WSR 15-01-066

PERMANENT RULES

PUBLIC DISCLOSURE COMMISSION

[Filed December 11, 2014, 3:41 p.m., effective January 11, 2015]

Effective Date of Rule: Thirty-one days after filing.

Purpose: Making inflationary adjustments to dollar amounts and reporting code values used by candidates, elected officials, and executive state officers when disclosing personal financial affairs.

Instructions are inserted on WAC 390-24-010 and 390-24-020 (forms for statement of financial affairs and amending statement of financial affairs, respectively) to explain that disclosing the cost of food and beverage served at certain legislative receptions is not required. This "housekeeping" amendment is consistent [with] WAC 390-20-020A adopted December 4, 2014, and filed under separate order for publication in WSR [Issue] 15-01 that creates an alternative method for disclosing lobbying expenditures for certain legislative receptions.

Citation of Existing Rules Affected by this Order: Amending 6 [WAC 390-16-071, 390-20-110, 390-24-010, 390-24-020, 390-24-202, and 390-24-301].

Statutory Authority for Adoption: RCW 42.17A.110 and 42.17A.125(2).

Adopted under notice filed as WSR 14-21-168 on October 22, 2014.

Number of Sections Adopted in Order to Comply with Federal Statute: New 0, Amended 0, Repealed 0; Federal Rules or Standards: New 0, Amended 0, Repealed 0; or Recently Enacted State Statutes: New 0, Amended 0, Repealed 0.

Number of Sections Adopted at Request of a Nongovernmental Entity: New 0, Amended 6, Repealed 0.

Number of Sections Adopted on the Agency's Own Initiative: New 0, Amended 0, Repealed 0.

Number of Sections Adopted in Order to Clarify, Streamline, or Reform Agency Procedures: New 0, Amended 0, Repealed 0.

Number of Sections Adopted Using Negotiated Rule Making: New 0, Amended 0, Repealed 0; Pilot Rule Making: New 0, Amended 0, Repealed 0; or Other Alternative Rule Making: New 0, Amended 0, Repealed 0.

Date Adopted: December 4, 2014.

Lori Anderson

Communications and

Training Officer

AMENDATORY SECTION (Amending WSR 12-03-002, filed 1/4/12, effective 2/4/12)

WAC 390-16-071 Annual report of major contributors and persons making independent expenditures.

(1) Any person, other than an individual (a) who made contributions to state office candidates and statewide ballot proposition committees totaling more than the aggregate amount during the preceding calendar year for contributions referenced in WAC 390-05-400, code section .180 (1), or (b) who made independent expenditures regarding state office candidates and statewide ballot propositions totaling more than the aggregate amount during the preceding calendar year for independent expenditures referenced in WAC 390-05-400, code section .180(1), shall file with the commission an annual report required pursuant to RCW 42.17A.630. This report shall not be required of a lobbyist employer filing an annual L-3 report pursuant to RCW 42.17A.630 or of a candidate's authorized committee or a political committee provided the information has been properly reported pursuant to RCW 42.17A.235 and 42.17A.240.

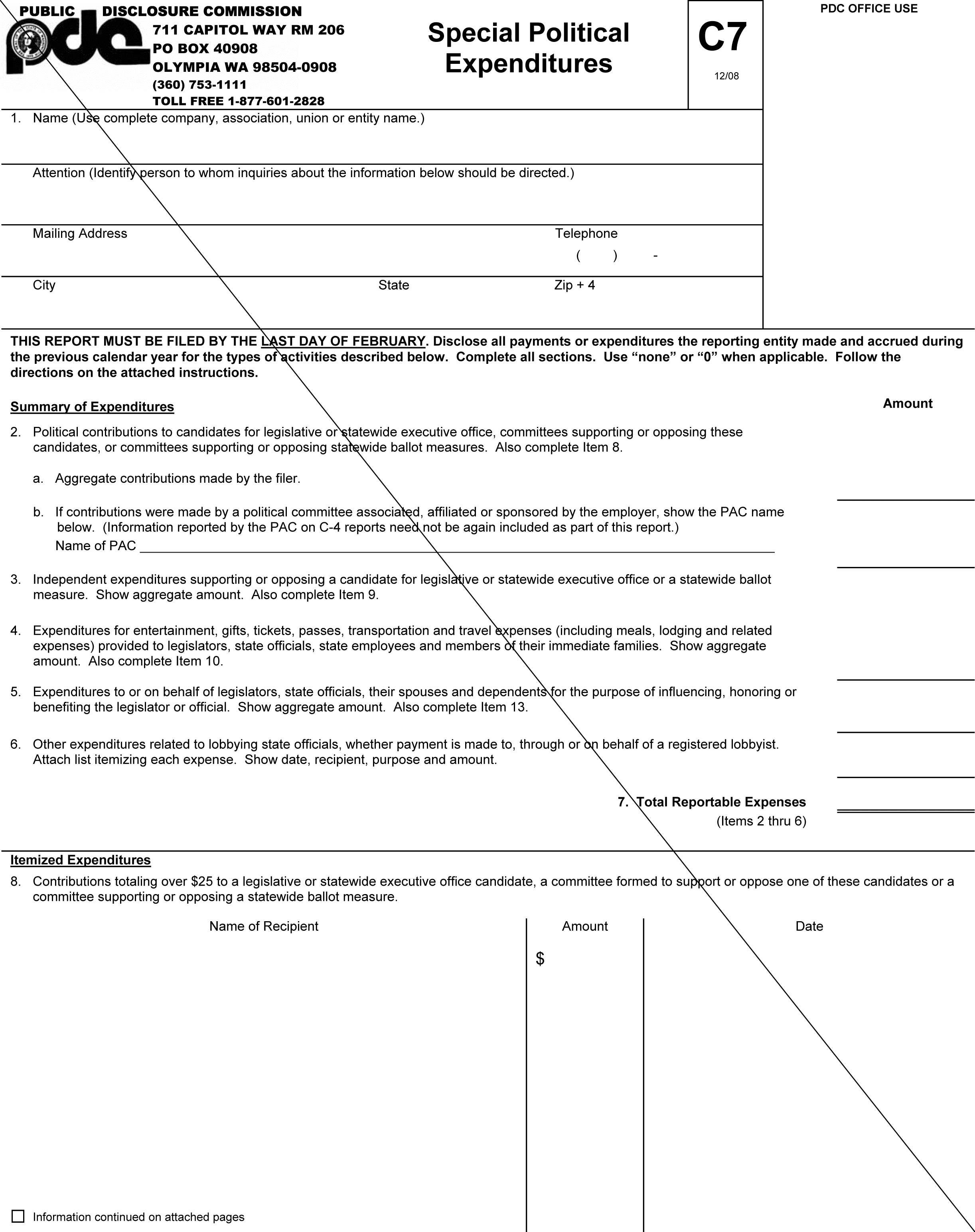

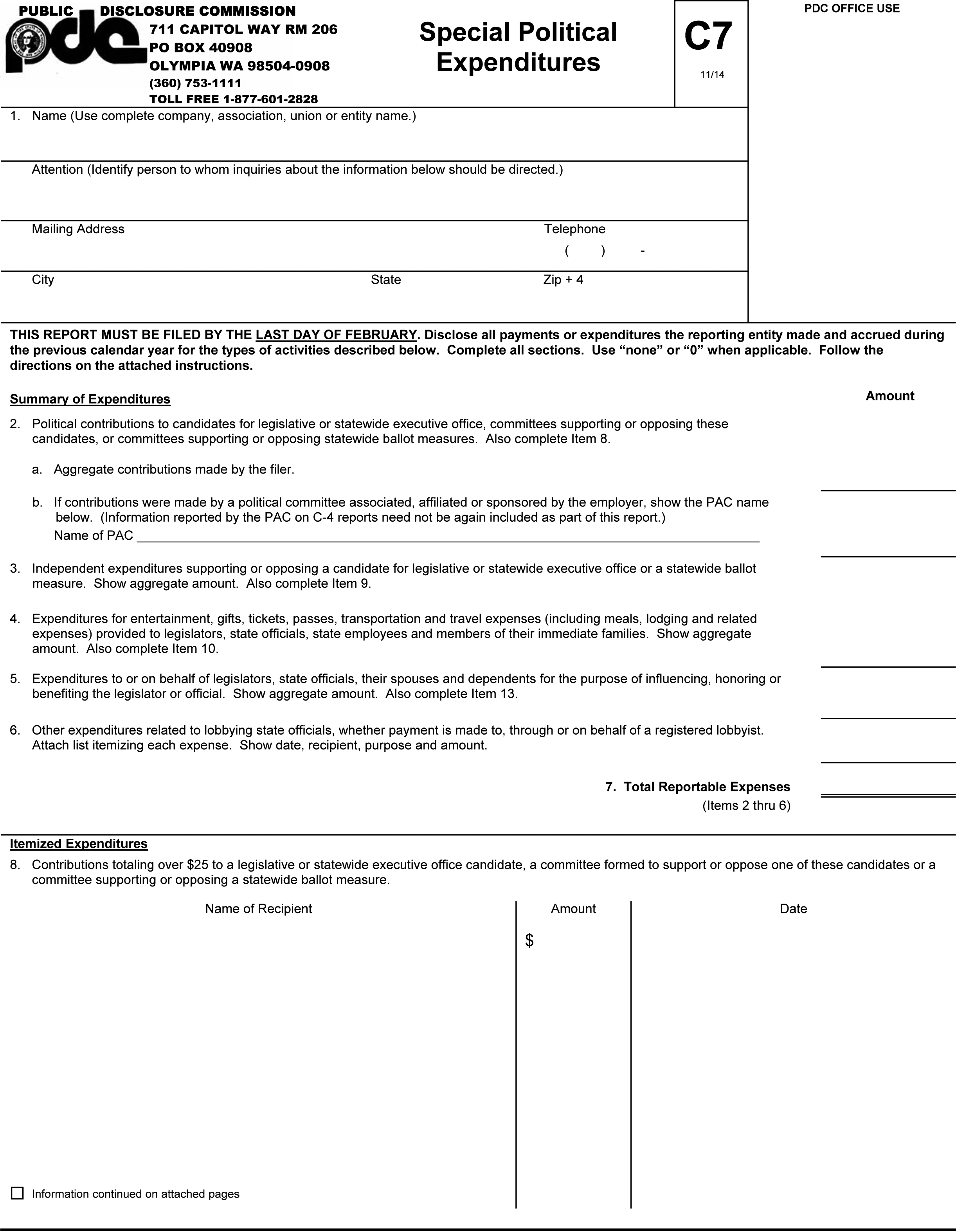

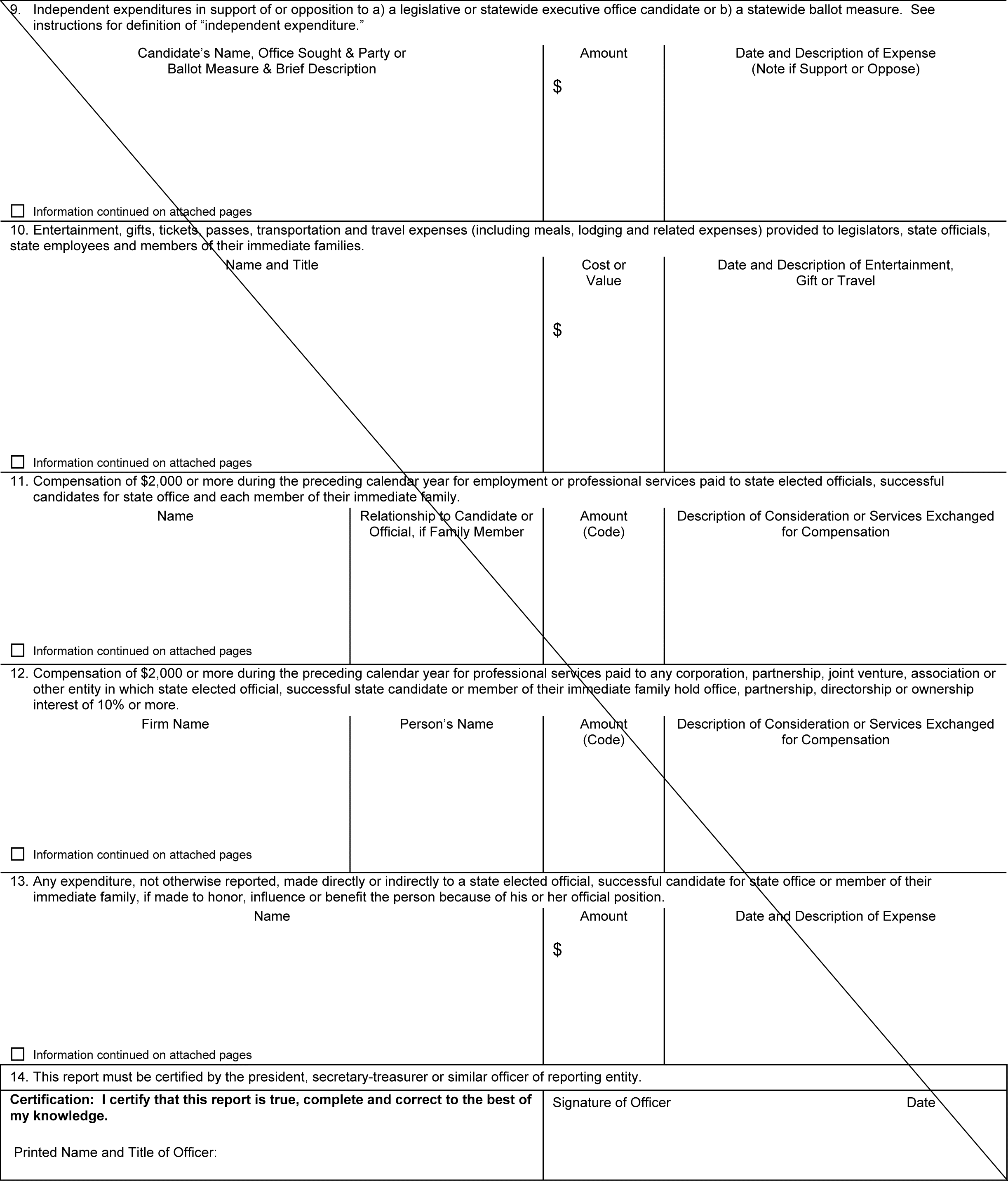

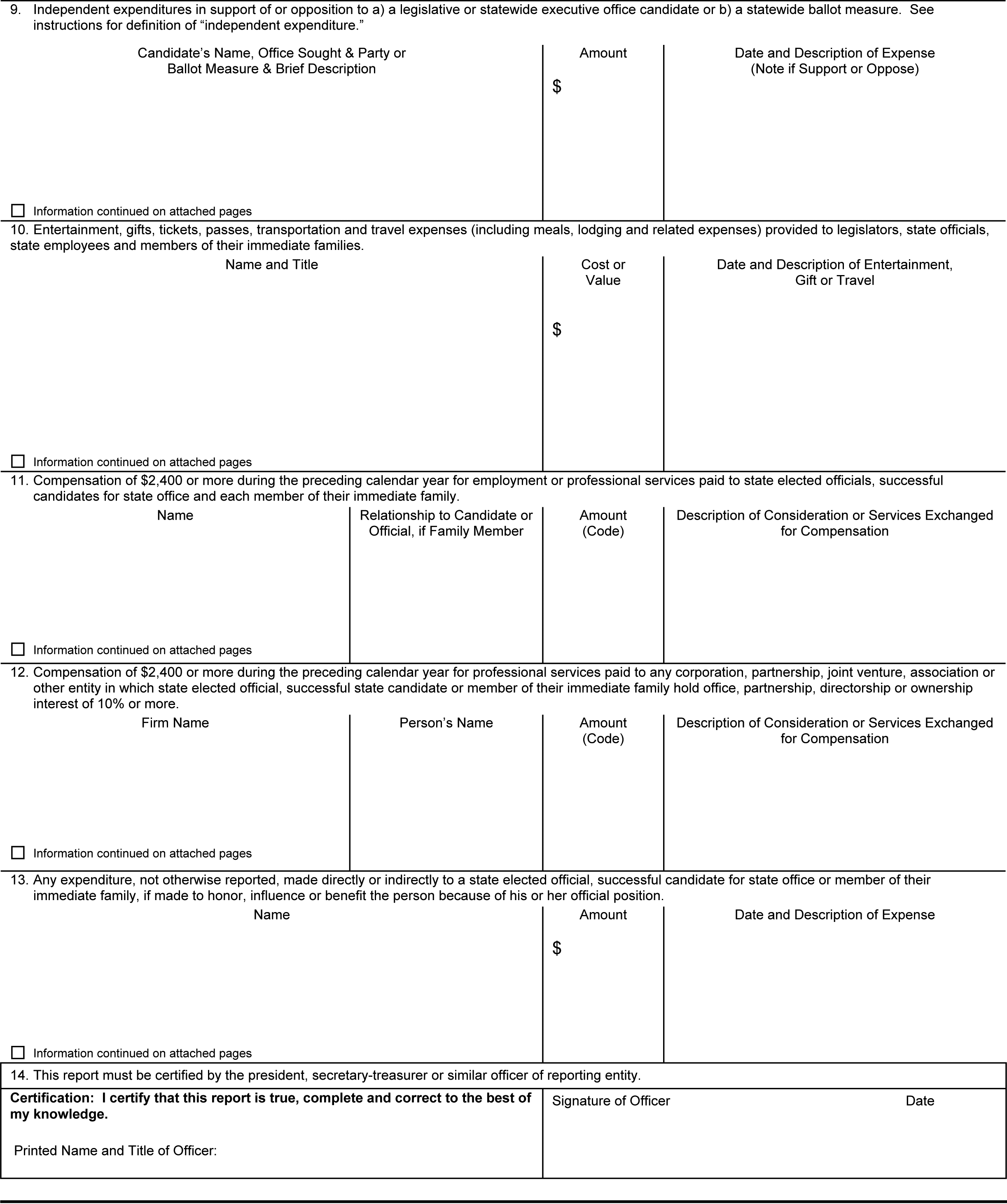

(2) The report is entitled "Special Political Expenditures" and is designated "C-7" revised ((12/08)) 11/14. Copies of this form are available on the commission's web site, www.pdc.wa.gov, and at the Commission Office, Room 206, Evergreen Plaza Building, Olympia, Washington 98504. Any attachments shall be on 8-1/2" x 11" white paper.

((  )) |

|

((  )) |

|

AMENDATORY SECTION (Amending WSR 09-01-063, filed 12/11/08, effective 1/11/09)

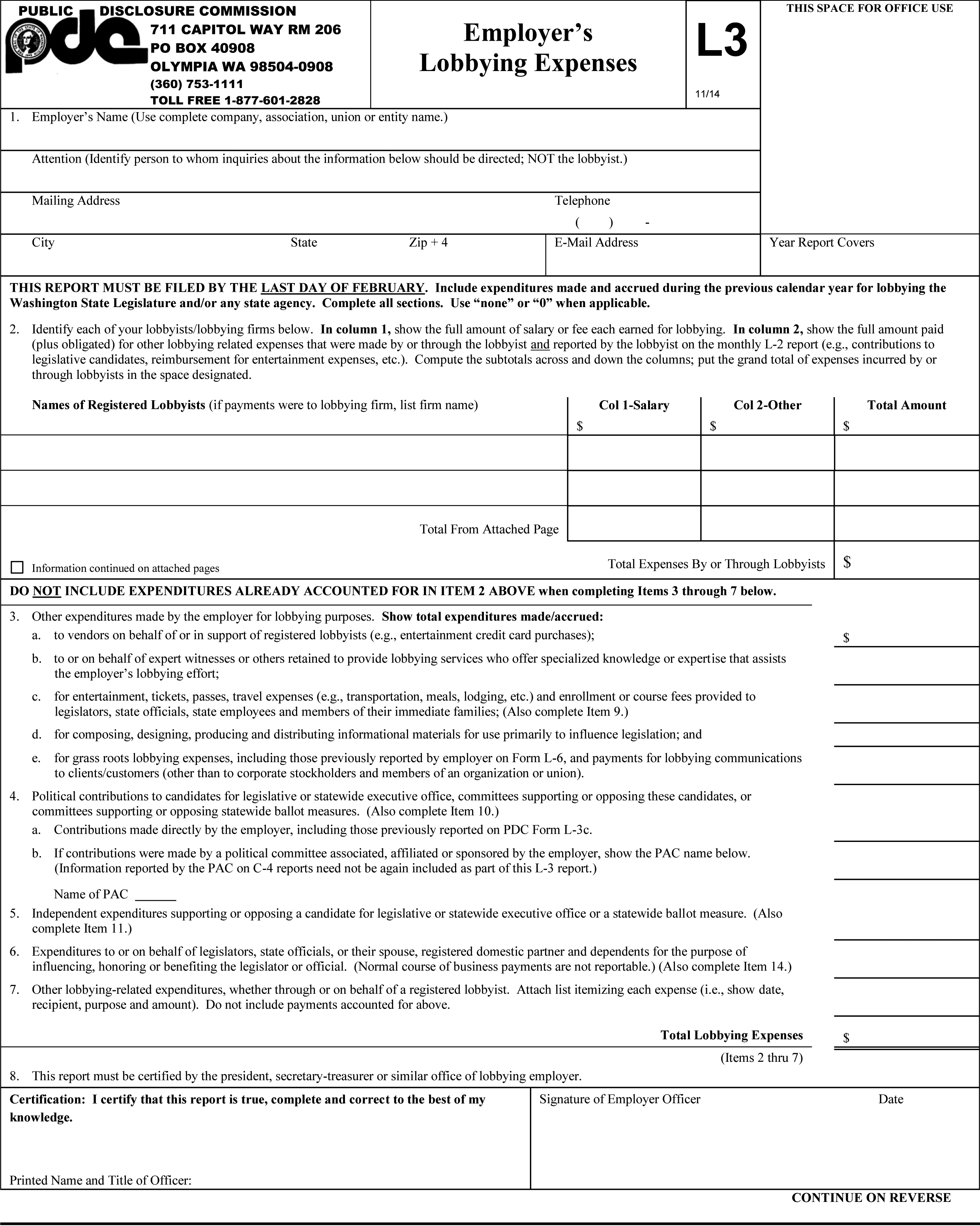

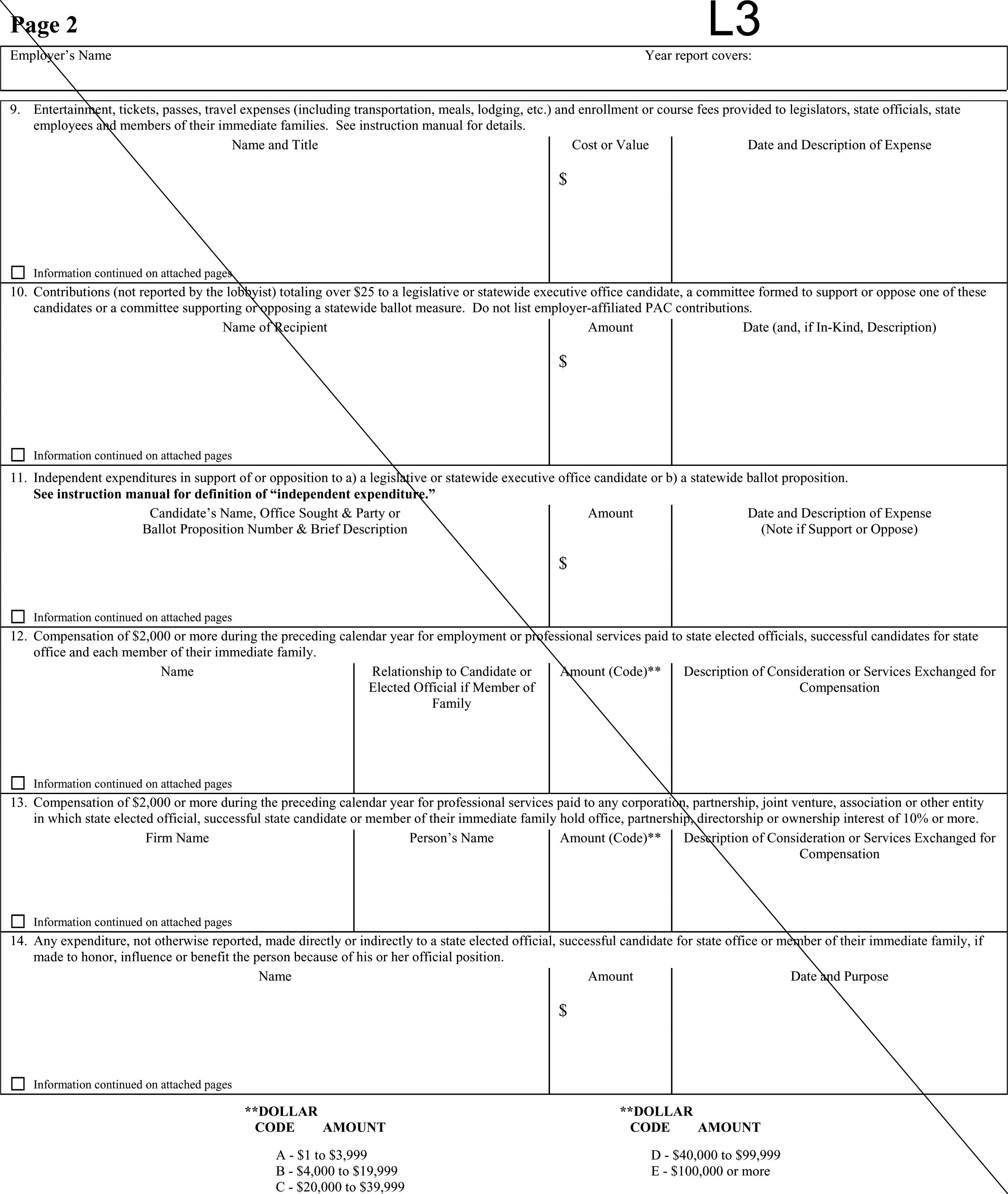

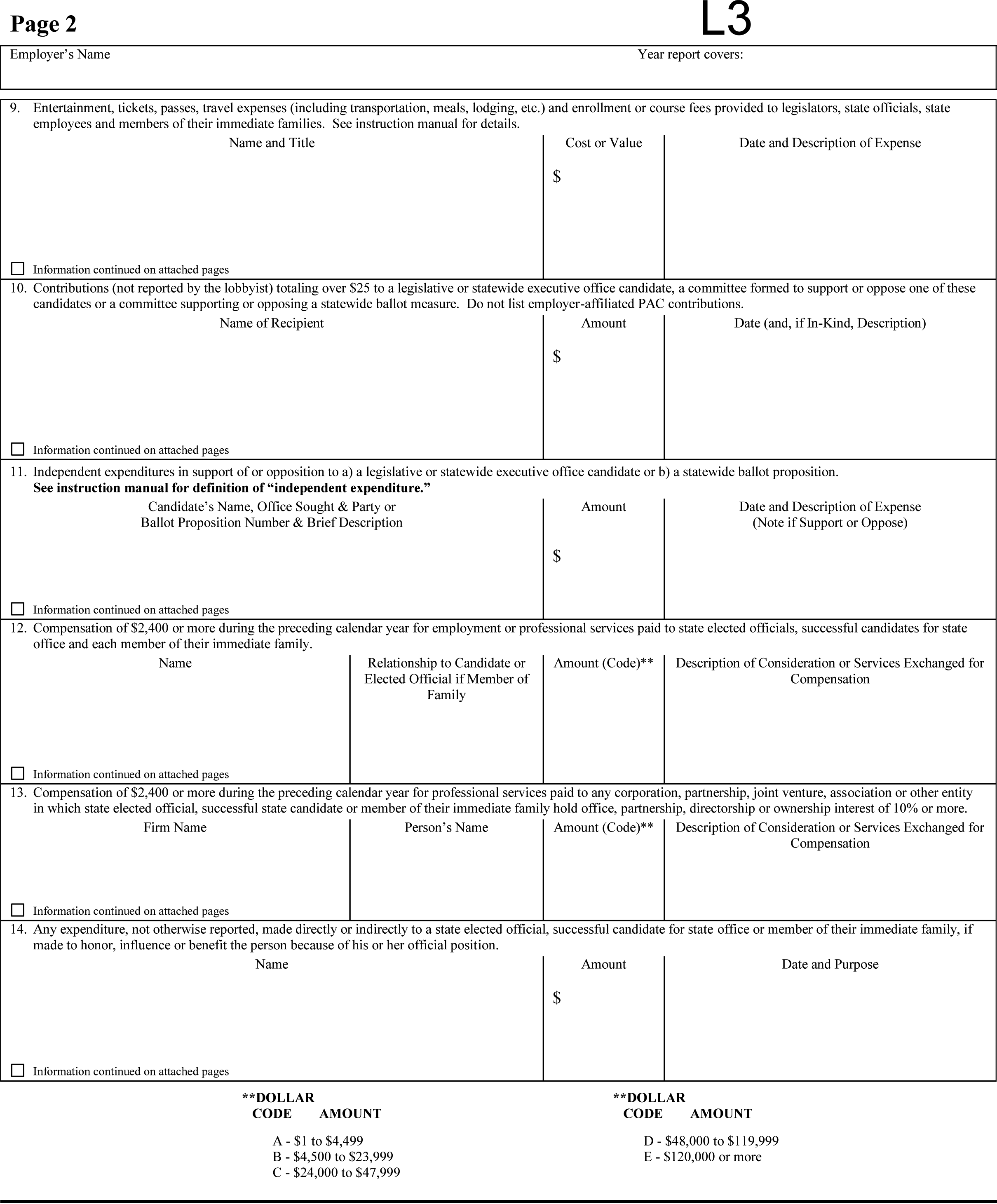

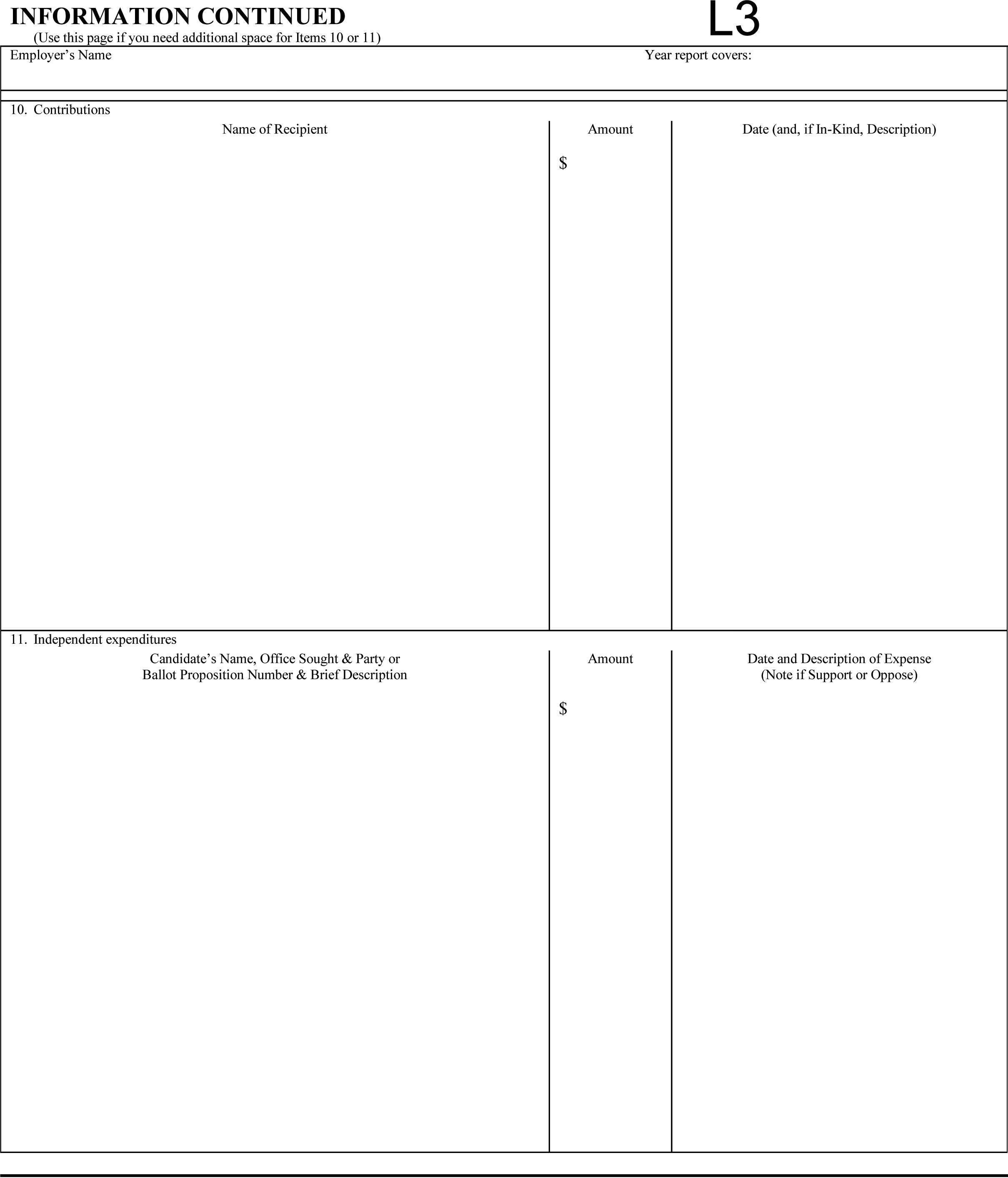

WAC 390-20-110 Forms for lobbyist employers report.

The official form for statement by employers of registered lobbyists as required by RCW 42.17.180 is designated "L-3," revised ((1/09)) 11/14. Copies of this form are available on the commission's web site, www.pdc.wa.gov, and at the Commission Office, 711 Capitol Way, Room 206, Evergreen Plaza Building, P.O. Box 40908, Olympia, Washington, 98504-0908. Any paper attachments shall be on 8-1/2" x 11" white paper.

((  )) |

|

((  )) |

|

|

|

|

Reviser's note: Notice of Objection: The Joint Administrative Rules Review Committee finds that WAC 390-20-110 has not been modified, amended, withdrawn, or repealed by the Public Disclosure Commission so as to conform with the intent of the Legislature as expressed in RCW 42.17.170 and 42.17.180. Therefore, pursuant to its authority under RCW 34.04.240, this notice of objection is filed.

The Joint Committee finds that WAC 390-20-110 requires the disclosure of information from lobbyists' employers which RCW 42.17.170 specifically excludes from reporting by lobbyists. It is the opinion of the Joint Committee that the Commission is attempting to obtain information from lobbyists' employers which the Commission would not otherwise be able to obtain from lobbyists themselves. This would thwart the express intent of the Legislature that such information is inappropriate for reporting. WAC 390-20-110 would effectively neuter the reporting exemptions in RCW 42.17.170—the Commission would have the information. This is not what the Legislature intended. [Joint Administrative Rules Review Committee, Memorandum, August 16, 1984—Filed August 28, 1984, WSR 84-18-014.]

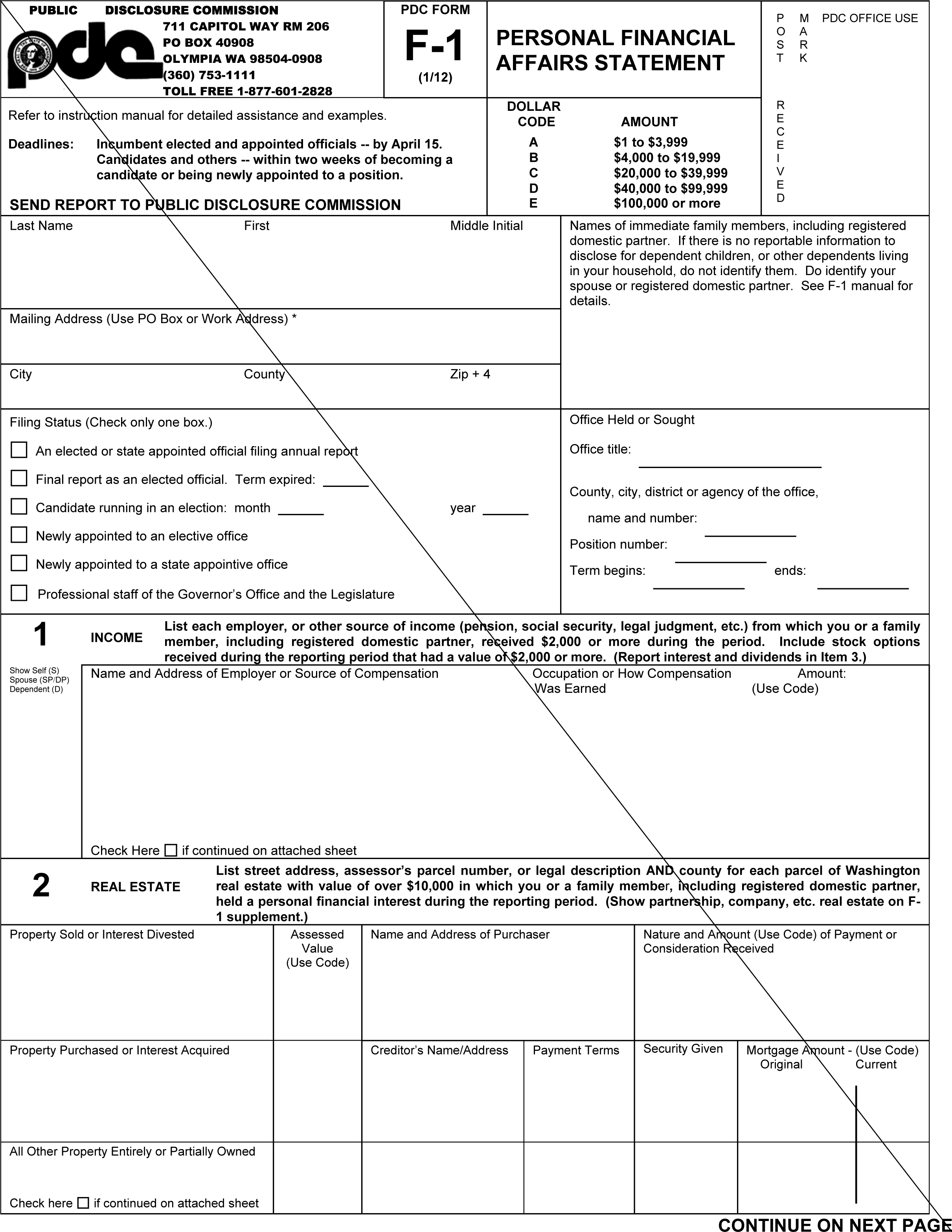

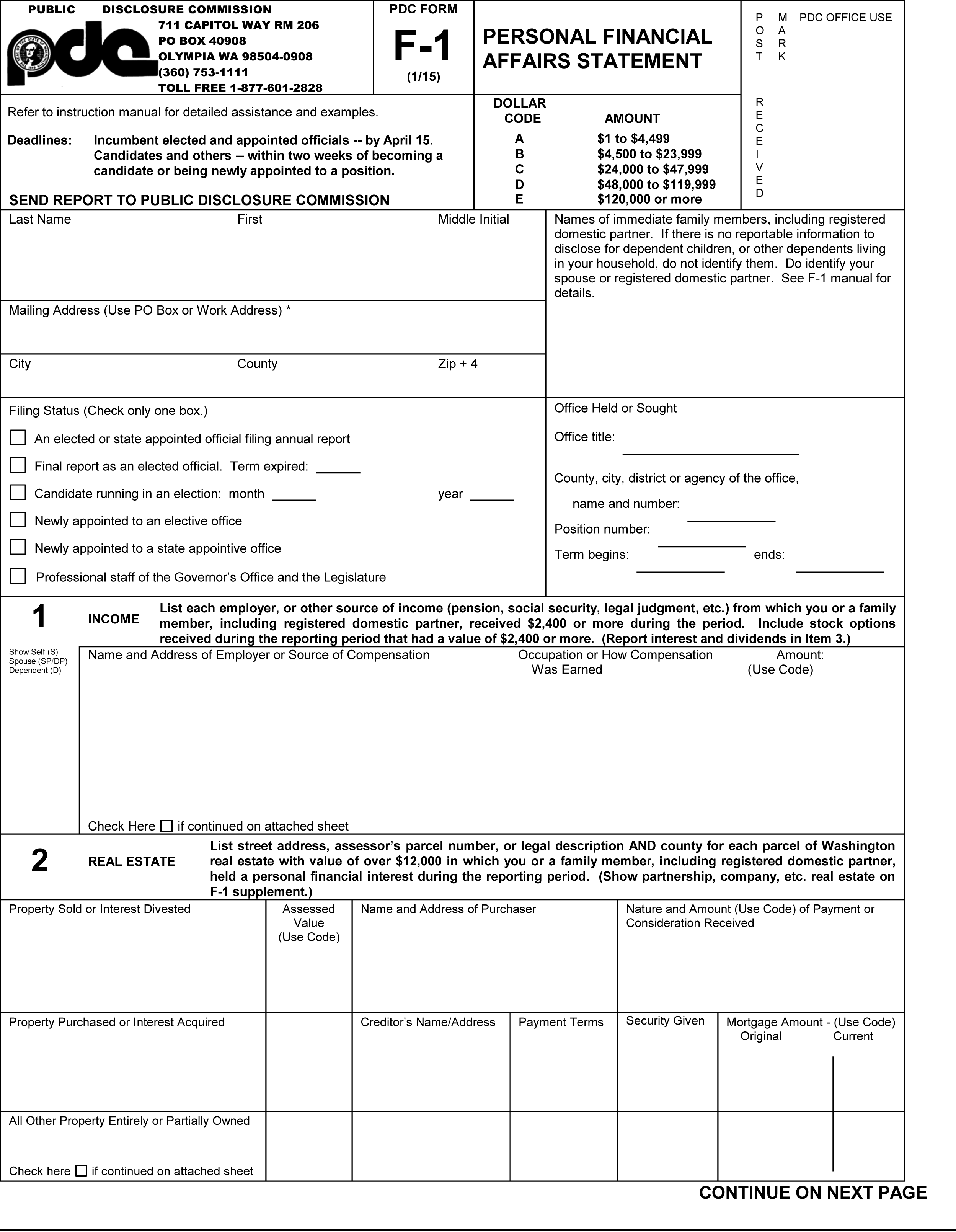

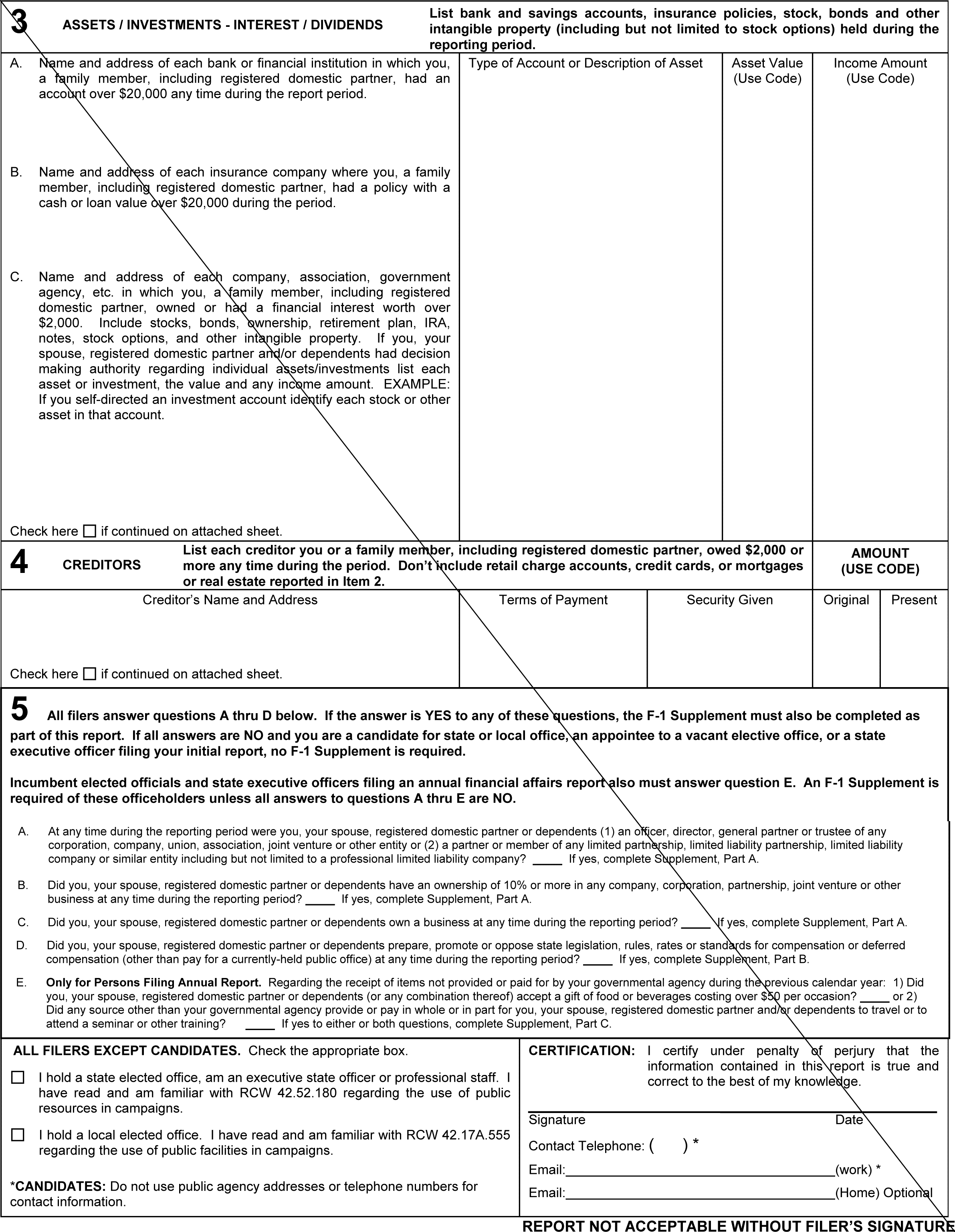

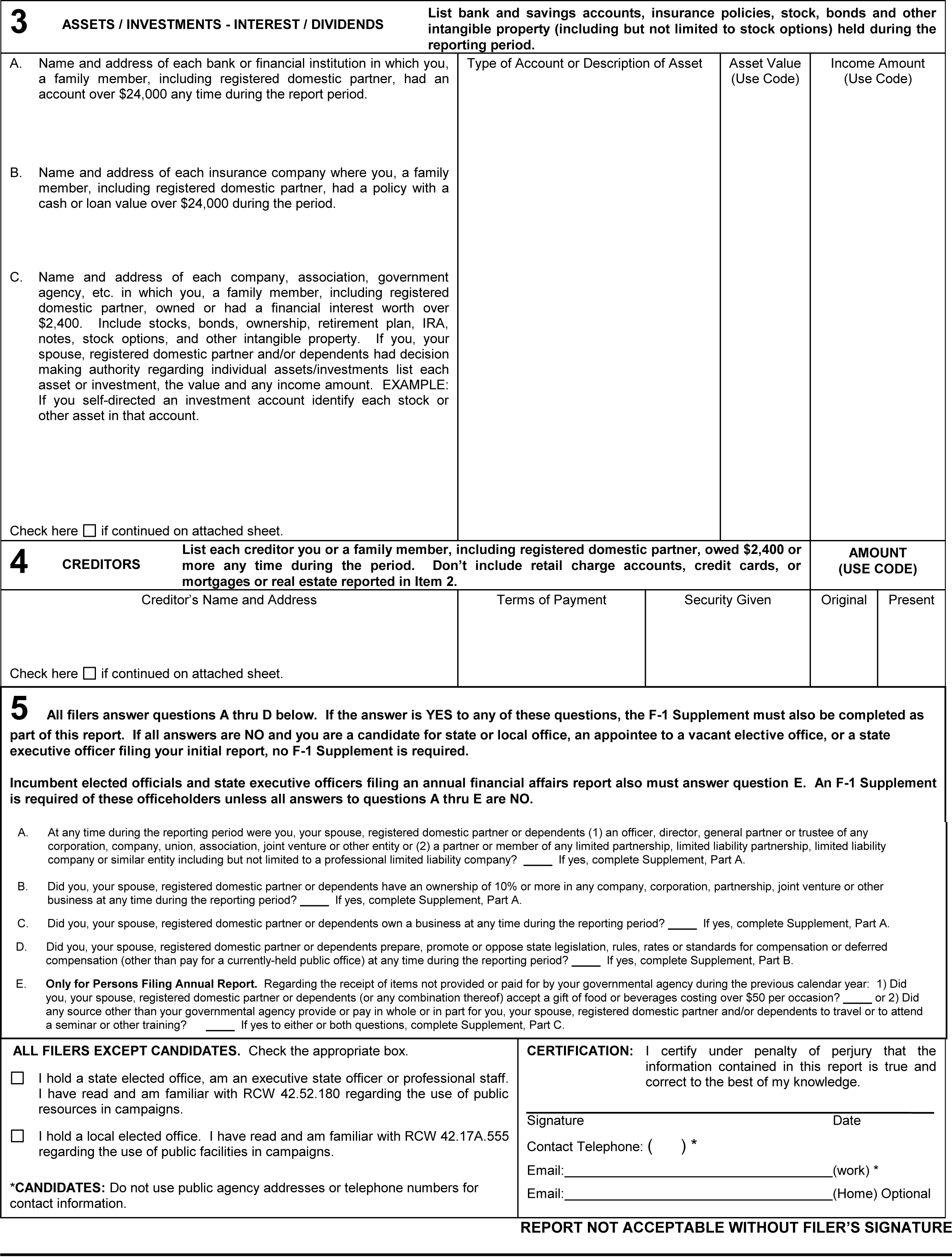

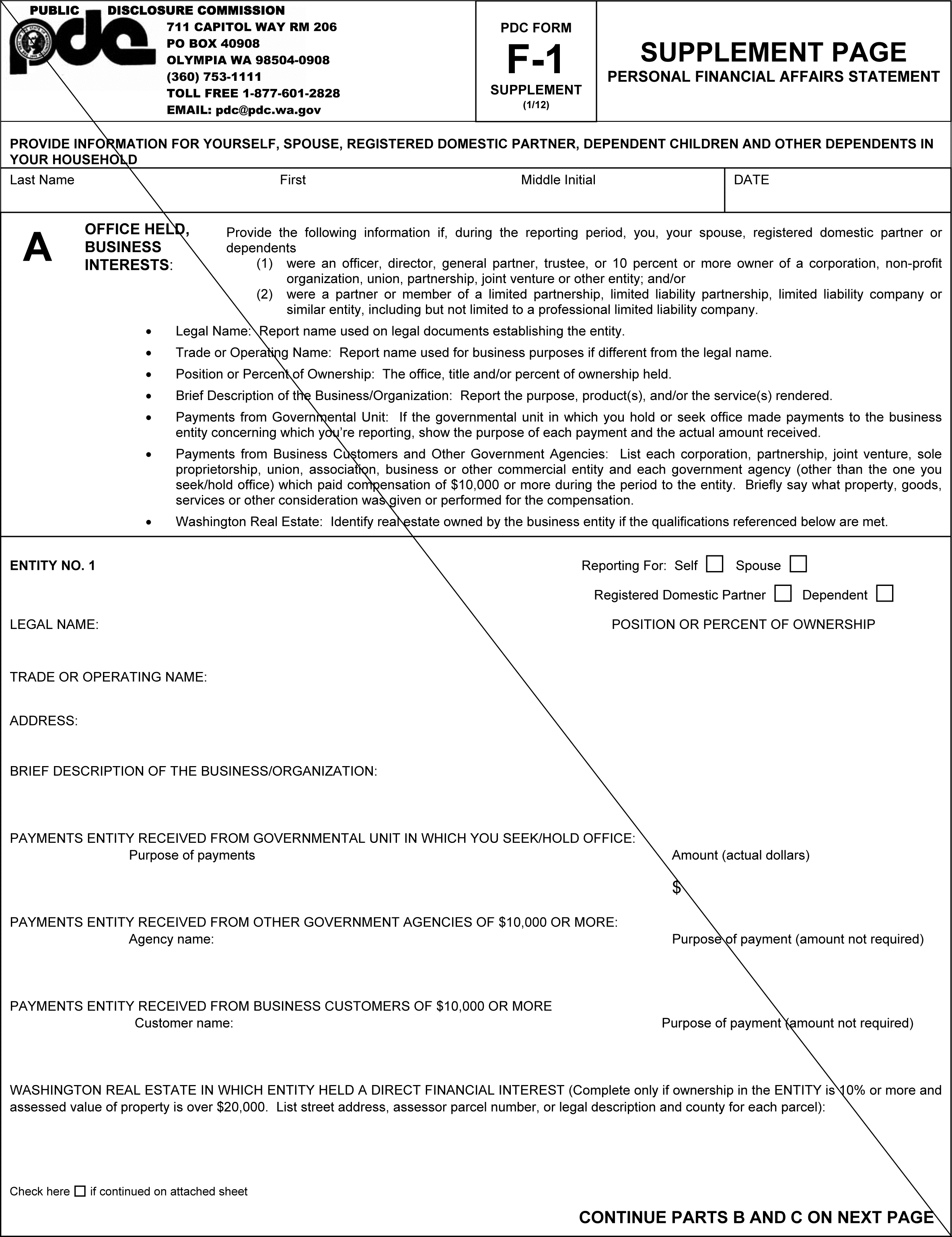

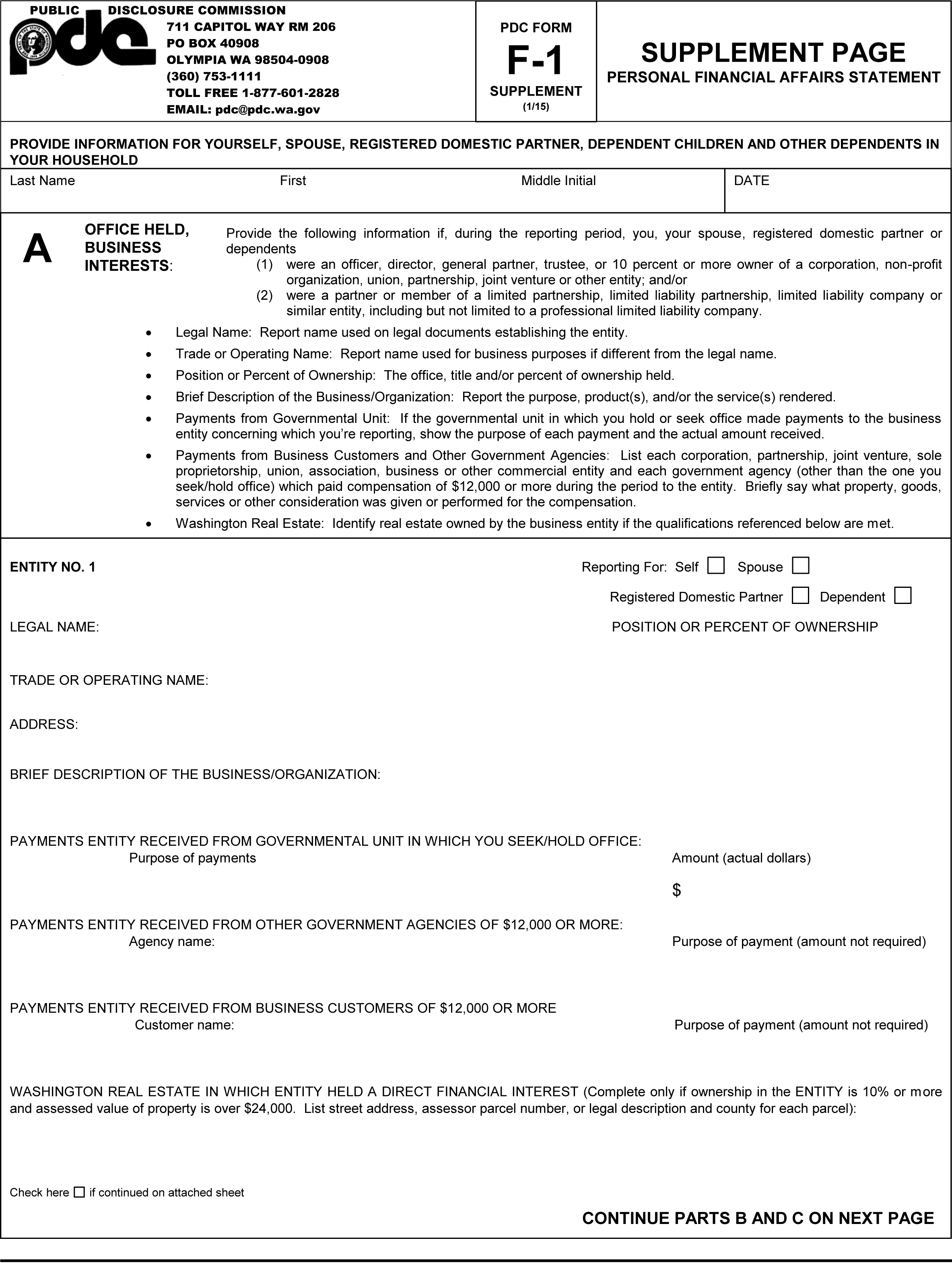

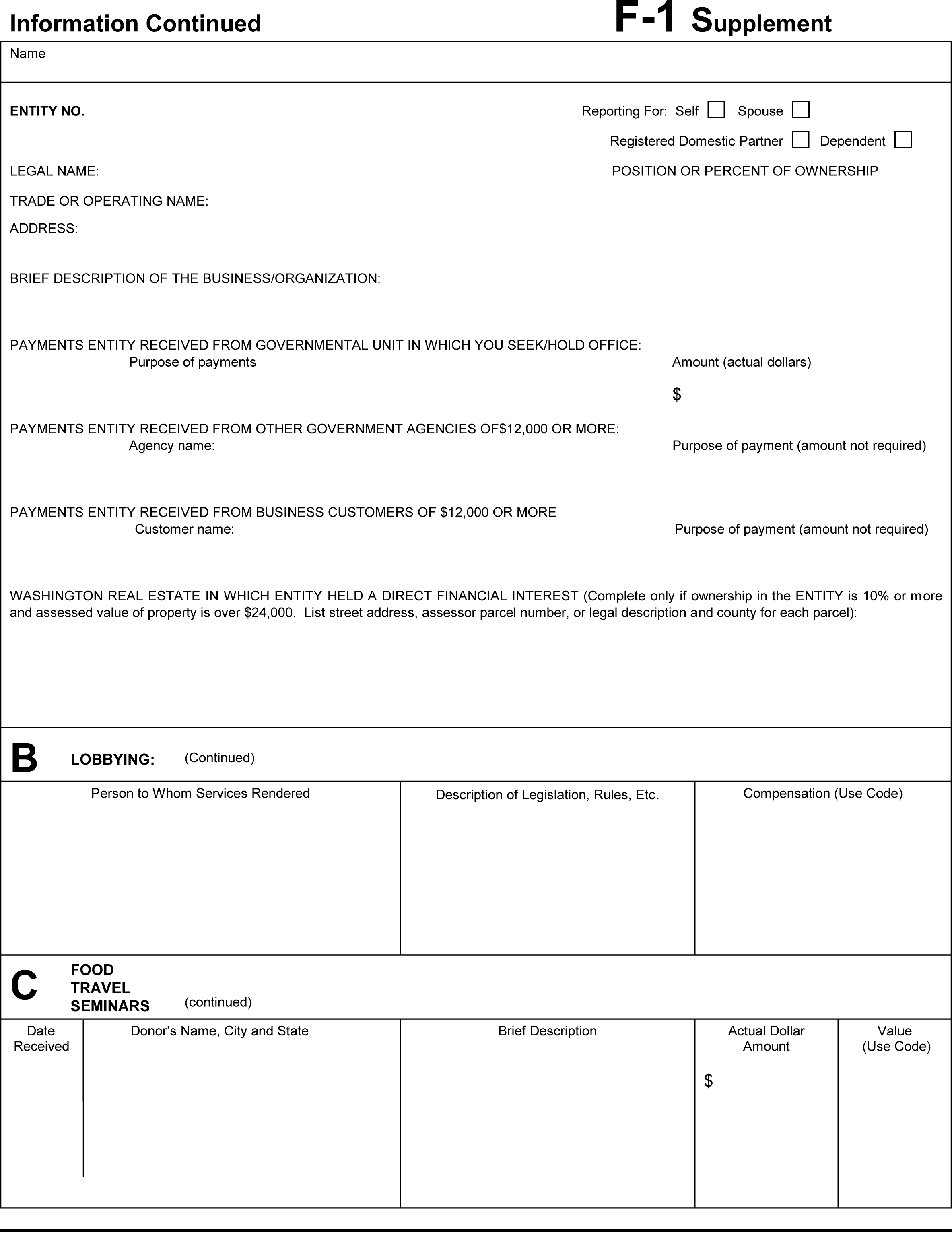

AMENDATORY SECTION (Amending WSR 12-03-002, filed 1/4/12, effective 2/4/12)

WAC 390-24-010 Forms for statement of financial affairs.

The official form for statements of financial affairs as required by RCW 42.17A.700 is designated "F-1," revised ((1/12)) 1/15. Copies of this form are available on the commission's web site, www.pdc.wa.gov, and at the Commission Office, 711 Capitol Way, Room 206, Evergreen Plaza Building, P.O. Box 40908, Olympia, Washington 98504-0908. Any paper attachments must be on 8-1/2" x 11" white paper.

((  )) |

|

((  )) |

|

((  )) |

|

((  )) |

|

|

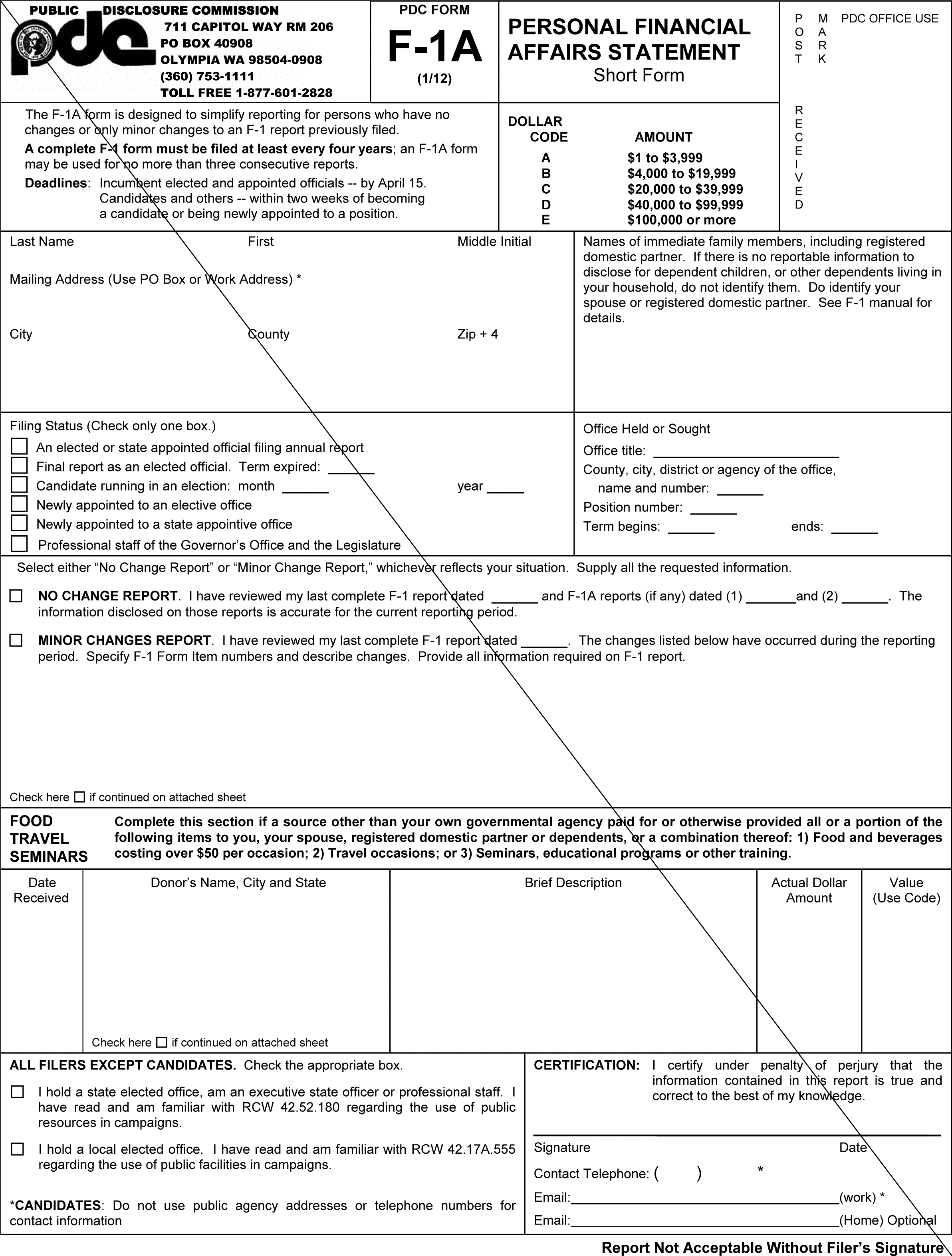

AMENDATORY SECTION (Amending WSR 12-03-002, filed 1/4/12, effective 2/4/12)

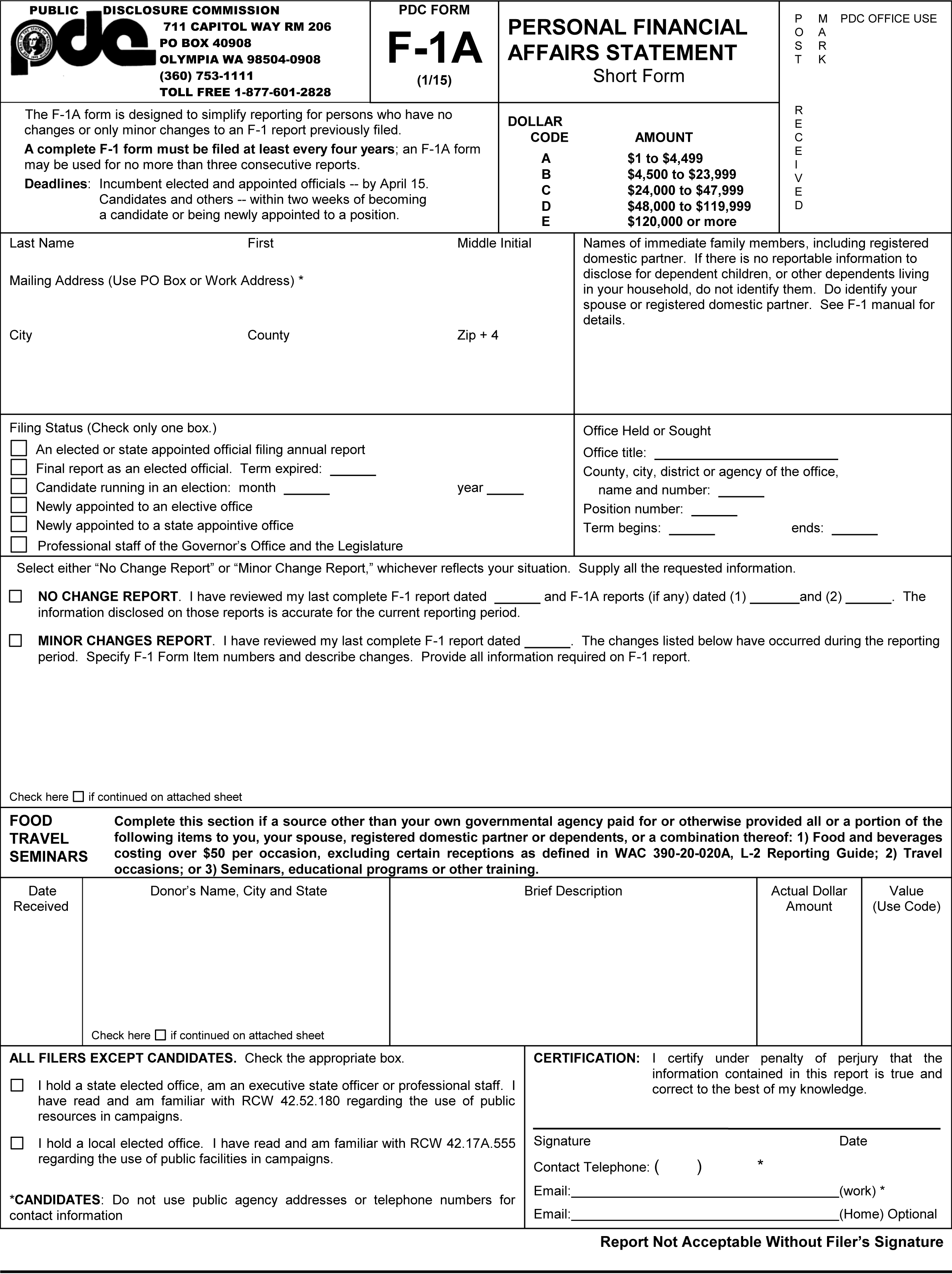

WAC 390-24-020 Forms for amending statement of financial affairs.

(1) The official form for amending statements of financial affairs as required by RCW 42.17A.700 for all persons who have previously filed the Form F-1 is designated Form "F-1A," revised ((1/12)) 1/15.

(2) No more than three F-1A forms may be filed to amend a previously submitted statement of financial affairs (Form F-1). The form can be used only to update information required on an F-1.

(3) The commission reserves the right to reject amendatory forms and require a new statement of financial affairs (Form F-1) at any time the amendments are confusing or create misunderstandings. Authority is delegated to the commission's executive director to make this determination.

(4) Copies of Form F-1A are available on the commission's web site, www.pdc.wa.gov and at the Commission Office, 711 Capitol Way, Room 206, Evergreen Plaza Building, P.O. Box 40908, Olympia, Washington 98504-0908. Any paper attachments must be on 8-1/2" x 11" white paper.

((  )) |

|

((  )) |

|

AMENDATORY SECTION (Amending WSR 12-03-002, filed 1/4/12, effective 2/4/12)

WAC 390-24-202 Report of compensation from sales commissions.

When a person receives compensation in the form of a commission on sales, the reporting of the compensation, required in RCW 42.17A.710, shall include:

(1) The name and address of the person or persons through whom a commission was paid;

(2) For purposes of RCW 42.17A.710 (1)(f), the name and address of each person (other than an individual) for whom a service was rendered or to whom a product was sold that resulted in a commission of $((2,000)) 2,400 or more in the aggregate;

(3) For purposes of RCW 42.17A.710 (1)(g)(i), the name and address of each governmental unit for whom a service was rendered or to whom a product was sold that resulted in a commission;

(4) For purposes of RCW 42.17A.710 (1)(g)(ii), the name and address of each person (other than an individual) for whom a service was rendered or to whom a product was sold that resulted in a commission of $((10,000)) 12,000 or more in the aggregate.

AMENDATORY SECTION (Amending WSR 12-03-002, filed 1/4/12, effective 2/4/12)

WAC 390-24-301 Changes in dollar amounts of reporting thresholds and code values.

Pursuant to the commission's authority in RCW 42.17A.125(2) to revise the monetary reporting thresholds and code values found in chapter 42.17A RCW to reflect changes in economic conditions, the following revisions are made:

Statutory Section |

Subject Matter |

Amount Enacted or Last Revised |

Revision Effective January ((1, 2008)) 12, 2015 |

.710 (1)(b) |

Bank Accounts |

$((15,000)) 20,000 |

$((20,000)) 24,000 |

.710 (1)(b) |

Other Intangibles |

$((1,500)) 2,000 |

$((2,000)) 2,400 |

.710 (1)(c) |

Creditors |

$((1,500)) 2,000 |

$((2,000)) 2,400 |

.710 (1)(f) |

Compensation |

$((1,500)) 2,000 |

$((2,000)) 2,400 |

.710 (1)(g)(ii) |

Compensation to Business Entity |

$((7,500)) 10,000 |

$((10,000)) 12,000 |

.710 (1)(g) |

Bank Interest Paid |

$((1,800)) 2,400 |

$((2,400)) 2,900 |

.710 (1)(h) |

Real Property- Acquired |

$((7,500)) 10,000 |

$((10,000)) 12,000 |

.710 (1)(i) |

Real Property- Divested |

$((7,500)) 10,000 |

$((10,000)) 12,000 |

.710 (1)(j) |

Real Property- Held |

$((7,500)) 10,000 |

$((10,000)) 12,000 |

.710 (1)(k) |

Real Property- Business |

$((15,000)) 20,000 |

$((20,000)) 24,000 |

.710 (1)(l) |

Food and Beverages |

$50 |

|

.710 (2) |

Dollar Code A |

Up to $((2,999)) 3,999 |

Up to $((3,999)) 4,499 |

Dollar Code B |

$((3,000-$14,999)) 4,000-$19,999 |

$((4,000-$19,999)) 4,500-$23,999 |

|

Dollar Code C |

$((15,000-$29,999)) 20,000-$39,999 |

$((20,000-$39,999)) 24,000-$47,999 |

|

Dollar Code D |

$((30,000-$74,999)) 40,000-$99,999 |

$((40,000-$99,999)) 48,000-$119,999 |

|

Dollar Code E |

$((75,000)) 100,000 and up |

$((100,000)) 120,000 and up |