WSR 14-21-166

PROPOSED RULES

DEPARTMENT OF AGRICULTURE

[Filed October 22, 2014, 8:14 a.m.]

Original Notice.

Preproposal statement of inquiry was filed as WSR 13-22-081.

Title of Rule and Other Identifying Information: Chapter 16-610 WAC, Livestock brand inspection.

Hearing Location(s): Natural Resources Building, 1111 Washington Street S.E., First Floor, Conference Room 175, Olympia, WA 98504, on December 8, 2014, at 12:30 p.m.; and at Central Washington University, 400 East University Way, Sue Lombard Hall, Ellensburg, WA 98926, on December 9, 2014, at 11:00 a.m.

Date of Intended Adoption: December 30, 2014.

Submit Written Comments to: Teresa Norman, P.O. Box 42560, Olympia, WA 98504-2560, e-mail WSDARulesComments@agr.wa.gov, fax (360) 902-2092, by 5:00 p.m., December 9, 2014.

Assistance for Persons with Disabilities: Contact Washington state department of agriculture (WSDA) receptionist by December 1, 2014, TTY (800) 833-6388, or 711.

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: The department proposes to amend chapter 16-610 WAC to:

• | Eliminate the livestock inspection exemption for private sales of unbranded, female, dairy breed cattle involving fifteen head or less; |

• | Clarify the need for a certificate of permit to accompany transactions involving cattle not being moved out-of-state when presented for an inspection by the buyer; and |

• | Add the reference for the animal disease traceability (ADT) fee to the cost of custom slaughter beef tags. |

Reasons Supporting Proposal: ADT in Washington relies on data collected mainly from two existing WSDA programs - our livestock inspection and animal health programs. While the livestock inspection program was historically created to verify ownership and protect assets, the information gathered by the program has become crucial for tracking in-state animal movement, something that is key for traceability. Any exemption undermines the integrity of ADT and the fifteen head exemption knowingly leaves a big gap in traceability efforts, creating an unnecessary risk to our livestock industries.

Statute Being Implemented: Chapter 16.57 RCW.

Rule is not necessitated by federal law, federal or state court decision.

Name of Proponent: WSDA, governmental.

Name of Agency Personnel Responsible for Drafting and Implementation: Lynn Briscoe, Olympia, (360) 902-1804; and Enforcement: David Bangart, Olympia, (360) 902-1946.

A small business economic impact statement has been prepared under chapter 19.85 RCW.

Small Business Economic Impact Statement

SUMMARY OF PROPOSED RULES: WSDA livestock inspection program is proposing to amend chapter 16-610 WAC.

The livestock inspection program is dedicated to providing asset protection for the livestock industry by recording brands, licensing feedlots and public livestock markets, and by conducting surveillance and inspection of livestock at time of sale and upon out-of-state movement. The purpose of this chapter is to regulate and govern the livestock inspection program and livestock industry.

The proposed amendments to this chapter include:

• | Eliminate the livestock inspection exemption for private sales of unbranded, female, dairy breed cattle involving fifteen head or less; |

• | Clarify the need for a certificate of permit to accompany transactions involving cattle not being moved out-of-state when presented for an inspection by the buyer; |

• | Add the reference for the ADT fee to the cost of custom slaughter beef tags. |

SMALL BUSINESS ECONOMIC IMPACT STATEMENT (SBEIS): Chapter 19.85 RCW, the Regulatory Fairness Act, requires an analysis of the economic impact proposed rules will have on regulated businesses. Preparation of an SBEIS is required when proposed rules have the potential to impose more than minor costs on businesses.

"Minor cost" means a cost that is less than one percent of annual payroll or the greater of either .3 percent of annual revenue or $100.

"Small business" means any business entity that is owned and operated independently from all other businesses and has fifty or fewer employees.

INDUSTRY ANALYSIS: The proposed rule impacts businesses that fall under the North American Industry Classification System codes corresponding to the regulated industry: 112111, Cattle farming or ranching; 112120, Dairy cattle and milk production; 424520, Cattle merchant wholesalers.

INVOLVEMENT OF SMALL BUSINESSES: Small businesses have been involved in writing the proposed rules and in providing the department with the expected costs associated with the changes. The department has been working with industry members, discussing ADT and the removal of the fifteen head exemption since 2007. There have been a number of work sessions with industry members and presentations at industry meetings. Along with existing efforts, a small business economic impact assessment survey was mailed to five hundred two dairy producers and cattle dealers to analyze the economic impact of proposed rules on small businesses. WSDA analyzed how the removal of the fifteen head exemption would impact the dairy industry in the state.

COST OF COMPLIANCE: RCW 19.85.040 directs agencies to analyze the costs of compliance for businesses required to comply with the proposed rule.

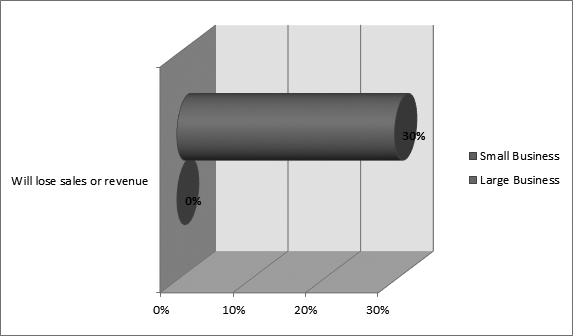

The program has analyzed the cost of compliance anticipated by regulated small businesses. Forty small businesses, three large businesses, and one unknown size business returned the small business economic impact survey. Seventy-eight percent of small businesses and thirty-three percent of the large businesses surveyed indicated that removing the fifteen head exemption would have an impact. Seventy-three percent of small businesses and thirty-three percent of large businesses indicated that they would need additional resources; eight percent of small businesses and zero percent of large businesses indicated that they would need to increase staff; and thirty percent of small businesses and zero percent of large businesses thought they may lose sales or revenue to comply with the laws.

The cost of a brand inspection on the class of cattle covered under the current fifteen head exemption is $1.60 per head ($24.00 for fifteen head).

JOBS CREATED OR LOST: Under RCW 19.85.040, agencies must provide an estimate of the number of jobs that will be created or lost as the result of compliance with the proposed rules.

In collecting information from representative small businesses through the survey the program estimates that eight percent of small businesses will need to increase their current staff by one or two employees to comply with the proposed changes.

DISPROPORTIONATE IMPACT TO SMALL BUSINESSES: RCW 19.85.040 directs agencies to determine whether the proposed rule will have a disproportionate cost impact on small businesses by comparing the cost of compliance for small business with the cost of compliance for the ten percent of the largest businesses required to comply with the proposed rules. Use one or more of the following as a basis for comparing costs:

• | Cost per employee; |

• | Cost per hour of labor; or |

• | Cost per one hundred dollars of sales. |

The program has opted to look at cost per one hundred dollars of sales as a basis for comparing costs. The program has analyzed the cost of compliance anticipated by regulated small businesses.

The following questions were asked and then charted for business that may experience impact from removing the fifteen head exemption language from chapter 16-610 WAC:

• | How much does your business expect to pay to comply with the rule? |

• | What kinds of resources will the business likely need i.e., equipment, supplies, labor, increased administrative costs or professional services? |

• | Will the business lose sales or revenue? If yes, how much revenue will be lost? |

• | Will the estimated cost of compliance be more than "minor" (defined as more than 3/10 of one percent of annual revenue; or more than $100; or more than one percent of annual payroll)? |

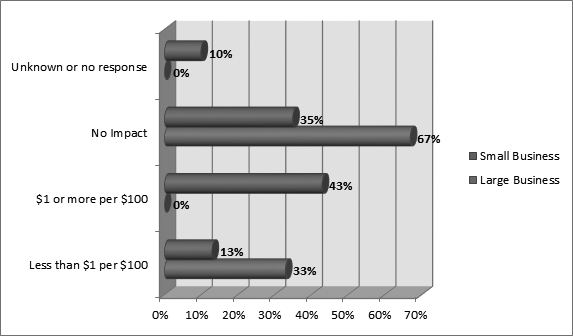

Question: How much does your business expect to pay to comply with the rule?

|

Question: What kinds of resources will the business likely need i.e., equipment, supplies, labor, increased administrative costs or professional services?

|

Question: Will the business lose sales or revenue?

|

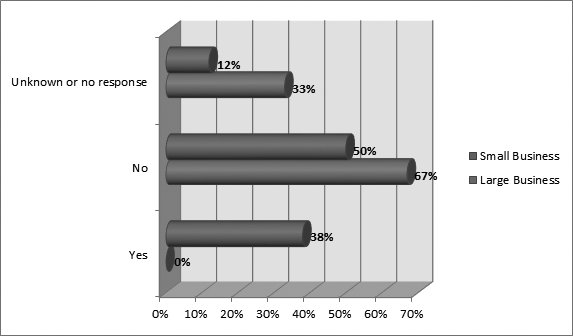

Question: Will the estimated cost of compliance be more than "minor" (defined as more than 3/10 of one percent of annual revenue; or more than $100; or more than one percent of annual payroll)?

|

CONCLUSION: To comply with chapter 19.85 RCW, the Regulatory Fairness Act, the livestock inspection program has analyzed the economic impact of the proposed rules on small businesses and has concluded that, depending upon the number of cattle sold per year, the costs may be more than minor (greater than $100.00), but there is no disproportionate impact between small and large businesses. The department will work with affected businesses for potential ways to mitigate costs for small businesses.

Please contact Dawn Grummer if you have any questions, (360) 902-1987, or by e-mail dgast@agr.wa.gov.

A copy of the statement may be obtained by contacting Dawn Grummer, P.O. Box 42560, Olympia, WA 98504-2560, phone (360) 902-1987, fax (360) 902-2087, e-mail dgast@agr.wa.gov.

A cost-benefit analysis is not required under RCW 34.05.328. WSDA is not a listed agency in RCW 34.05.328 (5)(a)(i).

October 22, 2014

Lynn M. Briscoe

Assistant Director

AMENDATORY SECTION (Amending WSR 10-21-016, filed 10/7/10, effective 11/7/10)

WAC 16-610-020 Cattle inspections for brands or other proof of ownership.

(1) All cattle must be inspected for brands or other proof of ownership:

(a) Before being moved out of Washington state, unless the provisions of WAC 16-610-035(2) apply.

(b) When offered for sale at any public livestock market or special sale approved by the director.

(c) Upon delivery to any cattle processing plant where the United States Department of Agriculture maintains a meat inspection program, unless the cattle:

(i) Originate from a certified feedlot; or

(ii) Are accompanied by an inspection certificate issued by the director, or a veterinarian certified by the director, or an agency in another state or Canadian province authorized by law to issue such a certificate.

(2) All cattle entering or reentering any certified feedlot licensed under chapter 16.58 RCW must be inspected for brands or other proof of ownership before commingling with other cattle unless the cattle are accompanied by an inspection certificate issued by the director, or a veterinarian certified by the director, or an agency in another state or Canadian province authorized by law to issue such a certificate.

(3) All cattle must be inspected for brands or other proof of ownership at any point of private sale, trade, gifting, barter, or any other action that constitutes a change of ownership((, except for individual private sales of unbranded female dairy breed cattle involving fifteen head or less)). For transactions involving cattle not being moved or transported out of Washington state:

(a) Cattle must be presented for an inspection within fifteen days from the date of the initial transaction and accompanied by a certificate of permit. It shall be the responsibility of the seller to notify the department immediately that a sale has occurred. It shall be the responsibility of the buyer to present the animals for inspection.

(b) Cattle sold for 4-H and FFA youth projects are exempt from the fifteen day inspection requirement and can be inspected, if not prior, when consigned to a terminal show.

(c) Until the earlier of January 1, 2016, or the date of notice that an electronic livestock movement reporting system is available for use, individual private sales of unbranded female dairy breed cattle involving fifteen head or less are exempt from the inspection requirement.

AMENDATORY SECTION (Amending WSR 07-14-057, filed 6/28/07, effective 7/29/07)

WAC 16-610-100 Identification of custom slaughtered animals.

(1) Any person presenting cattle for slaughter to a licensed custom slaughterer must give the custom slaughterer a completed certificate of permit. The certificate of permit documents the ownership of the animal at the time of slaughter.

(2) Any person licensed as a custom slaughterer must complete and attach a custom slaughter beef tag to each of the four quarters of all slaughtered cattle that are handled. In order to identify the owner of the carcass, these tags must remain attached to the quarters until the carcass is processed and the quarters are cut and wrapped.

(3) Only the department may provide custom slaughter beef tags to custom slaughterers. The fee for each set of four custom slaughter beef tags is one dollar and fifty cents plus the animal disease traceability fee owed to the department under chapter 16.36 RCW.

(4)(a) Custom meat facilities may accept carcasses of cattle slaughtered by the cattle owner only if a certificate of permit, signed by the owner, accompanies the carcass.

(b) Without a certificate of permit signed by the owner, custom meat facilities can only accept carcasses from mobile or fixed location custom farm slaughterers or officially inspected slaughter plants.