WSR 16-07-078

EXPEDITED RULES

DEPARTMENT OF REVENUE

[Filed March 17, 2016, 9:43 a.m.]

Title of Rule and Other Identifying Information: As a result of the adoption of WAC 458-20-100 Informal administrative reviews, new clarifying language concerning informal review hearings has been added to the following eight rules. The rules being amended under this proposal are WAC 458-20-17802, 458-20-19301, 458-20-217, 458-20-229, 458-20-240, 458-20-24001A, 458-20-24003, and 458-20-255.

NOTICE

THIS RULE IS BEING PROPOSED UNDER AN EXPEDITED RULE-MAKING PROCESS THAT WILL ELIMINATE THE NEED FOR THE AGENCY TO HOLD PUBLIC HEARINGS, PREPARE A SMALL BUSINESS ECONOMIC IMPACT STATEMENT, OR PROVIDE RESPONSES TO THE CRITERIA FOR A SIGNIFICANT LEGISLATIVE RULE. IF YOU OBJECT TO THIS USE OF THE EXPEDITED RULE-MAKING PROCESS, YOU MUST EXPRESS YOUR OBJECTIONS IN WRITING AND THEY MUST BE SENT TO Mark E. Bohe, Department of Revenue, P.O. Box 47453, Olympia, WA 98504-7453, e-mail markbohe@dor.wa.gov, AND RECEIVED BY May 23, 2016.

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: This proposal incorporates new terms used for informal review hearings under recently adopted WAC 458-20-100 Informal administrative reviews. The eight rules in this proposal are having the terms "Appeals Division" changed to "Administrative Review and Hearings Division;" and "appeal" changed to "review." Also, the term "section" is replaced with "rule."

Copies of draft rules are available for viewing and printing on our web site at Rules Agenda.

Reasons Supporting Proposal: This proposal incorporates new terms used for informal review hearings under recently adopted WAC 458-20-100 Informal administrative reviews. These amendments add clarifying language to the eight rules in this proposal.

Rule is not necessitated by federal law, federal or state court decision.

Name of Proponent: Department of revenue, governmental.

Name of Agency Personnel Responsible for Drafting: Mark Bohe, 1025 Union Avenue S.E., Suite #544, Olympia, WA, (360) 534-1574; Implementation and Enforcement: Marcus Glasper, 1025 Union Avenue S.E., Suite #500, Olympia, WA, (360) 534-1615.

March 17, 2016

Kevin Dixon

Rules Coordinator

AMENDATORY SECTION (Amending WSR 14-21-104, filed 10/15/14, effective 12/14/14)

WAC 458-20-17802 Collection of use tax by county auditors and department of licensing—Measure of tax.

(1) Introduction. The department of revenue (department) has authorized county auditors and the department of licensing to collect the use tax imposed by chapter 82.12 RCW when a person applies to transfer the certificate of title of a vehicle acquired without the payment of sales tax. See RCW 82.12.045. This rule explains how county auditors, their subagents, and the department of licensing determine the measure of the use tax. This rule does not relieve a seller registered with the department of the statutory requirement to collect sales tax when selling tangible personal property, including vehicles. RCW 82.08.020 and 82.08.0251. The use tax reporting responsibilities of Washington residents in other situations and the general nature of the use tax are addressed in WAC 458-20-178 (Use tax). The application of tax to vehicles acquired by Indians and Indian tribes is discussed in WAC 458-20-192 (Indians—Indian country).

Vehicle licensing locations and information about vehicle titles and registration are available from the department of licensing on their web site at: dol.wa.gov. This information is also available by contacting the local county auditor's office listed in the government pages of a telephone directory.

(2) What is use tax based on? For purposes of computing the amount of use tax due, the value of the article used is the measure of tax. The value of the article used is generally the purchase price. If the purchase price does not represent the true value of the article used, the value must be determined as nearly as possible according to the retail selling price at place of use of similar vehicles of like quality and character. RCW 82.12.010.

(3) Use of automated system to verify measure of tax. When a person applies to transfer the certificate of title of a vehicle, county auditors, their subagents, or the department of licensing must verify that the purchase price represents the true value. In doing so, county auditors, their subagents, or the department of licensing compare the vehicle's purchase price to the average retail value of comparable vehicles using an automated valuing system. The automated valuing system identifies the average retail value using a data base that is provided by a regional industry standard source specializing in providing valuation services to local, state, and federal governments, and the private sector.

In limited situations, the automated valuing system's data base may not provide the average retail value for a vehicle. For example, the automated valuing system's data base does not provide average retail value information for collectible vehicles or vehicles that are over twenty years of age. In the absence of an average retail value, county auditors, their subagents, or the department of licensing will determine the true value as nearly as possible according to the retail selling price at place of use of similar vehicles of like character and quality. To assist in this process, the department of revenue and the department of licensing may approve the use of alternative valuing authorities as necessary.

(4) What happens when the purchase price is presumed to represent the true value? County auditors, their subagents, or the department of licensing will use the purchase price to compute the amount of use tax due when the purchase price represents the vehicle's true value. County auditors, their subagents, or department of licensing will presume the purchase price represents the vehicle's true value if one of the following conditions is met:

(a) The vehicle's average retail value, as provided by the automated valuing system, is less than $5,000.

For example, a person buys a vehicle for $2,800. The automated valuing system indicates that the vehicle's average retail value is $4,900. The purchase price is presumed to represent the vehicle's true value because the average retail value is less than $5,000.

(b) The vehicle's purchase price is not more than $2,000 below the average retail value as provided by the automated valuing system.

For example, a person buys a used vehicle for $10,000. The automated valuing system indicates the vehicle's average retail value is $11,500. When compared to the average retail value, the purchase price is not more than $2,000 below the average retail value. Consequently, the purchase price is presumed to represent the vehicle's true value.

(5) What happens when the purchase price is not presumed to represent the true value? If the vehicle's purchase price is not presumed to be the true value as explained in subsection (4) of this rule, a person may remit use tax based on the average retail value as indicated by the automated valuing system or substantiate the true value of the vehicle using any one of the following methods.

(a) Industry-accepted pricing guide. A person applying to transfer a certificate of title may provide the county auditor, a subagent, or the department of licensing with documentation from one of the various industry-accepted pricing guides. The value from the industry-accepted pricing guide must represent the retail value of a similarly equipped vehicle of the same make, model, and year in a comparable condition. The purchase price is presumed to represent the vehicle's true value if the purchase price is not more than $2,000 below the retail value.

For example, a person buys a vehicle for $3,500. The automated valuing system indicates that the vehicle's average retail value is $5,700. An industry-accepted pricing guide shows that the retail value of a similarly-equipped vehicle in a comparable condition of the same make, model, and year is $5,000. When compared to the retail value established by the industry-accepted pricing guide, the purchase price is not more than $2,000 below the retail value. Consequently, the purchase price is presumed to represent the vehicle's true value.

(b) Declaration of buyer and seller. A person applying to transfer a certificate of title may provide to the county auditor, a subagent, or the department of licensing a Declaration of Buyer and Seller Regarding Value of Used Vehicle Sale (REV 32 2501) to substantiate that the purchase price is the true value of the vehicle. The declaration must be signed by both the buyer and the seller and must certify to the purchase price and the vehicle's condition under penalty of perjury. The department may review a declaration and assess additional tax, interest, and penalties. A person may ((appeal)) seek review of an assessment to the department as provided in WAC 458-20-100 (((Appeals)) Informal administrative reviews).

The declaration is available on the department's web site at dor.wa.gov. It is also available at all vehicle licensing locations, department's field offices, or by writing:

Department of Revenue

Taxpayer Services

P.O. Box 47478

Olympia, WA 98504-7478

(c) Written appraisal. A person applying to transfer a certificate of title may present to the county auditor, a subagent, or the department of licensing a written appraisal from an automobile dealer, insurance or other vehicle appraiser to substantiate the true value of the vehicle. If an automobile dealer performs the appraisal, the dealer must be currently licensed with the department of ((licensing's)) licensing dealer services division or be a licensed vehicle dealer in another jurisdiction.

The written appraisal must appear on company stationery or have the business card attached and include the vehicle description, including the vehicle make, model, and identification number (VIN). The person performing the appraisal must certify that the stated value represents the retail selling price of a similarly equipped vehicle of the same make, model, and year in a comparable condition. The department may review an appraisal and assess additional tax, interest, and penalties. A person may ((appeal)) seek review of an assessment to the department as provided in WAC 458-20-100 (((Appeals)) Informal administrative reviews).

(d) Declaration of use tax. A person applying to transfer a certificate of title may present to the county auditor, a subagent, or the department of licensing a Declaration of Use Tax (REV 32 2486e) to substantiate the true value of the vehicle. An authorized employee of the department must complete the declaration. Determining the true value may require a visual inspection that is not available at all department locations.

(e) Repair estimate. A person applying to transfer a certificate of title may present to the county auditor, a subagent, or the department of licensing a written repair estimate, prepared by an auto repair or auto body repair business. This estimate will then be used to assist with determining the true value of the vehicle. The written estimate must appear on company stationery or have the business card attached. In addition, the written estimate must include the vehicle description, including the vehicle make, model, and identification number (VIN), and an itemized list of repairs. The department may review an appraisal and assess additional tax, interest, and penalties. A person may ((appeal)) seek review of an assessment to the department as provided in WAC 458-20-100 (((Appeals)) Informal administrative reviews).

The purchase price is presumed to represent the true value if the total of the purchase price and the repair estimate is not more than $2,000 below the average retail value. For example, a person purchases a vehicle with extensive bumper damage for $1,700. The automated valuing system indicates that the vehicle's average retail value is $6,000. An estimate from an auto body repair business indicates a cost of $2,500 to repair the bumper damage. The purchase price is presumed to represent the vehicle's true value because when the total of the purchase price and the repair estimate ($1,700 + $2,500 = $4,200) is compared to the average retail value, the total is not more than $2,000 below the average retail value ($6,000).

AMENDATORY SECTION (Amending WSR 87-23-008, filed 11/6/87)

WAC 458-20-19301 Multiple activities tax credits.

(1) Introduction. Under the provisions of RCW 82.04.440 as amended effective August 12, 1987, Washington state's business and occupation taxes imposed under chapter 82.04 RCW were adjusted to achieve constitutional equality in the tax treatment of persons engaged in intrastate commerce (within this state only) and interstate commerce (between Washington and other states). The business and occupation tax system taxes the privilege of engaging in specified business activities based upon "gross proceeds of sales" (RCW 82.04.070) and the "value of products" (RCW 82.04.450) produced in this state. In order to maintain the integrity of this taxing system, to eliminate the possibility of discrimination between taxpayers, and to provide equal and uniform treatment of persons engaged in extracting, manufacturing, and/or selling activities regardless of where performed, a statutory system of internal and external tax credits was adopted, effective August 12, 1987. This tax credits system replaces the multiple activities exemption which, formerly, assured that the gross receipts tax would be paid only once by persons engaged in more than one taxable activity in this state in connection with the same end products. Unlike the multiple activities exemption which only prevented multiple taxation from within this state, the credits of the new system apply for gross receipts taxes paid to other taxing jurisdictions outside this state as well.

(2) Definitions. For purposes of this ((section)) rule the following terms will apply.

(a) "Credits" means the multiple activities tax credit(s) authorized under this statutory system also referred to as MATC.

(b) "Gross receipts tax" means a tax:

(i) Which is imposed on or measured by the gross volume of business, in terms of gross receipts or in other terms, and in the determination of which the deductions allowed would not constitute the tax an income tax or value added tax; and

(ii) Which is not, pursuant to law or custom, separately stated from the selling price.

(c) "Extracting tax" means a gross receipts tax imposed on the act or privilege of engaging in business as an extractor, and includes the tax imposed by RCW 82.04.230 (tax on extractors) and similar gross receipts taxes paid to other states.

(d) "Manufacturing tax" means a gross receipts tax imposed on the act or privilege of engaging in business as a manufacturer, and includes:

(i) The taxes imposed in RCW 82.04.240 (tax on manufacturers) and subsections (2) through (5) and (7) of RCW 82.04.260 (tax on special manufacturing activities) and

(ii) Similar gross receipts taxes paid to other states.

The term "manufacturing tax," by nature, includes a gross receipts tax upon the combination of printing and publishing activities when performed by the same person.

(e) "Selling tax" means a gross receipts tax imposed on the act or privilege of engaging in business as a wholesaler or retailer of tangible personal property in this state or any other state. The term "selling" has its common and ordinary meaning and includes the acts of making either wholesale sales or retail sales or both.

(f) "State" means:

(i) The state of Washington,

(ii) A state of the United States other than Washington or any political subdivision of such other state,

(iii) The District of Columbia,

(iv) Territories and possessions of the United States, and

(v) Any foreign country or political subdivision thereof.

(g) "Taxes paid" means taxes legally imposed and actually paid in terms of money, credits, or other emoluments to a taxing authority of any "state." The term does not include taxes for which liability for payment has accrued but for which payment has not actually been made. This term also includes business and occupation taxes being paid to Washington state together with the same combined excise tax return upon which MATC are taken.

(h) "Business," "manufacturer," "extractor," and other terms expressly defined in RCW 82.04.020 through 82.04.212 have the meanings given in those statutory sections regardless of how the terms may be used for other states' taxing purposes.

(3) Scope of credits. This integrated tax credits system is intended to assure that gross receipts from sales or the value of products determined by such gross receipts are taxed only one time, whether the activities occur entirely within this state or both within and outside this state. External tax credits arise when activities are taxed in this state and similar activities with respect to the same products produced and sold are also subject to similar taxes outside this state. There are five ways in which external tax credits may arise because of taxes paid in other states.

(a) Products or ingredients are extracted (taken from the ground) in this state and are manufactured or sold and delivered in another state which imposes a gross receipts tax on the latter activity(s). The credit created by payment of the other state's tax may be used to offset the Washington extracting tax liability.

(b) Products are manufactured, in whole or in part, in this state and sold and delivered in another state which imposes a gross receipts tax on the selling activity. Again, payment of the other state's tax may be taken as a credit against the Washington manufacturing tax liability.

(c) Conversely, products or ingredients are extracted outside this state upon which a gross receipts tax is paid in the state of extracting, and which are sold and delivered to buyers here. The other state tax payment may be taken as a credit against Washington's selling taxes.

(d) Similarly, products are manufactured, in whole or in part, outside this state and sold and delivered to buyers here. Any other state's gross receipts tax on manufacturing may be taken as a credit against Washington's selling tax.

(e) Products are partly manufactured in this state and partly in another state and are sold and delivered here or in another state. The combination of all other states' gross receipts taxes paid may be taken as credits against Washington's manufacturing and/or selling taxes.

Thus, the external tax credits may arise in the flow of commerce, either upstream or downstream from the taxable activity in this state, or both. Products extracted in another state, manufactured in Washington state, and sold and delivered in a third state may derive credits for taxes paid on both of the out-of-state activities.

Internal tax credits arise from multiple business activities performed entirely within this state, all of which are now subject to tax, but with the integrated credits offsetting the liabilities so that tax is only paid once on gross receipts. Under this system Washington extractors and manufacturers who sell their products in this state at wholesale and/or retail must report the value of products or gross receipts under each applicable tax classification. Credits may then be taken in the amount of the extracting and/or manufacturing tax paid to offset the selling taxes due. There are three ways in which credits may arise because of taxes paid exclusively in this state.

(f) Products are extracted in Washington and directly sold in Washington. Extracting business and occupation tax and selling business and occupation tax must both be reported but the payment of the former is a credit against the latter.

(g) Similarly, ingredients are extracted in Washington and manufactured into new products in this state. The extracting business and occupation tax reported and paid may be taken as a credit against manufacturing tax reported.

(h) Products manufactured in Washington are sold in Washington. Again, the payment of the manufacturing tax reported may be credited against the selling tax (wholesaling and/or retailing business and occupation tax) reported.

All of the external and internal tax credits derived from any flow of commerce may be used, repeatedly if necessary, to offset other tax liabilities related to the production and sale of the same products.

(4) Eligibility for taking credits. Statutory law places the following eligibility requirements and limitations upon the MATC system.

(a) The amount of the credit(s), however derived, may not exceed the Washington tax liability against which the credit(s) may be used. Any excess of credit(s) over liability may not be carried over or used for any purpose.

(b) The person claiming the credit(s) must be the same person who is legally obligated to pay both the taxes which give rise to the credit(s) and the taxes against which the credit is claimed. The MATC is not assignable.

(c) The taxes which give rise to the credit(s) must be actually paid before credit may be claimed against any other tax liability. Tax liability merely accrued is not creditable.

(d) The business activity subject to tax, and against which credit(s) is claimed, must involve the same ingredients or product upon which the tax giving rise to the credit(s) was paid. The credits must be product-specific.

(e) The effective date for developing and claiming credit(s) for products manufactured in Washington state and sold and delivered in other states which impose gross receipts selling taxes is June 1, 1987.

(f) The effective date for developing and claiming all credits other than those explained in subsection (e) above, is August 12, 1987.

(g) Persons who are engaged only in making wholesale or retail sales of tangible personal property which they have not extracted or manufactured are not entitled to claim MATC. Also, persons engaged in rendering services in this state are not so entitled, even if such services have been defined as "retail sales" under RCW 82.04.050. (See WAC 458-20-194 for rules governing apportionment of gross receipts from interstate services.)

(5) Other states' qualifying taxes. The law defines "gross receipts tax" paid to other states to exclude income taxes, value added taxes, retail sales taxes, use taxes, or other taxes which are generally stated separately from the selling price of products sold. Only those taxes imposed by other states which include gross receipts of a business activity within their measure or base are qualified for these credit(s). The burden rests with the person claiming any MATC for other states' taxes paid to show that the other states' tax was a tax on gross receipts as defined herein. Gross receipts taxes generally include:

(a) Business and occupation privileges taxes upon extracting, manufacturing, and selling activities which are similar to those imposed in Washington state in that the tax measure or base is not reduced by any allocation, apportionment, or other formulary method resulting in a downward adjustment of the tax base. If costs of doing business may be generally or routinely deducted from the tax base, the tax is not one which is similar to Washington state's gross receipts tax.

(b) Severance taxes measured by the selling price of the ingredients or products severed (oil, logs, minerals, natural products, etc.) rather than measured by costs of production, stumpage values, the volume or number of units produced, or some other formulary tax base.

(c) Business franchise or licensing taxes measured by the gross volume of business in terms of gross receipts or other financial terms rather than units of production or the volume of units sold.

Other states' tax payments claimed for MATC must be identifiable with the same ingredients or products which incurred tax liability in Washington state, i.e., they must be product specific.

(d) The department will periodically publish an excise tax bulletin listing current taxes in other jurisdictions which are either qualified or disqualified for credit under the MATC system.

(6) Deductions in combination with MATC. Effective August 12, 1987, with the enactment of the MATC system, the liability for actual payment of tax by persons who extract, manufacture, and sell products in this state was shifted from the selling activity (wholesaling or retailing) to the production activity (extracting and/or manufacturing). As explained, the payment of the production taxes may now be credited against the liability for selling taxes on the same products. However, the deductions from tax provided by chapter 82.04 RCW (business and occupation tax deductions) may still be taken before tax credits are computed and used, with noted exceptions. In order for the MATC system to result in the correct computation of tax liabilities and credit applications, the tax deductions which may apply for any reporting period must be taken equally against both levels of tax liability reported, i.e., at both the production and selling levels. Failure to report tax deductions in this manner will result in overreporting tax due and may result in overpayment of tax. Thus, with the exceptions noted below, tax deductions formerly reported only against selling activities should now be reported against production activities as well. All such deductions, the result of which is to reduce the measure of tax reported, should be taken against both the production taxes (extracting or manufacturing) and the selling taxes (wholesaling and/or retailing) equally.

(a) Example:

(i) A company manufactures products in Washington which it also sells at wholesale for $5,000 and delivers to a buyer in this state. The buyer defaults on part of the payment and the seller incurs a $2,000 credit loss which it writes off as a bad debt during the tax reporting period. The bad debt deduction provided by RCW 82.04.4284 must be shown on both the manufacturing-other line and the wholesaling-other line of the combined excise tax return. Taking the deduction on only one of those activities results in overreported tax liability on the $2,000 loss.

(b) Exceptions. The deductions generally provided by RCW 82.04.4286, for interstate or foreign sales (where goods are sold and delivered outside this state) may not be taken against tax reported at the production level (extracting or manufacturing). This is because the MATC system itself provides for tax credits instead of tax deductions on gross receipts from transactions involving goods produced in this state and sold in interstate or foreign commerce. Thus, deductions which eliminate transactions from tax reporting may be taken only against selling taxes.

(c) Applicable deductions should be shown on the front of the combined excise tax return (Column #3) on each applicable tax classification line and detailed on the back side of the return, as usual, before MATC is taken.

(d) It is not the intent of the MATC law to invalidate or nullify the business and occupation tax exemption for taxable amounts below minimum (see WAC 458-20-104). Thus any person whose gross receipts or value of products reported under any single tax classification with respect to the production and sale of any product is less than the minimum taxable amount will not incur tax liability merely because of the requirement to report those gross receipts or value of products on the same product under other tax classifications as well.

(i) Example: A person both manufactures and sells at wholesale $2,000 worth of widgets in the first quarter of a tax year. The requirement to report the $2,000 tax measure under both the manufacturing-other classification and the wholesaling-other classification gives the false appearance of $4,000 in gross receipts during this quarter. However, only the amount reported under the manufacturing-other classification need be considered to determine eligibility for the amount-below-minimum exemption.

(7) How and when to take MATC. The credits available under the MATC system are all to be taken on the combined excise tax return beginning in August, 1987 and thereafter. The return form has been modified to accommodate these credits. Each tax return upon which MATC has been taken must be accompanied by a completed Schedule C. This schedule details the business activities and credits computations. The line by line instructions insure that no more or no less credits are claimed than are authorized under the law.

(8) Consolidation of tax liabilities and credits. Under the MATC system a person's Washington tax liability for all activities involved in that person's production and sale of the same ingredients or products (extracting, and/or manufacturing, and/or selling) is to be reported only at the time of the sale of such products or at the time of that person's own use of such products for commercial or industrial consumption. All of the taxable activities are to be reported on that same periodic excise tax return. Also, all external and internal tax credits derived from the payment of any gross receipts taxes on any of these activities are to be taken at that time. Thus, the taxable activities and the tax credits are procedurally consolidated for reporting. This consolidation generally overcomes any need to track ingredients or products from their extraction to their sale. It also overcomes any need to report and pay Washington tax liability during one reporting period and to take credits against that tax liability in a different reporting period. Thus, except as noted below, there can be no credit carryovers or carrybacks under this system.

(a) Exception. Where different tax reporting periods are assigned by Washington state and another state to a company doing business both within and outside Washington state, the other state's gross receipts tax on the same products may not yet have been paid when the Washington tax is due for reporting and payment. In such cases the Washington tax due must be timely reported and paid during the period in which the sale is made. The external credit arising later, when the other state's tax is paid, may be taken as a credit against any Washington business and occupation tax reported during that later period. Thus, the limitation that the MATC must be product-specific by being limited to the amount of Washington tax paid on the same products does not mean that the credit(s) can only be used against precisely those same Washington taxes paid.

(i) In the situation described in subsection (a) above, if there is not sufficient Washington business and occupation tax due for payment in the later period, when the external tax credit arises, to allow for utilization of the entire credit, the amount of any overage may be carried forward and taken against Washington taxes reported in subsequent reporting periods until fully used.

When filing such exception returns, the full amount of any credits should be claimed, even though that credit amount will exceed the amount of tax liability reported for that period. The department of revenue itself will make the necessary adjustments and will perform the carrying over of any excess credits into future reporting periods.

(ii) In the same situation, if the person entitled to claim such credit overage is no longer engaged in taxable business in this state or for any other reason does not incur sufficient Washington business and occupation tax liability to fully utilize the perfected credit overage, a tax refund will be issued.

(iii) No tax refunds, MATC carryovers, or MATC carrybacks will be allowed under any circumstances other than those explained above.

(b) Special circumstances may arise where it is not possible to specifically identify ingredients or products as they move from production to sale (e.g., fungible commodities from various sources stored in a common warehouse). In such cases the taxpayer should seek advance approval from the department, in writing, for tax reporting and credit taking on a test period, formulary, or volume percentage basis, subject to audit verification.

(9) Recordkeeping requirements. Persons claiming the MATC must keep and preserve such records and documents as may be necessary to prove their entitlement to any credits taken under this system (RCW 82.32.070). It is not required to submit copies of such proofs when credits are claimed or together with the Schedule C detail. Rather, such records must be kept for a period no less than five years from the date of the tax return upon which the related tax credits are claimed. Such records are fully subject to audit for confirmation of the validity and amounts of credits taken. Records which must be preserved by persons claiming external tax credits include:

(a) Copies of sales contracts, or other written or memorialized evidence of any sales agreements, including purchase and billing invoices showing the origin state and destination state of products sold.

(b) Copies of shipping or other delivery documents identifying the products sold and delivered, reconcilable with the selling documents of subsection (a) above, if appropriate.

(c) Copies of production reports, transfer orders, and similar such documents which will reflect the intercompany or interdepartmental movement of extracted ingredients or manufactured products where no sale has occurred.

(d) Copies of tax returns or reports filed with other states' taxing authorities showing the kinds and amounts of taxes paid to such other states for which MATC is claimed.

(e) Copies of ((cancelled)) canceled checks or other proofs of actual tax payment to the other state(s) giving rise to the MATC claimed.

(f) Copies of any other state(s) taxing statutes, laws, ordinances, and other appropriate legal authorities necessary to establish the nature of the other states' tax as a gross receipts tax, as defined in this ((section)) rule.

(g) Failure to keep and preserve proofs of entitlement to the MATC will result in the denial of credits claimed and the assessment of all taxes offset or reduced by such credits as well as the additional assessment of interest and penalties as required by law. (See RCW 82.32.050.)

(10) MATC in combination with other credits. The tax credits authorized under this system may be taken in combination with other tax credits available under Washington law. Such other credit programs, however, authorize credit carryovers from reporting period to period until the credits are fully utilized. Thus, the MATC must be computed and used to offset business and occupation tax liabilities during any tax reporting period before any other program credits to which a claimant may be entitled are claimed or applied. Failure to compute and take the MATC before applying other available credits may result in the loss of the other credit benefits.

(11) Superseding provisions. The MATC provisions of this ((section)) rule supersede and control the provisions of other ((sections)) rules of chapter 458-20 WAC (other tax rules) relating to intrastate, interstate, and foreign transactions to the extent that such provisions are or appear to be contrary or conflicting.

(12) Unique or special credit situations—((Appeals)) Reviews. The provisions of this ((section)) rule generally explain the nature of the MATC system and the tax credit qualifications, limitations, and claiming procedures. The complexity of the integrated tax reporting and credit taking procedures may develop situations or questions which are not addressed herein. Such matters and requests for specialized rulings should be submitted to the department of revenue for prior determination before credits are claimed. Generally, prior determinations will be provided within sixty days after the department receives the information necessary to make such a ruling. Adverse rulings, tax credit denials, or tax assessments resulting from audits or other examinations of returns upon which the MATC is claimed may be administratively ((appealed)) reviewed under the provisions of chapter 82.32 RCW and WAC 458-20-100.

AMENDATORY SECTION (Amending WSR 14-22-023, filed 10/27/14, effective 11/27/14)

WAC 458-20-217 Lien for taxes.

(1) Introduction. This rule provides an overview of the administrative collection remedies and procedures available to the department of revenue (department) to collect unpaid and overdue tax liabilities. It discusses tax liens and the liens that apply to probate, insolvency, assignments for the benefit of creditors, bankruptcy and public improvement contracts. The rule also explains the personal liability of persons in control of collected but unpaid sales tax. Although the department may use judicial remedies to collect unpaid tax, most of the department's collection actions are enforced through the administrative collection remedies discussed in this rule.

(2) Tax liens. The department is not required to obtain a judgment in court to have a tax lien. A tax lien is created when a warrant issued under RCW 82.32.210 is filed with a superior court clerk who enters it into the judgment docket. A copy of the warrant may be filed in any county in this state in which the department believes the taxpayer has real and/or personal property. The department is not required to give a taxpayer notice prior to filing a tax warrant. Peters v Sjoholm, 95 Wn.2d 871, 877, 631 P.2d 937 (1981) appeal dismissed, cert. denied 455 U.S. 914 (1982). The tax lien is an encumbrance on property. The department may enforce a tax lien by administrative levy, seizure or through judicial collection remedies.

(a) Attachment of lien. The filed warrant becomes a specific lien upon all personal property used in the conduct of the business and a general lien against all other real and personal property owned by the taxpayer against whom the warrant was issued.

(i) The specific lien attaches to all goods, wares, merchandise, fixtures, equipment or other personal property used in the conduct of the business of the taxpayer. Other personal property includes both tangible and intangible property. For example, the specific lien attaches to business assets such as accounts receivable, chattel paper, royalties, licenses and franchises. The specific lien also attaches to property used in the business which is owned by persons other than the taxpayer who have a beneficial interest, direct or indirect, in the operation of the business. (See subsection (3) of this rule for what constitutes a beneficial interest.) The lien is perfected on the date it is filed with the superior court clerk. The lien does not attach to property used in the business that was transferred prior to the filing of the warrant. It does attach to all property existing at the time the warrant is filed as well as property acquired after the filing of the warrant. No sale or transfer of such personal property affects the lien.

(ii) The general lien attaches to all real and personal nonbusiness property such as the taxpayer's home and nonexempt personal vehicles.

(b) Lien priorities. The department does not need to levy or seize property to perfect its lien. The lien is perfected when the warrant is filed. The tax lien is superior to liens that vest after the warrant is filed.

(i) The lien for taxes is superior to bona fide interests of third persons that vested prior to the filing of the warrant if such persons have a beneficial interest in the business.

(ii) The lien for taxes is also superior to any interest of third persons that vested prior to the warrant if the interest is a mortgage of real or personal property or any other credit transaction that results in the mortgagee or the holder of the security acting as the trustee for unsecured creditors of the taxpayer mentioned in the warrant.

(iii) In most cases, to have a vested or perfected security interest in personal property, the secured party must file a UCC financing statement indicating its security interest. RCW 62A.9-301. See RCW 62A.9-302 for the exceptions to this general rule. The financing statement must be filed prior to the filing of the tax warrant for the lien to be superior to the department's lien.

(c) Period of lien. A filed tax warrant creates a lien that is enforceable for the same period as a judgment in a civil case that is docketed with the clerk of the superior court. RCW 82.32.210(4). A judgment lien expires ten years from the date of filing. RCW 4.56.310. The department may extend the lien for an additional ten years by filing a petition for an order extending the judgment with the clerk of the superior court. The petition must be filed within ninety days of the expiration of the original ten-year period. RCW 6.17.020.

(3) Persons who have a beneficial interest in a business. A third party who receives part of the profit, a benefit, or an advantage resulting from a contract or lease with the business has a beneficial interest in the operation of the business. A party whose only interest in the business is securing the payment of debt or receiving regular rental payments on equipment does not have a beneficial interest. Also, the mere loaning of money by a financial institution to a business and securing that debt with a UCC filing does not constitute a beneficial interest in the business. Rather, a party who owns property used by a delinquent taxpayer must also have a beneficial interest in the operation of that business before the lien will attach to the party's property. The definition of the term "beneficial interest" for purposes of determining lien priorities is not the same as the definition used for tax free transfers described in WAC 458-20-106.

(a) Third party. A third party is simply a party other than the taxpayer. For example, if the taxpayer is a corporation, an officer or shareholder of that corporation is a "third party" with a beneficial interest in the operation of the business. If the corporate insider has a security interest in property used by the business, the tax lien will be superior even if the corporate insider's lien was filed before the department's lien.

(b) Beneficial interest of lessor. In some cases a lessor or franchisor will have a beneficial interest in the leased or franchised business. For example, an oil company that leases a gas station and other equipment to an operator and requires the operator to sell its products is a third party with a beneficial interest in the business. Factors which support a finding of a beneficial interest in a business include the following:

(i) The business operator is required to pay the lessor or franchisor a percentage of gross receipts as rent;

(ii) The lessor or franchisor requires the business operator to use its trade name and restricts the type of business that may be operated on the premises;

(iii) The lease places restrictions on advertising and hours of operation; and/or

(iv) The lease requires the operator to sell the lessor's products.

(c) A third party who has a beneficial interest in a business with a filed lien is not personally liable for the amounts owing. Instead, the amount of tax, interest and penalties as reflected in the warrant becomes a specific lien upon the third party's property that is used in the business.

(4) Notice and order to withhold and deliver. A tax lien is sufficient to support the issuance of a writ of garnishment authorized by chapter 6.27 RCW. RCW 82.32.210(4). A tax lien also allows the department to issue a notice and order to withhold and deliver. A notice and order to withhold and deliver (order) is an administrative garnishment used by the department to obtain property of a taxpayer from a third party such as a bank or employer. See RCW 82.32.235. The department may issue an order when it has reason to believe that a party is in the possession of property that is or shall become due, owing or belonging to any taxpayer against whom a warrant has been filed.

(a) Service of order. The department may serve an order to withhold and deliver to any person, or to any political subdivision or department of the state. The order may be served by the sheriff or deputy sheriff of the county where service is made, by any authorized representative of the department, or by certified mail.

(b) Requirement to answer order. A person upon whom service has been made is required to answer the order in writing within twenty days of service of the order. The date of mailing or date of personal service is not included when calculating the due date of the answer. All answers must be true and made under oath. If an answer states that it cannot presently be ascertained whether any property is or shall become due, owing, or belonging to such taxpayer, the person served must answer when such fact can be ascertained. RCW 82.32.235.

(i) If the person served with an order possesses property of the taxpayer subject to the claim of the department, the party must deliver the property to the department or its duly authorized representative upon demand. If the indebtedness involved has not been finally determined, the department will hold the property in trust to apply to the indebtedness involved or for return without interest in accordance with the final determination of liability or nonliability. In the alternative, the department must be furnished a satisfactory bond conditioned upon final determination of liability. RCW 82.32.235.

(ii) If the party upon whom service has been made fails to answer an order to withhold and deliver within the time prescribed, the court may enter a default judgment against the party for the full amount claimed owing in the order plus costs. RCW 82.32.235.

(c) Continuing levy. A notice and order to withhold and deliver constitutes a continuing levy until released by the department. RCW 82.32.237.

(d) Assets that may be attached. Both tangible assets, as a vehicle, and intangible assets may be attached. Examples of intangible assets that may be attached by an order to withhold and deliver include, but are not limited to, checking or savings accounts; accounts receivable; refunds or deposits; contract payments; wages and commissions, including bonuses; liquor license deposits; rental income; dealer reserve accounts held by service stations or auto dealers; and funds held in escrow pending sale of a business. Certain insurance proceeds are subject to attachment such as the cash surrender value of a policy. The department may attach funds in a joint account that are owned by the delinquent taxpayer. Funds in a joint account with the right of survivorship are owned by the depositors in proportion to the amount deposited by each. RCW 30.22.090. The joint tenants have the burden to prove the separate ownership.

(e) Assets exempt from attachment. Examples of assets which are not attachable include Social Security, railroad retirement, welfare, and unemployment benefits payable by the federal or state government.

(5) Levy upon real and/or personal property. The department may issue an order of execution, pursuant to a filed warrant, directing the sheriff of the county in which the warrant was filed to levy upon and sell the real and/or personal property of the taxpayer in that county. RCW 82.32.220. If the department has reason to believe that a taxpayer has personal property in the taxpayer's possession that is not otherwise exempt from process or execution, the department may obtain a warrant to search for and seize the property. A search warrant is obtained from a superior or district court judge in the county in which the property is located. See RCW 82.32.245.

(6) Probate, insolvency, assignment for the benefit of creditors or bankruptcy. In all of these cases or conditions, the claim of the state for unpaid taxes and increases and penalties thereon, is a lien upon all real and personal property of the taxpayer. RCW 82.32.240. All administrators, executors, guardians, receivers, trustees in bankruptcy, or assignees for the benefit of creditors are required to notify the department of such administration, receivership, or assignment within sixty days from the date of their appointment and qualification. In cases of insolvency, this includes the duty of the person who is winding down the business to notify the department.

(a) The state does not have to take any action to perfect its lien. The lien attaches the date of the assignment for the benefit of creditors or of the initiation of the probate or bankruptcy. In cases of insolvency, the lien attaches at the time the business becomes insolvent. The lien, however, does not affect the validity or priority of any earlier lien that may have attached in favor of the state under any other provision of the Revenue Act.

(b) Any administrator, executor, guardian, receiver, or assignee for the benefit of creditors who does not notify the department as provided above is personally liable for payment of the taxes and all increases and penalties thereon. The personal liability is limited to the value of the property subject to administration that otherwise would have been available to pay the unpaid liability.

(c) In probate cases in which a surviving spouse or surviving domestic partner is separately liable for unpaid taxes and increases and penalties thereon, the department does not need to file a probate claim to protect the state's interest against the surviving spouse or surviving domestic partner. The department may collect from the separate property of the surviving spouse or surviving domestic partner and any assets formerly community property or property of the domestic partnership which become the property of the surviving spouse or the surviving domestic partner. If the deceased spouse or deceased domestic partner and/or the community or domestic partnership also was liable for the tax debt, the claim also could be asserted in the administration of the estate of the deceased spouse or deceased domestic partner.

(7) Lien on retained percentage of public improvement contracts. Every public entity engaging a contractor under a public improvement project of thirty-five thousand dollars or more, shall retain five percent of the total contract price, including all change orders, modifications, etc. This retainage is a trust fund held for the benefit of the department and other statutory claimants. In lieu of contract retainage, the public entity may require a bond. All taxes, increases, and penalties due or to become due under Title 82 RCW from a contractor or the contractor's successors or assignees with respect to a public improvement contract of thirty-five thousand dollars or more shall be a lien upon the amount of the retained percentage withheld by the disbursing officer under such contract. RCW 60.28.040.

(a) Priorities. The employees of a contractor or the contractor's successors or assignees who have not been paid the prevailing wage under the public improvement contract have a first priority lien against the bond or retainage. The department's lien for taxes, increases, and penalties due or to become due under such contract is prior to all other liens. The amount of all other taxes, increases and penalties due from the contractor is a lien upon the balance of the retained percentage after all other statutory lien claims have been paid. RCW 60.28.040.

(b) Release of funds. Upon final acceptance by the public entity or completion of the contract, the disbursing officer shall contact the department for its consent to release the funds. The officer cannot make any payment from the retained percentage until the department has certified that all taxes, increases, and penalties due have been paid or are readily collectible without recourse to the state's lien on the retained percentage. RCW 60.28.050 and 60.28.051.

(8) Personal liability for unpaid trust funds. The retail sales tax and all spirits taxes under RCW 82.08.150 are to be held in trust. RCW 82.08.050. As a trust fund, the retail sales tax and spirits taxes are not to be used to pay other corporate or personal debts.

Whenever the department has issued a warrant under RCW 82.32.210 for the collection of unpaid retail sales tax funds or spirits taxes funds collected and held in trust under RCW 82.08.050 from a limited liability business entity and that entity is terminated, dissolved, abandoned, or insolvent, RCW 82.32.145 authorizes the department to impose personal liability against any or all of the responsible individuals. For a responsible individual who is the current or a former chief executive or chief financial officer, personal liability may be imposed regardless of fault or whether the individual was or should have been aware of the unpaid retail sales tax or spirits taxes liability. Collection authority and procedures prescribed in chapter 82.32 RCW apply to the collection of personal liability assessments.

(a) Responsible individual.

(i) A responsible individual includes any current or former officer, manager, member, partner, or trustee of a limited liability business entity with an unpaid tax warrant issued by the department.

(A) "Officer" means any officer or assistant officer of a corporation, including the president, vice-president, secretary, and treasurer.

(B) "Manager" has the same meaning as in RCW 25.15.005.

(C) "Member" has the same meaning as in RCW 25.15.005, except that the term only includes members of member-managed limited liability companies.

(ii) "Responsible individual" also includes any current or former employee or other individual, but only if the individual had the responsibility or duty to remit payment of the limited liability business entity's unpaid sales tax liability reflected in a tax warrant issued by the department.

(A) A responsible individual may have "control and supervision" of collected retail sales tax or spirits taxes or the responsibility to report the tax under corporate bylaws, job description, or other proper delegation of authority. The delegation of authority may be established by written documentation or by conduct.

(B) Except for the current or a former chief executive or chief financial officer of a limited liability business entity, a responsible individual must have significant but not necessarily exclusive control or supervision of the trust funds. Neither a sales clerk who only collects the tax from the customer nor an employee who only deposits the funds in the bank has significant supervision or control of the retail sales tax or spirits taxes. An employee who has the responsibility to collect, account for, and deposit trust funds does have significant supervision or control of the tax.

(C) A person is not required to be a corporate officer or have a proprietary interest in the business to be a responsible individual.

(D) A member of the board of directors, a shareholder, or an officer may have trust fund liability if that person has the authority and discretion to determine which corporate debts should be paid and approves the payment of corporate debts out of the collected retail sales or spirits taxes trust funds.

(E) More than one person may have personal liability for the trust funds if the requirements for liability are present for each person.

(iii) Whenever a limited liability business entity with an unpaid tax warrant issued against it by the department has one or more limited liability business entities as a member, manager, or partner, "responsible individual" also includes any current and former officers, members, or managers of the limited liability business entity or entities or of any other limited liability business entity involved directly in the management of the limited liability business entity with an unpaid tax warrant issued against it by the department.

(b) Chief executive or chief financial officer.

(i) For a responsible individual who is the current or a former chief executive or chief financial officer of a limited liability business entity, liability under this rule applies regardless of fault or whether the individual was or should have been aware of the unpaid retail sales tax or spirits taxes liability of the limited liability business entity. There is no "willfully fails to pay" requirement for chief executive officers and chief financial officers.

(ii) A responsible individual who is the current or a former chief executive or chief financial officer is liable under this rule only for retail sales tax or spirits taxes liability accrued during the period that he or she was the chief executive or chief financial officer. However, if the responsible individual had the responsibility or duty to remit payment of the limited liability business entity's retail sales tax or spirits taxes to the department during any period of time that the person was not the chief executive or chief financial officer, that individual is also liable for retail sales tax or spirits taxes liability that became due during the period that he or she had the duty to remit payment of the limited liability business entity's taxes to the department but was not the chief executive or chief financial officer.

(iii) "Chief executive" means: The president of a corporation; or for other entities or organizations other than corporations or if a corporation does not have a president as one of its officers, the highest ranking executive manager or administrator in charge of the management of the company or organization.

(iv) "Chief financial officer" means: The treasurer of a corporation; or for entities or organizations other than corporations or if a corporation does not have a treasurer as one of its officers, the highest senior manager who is responsible for overseeing the financial activities of the entire company or organization.

(c) Other responsible individuals.

(i) For any other responsible individual, liability under this rule applies only if he or she willfully fails to pay or to cause to be paid to the department the retail sales tax or spirits taxes due from the limited liability business entity.

(A) "Willfully fails to pay or to cause to be paid" means that the failure was the result of an intentional, conscious, and voluntary course of action. Intent to defraud or bad motive is not required. For example, using collected retail sales tax or spirits taxes to pay other corporate obligations is a willful failure to pay the trust funds to the state.

(B) Depositing retail sales tax or spirits taxes funds in a bank account knowing that the bank might use the funds to off-set amounts owing to it is engaging in a voluntary course of action. It is a willful failure to pay if the bank exercises its right of set-off which results in insufficient funds to pay the corporate retail sales tax or spirits taxes that were collected and deposited in the account. To avoid personal liability in such a case, the responsible individual can set aside the collected retail sales tax or spirits taxes and not commingle it with other funds that are subject to attachment or set-off.

(C) If the failure to pay the trust funds to the state was due to reasons beyond an individual's control, the failure to pay is not willful. For example, if evidence is provided that the trust funds were unknowingly stolen or embezzled by another employee, the failure to pay is not considered willful. To find that a failure to pay the trust funds to the state was due to reasons beyond an individual's control, the facts must show both that the circumstances caused the failure to pay the tax and that the circumstances were beyond the individual's control.

(D) If a responsible individual instructs an employee or hires a third party to remit the collected retail sales tax or spirits taxes, the responsible individual is not relieved of personal liability for the tax if the tax is not paid.

(ii) Responsible individuals other than a current or former chief executive or chief financial officer of the limited liability business entity are liable under this rule only for retail sales tax or spirits taxes liability that became due during the period he or she had the responsibility or duty to remit payment of the limited liability business entity's taxes to the department.

(d) Limited liability business entity.

(i) A "limited liability business entity" is a type of business entity that generally shields its owners from personal liability for the debts, obligations, and liabilities of the entity, or a business entity that is managed or owned in whole or in part by an entity that generally shields its owners from personal liability for the debts, obligations, and liabilities of the entity. Limited liability business entities include corporations, limited liability companies, limited liability partnerships, trusts, general partnerships and joint ventures in which one or more of the partners or parties are also limited liability business entities, and limited partnerships in which one or more of the general partners are also limited liability business entities.

(ii) Whenever the department has issued a warrant under RCW 82.32.210 for the collection of unpaid retail sales tax or spirits taxes funds collected and held in trust under RCW 82.08.050 from a limited liability business entity and that business entity has been terminated, dissolved, or abandoned, or is insolvent, the department may pursue collection of the entity's unpaid state and local sales taxes, including penalties and interest on those taxes, against any or all of the responsible individuals.

(e) Requirements for liability. In order for a responsible individual to be held personally liable for collected and unpaid retail sales tax or spirits taxes:

(i) The tax must be the liability of a limited liability business entity.

(ii) The limited liability business entity must be terminated, dissolved, abandoned, or insolvent. Insolvent means the condition that results when the sum of the entity's debts exceeds the fair market value of its assets. The department may presume that an entity is insolvent if the entity refuses to disclose to the department the nature of its assets and liabilities.

(f) Extent of liability. Trust fund liability includes the collected but unpaid retail sales tax or spirits taxes as well as the interest and penalties due on the tax.

(g) Except for the current or a former chief executive or chief financial officer of a limited liability business entity, an individual is only liable for trust funds collected during the period he or she had the requisite control, supervision, responsibility, or duty to remit the tax, plus interest and penalties on those taxes.

(h) ((Appeal)) Review of personal liability assessment. Any person who receives a personal liability assessment is encouraged to request a supervisory conference if the person disagrees with the assessment. The request for the conference should be made to the department representative that issued the assessment or the representative's supervisor at the department's field office. A supervisory conference provides an opportunity to resolve issues with the assessment without further action. If unable to resolve the issue, the person receiving the assessment is entitled to administrative and judicial appeal procedures. RCW 82.32.145(4). See also RCW 82.32.160, 82.32.170, 82.32.180, 82.32.190, and 82.32.200.

While encouraged to request a supervisory conference, any person receiving a personal liability assessment may elect to forego the supervisory conference and proceed directly with an ((appeal)) administrative review of the assessment. Refer to WAC 458-20-100 for information about the department's informal administrative ((appeal procedures)) reviews, including how to timely file a petition for ((appeal)) review.

(9) Notice of lien. Under RCW 82.32.212, the department may issue a notice of lien to secure payment of a tax warrant issued under RCW 82.32.210. The notice of lien is an alternative to filing a lien under RCW 82.32.210. The notice of lien is against any real property in which the taxpayer has an ownership interest.

(a) To file a notice of lien the amount of the tax warrant at issue must exceed twenty-five thousand dollars. The department must determine that issuing the notice of tax lien would best protect the state's interest in collecting the amount due on the warrant.

(b) The notice of tax lien is recorded with a county auditor in lieu of filing a warrant with the clerk of a county superior court. A general lien authorized in RCW 82.32.210 can be filed (or refiled) if the department determines that filing or refiling the warrant is in the best interest of collecting the amount due on the tax warrant, or the warrant remains unpaid six months after the notice of lien is issued.

AMENDATORY SECTION (Amending WSR 08-14-038, filed 6/23/08, effective 7/24/08)

WAC 458-20-229 Refunds.

(1) Introduction. This ((section)) rule explains the procedures relating to refunds or credits for the overpayment of taxes, penalties, or interest. It describes the statutory time limits for refunds and the interest rates that apply to those refunds.

References to a "refund application" in this ((section)) rule include a request for a credit against future tax liability as well as a refund to the taxpayer.

Examples provided in this ((section)) rule should be used only as a general guide. The tax results of other situations must be determined after a review of all facts and circumstances.

(2) What are the time limits for a tax refund or credit?

(a) Time limits. No refund or credit may be made for taxes, penalties, or interest paid more than four years before the beginning of the calendar year in which a refund application is made or examination of records by the department is completed. See RCW 82.32.060. This is a nonclaim statute rather than a statute of limitations. This means a valid application must be filed within the statutory period, which may not be extended or tolled, unless a waiver extending the time for assessment has been entered into as described in (c) of this subsection.

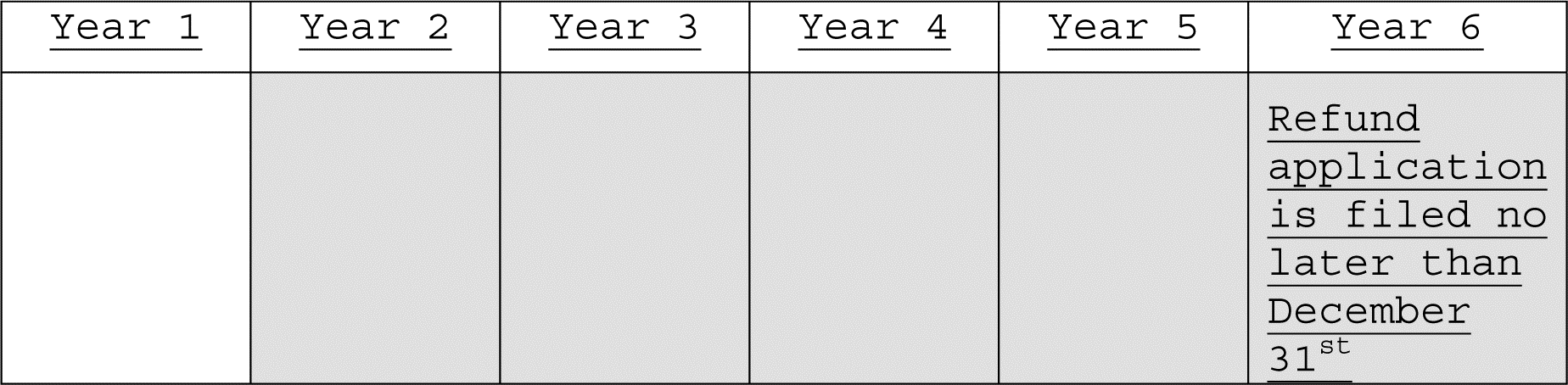

For example, a refund or credit may be granted for any overpayment made in a shaded year in the following chart:

|

(b) Relation back to date paid. Because the time limits relate to the date the taxes, penalties, or interest is paid, a refund application can be timely even though the payment concerned liabilities for a tax year normally outside the time limits. For example, Taxpayer P owes $1,000 in B&O tax for activity undertaken in December 2000. In January 2001, Taxpayer P makes an arithmetic error and submits a payment of $1,500 with its December 2000 tax return. In December 2005, Taxpayer P requests a refund of $500 for the overpayment of taxes for the December 2000 period. This request is timely because the overpayment occurred within the time limits, even though the payment concerned tax liabilities incurred (December 2000) outside the time limits.

Fact situations can be complicated. For example, Taxpayer P pays B&O taxes in Years 1 through 4. The department subsequently conducts an audit of Taxpayer P that includes Years 1-4. The audit is completed in Year 5. As a result of the audit, the department issues an assessment in Year 5 for $50,000 in additional retail sales taxes that were due from Years 1-4. Taxpayer P pays the assessment in full in Year 6. In Year 10, Taxpayer P files an application requesting a refund of B&O taxes. Taxpayer P's application is timely because it relates to a payment (payment of the assessment in Year 6) made no more than four years before the year in which the application is filed. It does not matter that the taxes relate to years outside the time limits; the actual payment occurred within four years before the refund application. Nor does it matter that the refund is based on an overpayment of B&O taxes while the assessment involved retail sales taxes, because both taxes relate to the same tax years. However, the amount of any refund is limited to $50,000 - the amount of the payment that occurred within the time limits.

Assume the same facts as described above. When the department reviews Taxpayer P's refund application, it determines that the refund is valid. After reviewing the new information, however, the department also determines that Taxpayer P should have paid $20,000 in additional B&O taxes during Years 1-4. Because Taxpayer P paid $30,000 more than the amount properly due ($50,000 overpayment less $20,000 underpayment), the amount of the refund will be $30,000.

(c) Waiver. Under RCW 82.32.050 or 82.32.100, a taxpayer may agree to waive the time limits and extend the time for the assessment of taxes, penalties and interest. If the taxpayer executes such a waiver, the time limits for a refund or credit are extended for the same period.

(3) How do I get a refund or credit?

(a) Departmental examination of returns. If the department performs an examination of the taxpayer's records and determines that the taxpayer has overpaid taxes, penalties, or interest, the department will issue a refund or a credit, at the taxpayer's option. In this situation, the taxpayer does not need to apply for a refund.

(b) Taxpayer application.

(i) If a taxpayer discovers that it has overpaid taxes, penalties, or interest, it may apply for a refund or credit. Refund application forms are available from the following sources:

• The department's internet web site at http://dor.wa.gov

• By facsimile by calling Fast Fax at 360-705-6705 or 800-647-7706 (using menu options)

• By writing to:

Taxpayer Services

Washington State Department of Revenue

P.O. Box 47478

Olympia, WA 98504-7478.

The application form should be submitted to the department at the following location:

Taxpayer Account Administration

P.O. Box 47476

Olympia, WA 98504-7476.

Taxpayers are encouraged to use the department's refund application form to ensure that all necessary information is provided for a timely valid application. However, while use of the department's application form is encouraged, it is not mandatory and any written request for refund or credit meeting the requirements of this ((section)) rule shall constitute a valid application. Filing an amended return showing an overpayment will also constitute an application for refund or credit, provided that the taxpayer also specifically identifies the basis for the refund or credit.

(ii) A taxpayer must submit a refund application within the time limits described in subsection (2)(a) of this ((section)) rule. An application must contain the following five elements:

(A) The taxpayer's name and UBI/TRA number must be on the application.

(B) The amount of the claim must be stated. Where the exact amount of the claim cannot be specifically ascertained at time of filing, the taxpayer may submit an application containing an estimated claim amount. Taxpayers must explain why the amount of the claim cannot be stated with specificity and how the estimated amount of the claim was determined.

(C) The tax type and taxable period must be on the application.

(D) The specific basis for the claim must be on the application. Any basis for a refund or credit not specifically identified in the initial refund application will be considered untimely, except that an application may be refiled to add additional bases at any time before the time limits in subsection (2) of this ((section)) rule expire.

(E) The signature of the taxpayer or the taxpayer's representative must be on the application. If the taxpayer is represented, the confidential taxpayer information waiver signed by the taxpayer specifically for that refund claim must be received by the department by the date the substantiation documents are first required, without regard to any extensions. If the signed confidential taxpayer information waiver for the refund claim lists the representative as an entity, every member or employee of that entity is authorized to represent the taxpayer. If the signed confidential taxpayer information waiver for the refund claim lists the representative as an individual, only that individual is authorized to represent the taxpayer.

(iii) If the nonclaim statute has run prior to the filing of the application, the department will deny the application and notify the taxpayer.

(iv) If the department determines that the taxpayer is not entitled to a refund as a matter of law, the application may be denied without requiring substantiation. The taxpayer shall be responsible for maintaining substantiation as may eventually be needed should taxpayer ((appeal)) seek review.

(v) The taxpayer is encouraged to file substantiation documents at the time of filing the application. However, once an application is filed, the taxpayer must submit sufficient substantiation to support the claim for refund or credit before the department can determine whether the claim is valid. The department will notify the taxpayer if additional substantiation is required. The taxpayer must provide the necessary substantiation within ninety days after such notice is sent, unless the documentation is under the control of a third party, not affiliated with or under the control of the taxpayer, in which case the taxpayer will have one hundred eighty days to provide the documentation. The department may request any other books, records, invoices or electronic equivalents and, where appropriate, federal and state tax returns to determine whether to accept or deny the claimed refund and to assess an existing deficiency.

(vi) In its discretion and upon good cause shown, the department may extend the period for providing substantiation upon its own or the taxpayer's request, which may not be unreasonably denied.

(vii) If the department does not receive the necessary substantiation within the applicable time period, the department shall deny the claim for lack of adequate substantiation and shall so notify the taxpayer. Any application denied for lack of adequate substantiation may be filed again with additional substantiation at any time before the time limits in subsection (2) of this ((section)) rule expire. Once the department determines that substantiation is sufficient, the department shall process the refund claim within ninety days, except that the department may extend the time of processing such claim upon notice to the taxpayer and explanation of why the claim cannot be completed within such time.

(viii) The following examples illustrate the refund application process:

(A) A taxpayer discovers in January 2005 that its June 2004 excise tax return was prepared using incorrect figures that overstated its sales, resulting in an overpayment of tax. The taxpayer files an amended June 2004 tax return with the department's taxpayer account administration division. The department will treat the taxpayer's amended June 2004 tax return as an application for a refund or credit of the amounts overpaid during that tax period, except that the taxpayer must also specifically identify the basis for the refund or credit and provide sufficient substantiation to support the claim for refund or credit. The taxpayer may satisfy this obligation by submitting a completed refund application form with its amended return or providing the additional required substantiation by other means.

(B) On December 31, 2005, a taxpayer files an amended return for the 2001 calendar year. The return includes changed figures indicating that an overpayment occurred, but does not provide any supporting substantiation. No written waiver of the time limits, under subsection (2)(c) of this ((section)) rule, for this time period exists. The department sends a letter notifying the taxpayer that the taxpayer's application is not complete and substantiation must be provided within ninety days or the application will be denied. If the taxpayer does not provide the necessary substantiation by the stated date, the claim will be denied and, if refiled, will not be granted because it is then past the nonclaim limit of the statute.

(C) Taxpayer submits a refund application on December 31, 2004, claiming that taxpayer overpaid use tax in 2000 on certain machinery and equipment obtained by the taxpayer at that time. No substantiation is provided with the application and no written waiver of the time limit, under subsection (2)(c) of this ((section)) rule, for this taxable period exists. The department sends a letter notifying the taxpayer that the taxpayer's application is not complete and substantiation must be provided within ninety days or the application will be denied. The taxpayer does not respond by the stated date. The claim will be denied and, if refiled, will not be granted since it is then past the nonclaim limit of the statute.

(D) Assume the same facts as in (b)(viii)(B) and (C) of this subsection, except that within ninety days from the date the department sent the letter the taxpayer submits substantiation, which the department deems sufficient. The taxpayer's claim is valid, notwithstanding that the substantiation was provided after the nonclaim limit expired.

(E) Assume the same facts as in (b)(viii)(B) and (C) of this subsection, except that before the ninety-day period expires, the taxpayer requests an additional fifteen days in which to respond, explaining why the substantiation will require the additional time to assemble. The department agrees to the extended deadline. If the taxpayer submits the requested substantiation within the resulting one hundred five-day period, the department will not deny the claim for failure to provide timely substantiation.

(F) Assume the same facts as in (b)(iii)(B) and (C) of this subsection, except that the taxpayer submits substantiation within ninety days. The department reviews the substantiation and finds that it is still insufficient. The department, in its discretion, may extend the deadline and request additional substantiation from the taxpayer or may deny the refund claim as not substantiated.

(4) May I get a refund of retail sales tax paid in error?