WSR 16-12-098

PROPOSED RULES

DEPARTMENT OF ECOLOGY

[Order 15-10—Filed May 31, 2016, 3:26 p.m.]

Supplemental notice to WSR 16-02-101.

Preproposal statement of inquiry was filed as WSR 15-19-115.

Title of Rule and Other Identifying Information: Ecology proposes a new rule (chapter 173-442 WAC, Clean air rule) and amendments to one existing rule (chapter 173-441 WAC, Reporting of emissions of greenhouse gases). Ecology initially filed a proposal in 2016, but withdrew the proposal to allow additional time for updating and refining the rule language in response to stakeholder input. This subsequent proposal addresses input from stakeholders. If you submitted a comment on the previous proposal, you will need to submit a new comment if you want ecology to include it in the record for this subsequent proposal. If your comment on the previous proposal has been addressed in the subsequent proposal, you do not need to resubmit your previous comment but are welcome to do so.

Hearing Location(s): Ecology is holding four public hearings on this rule proposal, one in western Washington, one in eastern Washington, and two webinars.

In-Person Hearings

The event will begin with a short presentation followed by a question and answer (Q&A) session. The hearing will start after the Q&A session and that is when ecology will accept oral comments. Staff will accept written comments at any time during the event. In-person hearings will conclude if no one has signed up to testify within thirty minutes of opening the hearing.

Eastern Washington - Evening

Date: Tuesday, July 12, 2016

Time: 6:00 p.m.

Location: The Davenport Grand Hotel

333 West Spokane Falls Boulevard

Spokane, WA 99201

Western Washington - Evening

Date: Thursday, July 14, 2016

Time: 6:00 p.m.

Location: The Red Lion Hotel

2300 Evergreen Park Drive S.W.

Olympia, WA 98502

Webinar Hearings

A webinar is an online forum accessible from any computer or smart phone with an internet connection. For more information about the webinar, and instructions on how to register and participate through the webinar, visit http://www.ecy.wa.gov/programs/air/rules/webinars.htm.

Evening Webinar

Date: Thursday, July 7, 2016

Time: 6:00 p.m.

Daytime Webinar

Date: Friday, July 15, 2016

Time: 10:00 a.m.

Ecology is offering the presentation, Q&A session, and public hearing, where we will accept oral comments, at this webinar. The webinar hearing will conclude if no one has signed up to testify within thirty minutes of opening the hearing.

For more information about the public hearings, visit our web site http://www.ecy.wa.gov/programs/air/rules/wac173442/1510inv.html.

Date of Intended Adoption: September 15, 2016 (on or after).

Submit Written Comments to: Sam Wilson, Department of Ecology, P.O. Box 47600, Olympia, WA 98504-7600, e-mail AQComments@ecy.wa.gov, fax (360) 407-7534, online submitted through the online comment tool http://www.ecy.wa.gov/climatechange/engagement.htm, by July 22, 2016.

Assistance for Persons with Disabilities: For special accommodations or documents in alternate format, call (360) 407-6800, 711 (relay service), or 877-833-6341 (TTY).

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: Ecology proposes a new rule (chapter 173-442 WAC, Clean air rule) and amendments to one existing rule (chapter 173-441 WAC, Reporting of emissions of greenhouse gases). Chapter 173-442 WAC will establish emission standards for greenhouse gas (GHG) emissions from certain stationary sources located in Washington state, petroleum product producers or importers, and natural gas distributors in Washington state. Parties covered under this program will reduce their GHG emissions over time. A wide variety of options to reduce emissions will be available.

Ecology will amend chapter 173-441 WAC as necessary to change the emissions covered by the reporting program, modify reporting requirements, and update administrative procedures to align with the new rule (chapter 173-442 WAC, Clean air rule). Ecology is no longer proposing to revise chapter 173-400 WAC as part of this rule making.

Reasons Supporting Proposal: The purpose of this rule making is to establish GHG emission standards for certain large emitters and reduce GHG emissions to protect human health and the environment. Over the past century, GHG emissions from human activity have risen to unprecedented levels, increasing the average global temperature and the ocean's acidity. Washington has experienced long-term climate change impacts consistent with those expected from climate change. Our state faces serious economic and environmental disruption from the effects of these long-term changes including:

• | An increase in pollution-related illness and death due to poor air quality; |

• | Declining water supply for drinking, agriculture, wildlife, and recreation; |

• | An increase in tree die-off and forest mortality because of increasing wildfires, insect outbreaks, and tree diseases; |

• | The loss of coastal lands due to sea level rise; |

• | An increase in ocean temperature and acidity; |

• | An increase in disease and mortality in freshwater fish (salmon, steelhead, and trout), because of warmer water temperatures in the summer and more fluctuation of water levels (river flooding and an increase of water flow in winter while summer flows decrease); and |

• | Elevated heat stress to field crops and tree fruit due to an increase in temperatures and a decline in irrigation water. |

Compliance actions to reduce GHG emissions, such as producing cleaner energy and increasing energy efficiency, potentially have the dual benefit of reducing other types of air pollution.

In 2008, Washington's legislature required the specific statewide GHG reductions (RCW 70.235.020) below.

• | By 2020, reduce overall emissions of GHGs in the state to 1990 levels. |

• | By 2035, reduce overall emissions of GHGs in the state to twenty-five percent below 1990 levels. |

• | By 2050, reduce overall emissions of GHGs in the state to fifty percent below 1990 levels or seventy percent below the state's expected emissions that year. |

Consistent with the legislature's intent to reduce GHG emissions, ecology is using its existing authority under the Washington Clean Air Act to adopt a rule that limits emissions of GHGs.

Rule is necessary because of state court decision, [King County Superior Court No. 14-2-25295-1].

Agency Comments or Recommendations, if any, as to Statutory Language, Implementation, Enforcement, and Fiscal Matters: Under RCW 70.94.331, ecology may adopt rules establishing emission standards for types of emissions or types of sources of emissions, or a combination of these.

Chapter 173-442 WAC is intended to establish emission standards for GHG emissions from certain stationary sources located in Washington state, petroleum product producers or importers, and natural gas distributors in Washington state.

Ecology has made a preliminary determination that it is in the public interest and will best protect the public welfare of the state if chapter 173-442 WAC is implemented and enforced statewide solely by ecology because:

• | The covered parties regulated by the rule are located throughout the state; and |

• | As the agency that crafted the rule, ecology is in the best position to ensure that the rule is implemented and enforced as intended; and |

• | As a single agency, ecology can ensure that the rule is consistently implemented and enforced statewide. |

Sole jurisdiction establishes a single regulating entity for business owners to interact with and provides greater confidence that regulatory determinations are made on an objective, impartial, and consistent basis.

Ecology is accepting comments on this issue during the formal public comment period, which ends on July 22, 2016.

Name of Proponent: Department of ecology, air quality program, governmental.

Name of Agency Personnel Responsible for Drafting: Neil Caudill, Olympia, Washington, (360) 407-6811 and Bill Drumheller, Olympia, Washington, (360) 407-7657; Implementation and Enforcement: Air Quality Program, Olympia, Washington, (360) 407-6000.

A small business economic impact statement has been prepared under chapter 19.85 RCW.

Small Business Economic Impact Statement

Executive Summary: Based on research and analysis required by the Regulatory Fairness Act (RFA), RCW 19.85.070, ecology has determined that the proposed rule, the clean air rule (chapter 173-442 WAC) and corresponding amendments to the reporting of emissions of GHGs rule (chapter 173-441 WAC) are not likely to have a disproportionate impact on small businesses.

RFA directs ecology to determine if there is likely to be disproportionate impact, and if legal and feasible, to reduce this disproportionate impact.

The proposed rule creates a program that limits and reduces GHG emissions from certain large emission contributors, referred to as covered parties, and allowing various compliance options to meet those limitations. It also includes reporting and verification of compliance.

The proposed rule establishes GHG emissions standards for:

• | Stationary sources. |

• | Petroleum product producers and/or importers. |

• | Natural gas distributors operating in Washington state. |

At the highest ownership or control level, the proposed rule is not likely to impact small businesses, defined by RFA as having fifty or fewer employees. This means that we are unable to make the comparison of per-employee compliance costs at small versus large businesses required by RFA. It also means that the proposed rule inherently is not likely to impose disproportionate costs on small businesses.

The range of employment at the highest level of ownership available for fuel importers likely covered by the proposed rule is between fifty-one - two hundred (only range available for parent entity) and eight hundred forty-five thousand (importer also covered as a stationary source and producer).

Depending on the compliance methods chosen, the proposed rule could result in between a loss of five hundred forty-four ongoing positions for twenty years (if covered parties reduce emissions using allowances from outside of the state), and a gain of nearly four thousand ongoing positions (if covered parties reduce emissions on site in the state).

Chapter 1: Background and Introduction:

1.1 Introduction: Based on research and analysis required by RFA, RCW 19.85.070, ecology has determined that the proposed rule, the clean air rule (chapter 173-442 WAC) and corresponding amendments to the reporting of emissions of GHGs rule (chapter 173-441 WAC) are not likely to have a disproportionate impact on small businesses.

RFA directs ecology to determine if there is likely to be disproportionate impact, and if legal and feasible, to reduce this disproportionate impact.

The small business economic impact statement (SBEIS) is intended to be read with the associate[d] cost-benefit and least-burdensome alternative analyses (Ecology Publication No. 16-02-008), which contains more in-depth discussion of the proposed rule and compliance costs.

1.2 Summary of the proposed rule: The proposed rule creates a program that limits and reduces GHG emissions from certain large emission contributors, referred to as covered parties, and allowing various compliance options to meet those limitations. It also includes reporting and verification of compliance.

The proposed rule establishes GHG emissions standards for:

• | Stationary sources. |

• | Petroleum product producers and/or importers. |

• | Natural gas distributors operating in Washington state. |

If they meet GHG emissions thresholds that begin at one hundred thousand metric tons (MT) per year of carbon dioxide equivalent emissions in 2017, these parties have a compliance obligation to limit and reduce GHG emissions over time, through 2035. They must afterward maintain the reduction achieved in 2035. The threshold for coverage under the proposed rule drops five thousand MT every three years through 2035, increasing the number of covered parties over time.

Covered parties with compliance obligations under the proposed rule must report compliance after every three-year compliance period, and have compliance verified by a third party. They have various options for compliance, including:

• | Reducing their own GHG emissions. |

• | Acquiring emissions reduction units from another covered party that has reduced GHG emissions in excess of what is required of them. |

• | Acquiring or generating emissions reduction units from approved GHG reduction projects in Washington state. |

• | Generating emission reduction units from approved GHG reduction programs in Washington, such as acquiring renewable energy credits (REC). |

• | Acquiring emissions reduction units from nonregulated parties that voluntarily participate. |

• | Purchasing allowances from established multisector carbon markets as approved by ecology. |

1.3 Reasons for the proposed rule: The reason for this proposed rule is to reduce GHG emissions to protect human health and the environment. GHG emissions as a result of human activities have increased to unprecedented levels, warming the climate.1 Washington has experienced long-term climate change impacts consistent with those expected from climate change.2 Washington faces serious economic and environmental disruption from the effects of these long-term changes.

1 IPCC, 2013: Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change [Stocker, T.F., D. Qin, G.-K. Plattner, M. Tignor, S.K. Allen, J. Boschung, A. Nauels, Y. Xia, V. Bex and P.M. Midgley (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA, 1535 pp.

2 Snover, A.K, G.S. Mauger, L.C. Whitely Binder, M. Krosby, and I. Tohver. 2013. Climate Change Impacts and Adaptation in Washington State: Technical Summaries for Decision Makers. State of Knowledge Report prepared for the Washington State Department of Ecology. Climate Impacts Group, University of Washington, Seattle.

For instance:

• | An increase in pollution-related illness and death due to poor air quality. |

• | Declining water supply for drinking, agriculture, wildlife, and recreation. |

• | An increase in tree die-off and forest mortality because of increasing wildfires, insect outbreaks, and tree diseases. |

• | The loss of coastal lands because of sea level rise. |

• | An increase in ocean temperature and ocean acidification. |

• | An increase in disease and mortality in freshwater fish (salmon, steelhead, and trout), because of warmer water temperatures in the summer and more fluctuation of water levels (river flooding and an increase of water flow in winter while summer flows decrease). |

• | Heat stress to field crops and tree fruit will be more prevalent because of an increase in temperatures and a decline in irrigation water. |

Compliance actions to reduce GHG emissions, such as producing cleaner energy and increasing energy efficiency, have the dual benefit of reducing other types of air pollution.

In 2008, Washington's legislature required the specific statewide GHG emission reductions (RCW 70.235.020) below:

• | By 2020, reduce overall emissions of GHGs in the state to 1990 levels. |

• | By 2035, reduce overall emissions of GHGs in the state to twenty-five percent below 1990 levels. |

• | By 2050, reduce overall emissions of GHGs in the state to fifty percent below 1990 levels or seventy percent below the state's expected emissions that year. |

Consistent with the legislature's intent to reduce GHG emissions, ecology is using its existing authority under the state Clean Air Act (chapter 70.94 RCW) to adopt a rule that limits GHG emissions.

Chapter 2: Analysis of Compliance Costs for Washington Businesses:

2.1 Introduction: Ecology analyzed the impacts of the proposed rule relative to business as usual (BAU), within the context of all existing requirements (federal and state laws and rules). This context for comparison is called BAU, and reflects the most likely regulatory circumstances that parties would face if the proposed rule were not adopted. It is discussed in Section 2.2, below.

2.2 BAU: BAU for our analyses generally consists of existing rules and laws, and their specific requirements. For economic analyses, BAU also includes the implementation of those regulations, including any guidelines and policies that result in behavior changes and real impacts. This is what allows us to make a consistent comparison between conditions that exist with or without the proposed new rule (chapter 173-442 WAC) and proposed amendments to the existing GHG reporting rule (chapter 173-441 WAC).

For this proposed rule making, BAU includes:

• | No existing GHG cap and reduction program at the state level. |

• | The existing GHG reporting rule (chapter 173-441 WAC), which covers a subset of the parties covered by the proposed rule, and requires annual reporting and payment of fees. |

• | The federal and Washington state clean air acts. |

• | Existing federal and state regulations, including those covering GHG reporting at the federal level, as well as those establishing energy policy. |

• | Existing federal and state permitting requirements and processes. |

While they might otherwise have been considered part of BAU, the proposed rule explicitly exempts compliance with Washington's emissions performance standard (chapter 80.80 RCW) requirements from being considered part of BAU. The state's carbon dioxide mitigation standard and commute trip reduction programs are also excluded.

The proposed rule also considers future compliance with state implementation of the federal clean power plan (CPP) as compliance with proposed rule requirements. However, since the state has not yet completed rule making determining the specific requirements of the CPP, and since the CPP is currently being held in a stay by the supreme court, we exclude its requirements from the BAU in this analysis. This means that impacts estimated in this analysis are likely overestimated for power producers that will be required to comply with the CPP.

2.3 Proposed rule requirements:

2.3.1 Clean air rule coverage: The proposed rule establishes standards for limiting and reducing GHG emissions for:

• | Certain stationary sources. |

• | Petroleum product producers or importers. |

• | Natural gas distributors in Washington state. |

2.3.2 Thresholds for compliance obligation under the proposed rule:

2.3.2.1 Existing emitters: If their covered GHG emissions are at least one hundred thousand MT per year, in carbon dioxide-equivalent units (CO2e), parties with covered GHG emissions must comply with the proposed rule starting in 2017. Emissions used for threshold comparisons are determined using a baseline emissions calculation based on past emissions during 2012 – 2016, or other relevant emissions data.

2.3.2.2 New emitters: The parties with covered GHG emissions must comply with the proposed rule starting in their first year of operation, if they exceed the following thresholds:

• | 100,000 MT per year in years 2017 through 2019. |

• | 95,000 MT per year in years 2020 through 2022. |

• | 90,000 MT per year in years 2023 through 2025. |

• | 85,000 MT per year in years 2026 through 2028. |

• | 80,000 MT per year in years 2029 through 2031. |

• | 75,000 MT per year in years 2032 through 2034. |

• | 70,000 MT per year in 2035 and thereafter. |

2.3.3 Clean air rule requirements: The proposed rule establishes the following requirements not required elsewhere in existing laws or rules:

• | GHG emissions standards and reductions over time. |

• | Compliance reporting. |

• | Verification of compliance. |

• | Development of an emissions reduction registry and reserve. |

2.3.4 Clean air rule compliance: Covered parties with compliance obligations, may comply with the proposed rule by reducing emissions in any of the following ways:

• | Own emissions reductions: Reduction of a covered party's own emissions below the emissions level set in the covered party's reduction pathway. |

• | Others' emissions reductions: Other parties' reductions of emissions below their emissions reduction pathways. Reductions can also come from those voluntarily participating in the program. |

• | Emissions reduction projects: Emissions reductions using projects, activities, or programs recognized by ecology as capable of generating emissions reduction units under the proposed rule. |

o | Emission reductions from projects can come from ownership of a project or from GHG credits available in markets for environmental commodities. |

o | Emission reductions from programs can come from several state-run programs, including acquiring RECs, i.e., existing energy credits generated by power producers using renewable energy production. |

• | External emissions markets: A covered party may use allowances when ecology determines the allowances are issued by an established multisector GHG emission reduction program, the covered party is allowed to purchase allowances within that program, and the allowances are derived from methodologies congruent with chapter 173-441 WAC. |

2.3.5 Corresponding amendments to other rules: Ecology is also proposing amendments to chapter 173-441 WAC (Reporting of emissions of greenhouse gases). These amendments correspond to and facilitate requirements and compliance set by the proposed rule. They include, but are not limited to, reallocation of fees:

• | The existing GHG emissions reporting rule (chapter 173-441 WAC) requires seventy-five percent of the reporting program's budget be paid for through facility reporter fees and twenty-five percent to be paid for through transportation fuel supplier reporter fees. |

• | The proposed rule reallocates fees based on full payment by covered facilities, and sets a zero fee for transportation fuel suppliers. It also removes the obligation for voluntary reporters to pay the fee. |

2.4 Likely compliance costs of the proposed rule: In the associated preliminary cost-benefit analysis, we estimated the likely costs associated with the proposed rule, as compared to BAU. Likely twenty year present value (if quantified) costs included:

• | Average twenty year present value cost of permanent reductions is between approximately $1.3 billion and $2.8 billion. |

• | Average twenty year present value cost of reductions going toward the reserve is between approximately $30 million and $62 million. |

• | Twenty year present value reporting costs of approximately $384,000. |

• | Twenty year present value verification costs of between approximately $33 million and $34 million. |

• | Twenty year present value costs of increased reporting fees of between approximately $2 million and $3 million. |

Quantified external present-value costs, taking average emission reduction costs across multiple scenarios, total between $1.4 billion and $2.8 billion over twenty years.

2.5 Potential lost sales or revenue: Depending on the methods used by covered parties to reduce GHG emissions, the proposed rule may result in reduced sales for some covered parties, or other areas of the state economy. Energy efficiency projects, for example, would reduce GHG emissions by reducing energy consumption. This would reduce sales (quantities) for energy producers, but could also result in changes to energy prices (e.g., passing on regulatory costs to customers). Similarly, transportation-related methods would reduce GHG emissions by reducing fuel consumption. This would also reduce sales (quantities) for fuel suppliers, but could also result in changes to fuel prices. Reductions in fuels from one source could also be counterbalanced by increases in fuels from another source, to meet market demand.

As a result of possible shifts such as these in demand and production, ecology also expects prices to change. Depending on the relative elasticities (responsiveness of the quantity of a good supplied or demanded, relative to changes in price) of covered parties' supply and demand, overall revenues may increase or decrease as a result of these changes in demand and production. See Appendix A of the preliminary cost-benefit and least burdensome alternative analyses for more information.

Ecology could not confidently identify the mix of on-site (internal), project-based, or market acquisition-based GHG emissions reduction methods that covered parties would choose under the proposed rule, and so could not quantify the degree to which sales quantities would be impacted.

Chapter 3: Quantification of Cost Ratios:

3.1 Introduction: For this analysis, ecology must estimate and compare the compliance costs per employee at small versus large covered partiers (the largest ten percent). In this chapter, we describe the affected covered parties' employment. Employment numbers are taken at the highest ownership level, to better reflect ability to incorporate compliance costs in business-wide decision making.

At the highest ownership or control level, the proposed rule is not likely to impact small businesses, defined by RFA as having fifty or fewer employees. This means that we are unable to make the comparison of per-employee compliance costs at small versus large businesses required by RFA. It also means that the proposed rule inherently is not likely to impose disproportionate costs on small businesses.

This information is, however, based on our best knowledge of likely covered parties at the time of this publication. While we are relatively certain of the facilities and fuel suppliers affected by the rule making, there is more uncertainty about the likely fuel importers that would be covered. Section 3.2 discusses this in greater depth.

3.2 Affected businesses: Ecology determined which businesses would likely be required to comply with the proposed rule and associated rule changes. For the proposed rule, these covered parties include stationary sources, petroleum fuel producers and importers, and natural gas distributors, and for associated rule changes to the reporting fee distribution, they also include transportation fuel suppliers.

Parties are generally affected as follows:

• | Covered parties incur costs under the proposed rule and associated fee changes. |

• | Transportation fuel suppliers are affected by associated changes to fees, and for these parties, fees are likely to decrease. These parties do not incur costs under the rule making. |

Covered parties likely to incur costs under the proposed rule are in a variety of industries (see Chapter 6 for NAICS codes), including but not limited to some energy producers, fuel importers and commodity traders, fuel producers, chemical and metals manufacturers, pulp and paper manufacturers, food producers, natural gas distributors, and waste facilities.

The range of employment at the highest level of ownership available for parties covered by the proposed rule, excluding importers, is between one hundred sixty (parent company employment information unavailable) and 845,000.3

3 Covered party web sites, third-party data bases such as D&B and Manta, annual reports, WA Employment Security Department records.

The range of employment at the highest level of ownership available for fuel importers likely covered by the proposed rule is between fifty-one - two hundred (only range available for parent entity) and eight hundred forty-five thousand (importer also covered as a stationary source and producer).4

4 Ibid.

3.3 Cost-to-employee ratios: The proposed rule and associated proposed rule amendments do not impose costs on small businesses. The proposed rule, therefore, does not impose disproportionate costs on small businesses, and RFA does not require ecology to include elements in the proposed rule that reduce disproportionate impact.

Chapter 4: Actions Taken to Reduce the Impact of the Rule on Small Businesses: Ecology determined the proposed rule is not likely to impose disproportionate costs on small businesses, because it does not create costs for identifiable small businesses (see Chapter 3). RFA, therefore, does not require ecology to mitigate this disproportionate impact to the degree that it is both legal and feasible.

Chapter 5: Involvement of Small Businesses and Local Government in the Development of the Proposed Rule: Ecology involved small businesses or their representatives in the development of the proposed rule, as well as local governments. Ecology held five webinars during the development of the proposed rule. Their attendees/participants included multiple representatives of local governments and small businesses (directly or as part of associations), as well as legislators representing the local and business interests of their constituencies. Below is a list of attendees of these webinars, as well as participants in smaller meetings held with ecology or the Washington state governor's office.

Parties represented or representing at ecology webinars and forums:

• | Access Institute of Research |

• | AEQUUS Corp. |

• | AGC of WA |

• | Agrium US Inc. |

• | Alcantar & Kahl |

• | Alcoa |

• | Ameresco |

• | American Carbon Registry |

• | American Fuel & Petrochemical Manufacturers |

• | American Lung Association |

• | Arbaugh & Associates, Inc. |

• | Ardargh Glass Inc. |

• | Argus Media |

• | Ash Grove Cement |

• | Assoc. WA Business |

• | ATI |

• | Avista Corp. |

• | Barr Engineering Co. |

• | Benton Clean Air Agency |

• | Benton PUD |

• | BHAS |

• | BlueGreen Alliance |

• | BNSF Railway |

• | Boeing |

• | Boise Cascade Wood Products, LLC |

• | Boise Paper |

• | Bonneville Power Administration |

• | BP |

• | Bridgewater Group Inc. |

• | Canadian Consulate General |

• | Capitol Strategies |

• | Carney Badley Spellman, PS |

• | Cascade Government Affairs |

• | Cascade Natural Gas Corporation, a Div. of MDU Resources Group |

• | Cascadia Law Group PLLC |

• | CH2M |

• | Chelan County PUD |

• | Chevron Corporation |

• | City of Everett |

• | City of Spokane |

• | City of Walla Walla |

• | Clark Public Utilities |

• | Clean Energy |

• | Climate Action Reserve |

• | Climate Change for Families |

• | Climate Solutions |

• | Coalition for Renewable Natural Gas, Inc. |

• | Communico |

• | Community Transit |

• | ConAgra Foods |

• | Concrete Nor'West |

• | Cowlitz County Public Works |

• | Cowlitz PUD |

• | Coyne, Jesernig, LLC |

• | Cyan Strategies |

• | Dave Bradley |

• | Davis Wright Tremaine LLP |

• | Davison Van Cleve PC |

• | Del Monte Foods Inc. |

• | Department of Commerce |

• | Department of Corrections |

• | Department of Ecology |

• | Diane L. Dick |

• | DNR |

• | EES Consulting |

• | Emerald Kalama Chemical, LLC |

• | Energy Northwest |

• | Energy Strategies LLC |

• | Environmental Energy |

• | Environmental Entrepreneurs |

• | Enwave Seattle |

• | ERA Environmental Management Solutions |

• | ERM |

• | Evergreen Carbon |

• | ExxonMobil |

• | Fairchild AFB |

• | Federal Government (Air Force) |

• | Flint Hills Resources, LP |

• | Fluor Corporation |

• | Forterra |

• | Friends of Toppenish Creek |

• | Frito Lay |

• | Georgia-Pacific |

• | GHG Management Institute |

• | Go Green Tri-Cities |

• | Gordon Thomas Honeywell Governmental Affairs |

• | Government of British Columbia |

• | Grant County Economic Development Council |

• | Grant County PUD |

• | Grant County Solid Waste |

• | Graymont |

• | Grays Harbor Energy |

• | Grays Harbor PUD |

• | Hammerschlag & Co. LLC |

• | Hampton Affiliates |

• | HDR Engineering |

• | House of Representatives |

• | House Republican Caucus |

• | ICIS |

• | Intalco Aluminum Corporation |

• | Interfor |

• | Invenergy LLC |

• | James Lester Adcock |

• | Janicki Bioenergy |

• | JR Simplot Company |

• | Julia Robinson |

• | Kaiser Aluminum |

• | King County |

• | King County Solid Waste |

• | Kinross |

• | KUOW News Radio |

• | Lamb Weston |

• | LCSC |

• | League of Women Voters |

• | Linde |

• | Linear Technology |

• | Local2020 |

• | LWVWA |

• | MFSA |

• | Naval Base Kitsap Bangor |

• | NAVFAC Northwest |

• | NCASI |

• | NextEra Energy |

• | Nippon Paper Industries |

• | Noble Americas Gas & Power |

• | Northwest Clean Air Agency |

• | Northwest Food Processors Assn. |

• | Northwest Gas Association |

• | Northwest Pulp & Paper Assn. |

• | NRDC |

• | Nucor Steel Seattle, Inc. |

• | NW Energy Coalition |

• | NW Natural |

• | NW Power and Conservation Council/WA Dept. of Commerce, Energy Office |

• | NW Seaport Alliance |

• | NWFPA |

• | OFM |

• | ONRC - SEFS U of W |

• | ORCAA |

• | Oregon DEQ |

• | Pacific Power |

• | PacifiCorp |

• | Parametrix |

• | Perkins Coie |

• | Phillips 66 |

• | PIRA Energy Group |

• | Plug In America |

• | Ponderay Newsprint Co. |

• | Port of Seattle |

• | PPRC |

• | PT AirWatchers |

• | Puget Sound Clean Air Agency |

• | Puget Sound Energy |

• | Puget Sound Regional Council |

• | Rainier Veneer, Inc. |

• | Ramboll Environ |

• | ravel |

• | RE Sources for Sustainable Communities |

• | REC Silicon |

• | REG |

• | Renewable Northwest |

• | Rep. Derek Kilmer |

• | Republic Services |

• | RNG Coalition |

• | Ross Strategic |

• | Rowley Properties, Inc. |

• | s2 sustainability consultants |

• | Saltchuk |

• | Schwabe, Williamson & Wyatt |

• | Schweitzer engineering laboratories |

• | SCS Engineers |

• | Seattle Aquarium |

• | Seattle City Light |

• | Seattle Public Utilities |

• | SEH America, Inc. |

• | SEI-US |

• | SGL Automotive Carbon Fibers |

• | Shell |

• | Shuttle Express |

• | Sierra Club |

• | Sightline |

• | Snohomish County |

• | Snohomish County Public Works |

• | Snohomish PUD |

• | Sonoco |

• | Sound Transit |

• | Southshore Environmental, Inc. |

• | Southwest Clean Air Agency |

• | Spectrum Glass |

• | Spokane Audubon Society |

• | Spokane Regional Clean Air Agency |

• | Spring Environmental, Inc. |

• | Ste. Michelle Wine Estates |

• | Stockholm Environment Institute |

• | Stoel Rives |

• | Strategies 360 |

• | SWCAA |

• | Tacoma Power |

• | Terre-Source LLC |

• | Tesoro |

• | The Climate Trust |

• | The Evergreen State College |

• | The News Tribune |

• | The Northwest Seaport Alliance |

• | The TSB Group |

• | Thompson Consulting Group |

• | Tidewater Barge Lines |

• | TransAlta |

• | TransCanada |

• | Transportation Choices |

• | Trinity Consultants |

• | True North Public Affairs |

• | Tyson Foods, Inc. |

• | U.S. Department of Energy |

• | Union of Concerned Scientists |

• | United Steelworkers Local 338 |

• | University of Washington |

• | Valero |

• | Van Ness Feldman, LLP |

• | Vitol Inc. |

• | WA Food Industry Assn. |

• | WA Oil Marketers Assn. |

• | WA PUD Association |

• | WaferTech, LLC |

• | Washington Environmental Council |

• | Washington Oil Marketers Association |

• | Washington State House of Representatives |

• | Washington State House Republican Caucus |

• | Washington State Legislature |

• | Washington State Senate |

• | Washington State Senate Committee Services |

• | Washington State University |

• | Washington Trucking Associations |

• | Waste Connections |

• | Waterside Energy |

• | WCV |

• | Western Pneumatic Tube Co. LLC |

• | Western Power Trading Forum |

• | Western States Petroleum Association |

• | Western Washington University |

• | WestRock |

• | Weyerhaeuser |

• | WFPA |

• | William H. Wilson, P.E. - Engineering Consulting |

• | Williams |

• | Williams, Northwest Pipeline LLC |

• | WSU Energy Program |

• | WSU Extension |

• | WY |

• | Yakima Regional Clean Air Agency |

Individual or group stakeholder meetings (some including the office of the governor) with:

• | Alaska Airlines |

• | Alcoa |

• | Alliance (Labor, Health, environmental advocates, social equality advocates) |

• | Ashgrove Cement |

• | Asian Pacific Islander Coalition |

• | Association of Washington Business (AWB) |

• | Avista |

• | Boeing |

• | BNSF Railway |

• | British Petroleum |

• | California Air Resources Board |

• | Clark PUD |

• | Clean Tech Alliance |

• | Climate Solutions |

• | Community to Community |

• | Coyne, Jesernig, LLC |

• | Duwamish River Cleanup Coalition/TAG |

• | Friends of Toppenish Creek |

• | Front & Centered |

• | Got Green? |

• | Grays Harbor Energy Center |

• | Green Diamond |

• | House Representative Richard DeBolt |

• | Industrial Customer of Northwest Utilities (ICNU) |

• | Kaiser Aluminum |

• | King County Council |

• | Klickitat PUD |

• | Latino Community Fund |

• | NextGen |

• | Northwest Energy Coalition |

• | Northwest Pulp and Paper Association |

• | Nucor Steel Seattle, Inc. |

• | OneAmerica |

• | PacifiCorp |

• | Phillips 66 |

• | Public Generating Pool |

• | Puget Sound Energy |

• | Puget Sound Sage |

• | Republic |

• | Renewable NW |

• | Renewable Products Marketing Group |

• | Shell |

• | Sierra Club |

• | Snohomish PUD |

• | Stockholm Environment Institute |

• | Stoel Rives, LLP |

• | Tacoma Power |

• | Tesoro |

• | TransAlta |

• | Tulalip Tribes |

• | Union of Concerned Scientists |

• | U.S. Oil & Refining Co. |

• | Valero Energy |

• | Washington Can! |

• | Washington Environmental Council |

• | Washington Physicians for Social Responsibility |

• | Washington PUD Association |

• | Western States Petroleum Association |

• | Weyerhaeuser |

Ecology also briefed the directors of the seven local clean air agencies on the rule, during a meeting of the Washington air quality manager group.

Chapter 6: The SIC Codes of Impacted Industries: The SIC (standard industry classification) system has long been replaced by the North American Industry Classification System (NAICS). The proposed rule applies to the following NAICS for stationary sources and fuel suppliers. The covered NAICS for fuel importers is more difficult to encompass, as fuel importers may be independent, but may also be part of businesses or other entities that perform other primary functions. This broadens the list of possibly affected NAICS to at least the set of 4-digit NAICS codes, and their underlying 5+ digit codes, below.

Table 1: Likely affected business NAICS codes

2111 |

3241 |

3274 |

3344 |

4247 |

4841 |

2211 |

3253 |

3311 |

3364 |

4451 |

4862 |

3114 |

3272 |

3313 |

4246 |

4471 |

5622 |

3221 |

3273 |

3314 |

4247 |

4543 |

6113 |

Chapter 7: Impacts on Jobs: Ecology used the Washington state office of financial management's 2007 Washington input-output model5 (OFM-IO) to estimate the proposed rule's impact on jobs across the state. This includes direct, indirect, and induced (from spending of wages) jobs impacts. This methodology estimates the impact as reductions or increases in spending in certain sectors of the state economy flow through to purchases, suppliers, and demand for other goods. Direct compliance costs incurred by an industry are entered in the OFM-IO model as a decrease in spending and investment. If that compliance cost money is spent in another industry, it is entered in the model as an increase in production.6

5 WA Office of Financial Management (2007). Washington state input-output model. http://www.ofm.wa.gov/economy/io/2007/default.asp.

6 Costs that are passed through to customers are indirectly represented in this analysis; direct compliance costs are incurred by the covered entities, and not offset by price increases. Models directly representing costs that are passed through to consumers would still include the offsetting spending on on-site (internal) or project-based GHG emissions reductions, but would reduce spending across a basket of goods purchased by consumers instead of reducing output at the basket of covered entities. This type of modeling would have impacts consistent with the results above.

Cost-savings resulting from GHG emissions reduction projects that improve efficiency, or those that may benefit the public through reduced energy spending are not included in this modeling. Models representing these cost-savings would reduce negative impacts to the economy, by reducing net compliance costs for covered entities, or reducing net costs to consumers, or both. Because we could not quantify the expected cost-reductions resulting from efficiency projects, or how many such projects would be undertaken, we could not quantitatively include these cost-savings in this modeling.

Ecology estimated jobs impacts (full-time employees; FTEs), for various scenarios of how covered parties comply with the proposed rule, using high-end compliance costs of reducing carbon emissions. Because some categories of covered party contained multiple industries, we conservatively estimated net jobs impacts by assuming costs were borne by the industry with the largest jobs impact per dollar of cost, and transfers (if any) were gained by the industry with the lowest jobs impact per dollar of cost. We translated them to equivalent numbers of ongoing positions.

Depending on the compliance methods chosen, the proposed rule could result in:7

7 Note that this model does not allow for impacts of pass-through costs, shifts in demand resulting from efficiency improvements, or macroeconomic variables.

• | A net gain of three thousand nine hundred eighty-eight equivalent ongoing positions, if covered parties reduce emissions on site, and those payments are transferred to in-state engineering services. |

• | A net loss of forty-three equivalent ongoing positions, if covered parties reduce emissions using in-state projects, assuming those payments are transferred to the industries of registered project developers with the lowest positive jobs impacts (to maintain conservatively high potential job loss estimates). |

• | A net loss of five hundred forty-four equivalent ongoing positions, if covered parties reduce emissions using market allowances, assuming those payments are fully transferred out-of-state. |

• | If covered parties reduce emissions using RECs: |

o | A net loss of four hundred forty-eight equivalent ongoing positions, if payments are transferred to parties out-of-state. |

o | A net gain of one hundred forty-two equivalent ongoing positions, if payments are transferred to utilities in the state. |

These impacts are estimated using high-end twenty year present value compliance costs, and baseline emissions based on reported GHG emissions to date. They exclude minor contributions of reporting and verification costs. Real jobs impacts will likely result from a combination of compliance through on-site, project, and market GHG emissions reductions, and will be within this range of jobs impacts.

A copy of the statement may be obtained by contacting Kasia Patora, Economics and Regulatory Research, Department of Ecology, P.O. Box 47600, Olympia, WA 98504-7600, phone (360) 407-6184, fax (360) 407-6989, e-mail Kasia.Patora@ecy.wa.gov.

A cost-benefit analysis is required under RCW 34.05.328. A preliminary cost-benefit analysis may be obtained by contacting Kasia Patora, Economics and Regulatory Research, Department of Ecology, P.O. Box 47600, Olympia, WA 98504-7600, phone (360) 407-6184, fax (360) 407-6989, e-mail Kasia.Patora@ecy.wa.gov.

May 31, 2016

Polly Zehm

Deputy Director

AMENDATORY SECTION (Amending WSR 15-04-051, filed 1/29/15, effective 3/1/15)

WAC 173-441-020 Definitions.

The definitions in this section apply throughout this chapter unless the context clearly requires otherwise.

(1) Definitions specific to this chapter:

(a) "Biomass" means nonfossilized and biodegradable organic material originating from plants, animals, or microorganisms, including products, by-products, residues and waste from agriculture, forestry, and related industries as well as the nonfossilized and biodegradable organic fractions of industrial and municipal wastes, including gases and liquids recovered from the decomposition of nonfossilized and biodegradable organic material.

(b) "Carbon dioxide equivalent" or "CO2e" means a metric measure used to compare the emissions from various greenhouse gases based upon their global warming potential.

(c) "Department of licensing" or "DOL" means the Washington state department of licensing.

(d) "Director" means the director of the department of ecology.

(e) "Ecology" means the Washington state department of ecology.

(f) "Facility" unless otherwise specified in any subpart of 40 C.F.R. Part 98 as adopted by ((January 1, 2015)) May 1, 2016, means any physical property, plant, building, structure, source, or stationary equipment located on one or more contiguous or adjacent properties in actual physical contact or separated solely by a public roadway or other public right of way and under common ownership or common control, that emits or may emit any greenhouse gas. Operators of military installations may classify such installations as more than a single facility based on distinct and independent functional groupings within contiguous military properties.

(g) "Greenhouse gas," "greenhouse gases," "GHG," and "GHGs" includes carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, and sulfur hexafluoride. Beginning on January 1, 2012, "greenhouse gas" also includes any other gas or gases designated by ecology by rule in Table A-1 in WAC 173-441-040.

(h) "Person" includes:

(i) An owner or operator, as those terms are defined by the United States Environmental Protection Agency in its mandatory greenhouse gas reporting regulation in 40 C.F.R. Part 98, as adopted by ((January 1, 2015)) May 1, 2016; and

(ii) A supplier.

(i) "Product data" means data related to a facility's production that is part of the annual GHG report.

(j) "Supplier" means any person who is:

(i) A motor vehicle fuel or special fuel supplier or ((a motor vehicle fuel importer)) distributor, as those terms are defined in RCW ((82.36.010;)) 82.38.020; or

(ii) ((A special fuel supplier or a special fuel importer, as those terms are defined in RCW 82.38.020; or

(2) Definitions specific to suppliers. Suppliers must use the definitions found in the following ((regulations)) statutes unless the definition is in conflict with a definition found in subsection (1) of this section. These definitions do not apply to facilities.

(a) ((WAC 308-72-800;

(b) WAC 308-77-005; and

(b) Chapter 82.42 RCW.

(3) Definitions from 40 C.F.R. Part 98. For those terms not listed in subsection (1) or (2) of this section, the definitions found in 40 C.F.R. § 98.6 or a subpart as adopted in WAC 173-441-120, as adopted by ((January 1, 2015)) May 1, 2016, are adopted by reference as modified in WAC 173-441-120(2).

(4) Definitions from chapter 173-400 WAC. If no definition is provided in subsections (1) through (3) in this section, use the definition found in chapter 173-400 WAC.

AMENDATORY SECTION (Amending WSR 15-04-051, filed 1/29/15, effective 3/1/15)

WAC 173-441-050 General monitoring, reporting, recordkeeping and verification requirements.

Persons subject to the requirements of this chapter must submit GHG reports to ecology, as specified in this section.

(1) General. Follow the procedures for emission calculation, monitoring, quality assurance, missing data, recordkeeping, and reporting that are specified in each relevant section of this chapter.

(2) Schedule. The annual GHG report must be submitted as follows:

(a) Report submission due date:

(i) A person required to report GHG emissions to the United States Environmental Protection Agency under 40 C.F.R. Part 98 must submit the report required under this chapter to ecology no later than March 31st of each calendar year for GHG emissions in the previous calendar year.

(ii) A person not required to report GHG emissions to the United States Environmental Protection Agency under 40 C.F.R. Part 98 must submit the report required under this chapter to ecology no later than October 31st of each calendar year for GHG emissions in the previous calendar year.

(iii) Unless otherwise stated, if the final day of any time period falls on a weekend or a state holiday, the time period shall be extended to the next business day.

(b) Reporting requirements begin:

(i) For an existing facility or supplier that began operation before January 1, 2012, report emissions for calendar year 2012 and each subsequent calendar year.

(ii) For a new facility or supplier that begins operation on or after January 1, 2012, and becomes subject to the rule in the year that it becomes operational, report emissions beginning with the first operating month and ending on December 31st of that year. Each subsequent annual report must cover emissions for the calendar year, beginning on January 1st and ending on December 31st.

(iii) For any facility or supplier that becomes subject to this rule because of a physical or operational change that is made after January 1, 2012, report emissions for the first calendar year in which the change occurs.

(A) Facilities begin reporting with the first month of the change and ending on December 31st of that year. For a facility that becomes subject to this rule solely because of an increase in hours of operation or level of production, the first month of the change is the month in which the increased hours of operation or level of production, if maintained for the remainder of the year, would cause the facility or supplier to exceed the applicable threshold.

(B) Suppliers begin reporting January 1st and ending on December 31st the year of the change.

(C) For both facilities and suppliers, each subsequent annual report must cover emissions for the calendar year, beginning on January 1st and ending on December 31st.

(3) Content of the annual report. Each annual GHG report must contain the following information:

(a) Facility name or supplier name (as appropriate), facility or supplier ID number, and physical street address of the facility or supplier, including the city, state, and zip code. If the facility does not have a physical street address, then the facility must provide the latitude and longitude representing the geographic centroid or center point of facility operations in decimal degree format. This must be provided in a comma-delimited "latitude, longitude" coordinate pair reported in decimal degrees to at least four digits to the right of the decimal point.

(b) Year and months covered by the report.

(c) Date of submittal.

(d) For facilities, report annual emissions of each GHG (as defined in WAC 173-441-020) and each fluorinated heat transfer fluid, as follows:

(i) Annual emissions (including biogenic CO2) aggregated for all GHGs from all applicable source categories in WAC 173-441-120 and expressed in metric tons of CO2e calculated using Equation A-1 of WAC 173-441-030 (1)(b)(iii).

(ii) Annual emissions of biogenic CO2 aggregated for all applicable source categories in WAC 173-441-120, expressed in metric tons.

(iii) Annual emissions from each applicable source category in WAC 173-441-120, expressed in metric tons of each applicable GHG listed in subsections (3)(d)(iii)(A) through (F) of this section.

(A) Biogenic CO2.

(B) CO2 (including biogenic CO2).

(C) CH4.

(D) N2O.

(E) Each fluorinated GHG.

(F) For electronics manufacturing each fluorinated heat transfer fluid that is not also a fluorinated GHG as specified under WAC 173-441-040.

(iv) Emissions and other data for individual units, processes, activities, and operations as specified in the "data reporting requirements" section of each applicable source category referenced in WAC 173-441-120.

(v) Indicate (yes or no) whether reported emissions include emissions from a cogeneration unit located at the facility.

(vi) When applying subsection (3)(d)(i) of this section to fluorinated GHGs and fluorinated heat transfer fluids, calculate and report CO2e for only those fluorinated GHGs and fluorinated heat transfer fluids listed in WAC 173-441-040.

(vii) For reporting year 2014 and thereafter, you must enter into verification software specified by the director the data specified in the verification software records provision in each applicable recordkeeping section. For each data element entered into the verification software, if the software produces a warning message for the data value and you elect not to revise the data value, you may provide an explanation in the verification software of why the data value is not being revised. Whenever the use of verification software is required or voluntarily used, the file generated by the verification software must be submitted with the facility's annual GHG report.

(e) For suppliers, report the following information:

(i) Annual emissions of CO2, expressed in metric tons of CO2, as required in subsections (3)(e)(i)(A) and (B) of this section that would be emitted from the complete combustion or oxidation of the fuels reported to DOL as sold in Washington state during the calendar year.

(A) Aggregate biogenic CO2.

(B) Aggregate CO2 (including nonbiogenic and biogenic CO2).

(ii) All contact information reported to DOL not included in (a) of this subsection.

(f) A written explanation, as required under subsection (4) of this section, if you change emission calculation methodologies during the reporting period.

(g) Each data element for which a missing data procedure was used according to the procedures of an applicable subpart referenced in WAC 173-441-120 and the total number of hours in the year that a missing data procedure was used for each data element.

(h) A signed and dated certification statement provided by the designated representative of the owner or operator, according to the requirements of WAC 173-441-060 (5)(a).

(i) NAICS code(s) that apply to the facility or supplier.

(i) Primary NAICS code. Report the NAICS code that most accurately describes the facility or supplier's primary product/activity/service. The primary product/activity/service is the principal source of revenue for the facility or supplier. A facility or supplier that has two distinct products/activities/services providing comparable revenue may report a second primary NAICS code.

(ii) Additional NAICS code(s). Report all additional NAICS codes that describe all product(s)/activity(s)/service(s) at the facility or supplier that are not related to the principal source of revenue.

(j) Legal name(s) and physical address(es) of the highest-level United States parent company(s) of the owners (or operators) of the facility or supplier and the percentage of ownership interest for each listed parent company as of December 31st of the year for which data are being reported according to the following instructions:

(i) If the facility or supplier is entirely owned by a single United States company that is not owned by another company, provide that company's legal name and physical address as the United States parent company and report one hundred percent ownership.

(ii) If the facility or supplier is entirely owned by a single United States company that is, itself, owned by another company (e.g., it is a division or subsidiary of a higher-level company), provide the legal name and physical address of the highest-level company in the ownership hierarchy as the United States parent company and report one hundred percent ownership.

(iii) If the facility or supplier is owned by more than one United States company (e.g., company A owns forty percent, company B owns thirty-five percent, and company C owns twenty-five percent), provide the legal names and physical addresses of all the highest-level companies with an ownership interest as the United States parent companies and report the percent ownership of each company.

(iv) If the facility or supplier is owned by a joint venture or a cooperative, the joint venture or cooperative is its own United States parent company. Provide the legal name and physical address of the joint venture or cooperative as the United States parent company, and report one hundred percent ownership by the joint venture or cooperative.

(v) If the facility or supplier is entirely owned by a foreign company, provide the legal name and physical address of the foreign company's highest-level company based in the United States as the United States parent company, and report one hundred percent ownership.

(vi) If the facility or supplier is partially owned by a foreign company and partially owned by one or more United States companies, provide the legal name and physical address of the foreign company's highest-level company based in the United States, along with the legal names and physical addresses of the other United States parent companies, and report the percent ownership of each of these companies.

(vii) If the facility or supplier is a federally owned facility, report "U.S. Government" and do not report physical address or percent ownership.

(k) An indication of whether the facility includes one or more plant sites that have been assigned a "plant code" by either the Department of Energy's Energy Information Administration or by the Environmental Protection Agency's (EPA) Clean Air Markets Division.

(4) Emission calculations. In preparing the GHG report, you must use the calculation methodologies specified in the relevant sections of this chapter. For each source category, you must use the same calculation methodology throughout a reporting period unless you provide a written explanation of why a change in methodology was required.

(5) Verification. To verify the completeness and accuracy of reported GHG emissions, ecology may review the certification statements described in subsection (3)(h) of this section and any other credible evidence, in conjunction with a comprehensive review of the GHG reports and periodic audits of selected reporting facilities. Nothing in this section prohibits ecology from using additional information to verify the completeness and accuracy of the reports.

(6) Recordkeeping. A person that is required to report GHGs under this chapter must keep records as specified in this subsection. Retain all required records for at least three years from the date of submission of the annual GHG report for the reporting year in which the record was generated. Upon request by ecology, the records required under this section must be made available to ecology. Records may be retained off-site if the records are readily available for expeditious inspection and review. For records that are electronically generated or maintained, the equipment or software necessary to read the records must be made available, or, if requested by ecology, electronic records must be converted to paper documents. You must retain the following records, in addition to those records prescribed in each applicable section of this chapter:

(a) A list of all units, operations, processes, and activities for which GHG emissions were calculated.

(b) The data used to calculate the GHG emissions for each unit, operation, process, and activity, categorized by fuel or material type. These data include, but are not limited to, the following information:

(i) The GHG emissions calculations and methods used.

(ii) Analytical results for the development of site-specific emissions factors.

(iii) The results of all required analyses for high heat value, carbon content, and other required fuel or feedstock parameters.

(iv) Any facility operating data or process information used for the GHG emission calculations.

(c) The annual GHG reports.

(d) Missing data computations. For each missing data event, also retain a record of the cause of the event and the corrective actions taken to restore malfunctioning monitoring equipment.

(e) Owners or operators required to report under WAC 173-441-030(1) must keep a written GHG monitoring plan (monitoring plan, plan).

(i) At a minimum, the GHG monitoring plan must include the following elements:

(A) Identification of positions of responsibility (i.e., job titles) for collection of the emissions data.

(B) Explanation of the processes and methods used to collect the necessary data for the GHG calculations.

(C) Description of the procedures and methods that are used for quality assurance, maintenance, and repair of all continuous monitoring systems, flow meters, and other instrumentation used to provide data for the GHGs reported under this chapter.

(ii) The GHG monitoring plan may rely on references to existing corporate documents (e.g., standard operating procedures, quality assurance programs under appendix F to 40 C.F.R. Part 60 or appendix B to 40 C.F.R. Part 75, and other documents) provided that the elements required by (e)(i) of this subsection are easily recognizable.

(iii) The owner or operator must revise the GHG monitoring plan as needed to reflect changes in production processes, monitoring instrumentation, and quality assurance procedures; or to improve procedures for the maintenance and repair of monitoring systems to reduce the frequency of monitoring equipment downtime.

(iv) Upon request by ecology, the owner or operator must make all information that is collected in conformance with the GHG monitoring plan available for review during an audit. Electronic storage of the information in the plan is permissible, provided that the information can be made available in hard copy upon request during an audit.

(f) The results of all required certification and quality assurance tests of continuous monitoring systems, fuel flow meters, and other instrumentation used to provide data for the GHGs reported under this chapter.

(g) Maintenance records for all continuous monitoring systems, flow meters, and other instrumentation used to provide data for the GHGs reported under this chapter.

(h) Suppliers must retain any other data specified in WAC 173-441-130(5).

(7) Annual GHG report revisions.

(a) A person must submit a revised annual GHG report within forty-five days of discovering that an annual GHG report that the person previously submitted contains one or more substantive errors. The revised report must correct all substantive errors.

(b) Ecology may notify the person in writing that an annual GHG report previously submitted by the person contains one or more substantive errors. Such notification will identify each such substantive error. The person must, within forty-five days of receipt of the notification, either resubmit the report that, for each identified substantive error, corrects the identified substantive error (in accordance with the applicable requirements of this chapter) or provide information demonstrating that the previously submitted report does not contain the identified substantive error or that the identified error is not a substantive error.

(c) A substantive error is an error that impacts the quantity of GHG emissions reported or otherwise prevents the reported data from being validated or verified.

(d) Notwithstanding (a) and (b) of this subsection, upon request by a person, ecology may provide reasonable extensions of the forty-five day period for submission of the revised report or information under (a) and (b) of this subsection. If ecology receives a request for extension of the forty-five day period, by e-mail to ghgreporting@ecy.wa.gov, at least two business days prior to the expiration of the forty-five day period, and ecology does not respond to the request by the end of such period, the extension request is deemed to be automatically granted for thirty more days. During the automatic thirty-day extension, ecology will determine what extension, if any, beyond the automatic extension is reasonable and will provide any such additional extension.

(e) The owner or operator must retain documentation for three years to support any revision made to an annual GHG report.

(8) Calibration and accuracy requirements. The owner or operator of a facility that is subject to the requirements of this chapter must meet the applicable flow meter calibration and accuracy requirements of this subsection. The accuracy specifications in this subsection do not apply where either the use of company records (as defined in WAC 173-441-020(3)) or the use of "best available information" is specified in an applicable subsection of this chapter to quantify fuel usage and/or other parameters. Further, the provisions of this subsection do not apply to stationary fuel combustion units that use the methodologies in 40 C.F.R. Part 75 to calculate CO2 mass emissions. Suppliers subject to the requirements of this chapter must meet the calibration accuracy requirements in chapters 308-72, 308-77, and 308-78 WAC.

(a) Except as otherwise provided in (d) through (f) of this subsection, flow meters that measure liquid and gaseous fuel feed rates, process stream flow rates, or feedstock flow rates and provide data for the GHG emissions calculations, must be calibrated prior to January 1, 2012, using the procedures specified in this subsection when such calibration is specified in a relevant section of this chapter. Each of these flow meters must meet the applicable accuracy specification in (b) or (c) of this subsection. All other measurement devices (e.g., weighing devices) that are required by a relevant subsection of this chapter, and that are used to provide data for the GHG emissions calculations, must also be calibrated prior to January 1, 2012; however, the accuracy specifications in (b) and (c) of this subsection do not apply to these devices. Rather, each of these measurement devices must be calibrated to meet the accuracy requirement specified for the device in the applicable subsection of this chapter, or, in the absence of such accuracy requirement, the device must be calibrated to an accuracy within the appropriate error range for the specific measurement technology, based on an applicable operating standard including, but not limited to, manufacturer's specifications and industry standards. The procedures and methods used to quality-assure the data from each measurement device must be documented in the written monitoring plan, pursuant to subsection (6)(e)(i)(C) of this section.

(i) All flow meters and other measurement devices that are subject to the provisions of this subsection must be calibrated according to one of the following: You may use the manufacturer's recommended procedures; an appropriate industry consensus standard method; or a method specified in a relevant section of this chapter. The calibration method(s) used must be documented in the monitoring plan required under subsection (6)(e) of this section.

(ii) For facilities and suppliers that become subject to this chapter after January 1, 2012, all flow meters and other measurement devices (if any) that are required by the relevant subsection(s) of this chapter to provide data for the GHG emissions calculations must be installed no later than the date on which data collection is required to begin using the measurement device, and the initial calibration(s) required by this subsection (if any) must be performed no later than that date.

(iii) Except as otherwise provided in (d) through (f) of this subsection, subsequent recalibrations of the flow meters and other measurement devices subject to the requirements of this subsection must be performed at one of the following frequencies:

(A) You may use the frequency specified in each applicable subsection of this chapter.

(B) You may use the frequency recommended by the manufacturer or by an industry consensus standard practice, if no recalibration frequency is specified in an applicable subsection.

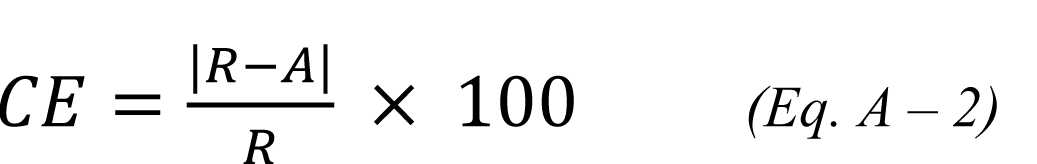

(b) Perform all flow meter calibration at measurement points that are representative of the normal operating range of the meter. Except for the orifice, nozzle, and venturi flow meters described in (c) of this subsection, calculate the calibration error at each measurement point using Equation A–2 of this subsection. The terms "R" and "A" in Equation A–2 must be expressed in consistent units of measure (e.g., gallons/minute, ft3/min). The calibration error at each measurement point must not exceed 5.0 percent of the reference value.

|

Where:

CE |

= |

Calibration error |

(%) |

R |

= |

Reference value |

|

A |

= |

Flow meter response to the reference value |

|

(c) For orifice, nozzle, and venturi flow meters, the initial quality assurance consists of in situ calibration of the differential pressure (delta-P), total pressure, and temperature transmitters.

(i) Calibrate each transmitter at a zero point and at least one upscale point. Fixed reference points, such as the freezing point of water, may be used for temperature transmitter calibrations. Calculate the calibration error of each transmitter at each measurement point, using Equation A–3 of this subsection. The terms "R," "A," and "FS" in Equation A–3 of this subsection must be in consistent units of measure (e.g., milliamperes, inches of water, psi, degrees). For each transmitter, the CE value at each measurement point must not exceed 2.0 percent of full-scale. Alternatively, the results are acceptable if the sum of the calculated CE values for the three transmitters at each calibration level (i.e., at the zero level and at each upscale level) does not exceed 6.0 percent.

|

Where:

CE |

= |

Calibration error |

(%) |

R |

= |

Reference value |

|

A |

= |

Transmitter response to the reference value |

|

FS |

= |

Full-scale value of the transmitter |

|

(ii) In cases where there are only two transmitters (i.e., differential pressure and either temperature or total pressure) in the immediate vicinity of the flow meter's primary element (e.g., the orifice plate), or when there is only a differential pressure transmitter in close proximity to the primary element, calibration of these existing transmitters to a CE of 2.0 percent or less at each measurement point is still required, in accordance with (c)(i) of this subsection; alternatively, when two transmitters are calibrated, the results are acceptable if the sum of the CE values for the two transmitters at each calibration level does not exceed 4.0 percent. However, note that installation and calibration of an additional transmitter (or transmitters) at the flow monitor location to measure temperature or total pressure or both is not required in these cases. Instead, you may use assumed values for temperature and/or total pressure, based on measurements of these parameters at a remote location (or locations), provided that the following conditions are met:

(A) You must demonstrate that measurements at the remote location(s) can, when appropriate correction factors are applied, reliably and accurately represent the actual temperature or total pressure at the flow meter under all expected ambient conditions.

(B) You must make all temperature and/or total pressure measurements in the demonstration described in (c)(ii)(A) of this subsection with calibrated gauges, sensors, transmitters, or other appropriate measurement devices. At a minimum, calibrate each of these devices to an accuracy within the appropriate error range for the specific measurement technology, according to one of the following: You may calibrate using a manufacturer's specification or an industry consensus standard.

(C) You must document the methods used for the demonstration described in (c)(ii)(A) of this subsection in the written GHG monitoring plan under subsection (6)(e)(i)(C) of this section. You must also include the data from the demonstration, the mathematical correlation(s) between the remote readings and actual flow meter conditions derived from the data, and any supporting engineering calculations in the GHG monitoring plan. You must maintain all of this information in a format suitable for auditing and inspection.

(D) You must use the mathematical correlation(s) derived from the demonstration described in (c)(ii)(A) of this subsection to convert the remote temperature or the total pressure readings, or both, to the actual temperature or total pressure at the flow meter, or both, on a daily basis. You must then use the actual temperature and total pressure values to correct the measured flow rates to standard conditions.

(E) You must periodically check the correlation(s) between the remote and actual readings (at least once a year), and make any necessary adjustments to the mathematical relationship(s).

(d) Fuel billing meters are exempted from the calibration requirements of this section and from the GHG monitoring plan and recordkeeping provisions of subsections (6)(e)(i)(C) and (g) of this section, provided that the fuel supplier and any unit combusting the fuel do not have any common owners and are not owned by subsidiaries or affiliates of the same company. Meters used exclusively to measure the flow rates of fuels that are used for unit startup are also exempted from the calibration requirements of this section.

(e) For a flow meter that has been previously calibrated in accordance with (a) of this subsection, an additional calibration is not required by the date specified in (a) of this subsection if, as of that date, the previous calibration is still active (i.e., the device is not yet due for recalibration because the time interval between successive calibrations has not elapsed). In this case, the deadline for the successive calibrations of the flow meter must be set according to one of the following: You may use either the manufacturer's recommended calibration schedule or you may use the industry consensus calibration schedule.

(f) For units and processes that operate continuously with infrequent outages, it may not be possible to meet the deadline established in (a) of this subsection for the initial calibration of a flow meter or other measurement device without disrupting normal process operation. In such cases, the owner or operator may postpone the initial calibration until the next scheduled maintenance outage. The best available information from company records may be used in the interim. The subsequent required recalibrations of the flow meters may be similarly postponed. Such postponements must be documented in the monitoring plan that is required under subsection (6)(e) of this section.

(g) If the results of an initial calibration or a recalibration fail to meet the required accuracy specification, data from the flow meter must be considered invalid, beginning with the hour of the failed calibration and continuing until a successful calibration is completed. You must follow the missing data provisions provided in the relevant missing data sections during the period of data invalidation.

(9) Measurement device installation. 40 C.F.R. § 98.3(j) and 40 C.F.R. § 98.3(d) as adopted by ((January 1, 2015)) May 1, 2016, are adopted by reference as modified in WAC 173-441-120(2).

AMENDATORY SECTION (Amending WSR 15-04-051, filed 1/29/15, effective 3/1/15)

WAC 173-441-080 Standardized methods and conversion factors incorporated by reference.

(1) The materials incorporated by reference by EPA in 40 C.F.R. § 98.7, as adopted by ((January 1, 2015)) May 1, 2016, are incorporated by reference in this chapter for use in the sections of this chapter that correspond to the sections of 40 C.F.R. Part 98 referenced here.

(2) Table A–2 of this section provides a conversion table for some of the common units of measure used in this chapter.

Table A-2:

Units of Measure Conversions

To convert from |

To |

Multiply by |

Kilograms (kg) |

Pounds (lbs) |

2.20462 |

Pounds (lbs) |

Kilograms (kg) |

0.45359 |

Pounds (lbs) |

Metric tons |

4.53592 x 10-4 |

Short tons |

Pounds (lbs) |

2,000 |

Short tons |

Metric tons |

0.90718 |

Metric tons |

Short tons |

1.10231 |

Metric tons |

Kilograms (kg) |

1,000 |

Cubic meters (m3) |

Cubic feet (ft3) |

35.31467 |

Cubic feet (ft3) |

Cubic meters (m3) |

0.028317 |

Gallons (liquid, US) |

Liters (l) |

3.78541 |

Liters (l) |

Gallons (liquid, US) |

0.26417 |

Barrels of liquid fuel (bbl) |

Cubic meters (m3) |

0.15891 |

Cubic meters (m3) |

Barrels of liquid fuel (bbl) |

6.289 |

Barrels of liquid fuel (bbl) |