WSR 23-01-110

PERMANENT RULES

OFFICE OF THE

INSURANCE COMMISSIONER

[Insurance Commissioner Matter R 2022-02—Filed December 19, 2022, 3:19 p.m., effective January 19, 2023]

Effective Date of Rule: Thirty-one days after filing.

Purpose: Chapter 263, Laws of 2022, amends state law related to health carrier coverage of emergency services, the Balance Billing Protection Act (BBPA), and network access provisions for services subject to the balance billing prohibition under the BBPA. Rule making is necessary to revise the independent review organization rule at chapter 284-43A WAC, BBPA rules at chapter 284-43B WAC, and the office of the insurance commissioner network access rules at chapter 284-170 WAC to be consistent with the new law. The rules will facilitate implementation of the law changes by ensuring that all affected entities understand their rights and obligations under the new law.

Citation of Rules Affected by this Order: New WAC 284-43B-015, 284-43B-032, 284-43B-037, 284-43B-095, 284-43B-100 and 284-170-220; repealing WAC 284-43B-080; and amending WAC 284-43A-010, 284-43B-010, 284-43B-020, 284-43B-030, 284-43B-035, 284-43B-040, 284-43B-050, 284-43B-060, 284-43B-070, 284-43B-085, 284-43B-090, 284-170-200, 284-170-210, 284-170-280, and 284-170-285.

Adopted under notice filed as WSR 22-21-127 on October 18, 2022.

Changes Other than Editing from Proposed to Adopted Version: In WAC 284-43B-020, references to "emergency behavioral health services facilities" were corrected to read "emergency behavioral health services providers" to be consistent with the term defined in RCW

48.43.005.

In WAC 284-43B-050 (2)(b)(ii), the term "emergency behavioral health services provider" is corrected to read "behavioral health emergency services provider."

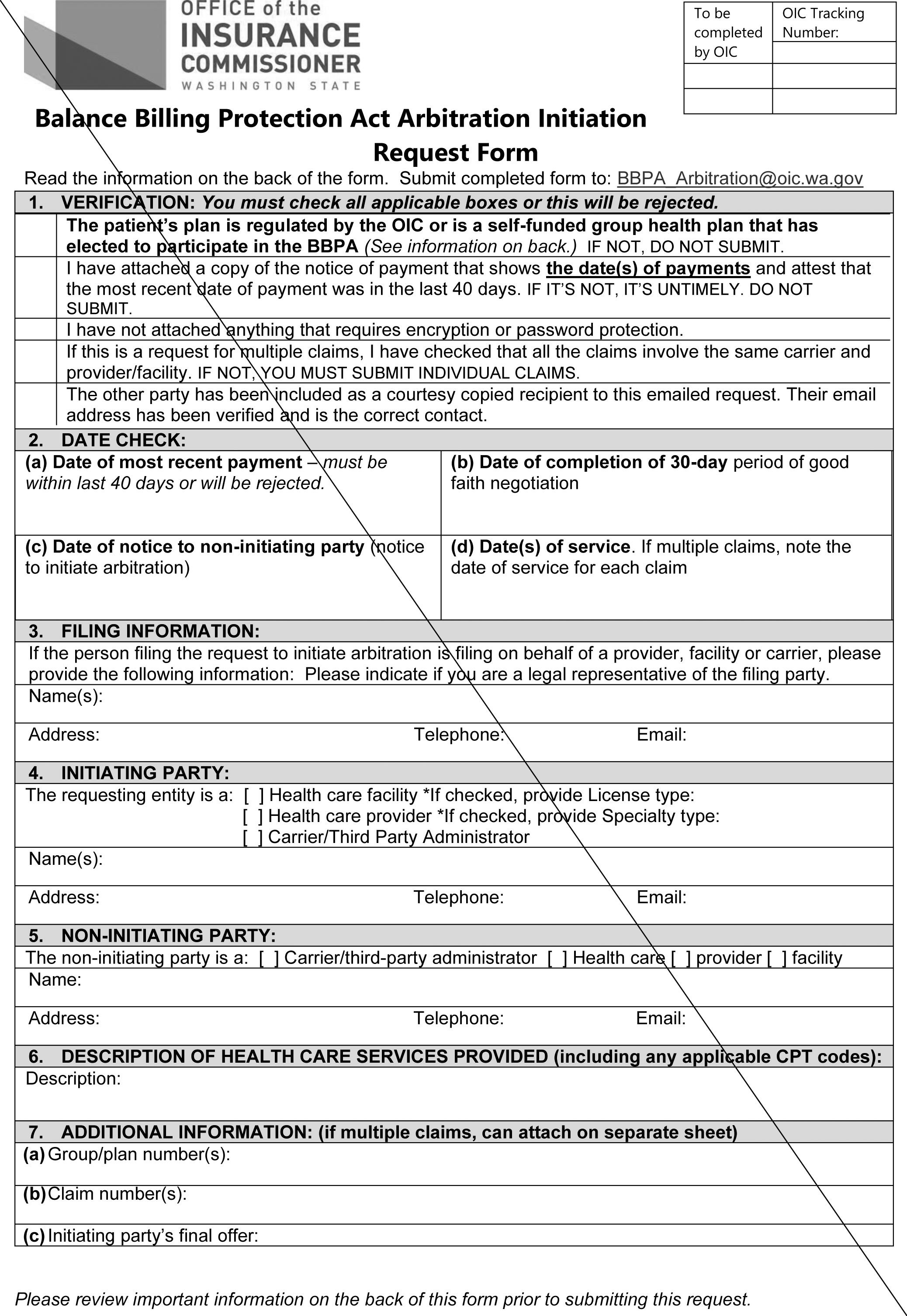

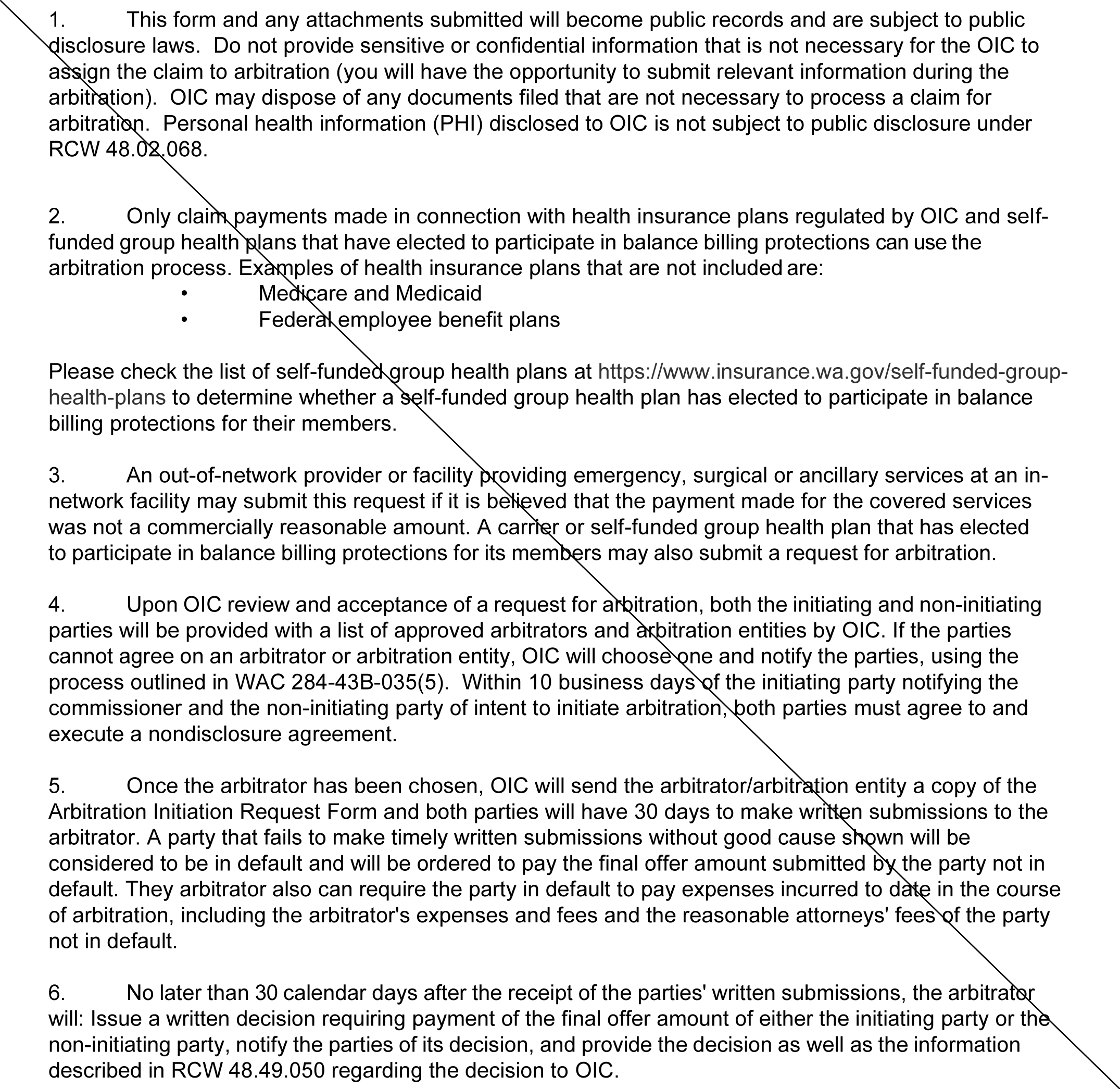

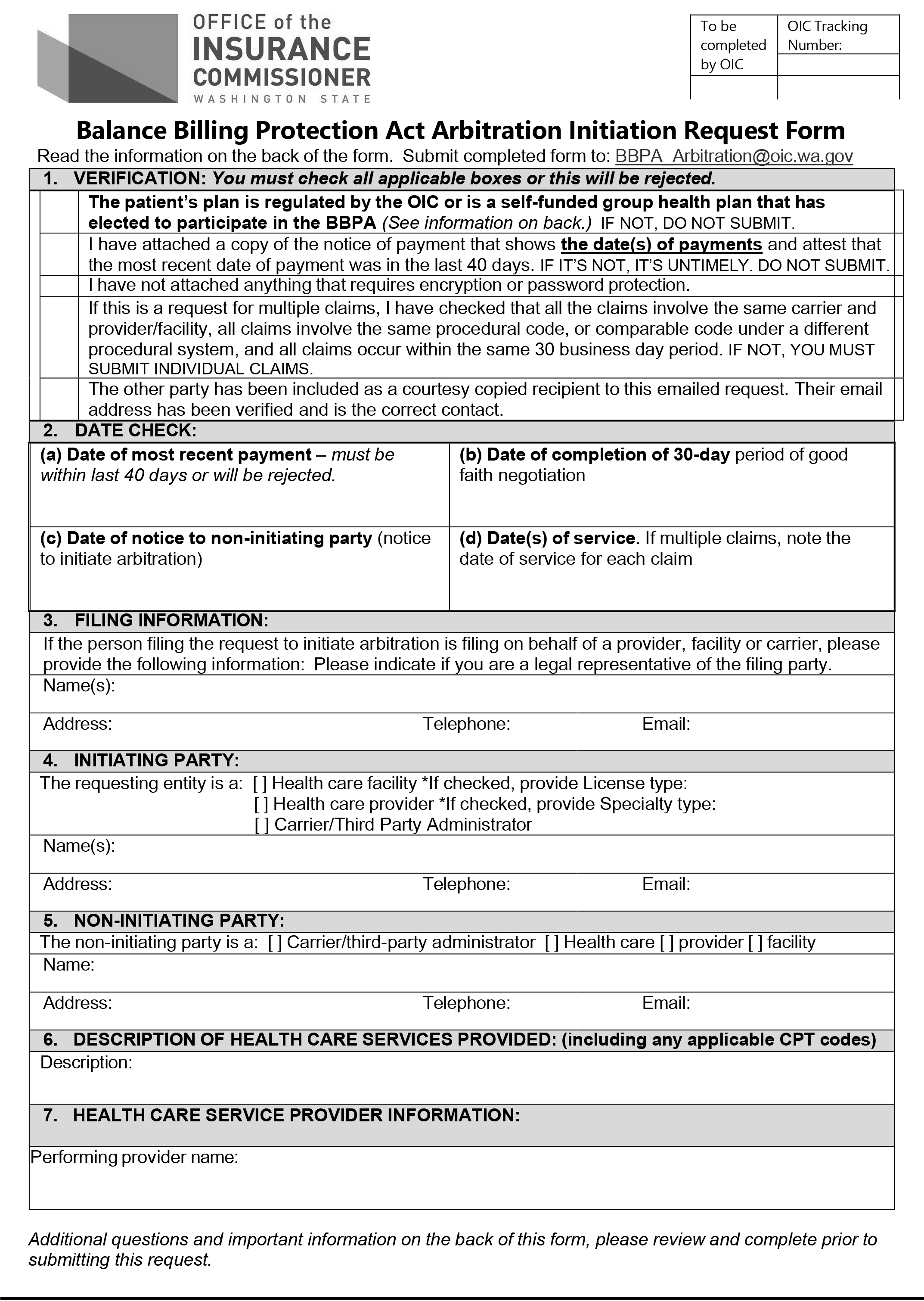

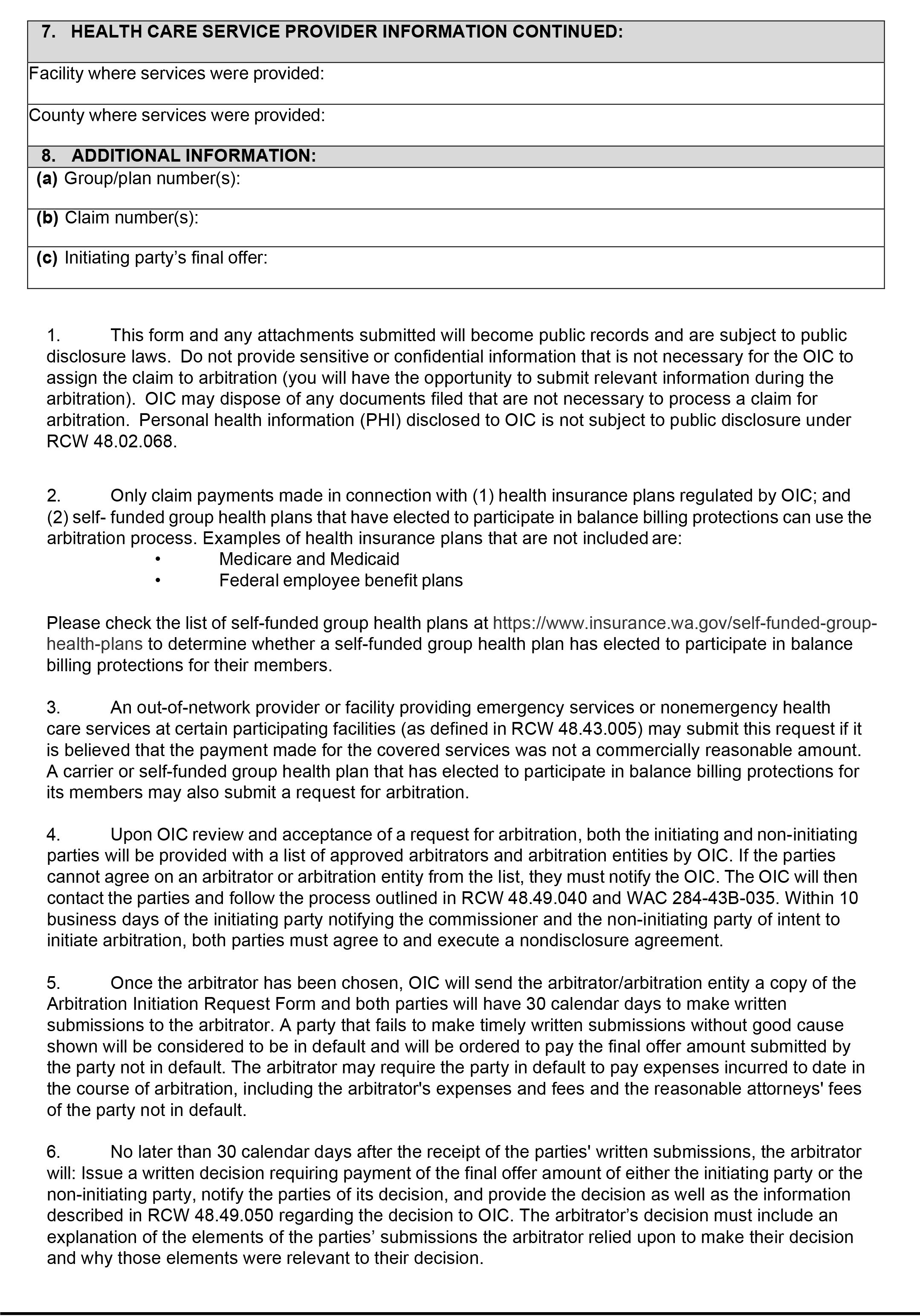

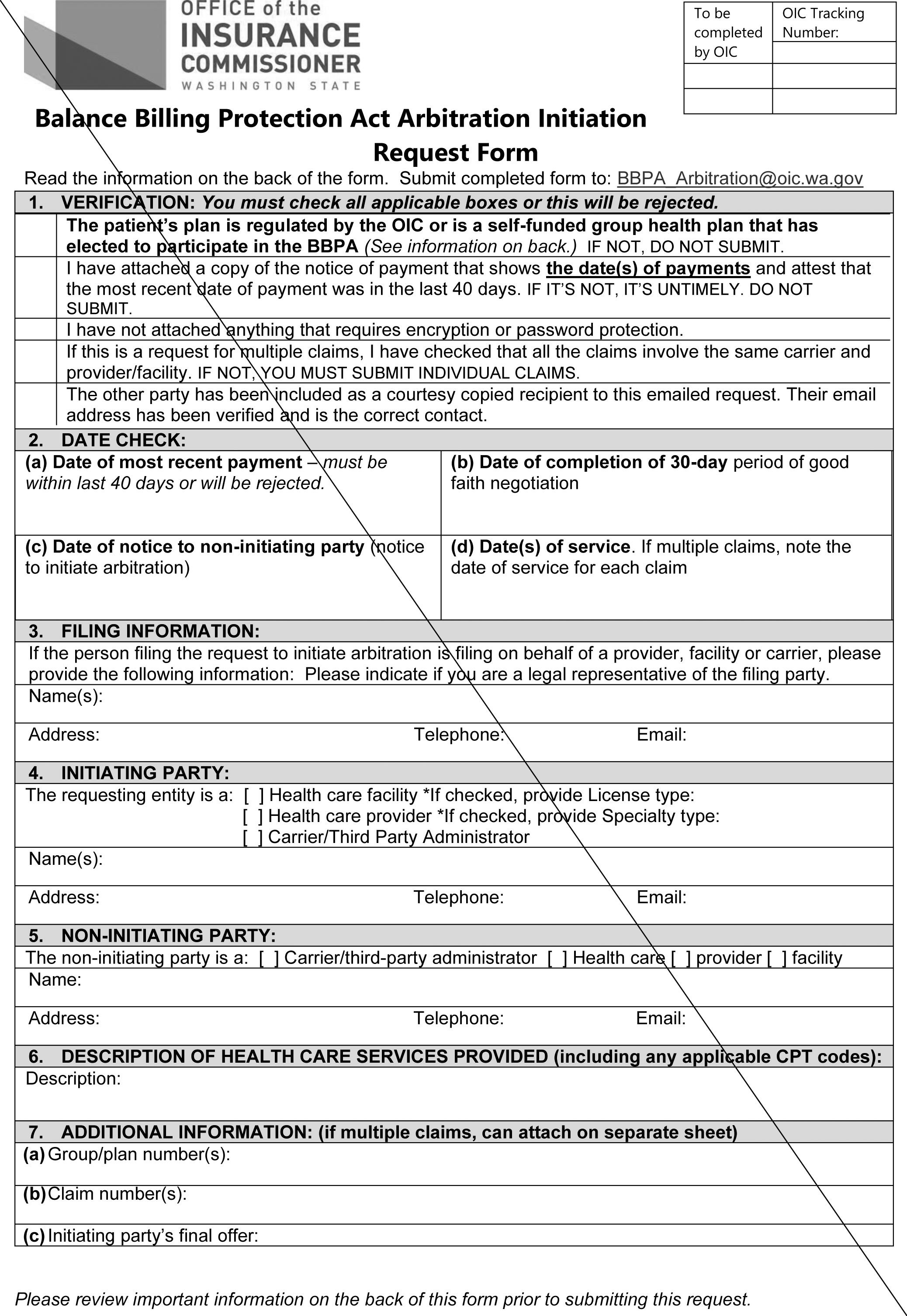

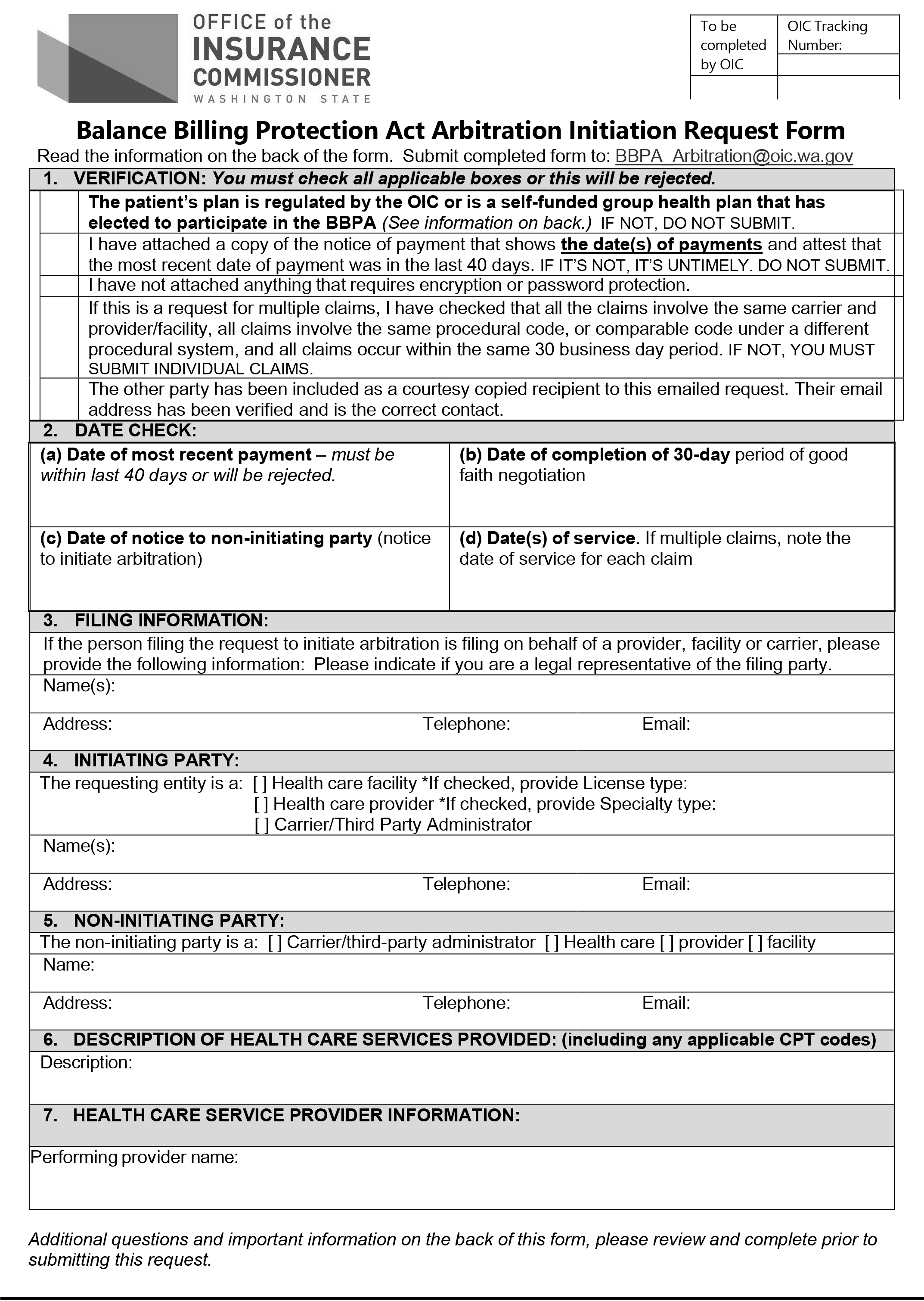

The arbitration initiation request form in WAC 284-43B-085 Appendix A was modified to remove reference to attaching separate sheets. This revision makes the form in rule consistent with the electronic submission requirement in WAC 284-43B-035(1).

In WAC 284-170-210 (2)(b)(iii), the semicolon at the end of that subsection was changed to a period to correct punctuation.

In WAC 284-170-210(3), the "alternate access delivery request" reference is corrected to read "alternate access delivery system."

A final cost-benefit analysis is available by contacting Rules Coordinator, P.O. Box 40255, Olympia, WA 98504, phone 360-725-7171, fax 360-586-3109, email RulesCoordinator@oic.wa.gov, website www.insurance.wa.gov.

Number of Sections Adopted in Order to Comply with Federal Statute: New 0, Amended 0, Repealed 0; Federal Rules or Standards: New 0, Amended 0, Repealed 0; or Recently Enacted State Statutes: New 6, Amended 15, Repealed 1.

Number of Sections Adopted at the Request of a Nongovernmental Entity: New 0, Amended 0, Repealed 0.

Number of Sections Adopted on the Agency's own Initiative: New 0, Amended 0, Repealed 0.

Number of Sections Adopted in Order to Clarify, Streamline, or Reform Agency Procedures: New 0, Amended 0, Repealed 0.

Number of Sections Adopted using Negotiated Rule Making: New 0, Amended 0, Repealed 0; Pilot Rule Making: New 0, Amended 0, Repealed 0; or Other Alternative Rule Making: New 0, Amended 0, Repealed 0.

Date Adopted: December 19, 2022.

Mike Kreidler

Insurance Commissioner

OTS-4112.1

AMENDATORY SECTION(Amending WSR 16-23-168, filed 11/23/16, effective 1/1/17)

WAC 284-43A-010Definitions.

The definitions in this section apply throughout the chapter unless the context clearly requires otherwise.

(1) "Adverse benefit determination" has the same meaning as defined in RCW

48.43.005 and includes:

(a) The determination includes any decision by a health carrier's designee utilization review organization that a request for a benefit under the health carrier's health benefit plan does not meet the health carrier's requirements for medical necessity, appropriateness, health denied, reduced, or terminated or payment is not provided or made, in whole or in part for the benefit;

(b) The denial, reduction, termination, or failure to provide or make payment, in whole or in part, for a benefit based on a determination by a health carrier or its designee utilization review organization of a covered person's eligibility to participate in the health carrier's health benefit plan;

(c) Any prospective review or retrospective review determination that denies, reduces, or terminates or fails to provide or make payment in whole or in part for a benefit;

(d) A rescission of coverage determination; ((or))

(e) A carrier's denial of an application for coverage; or

(f) Any adverse determination made by a carrier under RCW 48.49.020, 48.49.030, or sections 2799A-1 or 2799A-2 of the Public Health Service Act (42 U.S.C. Sec. 300gg-111 or 300gg-112) and federal regulations implementing those provisions of P.L. 116-260. Examples of such determinations include, but are not limited to: (i) Calculation of enrollee cost-sharing;

(ii) Application of consumer cost-sharing to an enrollee's deductible and maximum out-of-pocket; and

(iii) Determination of whether a claim is subject to the Balance Billing Protection Act.

(2) "Appellant" means an applicant or a person covered as an enrollee, subscriber, policyholder, participant, or beneficiary of an individual or group health plan, and when designated, their representative, as defined in WAC 284-43-3010. Consistent with the requirements of WAC 284-43-3170, providers seeking expedited review of an adverse benefit determination on behalf of an appellant may act as the appellant's representative even if the appellant has not formally notified the health plan or carrier of the designation.

(3) "Applicant" means a person or entity seeking to become a Washington certified independent review organization (IRO).

(4) "Attending provider" includes "treating provider" or "ordering provider" as used in WAC 284-43-4040 and 284-43-4060.

(5) "Carrier" or "health carrier" has the same meaning in this chapter as in WAC 284-43-0160(14).

(6) "Case" means a dispute relating to a carrier's decision to deny, modify, reduce, or terminate coverage of or payment for health care service for an enrollee, which has been referred to a specific IRO by the insurance commissioner under RCW

48.43.535.

(7) "Clinical peer" means a physician or other health professional who holds an unrestricted license or certification and is in the same or similar specialty as typically manages the medical condition, procedures, or treatment under review. Generally, as a peer in a similar specialty, the individual must be in the same profession, i.e., the same licensure category, as the attending provider. In a profession that has organized, board-certified specialties, a clinical peer generally will be in the same formal specialty.

(8) "Clinical reviewer" means a medical reviewer, as defined in this section.

(9) "Conflict of interest" means violation of any provision of WAC 284-43A-050 including, but not limited to, material familial, professional and financial affiliations.

(10) "Contract specialist" means a reviewer who deals with interpretation of health plan coverage provisions. If a clinical reviewer is also interpreting health plan coverage and contract provisions, that reviewer shall have the qualifications required of a contract specialist and clinical reviewer.

(11) "Commissioner" means the Washington state insurance com-missioner.

(12) "Enrollee" or "covered person" means an individual covered by a health plan including a subscriber, a policyholder, or beneficiary of a group plan, as defined in WAC 284-43-0160(5); means an "appellant" as defined in WAC 284-43-3010; and also means a person lawfully acting on behalf of the enrollee including, but not limited to, a parent or guardian.

(13) "Evidence-based standard" means the conscientious, explicit, and judicious use of the current best evidence based on the overall systematic review of the research in making decisions about the care of individual patients.

(14) "Health care provider" or "provider" as used in WAC 284-43-0160 (13)(a) and (b), means:

(a) A person regulated under Title

18 RCW or chapter

70.127 RCW, to practice health or health-related services or otherwise practicing health care services in this state consistent with state law; or

(b) An employee or agent of a person described in (a) of this subsection, acting in the course and scope of his or her employment.

(15) "Independent review" means the process of review and determination of a case referred to an IRO under RCW

48.43.535.

(16) "Independent review organization" or "IRO" means an entity certified by the commissioner under this chapter.

(17) "Material familial affiliation" means any relationship as a spouse, child, parent, sibling, spouse's parent, or child's spouse.

(18) "Material professional affiliation" includes, but is not limited to, any provider-patient relationship, any partnership or employment relationship, or a shareholder or similar ownership interest in a professional corporation.

(19) "Material financial affiliation" means any financial interest including employment, contract or consultation which generates more than five percent of total annual revenue or total annual income of an IRO or an individual director, officer, executive or reviewer of the IRO. This includes a consulting relationship with a manufacturer regarding technology or research support for a specific product.

(20) "Medical reviewer" means a physician or other health care provider who is assigned to an external review case by a certified IRO, consistent with this chapter.

(21) "Medical, scientific, and cost-effectiveness evidence" means published evidence on results of clinical practice of any health profession which complies with one or more of the following requirements:

(a) Peer-reviewed scientific studies published in or accepted for publication by medical and mental health journals that meet nationally recognized requirements for scientific manuscripts and that submit most of their published articles for review by experts who are not part of the editorial staff;

(b) Peer-reviewed literature, biomedical compendia, and other medical literature that meet the criteria of the National Institute of Health's National Library of Medicine for indexing in Index Medicus, Excerpta Medicus (EMBASE), Medline, and MEDLARS database Health Services Technology Assessment Research (HSTAR);

(c) Medical journals recognized by the Secretary of Health and Human Services, under Section 1861 (t)(2) of the federal Social Security Act;

(d) The American Hospital Formulary Service-Drug Information, the American Medical Association Drug Evaluation, the American Dental Association Accepted Dental Therapeutics, and the United States Pharmacopoeia-Drug Information;

(e) Findings, studies, or research conducted by or under the auspices of federal government agencies and nationally recognized federal research institutes including the Federal Agency for Healthcare Research and Quality, National Institutes of Health, National Cancer Institute, National Academy of Sciences, Centers for Medicare and Medicaid Services, Congressional Office of Technology Assessment, and any national board recognized by the National Institutes of Health for the purpose of evaluating the medical value of health services;

(f) Clinical practice guidelines that meet Institute of Medicine criteria; or

(g) In conjunction with other evidence, peer-reviewed abstracts accepted for presentation at major scientific or clinical meetings.

(22) "Referral" means receipt by an IRO of notification from the insurance commissioner or designee that a case has been assigned to that IRO under provisions of RCW

48.43.535.

(23) "Reviewer" or "expert reviewer" means a clinical reviewer or a contract specialist, as defined in this section.

OTS-4113.3

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

WAC 284-43B-010Definitions.

(1) The definitions in RCW

48.43.005 apply throughout this chapter unless the context clearly requires otherwise, or the term is defined otherwise in subsection (2) of this section.

(2) The following definitions shall apply throughout this chapter:

(a)

"Air ambulance service" has the same meaning as defined in RCW 48.43.005.(b) "Allowed amount" means the maximum portion of a billed charge a health carrier will pay, including any applicable enrollee cost-sharing responsibility, for a covered health care service or item rendered by a participating provider or facility or by a nonparticipating provider or facility.

(((b)))(c) "Balance bill" means a bill sent to an enrollee by ((an out-of-network))a nonparticipating provider ((or)), facility, behavioral health emergency services provider or air ambulance service provider for health care services provided to the enrollee after the provider or facility's billed amount is not fully reimbursed by the carrier, exclusive of ((permitted)) cost-sharing allowed under WAC 284-43B-020.

((

(c)))

(d) "Behavioral health emergency services provider" has the same meaning as defined in RCW 48.43.005.(e) "De-identified" means, for the purposes of this rule, the removal of all information that can be used to identify the patient from whose medical record the health information was derived.

(((d)))(f) "Emergency medical condition" ((means a medical, mental health, or substance use disorder condition manifesting itself by acute symptoms of sufficient severity including, but not limited to, severe pain or emotional distress, such that a prudent layperson, who possesses an average knowledge of health and medicine, could reasonably expect the absence of immediate medical, mental health, or substance use disorder treatment attention to result in a condition (i) placing the health of the individual, or with respect to a pregnant woman, the health of the woman or her unborn child, in serious jeopardy, (ii) serious impairment to bodily functions, or (iii) serious dysfunction of any bodily organ or part.

(e) "Emergency services" means a medical screening examination, as required under section 1867 of the Social Security Act (42 U.S.C. 1395dd), that is within the capability of the emergency department of a hospital, including ancillary services routinely available to the emergency department to evaluate that emergency medical condition, and further medical examination and treatment, to the extent they are within the capabilities of the staff and facilities available at the hospital, as are required under section 1867 of the Social Security Act (42 U.S.C. 1395dd) to stabilize the patient. Stabilize, with respect to an emergency medical condition, has the meaning given in section 1867 (e)(3) of the Social Security Act (42 U.S.C. 1395dd (e)(3)).

(f)))

has the same meaning as defined in RCW 48.43.005. (g) "Emergency services" has the same meaning as defined in RCW 48.43.005. (h) "Facility" or "health care facility" means:

(i) With respect to the provision of emergency services, a hospital

or freestanding emergency department licensed under chapter

70.41 RCW

(including an "emergency department of a hospital" or "independent freestanding emergency department" described in section 2799A-1(a) of the Public Health Service Act (42 U.S.C. Sec. 300gg-111(a) and 45 C.F.R. Sec. 149.30)) or a behavioral health emergency services provider; and (ii) With respect to provision of nonemergency services, a hospital licensed under chapter 70.41 RCW, a hospital outpatient department, a critical access hospital or an ambulatory surgical facility licensed under chapter

70.230 RCW

(including a "health care facility" described in section 2799A-1(b) of the Public Health Service Act (42 U.S.C. Sec. 300gg-111(b) and 45 C.F.R. Sec. 149.30)). (i) "Hospital outpatient department" means an entity or site that provides outpatient services and:

(i) Is a provider-based facility under 42 C.F.R. Sec. 413.65;

(ii) Charges a hospital facility fee in billing associated with the receipt of outpatient services from the entity or site; or

(iii) Bills the consumer or their health plan under a hospital's national provider identifier or federal tax identification number.

(((g)))(j) "In-network" or "participating" means a provider or facility that has contracted with a carrier or a carrier's contractor or subcontractor to provide health care services to enrollees and be reimbursed by the carrier at a contracted rate as payment in full for the health care services, including applicable cost-sharing obligations. A single case reimbursement agreement between a provider or facility and a carrier used for the purpose described in WAC 284-170-200 constitutes a contract exclusively for purposes of this definition under the Balance Billing Protection Act and is limited to the services and parties to the agreement.

(((h) "Median in-network contracted rate for the same or similar service in the same or similar geographical area" means the median amount negotiated for an emergency or surgical or ancillary service for participation in the carrier's health plan network with in-network providers of emergency or surgical or ancillary services furnished in the same or similar geographic area. If there is more than one amount negotiated with the health plan's in-network providers for the emergency or surgical or ancillary service in the same or similar geographic area, the median in-network contracted rate is the median of these amounts. In determining the median described in the preceding sentence, the amount negotiated for each claim for the same or similar service with each in-network provider is treated as a separate amount (even if the same amount is paid to more than one provider or to the same provider for more than one claim). If no per-service amount has been negotiated with any in-network providers for a particular service, the median amount must be calculated based upon the service that is most similar to the service provided. For purposes of this subsection "median" means the middle number of a sorted list of reimbursement amounts negotiated with in-network providers with respect to a certain emergency or surgical or ancillary service, with each paid claim's negotiated reimbursement amount separately represented on the list, arranged in order from least to greatest. If there is an even number of items in the sorted list of negotiated reimbursement amounts, the median is found by taking the average of the two middlemost numbers.

(i)))

(k) "Nonemergency health care services performed by nonparticipating providers at certain participating facilities" has the same meaning as defined in RCW 48.43.005. (l) "Offer to pay," "carrier payment," or "payment notification" means a claim that has been adjudicated and paid by a carrier to ((an out-of-network or))a nonparticipating provider for emergency services or for ((surgical or ancillary services provided at an in-network facility))nonemergency health care services performed by nonparticipating providers at certain participating facilities.

((

(j)))

(m) "Out-of-network" or "nonparticipating" ((

means a provider or facility that has not contracted with a carrier or a carrier's contractor or subcontractor to provide health care services to enrollees))

has the same meaning as defined in RCW 48.43.005.

((

(k)))

(n) "Provider" means a person regulated under Title

18 RCW or chapter

70.127 RCW to practice health or health-related services or otherwise practicing health care services in this state consistent with state law, or an employee or agent of a person acting in the course and scope of his or her employment, that provides emergency services, or ((

surgical or ancillary services at an in-network facility.(l) "Surgical or ancillary services" means surgery, anesthesiology, pathology, radiology, laboratory, or hospitalist services))nonemergency health care services at certain participating facilities.

NEW SECTION

WAC 284-43B-015Coverage of emergency services.

(1) Coverage of emergency services is governed by RCW

48.43.093. Emergency services, as defined in RCW

48.43.005, include services provided after an enrollee is stabilized and as part of outpatient observation or an inpatient or outpatient stay with respect to the visit during which screening and stabilization services have been furnished. Poststabilization services relate to medical, mental health or substance use disorder treatment necessary in the short term to avoid placing the health of the individual, or with respect to a pregnant person, the health of a person or their unborn child, in serious jeopardy, serious impairment to bodily functions, or serious dysfunction of any bodily organ or part.

(2) A carrier may require notification of stabilization or inpatient admission of an enrollee as provided in RCW

48.43.093. Regardless of such notification, payment and cost-sharing for poststabilization services provided by a nonparticipating facility, provider or behavioral health emergency services provider and dispute resolution related to those services are governed by RCW

48.49.040 and

48.49.160.

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

WAC 284-43B-020Balance billing prohibition and consumer cost-sharing.

(1) If an enrollee receives any emergency services from ((an out-of-network))a nonparticipating facility ((or)), provider, or behavioral health emergency services provider, any nonemergency ((surgical or ancillary services at an in-network facility from an out-of-network provider))health care services performed by a nonparticipating provider at certain participating facilities, or any air ambulance services from a nonparticipating provider:

(a) The enrollee satisfies ((his or her))their obligation to pay for the health care services if ((he or she pays))they pay the in-network cost-sharing amount specified in the enrollee's or applicable group's health plan contract. The enrollee's obligation must be ((determined using the carrier's median in-network contracted rate for the same or similar service in the same or similar geographical area))calculated as if the total amount charged for the services were equal to:

(i) For emergency services other than services provided by emergency behavioral health services providers, for nonemergency health care services performed by a nonparticipating provider at certain participating facilities, and for air ambulance services, the lesser of the qualifying payment amount, as determined in accordance with 45 C.F.R. Sec. 149.140, or billed charges; and

(ii) For services provided by emergency behavioral health services providers, the qualifying payment amount, as determined in accordance with 45 C.F.R. Sec. 149.140. The carrier must provide an explanation of benefits to the enrollee and the ((out-of-network))nonparticipating provider, facility, emergency behavioral health services provider or air ambulance provider that reflects the cost-sharing amount determined under this subsection.

(b) The carrier, ((out-of-network))nonparticipating provider, ((or out-of-network))nonparticipating facility, nonparticipating behavioral health emergency services provider or nonparticipating air ambulance provider and any agent, trustee, or assignee of the carrier, ((out-of-network))nonparticipating provider, ((or out-of-network))nonparticipating facility, nonparticipating emergency behavioral health services provider or nonparticipating air ambulance provider must ensure that the enrollee incurs no greater cost than the amount determined under (a) of this subsection.

(c)(i) For emergency services provided to an enrollee, the ((out-of-network))nonparticipating provider ((or out-of-network)), nonparticipating facility, or nonparticipating emergency behavioral health services provider and any agent, trustee, or assignee of the ((out-of-network))nonparticipating provider ((or out-of-network)), nonparticipating facility or nonparticipating behavioral health emergency services provider may not balance bill or otherwise attempt to collect from the enrollee any amount greater than the amount determined under (a) of this subsection. This does not impact the provider's, facility's, or behavioral health emergency services provider's ability to collect a past due balance for an applicable in-network cost-sharing amount with interest;

(ii) ((For emergency services provided to an enrollee in an out-of-network hospital located and licensed in Oregon or Idaho, the carrier must hold an enrollee harmless from balance billing; and

(iii))) For nonemergency ((surgical or ancillary services provided at an in-network facility))health care services performed by nonparticipating providers at certain participating facilities, the ((out-of-network))nonparticipating provider and any agent, trustee, or assignee of the ((out-of-network))nonparticipating provider may not balance bill or otherwise attempt to collect from the enrollee any amount greater than the amount determined under (a) of this subsection. This does not impact the provider's ability to collect a past due balance for an applicable in-network cost-sharing amount with interest.

(d) For emergency services ((and)), nonemergency ((surgical or ancillary services provided at an in-network facility))health care services performed by nonparticipating providers at certain participating facilities and air ambulance services, the carrier must treat any cost-sharing amounts determined under (a) of this subsection paid or incurred by the enrollee for ((an out-of-network provider or facility's))a nonparticipating provider's, facility's, behavioral health emergency services provider's or air ambulance provider's services in the same manner as cost-sharing for health care services provided by ((an in-network))a participating provider ((or)), facility, behavioral health emergency services provider, or air ambulance services provider and must apply any cost-sharing amounts paid or incurred by the enrollee for such services toward the enrollee's deductible and maximum out-of-pocket payment obligation.

(e) If the enrollee pays ((an out-of-network))a nonparticipating provider ((or out-of-network)), nonparticipating facility, nonparticipating behavioral health emergency services provider or nonparticipating air ambulance services provider an amount that exceeds the in-network cost-sharing amount determined under (a) of this subsection, the ((provider or facility))nonparticipating provider, nonparticipating facility, nonparticipating behavioral health emergency services provider or nonparticipating air ambulance services provider must refund any amount in excess of the in-network cost-sharing amount to the enrollee within ((thirty))30 business days of the ((provider or facility's))nonparticipating provider, nonparticipating facility, nonparticipating behavioral health emergency services provider or nonparticipating air ambulance services provider's receipt of the enrollee's payment. Simple interest must be paid to the enrollee for any unrefunded payments at a rate of ((twelve))12 percent ((per annum)) beginning on the first calendar day after the ((thirty))30 business days.

(2) The carrier must make payments for health care services described in RCW

48.49.020, provided by ((

an out-of-network provider or facility))

a nonparticipating provider, nonparticipating facility, nonparticipating behavioral health emergency services provider or nonparticipating air ambulance services provider directly to the provider or facility, rather than the enrollee.

(3) A health care provider ((

or facility, or any of its agents, trustees or assignees may not require a patient at any time, for any procedure, service, or supply, to sign or execute by electronic means, any document that would attempt to avoid, waive, or alter any provision of this section))

, health care facility, behavioral health emergency services provider or air ambulance service provider may not request or require a patient at any time, for any procedure, service, or supply, to sign or otherwise execute by oral, written, or electronic means, any document that would attempt to avoid, waive, or alter any provision of RCW 48.49.020 and 48.49.030 or sections 2799A-1 et seq. of the Public Health Service Act and federal regulations adopted to implement those sections of P.L. 116-260. This prohibition supersedes any provision of sections 2799A-1 et seq. of the Public Health Service Act and federal regulations adopted to implement those sections of P.L. 116-260 that would authorize a provider or facility to ask a patient to consent to waive their balance billing protections.

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

WAC 284-43B-030Out-of-network claim payment and placing a claim into dispute.

For services described in RCW 48.49.020(1) (other than air ambulance services) provided prior to July 1, 2023, or a later date determined by the commissioner, and for services provided by a nonparticipating emergency behavioral health services provider if the federal government does not authorize use of the federal independent dispute resolution system for these disputes, the allowed amount paid to ((

an out-of-network provider for health care services described under RCW 48.49.020))

a nonparticipating provider or facility for emergency services and nonemergency health care services performed by nonparticipating providers at certain participating facilities, shall be a commercially reasonable amount, based on payments for the same or similar services provided in the same or a similar geographic area.

(1) Within ((thirty))30 calendar days of receipt of a claim from ((an out-of-network))a nonparticipating provider or facility, the carrier shall offer to pay the provider or facility a commercially reasonable amount. Payment of an adjudicated claim shall be considered an offer to pay. The amount actually paid to ((an out-of-network))a nonparticipating provider by a carrier may be reduced by the applicable consumer cost-sharing determined under WAC 284-43B-020 (1)(a). The date of receipt by the provider or facility of the carrier's offer to pay is five calendar days after a transmittal of the offer is mailed to the provider or facility, or the date of transmittal of an electronic notice of payment. The claim submitted by the ((out-of-network))nonparticipating provider or facility to the carrier must include the following information:

(a) Patient name;

(b) Patient date of birth;

(c) Provider name;

(d) Provider location;

(e) Place of service, including the name and address of the facility in which, or on whose behalf, the service that is the subject of the claim was provided;

(f) Provider federal tax identification number;

(g) Federal Center for Medicare and Medicaid Services individual national provider identifier number, and organizational national provider identifier number, if the provider works for an organization or is in a group practice that has an organization number;

(h) Date of service;

(i) Procedure code; and

(j) Diagnosis code.

(2) If the ((out-of-network))nonparticipating provider or facility wants to dispute the carrier's offer to pay, the provider or facility must notify the carrier no later than ((thirty))30 calendar days after receipt of the offer to pay or payment notification from the carrier. A carrier may not require a provider or facility to reject or return payment of the adjudicated claim as a condition of putting the payment into dispute.

(3) If the ((out-of-network))nonparticipating provider or facility disputes the carrier's offer to pay, the carrier and provider or facility have ((thirty))30 calendar days after the provider or facility receives the offer to pay to negotiate in good faith.

(4) If the carrier and the ((

out-of-network))

nonparticipating provider or facility do not agree to a commercially reasonable payment amount within the ((

thirty-calendar))

30-calendar day period under subsection (3) of this section, and the carrier, ((

out-of-network))

nonparticipating provider or ((

out-of-network))

nonparticipating facility chooses to pursue further action to resolve the dispute, the dispute shall be resolved through arbitration, as provided in RCW

48.49.040.

NEW SECTION

WAC 284-43B-032Applicable dispute resolution system.

(1) Effective for services provided on or after July 1, 2023, or a later date determined by the commissioner, services described in RCW

48.49.020(1) other than air ambulance services are subject to the independent dispute resolution process established in sections 2799A-1 and 2799A-2 of the Public Health Service Act (42 U.S.C. Secs. 300gg-111 and 300gg-112) and federal regulations implementing those sections of P.L. 116-260 (enacted December 27, 2020). Until July 1, 2023, or a later date determined by the commissioner, the arbitration process in this chapter governs the dispute resolution process for those services.

(2) Effective for services provided on or after July 1, 2023, or a later date determined by the commissioner, if the federal independent dispute resolution process is available to the state, behavioral emergency services provider services described in RCW

48.49.020(3) are subject to the independent dispute resolution process established in section 2799A-1 and 2799A-2 of the Public Health Service Act (42 U.S.C. Secs. 300gg-111 and 300gg-112) and federal regulations implementing those sections of P.L. 116-260 (enacted December 27, 2020). Until July 1, 2023, or a later date determined by the commissioner, or if the federal independent dispute resolution process is not available to the state for resolution of these disputes, the arbitration process in this chapter governs the dispute resolution process for those services.

(3) The office of the insurance commissioner must provide a minimum of four months advance notice of the date on which the dispute resolution process will transition to the federal independent dispute resolution process. The notice must be posted on the website of the office of the insurance commissioner.

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

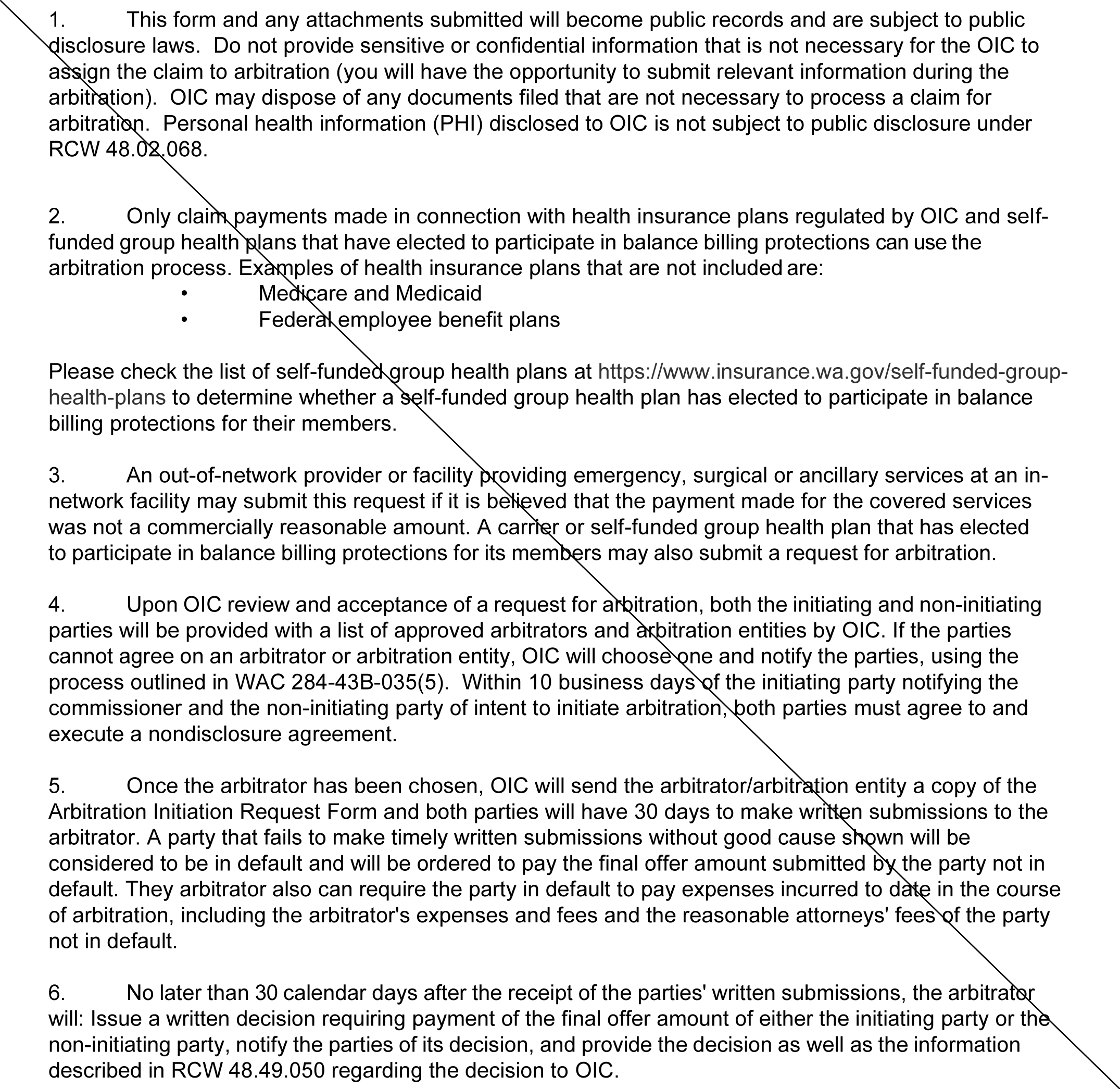

WAC 284-43B-035Arbitration initiation and selection of arbitrator.

(1)(a) To initiate arbitration, the carrier, provider, or facility must provide written notification to the commissioner and the noninitiating party no later than ((

ten))

10 calendar days following completion of the period of good faith negotiation under WAC 284-43B-030(3) using the arbitration initiation request form found in Appendix A of this rule.

A request must be submitted electronically through the website of the office of the insurance commissioner. When multiple claims are addressed in a single arbitration proceeding, subsection (3) of this section governs calculation of the ((

ten))

10 calendar days.

Each arbitration initiation request must be submitted to the commissioner individually and constitutes a distinct arbitration proceeding unless consolidation of requests is authorized by a court under chapter 7.04A RCW. The commissioner will assign a unique number or designation to each arbitration initiation request. The parties must include that designation in all communication related to that request. Any information submitted to the commissioner with the arbitration initiation request must be included in the notice to the noninitiating party under RCW

48.49.040. A provider

or facility initiating arbitration must send the arbitration initiation request form to the email address appearing on the website established by the designated lead organization for administration simplification in Washington state under (c) of this subsection. Any patient information submitted to the commissioner with an arbitration initiation request form must be de-identified to ensure that protected health information is not disclosed.

(b) The written notification to the commissioner must be made electronically and provide dates related to each of the time period limitations described in WAC 284-43B-030 (1) through (3)

and subsection (1)(a) of this section. The commissioner's review of the arbitration initiation request form is limited to the information necessary to determine that the request has been timely submitted and is complete.

The commissioner's review does not include a review of whether particular claims included in the request are subject to chapter 48.49 RCW or whether claims are appropriately bundled under subsection (3) of this section. A party seeking to challenge whether a claim is subject to chapter 48.49 RCW or whether claims are appropriately bundled may raise those issues during arbitration.(c) Each carrier must provide the designated lead organization for administrative simplification in Washington state with the email address and telephone number of the carrier's designated contact for receipt of notices to initiate arbitration. The email address and phone number provided must be specific to the carrier staff responsible for receipt of notices or other actions related to arbitration proceedings. The initial submission of information to the designated lead organization must be made on or before November 10, 2020. The carrier must keep its contact information accurate and current by submitting updated contact information to the designated lead organization as directed by that organization.

(2) Within ((

ten))

10 business days of a party notifying the commissioner and the noninitiating party of intent to initiate arbitration, both parties shall agree to and execute a nondisclosure agreement. The nondisclosure agreement must prohibit either party from sharing or making use of any confidential or proprietary information acquired or used for purposes of one arbitration in any subsequent arbitration proceedings. The nondisclosure agreement must not preclude the arbitrator from submitting the arbitrator's decision to the commissioner under RCW

48.49.040 or impede the commissioner's duty to prepare the annual report under RCW

48.49.050.

(3) If ((

an out-of-network))

a nonparticipating provider or ((

out-of-network))

nonparticipating facility chooses to address multiple claims in a single arbitration proceeding as provided in RCW

48.49.040, notification must be provided no later than ((

ten))

10 calendar days following completion of the period of good faith negotiation under WAC 284-43B-030(3) for the most recent claim that is to be addressed through the arbitration. All of the claims at issue must:

(a) Involve identical carrier and provider, provider group or facility parties. ((A provider group may bundle claims billed using a common federal taxpayer identification number on behalf of the provider members of the group;))Items and services are billed by the same provider, provider group or facility if the items or services are billed with the same national provider identifier or tax identification number;

(b) ((Involve claims with the same or related current procedural terminology codes relevant to a particular procedure))Involve the same or similar items and services. The services are considered to be the same or similar items or services if each is billed under the same service code, or a comparable code under a different procedural code system, such as current procedural terminology (CPT) codes with modifiers, if applicable, health care common procedure coding system (HCPCS) with modifiers, if applicable, or diagnosis-related group (DRG) codes with modifiers, if applicable; and

(c) Occur within ((a two month))the same 30 business day period of one another, such that the earliest claim that is the subject of the arbitration occurred no more than ((two months))30 business days prior to the latest claim that is the subject of the arbitration. For purposes of this subsection, a provider or facility claim occurs on the date the service is provided to a patient or, in the case of inpatient facility admissions, the date the admission ends.

(4) A notification submitted to the commissioner later than ((ten))10 calendar days following completion of the period of good faith negotiation will be considered untimely and will be rejected. Any revision to a previously timely submitted arbitration initiation request form must be submitted to the commissioner within the 10 calendar day period applicable to submission of the original request. A party that has submitted an untimely notice is permanently foreclosed from seeking arbitration related to the claim or claims that were the subject of the untimely notice.

(5) Within seven calendar days of receipt of notification from the initiating party, the commissioner must provide the parties with a list of approved arbitrators or entities that provide arbitration. The commissioner will use the email ((address))addresses for the initiating party and the noninitiating party ((provided))indicated on the arbitration initiation request form for all communication related to the arbitration request. The arbitrator selection process must be completed within ((twenty))20 calendar days of receipt of the original list of arbitrators from the commissioner, as follows:

(a) If the parties are unable to agree on an arbitrator from the original list sent by the commissioner, they must notify the commissioner within five calendar days of receipt of the original list of arbitrators. The commissioner must send the parties a list of ((five arbitrators))two individual arbitrators and three arbitration entities within five calendar days of receipt of notice from the parties under this subsection. Each party is responsible for reviewing the list of five arbitrators and arbitration entities and notifying the commissioner and the other party within three calendar days of receipt of the list:

(i) Whether they are taking the opportunity to veto up to two of the five arbitrators or arbitration entities on this list, and if so, which arbitrators or arbitration entities have been vetoed; and

(ii) If there is a conflict of interest as described in subsection (6) of this section with any of the arbitrators or arbitration entities on the list, to avoid the commissioner assigning an arbitrator or arbitration entity with a conflict of interest to an arbitration.

(b) If, after the opportunity to veto up to two of the five named arbitrators or arbitration entities on the list of five arbitrators and arbitration entities sent by the commissioner to the parties, more than one arbitrator or arbitration entity remains on the list, the parties must notify the commissioner within five calendar days of receipt of the list of five arbitrators or arbitration entities. The commissioner will choose the arbitrator from among the remaining arbitrators on the list. If a party fails to timely provide the commissioner with notice of their veto, the commissioner will choose the arbitrator from among the remaining arbitrators or arbitration entities on the list.

(6) Before accepting any appointment, an arbitrator shall ensure that there is no conflict of interest that would adversely impact the arbitrator's independence and impartiality in rendering a decision in the arbitration. A conflict of interest includes (a) current or recent ownership or employment of the arbitrator or a close family member by any health carrier; (b) serves as or was employed by a physician, health care provider, or a health care facility; (c) has a material professional, familial, or financial conflict of interest with a party to the arbitration to which the arbitrator is assigned.

(7) For purposes of this subsection, the date of receipt of a list of arbitrators is the date of electronic transmittal of the list to the parties by the commissioner. The date of receipt of notice from the parties to the commissioner is the date of electronic transmittal of the notice to the commissioner by the parties.

(8) If a noninitiating party fails to timely respond without good cause to a notice initiating arbitration, the initiating party will choose the arbitrator.

(9) ((

Good cause for purposes of delay in written submissions to the arbitrator under RCW 48.49.040 includes a stipulation that the parties intend to complete settlement negotiations prior to making such submissions to the arbitrator.(10) If the parties settle the dispute before the arbitrator issues a decision, the parties must submit to the commissioner notice of the date of the settlement and whether the settlement includes an agreement for the provider to contract with the carrier as an in-network provider.

(11) Any enrollee or patient information submitted to the arbitrator in support of the final offer shall be de-identified to ensure that protected health information is not disclosed.

(12) The arbitrator must submit to the commissioner:

(a) Their decision; and

(b) The information required in RCW 48.49.050 using the form found in Appendix B to this rule.))

Where a dispute resolution matter initiated under sections 2799A-1 and 2799A-2 of the Public Health Service Act (42 U.S.C. Secs. 300gg-111 and 300gg-112) and federal regulations implementing those provisions of P.L. 116-260 (enacted December 27, 2020) results in a determination by a certified independent dispute resolution entity that such process does not apply to the dispute or to portions thereof, RCW 48.49.040 (3)(b) governs initiation of arbitration under this chapter. NEW SECTION

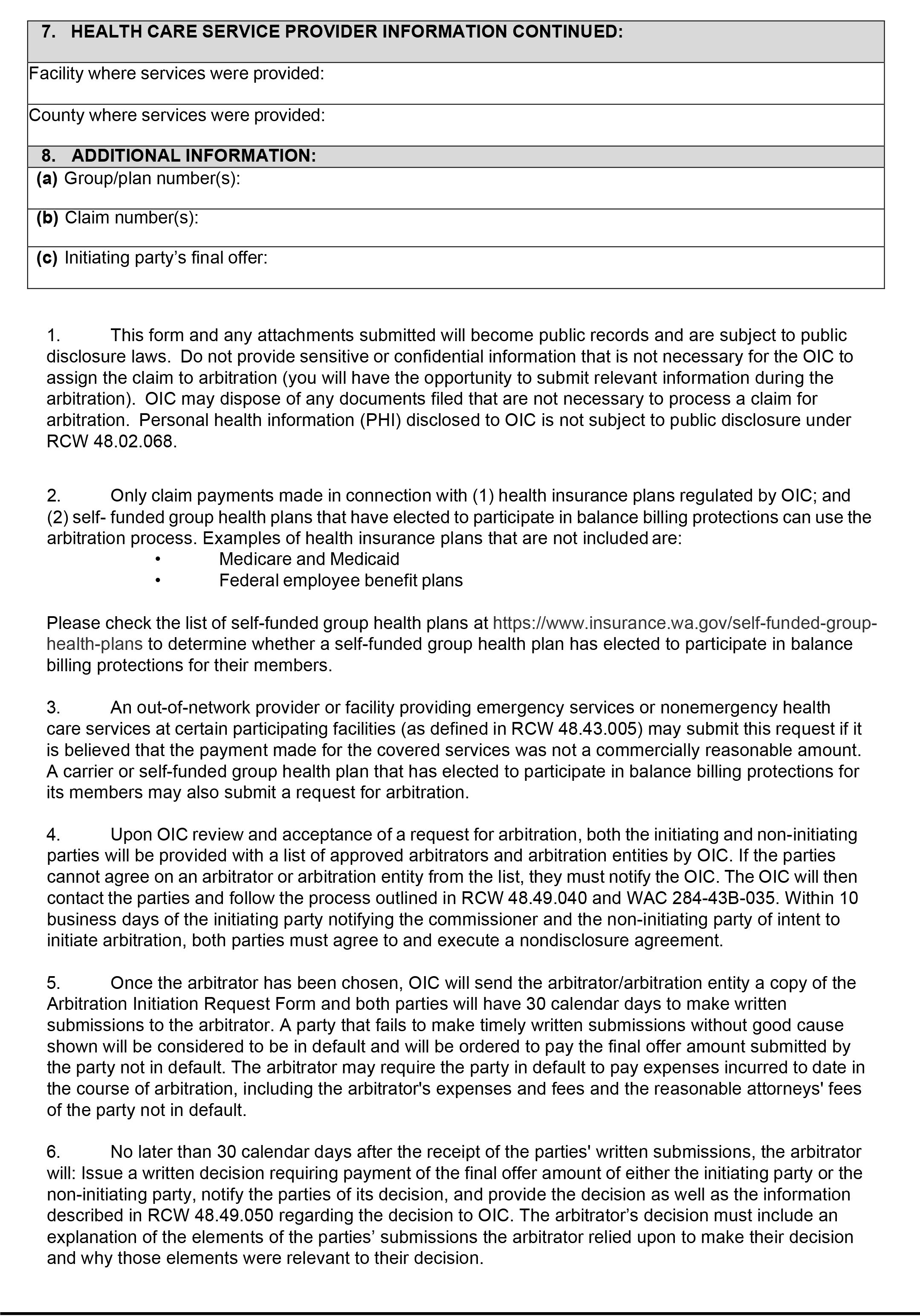

WAC 284-43B-037Arbitration proceedings.

(1) For purposes of calculating the date that written submissions to the arbitrator under RCW

48.49.040 are due, final selection of the arbitrator occurs on the date that the commissioner sends by electronic transmittal the notice of selection to the arbitrator. The parties must be copied on such notice.

(2) Good cause for purposes of delay in written submissions to the arbitrator under RCW

48.49.040 includes a stipulation that the parties intend to complete settlement negotiations prior to making such submissions to the arbitrator.

(3) If the parties agree on an out-of-network rate for the services at issue after submitting an arbitration initiation request but before the arbitrator has made a decision, they must provide notice to the commissioner as provided in RCW

48.49.040(7).

(4) If an initiating party withdraws an arbitration initiation request at any point before the arbitrator has made a decision, the party must submit to the commissioner notice of the date of the withdrawal of the request, as soon as possible, but no later than three business days after the date of the withdrawal.

(5) Any enrollee or patient information submitted to the arbitrator in support of the final offer shall be de-identified to ensure that protected health information is not disclosed.

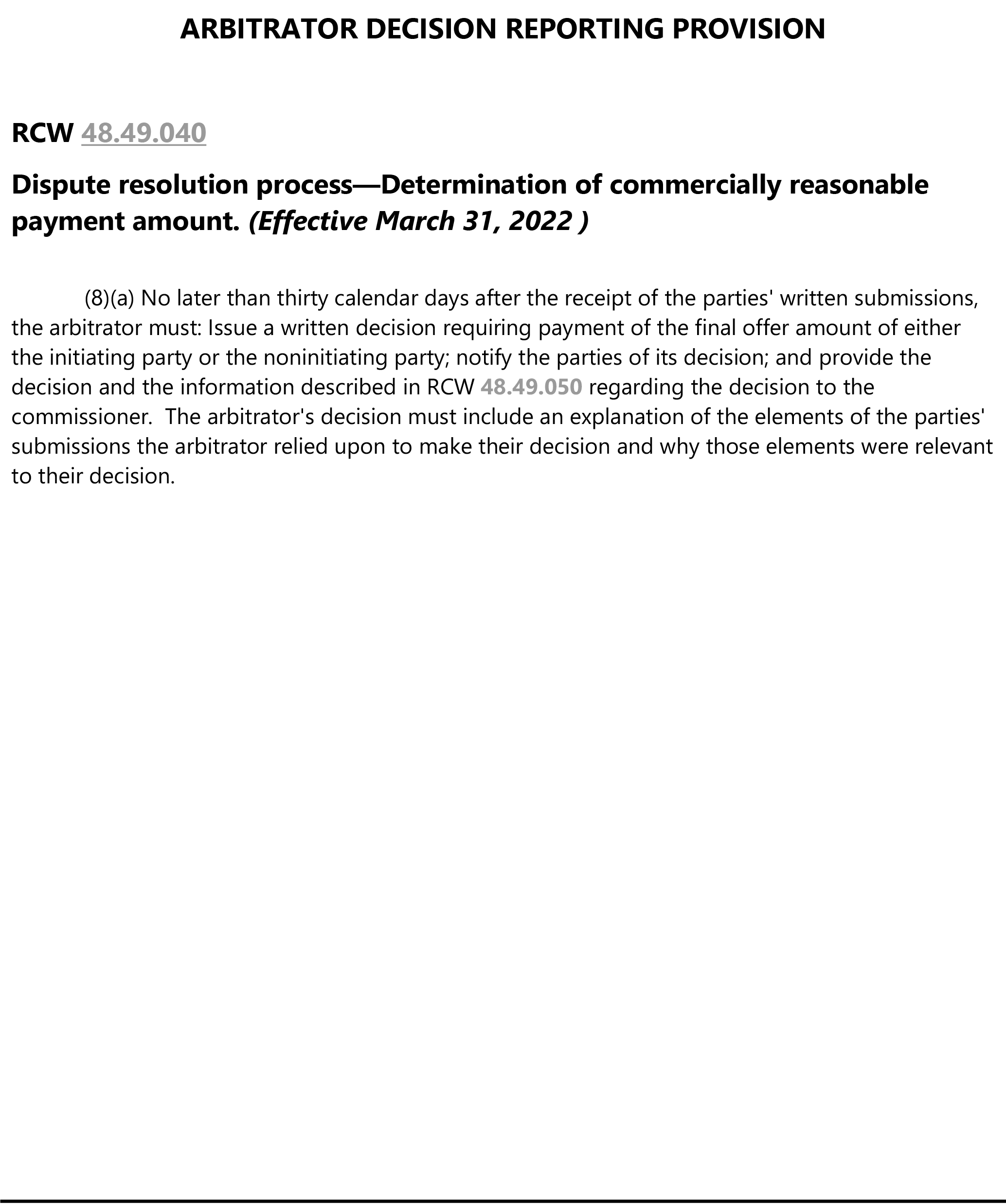

(6) The decision of the arbitrator is final and binding on the parties and is not subject to judicial review. The arbitrator must submit to the commissioner:

(a) Their decision, including an explanation of the elements of the parties' submissions the arbitrator relied upon to make their decision and why those elements were relevant to their decision; and

(b) The information required in RCW

48.49.050 using the form found in Appendix B to this rule, or for arbitration proceedings under RCW

48.49.135, using the form found in Appendix C to this rule.

(7)(a) For the calendar year beginning January 1, 2023, arbitrators must charge a fixed fee for single claim proceedings within the range of $200-$650. If an arbitrator chooses to charge a different fixed fee for bundled claim proceedings, that fee must be within the range of $268-$800. Beginning January 1, 2024, and January 1st of each year thereafter, the arbitrator may adjust the fee range by the annual consumer price index-urban as determined annually by the United States Bureau of Labor Statistics.

(b) Expenses incurred during arbitration, including the arbitrator's expenses and fees, but not including attorneys' fees, must be divided equally among the parties to the arbitration. Arbitrator fees must be paid to the arbitrator by the parties within 30 calendar days of receipt of the arbitrator's decision by the parties.

(c) If the parties reach an agreement before the arbitrator makes their decision, the arbitrator fees must be paid by the parties within 30 calendar days of the date the settlement is reported to the commissioner as required under RCW

48.49.040.

(8) RCW

48.49.040(13) governs arbitration proceedings initiated under RCW

48.49.135. The determination of the rate to be paid to the out-of-network or nonparticipating provider must be accomplished through a single arbitration proceeding.

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

WAC 284-43B-040Determining whether an enrollee's health plan is subject to the requirements of the act.

(1) To implement RCW ((

48.49.030))

48.49.170 carriers must make information regarding whether an enrollee's health plan is subject to the requirements of chapter

48.49 RCW

or section 2799A-1 et seq. of the Public Health Service Act (42 U.S.C. Sec. 300gg-111 et seq.) and federal regulations implementing those provisions of P.L. 116-260 available to providers and facilities by:

(a) Using the most current version of the Health Insurance Portability and Accountability Act (HIPAA) mandated X12 Health Care Eligibility Benefit Response (271) transaction information through use of ((a))the most appropriate standard message that is placed in a standard location within the 271 transaction; ((and))

(b) Beginning April 1, 2021, and until December 31, 2022, using the most current version of the Health Insurance Portability and Accountability Act (HIPAA) mandated X12 Health Care Claim Payment and Remittance Advice (835) transaction through compliant use of the X12 industry standard Remark Code N830 to indicate that the claim was processed in accordance with this state's balance billing rules;

(c) Beginning January 1, 2023, using the appropriate version of the Health Insurance Portability and Accountability Act (HIPAA) mandated X12 Health Care Claim Payment and Remittance Advice (835) transaction through compliant use of the applicable X12 industry standard Remark Code to indicate whether a claim was processed in accordance with this state's balance billing rules or the federal No Surprises Act.

(2) The designated lead organization for administrative simplification in Washington state:

(a) After consultation with carriers, providers and facilities through a new or an existing workgroup or committee, must post the language of the most appropriate standard message and the location within the 271 transaction in which the message is to be placed on its website on or before November 1, ((2019))2022;

(b) Must post on its website on or before December 1, 2020, instructions on compliant use of the X12 industry standard Remark Code N830 in the X12 Health Care Claim Payment and Remittance Advice (835) transaction; ((and))

(c) Must post on its website on or before December 1, 2022, instructions on compliant use of the appropriate X12 industry standard Remark code or codes as provided in subsection (1)(c) of this section; and

(d) Must post on its website on or before December 1, 2020, the information reported by carriers under WAC 284-43B-035(1).

(3) A link to the information referenced in subsection (2) of this section also must be posted on the website of the office of the insurance commissioner.

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

WAC 284-43B-050Notice of consumer rights and transparency.

(1) The commissioner shall develop a standard template for a notice of consumer ((rights))protections from balance billing under the Balance Billing Protection Act and the federal No Surprises Act (P.L. 116-260). The notice may be modified periodically, as determined necessary by the commissioner. The notice template will be posted on the public website of the office of the insurance commissioner.

(2) The standard template for the notice of consumer ((rights))protections developed under ((the Balance Billing Protection Act))subsection (1) of this section must be provided to consumers enrolled in any health plan issued in Washington state as follows:

(a) Carriers must:

(i) Include the notice in the carrier's communication to an enrollee, in electronic or any other format, that authorizes nonemergency ((surgical or ancillary services at an in-network facility))services to be provided at facilities referenced in WAC 284-43B-010 (2)(h)(ii);

(ii)

Include the notice in each explanation of benefits sent to an enrollee for items or services with respect to which the requirements of RCW 48.49.020 and WAC 284-43B-020 apply;(iii) Post the notice on their website in a prominent and relevant location, such as in a location that addresses coverage of emergency services and prior authorization requirements for nonemergency ((surgical or ancillary services performed at in-network))health care services performed by nonparticipating providers at certain participating facilities; and

(((iii)))(iv) Provide the notice to any enrollee upon request.

(b) Health care facilities and providers must:

(i) For any facility or provider that is owned and operated independently from all other businesses and that has more than ((fifty))50 employees, upon confirming that a patient's health plan is subject to the Balance Billing Protection Act or the federal No Surprises Act (P.L. 116-260):

(A) Include the notice in any communication to a patient, in electronic or any other format related to scheduling of nonemergency ((surgical or ancillary services at a facility))health care services performed by nonparticipating providers at certain participating facilities. Text messaging used as a reminder or follow-up after a patient has already received the full text of the notice under this subsection may provide the notice through a link to the provider's webpage that takes the patient directly to the notice. Telephone calls to patients following the patient's receipt of the full text of the notice under this subsection do not need to include the notice; and

(B) For facilities providing emergency ((medical)) services, including behavioral health emergency services providers, provide or mail the notice to a patient within ((seventy-two))72 hours following a patient's receipt of emergency ((medical)) services.

(ii) Post the notice on their website, if the provider, behavioral health emergency services provider or facility maintains a website, in a prominent and relevant location near the list of the carrier health plan provider networks with which the provider, behavioral health emergency services provider or facility is an in-network provider; ((and))

(iii) If services were provided at a health care facility or in connection with a visit to a health care facility, provide the notice to patients no later than the date and time on which the provider or facility requests payment from the patient, or with respect to a patient from who the provider or facility does not request payment, no later than the date on which the provider or facility submits a claim to the carrier; and

(iv) Provide the notice upon request of a patient.

(3) The notice required in this section may be provided to a patient or an enrollee electronically if it includes the full text of the notice and if the patient or enrollee has affirmatively chosen to receive such communications from the carrier, provider, or facility electronically. Except as authorized in subsection (2)(b)(i)(A) of this section, the notice may not be provided through a hyperlink in an electronic communication.

(4) For claims processed on or after July 1, 2020, when processing a claim that is subject to the balance billing prohibition in RCW

48.49.020, the carrier must indicate on any form used by the carrier to notify enrollees of the amount the carrier has paid on the claim:

(a) Whether the claim is subject to the prohibition in the act; and

(b) The federal Center for Medicare and Medicaid Services individual national provider identifier number, and organizational national provider identifier number, if the provider works for an organization or is in a group practice that has an organization number.

(5) Carriers must ensure that notices provided under this subsection are inclusive for those patients who may have disabilities or limited-English proficiency, consistent with carriers' obligations under WAC 284-43-5940 through 284-43-5965. To assist in meeting this language access requirement, carriers may use translated versions of the notice of consumer protections from balance billing posted on the website of the office of the insurance commissioner.

(6) A facility

, behavioral health emergency services provider or health care provider meets its obligation under RCW

48.49.070 or

48.49.080, to include a listing on its website of the carrier health plan provider networks in which the facility or health care provider participates by posting this information on its website for in-force contracts, and for newly executed contracts within ((

fourteen))

14 calendar days of receipt of the fully executed contract from a carrier. If the information is posted in advance of the effective date of the contract, the date that network participation will begin must be indicated.

(((6)))(7) Not less than ((thirty))30 days prior to executing a contract with a carrier((,)):

(a)(i) A hospital, freestanding emergency department, behavioral health emergency services provider or ambulatory surgical facility must provide the carrier with a list of the nonemployed providers or provider groups that have privileges to practice at the hospital, freestanding emergency department, behavioral health emergency services provider or ambulatory surgical facility ((or));

(ii) A hospital, hospital outpatient department, critical access hospital or ambulatory surgical center must provide the carrier with a list of the nonemployed providers or provider groups that are contracted to provide ((surgical or ancillary services at the hospital or ambulatory surgical))nonemergency health care services at the facility.

(b) The list must include the name of the provider or provider group, mailing address, federal tax identification number or numbers and contact information for the staff person responsible for the provider's or provider group's contracting. ((The hospital or ambulatory surgical facility))

(c) Any facility providing carriers information under this subsection must notify the carrier within ((thirty))30 days of a removal from or addition to the nonemployed provider list. ((A hospital or ambulatory surgical))The facility also must provide an updated list of these providers within ((fourteen))14 calendar days of a written request for an updated list by a carrier.

(((7) An in-network))(8) A participating provider must submit accurate information to a carrier regarding the provider's network status in a timely manner, consistent with the terms of the contract between the provider and the carrier.

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

WAC 284-43B-060Enforcement.

(1)(a) If the commissioner has cause to believe that any health facility

, behavioral health emergency services provider or provider has engaged in a pattern of unresolved violations of RCW

48.49.020 or

48.49.030, the commissioner may submit information to the department of health or the appropriate disciplining authority for action.

(b) In determining whether there is cause to believe that a health care provider, behavioral health emergency services provider or facility has engaged in a pattern of unresolved violations, the commissioner shall consider, but is not limited to, consideration of the following:

(i) Whether there is cause to believe that the health care provider

, behavioral health emergency services provider or facility has committed two or more violations of RCW

48.49.020 or

48.49.030;

(ii) Whether the health care provider

, behavioral health emergency services provider or facility has failed to submit claims to carriers containing all of the elements required in WAC 284-43B-030(1) on multiple occasions, putting a consumer or consumers at risk of being billed for services to which the prohibition in RCW

48.49.020 applies;

(iii) Whether the health care provider

, behavioral health emergency services provider or facility has been nonresponsive to questions or requests for information from the commissioner related to one or more complaints alleging a violation of RCW

48.49.020 or

48.49.030; and

(iv) Whether, subsequent to correction of previous violations, additional violations have occurred.

(c) Prior to submitting information to the department of health or the appropriate disciplining authority, the commissioner may provide the health care provider

, behavioral health emergency services provider or facility with an opportunity to cure the alleged violations or explain why the actions in question did not violate RCW

48.49.020 or

48.49.030.

(2) In determining whether a carrier has engaged in a pattern of unresolved violations of any provision of this chapter, the commissioner shall consider, but is not limited to, consideration of the following:

(a) Whether a carrier has failed to timely respond to arbitration initiation request notifications from providers or facilities;

(b) Whether a carrier has failed to comply with the requirements of WAC 284-43-035 related to choosing an arbitrator or arbitration entity;

(c) Whether a carrier has met its obligation to maintain current and accurate carrier contact information related to initiation of arbitration proceedings under WAC 284-43-035;

(d) Whether a carrier has complied with the requirements of WAC 284-43-040;

(e) Whether a carrier has complied with the consumer notice requirements under WAC 284-43-050; and

(f) Whether a carrier has committed two or more violations of chapter

48.49 RCW or this chapter.

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

WAC 284-43B-070Self-funded group health plan opt in.

(1) A self-funded group health plan that elects to participate in RCW

48.49.020 through

48.49.040 and 48.49.160, shall provide notice to the commissioner of their election decision on a form prescribed by the commissioner. The completed form must include an attestation that the self-funded group health plan has elected to participate in and be bound by RCW

48.49.020 through

48.49.040, 48.49.160 and rules adopted to implement those sections of law. If the form is completed by the self-funded group health plan, the plan must inform any entity that administers the plan of their election to participate. The form will be posted on the commissioner's public website for use by self-funded group health plans.

(2) A self-funded group health plan election to participate is for a full year. The plan may elect to initiate its participation on January 1st of any year or in any year on the first day of the self-funded group health plan's plan year.

(3) A self-funded group health plan's election occurs on an annual basis. On its election form, the plan must indicate whether it chooses to affirmatively renew its election on an annual basis or whether it should be presumed to have renewed on an annual basis until the commissioner receives advance notice from the plan that it is terminating its election as of either December 31st of a calendar year or the last day of its plan year. Notices under this subsection must be submitted to the commissioner at least ((fifteen))15 days in advance of the effective date of the election to initiate participation and the effective date of the termination of participation.

(4) A self-funded plan operated by an out-of-state employer that has at least one employee who resides in Washington state may elect to participate in balance billing protections as provided in RCW

48.49.130 on behalf of their Washington state resident employees and dependents. If a self-funded group health plan established by Washington state employer has elected to participate in balance billing protections under RCW

48.49.130 and has employees that reside in other states, those employees are protected from balance billing when receiving care from a Washington state provider.

(5) Self-funded group health plan sponsors and their third party administrators may develop their own internal processes related to member notification, member appeals and other functions associated with their fiduciary duty to enrollees under the Employee Retirement Income Security Act of 1974 (ERISA).

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

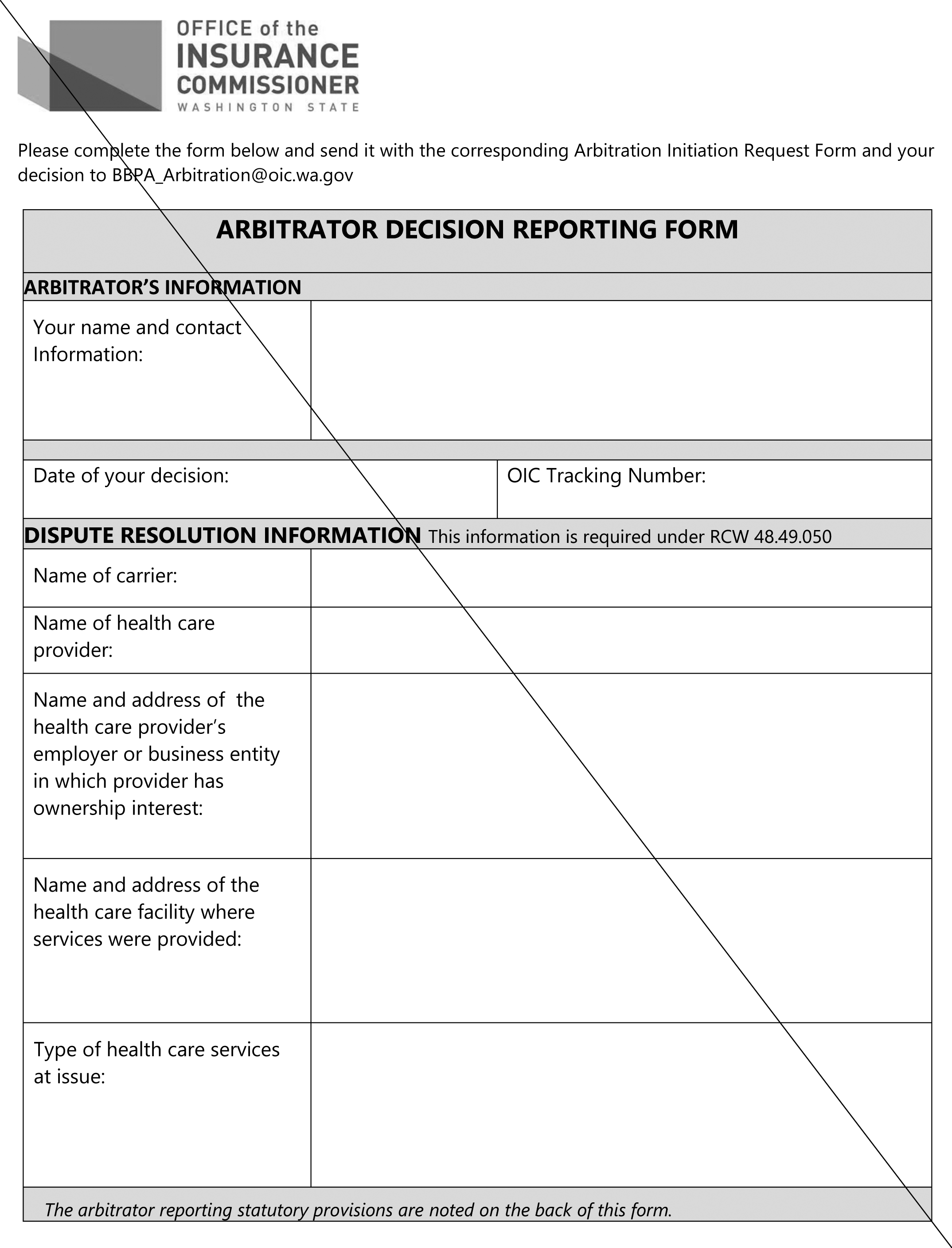

WAC 284-43B-085Appendix A.

AMENDATORY SECTION(Amending WSR 20-22-076, filed 11/2/20, effective 12/3/20)

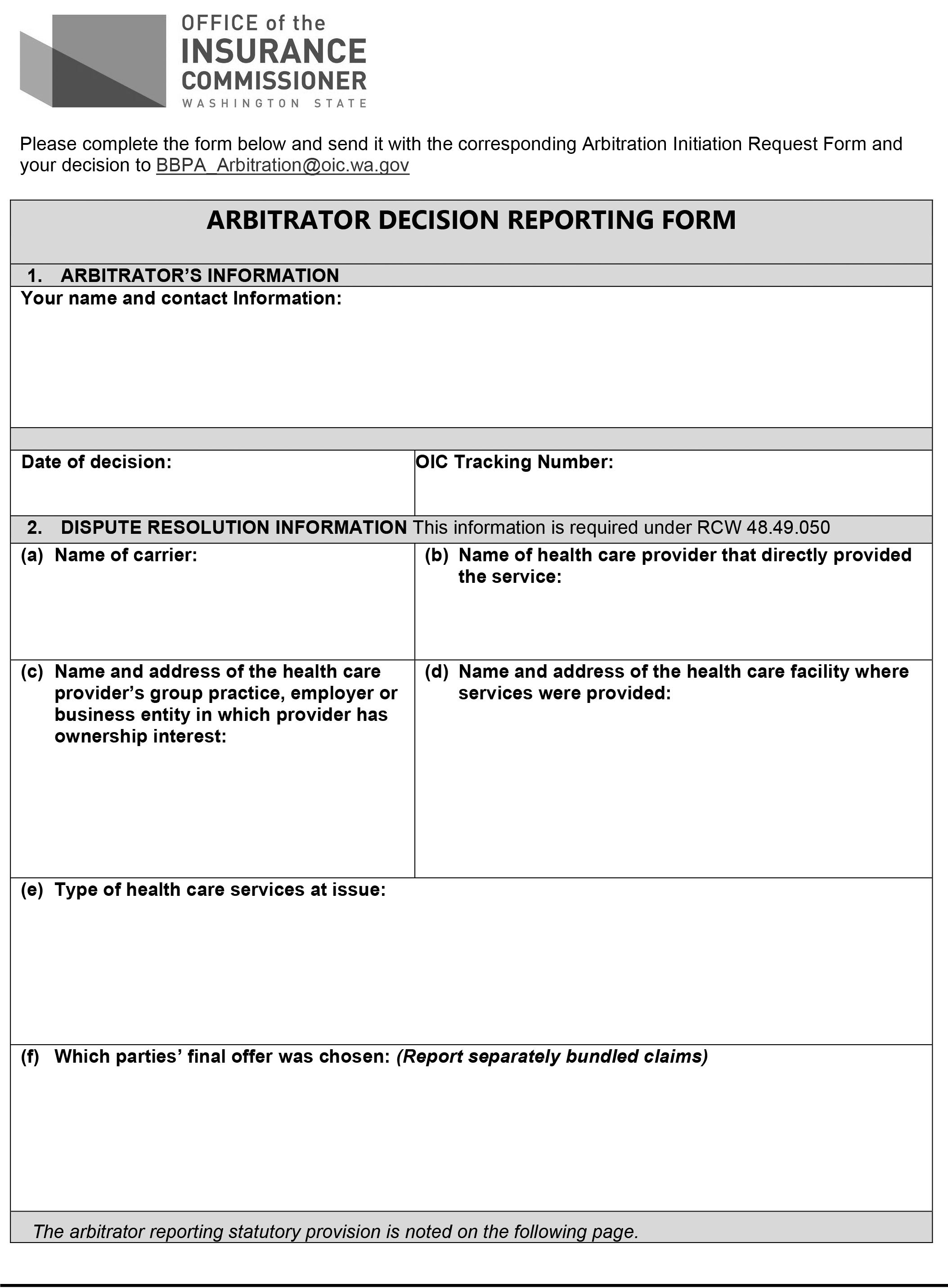

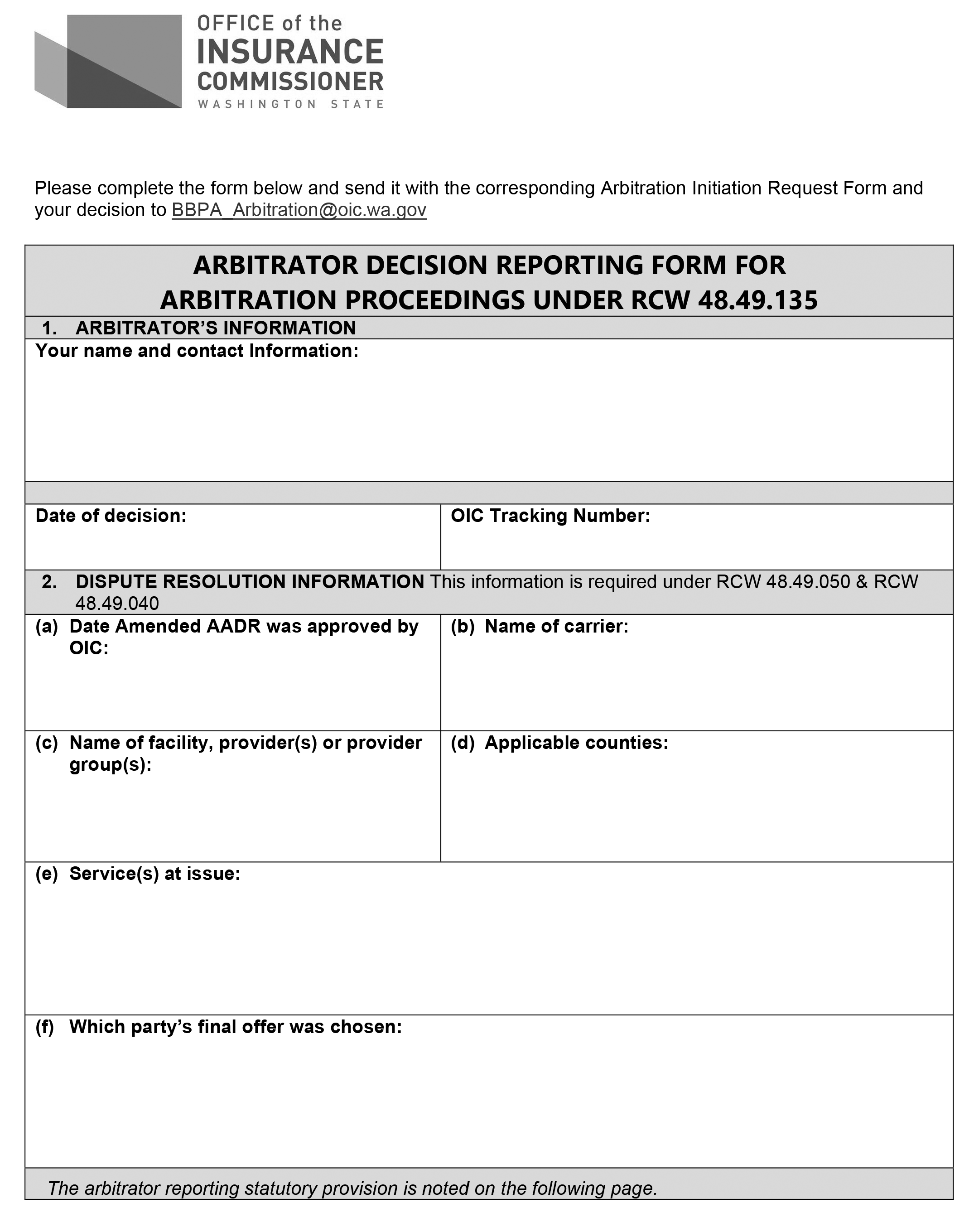

WAC 284-43B-090Appendix B.

NEW SECTION

WAC 284-43B-095Appendix C.

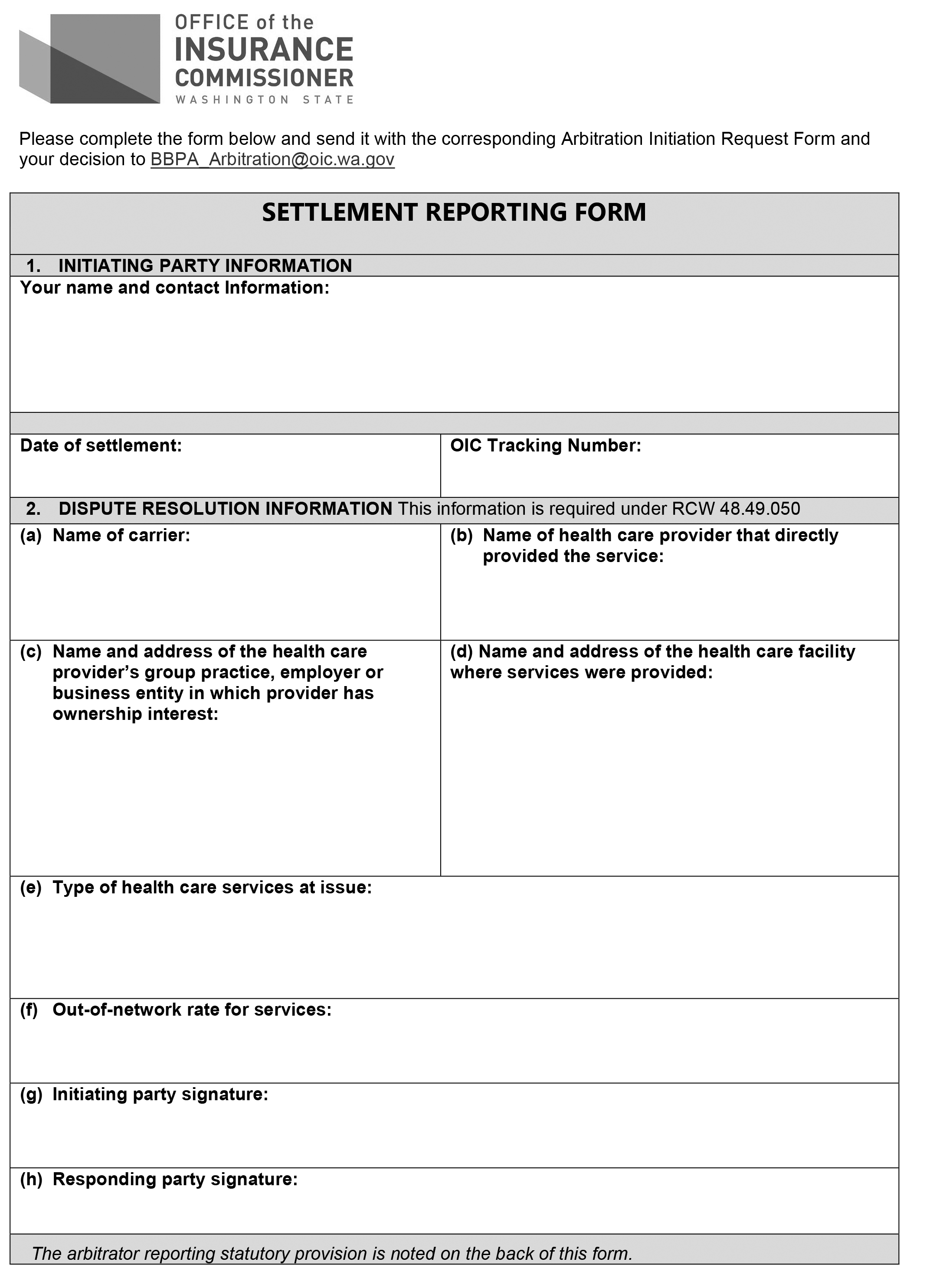

NEW SECTION

WAC 284-43B-100Appendix D.

REPEALER

The following section of the Washington Administrative Code is repealed:

WAC 284-43B-080 | Effective date. |

OTS-4114.3

AMENDATORY SECTION(Amending WSR 21-01-094, filed 12/11/20, effective 1/11/21)

WAC 284-170-200Network access—General standards.

(1) An issuer must maintain each provider network for each health plan in a manner that is sufficient in numbers and types of providers and facilities to assure that, to the extent feasible based on the number and type of providers and facilities in the service area, all health plan services provided to enrollees will be accessible in a timely manner appropriate for the enrollee's condition. An issuer must demonstrate that for each health plan's defined service area, a comprehensive range of primary, specialty, institutional, and ancillary services are readily available without unreasonable delay to all enrollees and that emergency services are accessible ((twenty-four))24 hours per day, seven days per week without unreasonable delay.

(2) Each enrollee must have adequate choice among health care providers, including those providers which must be included in the network under WAC 284-170-270, and for qualified health plans and qualified stand-alone dental plans, under WAC 284-170-310.

(3) An issuer's service area must not be created in a manner designed to discriminate or that results in discrimination against persons because of age, gender, gender identity, sexual orientation, disability, national origin, sex, family structure, ethnicity, race, health condition, employment status, or socioeconomic status.

(4) An issuer must establish sufficiency and adequacy of choice of providers based on the number and type of providers and facilities necessary within the service area for the plan to meet the access requirements set forth in this subchapter. Where an issuer establishes medical necessity or other prior authorization procedures, the issuer must ensure sufficient qualified staff is available to provide timely prior authorization decisions on an appropriate basis, without delays detrimental to the health of enrollees.

(5) In any case where the issuer has an absence of or an insufficient number or type of participating providers or facilities to provide a particular covered health care service, the issuer must ensure through referral by the primary care provider or otherwise that the enrollee obtains the covered service from a provider or facility within reasonable proximity of the enrollee at no greater cost to the enrollee than if the service were obtained from network providers and facilities. An issuer must satisfy this obligation even if an alternate access delivery request has been submitted and is pending commissioner approval.

An issuer may use facilities in neighboring service areas to satisfy a network access standard if one of the following types of facilities is not in the service area, or if the issuer can provide substantial evidence of good faith efforts on its part to contract with the facilities in the service area. Such evidence of good faith efforts to contract will include documentation about the efforts to contract but not the substantive contract terms offered by either the issuer or the facility. This applies to the following types of facilities:

(a) Tertiary hospitals;

(b) Pediatric community hospitals;

(c) Specialty or limited hospitals, such as burn units, rehabilitative hospitals, orthopedic hospitals, and cancer care hospitals;

(d) Neonatal intensive care units; and

(e) Facilities providing transplant services, including those that provide solid organ, bone marrow, and stem cell transplants.

(6) An issuer must establish and maintain adequate arrangements to ensure reasonable proximity of network providers and facilities to the business or personal residence of enrollees, and located so as to not result in unreasonable barriers to accessibility. Issuers must make reasonable efforts to include providers and facilities in networks in a manner that limits the amount of travel required to obtain covered benefits.

(7) A single case provider reimbursement agreement must be used only to address unique situations that typically occur out-of-network and out of service area, where an enrollee requires services that extend beyond stabilization or one time urgent care. Single case provider reimbursement agreements must not be used to fill holes or gaps in the network and do not support a determination of network access.

(8) An issuer must disclose to enrollees that limitations or restrictions on access to participating providers and facilities may arise from the health service referral and authorization practices of the issuer. A description of the health plan's referral and authorization practices, including information about how to contact customer service for guidance, must be set forth as an introduction or preamble to the provider directory for a health plan. In the alternative, the description of referral and authorization practices may be included in the summary of benefits and explanation of coverage for the health plan.

(9) To provide adequate choice to enrollees who are American Indians/Alaska Natives, each health issuer must maintain arrangements that ensure that American Indians/Alaska Natives who are enrollees have access to covered medical and behavioral health services provided by Indian health care providers.

Issuers must ensure that such enrollees may obtain covered medical and behavioral health services from an Indian health care provider at no greater cost to the enrollee than if the service were obtained from network providers and facilities, even if the Indian health care provider is not a contracted provider. Issuers are not responsible for credentialing providers and facilities that are part of the Indian health system. Nothing in this subsection prohibits an issuer from limiting coverage to those health services that meet issuer standards for medical necessity, care management, and claims administration or from limiting payment to that amount payable if the health service were obtained from a network provider or facility.

(10) An issuer must have a demonstrable method and contracting strategy to ensure that contracting hospitals in a plan's service area have the capacity to serve the entire enrollee population based on normal utilization.

(11) At a minimum, an issuer's provider network must adequately provide for mental health and substance use disorder treatment, including behavioral health therapy. An issuer must include a sufficient number and type of mental health and substance use disorder treatment providers and facilities within a service area based on normal enrollee utilization patterns.

(a) Adequate networks must include crisis intervention and stabilization, psychiatric inpatient hospital services, including voluntary psychiatric inpatient services, and services from mental health providers.

(b) There must be mental health providers of sufficient number and type to provide diagnosis and medically necessary treatment of conditions covered by the plan through providers acting within their scope of license and scope of competence established by education, training, and experience to diagnose and treat conditions found in the most recent version of the Diagnostic and Statistical Manual of Mental Disorders or other recognized diagnostic manual or standard.

(c) An issuer must establish a reasonable standard for the number and geographic distribution of mental health providers who can treat serious mental illness of an adult and serious emotional disturbances of a child, taking into account the various types of mental health practitioners acting within the scope of their licensure.

The issuer must measure the adequacy of the mental health network against this standard at least twice a year, and submit an action plan with the commissioner if the standard is not met.

(d) Emergency mental health services and substance use disorder services, including ((

crisis intervention and crisis stabilization)) services

provided by behavioral health emergency services providers, as defined in RCW 48.43.005, must be included in an issuer's provider network.

(e) An issuer's monitoring of network access and adequacy must be based on its classification of mental health and substance use disorder services to either primary or specialty care, ensuring that a sufficient number of providers of the required type are in its network to provide the services as classified. An issuer may use the classifications established in WAC 284-43-7020 for this element of its network assessment and monitoring.

(f) An issuer must ensure that an enrollee can identify information about mental health services and substance use disorder treatment including benefits, providers, coverage, and other relevant information by calling a customer service representative during normal business hours, by using the issuer's transparency tool developed pursuant to RCW

48.43.007 and by referring to the network provider directory.

(12) The provider network must include preventive and wellness services, including chronic disease management and smoking cessation services as defined in RCW

48.43.005 and WAC 284-43-5640(9) and 284-43-5642(9). If these services are provided through a quit-line or help-line, the issuer must ensure that when follow-up services are medically necessary, the enrollee will have access to sufficient information to access those services within the service area. Contracts with quit-line or help-line services are subject to the same conditions and terms as other provider contracts under this section.

(13) For the essential health benefits category of ambulatory patient services, as defined in WAC 284-43-5640(1) and 284-43-5642(1), an issuer's network is adequate if:

(a) The issuer establishes a network that affords enrollee access to urgent appointments without prior authorization within ((forty-eight))48 hours, or with prior authorization, within ((ninety-six))96 hours of the referring provider's referral.

(b) For primary care providers the following must be demonstrated:

(i) The ratio of primary care providers to enrollees within the issuer's service area as a whole meets or exceeds the average ratio for Washington state for the prior plan year;

(ii) The network includes such numbers and distribution that ((eighty))80 percent of enrollees within the service area are within ((thirty))30 miles of a sufficient number of primary care providers in an urban area and within ((sixty))60 miles of a sufficient number of primary care providers in a rural area from either their residence or work; and

(iii) Enrollees have access to an appointment, for other than preventive services, with a primary care provider within ((ten))10 business days of requesting one.

(c) For specialists:

(i) The issuer documents the distribution of specialists in the network for the service area in relation to the population distribution within the service area; and

(ii) The issuer establishes that when an enrollee is referred to a specialist, the enrollee has access to an appointment with such a specialist within ((fifteen))15 business days for nonurgent services.

(d) For preventive care services, and periodic follow-up care including, but not limited to, standing referrals to specialists for chronic conditions, periodic office visits to monitor and treat pregnancy, cardiac or mental health conditions, and laboratory and radiological or imaging monitoring for recurrence of disease, the issuer permits scheduling such services in advance, consistent with professionally recognized standards of practice as determined by the treating licensed health care provider acting within the scope of his or her practice.

(14) The network access requirements in this subchapter apply to stand-alone dental plans offered through the exchange or where a stand-alone dental plan is offered outside of the exchange for the purpose of providing the essential health benefit category of pediatric oral benefits. All such stand-alone dental plans must ensure that all covered services to enrollees will be accessible in a timely manner appropriate for the enrollee's conditions.

(a) An issuer of such stand-alone dental plans must demonstrate that, for the dental plan's defined service area, all services required under WAC 284-43-5700(3) and 284-43-5702(4), as appropriate, are available to all enrollees without unreasonable delay.

(b) Dental networks for pediatric oral services must be sufficient for the enrollee population in the service area based on expected utilization.

(15) Issuers must meet all requirements of this subsection for all provider networks. An alternate access delivery request under WAC 284-170-210 may be proposed only if: