WSR 15-24-126

PERMANENT RULES

OFFICE OF

INSURANCE COMMISSIONER

[Insurance Commissioner Matter No. R 2015-09—Filed December 2, 2015, 8:48 a.m., effective January 2, 2016]

Effective Date of Rule: Thirty-one days after filing.

Purpose: These rules amend the existing credit for reinsurance rules and adopt new rules to conform Washington's rules regarding credit for reinsurance to the NAIC Credit for Reinsurance Model Regulation and amendments made by the 2015 legislative session to the credit for reinsurance laws.

Citation of Existing Rules Affected by this Order: Repealing WAC 284-13-505 and 284-13-515; and amending WAC 284-13-500, 284-13-510, 284-13-520, 284-13-530, 284-13-535, 284-13-540, 284-13-550, 284-13-560, 284-13-570, 284-13-580, 284-13-590, and 284-13-595.

Statutory Authority for Adoption: RCW 48.02.060, 48.12.430 (1)(b) and (c), (3)(b), (4), (5), 48.12.480.

Other Authority: Chapter 63, Laws of 2015.

Adopted under notice filed as WSR 15-21-048 on October 16, 2015.

Changes Other than Editing from Proposed to Adopted Version: The changes from the proposal to the adopted version amend the session law citations contained in the proposal to the codified RCW citations.

In WAC 284-13-540 "section 4(2), chapter 63, Laws of 2015" was amended to read "RCW 48.12.465(2)["] to both change to the codified RCW citation from the session law citation and to correct the incorrect citation made in the proposal.

In WAC 284-13-532 (1)(a) the date was changed from "August 1, 1995" to "January 1, 1993" and in (b) from "July 31, 1995" to "December 31, 1992" to conform with the NAIC model and section (6)(3)(c), chapter 63, Laws of 2015.

A final cost-benefit analysis is available by contacting Jim Tompkins, P.O. Box 40258, Olympia, WA 98504-0258, phone (360) 725-7036, fax (360) 586-3109, e-mail rulescoordinator@oic.wa.gov.

Number of Sections Adopted in Order to Comply with Federal Statute: New 0, Amended 0, Repealed 0; Federal Rules or Standards: New 0, Amended 0, Repealed 0; or Recently Enacted State Statutes: New 19, Amended 12, Repealed 2.

Number of Sections Adopted at Request of a Nongovernmental Entity: New 0, Amended 0, Repealed 0.

Number of Sections Adopted on the Agency's Own Initiative: New 19, Amended 12, Repealed 2.

Number of Sections Adopted in Order to Clarify, Streamline, or Reform Agency Procedures: New 0, Amended 0, Repealed 0.

Number of Sections Adopted Using Negotiated Rule Making: New 0, Amended 0, Repealed 0; Pilot Rule Making: New 0, Amended 0, Repealed 0; or Other Alternative Rule Making: New 19, Amended 12, Repealed 2.

Date Adopted: December 2, 2015.

Mike Kreidler

Insurance Commissioner

AMENDATORY SECTION (Amending WSR 93-19-002, filed 9/1/93, effective 10/2/93)

WAC 284-13-500 Purpose.

The purpose of ((this regulation)) WAC 284-13-500 through 284-13-590 is to set forth rules and procedural requirements which the commissioner deems necessary to carry out the provisions of RCW ((48.12.160)) 48.12.400 through 48.12.499. The actions and information required by ((this regulation)) WAC 284-13-500 through 284-13-590 are hereby declared to be necessary and appropriate in the public interest and for the protection of the ceding insurers in this state.

NEW SECTION

WAC 284-13-503 Severability clause.

If any provision of WAC 284-13-500 through 284-13-590 or its application to any person or circumstances is held invalid, the remainder of WAC 284-13-500 through 284-13-590 to other persons or circumstances is not affected.

AMENDATORY SECTION (Amending WSR 93-19-002, filed 9/1/93, effective 10/2/93)

WAC 284-13-510 Credit for reinsurance—Reinsurer holding certificate of authority in this state.

((Pursuant to RCW 48.12.160)) Under RCW 48.12.410, the commissioner shall allow credit for reinsurance ceded by a domestic insurer to an assuming insurer((s)) that held a certificate of authority ((to transact that kind of insurance)) in this state as of ((the)) any date ((of the ceding insurer's)) on which statutory financial statement credit for reinsurance is claimed.

NEW SECTION

WAC 284-13-516 Credit for reinsurance—Accredited reinsurers.

(1) Under RCW 48.12.415, the commissioner shall allow credit for reinsurance ceded by a domestic insurer to an assuming insurer that is accredited as a reinsurer in this state as of the date on which statutory financial statement credit for reinsurance is claimed. An accredited reinsurer must:

(a) File a properly executed Form AR-1 as set forth in WAC 284-13-595 as evidence of its submission to this state's jurisdiction and to this state's authority to examine its books and records;

(b) File with the commissioner a certified copy of a certificate of authority or other acceptable evidence that it is licensed to transact insurance or reinsurance in at least one state, or, in the case of a United States branch of an alien assuming insurer, is entered through and licensed to transact insurance or reinsurance in at least one state;

(c) File annually with the commissioner a copy of its annual statement filed with the insurance department of its state of domicile or, in the case of an alien assuming insurer, with the state through which it is entered and in which it is licensed to transact insurance or reinsurance, and a copy of its most recent audited financial statement; and

(d) Maintain a surplus as regards policyholders in an amount not less than twenty million dollars, or obtain the affirmative approval of the commissioner upon a finding that it has adequate financial capacity to meet its reinsurance obligations and is otherwise qualified to assume reinsurance from domestic insurers.

(2) If the commissioner determines that the assuming insurer has failed to meet or maintain any of these qualifications, the commissioner may upon written notice and opportunity for hearing, suspend or revoke the accreditation. Credit shall not be allowed a domestic ceding insurer under this section if the assuming insurer's accreditation has been revoked by the commissioner, or if the reinsurance was ceded while the assuming insurer's accreditation was under suspension by the commissioner.

NEW SECTION

WAC 284-13-517 Credit for reinsurance—Reinsurer domiciled in another state.

(1) Under RCW 48.12.420, the commissioner shall allow credit for reinsurance ceded by a domestic insurer to an assuming insurer that as of any date on which statutory financial statement credit for reinsurance is claimed:

(a) Is domiciled in, or in the case of a United States branch of an alien assuming insurer is entered through, a state that employs standards regarding credit for reinsurance substantially similar to those applicable under RCW 48.12.400 through 48.12.499, and WAC 284-13-500 through 284-13-590;

(b) Maintains a surplus as regards policyholders in an amount not less than twenty million dollars; and

(c) Files a properly executed Form AR-1 with the commissioner as evidence of its submission to this state's authority to examine its books and records.

(2) The provisions of this section relating to surplus as regards policyholders does not apply to reinsurance ceded and assumed under pooling arrangements among insurers in the same holding company system. As used in this section, "substantially similar" standards means credit for reinsurance standards that the commissioner determines equal or exceed the standards of RCW 48.12.400 through 48.12.499, and WAC 284-13-500 through 284-13-590.

AMENDATORY SECTION (Amending WSR 97-05-012, filed 2/10/97, effective 3/13/97)

WAC 284-13-520 Credit for reinsurance—Certain reinsurers maintaining trust funds.

(((1) Pursuant to RCW 48.12.160 (1)(a))) Under RCW 48.12.425, the commissioner shall allow credit for reinsurance ceded by a domestic insurer to an assuming insurer ((described in subsection (2) of this section which, as of the date of the ceding insurer's statutory financial statement)) which, as of any date on which statutory financial statement credit for reinsurance is claimed, and thereafter for so long as credit for reinsurance is claimed, maintains a trust fund in an amount prescribed ((below)) in WAC 284-13-530 through 284-13-538 in a qualified United States financial institution as ((provided in WAC 284-13-515)) defined in RCW 48.12.465(2), for the payment of the valid claims of its United States ((policyholders and)) domiciled ceding insurers, their assigns and successors in interest. The assuming insurer ((shall)) must report annually to the commissioner substantially the same information as that required to be reported on the NAIC annual statement form by licensed insurers, to enable the commissioner to determine the sufficiency of the trust fund.

(((2) The trust fund for a group of insurers that includes incorporated and unincorporated underwriters shall consist of:

(a) For reinsurance ceded under reinsurance agreements with an inception, amendment or renewal date on or after August 1, 1995, funds in trust in an amount not less than the group's several liabilities attributable to business ceded by United States domiciled insurers to any member of the group;

(b) For reinsurance ceded under reinsurance agreements with an inception date on or before July 31, 1995, and not amended or renewed after that date, notwithstanding the other provisions of this regulation, funds in trust in an amount not less than the group's several insurance and reinsurance liabilities attributable to business written in the United States; and

(c) In addition, the group shall maintain a trusteed surplus of which one hundred million dollars shall be held jointly and exclusively for the benefit of the United States ceding insurers of any member of the group for all years of account. The group shall make available to the commissioner annual certifications by the group's domiciliary regulator and its independent public accountants of the solvency of each underwriter member of the group.

(3) The credit allowed for reinsurance shall not be greater than the amount of funds held in trust.

(4) The trust established shall comply with WAC 284-13-535.))

AMENDATORY SECTION (Amending WSR 97-05-012, filed 2/10/97, effective 3/13/97)

WAC 284-13-530 Credit for reinsurance—Certain alien reinsurers maintaining trust funds—Single alien insurer.

(((1) Under RCW 48.12.160 (1)(b), the commissioner shall allow credit for reinsurance ceded by a domestic insurer to)) The trust fund for a single assuming alien insurer ((which, as of the date of the ceding insurer's statutory financial statement, maintains a trust fund)) must consist of funds in trust in an amount not less than the assuming ((alien)) insurer's liabilities attributable to reinsurance ceded by United States domiciled insurers ((plus)), and in addition, the assuming insurer must maintain a trusteed surplus of not less than twenty million dollars, ((and the assuming alien insurer maintaining the trust fund has received a registration from the commissioner. The assuming alien insurer shall report on or before February 28 to the commissioner substantially the same information as that required to be reported on the NAIC annual statement form by licensed insurers, to enable the commissioner to determine the sufficiency of the trust fund. To be registered the assuming alien insurer must:

(a) File a properly executed Form AR-1 under WAC 284-13-595 as evidence of its submission to this state's jurisdiction and to this state's authority to examine its books and records under chapter 48.03 RCW.

(b) File with the commissioner a certified copy of a letter or a certificate of authority or of compliance issued by the assuming alien insurer's alien domiciliary jurisdiction and the domiciliary jurisdiction of its United States reinsurance trust.

(c) File with the commissioner within sixty days after its financial statements are due to be filed with its domiciliary regulator, a copy of the assuming alien insurer's annual financial report converted to United States dollars, and a copy of its most recent audited financial statement converted to United States dollars.

(d) File annually with the commissioner on or before February 28, a statement of actuarial opinion in conformance with the NAIC's annual statement and instructions attesting to the adequacy of the reserves for United States liabilities which are backed by the trust fund. Unless the commissioner notifies the assuming alien insurer otherwise, the opinion may be given by an actuary of the assuming alien insurer, who is duly qualified to provide actuarial opinions in the domiciliary jurisdiction of the assuming alien insurer.

(e) File and maintain with the commissioner a list of the assuming alien insurer's United States reinsurance intermediaries.

(f) File and maintain with the commissioner copies of service and management agreements, including binding authorities, entered into by the assuming alien insurer.

(g) File annually with the commissioner a holding company registration statement containing the information required by RCW 48.31B.025 (2)(a) through (e) in the form proscribed in WAC 284-18-920.

(h) File annually with the commissioner the assuming alien insurer's account and report which reports the overall business of the assuming alien insurer in United States dollars.

(i) File other information, financial or otherwise, which the commissioner reasonably requests.

(2) If the commissioner determines that the assuming alien insurer has failed to meet or maintain any of these qualifications, the commissioner may, consistent with chapters 48.04 and 34.05 RCW, revoke the registration of the assuming insurer maintaining the trust fund. No credit shall be allowed a domestic ceding insurer with respect to reinsurance ceded after December 31, 1997, if the assuming alien insurer's registration under this section has been denied or revoked by the commissioner.

(3) The required amount of the trust shall be based upon the gross United States liabilities, including incurred but not reported claims (IBNR), of the assuming alien insurer reduced only for those liabilities for which specific collateralization has been provided to individual ceding companies, with such adjustments, if any, as the commissioner may from time to time consider appropriate.

(4) The credit allowed for reinsurance shall not be greater than the amount of funds held in trust.

(5) The trust established shall comply with WAC 284-13-535)) except as provided in WAC 284-13-531.

NEW SECTION

WAC 284-13-531 Credit for reinsurance—Certain alien reinsurers maintaining trust funds—Assuming insurer discontinuing business.

At any time after the assuming insurer has permanently discontinued underwriting new business secured by the trust for at least three full years, the commissioner with principal regulatory oversight of the trust may authorize a reduction in the required trusteed surplus, but only after a finding, based on an assessment of the risk, that the new required surplus level is adequate for the protection of United States ceding insurers, policyholders and claimants in light of reasonably foreseeable adverse loss development. The risk assessment may involve an actuarial review, including an independent analysis of reserves and cash flows, and must consider all material risk factors, including when applicable, the lines of business involved, the stability of the incurred loss estimates and the effect of the surplus requirements on the assuming insurer's liquidity or solvency. The minimum required trusteed surplus may not be reduced to an amount less than thirty percent of the assuming insurer's liabilities attributable to reinsurance ceded by United States ceding insurers covered by the trust.

NEW SECTION

WAC 284-13-532 Credit for reinsurance—Certain alien reinsurers maintaining trust funds—Group of incorporated and individual unincorporated underwriters.

(1) The trust fund for a group including incorporated and individual unincorporated underwriters must consist of:

(a) For reinsurance ceded under reinsurance agreements with an inception, amendment or renewal date on or after January 1, 1993, funds in trust in an amount not less than the respective underwriters' several liabilities attributable to business ceded by United States domiciled ceding insurers to any underwriter of the group;

(b) For reinsurance ceded under reinsurance agreements with an inception date on or before December 31, 1992, and not amended or renewed after that date, notwithstanding the other provisions of WAC 284-13-500 through 284-13-590, funds in trust in an amount not less than the respective underwriters' several insurance and reinsurance liabilities attributable to business written in the United States; and

(c) In addition to these trusts, the group must maintain a trusteed surplus of which one hundred million dollars must be held jointly for the benefit of the United States domiciled insurers of any member of the group for all the years of account.

(2) The incorporated members of the group must not be engaged in any business other than underwriting as a member of the group and are subject to the same level of regulation and solvency control by the group's domiciliary regulator as are the unincorporated members. The group must, within ninety days after its financial statements are due to be filed with the group's domiciliary regulator, provide to the commissioner:

(a) An annual certification by the group's domiciliary regulator of the solvency of each underwriter member of the group; or

(b) If a certification is unavailable, a financial statement, prepared by independent public accountants, of each underwriter member of the group.

NEW SECTION

WAC 284-13-533 Credit for reinsurance—Certain alien reinsurers maintaining trust funds—Group of incorporated insurers under common administration.

(1) The trust fund for a group of incorporated insurers under common administration, whose members possess aggregate policyholders surplus of ten billion dollars (calculated in substantially the same manner as prescribed by the annual statement instructions and accounting practices and procedures manual of the NAIC) and which has continuously transacted an insurance business outside the United States for at least three years immediately prior to making application for accreditation, must:

(a) Consist of funds in trust in an amount not less than the assuming insurers' several liabilities attributable to business ceded by United States domiciled ceding insurers to any member of the group under reinsurance contracts issued in the name of the group;

(b) Maintain a joint trusteed surplus of which one hundred million dollars must be held jointly for the benefit of United States domiciled ceding insurers of any member of the group; and

(c) File a properly executed Form AR-1 as evidence of the submission to this state's authority to examine the books and records of any of its members and must certify that any member examined will bear the expense of the examination.

(2) Within ninety days after the statements are due to be filed with the group's domiciliary regulator, the group must file with the commissioner an annual certification of each underwriter member's solvency by the member's domiciliary regulators, and financial statements, prepared by independent public accountants, of each underwriter member of the group.

AMENDATORY SECTION (Amending WSR 97-05-012, filed 2/10/97, effective 3/13/97)

WAC 284-13-535 Trust fund requirements.

((The trust under RCW 48.12.160 (1)(a), (b) or (c)(i) shall be established in a form filed with and approved by the commissioner and complying with that statute and this section. The trust instrument shall provide that:))

(1) Credit for reinsurance is not granted unless the form of the trust and any amendments to the trust have been approved by either the commissioner of the state where the trust is domiciled or the commissioner of another state who, under the terms of the trust instrument, has accepted responsibility for regulatory oversight of the trust. The form of the trust and any trust amendments also must be filed with the commissioner of every state in which the ceding insurer beneficiaries of the trust are domiciled. The trust instruments must provide that:

(a) Contested claims ((shall)) must be valid and enforceable out of funds in trust to the extent remaining unsatisfied thirty days after entry of the final order of any court of competent jurisdiction in the United States.

(((2))) (b) Legal title to the assets of the trust ((shall)) must be vested in the trustee for the benefit of the grantor's United States ((policyholders and)) ceding insurers, their assigns and successors in interest.

(((3))) (c) The trust ((shall)) must be subject to examination as determined by the commissioner.

(((4))) (d) The trust ((shall)) must remain in effect for as long as the assuming insurer, or any member or former member of a group of insurers, ((shall have)) has outstanding obligations under reinsurance agreements subject to the trust((.

(5))) ; and

(e) No later than February 28 of each year the trustees of the trust ((shall)) must report to the commissioner in writing setting forth the balance in the trust and listing the trust's investments at the preceding year end, and ((shall)) must certify the date of termination of the trust, if so planned, or certify that the trust ((shall)) does not expire prior to the ((next)) following December 31.

(((6) Furnish to the commissioner a statement of all assets in the trust account upon its inception and at intervals no less frequent than the end of each calendar quarter.

(7) At least sixty days, but not more than one hundred twenty days, prior to termination of the trust, written notification of termination shall be delivered by the trustee to the commissioner.

(8))) (2)(a) Notwithstanding any other provisions in the trust instrument, if the trust fund is inadequate because it contains an amount less than the amount required by ((RCW 48.12.160, WAC 284-13-520 and 284-13-530)) this section or if the grantor(s) of the trust has been declared insolvent or placed in receivership, rehabilitation, liquidation or similar proceedings under the laws of its state or country of domicile, the trustee ((shall)) must comply with an order of the commissioner with regulatory oversight over the trust or with an order of a court of competent jurisdiction directing the trustee to transfer to the commissioner with regulatory oversight over the trust or other designated receiver all of the assets of the trust fund.

(b) The assets ((shall be applied)) must be distributed by and claims must be filed with and valued by the commissioner with regulatory oversight over the trust in accordance with the laws of the state in which the trust is domiciled ((that are)) applicable to the liquidation of insurance companies.

(c) If the commissioner with regulatory oversight over the trust determines that the assets of the trust fund or any part thereof are not necessary to satisfy the claims of the United States ((ceding insurers of the grantor(s))) beneficiaries of the trust, ((the assets or part thereof shall be returned by)) the commissioner with regulatory oversight over the trust must return the assets, or any part thereof, to the trustee for distribution ((in accordance with)) under the trust agreement.

(((9) No amendment to the trust shall be effective unless:

(a) It has been reviewed and approved in advance by either the commissioner of the state where the trust is domiciled or the commissioner of another state who, pursuant to the terms of the trust instrument, has accepted responsibility for regulatory oversight of the trust; and

(b) It has been filed with the commissioner and it has not been disapproved within thirty days of its receipt by the commissioner.

(10) The form of the trust and any amendments to the trust shall also be filed with the commissioner of every state in which the ceding insurer beneficiaries of the trust are domiciled.)) (d) The grantor must waive any right otherwise available to it under United States law that is inconsistent with this section.

NEW SECTION

WAC 284-13-536 Credit for reinsurance—Certain reinsurers maintaining trust funds—Liabilities defined.

For purposes of WAC 284-13-520 through 284-13-538, liabilities means the assuming insurer's gross liabilities attributable to reinsurance ceded by United States domiciled insurers excluding liabilities that are not otherwise secured by acceptable means, and, must include:

(1) For business ceded by domestic insurers authorized to write accident and disability, and property and casualty insurance:

(a) Losses and allocated loss expenses paid by the ceding insurer, recoverable from the assuming insurer;

(b) Reserves for losses reported and outstanding;

(c) Reserves for losses incurred but not reported;

(d) Reserves for allocated loss expenses; and

(e) Unearned premiums.

(2) For business ceded by domestic insurers authorized to write life, disability and annuity insurance:

(a) Aggregate reserves for life policies and contracts net of policy loans and net due and deferred premiums;

(b) Aggregate reserves for accident and disability policies;

(c) Deposit funds and other liabilities without life or disability contingencies; and

(d) Liabilities for policy and contract claims.

NEW SECTION

WAC 284-13-537 Trust fund requirements—Assets.

Assets deposited in trusts established under RCW 48.12.405 through 48.12.455, and WAC 284-13-520 through 284-13-538 must be valued according to their current fair market value and must consist only of cash in United States dollars, certificates of deposit issued by a United States financial institution as defined in RCW 48.12.465(1), clean, irrevocable, unconditional and "evergreen" letters of credit issued or confirmed by a qualified United States financial institution, as defined in RCW 48.12.465(1), and investments of the type specified in this section, but investments in or issued by an entity controlling, controlled by, or under common control with either the grantor or beneficiary of the trust must not exceed five percent of total investments. No more than twenty percent of the total investments in the trust may be foreign investments authorized under subsections (1)(e), (3), (6)(b), or (7) of this section, and no more than ten percent of the total of the investments in the trust may be securities denominated in foreign currencies. For purposes of applying the preceding sentence, a depository receipt denominated in United States dollars and representing rights conferred by a foreign security must be classified as a foreign investment denominated in foreign currency. The assets of a trust established to satisfy the requirements of RCW 48.12.405 through 48.12.455, must be invested only as follows:

(1) Government obligations that are not in default as to principal or interest, that are valid and legally authorized and that are issued, assumed or guaranteed by:

(a) The United States or by any agency or instrumentality of the United States;

(b) A state of the United States;

(c) A territory, possession or other governmental unit of the United States;

(d) An agency or instrumentality of a government unit referred to in subsections (1)(b) and (c) of this section if the obligations shall by law (statutory or otherwise) payable, as to both principal and interest, from taxes levied or by law required to be levied or from adequate special revenues pledged or otherwise appropriated or by law required to be provided for making these payments, but shall not be obligations eligible for investment under this subsection if payable solely out of special assessments on properties benefited by local improvements; or

(e) The government of any other country that is a member of the Organization for Economic Cooperation and Development and whose government obligations are rated A or higher, or the equivalent, by a rating agency recognized by the Securities Valuation Office of the NAIC.

(2) Obligations that are issued in the United States, or that are dollar denominated and issued in a non-United States market, by a solvent United States institution (other than an insurance company) or that are assumed or guaranteed by a solvent United States institution (other than an insurance company) and that are not in default as to principal or interest if the obligations:

(a) Are rated A or higher (or the equivalent) by a securities rating agency recognized by the Securities Valuation Office of the NAIC, or if not so rated, are similar in structures and other material respects to other obligations of the same institution that are so rated;

(b) Are insured by at least one authorized insurer (other than the investing insurer or a parent, subsidiary or affiliate of the investing insurer) licensed to insure obligations in this state and, after considering the insurance, are rated AAA (or the equivalent) by a securities rating agency recognized by the Securities Valuation Office of the NAIC; or

(c) Have been designated as Class one or Class two by the Securities Valuation Office of the NAIC.

(3) Obligations issued, assumed or guaranteed by a solvent non-United States institution chartered in a country that is a member of the Organization for Economic Cooperation and Development or obligations of United States corporations issued in a non-United States currency, provided that in either case the obligations are rated A or higher, or the equivalent, by a rating agency recognized by the Securities Valuation Office of the NAIC.

(4) An investment made under subsections (1), (2), or (3) of this section are subject to the following additional limitations:

(a) An investment in or loan upon the obligations of an institution other than an institution that issues mortgage-related securities must not exceed five percent of the assets of the trust;

(b) An investment in any one mortgage-related security must not exceed five percent of the assets of the trust;

(c) The aggregate total investment in mortgage-related securities must not exceed twenty-five percent of the assets of the trust; and

(d) Preferred or guaranteed shares issued or guaranteed by a solvent United States institution are permissible investments if all of the institution's obligations are eligible as investments under subsection (2)(a) and (c) of this section, but must not exceed two percent of the assets of the trust.

(5) As used in WAC 284-13-500 through 284-13-590:

(a) "Mortgage-related security" means an obligation that is rated AA or higher (or the equivalent) by a securities rating agency recognized by the Securities Valuation Office of the NAIC that either:

(i) Represents ownership of one or more promissory notes or certificates of interest or participation in the notes (including any rights designed to assure servicing of, or the receipt or timeliness of receipt by the holders of the notes, certificates, or participation of amounts payable under, the notes, certificates or participation), that:

(A) Are directly secured by a first lien on a single parcel of real estate, including stock allocated to a dwelling unit in a residential cooperative housing corporation, upon which is located a dwelling or mixed residential and commercial structure, or on a residential manufactured home as defined in 42 U.S.C. Section 5402(6), whether the manufactured home is considered real or personal property under the laws of the state in which it is located; and

(B) Were originated by a savings and loan association, savings bank, commercial bank, credit union, insurance company, or similar institution that is supervised and examined by a federal or state housing authority, or by a mortgage approved by the Secretary of Housing and Urban Development under 12 U.S.C. Sections 1709 and 1715-b, or where the notes involve a lien on the manufactured home, by an institution or by a financial institution approved for insurance by the Secretary of Housing and Urban Development under 12 U.S.C. Section 1703; or

(ii) Is secured by one or more promissory notes or certificates of deposit or participations in the notes (with or without recourse to the insurer of the notes) and, by its terms, provides for payments of principal in relation to payments, or reasonable projections of payments, or notes meeting the requirements of subsection (5)(a)(i)(A) and (B) of this section.

(b) "Promissory note" when used in connection with a manufactured home, shall also include a loan, advance or credit sale as evidenced by a retail installment sales contract or other instrument.

(6) Equity interests.

(a) Investments in common shares or partnership interests of a solvent United States institution are permissible if:

(i) Its obligations and preferred shares, if any, are eligible as investments under this section; and

(ii) The equity interests of the institution (except an insurance company) are registered on a National Securities Exchange as provided in the Securities Exchange Act of 1934, 15 U.S.C. Sections 78a to 78kk or otherwise registered under the act, and if otherwise registered, price quotations for them are furnished through a nationwide automated quotations system approved by the Financial Industry Regulatory Authority, or successor organization. A trust must not invest in equity interests under this section an amount exceeding one percent of the assets of the trust even though the equity interests are not so registered and are not issued by an insurance company.

(b) Investments in common shares of a solvent institution organized under the laws of a country that is a member of the Organization for Economic Cooperation and Development, if:

(i) All its obligations are rated A or higher, or the equivalent, by a rating agency recognized by the Securities Valuation Office of the NAIC; and

(ii) The equity interests of the institution are registered on a securities exchange regulated by the government of a country that is a member of the Organization for Economic Cooperation and Development.

(c) An investment in or a loan upon any one institution's outstanding equity interests must not exceed one percent of the assets of the trust. The cost of an investment in equity made under this subsection, when added to the aggregate cost of other investments in equity interests then held under this subsection, must not exceed ten percent of the assets of the trust.

(7) Obligations issued, assumed or guaranteed by a multinational development bank, provided the obligations are rated A or higher, or the equivalent, by a rating agency recognized by the Securities Valuation Office of the NAIC.

(8) Investment companies.

(a) Securities of an investment company registered under the Investment Company Act of 1940, 15 U.S.C. Section 80a, are permissible investments if the investment company:

(i) Invests at least ninety percent of its assets in the type of securities that qualify as an investment under subsections (1), (2), or (3) of this section or invests in securities that are determined by the commissioner to be substantively similar to the type of securities set forth in subsections (1), (2), or (3) of this section; or

(ii) Invests at least ninety percent of its assets in the type of equity interests that qualify as an investment under subsection (6)(a) of this section.

(b) Investments made by a trust in investment companies under this subsection must not exceed the following limitations:

(i) An investment in an investment company qualifying under (a)(i) of this subsection must not exceed ten percent of the assets in the trust and the aggregate amount of investment in qualifying investment companies must not exceed twenty-five percent of the assets in the trust; and

(ii) Investments in an investment company qualifying under (a)(ii) of this subsection must not exceed five percent of the assets in the trust and the aggregate amount of investment in qualifying investment companies must be included when calculating the permissible aggregate value of equity interests under subsection (6)(a) of this section.

(9) Letters of credit.

(a) In order for a letter of credit to qualify as an asset of the trust, the trustee must have the right and the obligation under the deed of trust or some other binding agreement (as duly approved by the commissioner), to immediately draw down the full amount of the letter of credit and hold the proceeds in trust for the beneficiaries of the trust if the letter of credit will otherwise expire without being renewed or replaced.

(b) The trust agreement must provide that the trustee is liable for its negligence, willful misconduct or lack of good faith. The failure of the trustee to draw against the letter of credit in circumstances where the draw would be required is either negligence, willful misconduct, or both.

NEW SECTION

WAC 284-13-538 Specific securities provided to a ceding insurer.

A specific security provided to a ceding insurer by an assuming insurer under WAC 284-13-53901 must be applied, until exhausted, to the payment of liabilities of the assuming insurer to the ceding insurer holding the specific security prior to, and as a condition precedent for, presentation of a claim by the ceding insurer for payment by a trustee of a trust established by the assuming insurer under WAC 284-13-520 through 284-13-538.

NEW SECTION

WAC 284-13-539 Credit for reinsurance—Certified reinsurers.

(1) Under RCW 48.12.430, the commissioner shall allow credit for reinsurance ceded by a domestic insurer to an assuming insurer that has been certified as a reinsurer in this state at all times for which statutory financial statement credit for reinsurance is claimed under this section. The credit allowed must be based upon the security held by or on behalf of the ceding insurer in accordance with a rating assigned to the certified reinsurer by the commissioner. The security must be in a form consistent with RCW 48.12.430 and 48.12.460, and WAC 284-13-550, 284-13-560 or 284-13-570. The amount of security required in order for full credit to be allowed must correspond with the following requirements:

(a)

Ratings |

Security Required |

|

Secure - 1 |

0% |

|

Secure - 2 |

10% |

|

Secure - 3 |

20% |

|

Secure - 4 |

50% |

|

Secure - 5 |

75% |

|

Vulnerable - 6 |

100% |

|

(b) Affiliated reinsurance transactions shall receive the same opportunity for reduced security requirements as all other reinsurance transactions.

(c) The commissioner must require the certified reinsurer to post one hundred percent, for the benefit of the ceding insurer or its estate, security upon the entry of an order of rehabilitation, liquidation or conservation against the ceding insurer.

(d) In order to facilitate the prompt payment of claims, a certified reinsurer is not required to post security for a catastrophe recoverables for a period of one year from the date of the first instance of a liability reserve entry by the ceding company as a result of a loss from a catastrophe occurrence as recognized by the commissioner. The one year deferral period is contingent upon the certified reinsurer continuing to pay claims in a timely manner. Reinsurance recoverables for only the following lines of business as reported on the NAIC annual financial statement related specifically to the catastrophe occurrence will be included in the deferral:

(i) Line 1: Fire.

(ii) Line 2: Allied lines.

(iii) Line 3: Farmowners multiple peril.

(iv) Line 4: Homeowners multiple peril.

(v) Line 5: Commercial multiple peril.

(vi) Line 9: Inland marine.

(vii) Line 12: Earthquake.

(viii) Line 21: Auto physical damage.

(e) Credit for reinsurance under this section applies only to reinsurance contracts entered into or renewed on or after the effective date of the certification of the assuming insurer. Any reinsurance contract entered into prior to the effective date of the certification of the assuming insurer that is subsequently amended after the effective date of the certification of the assuming insurer, or a new reinsurance contract, covering any risk for which collateral was provided previously, is only subject to this section with respect to losses incurred and reserves reported from and after the effective date of the amendment or new contract.

(f) Nothing in this section prohibits the parties to a reinsurance agreement from agreeing to provisions establishing security requirements that exceed the minimum security requirements established for certified reinsurers under this section.

(2)(a) The commissioner shall post notice on the commissioner's web site promptly upon receipt of any application for certification, including instructions on how members of the public may respond to the application. The commissioner may not take final action on the application until at least thirty days after posting the notice required by (a) of this subsection.

(b) The commissioner shall issue notice to an assuming insurer that has made application and been approved as a certified reinsurer. Included in the notice shall be the rating assigned the certified reinsurer under subsection (1) of this section. The commissioner shall publish a list of all certified reinsurers and their ratings.

(c) In order to be eligible for certification, the assuming insurer must meet the following requirements:

(i) The assuming insurer must be domiciled and licensed to transact insurance or reinsurance in a qualified jurisdiction, as determined by the commissioner under subsection (3) of this section.

(ii) The assuming insurer must maintain capital and surplus, or its equivalent, of no less than two hundred fifty million dollars calculated under (d)(viii) of this subsection. This requirement may also be satisfied by an association including incorporated and individual unincorporated underwriters having a minimum capital and surplus equivalent (net of liabilities) of at least two hundred fifty million dollars and a central fund containing a balance of at least two hundred fifty million dollars.

(iii) The assuming insurer must maintain financial strength ratings from two or more rating agencies deemed acceptable by the commissioner. These ratings must be based on interactive communication between the rating agency and the assuming insurer and must not be based solely on publicly available information. These financial strength ratings will be one factor used by the commissioner in determining the rating that is assigned to the assuming insurer. Acceptable rating agencies include the following:

(A) Standard & Poor's;

(B) Moody's Investors Service;

(C) Fitch Ratings;

(D) A.M. Best Company; or

(E) Any other nationally recognized statistical rating organization.

(iv) The certified reinsurer must comply with any other requirements reasonably imposed by the commissioner.

(d) Each certified reinsurer must be rated on a legal entity basis, with due consideration being given to the group rating where appropriate, except that an association including incorporated and individual unincorporated underwriters that has been approved to do business as a single certified reinsurer may be evaluated on the basis of its group rating. Factors that may be considered as part of the evaluation process include, but are not limited to, the following:

(i) The certified reinsurer's financial strength rating from an acceptable rating agency. The maximum rating that a certified reinsurer may be assigned will correspond to its financial strength rating as outlined in the table below. The commissioner must use the lowest financial strength rating received from an approved rating agency in establishing the maximum rating of a certified reinsurer. A failure to obtain or maintain at least two financial strength ratings from acceptable rating agencies will result in loss of eligibility for certification:

Ratings |

Best |

S&P |

Moody's |

Fitch |

Secure - 1 |

A++ |

AAA |

Aaa |

AAA |

Secure - 2 |

A+ |

AA+, AA, AA- |

Aa1, Aa2, Aa3 |

AA+, AA, AA- |

Secure - 3 |

A |

A+, A |

A1, A2 |

A+, A |

Secure - 4 |

A- |

A- |

A3 |

A- |

Secure - 5 |

B++, B+ |

BBB+, BBB, BBB- |

Baa1, Baa2, Baa3 |

BBB+, BBB, BBB- |

Vulnerable - 6 |

B, B-, C++, C+, C, C-, D, E, F |

BB+, BB, BB-, B+, B, B-, CCC, CC, C, D, R |

Ba1, Ba2, Ba3, B1, B2, B3, Caa, Ca, C |

BB+, BB, BB-, B+, B, B-, CCC+, CC, CCC-, DD |

(ii) The business practices of the certified reinsurer in dealing with its ceding insurers, including its record of compliance with reinsurance contractual terms and obligations;

(iii) For certified reinsurers domiciled in the United States, a review of the most recent applicable NAIC annual statement blank, either schedule F (for property/casualty reinsurers) or schedule S (for life and disability reinsurers);

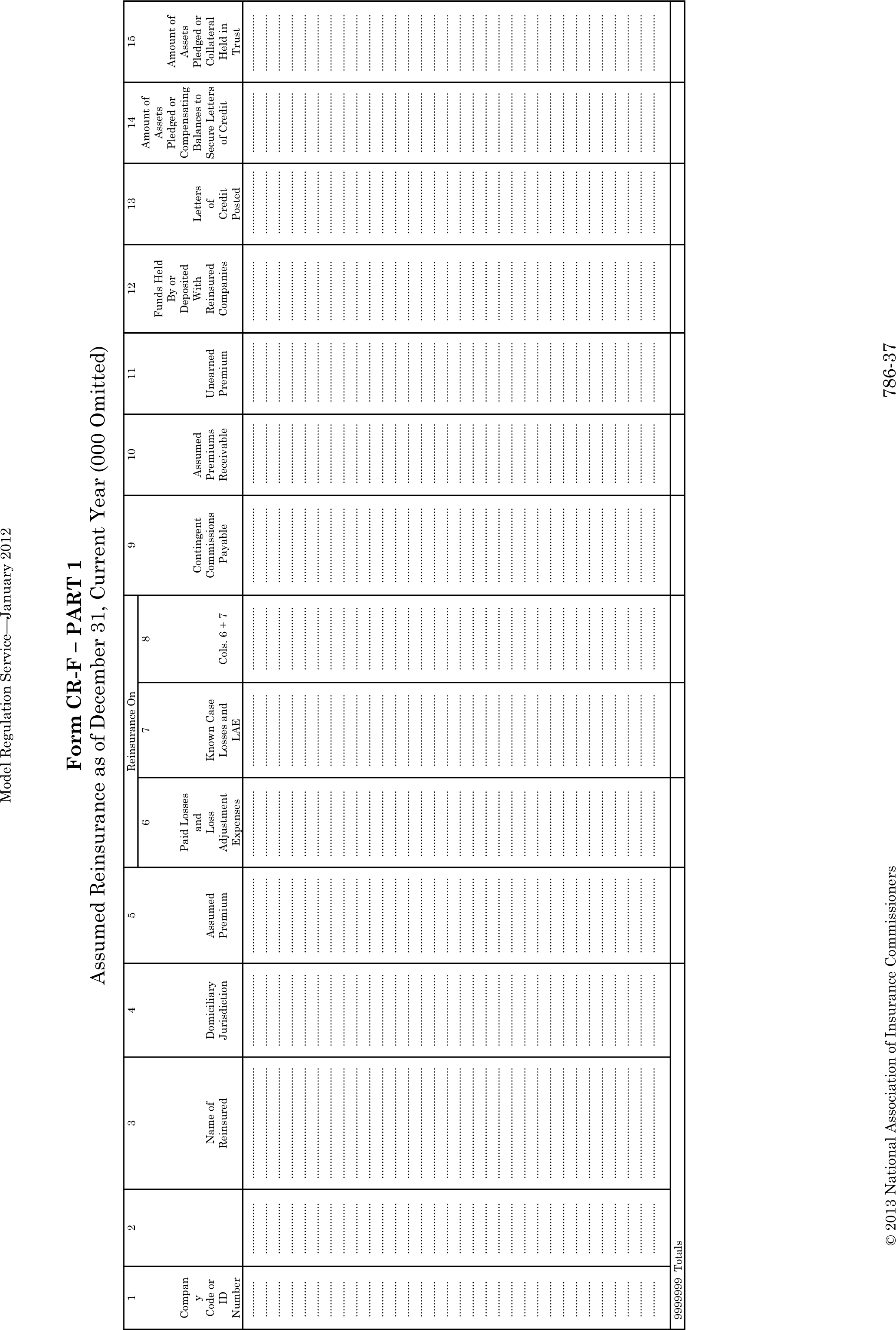

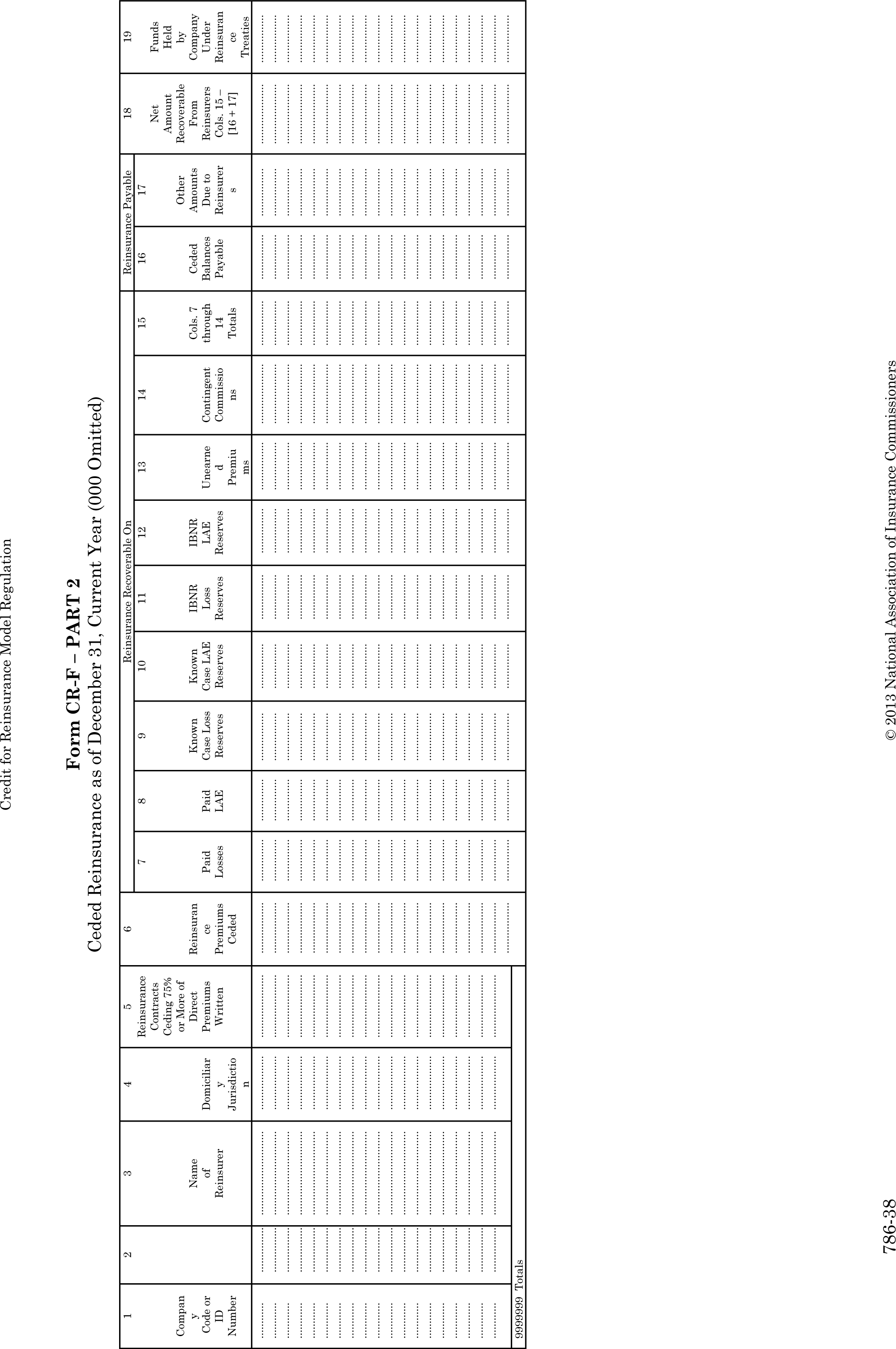

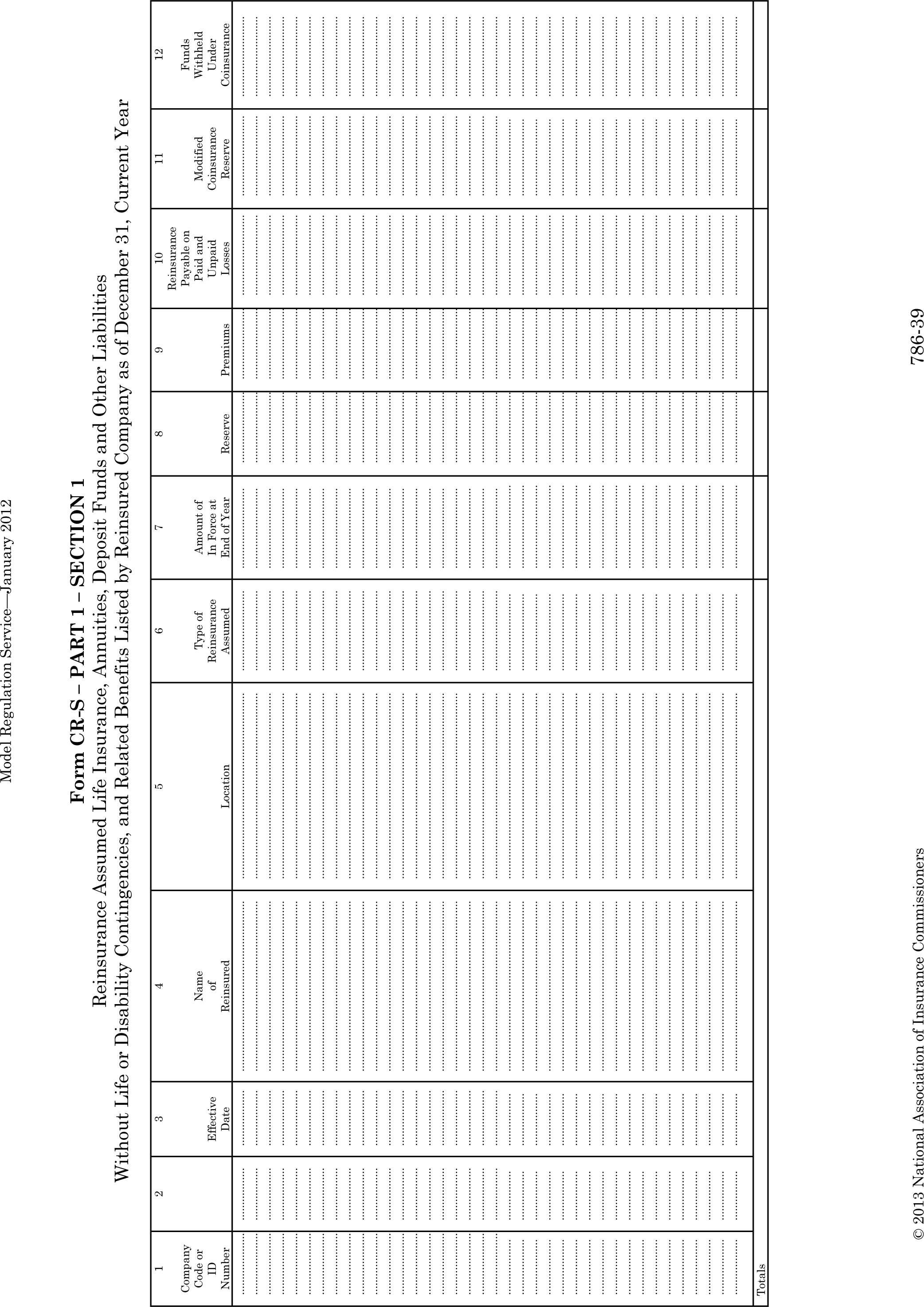

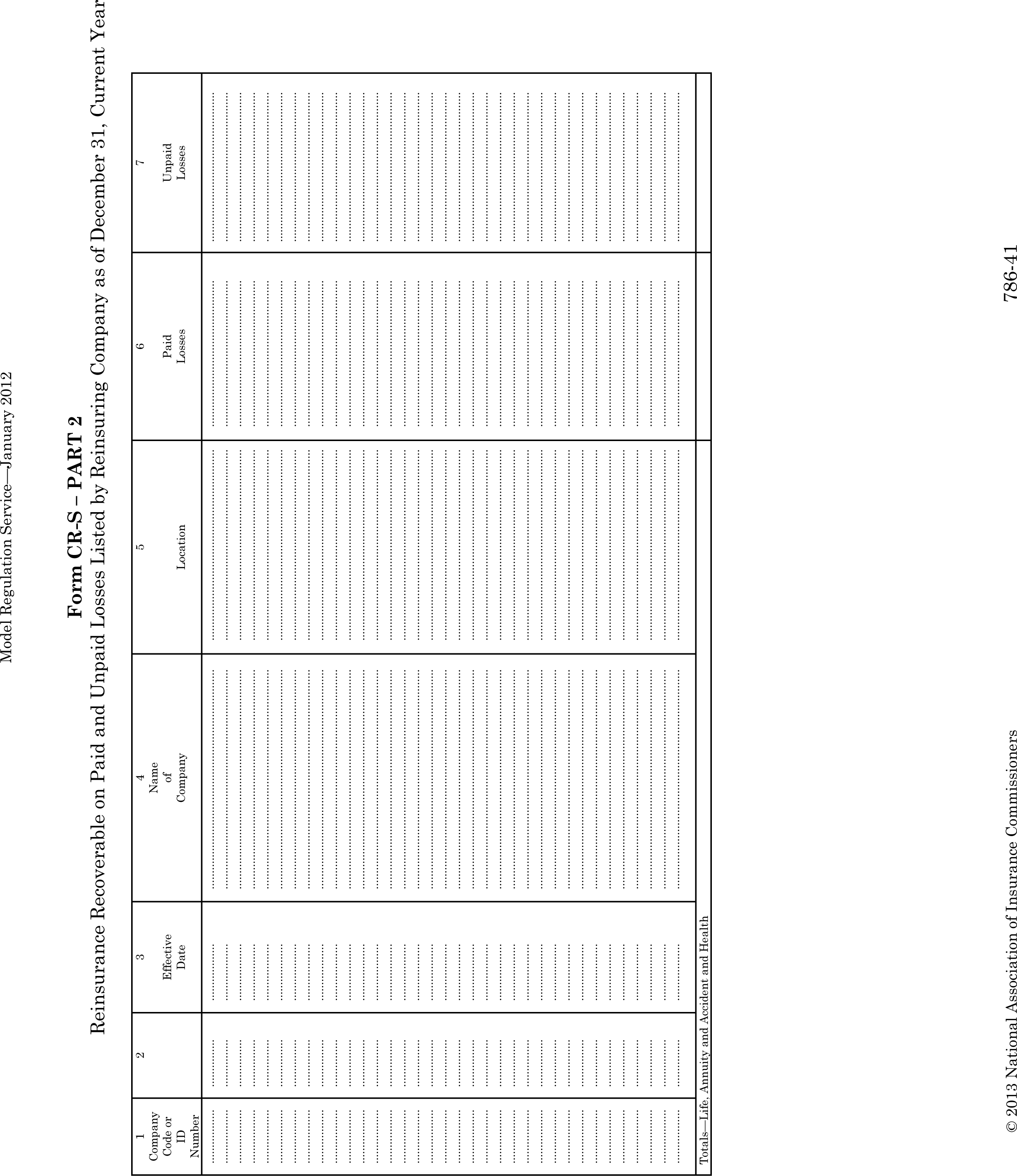

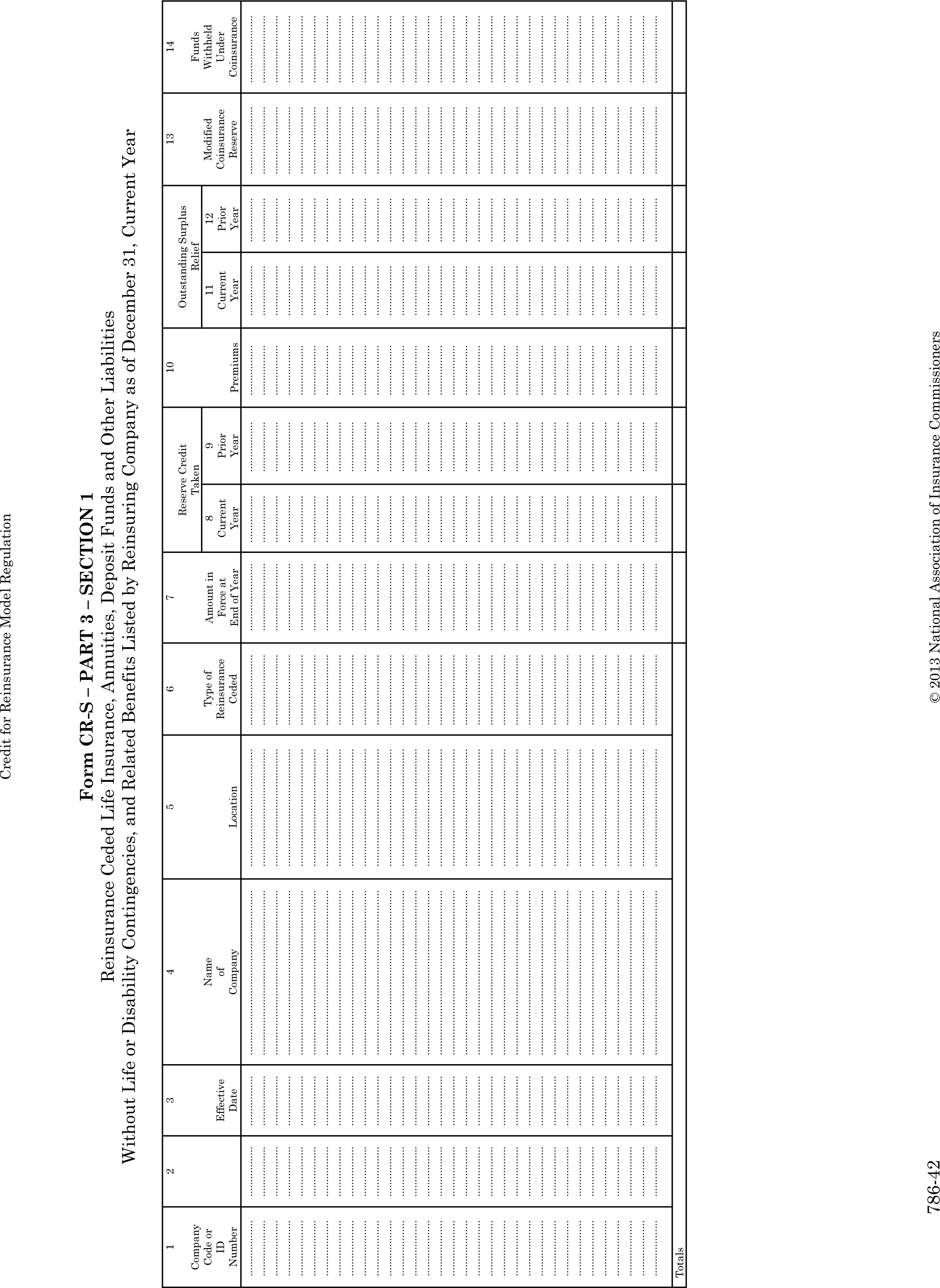

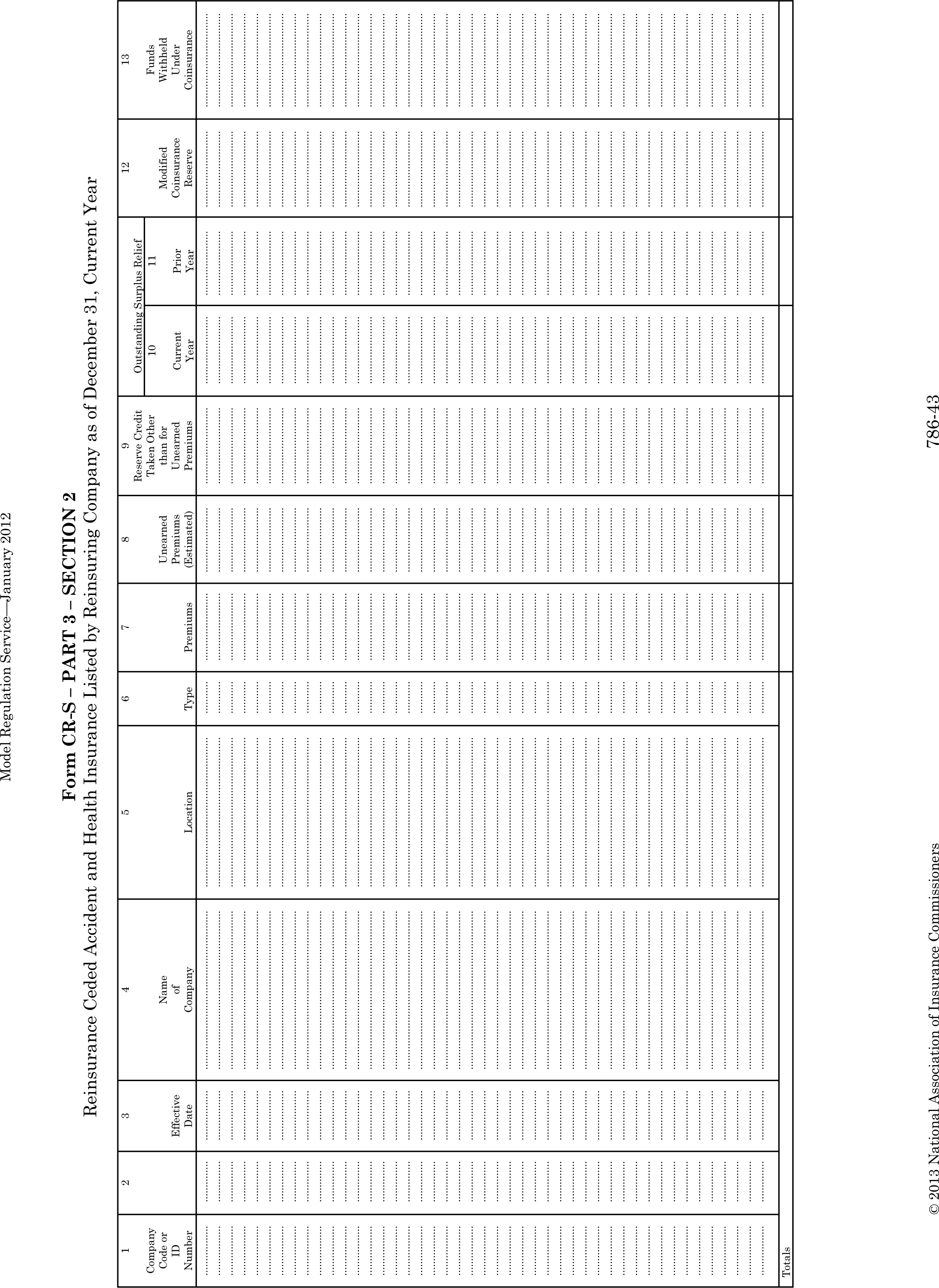

(iv) For certified reinsurers not domiciled in the United States, a review annually of Form CR-F (for property/casualty reinsurers) or Form CR-S (for life and disability reinsurers) set forth in WAC 284-13-59502 through 284-13-59508;

(v) The reputation of the certified reinsurer for prompt payment of claims under reinsurance agreements, based on an analysis of ceding insurers' schedule F reporting of overdue reinsurance recoverables, including the proportion of obligations that are more than ninety days past due or are in dispute, with specific attention given to obligations payable to companies that are in administrative supervision or receivership;

(vi) Regulatory actions against the certified reinsurer;

(vii) The report of the independent auditor on the financial statements of the insurance enterprise, on the basis described in (d)(viii) of this subsection;

(viii) For certified reinsurers not domiciled in the United States, audited financial statements (audited United States GAAP basis if available, audited IFRS basis statements are allowed but most include an audited footnote reconciling equity and net income to a United States GAAP basis, or, with the permission of the insurance commissioner, audited IFRS statements with reconciliation to United States GAAP certified by an officer of the company), regulatory filings, and actuarial opinions (as filed with non-United States jurisdiction supervisor). Upon the initial application for certification, the commissioner will consider audited financial statements for the last three years filed with its non-United States jurisdiction supervisor;

(ix) The liquidation priority of obligations to a ceding insurer in the certified reinsurer's domiciliary jurisdiction in the context of an insolvency proceeding;

(x) A certified reinsurer's participation in any solvent scheme of arrangement, or similar procedure, which involves United States ceding insurers. The commissioner must receive prior notice from a certified reinsurer that proposes participation by the certified reinsurer in a solvent scheme arrangement; and

(xi) Any other information deemed relevant by the commissioner.

(e) Based on the analysis conducted under (d)(v) of this subsection of a certified reinsurer's reputation for prompt payment of claims, the commissioner may make appropriate adjustments in the security the certified reinsurer is required to post to protect its liabilities to United States ceding insurers, provided that the commissioner must, at a minimum, increase the security the certified reinsurer is required to post by one rating level under (d)(i) of this subsection if the commissioner finds that:

(i) More than fifteen percent of the certified reinsurer's ceding insurance clients have overdue reinsurance recoverables on paid losses of ninety days or more which are not in dispute and which exceed one hundred thousand dollars for each cedent; or

(ii) The aggregate amount of reinsurance recoverables on paid losses which are not in dispute that are overdue by ninety days or more exceeds fifty million dollars.

(f) The assuming insurer must submit a properly executed Form CR-1 set forth under WAC 284-13-59501 as evidence of its submission to the jurisdiction of this state, appointment of the commissioner as an agent for service of process in this state, and agreement to provide security for one hundred percent of the assuming insurer's liabilities attributable to reinsurance ceded by United States ceding insurers if it resists enforcement of a final United States judgment. The commissioner will not certify any assuming insurer that is domiciled in a jurisdiction that the commissioner has determined does not adequately and promptly enforce final United States judgments or arbitration awards.

(g) The certified reinsurer must agree to meet applicable information filing requirements as determined by the commissioner, both with respect to an initial application for certification and on an ongoing basis. The applicable information filing requirements are as follows:

(i) Notification within ten days of any regulatory actions taken against the certified reinsurer, any change in the provisions of its domiciliary license or any change in rating by an approved rating agency, including a statement describing the changes and the reasons therefore;

(ii) Annually, Form CR-F or CR-S, as applicable per the instructions posted on the National Association of Insurance Commissioner's web site;

(iii) Annually, the report of the independent auditor on the financial statements of the insurance enterprise, on the basis described in (g)(iv) of this subsection;

(iv) Annually, audited financial statements (audited United States GAAP basis if available, audited IFRS basis statements are allowed but must include an audited footnote reconciling equity and net income to a United States GAAP basis, or, with the permission of the commissioner, audited IFRS statements with reconciliation to United States GAAP certified by an officer of the company), regulatory filings, and actuarial opinion (as filed with the certified reinsurer's supervisor). Upon the initial certification, audited financial statements for the last three years filed with the certified reinsurer's supervisor;

(v) At least annually, an audited list of all disputed and overdue reinsurance claims regarding reinsurance assumed from United States domestic ceding insurers;

(vi) A certification from the certified reinsurer's domestic regulator that the certified reinsurer is in good standing and maintains capital in excess of the jurisdiction's highest regulatory action level; and

(vii) Any other information that the commissioner may reasonably require.

(h) Change in rating or revocation of certification.

(i) In the case of a downgrade by a rating agency or other disqualifying circumstance, the commissioner must upon notice assign a new rating to the certified reinsurer in accordance with the requirements of subsection (2)(d)(i) of this section.

(ii) The commissioner has the authority to suspend, revoke, or otherwise modify a certified reinsurer's certification at any time if the certified reinsurer fails to meet its obligations or security requirements under this section, or if other financial or operating results of the certified reinsurer, or documented significant delays in payment by the certified reinsurer, lead the commissioner to reconsider the certified reinsurer's ability or willingness to meet its contractual obligations.

(iii) If the rating of a certified reinsurer is upgraded by the commissioner, the certified reinsurer may meet the security requirements applicable to its new rating on a prospective basis, but the commissioner must require the certified reinsurer to post security under the previously applicable security requirements as to all contracts in force on or before the effective date of the upgraded rating. If the rating of a certified reinsurer is downgraded by the commissioner, the commissioner must require the certified reinsurer to meet the security requirements applicable to its new rating for all business it has assumed as a certified reinsurer.

(iv) Upon revocation of the certification of a certified reinsurer by the commissioner, the assuming insurer is required to post security in accordance with WAC 284-13-540 in order for the ceding insurer to continue to take credit for reinsurance ceded to the assuming insurer. If funds continue to be held in trust under WAC 284-13-520 through 284-13-538, the commissioner may allow additional credit equal to the ceding insurer's pro rata share of the funds, discounted to reflect the risk of uncollectability and anticipated expenses of trust administration. Notwithstanding the change of a certified reinsurer's rating or revocation of its certification, a domestic insurer that has ceded reinsurance to that certified reinsurer may not be denied credit for reinsurance for a period of three months for all reinsurance ceded to that certified reinsurer, unless the reinsurance is found by the commissioner to be at high risk of uncollectability.

(3)(a) If, upon conducting an evaluation under this section with respect to the reinsurance supervisory system of any non-United States assuming insurer, the commissioner determines that the jurisdiction qualifies to be recognized as a qualified jurisdiction, the commissioner must publish notice and evidence of the recognition in an appropriate manner. The commissioner may establish a procedure to withdraw recognition of those jurisdictions that are no longer qualified.

(b) In order to determine whether the domiciliary jurisdiction of a non-United States assuming insurer is eligible to be recognized as a qualified jurisdiction, the commissioner must evaluate the reinsurance supervisory system of the non-United States jurisdiction, both initially and on an ongoing basis, and consider the rights, benefits and the extent of reciprocal recognition afforded by the non-United States jurisdiction to reinsurers licensed and domiciled in the United States. The commissioner must determine the appropriate approach for evaluating the qualifications of the jurisdictions, and create and publish a list of jurisdictions whose reinsurers may be approved by the commissioner as eligible for certification. A qualified jurisdiction must agree to share information and cooperate with the commissioner with respect to all certified reinsurers domiciled within that jurisdiction. Additional factors to be considered in determining whether to recognize a qualified jurisdiction, in the discretion of the commissioner include, but are not limited to, the following:

(i) The framework under which the assuming insurer is regulated.

(ii) The structure and authority of the domiciliary regulator with respect to solvency regulation requirements and financial surveillance.

(iii) The substance of financial and operating standards for assuming insurers in the domiciliary jurisdiction.

(iv) The form and substance of financial reports required to be filed or made publicly available by reinsurers in the domiciliary jurisdiction and the accounting principles used.

(v) The domiciliary regulator's willingness to cooperate with United States regulators in general and the commissioner in particular.

(vi) The history of performance by assuming insurers in the domiciliary jurisdiction.

(vii) Any documented evidence of substantial problems with the enforcement of final United States judgments in the domiciliary jurisdiction. A jurisdiction will not be considered to be a qualified jurisdiction if the commissioner has determined that it does not adequately and promptly enforce final United States judgments or arbitration awards.

(viii) Any relevant international standards or guidance with respect to mutual recognition of reinsurance supervision adopted by the International Association of Insurance Supervisors or successor organization.

(ix) Any other matters deemed relevant by the commissioner.

(c) A list of qualified jurisdictions shall be published through the NAIC committee process. The commissioner shall consider the list in determining qualified jurisdictions. If the commissioner approves a jurisdiction as qualified that does not appear on the list of qualified jurisdictions, the commissioner shall provide thoroughly documented justification with respect to the criteria provided under (b)(i) through (ix) of this subsection.

(d) United States jurisdictions that meet the requirements for accreditation under the NAIC financial standards and accreditation program are recognized as qualified jurisdictions.

(4)(a) If an applicant for certification has been certified as a reinsurer in an NAIC accredited jurisdiction, the commissioner has the discretion to defer to that jurisdiction's certification, and to defer to the rating assigned by that jurisdiction, if the assuming insurer submits a properly executed CR-1 and additional information as the commissioner requires. The assuming insurer is considered to be a certified reinsurer in this state.

(b) Any change in the certified reinsurer's status or rating in the other jurisdiction applies automatically in this state as of the date it takes effect in the other jurisdiction. The certified reinsurer must notify the commissioner of any change in its status or rating within ten days after receiving notice of the change.

(c) The commissioner may withdraw recognition of the other jurisdiction's rating at any time and assign a new rating in accordance with subsection (2)(h) of this section.

(d) The commissioner may withdraw recognition of the other jurisdiction's certification at any time, with notice to the certified reinsurer. Unless the commissioner suspends or revokes the certified reinsurer's certification under subsection (2)(h) of this section, the certified reinsurer's certification remains in good standing in this state for a period of three months, which is extended if additional time is necessary to consider the assuming insurer's application for certification in this state.

(5) In addition to the clauses required under WAC 284-13-580, reinsurance contracts entered into or renewed under this section must include a proper funding clause, which requires the certified reinsurer to provide and maintain security in an amount sufficient to avoid the imposition of any financial statement penalty on the ceding insurer under this section for reinsurance ceded to the certified reinsurer.

(6) The commissioner will comply with all reporting and notification requirements that may be established by the NAIC with respect to certified reinsurers and qualified jurisdictions.

NEW SECTION

WAC 284-13-53901 Credit for reinsurance required by law.

Under RCW 48.12.435, the commissioner shall allow credit for reinsurance ceded by a domestic insurer to an assuming insurer not meeting the requirements of RCW 48.12.410 through 48.12.430, but only as to the insurance of risks located in jurisdictions where the reinsurance is required by the applicable law or regulation of that jurisdiction. As used in this section, "jurisdiction" means state, district or territory of the United States and lawful national government.

AMENDATORY SECTION (Amending WSR 97-05-012, filed 2/10/97, effective 3/13/97)

WAC 284-13-540 ((Credit)) Asset or reduction from liability for reinsurance ceded to an unauthorized assuming insurer ((that does not have a certificate of authority)) not meeting the requirements of WAC 284-13-510 through 284-13-53901.

((Pursuant to RCW 48.12.160 (1)(c))) Under RCW 48.12.460, the commissioner shall allow a reduction from liability for reinsurance ceded by a domestic insurer to an assuming insurer not meeting the requirements of RCW 48.12.405 through 48.12.455, in an amount not exceeding the liabilities carried by the ceding insurer. ((Such)) The reduction shall ((not be greater than)) be in the amount of funds ((or other assets that are of the types and amounts that are authorized under chapter 48.13 RCW, held subject to withdrawal by and under the control of the ceding insurer)) held by or on behalf of the ceding insurer, including funds ((or other such assets)) held in trust for the exclusive benefit of the ceding insurer, under a reinsurance contract with ((such)) the assuming insurer as security for the payment of obligations ((thereunder. Such)) under the reinsurance contract. The security must be held in ((a qualified)) the United States ((financial institution as defined in WAC 284-13-515)) subject to withdrawal solely by, and under the exclusive control of, the ceding insurer, or in the case of a trust, held in a qualified United States financial institution as defined in RCW 48.12.465(2). This security may be in the form of any of the following:

(1) ((Deposits or funds that are assets of the types and amounts that are authorized under chapter 48.13 RCW; or

(2))) (a) Cash;

(b) Securities listed by the Securities Valuation Office of the NAIC, including those exempt from filing as defined by the purposes and procedures manual of the Securities Valuation Office, and qualifying as admitted assets;

(c) Clean, irrevocable, unconditional, and "evergreen" letters of credit issued or confirmed by a qualified United States institution, as defined in ((WAC 284-13-515)) RCW 48.12.465(1), effective no later than December 31 of the year for which filing is being made, and in the possession of, or in trust, the ceding ((company)) insurer on or before the filing date of its annual statement. Letters of credit meeting applicable standards of issuer acceptability as of the dates of their issuance (or confirmation) shall, notwithstanding the issuing (or confirming) institution's subsequent failure to meet applicable standards of issuer acceptability, continue to be acceptable as security until their expiration, extension, renewal, modification, or amendment, whichever first occurs((.)); or

(d) Any other form of security acceptable to the commissioner.

(2) An admitted asset or a reduction from liability for reinsurance ceded to an unauthorized assuming insurer ((pursuant to)) under this section ((shall be)) is allowed only when the requirements of WAC ((284-13-560 are met)) 284-13-580 and the applicable portions of WAC 284-13-550, 284-13-560, or 284-13-570 have been satisfied.

AMENDATORY SECTION (Amending WSR 97-05-012, filed 2/10/97, effective 3/13/97)

WAC 284-13-550 Trust agreements qualified under WAC 284-13-540.

(1) As used in this section:

(a) "Beneficiary" means the entity for whose sole benefit the trust has been established and any successor of the beneficiary by operation of law. If a court of law appoints a successor in interest to the named beneficiary, then the named beneficiary includes and is limited to the court appointed domiciliary receiver (including conservator, rehabilitator, or liquidator).

(b) "Grantor" means the entity that has established a trust for the sole benefit of the beneficiary. When established in conjunction with a reinsurance agreement, the grantor is the ((assuming alien insurer not holding a certificate of authority for that kind of business)) unlicensed, unaccredited insurer.

(c) "Obligations," as used in subsection (2)(k) of this section, means:

(i) Reinsured losses and allocated loss expenses paid by the ceding company, but not recovered from the assuming insurer;

(ii) Reserves for reinsured losses reported and outstanding;

(iii) Reserves for reinsured losses incurred but not reported; and

(iv) Reserves for allocated reinsured loss expenses and unearned premiums.

(2) Required conditions.

(a) The trust agreement ((shall)) must be entered into between the beneficiary, the grantor, and a trustee which ((shall)) must be a qualified United States financial institution as defined in ((WAC 284-13-515)) RCW 48.12.465(2).

(b) The trust agreement ((shall)) must create a trust account into which assets ((shall)) must be deposited.

(c) All assets in the trust account ((shall)) must be held by the trustee at the trustee's office in the United States.

(d) The trust agreement ((shall)) must provide that:

(i) The beneficiary ((shall)) must have the right to withdraw assets from the trust account at any time, without notice to the grantor, subject only to written notice from the beneficiary to the trustee;

(ii) No other statement or document is required to be presented ((in order)) to withdraw assets, except that the beneficiary may be required to acknowledge receipt of withdrawn assets;

(iii) It is not subject to any conditions or qualifications outside of the trust agreement; and

(iv) It ((shall)) must not contain references to any other agreements or documents except as provided for under (k) and (l) of this subsection.

(e) The trust agreement ((shall)) must be established for the sole benefit of the beneficiary.

(f) The trust agreement ((shall)) must require the trustee to:

(i) Receive assets and hold all assets in a safe place;

(ii) Determine that all assets are in such form that the beneficiary, or the trustee upon direction by the beneficiary, may whenever necessary negotiate ((any such)) the assets, without consent or signature from the grantor or any other person or entity;

(iii) Furnish to the grantor and the beneficiary a statement of all assets in the trust account upon its inception and at intervals no less frequent than the end of each calendar quarter;

(iv) Notify the grantor and the beneficiary within ten days, of any deposits to or withdrawals from the trust account;

(v) Upon written demand of the beneficiary, immediately take any and all steps necessary to transfer absolutely and unequivocally all right, title, and interest in the assets held in the trust account to the beneficiary and deliver physical custody of the assets to the beneficiary; and

(vi) Allow no substitutions or withdrawals of assets from the trust account, except on written instructions from the beneficiary, except that the trustee may, without the consent of but with notice to the beneficiary, upon call or maturity of any trust asset, withdraw ((such)) the asset upon condition that the proceeds are paid into the trust account.

(g) The trust agreement ((shall)) must provide that at least thirty days, but not more than forty-five days, prior to termination of the trust account, written notification of termination ((shall)) must be delivered by the trustee to the beneficiary.

(h) The trust agreement ((shall)) must be made subject to and governed by the laws of the state in which the trust is ((established)) domiciled.

(i) The trust agreement ((shall)) must prohibit invasion of the trust corpus for the purpose of paying compensation to, or reimbursing the expenses of, the trustee. In order for a letter of credit to qualify as an asset of the trust, the trustee must have the right and the obligation under the deed of trust or some other binding agreement (as duly approved by the commissioner), to immediately draw down the full amount of the letter of credit and hold the proceeds in trust for the beneficiaries of the trust if the letter of credit will otherwise expire without being renewed or replaced.

(j) The trust agreement ((shall)) must provide that the trustee ((shall be)) is liable for its own negligence, willful misconduct, or lack of good faith. The failure of the trustee to draw against the letter of credit in circumstances where the draw would be required is either negligence, or willful misconduct, or both.

(k) Notwithstanding other provisions of ((this regulation)) WAC 284-13-500 through 284-13-590, when a trust agreement is established in conjunction with a reinsurance agreement covering risks other than life, annuities, and disability, where it is customary practice to provide a trust agreement for a specific purpose, ((such a)) the trust agreement may((, notwithstanding any other conditions in this regulation,)) provide that the ceding insurer ((shall)) must undertake to use and apply amounts drawn upon the trust account, without diminution because of the insolvency of the ceding insurer or the assuming insurer, only for the following purposes:

(i) To pay or reimburse the ceding insurer for the assuming insurer's share under the specific reinsurance agreement regarding any losses and allocated loss expenses paid by the ceding insurer, but not recovered from the assuming insurer, or for unearned premiums due to the ceding insurer if not otherwise paid by the assuming insurer;

(ii) To make payment to the assuming insurer of any amounts held in the trust account that exceed one hundred two percent of the actual amount required to fund the assuming insurer's obligations under the specific reinsurance agreement; or

(iii) Where the ceding insurer has received notification of termination of the trust ((account)) and where the assuming insurer's entire obligations under the specific reinsurance agreement remain unliquidated and undischarged ten days prior to the termination date, to withdraw amounts equal to the obligations and deposit those amounts in a separate account, in the name of the ceding insurer in any qualified United States financial institution as defined in ((WAC 284-13-515)) RCW 48.12.465(2), apart from its general assets, in trust for ((such)) the uses and purposes specified in (k)(i) and (ii) of this subsection as may remain executory after ((such)) the withdrawal and for any period after the termination date.

(l) Notwithstanding other provisions of ((this regulation)) WAC 284-13-500 through 284-13-590, when a trust agreement is established to meet the requirements of WAC 284-13-540 in conjunction with a reinsurance agreement covering life, annuities, and disability risks, where it is customary ((practice)) to provide a trust agreement for a specific purpose, ((such a)) the trust agreement may provide that the ceding insurer ((shall)) must undertake to use and apply amounts drawn upon the trust account, without diminution because of the insolvency of the ceding insurer or the assuming insurer, only for the following purposes:

(i) To pay or reimburse the ceding insurer for:

(A) The assuming insurer's share under the specific reinsurance agreement of premiums returned, but not yet recovered from the assuming insurer, to the owners of policies reinsured under the reinsurance agreement on account of cancellations of the policies; and

(B) The assuming insurer's share under the specific reinsurance agreement of surrenders and benefits or losses paid by the ceding insurer, but not yet recovered from the assuming insurer, under the terms and provisions of the policies reinsured under the reinsurance agreement.

(ii) To ((make payment)) pay to the assuming insurer ((of)) amounts held in the trust account in excess of the amount necessary to secure the credit or reduction from liability for reinsurance taken by the ceding insurer; or

(iii) Where the ceding insurer has received notification of termination of the trust ((account)) and where the assuming insurer's entire obligations under the specific reinsurance agreement remain unliquidated and undischarged ten days prior to the termination date, to withdraw amounts equal to the assuming insurer's share of liabilities, to the extent that the liabilities have not been funded by the assuming insurer, and deposit those amounts in a separate account, in the name of the ceding insurer in any qualified United States financial institution ((as defined in WAC 284-13-515)) apart from its general assets, in trust for such uses and purposes specified in (l)(i) and (ii) of this subsection as may remain executory after ((such)) withdrawal and for any period after the termination date.

(m) Either the reinsurance agreement ((entered into in conjunction with)) or the trust agreement ((may, but need not, contain the provisions required by subsection (4)(a)(ii) of this section, so long as these required conditions are included in the trust agreement.

(n) Notwithstanding any other provision in the trust instrument, if the grantor(s) of the trust has been declared insolvent or placed into receivership, rehabilitation, liquidation or similar proceedings under the laws of its state or country of domicile, the trustee shall comply with an order of the commissioner with regulatory oversight over the trust or court of competent jurisdiction directing the trustee to transfer to the commissioner with regulatory oversight or other designated receiver all of the assets of the trust fund. The assets shall be applied in accordance with the priority statutes and laws of the state in which the trust is domiciled applicable to the assets of insurance companies in liquidation. If the commissioner with regulatory oversight determines that the assets of the trust fund or any part thereof are not necessary to satisfy claims of the United States ceding insurers of the grantor(s) of the trust, the assets or any part thereof shall be returned to the trustee for distribution in accordance with the trust agreement.)) must stipulate that assets deposited in the trust account must be valued according to their current fair market value and must consist only of cash in United States dollars, certificates of deposit issued by a United States bank and payable in United States dollars, and investments permitted by Title 48 RCW or any combination of the above, provided investments in or issued by an entity controlling, controlled by or under common control with either the grantor or the beneficiary of the trust must not exceed five percent of total investments. The agreement may further specify the types of investments to be deposited. If the reinsurance agreement covers life, annuities or accident and disability risks, then the provisions required by this subsection (2)(m) of this section must be included in the reinsurance agreement.

(3) Permitted conditions.

(a) The trust agreement may provide that the trustee may resign upon delivery of a written notice of resignation, effective not less than ninety days after ((receipt by)) the beneficiary and grantor ((of)) receive the notice((,)) and that the trustee may be removed by the grantor by delivery to the trustee and the beneficiary of a written notice of removal, effective not less than ninety days after ((receipt by)) the trustee and the beneficiary ((of)) receive the notice, provided that no such resignation or removal shall be effective until a successor trustee has been duly appointed and approved by the beneficiary and the grantor and all assets in the trust have been duly transferred to the new trustee.

(b) The grantor may have the full and unqualified right to vote any shares of stock in the trust account and to receive from time to time payments of any dividends or interest upon any shares of stock or obligations included in the trust account. Any ((such)) interest or dividends ((shall)) must be either forwarded promptly upon receipt to the grantor or deposited in a separate account established in the grantor's name.

(c) The trustee may be given authority to invest, and accept substitutions of, any funds in the account, provided that no investment or substitution shall be made without prior approval of the beneficiary, unless the trust agreement specifies categories of investments acceptable to the beneficiary and authorizes the trustee to invest funds and to accept substitutions ((which)) that the trustee determines are at least equal in current fair market value to the assets withdrawn and that are consistent with the restrictions in subsection (4)(a)(ii) of this section.

(d) The trust agreement may provide that the beneficiary may at any time designate a party to which all or part of the trust assets are to be transferred. ((Such)) Transfer may be conditioned upon the trustee receiving, prior to or simultaneously, other specified assets.

(e) The trust agreement may provide that, upon termination of the trust account, all assets not previously withdrawn by the beneficiary ((shall)) must, with written approval by the beneficiary, be delivered over to the grantor.

(4) Additional conditions applicable to reinsurance agreements.

(a) A reinsurance agreement((, which is entered into in conjunction with a trust agreement and the establishment of a trust account,)) may contain provisions that:

(i) Require the assuming insurer to enter into a trust agreement and to establish a trust account for the benefit of the ceding insurer, and specifying what the agreement is to cover;

(ii) ((Stipulate that assets deposited in the trust account shall be valued according to their current fair market value and shall consist only of cash (United States legal tender), certificates of deposit (issued by a United States bank and payable in United States legal tender), and investments of the types permitted by Title 48 RCW or any combination of the above, provided that such investments are issued by an institution that is not the parent, subsidiary, or affiliate of either the grantor or the beneficiary. The reinsurance agreement may further specify the types of investments to be deposited. Where a trust agreement is entered into in conjunction with a reinsurance agreement covering risks other than life, annuities, and disability, then the trust agreement may contain the provisions described by this paragraph in lieu of including such provisions in the reinsurance agreement;

(iii))) Require the assuming insurer, prior to depositing assets with the trustee, to execute assignments or endorsements in blank, or to transfer legal title to the trustee of all shares, obligations, or any other assets requiring assignments, in order that the ceding insurer, or the trustee upon the direction of the ceding insurer, may whenever necessary negotiate these assets without consent or signature from the assuming insurer or any other entity;

(((iv))) (iii) Require that all settlements of account between the ceding insurer and the assuming insurer be made in cash or its equivalent; and