SBEIS

Relevant Information for State Register Publication

Proposed Chapter 173-424 WAC, Clean Fuels Program Rule

This SBEIS presents the:

| • | Compliance requirements of the proposed rule. |

| • | Results of the analysis of relative compliance cost burden. |

| • | Consideration of lost sales or revenue. |

| • | Cost-mitigating action taken by ecology, if required. |

| • | Small business and local government consultation. |

| • | Industries likely impacted by the proposed rule. |

| • | Expected net impact on jobs statewide. |

A small business is defined by RFA (chapter 19.85 RCW) as having 50 or fewer employees. Estimated costs are determined as compared to the existing regulatory environment—the regulations in the absence of the rule. The SBEIS only considers costs to "businesses in an industry" in Washington state. This means that impacts, for this document, are not evaluated for government agencies.

The existing regulatory environment is called the "baseline" in this document. It includes only existing laws and rules at federal and state levels.

This information is excerpted from ecology's complete set of regulatory analyses of the proposed rule. For complete discussion of the likely costs, benefits, minimum compliance burden, and relative burden on small businesses, see the regulatory analyses (Ecology publication no. 22-02-029, July 2022).

CHOICE TO COMPLETE AN SBEIS: The analyses required under RFA, and their inclusion in an SBEIS, are based on whether the proposed rule would impose compliance costs on small businesses. A rule is otherwise exempt from these analyses under RCW 19.85.025(4).

Based on available information, we did not identify any small businesses that would have credit deficits under the proposed rule. These known transportation fuel suppliers and electric utilities include only:

| • | Large businesses themselves, or part of larger businesses, averaging 8,857 employees. |

| • | Publicly owned. |

However, we do not have full information concerning all potential entities incurring any kind of direct compliance cost under the proposed rule. Specifically, we do not have comprehensive information about all potential credit generators that could opt into the program.

While we may be able to make some assumptions about opt-in entities, we cannot be certain of all their attributes, and about whether any are small businesses. Due to uncertainty about the employment attributes of opt-in entities, we chose to complete the analyses required under RFA, to fully understand potential disproportion in the impacts of the proposed rule.

Opt-in entities would incur compliance costs related to registration and reporting. We note, however, that opt-in entities are not likely to opt in unless they expect a private net benefit, i.e., the costs they incur complying with the proposed rule's registration and reporting requirements are outweighed by the benefits of generating and selling credits.

As RFA requires analyses specifically related to employment impacts and price or output impacts (as they play into revenue and profits), we also determined this analysis would be the most appropriate space to discuss additional modeling performed to fully understand the potential impacts of the proposed rule.

COMPLIANCE REQUIREMENTS OF THE PROPOSED RULE, INCLUDING PROFESSIONAL SERVICES:Baseline: The baseline for our analyses generally consists of existing rules and laws, and their requirements. This is what allows us to make a consistent comparison between the state of the world with and without the proposed rule.

For this analysis, the baseline includes:

| • | Chapter 70A.535 RCW, Transportation fuel—Clean fuels program. |

| • | Chapter 70A.30 RCW, Motor vehicle emission standards. |

| • | Chapter 70A.45 RCW, Limiting greenhouse gas emissions. |

| • | Chapter 173-455 WAC, Air quality fee rule. |

Proposed: The proposed rule would establish:

| • | Definitions specific to the clean fuels program. |

| • | Applicability and exemptions for fuels. |

| • | General requirements for regulated parties, opt-in entities, and credit aggregators. |

| • | Identification of first fuel reporting entities, subsequent reporting entities, and credit or deficit generators, for: |

| º | Liquid fuels. |

| º | Gaseous fuels. |

| º | Electricity. |

| º | The backstop aggregator. |

| • | Registration requirements. |

| • | Recordkeeping requirements. |

| • | Reporting requirements. |

| • | Credit and deficit generation procedures. |

| • | Credit transaction procedures. |

| • | Required calculation methods for credits and deficits. |

| • | How compliance must be demonstrated. |

| • | A credit clearance market. |

| • | Advance credit procedures. |

| • | Credit generation methods for zero-emission vehicle infrastructure. |

| • | Carbon intensity calculations and procedures. |

| • | Authority to suspend, revoke, or modify accounts, carbon intensities, or credits. |

| • | Public disclosure requirements. |

| • | Emergency deferral procedures in the event of a fuels shortage. |

| • | Forecast deferral procedures. |

| • | Validation and verification requirements. |

Proposed amendments to the fee rule would:

| • | Set the procedure for determining clean fuels program fees based on workload. |

COSTS OF COMPLIANCE: EQUIPMENT: Compliance with the proposed rule, compared to the baseline, is not likely to impose additional costs of equipment beyond those underlying costs of reducing carbon intensity of transportation fuels in the state (see Costs of compliance: Other, below).

COSTS OF COMPLIANCE: SUPPLIES: Compliance with the proposed rule, compared to the baseline, is not likely to impose additional costs of supplies beyond those underlying costs of reducing carbon intensity of transportation fuels in the state (see Costs of compliance: Other, below).

COSTS OF COMPLIANCE: LABOR: Compliance with the proposed rule, compared to the baseline, is not likely to impose additional costs of labor beyond those underlying costs of reducing carbon intensity of transportation fuels in the state (see Costs of compliance: Other, below).

COSTS OF COMPLIANCE: PROFESSIONAL SERVICES: Compliance with the proposed rule, compared to the baseline, is not likely to impose additional costs of professional services beyond those underlying costs of reducing carbon intensity of transportation fuels in the state (see Costs of compliance: Other, below).

COSTS OF COMPLIANCE: ADMINISTRATIVE COSTS: Where applicable, ecology estimates administrative costs (overhead) as part of the cost of labor and professional services, above.

COSTS OF COMPLIANCE: OTHER: We estimated costs associated with the clean fuels program based on an analysis performed by Berkeley Research Group (BRG; BRG Energy & Climate, 2022. Washington Department of Ecology Clean Fuel Standard Cost Benefit Analysis Report, May 12, 2022, https://ecology.wa.gov/DOE/files/22/22790fe6-fc3a-414d-b3ba-036af0975258.pdf) in compliance with the authorizing statute (chapter 70A.535 RCW). BRG analysis estimated the costs and benefits of the clean fuels program. The baseline for the BRG analysis is the same as for this preliminary regulatory analysis. The report presented costs per gallon of gas and diesel, and we converted these to overall costs using supporting modeling data provided by BRG.

The BRG analysis focused on two scenarios:

| • | Least cost: A least-cost approach to achieving the required 20 percent reduction by 2038, for entities required to comply. This scenario does not correspond to the proposed rule. |

| • | Accelerated reduction: A least cost approach to achieving the required 20 percent reduction by 2034, reducing average carbon intensity by a full 10 percent in 2034. The accelerated reduction scenario aligns with the requirements of the proposed rule. |

Under the Accelerated Reduction scenario, BRG found the following costs per gallon equivalent of transportation fuels.

Impacts of accelerated reduction scenario on consumer fuel prices, 2020$/GGE:

Year | Consumer Gasoline | Consumer Diesel |

2023 | 0.007 | (0.016) |

2024 | 0.017 | (0.006) |

2025 | 0.036 | 0.014 |

2026 | 0.056 | 0.034 |

2027 | 0.076 | 0.054 |

2028 | 0.105 | 0.083 |

2029 | 0.134 | 0.113 |

2030 | 0.164 | 0.142 |

2031 | 0.193 | 0.171 |

2032 | 0.193 | 0.171 |

2033 | 0.193 | 0.170 |

2034 | 0.389 | 0.368 |

2035 | 0.389 | 0.367 |

2036 | 0.389 | 0.366 |

2037 | 0.005 | 0.005 |

2038 | 0.005 | 0.005 |

(Source: BRG)

Impacts of accelerated reduction scenario on nonconsumer fuel prices, 2020$/GGE:

Year | Unblended Gasoline | Ethanol | Renewable Naphtha | Electricity | Fossil Diesel | Biodiesel | Renewable Diesel | Hydrogen | CNG | RNG | Propane | Renewable Propane |

2023 | 0.045 | (0.430) | (0.658) | (1.833) | 0.031 | (0.869) | (0.951) | 0.504 | (0.368) | (0.634) | (0.459) | (0.686) |

2024 | 0.055 | (0.420) | (0.648) | (1.840) | 0.041 | (0.859) | (0.941) | (0.728) | (0.359) | (0.624) | (0.449) | (0.676) |

2025 | 0.075 | (0.401) | (0.629) | (1.837) | 0.061 | (0.839) | (0.921) | (0.708) | (0.339) | (0.604) | (0.429) | (0.657) |

2026 | 0.094 | (0.381) | (0.609) | (1.835) | 0.081 | (0.819) | (0.901) | (0.688) | (0.319) | (0.584) | (0.410) | (0.637) |

2027 | 0.114 | (0.361) | (0.589) | (1.832) | 0.101 | (0.799) | (0.881) | (0.668) | (0.299) | (0.564) | (0.390) | (0.617) |

2028 | 0.143 | (0.332) | (0.560) | (1.819) | 0.131 | (0.770) | (0.851) | (1.879) | (0.269) | (0.534) | (0.360) | (0.587) |

2029 | 0.173 | (0.303) | (0.531) | (1.806) | 0.160 | (0.740) | (0.821) | (1.850) | (0.239) | (0.504) | (0.330) | (0.557) |

2030 | 0.202 | (0.273) | (0.501) | (1.794) | 0.190 | (0.710) | (0.791) | (1.820) | (0.209) | (0.474) | (0.300) | (0.527) |

2031 | 0.231 | (0.244) | (0.472) | (1.764) | 0.220 | (0.680) | (0.762) | (1.790) | (0.180) | (0.445) | (0.270) | (0.497) |

2032 | 0.231 | (0.244) | (0.472) | (1.764) | 0.220 | (0.680) | (0.762) | (1.790) | (0.180) | (0.445) | (0.270) | (0.497) |

2033 | 0.231 | (0.244) | (0.472) | (1.764) | 0.220 | (0.680) | (0.762) | (1.790) | (0.180) | (0.445) | (0.270) | (0.497) |

2034 | 0.427 | (0.048) | (0.276) | (1.568) | 0.419 | (0.481) | (0.563) | (1.591) | 0.019 | (0.246) | (0.072) | (0.299) |

2035 | 0.427 | (0.048) | (0.276) | (1.568) | 0.419 | (0.481) | (0.563) | (1.591) | 0.019 | (0.246) | (0.072) | (0.299) |

2036 | 0.427 | (0.048) | (0.276) | (1.568) | 0.419 | (0.481) | (0.563) | (1.591) | 0.019 | (0.246) | (0.072) | (0.299) |

2037 | 0.005 | (0.001) | (0.004) | (0.020) | 0.005 | (0.006) | (0.007) | (0.020) | 0.000 | (0.003) | (0.001) | (0.004) |

2038 | 0.005 | (0.001) | (0.004) | (0.020) | 0.005 | (0.006) | (0.007) | (0.020) | 0.000 | (0.003) | (0.001) | (0.004) |

(Source: BRG)

Calculations: We multiplied these values by the fuel volumes modeled by BRG, and estimated the following total costs, cost savings, and net costs in each year of the program. A negative net cost reflects a net benefit.

Total costs by year, billions, 2020$.

Year | Costs | Cost Savings | Net Costs |

2023 | $0.15 | $0.33 | ($0.18) |

2024 | $0.18 | $0.33 | ($0.15) |

2025 | $0.25 | $0.34 | ($0.09) |

2026 | $0.32 | $0.34 | ($0.03) |

2027 | $0.38 | $0.35 | $0.03 |

2028 | $0.47 | $0.36 | $0.11 |

2029 | $0.56 | $0.38 | $0.18 |

2030 | $0.64 | $0.21 | $0.42 |

2031 | $0.71 | $0.20 | $0.51 |

2032 | $0.68 | $0.20 | $0.49 |

2033 | $0.65 | $0.19 | $0.46 |

2034 | $1.15 | $0.12 | $1.03 |

2035 | $1.06 | $0.12 | $0.94 |

2036 | $1.01 | $0.08 | $0.93 |

2037 | $0.01 | $0.00 | $0.01 |

2038 | $0.01 | $0.00 | $0.01 |

Ecology's regulatory analyses reflect streams of costs and benefits in present values. A present value reflects future values in current value, reflecting the opportunity cost of having funds later versus now. The table below summarizes the total present value costs, cost-savings, and net costs likely generated by the proposed rule.

Total present value costs and cost-savings, billions, 2020$.

Total Present Value Costs | Total Present Value Cost-Savings | Total Present Value Net Costs |

$6.52 | $3.07 | $3.45 |

Reporting costs: We estimated reporting costs using CARB's estimated recordkeeping and reporting costs for the California low carbon fuel standard. CARB estimated annual costs of $216,658 per reporting entity (converted to 2020-dollars). We identified 26 transportation fuel suppliers potentially required to comply with the proposed rule. If all 26 of these suppliers incur reporting costs, they would pay a total of $5.6 million per year. We also identified up to 60 electric utilities in Washington, which would collectively incur a total of $13.0 million per year in reporting costs.

Ecology's regulatory analyses reflect streams of costs and benefits in present values. A present value reflects future values in current value, reflecting the opportunity cost of having funds later versus now. The table below summarizes the total present value reporting costs estimated for the proposed rule.

Total present value costs of reporting, billions, 2020$.

Fuel Supplier Costs | Electric Utility Costs | Total Present Value Costs |

$0.01 | $0.01 | $0.02 |

COMPARISON OF COMPLIANCE COST FOR SMALL VERSUS LARGE BUSINESSES: The average affected business likely to have a credit deficit under the proposed rule employs approximately 8,857 people, and there are not likely small businesses in this group.

For potential opt-in entities, we do not have comprehensive knowledge of their attributes or the internal business decisions. We assume, however, that opt-in entities would only choose to participate based on a positive expected private net benefit (accounting for compliance costs and the benefits of selling credits).

Therefore, overall, we conclude that no small businesses would incur net compliance costs under the proposed rule. Therefore ecology is not required, under RFA, to include all legal and feasible elements in the proposed rule to mitigate disproportionate costs on small businesses. Note, however, that we have voluntarily completed the additional analyses and considerations required under RFA.

CONSIDERATION OF LOST SALES OR REVENUE: Businesses that would incur compliance costs under the proposed rule could experience reduced sales or revenues if the proposed rule significantly affects the prices of the goods they sell. The degree to which this could happen is strongly related to each business's production and pricing model (whether additional lump-sum costs would significantly affect marginal costs), as well as the specific attributes of the markets in which they sell goods, including the degree of influence each firm has on market prices, as well as the relative responsiveness of market demand to price changes.

BRG estimated the following impacts to consumer prices, based on an assumed full pass-through of producer, wholesaler, or retailer costs to consumers.

Policy impacts of Accelerated Reduction scenario on consumer fuel prices, 2020$/GGE.

Year | Consumer Gasoline | Consumer Diesel |

2023 | 0.007 | (0.016) |

2024 | 0.017 | (0.006) |

2025 | 0.036 | 0.014 |

2026 | 0.056 | 0.034 |

2027 | 0.076 | 0.054 |

2028 | 0.105 | 0.083 |

2029 | 0.134 | 0.113 |

2030 | 0.164 | 0.142 |

2031 | 0.193 | 0.171 |

2032 | 0.193 | 0.171 |

2033 | 0.193 | 0.170 |

2034 | 0.389 | 0.368 |

2035 | 0.389 | 0.367 |

2036 | 0.389 | 0.366 |

2037 | 0.005 | 0.005 |

2038 | 0.005 | 0.005 |

(Source: BRG)

Based on supporting data provided by BRG, we identified that consumption of gasoline would consistently decrease over the course of the clean fuels program, while consumption of fossil diesel would decrease through 2032, increasing through 2035, and decreasing again through 2038.

Considering only these impacts to fossil-based gasoline and diesel, decreases in output could outweigh increases in prices in some years, resulting in reduced revenues. Thanks to the flexibility of transportation fuel suppliers over time, however, this may not be the case. Suppliers could choose to change the types of fuel they supply and how fuels are blended, to mitigate or avoid negative impacts to fossil fuel revenues. Moreover, expanded electrification and alternative fuel production would support additional revenues to new entrants to the Washington transportation fuels sector, including utilities or businesses specializing in electric vehicle charging.

MITIGATION OF DISPROPORTIONATE IMPACT: RFA (RCW 19.85.030(2)) states that: "Based upon the extent of disproportionate impact on small business identified in the statement prepared under RCW 19.85.040, the agency shall, where legal and feasible in meeting the stated objectives of the statutes upon which the rule is based, reduce the costs imposed by the rule on small businesses. The agency must consider, without limitation, each of the following methods of reducing the impact of the proposed rule on small businesses:

(a) Reducing, modifying, or eliminating substantive regulatory requirements;

(b) Simplifying, reducing, or eliminating recordkeeping and reporting requirements;

(c) Reducing the frequency of inspections;

(d) Delaying compliance timetables;

(e) Reducing or modifying fine schedules for noncompliance; or

(f) Any other mitigation techniques including those suggested by small businesses or small business advocates."

Based on the absence of small businesses among likely entities with deficits under the proposed rule, and the absence of opt-in entities that would see compliance costs (rather than a benefit), ecology is not required to consider the above options or mitigate the likely nonexistent disproportionate costs. Nonetheless, we note that during development of the proposed rule, ecology considered alternative rule contents, and did not include the following elements in the rule because they would have imposed additional burden on covered parties:

| • | Compliance years: Making 2023 a full compliance year. |

| • | GREET model: Using the most recent version of the Argonne GREET model. |

| • | Verification: Including third-party verification at the start of the program. |

SMALL BUSINESS AND LOCAL GOVERNMENT CONSULTATION:We involved small businesses and local governments in its development of the proposed rule, using:

| • | Stakeholder meetings held 10/6/21, 11/16/21, 1/27/22, 3/15/22, 4/13/22. |

| • | Stakeholder meeting notices and meeting materials, project updates, and rule announcement notice. |

Attendance at stakeholder meetings included representation from the following, which includes representation of small businesses and local governments:

| • | Clean Fuels Alliance America. |

| • | Renewable Fuels Association. |

| • | Renewable Natural Gas Coalition. |

| • | Airlines for America. |

| • | Superior Court Judges Association. |

| • | Renewable Hydrogen Alliance. |

| • | Pacific Merchant Shipping Association. |

| • | NW Energy Coalition. |

| • | City of Tacoma. |

| • | Port of Seattle. |

| • | City of Seattle. |

| • | King County. |

| • | Port of Kalama. |

NAICS CODES OF INDUSTRIES IMPACTED BY THE PROPOSED RULE: 2211, Electric Power Generation, Transmission and Distribution

3241, Petroleum and Coal Products Manufacturing

3251, Basic Chemical Manufacturing

4247, Petroleum and Petroleum Products Merchant Wholesalers

4251, Wholesale Trade Agents and Brokers

4451, Grocery and Convenience Retailers

4471, Gasoline Stations

4921, Couriers and Express Delivery Services

The proposed rule may also impose compliance costs on businesses in the following industries that ecology assumes are likely to opt-into the clean fuels program because they expect a net benefit from participation:

Aviation fuels manufacturing (NAICS 324110)

Electric vehicle charging companies (no current NAICS available)

Electric vehicle manufacturers (NAICS 336110)

Electric or hydrogen vehicle fleet owners (various possible NAICS)

IMPACT ON JOBS: BRG estimated the following impacts to jobs resulting from the proposed rule, as reflected in their corresponding Accelerated Reduction scenario.

Overall employment impacts.

Year | Indirect | Induced | Direct | Total Net |

2023 | 15 | 7 | -5 | 17 |

2024 | 17 | 8 | -5 | 20 |

2025 | 18 | 8 | -4 | 22 |

2026 | 20 | 9 | -4 | 25 |

2027 | 23 | 10 | -3 | 30 |

2028 | 25 | 11 | -2 | 34 |

2029 | 27 | 12 | -2 | 37 |

2030 | 31 | 14 | -1 | 44 |

2031 | 36 | 16 | 1 | 53 |

2032 | 44 | 20 | 3 | 67 |

2033 | 56 | 25 | 7 | 88 |

2034 | 54 | 24 | 6 | 84 |

2035 | 71 | 31 | 11 | 113 |

2036 | 92 | 41 | 21 | 154 |

2037 | 1 | 1 | 0 | 2 |

2038 | 2 | 1 | 1 | 4 |

(Source: BRG)

A copy of the statement may be obtained by contacting Rachel Assink, Department of Ecology, Air Quality Program, P.O. Box 47600, Olympia, WA 98504-7600, phone 425-531-3444, for Washington relay service or TTY call 711 or 877-833-6341, email rachel.assink@ecy.wa.gov.

July 18, 2022

Heather R. Bartlett

Deputy Director

OTS-3854.4

Chapter 173-424 WAC

CLEAN FUELS PROGRAM RULE

PART 1 - OVERVIEW

NEW SECTION

WAC 173-424-100Purpose.

This rule establishes requirements for suppliers and consumers of certain transportation fuels in Washington in order to reduce the lifecycle greenhouse gas emissions per unit energy (carbon intensity) of transportation fuels used in the state.

NEW SECTION

WAC 173-424-110Definitions.

Except as provided elsewhere in this chapter, the definitions in this section apply throughout the chapter:

(1) "Above the rack" means sales of transportation fuel at pipeline origin points, pipeline batches in transit, barge loads in transit, and at terminal tanks before the transportation fuel has been loaded into trucks.

(2) "Advance credits" refers to credits advanced under WAC 173-424-550 for actions that will result in reductions of the carbon intensity of Washington's transportation fuels.

(3) "Aggregation indicator" means an identifier for reported transactions that are a result of an aggregation or summing of more than one transaction in Washington fuels reporting system (WFRS). An entry of "true" indicates that multiple transactions have been aggregated and are reported with a single transaction number. An entry of "false" indicates that the transaction record represent a single fuel transaction.

(4) "Aggregator" or "credit aggregator" means a person who registers to participate in the clean fuels program, described in WAC 173-424-140(3), on behalf of one or more credit generators to facilitate credit generation and to trade credits.

(5) "Aggregator designation form" means an ecology-approved document that specifies that a credit generator has designated an aggregator to act on its behalf.

(6) "Alternative fuel" means any transportation fuel that is not gasoline or a diesel fuel, including those fuels specified in WAC 173-424-120(2).

(7) "Alternative fuel portal" or "AFP" means the portion of the WFRS where fuel producers can register their production facilities and submit fuel pathway code applications and physical pathway demonstrations.

(8) "Alternative jet fuel" means a fuel made from petroleum or nonpetroleum sources that can be blended and used with conventional petroleum jet fuels without the need to modify aircraft engines and existing fuel distribution infrastructure. To generate credits under this CFP, such fuel must have a lower carbon intensity than the applicable annual carbon intensity standard in Table 2 of WAC 173-424-900. Alternative jet fuel includes those jet fuels derived from co-processed feedstocks at a conventional petroleum refinery.

(9) "Animal fat" means the inedible fat that originates from a rendering facility as a product of rendering the by-products from meat processing facilities including animal parts, fat, and bone. "Yellow grease" must be reported under an applicable animal fat pathway if evidence is not provided to the verifier or ecology to confirm the quantity that is animal fat and the quantity that is used cooking oil.

(10) "Application" means the type of vehicle where the fuel is consumed in terms of LDV/MDV for light-duty vehicle/medium-duty vehicle or HDV for heavy-duty vehicle.

(11) "Backstop aggregator" means a qualified entity approved by ecology under WAC 173-424-140(3) to aggregate credits for electricity used as a transportation fuel, when those credits would not otherwise be generated.

(12) "Base credits" refers to electricity credits that are generated by the carbon reduction between the gasoline or diesel standard and the carbon intensity of utility electricity.

(13) "Battery electric vehicle" or "BEV" means any vehicle that operates solely by use of a battery or battery pack, or that is powered primarily through the use of an electric battery or battery pack but uses a flywheel or capacitor that stores energy produced by the electric motor or through regenerative braking to assist in vehicle operation.

(14) "Below the rack" means sales of clear or blended gasoline or diesel fuel where the fuel is being sold as a finished fuel for use in a motor vehicle.

(15) "Bill of lading" means a document issued that lists goods being shipped and specifies the terms of their transport.

(16) "Bio-CNG" means biomethane which has been compressed to CNG. Bio-CNG has equivalent performance characteristics when compared to fossil CNG.

(17) "Biodiesel" means a motor vehicle fuel consisting of mono alkyl esters of long chain fatty acids derived from vegetable oils, animal fats, or other nonpetroleum resources, not including palm oil, designated as B100 and complying with ASTM D6751.

(18) "Biodiesel blend" means a fuel comprised of a blend of biodiesel with petroleum-based diesel fuel, designated BXX. In the abbreviation BXX, the XX represents the volume percentage of biodiesel fuel in the blend.

(19) "Bio-L-CNG" means biomethane which has been compressed, liquefied, regasified, and recompressed into L-CNG, and has performance characteristics at least equivalent to fossil L-CNG.

(20) "Bio-LNG" means biomethane which has been compressed and liquefied into LNG. Bio-LNG has equivalent performance characteristics when compared to fossil LNG.

(21) "Biogas" means gas comprised primarily of methane and carbon dioxide, produced by the anaerobic decomposition of organic matter in a landfill, lagoon, or constructed reactor (digester). Biogas often contains a number of other impurities, such as hydrogen sulfide, and it cannot be directly injected into natural gas pipelines or combusted in most natural-gas-fueled vehicles unless first upgraded to biomethane. It can be used as a fuel in boilers and engines to produce electrical power.

(22) "Biomass" means nonfossilized and biodegradable organic material originating from plants, animals, or microorganisms, including: Products, by-products, residues and waste from agriculture, forestry, and related industries; the nonfossilized and biodegradable organic fractions of industrial and municipal wastes; and gases and liquids recovered from the decomposition of nonfossilized and biodegradable organic material.

(23) "Biomass-based diesel" means a biodiesel or a renewable diesel.

(24) "Biomethane" means methane derived from biogas, or synthetic natural gas derived from renewable resources, including the organic portion of municipal solid waste, which has been upgraded to meet standards for injection to a natural gas common carrier pipeline, or for use in natural gas vehicles, natural gas equipment, or production of renewable hydrogen. Biomethane contains all of the environmental attributes associated with biogas and can also be referred to as renewable natural gas.

(25) "Blendstock" means a fuel component that is either used alone or is blended with one or more other components to produce a finished fuel used in a motor vehicle. Each blendstock corresponds to a fuel pathway in the Washington Greenhouse Gases, Regulated Emissions, and Energy use in Transportation version 3.0 (WA-GREET 3.0) model, (November 28, 2022), which is incorporated herein by reference. A blendstock that is used directly as a transportation fuel in a vehicle is considered a finished fuel.

(26) "Bulk system" means a fuel distribution system consisting of refineries, pipelines, vessels, and terminals. Fuel storage and blending facilities that are not fed by pipeline or vessel are considered outside the bulk transfer system.

(27) "Business partner" refers to the second party that participates in a specific transaction involving the regulated party. This can either be the buyer or seller of fuel, whichever applies to the specific transaction.

(28) "Buy/sell board" means a section of the WFRS where registered parties can post that they are interested in buying or selling credits.

(29) "Carbon intensity" or "CI" means the amount of lifecycle greenhouse gas emissions per unit of energy of fuel expressed in grams of carbon dioxide equivalent per megajoule (gCO2e/MJ).

(30) "Cargo handling equipment" or "CHE" means any off-road, self-propelled vehicle or equipment, other than yard trucks, used at a port or intermodal rail yard to lift or move container, bulk, or liquid cargo carried by ship, train, or another vehicle, or used to perform maintenance and repair activities that are routinely scheduled or that are due to predictable process upsets. Equipment includes, but is not limited to, rubber-tired gantry cranes, top handlers, side handlers, reach stackers, loaders, aerial lifts, excavators, tractors, and dozers.

(31) "Carryback credit" means a credit that was generated during or before the prior compliance period that a regulated party acquires between January 1st and April 30th of the current compliance period to meet its compliance obligation for the prior compliance period.

(32) "Clean fuel standard" or "low carbon fuel standard" means the annual average carbon intensity a regulated party must comply with, as listed in Table 1 under WAC 173-424-900 for gasoline and gasoline substitutes and in Table 2 under WAC 173-424-900 for diesel fuel and diesel substitutes.

(33) "Clear diesel" means a light middle or middle distillate grade diesel fuel derived from crude oil that has not been blended with a renewable fuel.

(34) "Clear gasoline" means gasoline derived from crude oil that has not been blended with a renewable fuel.

(35) "Compliance period" means each calendar year(s) during which regulated parties must demonstrate compliance under WAC 173-424-140.

(36) "Compressed natural gas" or "CNG" means natural gas stored inside a pressure vessel at a pressure greater than the ambient atmospheric pressure.

(37) "Conventional jet fuel" means aviation turbine fuel including commercial and military jet fuel. Commercial jet fuel includes products known as Jet A, Jet A-1, and Jet B. Military jet fuel includes products known as JP-5 and JP-8.

(38) "Co-processing" means the processing and refining of renewable or alternative low-carbon feedstocks intermingled with crude oil and its derivatives at petroleum refineries.

(39) "Credit facilitator" means a person in the WFRS that a regulated party designates to initiate and complete credit transfers on behalf of the regulated party.

(40) "Credit generator" means a person eligible to generate credits by providing clean fuels for use in Washington and who voluntarily registers to participate in the clean fuels program.

(41) "Credits" and "deficits" mean the units of measure used for determining a regulated entity's compliance with the average carbon intensity requirements in WAC 173-424-900. Credits and deficits are denominated in units of metric tons of carbon dioxide equivalent (CO2e), and are calculated pursuant to WAC 173-424-540 and 173-424-560.

(42) "Crude oil" means any naturally occurring flammable mixture of hydrocarbons found in geologic formations.

(43) "Day" means a calendar day unless otherwise specified as a business day.

(44) "Deferral" means a delay or change in the applicability of a scheduled applicable clean fuel standard for a period of time, accomplished pursuant to an order issued under WAC 173-424-720 or 173-424-730 as directed under RCW 70A.535.110 and 70A.535.120.

(45) "Deficit generator" means a fuel reporting entity who generates deficits in the CFP program.

(46) "Denatured fuel ethanol" or "ethanol" means nominally anhydrous ethyl alcohol meeting ASTM D4806 standards. It is intended to be blended with gasoline for use as a fuel in a spark-ignition internal combustion engine. Before it is blended with gasoline, the denatured fuel ethanol is first made unfit for drinking by the addition of substances approved by the Alcohol and Tobacco Tax and Trade Bureau.

(47) "Diesel fuel" or "diesel" means either:

(a) A light middle distillate or middle distillate fuel suitable for compression ignition engines blended with not more than five volume percent biodiesel and conforming to the specifications of ASTM D975; or

(b) A light middle distillate or middle distillate fuel blended with at least five and not more than 20 volume percent biodiesel suitable for compression ignition engines conforming to the specifications of ASTM D7467.

(48) "Direct current fast charging" means charging an electric vehicle at 50 kW and higher using direct current.

(49) "Disproportionately impacted communities" means communities that are identified by the department of health pursuant to chapters 70A.02 and 19.405 RCW.

(50) "Distiller's corn oil" has the same meaning as "technical corn oil."

(51) "Distiller's sorghum oil" has the same meaning as "technical sorghum oil."

(52) "Duty-cycle testing" means a test procedure used for emissions and vehicle efficiency testing.

(53) "E10" means gasoline containing 10 volume percent fuel ethanol.

(54) "E100" also known as "denatured fuel ethanol," means nominally anhydrous ethyl alcohol.

(55) "Ecology" means the Washington state department of ecology.

(56) "Electric cargo handling equipment (eCHE)" means cargo handling equipment using electricity as the fuel.

(57) "Electric ground support equipment (eGSE)" means self-propelled vehicles used off-road at airports to support general aviation activities that use electric batteries for propulsion and functional energy and only has electric motors. For the purpose of this rule that includes, but is not limited to, pushbacks, belt loaders, and baggage tractors.

(58) "Electric power for ocean-going vessel (eOGV)" means shore power provided to an ocean going vessel at-berth.

(59) "Electric transport refrigeration units (eTRU)" means refrigeration systems powered by electricity designed to refrigerate or heat perishable products that are transported in various containers, including semi-trailers, truck vans, shipping containers, and rail cars.

(60) "Electric vehicle (EV)," for purposes of this regulation, refers to battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

(61) "Emergency period" is the period of time in which an emergency action under WAC 173-424-720 is in effect.

(62) "Energy economy ratio (EER)" means the dimensionless value that represents the efficiency of a fuel as used in a powertrain as compared to a reference fuel used in the same powertrain.

(a) EERs are often a comparison of miles per gasoline gallon equivalent (mpge) between two fuels.

(b) EERs for fixed guideway systems are based on MJ/number of passenger-miles.

(63) "Environmental attribute" means greenhouse gas emission reduction recognition in any form, including verified emission reductions, voluntary emission reductions, offsets, allowances, credits, avoided compliance costs, emission rights and authorizations under any law or regulation, or any emission reduction registry, trading system, or reporting or reduction program for greenhouse gas emissions that is established, certified, maintained, or recognized by any international, governmental, or nongovernmental agency.

(64) "Export" means transportation fuel reported in the WFRS that is delivered to locations outside of Washington state by any means of transport, other than in the fuel tank of a motor vehicle for the purpose of propelling the motor vehicle.

(65) "Feedstock transfer document" means a document, or combination of documents, that demonstrates the delivery of specified source feedstocks from the point of origin to the fuel production facility as required under WAC 173-424-600(6).

(66) "Finished fuel" means a transportation fuel that is used directly in a vehicle for transportation purposes without requiring additional chemical or physical processing.

(67) "First fuel reporting entity" means the first entity responsible for reporting in the WFRS for a given amount of fuel. This entity initially holds the status as the fuel reporting entity and the credit or deficit generator for this fuel amount, but may transfer either status pursuant to WAC 173-424-200 or 173-424-210.

(68) "Fixed guideway" means a public transportation facility using and occupying a separate right of way for the exclusive use of public transportation using rail, a fixed catenary system, an aerial tramway, or for a bus rapid transit system.

(69) "Fossil" means any naturally occurring flammable mixture of hydrocarbons found in geologic formations such as rock or strata. When used as an adjective preceding a type of fuel (e.g., "fossil gasoline," or "fossil LNG"), it means the subset of that type of fuel that is derived from a fossil source.

(70) "Fuel pathway" means a detailed description of all stages of fuel production and use for any particular transportation fuel, including feedstock generation or extraction, production, distribution, and combustion of the fuel by the consumer. The fuel pathway is used to calculate the carbon intensity of each transportation fuel through a complete well-to-wheel analysis of that fuel's life cycle greenhouse gas emissions.

(71) "Fuel pathway applicant" refers to an entity that has registered in the alternative fuel portal pursuant to WAC 173-424-300 and has submitted an application including all required documents and attestations in support of the application requesting a certified fuel pathway.

(72) "Fuel pathway code" or "FPC" means the identifier used in the WFRS that applies to a specific fuel pathway as approved or issued under WAC 173-424-600 through 173-424-630.

(73) "Fuel pathway holder" means a fuel pathway applicant that has received a certified fuel pathway carbon intensity based on site-specific data, including a provisional fuel pathway from ecology, or who has a certified fuel pathway code from the California air resources board or Oregon department of environmental quality that has been approved for use in Washington by ecology.

(74) "Fuel production facility" means the facility at which a regulated or opt-in fuel is produced. With respect to biomethane, a fuel production facility means the facility at which the fuel is upgraded, purified, or processed to meet the standards for injection to a natural gas common carrier pipeline or for use in natural gas vehicles.

(75) "Fuel reporting entity" means an entity that is required to report fuel transactions in the WFRS pursuant to WAC 173-424-200 through 173-424-220. Fuel reporting entity refers to the first fuel reporting entity and to any entity to whom the reporting entity status is passed for a given quantity of fuel.

(76) "Fuel supply equipment" refers to equipment registered in the WFRS that dispenses alternative fuel into vehicles including, but not limited to, electric vehicle chargers, hydrogen fueling stations, and natural gas fueling equipment.

(77) "Gasoline" means a fuel suitable for spark ignition engines and conforming to the specifications of ASTM D4814.

(78) "Heavy-duty vehicle" or "HDV" means a vehicle that is rated at or greater than 14,001 pounds gross vehicle weight rating (GVWR).

(79) "Home fueling" means the dispensing of fuel by use of a fueling appliance that is located on or within a residential property with access limited to a single household.

(80) "Hybrid electric vehicle (HEV)" means any vehicle that can draw propulsion energy from both of the following on-vehicle sources of stored energy:

(a) A consumable fuel; and

(b) An energy storage device, such as a battery, capacitor, or flywheel.

(81) "Hydrogen station capacity evaluator" or "HySCapE" means a tool developed by the National Renewable Energy Laboratory to determine the dispensing capacity of a hydrogen station, HySCapE Version 1.0 (August 13, 2018).

(82) "Illegitimate credits" means credits that were not generated in compliance with (either say "the CFS" or cite to the WAC provision on credit generation. I believe "division" is specific to the Oregon program).

(83) "Import" means to have ownership title to transportation fuel at the time it is brought from outside Washington into Washington by any means of transport other than in the fuel tank of a motor vehicle for the purpose of propelling that motor vehicle.

(84) "Importer" means:

(a) With respect to any liquid fuel, the person who imports the fuel; or

(b) With respect to any biomethane, the person who owns the biomethane when it is either physically transported into Washington or injected into a pipeline located outside of Washington and delivered for use in Washington.

(85) "Incremental credit" means a credit that is generated by an action to further lower the carbon intensity of electricity. Incremental credits are calculated from the difference between the carbon intensity of statewide grid or utility-specific electricity and the carbon intensity of renewable electricity.

(86) "Indirect land use change" means the average lifecycle greenhouse gas emissions caused by an increase in land area used to grow crops that is caused by increased use of crop-based transportation fuels, and expressed as grams of carbon dioxide equivalent per megajoule of energy provided (gCO2e/MJ). Indirect land use change values for biofuels are listed in Table 5 under WAC 173-424-900. Indirect land use change for fuel made from sugarcane, corn, sorghum, soybean, canola, and palm feedstocks is calculated using the protocol developed by the California air resources board.

(87) "Ineligible specified source feedstock" means a feedstock specified in WAC 173-424-600 (6)(a) through (c) that does not meet the chain-of-custody documentation requirements specified in WAC 173-424-600 (6)(d).

(88) "Invoice" means the receipt or other record of a sale transaction, specifying the price and terms of sale, that describes an itemized list of goods shipped.

(89) "Lifecycle greenhouse gas emissions" are:

(a) The aggregated quantity of greenhouse gas emissions, including direct emissions and significant indirect emissions, such as significant emissions from changes in land use associated with the fuels, as approved by ecology;

(b) Measured over the full fuel lifecycle, including all stages of fuel production, from feedstock generation or extraction, production, distribution, and combustion of the fuel by the consumer; and

(c) Stated in terms of mass values for all greenhouse gases as adjusted to CO2e to account for the relative global warming potential of each gas.

(90) "Light-duty vehicle" and "medium-duty vehicle" mean a vehicle category that includes both light-duty (LDV) and medium-duty vehicles (MDV).

(a) "LDV" means a vehicle that is rated at 8,500 pounds or less GVWR.

(b) "MDV" means a vehicle that is rated between 8,501 and 14,000 pounds GVWR.

(91) "Liquefied compressed natural gas" or "L-CNG" means natural gas that has been liquefied and transported to a dispensing station where it was then regasified and compressed to a pressure greater than ambient pressure.

(92) "Liquefied natural gas" or "LNG" means natural gas that has been liquefied.

(93) "Liquefied petroleum gas" or "propane" or "LPG" means a petroleum product composed predominantly of any of the hydrocarbons, or mixture thereof; propane, propylene, butanes, and butylenes maintained in the liquid state.

(94) "Low-carbon intensity (Low-CI) electricity" means any electricity that is determined to have a carbon intensity that is less than the average grid or utility specific, as applicable including, but not limited to, a renewable resource as defined in RCW 19.405.020(34).

(95) "Motor vehicle" means any vehicle, vessel, watercraft, engine, machine, or mechanical contrivance that is self-propelled.

(96) "M-RETS renewable thermal" means the electronic tracking and trading system for North American biomethane and other renewable thermal attributes run by the M-RETS organization. For the purposes of this division, only the biomethane or renewable natural gas certificates generated by this system are recognized.

(97) "Multifamily housing" means a structure or facility established primarily to provide housing that provides four or more living units in which each unit shares a floor or ceiling on at least one side.

(98) "Multifuel vehicle" means a vehicle that uses two or more distinct fuels for its operation. A multifuel vehicle (also called a vehicle operating in blended-mode) includes a bi-fuel vehicle and can have two or more fueling ports onboard the vehicle. A fueling port can be an electrical plug or a receptacle for liquid or gaseous fuel. For example, most plug-in hybrid electric vehicles use both electricity and gasoline as the fuel source and can be "refueled" using two separately distinct fueling ports.

(99) "Natural gas" means a mixture of gaseous hydrocarbons and other compounds with at least 80 percent methane by volume.

(100) "Ocean-going vessel" means a commercial, government, or military vessel meeting any one of the following criteria:

(a) A vessel greater than or equal to 400 feet in length overall;

(b) A vessel greater than or equal to 10,000 gross tons pursuant to the convention measurement (international system);

(c) A vessel propelled by a marine compression ignition engine with a per-cylinder displacement of greater than or equal to 30 liters.

(101) "OPGEE" or "OPGEE model" means the oil production greenhouse gas emissions estimator version 2.0 (June 20, 2018) posted at http://www.arb.ca.gov/fuels/lcfs/lcfs.htm, which is incorporated herein by reference.

(102) "Opt-in fuel reporting entity" means an entity that meets the requirements of WAC 173-424-120 and voluntarily opts in to be a fuel reporting entity and is therefore subject to the requirements set forth in this chapter.

(103) "Petroleum intermediate" means a petroleum product that can be further processed to produce gasoline, diesel, or other petroleum blendstocks.

(104) "Petroleum product" means all refined and semi-refined products that are produced at a refinery by processing crude oil and other petroleum-based feedstocks, including petroleum products derived from co-processing biomass and petroleum feedstock together. "Petroleum product" does not include plastics or plastic products.

(105) "Physical transport mode" means the applicable combination of actual fuel delivery methods, such as truck routes, rail lines, pipelines and any other fuel distribution methods through which the regulated party reasonably expects the fuel to be transported under contract from the entity that generated or produced the fuel, to any intermediate entities and ending in Washington. The fuel pathway holder and any entity reporting the fuel must demonstrate that the actual feedstock transport mode and distance conforms to the stated mode and distance in the certified pathway.

(106) "Plug-in hybrid electric vehicle" or "PHEV" means a hybrid electric vehicle with the capability to charge a battery from an off-vehicle electric energy source that cannot be connected or coupled to the vehicle in any manner while the vehicle is being driven.

(107) "Position holder" means any person that has an ownership interest in a specific amount of fuel in the inventory of a terminal operator. This does not include inventory held outside of a terminal, retail establishments, or other fuel suppliers not holding inventory at a fuel terminal.

(108) "Power purchase agreement" means a written agreement between an electricity service supplier and a customer that specifies the source or sources of electricity that will supply the customer.

(109) "Private access fueling facility" means a fueling facility with access restricted to privately-distributed electronic cards (cardlock) or is located in a secure area not accessible to the public.

(110) "Producer" means:

(a) With respect to any liquid fuel and renewable propane, the person who makes the fuel; or

(b) With respect to any biomethane, the person who refines, treats, or otherwise processes biogas into biomethane.

(111) "Product transfer document" or "PTD" means a document that authenticates the transfer of ownership of fuel from a fuel reporting entity to the recipient of the fuel. A PTD is created by a fuel reporting entity to contain information collectively supplied by other fuel transaction documents, including bills of lading, invoices, contracts, meter tickets, rail inventory sheets, renewable fuels standard (RFS) product transfer documents, etc.

(112) "Public access fueling facility" means a fueling facility that is not a private-access fueling dispenser.

(113) "Public transit agency" means an entity that operates a public transportation system.

(114) "Public transportation" means regular, continuing shared passenger-transport services along set routes which are available for use by the general public.

(115) "Rack" means a mechanism for delivering motor vehicle fuel or diesel from a refinery or terminal into a truck, trailer, railroad car, or other means of nonbulk transfer.

(116) "Registered party" means a regulated party, credit generator, aggregator, or an out-of-state fuel producer that has an ecology-approved registration under WAC 173-424-300 to participate in the clean fuels program.

(117) "Regulated fuel" means a transportation fuel identified under WAC 173-424-120(2).

(118) "Regulated party" means a person responsible for compliance with requirements listed under WAC 173-424-140(1).

(119) "Renewable fuel standard" means the program administered by the United States Environmental Protection Agency, under 40 C.F.R. Part 80: Regulation of fuels and fuel additives, Subparts K and M.

(120) "Renewable gasoline" means a spark ignition engine fuel that substitutes for fossil gasoline and that is produced from renewable resources.

(121) "Renewable hydrocarbon diesel" or "renewable diesel" means a diesel fuel that is produced from nonpetroleum renewable resources but is not a monoalkylester and which is registered as a motor vehicle fuel or fuel additive under 40 C.F.R. Part 79. This includes the renewable portion of a diesel fuel derived from co-processing biomass with a petroleum feedstock.

(122) "Renewable hydrocarbon diesel blend" or "renewable diesel blend" means a fuel comprised of a blend of renewable hydrocarbon diesel with petroleum-based diesel fuel, designated RXX. In the abbreviation RXX, the XX represents the volume percentage of renewable hydrocarbon diesel fuel in the blend.

(123) "Renewable hydrogen" means hydrogen produced using renewable resources both as the source for the hydrogen and the source for the energy input into the production process, as defined in RCW 19.405.020(32). It includes hydrogen derived from:

(a) Electrolysis of water or aqueous solutions using renewable electricity;

(b) Catalytic cracking or steam methane reforming of biomethane; or

(c) Thermochemical conversion of biomass, including the organic portion of municipal solid waste (MSW).

Renewable electricity, for the purpose of renewable hydrogen production by electrolysis, means electricity derived from sources that qualify as renewable energy resources as defined in RCW 19.405.020(34).

(124) "Renewable naphtha" means naphtha that is produced from nonpetroleum renewable resources.

(125) "Renewable propane" means liquefied petroleum gas (LPG or propane) that is produced from nonpetroleum renewable resources.

(126) "Shore power" means electrical power being provided either by the local utility or by distributed generation to ocean-going vessels at-berth.

(127) "Single-family residence" means a building designed to house a family in a single residential unit. A single-family residence is either detached or attached including duplex or townhouse units.

(128) "Site-specific data" and "site-specific input" means an input value used in determination of fuel pathway carbon intensity value, or the raw operational data used to calculate an input value, which is required to be unique to the facility, pathway, and feedstock. All site-specific inputs must be measured, metered or otherwise documented, and verifiable, e.g., consumption of natural gas or grid electricity at a fuel production facility must be documented by invoices from the utility.

(129) "Small importer of finished fuels" means any person who imports into Washington 500,000 gallons or less of finished fuels in a given calendar year. Any fuel imported by persons that are related, or share common ownership or control, shall be aggregated together to determine whether a person meets this definition.

(130) "Specified source feedstocks" are feedstocks for fuel pathways that require chain of custody evidence to be eligible for a reduced CI associated with the use of a waste, residue, by-product, or similar material under the pathway certification process under WAC 173-424-600.

(131) "Station operational status system (SOSS)" means a software database tool developed and maintained by California fuel cell partnership to publicly monitor the operational status of hydrogen stations.

(132) "Substitute fuel pathway code" means a fuel pathway code that is used to report transactions that are sales or purchases without obligation, exports, loss of inventory, not for transportation use, and exempt fuel use when the seller of a fuel does not pass along the credits or deficits to the buyer and the buyer does not have accurate information on the carbon intensity of the fuel or its blendstocks.

(133) "Technical corn oil" means inedible oil recovered from thin stillage or the distiller's grains and solubles produced by a dry mill corn ethanol plant, termed distiller's corn oil (DCO), or other nonfood grade corn oil from food processing operations.

(134) "Technical sorghum oil" means inedible oil recovered from thin stillage or the distiller's grains and solubles produced by a dry mill sorghum ethanol plant, termed distiller's sorghum oil (DSO), or other nonfood grade sorghum oil from food processing operations.

(135) "Tier 1 calculator," "simplified calculator," or "WA-GREET 3.0 Tier 1 calculator" means the tools used to calculate lifecycle emissions for commonly produced fuels, including the instruction manuals on how to use the calculators. Ecology will make available copies of these simplified calculators on its website (https://www.ecology.wa.gov). The simplified calculators used in the program are:

(a) Tier 1 simplified calculator for starch and corn fiber ethanol;

(b) Tier 1 simplified CI calculator for sugarcane-derived ethanol;

(c) Tier 1 simplified CI calculator for biodiesel and renewable diesel;

(d) Tier 1 simplified CI calculator for LNG and L-CNG from North American Natural Gas;

(e) Tier 1 simplified CI calculator for biomethane from North American landfills;

(f) Tier 1 simplified CI calculator for biomethane from anaerobic digestion of wastewater sludge;

(g) Tier 1 simplified CI calculator for biomethane from food, green, and other organic wastes; and

(h) Tier 1 simplified CI calculator for biomethane from AD of dairy and swine manure.

(136) "Tier 2 calculator" or "WA-GREET 3.0 model" means the tool used to calculate lifecycle emissions for next generation fuels, including the instruction manual on how to use the calculator. Next generation fuels include, but are not limited to, cellulosic alcohols, hydrogen, drop-in fuels, or first generation fuels produced using innovative production processes. Ecology will make available a copy of the Tier 2 calculator on its website (https://www.ecology.wa.gov).

(137) "Total amount (TA)" means the total quantity of fuel reported by a fuel reporting entity irrespective of whether the entity retained status as the credit or deficit generator for that specific fuel volume. TA is calculated as the difference between the fuel reported using transaction types that increase the net fuel quantity reported in the WFRS and fuel reported using transaction type that decrease the net fuel quantity reported in the WFRS. Transaction types that increase the TA include: Production in Washington, production for import, import, purchased with obligation, purchased without obligation, gain of inventory. Transaction types that decrease the TA include: Sold with obligation, sold without obligation, loss of inventory, export, not used for transportation.

(138) "Transaction date" means the title transfer date as shown on the product transfer document.

(139) "Transaction quantity" means the amount of fuel reported in a transaction. A transaction quantity must be reported in units, provided in Table 3 in WAC 173-424-900 and in the WFRS.

(140) "Transaction type" means the nature of the fuel transaction as defined below:

(a) "Produced in Washington" means the transportation fuel was produced at a facility in Washington;

(b) "Import within the bulk system" means the transportation fuel was produced outside of Washington and later imported into Washington and placed into the bulk system;

(c) "Import outside the bulk system" means the transportation fuel was imported into Washington and delivered outside the bulk system;

(d) "Purchased with obligation" means the transportation fuel was purchased with the compliance obligation passing to the purchaser;

(e) "Purchased without obligation" means the transportation fuel was purchased with the compliance obligation retained by the seller;

(f) "Sold with obligation" means the transportation fuel was sold with the compliance obligation passing to the purchaser;

(g) "Sold without obligation" means the transportation fuel was sold with the compliance obligation retained by the seller;

(h) "Position holder sale" means the transportation fuel was sold below the rack without a transfer of the compliance obligation;

(i) "Position holder sale for export" means the transportation fuel was sold below the rack to an entity who exported the fuel;

(j) "Purchase below the rack for export" means the transportation fuel was purchased below the rack and exported;

(k) "Export" means a transportation fuel that was reported under the clean fuels program but was later moved from a location inside of Washington to a location outside of Washington, and is not used for transportation in Washington;

(l) "Loss of inventory" means the fuel exited the Washington fuel pool due to volume loss, such as through evaporation or due to different temperatures or pressurization;

(m) "Gain of inventory" means the fuel entered the Washington fuel pool due to a volume gain, such as through different temperatures or pressurization;

(n) "Not used for transportation" means a transportation fuel was reported with compliance obligation under the CFP but was later used in an application unrelated to the movement of goods or people in Washington, such as process heat at an industrial facility, home or commercial building heating, or electric power generation;

(o) "EV charging" means providing electricity to recharge EVs including BEVs and PHEVs;

(p) "LPGV fueling" means the dispensing of liquefied petroleum gas at a fueling station designed for fueling liquefied petroleum gas vehicles;

(q) "NGV fueling" means the dispensing of natural gas at a fueling station designed for fueling natural gas vehicles;

(r) "Exempt fuel use - aircraft," "exempt fuel use - racing activity vehicles," "exempt fuel use - military tactical and support vehicle and equipment," "exempt fuel use - locomotives," "exempt fuel use - watercraft," "exempt fuel use - farm vehicles, tractors, implements of husbandry," "exempt fuel use - motor trucks primary used to transport logs," "exempt fuel use - off-highway construction vehicles, all of which must meet WAC 173-424-130" means that the fuel was delivered or sold into the category of vehicles or fuel users that are exempt under WAC 173-424-130; or

(s) "Production for import into Washington" means the transportation fuel was produced outside of Washington and imported into Washington for use in transportation.

(141) "Transportation fuel" means gasoline, diesel, any other flammable or combustible gas or liquid and electricity that can be used as a fuel for the operation of a motor vehicle. Transportation fuel does not mean unrefined petroleum products.

(142) "Unbundled renewable energy credit" means a renewable energy credit that is sold, delivered, or purchased separately from electricity.

(143) "Unit of fuel" means fuel quantities expressed to the largest whole unit of measure, with any remainder expressed in decimal fractions of the largest whole unit.

(144) "Unit of measure" means either:

(a) The International System of Units defined in NIST Special Publication 811 (2008) commonly called the metric system;

(b) U.S. customer units defined in terms of their metric conversion factors in NIST Special Publications 811 (2008); or

(c) Commodity specific units defined in either:

(i) The NIST Handbook 130 (2015), Method of Sale Regulation; or

(ii) Chapter 16-662 WAC.

(145) "Unspecified source of electricity" or "unspecified source" means a source of electricity that is not a specified source at the time of entry into the transaction to procure the electricity. The generation of such electricity will be assigned an emissions factor of 0.437 metric tons per megawatt-hour of electricity as measured by the utility at the first point of receipt in Washington, unless ecology assigns another number as directed by RCW 19.405.070(2). This includes the GHG emission factor 0.428 metric tons per megawatt-hour for electricity generation, and the two percent GHG emissions due to transmission losses between the point of generation and the first point of receipt in Washington.

(146) "Used cooking oil" or "UCO" means fats and oils originating from commercial or industrial food processing operations, including restaurants that have been used for cooking or frying. Feedstock characterized as UCO must contain only fats, oils, or greases that were previously used for cooking or frying operations. UCO must be characterized as "processed UCO" if it is known that processing has occurred prior to receipt by the fuel production facility or if evidence is not provided to the verifier or ecology to confirm that it is "unprocessed UCO."

(147) "Utility renewable electricity product" means a product where a utility customer has elected to purchase renewable electricity through a product that retires RECs or represents a bundled purchase of renewable electricity and its RECs.

(148) "Validation" means verification of a fuel pathway application.

(149) "Verification" means a systematic, independent, and documented process for evaluation of reported data against the requirements specified in this chapter.

(150) "Washington fuels reporting system" or "WFRS" means the interactive, secured, web-based, electronic data tracking, reporting, and compliance system that ecology develops, manages, and operates to support the clean fuels program.

(151) "WFRS reporting deadlines" means the quarterly and annual reporting dates in WAC 173-424-410 and 173-424-430.

(152) "WA-GREET" means the greenhouse gases, regulated emissions, and energy in transportation (GREET) model developed by Argonne National Laboratory that ecology modifies and maintains for use in the Washington clean fuels program. The most current version is WA-GREET 3.0. Ecology will make available a copy of WA-GREET 3.0 on its website (www.ecology.wa.gov). As used in this rule, WA-GREET refers to both the full model and the fuel-specific simplified calculators that the program has adopted.

(153) "Yellow grease" means a commodity produced from a mixture of:

(a) Used cooking oil; and

(b) Rendered animal fats that were not used for cooking.

This mixture often is combined from multiple points of origin. Yellow grease must be characterized as "animal fat" if evidence is not provided to the verifier or ecology to confirm the quantity that is animal fat and the quantity that is used cooking oil.

Abbreviations. For the purposes of this chapter, the following acronyms apply.

"AEZ-EF" means agro-ecological zone emissions factor model.

"AFP" means alternative fuel portal.

"AJF" means alternative jet fuel.

"ASTM" means ASTM International (formerly American Society for Testing and Materials).

"BEV" means battery electric vehicles.

"WA-GREET" means Washington-modified greenhouse gases, regulated emissions, and energy use in transportation model.

"CARB" means California air resources board.

"CA-GREET" means the California air resources board adopted version of GREET model.

"CCM" means credit clearance market.

"CEC" means California energy commission.

"CFP" means clean fuels program established under this chapter to implement chapter 70A.535 RCW.

"CFR" means Code of Federal Regulations.

"CFS" means clean fuel standard or carbon intensity standard.

"CHAdeMO" means charge de move, a DC fast charging protocol.

"CI" means carbon intensity.

"CNG" means compressed natural gas.

"DC" means direct current.

"DCO" means distiller's corn oil or technical corn oil.

"DSO" means distiller's sorghum oil or technical sorghum oil.

"eCHE" means electric cargo handling equipment.

"EDU" means electrical distribution utility.

"EER" means energy economy ratio.

"eTRU" means electric transport refrigeration unit.

"eOGV" means electric power for ocean-going vessel.

"EV" means electric vehicle.

"FCV" means fuel cell vehicle.

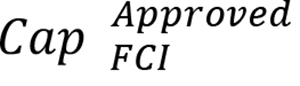

"FCI" means direct current fast charging infrastructure.

"FEIN" means federal employer identification number.

"FPC" means fuel pathway code.

"FSE" means fueling supply equipment.

"(gCO2e/MJ)" means grams of carbon dioxide equivalent per megajoule.

"GTAP" means the global trade analysis project model.

"GVWR" means gross vehicle weight rating.

"HySCapE" means hydrogen station capacity evaluator.

"H2" means hydrogen.

"HDV" means heavy-duty vehicles.

"HDV-CIE" means a heavy-duty vehicle compression-ignition engine.

"HDV-SIE" means a heavy-duty vehicle spark-ignition engine.

"HEV" means hybrid electric vehicle.

"HRI" means hydrogen refueling infrastructure.

"ICEV" means internal combustion engine vehicle.

"LUC" means land use change.

"LCA" means life cycle analysis.

"L-CNG" means liquefied compressed natural gas.

"LDV" means light-duty vehicles.

"LNG" means liquefied natural gas.

"LPG" means liquefied petroleum gas.

"LPGV" means liquefied petroleum gas vehicle.

"MCON" means marketable crude oil name.

"MDV" means medium-duty vehicles.

"MMBtu" means million British thermal units.

"MT" means metric tons (of carbon dioxide equivalent).

"NG" means natural gas.

"NGV" means a natural gas vehicle.

"OPGEE" means oil production greenhouse gas emissions estimator model.

"OR-DEQ" means Oregon department of environmental quality.

"PHEV" means plug-in hybrid vehicles.

"PTD" means product transfer document.

"RFS" means the renewable fuel standard.

"REC" means renewable energy certificate.

"RTC" means renewable thermal certificate.

"RNG" means renewable natural gas or biomethane.

"RFS" means the renewable fuel standard implemented by the U.S. Environmental Protection Agency.

"SAE CCS" means Society of Automotive Engineers combined charging system, a DC fast charging protocol.

"SMR" means steam methane reformation.

"SOSS" means station operational status system.

"UCO" means used cooking oil.

"U.S. EPA" means the United States Environmental Protection Agency.

"WFRS" means Washington fuels reporting system, the electronic reporting, trading, and compliance platform for the clean fuels program.

"WREGIS" means the western renewable energy generation information system run by the western electricity coordinating council.

NEW SECTION

WAC 173-424-120Applicability.

(1) Except as exempted in WAC 173-424-130, this rule applies to:

(a) Any transportation fuel, as defined in WAC 173-424-110, that is sold, supplied, or offered for sale in Washington; and

(b) Any fuel reporting entity, as defined in WAC 173-424-110 and specified in WAC 173-424-200 through 173-424-220 is responsible for reporting a transportation fuel in a calendar year.

(2) Regulated fuels. This rule applies to the following types of transportation fuels including, but not limited to:

(a) Gasoline;

(b) Diesel or diesel fuel;

(c) Fossil compressed natural gas (fossil CNG), fossil liquefied natural gas (fossil LNG), or fossil liquefied compressed natural gas (fossil L-CNG);

(d) Compressed or liquefied hydrogen (hydrogen);

(e) A fuel blend containing greater than 10 percent ethanol by volume;

(f) A fuel blend containing biomass-based diesel;

(g) Denatured fuel ethanol (E100);

(h) Neat biomass-based diesel (B100 or R100);

(i) Fossil LPG/propane; and

(j) Other liquid or nonliquid transportation fuels as determined by ecology.

(3) Opt-in fuel.

(a) Each fuel in (b) of this subsection is presumed to meet the carbon intensity standards (benchmarks) in WAC 173-424-900 Table 1 and 2 through December 31, 2038.

(b) A fuel provider for the following alternative fuels may generate CFP credits for such fuels by electing to opt into the CFP as an opt-in fuel reporting entity under WAC 173-424-140(2) and meeting all applicable requirements of the CFP:

(i) Electricity;

(ii) Bio-CNG;

(iii) Bio-LNG;

(iv) Bio-L-CNG;

(v) Alternative jet fuel; and

(vi) Renewable propane or renewable LPG.

(4) Annual carbon intensity benchmarks for an alternative fuel intended for use in a single-fuel vehicle.

(a) Gasoline and gasoline substitutes. A regulated party or credit generator must comply with the benchmarks for gasoline and gasoline substitutes in WAC 173-424-900 Table 1 for alternative fuel intended to be used in a single-fuel light-duty or medium-duty vehicle.

(b) Diesel and diesel substitute. A regulated party or credit generator must comply with the benchmarks for diesel fuel and diesel fuel substitutes in WAC 173-424-900 Table 2 for alternative fuel intended to be used in a single-fuel application other than a single-fuel light-duty or medium-duty vehicle.

(c) Carbon intensity benchmarks for transportation fuels intended for use in multifuel vehicles. Credit and deficit calculations for alternative fuel provided for use in a multifueled vehicle shall be established via:

(i) The benchmarks for gasoline set forth in WAC 173-424-900 Table 1 if one of the fuels used in the multifuel vehicle is gasoline; or

(ii) The benchmarks for diesel fuel set forth in WAC 173-424-900 Table 2 if one of the fuels used in the multifuel vehicle is diesel fuel.

NEW SECTION

WAC 173-424-130Exemptions.

(1) Exempt fuels. The CFP rule does not apply to transportation fuel supplied in Washington at an aggregated quantity of less than 360,000 gallons per year as measured by all providers of such fuel.

(2) Exempt fuel uses.

(a) Transportation fuels supplied for use in any of the following motor vehicles are exempt from regulated fuels definition:

(i) Aircrafts. This includes conventional jet fuel or aviation gasoline, and alternative jet fuel;

(ii) Marine vessels;

(iii) Railroad locomotive applications; and

(iv) Military tactical vehicles and tactical support equipment.

(b) The following transportation fuels are exempt from carbon intensity reduction requirements until January 1, 2028:

(i) Special fuel used in off-road vehicles used primarily to transport logs;

(ii) Dyed special fuel used in vehicles that are not designed primarily to transport persons or property, that are not designed to be primarily operated on highways, and that are used primarily for construction work including, but not limited to, mining and timber harvest operations; and

(iii) Dyed special fuel used for agricultural purposes exempt from chapter 82.38 RCW.

(c) Fuels listed under (a) and (b) of this subsection are eligible to generate credits.

(3) To be exempt under subsection (2) of this section, the regulated party must document that the fuel was supplied for use in motor vehicles listed in subsection (2) of this section. The method of documentation is subject to approval by ecology and must, at a minimum:

(a) Establish that the fuel was sold through a dedicated source or single supplier to use in one of the specified motor vehicles listed in subsection (2) of this section; or

(b) For each fuel transaction if the fuel is not sold through a dedicated source.

NEW SECTION

WAC 173-424-140General requirements.

(1) Regulated party.

(a) Regulated fuels producers in Washington, or importers into Washington, must comply with the requirements of this rule.

(b) The regulated parties for regulated fuels are designated under WAC 173-424-200.

(c) The regulated parties for regulated fuels must comply with:

(i) Register under WAC 173-424-300;

(ii) Keep records under WAC 173-424-400;

(iii) Report quarterly under WAC 173-424-410 and annually under WAC 173-424-430; and

(iv) Comply with the clean fuel standard for:

(A) Gasoline and gasoline substitutes in WAC 173-424-900 Table 1; or

(B) Diesel fuel and diesel fuel substitutes in WAC 173-424-900 Table 2.

(2) Opt-in fuel reporting entity.

(a) An out-of-state producer of ethanol, biodiesel, renewable diesel, alternative jet fuel, renewable natural gas, or renewable propane that is not an importer is not required to participate in the program. Any out-of-state producer that is not an importer who chooses voluntarily to participate in the program may retain the ability to generate credits or deficits for the specific volumes of their fuel that is imported into Washington, only if it opts in as a first fuel reporting entity and meets the requirements of WAC 173-424-200 and 173-424-210.

(b) Opting in procedure: Opting into the CFP becomes effective when the opt-in entity establishes an account in the WFRS, pursuant to the voluntary participation under subsection (4) of this section. The opt-in entity may not report and generate credits and deficits based on transactions that precede the quarter in which the entity opted in.

(c) A fuel supplier choosing to opt-in to the CFP under WAC 173-424-120 must:

(i) Register as required by WAC 173-424-300;

(ii) Keep records as required under WAC 173-424-400;

(iii) Report quarterly and annually under WAC 173-424-410 and 173-424-430.

(d) Opting out procedure. In order to opt-out of the CFP, an opt-in entity must complete the following:

(i) Provide ecology a 90-day notice of intent to opt-out and a proposed effective opt-out date;

(ii) Submit in the WFRS any outstanding quarterly fuel transactions up to the quarter in which the effective opt-out date falls and a final annual compliance report that covers the year through the opt-out date; and

(iii) Identify in the 90-day notice any actions to be taken to eliminate any remaining deficits by the effective opt-out date.

(3) Credit aggregator requirements.

(a) Aggregators must:

(i) Register according to WAC 173-424-300;

(ii) Keep records as required under WAC 173-424-400;

(iii) Report quarterly as required under WAC 173-424-410; and

(iv) Report annually as required under WAC 173-424-430.

(b) Designation of aggregator.

(i) Aggregators may facilitate credit generation and trade credits only if a regulated party or an eligible credit generator has authorized an aggregator to act on its behalf by submitting an aggregator designation form to ecology.

(ii) Aggregator designations may only take effect at the start of the next full calendar quarter after ecology receives such notice.

(iii) A regulated party or credit generator already registered with the program may also serve as an aggregator for others;

(iv) An aggregator must notify ecology when a credit generator or regulated party has withdrawn designation of the aggregator. Aggregator withdrawals may only take effect at the end of the current full calendar quarter when ecology receives such notice.

(4) Voluntary participation. Voluntary participation in the CFP shall conclusively establish consent to be subject to the jurisdiction of the state of Washington, its courts, and the administrative authority of ecology to implement the CFP. Failure to consent to such jurisdiction excludes participation in the CFP.

PART 2 – DESIGNATION OF REGULATED PARTIES AND CREDIT GENERATORS

NEW SECTION

WAC 173-424-200Designation of fuel reporting entities for liquid fuels.