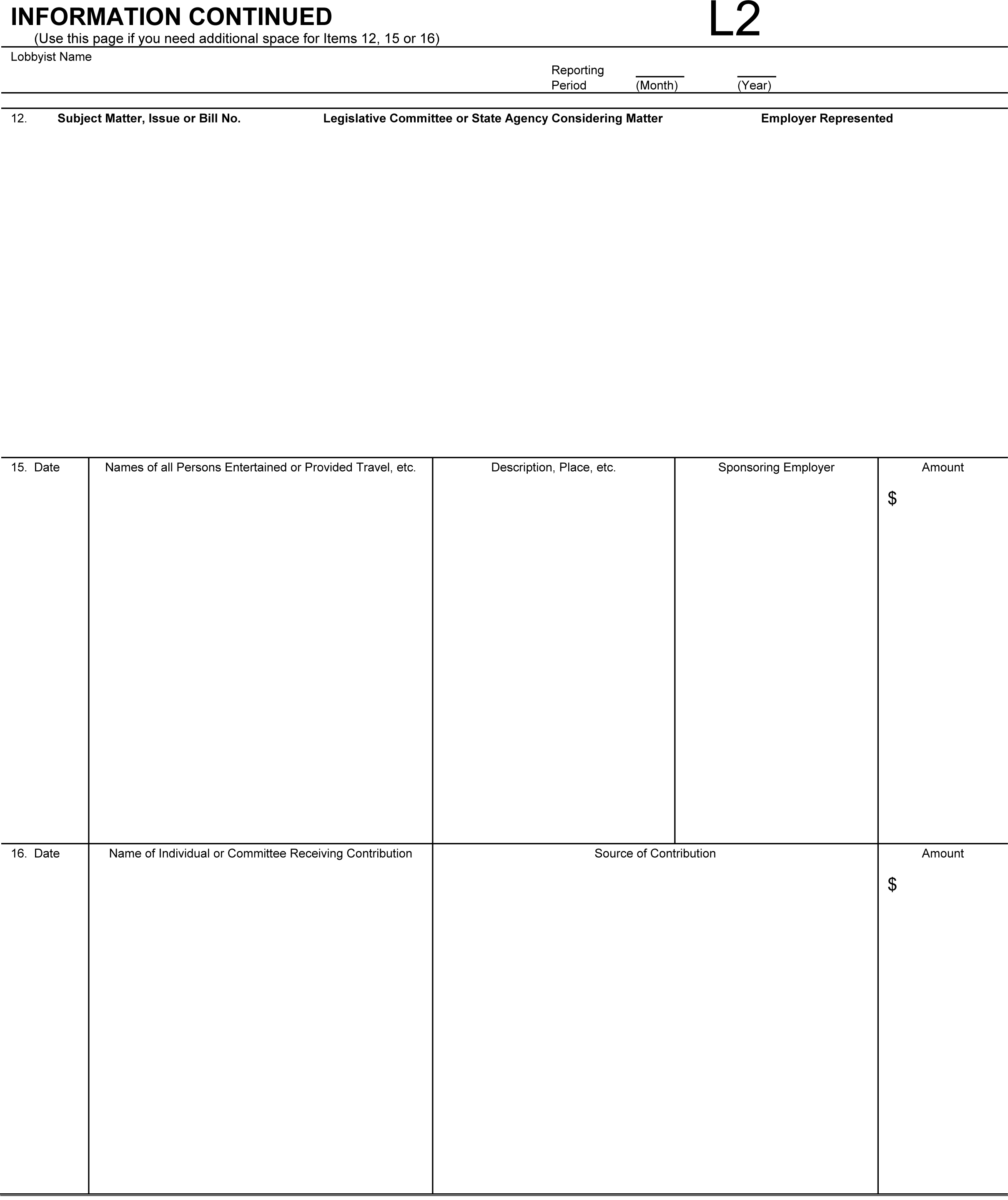

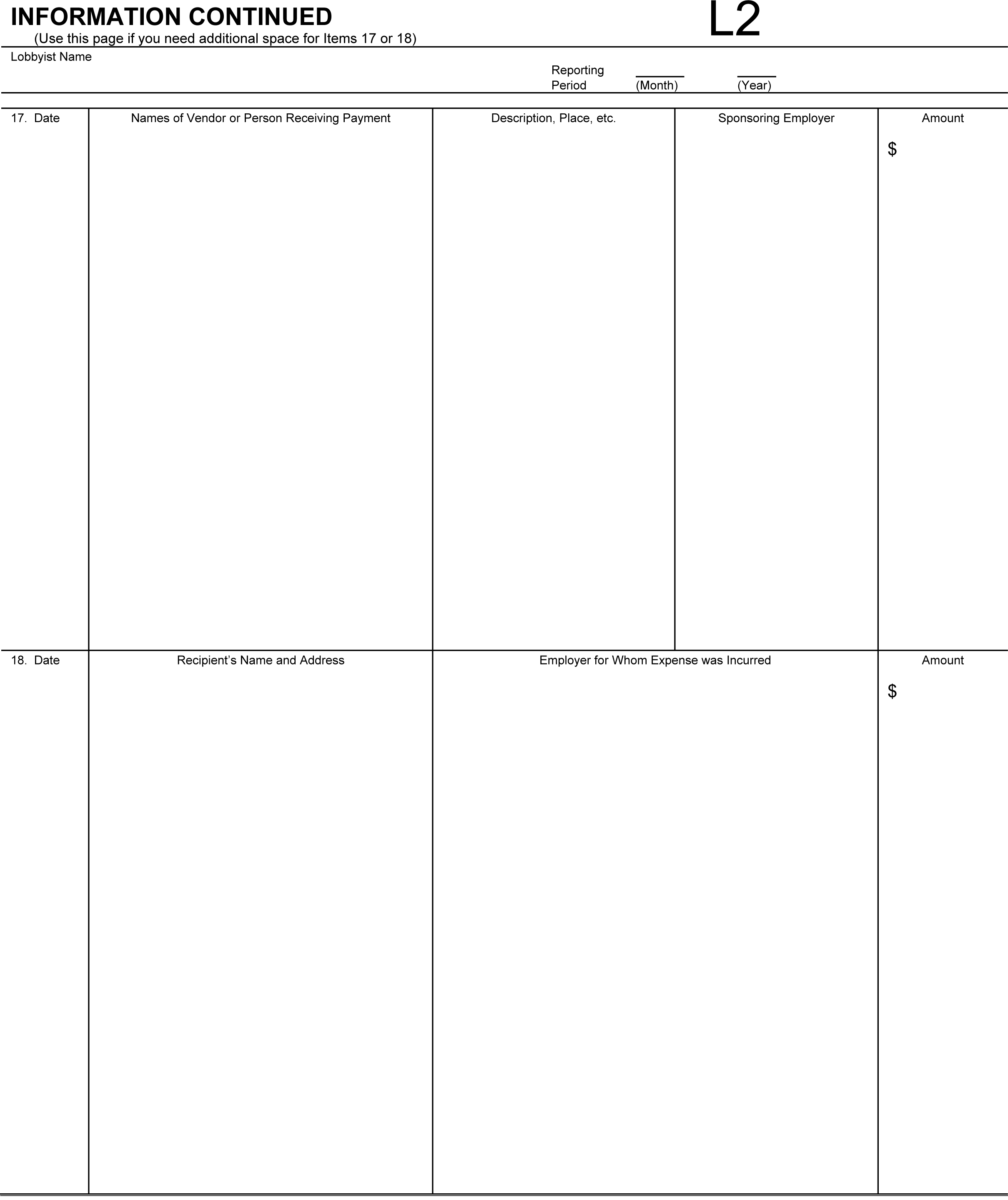

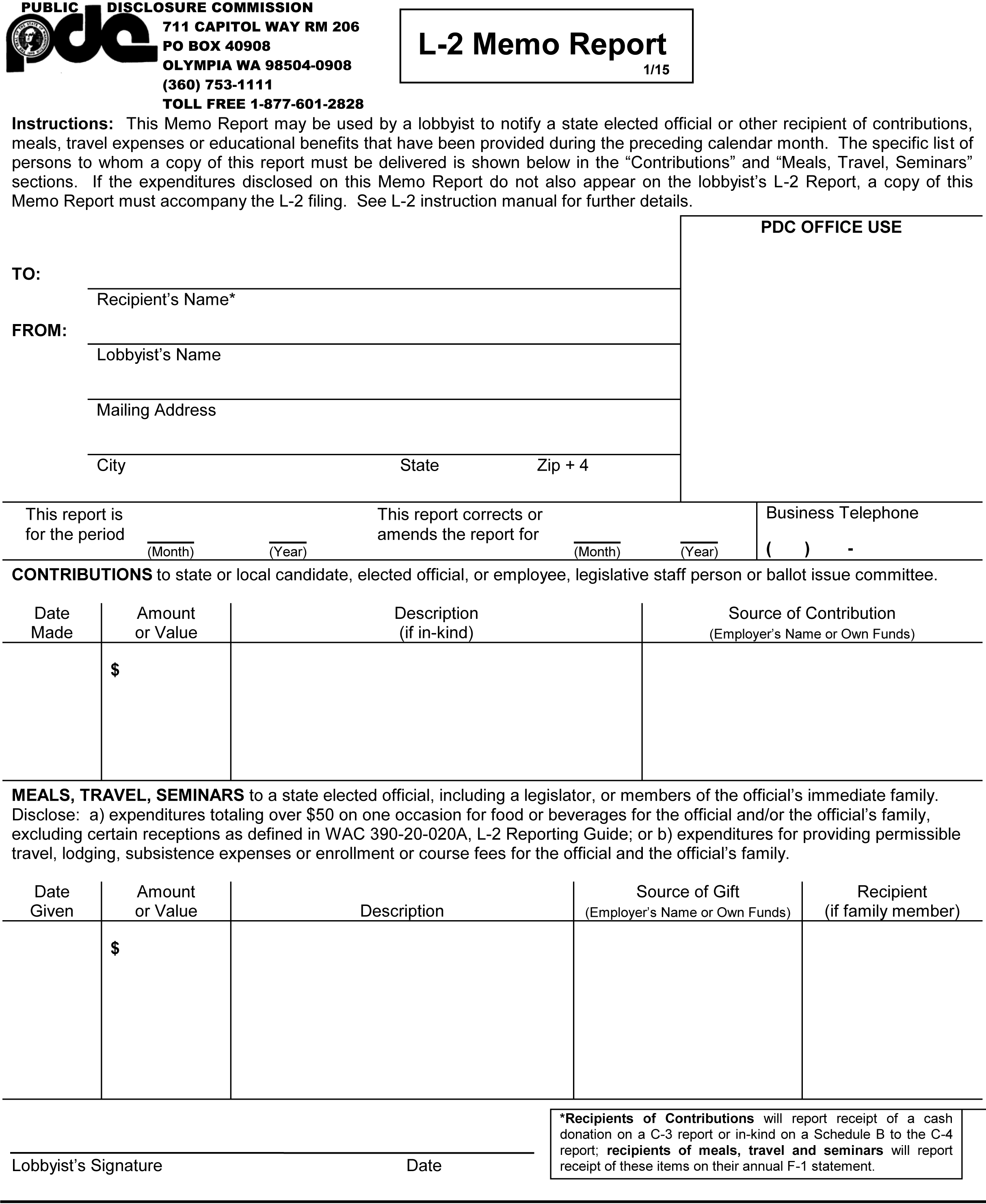

WAC 390-20-020 Forms for lobbyist report of expenditures.

The official form for the lobbyist report of expenditures is designated "L-2," revised ((12/14)) 1/15 which includes the L-2 Memo Report, dated ((1/02)) 1/15. Copies of this form are available on the commission's web site, www.pdc.wa.gov, and at the Commission Office, Room 206, Evergreen Plaza Building, Olympia, Washington 98504. Any attachments shall be on 8-1/2" x 11" white paper.

((  )) |

|

((  )) |

|

|

|

((  )) |

|

NEW SECTION

WAC 390-20-020A L-2 Reporting guide.

For Entertainment, Receptions, Travel and Educational Expenditures

Typical Expenditures* (Only permitted if receipt could not reasonably be expected to influence the performance of the officer's or employee's official duties.) |

Expense Included on Line 5 |

Expense Included on Line 15 |

Give Copy of L-2 or Memo Report to Elected Official |

||

Entertaining State Officials, Employees or Their Families: |

|||||

□ |

Any type of entertainment occasion costing $50 or less |

Yes |

No |

No |

|

□ |

Breakfast, lunch or dinner for legislator or other state official or employee (singly, or in conjunction with family member(s)) and total cost for occasion is: |

||||

º |

$50 or less |

Yes |

No |

No |

|

º |

More than $50, and amount attributable to legislator/family is more than $50 |

Yes |

Yes |

Yes |

|

□ |

Tickets to theater, sporting events, etc., costing $50 or less |

Yes |

Yes |

No |

|

□ |

Golf outing at which no more than $50 was spent on each official, including any member(s) of the official's family |

Yes |

Yes |

No |

|

Receptions: |

|||||

□ |

Reception to which the entire legislature, all members of a chamber, or any of the two largest caucuses recognized in each chamber are invited and is: |

Yes |

Yes, except that a per-person cost is not required |

No |

|

º |

Sponsored by a person other than a lobbyist; |

||||

º |

Attended by individuals other than legislators, lobbyists, and lobbyist employers; |

||||

º |

A social event; and |

||||

º |

Does not include a sit-down meal. |

||||

□ |

All other receptions |

Yes |

Yes |

Yes, if the food and beverage cost for the legislator and family members exceeds $50 |

|

Travel-Related Expenditures for Officials, Employees: |

|||||

□ |

Travel, lodging, meals for office-related appearance or speech at lobbyist employer's annual conference |

Yes |

Yes |

Yes |

|

□ |

Travel, lodging, meals for office-related tour of lobbyist employer's manufacturing plant or other facility |

Yes |

Yes |

Yes |

|

Educational Expenditures for Officials, Employees: |

|||||

□ |

Travel, lodging, meals, tuition to attend seminar sponsored by nonprofit organization |

Yes |

Yes |

Yes |

|

Other Lobbying-Related Items: |

|||||

□ |

Flowers costing any amount to officials, staff and/or family |

Yes |

No |

No |

|

□ |

Candy costing $50 or less per official or employee |

Yes |

No |

No |

|

□ |

Golf balls, coffee cups or other promotional items |

Yes |

No |

No |

|

□ |

Fruit baskets costing $50 or less per official or employee |

Yes |

No |

No |

|

Note: | References to employees or staff do not constitute authority to provide impermissible items to regulatory, contracting or purchasing employees. |