WSR 24-14-057

PROPOSED RULES

DEPARTMENT OF ECOLOGY

[Order 23-01—Filed June 27, 2024, 9:31 a.m.]

Original Notice.

Preproposal statement of inquiry was filed as WSR 23-14-026.

Title of Rule and Other Identifying Information: Chapter 173-441 WAC, Reporting of emissions of greenhouse gases rule; and chapter 173-446 WAC, Climate Commitment Act program rule, electricity markets rule making.

For more information on this rule making, please visit https://ecology.wa.gov/regulations-permits/laws-rules-rulemaking/rulemaking/wac-173-441-446.

Hearing Location(s): On August 6, 2024, at 1:00 p.m. Hearing via webinar. Join online and see instructions https://waecy-wa-gov.zoom.us/meeting/register/tZAkdeCrqTgiH9WgLsdLU9TAdqV-5Z5bcddJ. Presentation and question and answer session followed by the hearing. This is an online meeting that you can attend from any computer using internet access; and

On August 8, 2024, at 9:00 a.m. Hearing via webinar. Join online and see instructions https://waecy-wa-gov.zoom.us/meeting/register/tZIsduypqzgiEtPFx2hAdGWb5y0eUSL6Pcv-]. Presentation and question and answer session followed by the hearing. This is an online meeting that you can attend from any computer using internet access.

Date of Intended Adoption: December 3, 2024.

Submit Written Comments to: Gopika Patwa, Department of Ecology, Climate Pollution Reduction Program, P.O. Box 47600, Olympia, WA 98504-7600; or Department of Ecology, Climate Pollution Reduction Program, 300 Desmond Drive S.E., Lacey, WA 98503, email gopika.patwa@ecy.wa.gov, https://aq.ecology.commentinput.com?id=ijhB5kQRH, beginning June 27, 2024, 12:00 a.m., by August 20, 2024, 11:59 p.m.

Assistance for Persons with Disabilities: Contact ecology ADA coordinator, phone 360-407-6831, speech disability may call TTY at 877-833-6341, impaired hearing may call Washington relay service at 711, email ecyADAcoordinator@ecy.wa.gov, by August 2, 2024.

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: In 2021, the Washington legislature passed the Climate Commitment Act (CCA), which established a cap-and-invest program to help Washington meet statutory greenhouse gas (GHG) emission limits.

To align with the requirements of the CCA, this rule making is proposing amendments to chapter 173-441 WAC, Reporting of emissions of greenhouse gases; and chapter 173-446 WAC, Climate Commitment Act program rule.

The purpose of these updates is to help determine which electricity importers from centralized electricity markets should be covered under the cap-and-invest program. This rule does not modify the eligibility criteria for inclusion under the cap-and-invest program. The rule establishes a framework that identifies the resources supplying the relevant electricity into centralized electricity markets based on the market mechanisms that operators of these markets put in place. The resulting compliance obligation is assigned in the CCA program rule (chapter 173-446 WAC), with the processes and procedures for identifying resources contained with the reporting of emissions of GHG rule (chapter 173-441 WAC). Supporting changes to the reporting rule will also ensure that appropriate data are available.

The proposal applies to existing and future centralized electricity markets including the Energy Imbalance Market, the Extended Day Ahead Market, and the Markets+ initiative underway by the Southwest Power Pool. The proposal also addresses other issues related to the reporting of GHG emissions for entities importing electricity to Washington.

Specifically, this rule making proposes to provide:

| |

| • | A framework for addressing imports of electricity from specified resources through centralized electricity markets. |

| • | A process for identifying the electricity importer for imported electricity from centralized electricity markets. |

| • | Methods for assigning GHG emissions to imports of electricity from centralized electricity markets. |

| • | Equitable treatment across and between bilateral and centralized electricity markets. |

| • | Nonsubstantive administrative and process-related changes for clarity and to harmonize the rule with recent statutory changes. |

Reasons Supporting Proposal: This rule making is required by RCW

70A.65.080 (1)(c). The rule making is necessary to ensure that specified sources of electricity imported into the state from centralized electricity markets can be identified and counted as covered emissions in the cap-and-invest program. Currently, there is a lack of clear methodologies and procedures to assign the compliance obligations on the importing entity. Additionally, this rule making will allow centralized electricity market operators to put in place the necessary data infrastructure to track importing entities and report that information to the department of ecology (ecology).

Statutory Authority for Adoption: RCW

70A.65.080 (1)(c).

Statute Being Implemented: Greenhouse gas emissions

—Cap and invest program, program coverage, RCW

70A.65.080 (1)(c); Greenhouse Gas emissions

—Cap and invest program, adoption of rules, RCW

70A.65.220; Washington Clean Air Act, Classification of air contaminant sources

—Registration

—Fee

—Registration program defined

—Adoption of rules requiring persons to report emissions of greenhouse gases, RCW

70A.15.2200(5).

Rule is not necessitated by federal law, federal or state court decision.

Name of Proponent: Department of ecology, governmental.

Name of Agency Personnel Responsible for Drafting: Gopika Patwa, Lacey, 360-338-2419; Implementation and Enforcement: Lindsey Kennelly, Lacey, 360-584-7426.

A school district fiscal impact statement is not required under RCW

28A.305.135.

A cost-benefit analysis is required under RCW

34.05.328. A preliminary cost-benefit analysis may be obtained by contacting Gopika Patwa, Department of Ecology, Climate Pollution Reduction Program, P.O. Box 47600, Olympia, WA 98504-7600, phone 360-338-2419, speech disability may call TTY at 877-833-6341, impaired hearing may call Washington relay service at 711, email

gopika.patwa@ecy.wa.gov.

This rule proposal, or portions of the proposal, is exempt from requirements of the Regulatory Fairness Act because the proposal:

Is exempt under RCW

19.85.025(3) as the rules only correct typographical errors, make address or name changes, or clarify language of a rule without changing its effect; and rule content is explicitly and specifically dictated by statute.

Scope of exemption for rule proposal:

Is partially exempt:

Explanation of partial exemptions: Ecology baselines are typically complex, consisting of multiple requirements fully or partially specified by existing rules, statutes, or federal laws. Where the proposed rule differs from this baseline of existing requirements, it is typically subject to (i.e., not exempt from) analysis required under the Regulatory Fairness Act (RFA; chapter

19.85 RCW) based on meeting criteria referenced in RCW

19.85.025(3) as defined by the Administrative Procedure Act in RCW

34.05.310. The small business economic impact statement below includes a summary of the baseline for this rule making, and whether or how the proposed rule differs from the baseline.

The proposed rule does impose more-than-minor costs on businesses.

Small Business Economic Impact Statement (SBEIS)

This SBEIS presents the:

| |

| • | Compliance requirements of the proposed rule. |

| • | Results of the analysis of relative compliance cost burden. |

| • | Consideration of lost sales or revenue. |

| • | Cost-mitigating action taken by ecology, if required. |

| • | Small business and local government consultation. |

| • | Industries likely impacted by the proposed rule. |

| • | Expected net impact on jobs statewide. |

A small business is defined by RFA as having 50 or fewer employees. Estimated costs are determined as compared to the existing regulatory environment; the regulations in the absence of the rule. The SBEIS only considers costs to "businesses in an industry" in Washington state. This means that impacts, for this analysis, are not evaluated for government agencies.

The existing regulatory environment is called the "baseline" in this analysis. It includes only existing laws and rules at federal and state levels.

This information is excerpted from ecology's complete set of regulatory analyses for this rule making. For complete discussion of the likely costs, benefits, minimum compliance burden, and relative burden on small businesses, see the associated Preliminary Regulatory Analyses document (PRA; ecology publication no. 24-14-052, June 2024). We have retained the section numbering, table numbers, and chapter references from the PRA for easier cross-referencing.

COMPLIANCE REQUIREMENTS OF THE PROPOSED RULE, INCLUDING PROFESSIONAL SERVICES: The baseline for our analyses generally consists of existing laws and rules. This is what allows us to make a consistent comparison between the state of the world with and without the proposed rule amendments.

For this rule making, the baseline includes:

| |

| • | The CCA law, chapter 70A.65 RCW (Greenhouse gas emissions—Cap and invest program). |

| • | Section 2200 of the Washington Clean Air Act, RCW 70A.15.2200 (Classification of air contaminant sources—Registration—Fee—Registration program defined—Adoption of rules requiring persons to report emissions of greenhouse gases). |

| • | The existing GHG reporting rule, chapter 173-441 WAC (Reporting of emissions of greenhouse gases). |

| • | The existing CCA rule, chapter 173-446 WAC (Climate Commitment Act program rule). |

| • | E2SSB 6058, section 11, chapter 352, Laws of 2024 (Carbon market linkage—California—Québec carbon market). |

| • | Chapter 19.405 RCW (Washington Clean Energy Transformation Act; CETA). |

| • | California Air Resources Board (CARB) Regulation for the Mandatory Reporting of Greenhouse Gas Emissions (Title 17 California Code of Regulations (CCR), Div. 3, Ch. 1, Subchapter 10, Article 2). |

| • | CARB California Cap on Greenhouse Gas Emissions and Market-Based Compliance Mechanisms (Title 17 CCR, Div. 3, Ch. 1, Subchapter 10, Article 5). |

| • | The Federal Power Act (16 U.S.C. Ch. 12). |

| • | Federal Energy Regulatory Commission (FERC) regulation and approval of market tariffs. |

2.3 Proposed rule amendments:

The proposed rule amendments would:

| |

| • | Amend reporting requirements in the GHG reporting rule (chapter 173-441 WAC): |

| |

| o | Amending the definition of "electric power entity" (EPE). |

| o | Changing annual report submission requirements. |

| o | Adding, removing, or changing definitions specific to EPE reporting requirements. |

| o | Expanding data requirements and calculation methods from the EIM to all centralized electricity markets (CEMs). |

| o | Specifying how EPEs must report imported CEM electricity. |

| o | Specifying GHG emissions equations and applicability. |

| o | Expanding documentation requirements. |

| o | Amending requirements for registration of import or export sources. |

| o | Making changes without material impacts: |

| |

| ■ | Clarify language and update terminology. |

| ■ | Remove obsolete requirements and language. |

| |

| • | Amend the CCA rule (chapter 173-446 WAC): |

| |

| o | Adding definitions consistent with the GHG reporting rule. |

| o | Amending covered emissions to reflect electricity imported from CEMs. |

2.3.1 Amending the definition of EPE (chapter 173-441 WAC): The proposed rule amendments would expand the definition of EPE to include entities that transact electric power in Washington. This proposed amendment would extend reporting requirements to electricity importers and exporters, retail providers, and asset controlling suppliers that transact electric power in the state. This would result in reporting costs for entities that transact power in Washington but are not suppliers, and benefits of comprehensive GHG emissions data collection related to electricity transactions in the state if that data is not being collected under the baseline.

Definitions do not, in and of themselves, have impact beyond how the defined terms are used in the rule. Where definitions inform the coverage, scope, or type(s) of impacts under the proposed rule amendments, associated costs and benefits associated with those sections of the rule below include the relevant baseline and proposed definitions.

2.3.2 Changing annual report submission requirements (chapter 173-441 WAC): The proposed rule amendments would require each EPE to submit a single annual report by June 1 of each year.

This proposed amendment would reduce reporting costs for EPEs by not requiring a preliminary report by March 31 of each year. Ecology believes that a single annual report is sufficient to provide necessary GHG emissions reporting data to meet program needs. This would also be consistent with similar requirements for EPE reporting in other jurisdictions.

2.3.3 Adding, removing, or changing definitions specific to EPE reporting requirements (chapter 173-441 WAC): The proposed rule amendments would add, remove, or change various definitions specific to EPEs:

| |

| • | The proposed amendments would add definitions of: |

| |

| o | "Centralized electricity market" (CEM) |

| o | "Deemed market importer" |

| o | "Market operator" |

| o | "Market participant" |

| o | "Markets+" |

| o | "Surplus electricity" |

| |

| • | The proposed amendments would remove definitions of: |

| |

| o | "First jurisdictional deliverer" (FJD). |

| o | "Generation providing entity" (GPE). |

| |

| • | The proposed amendments would amend definitions of: |

| |

| o | "Direct delivery of electricity" |

| o | "Electricity importer" |

| o | "Electricity transaction" |

| o | "Exported electricity" |

| o | "Imported electricity" |

| o | "Power contract" |

| o | "Specified source" |

Definitions do not, in and of themselves, have impact beyond how the defined terms are used in the rule. Where definitions inform the coverage, scope, or type(s) of impacts under the proposed rule amendments, associated costs and benefits associated with those sections of the rule below include the relevant baseline and proposed definitions.

2.3.4 Expanding data requirements and calculation methods from the EIM to all CEMs (chapter 173-441 WAC): The proposed rule amendments would replace the EIM with CEMs.

This proposed rule amendment would result in expansion of the types of CEMs the GHG reporting rule applies to. This would, in turn, contribute to costs associated with reporting emissions from electricity from these markets, as well as benefits of supporting centralized market functions, efficiencies, and use in Washington.

2.3.5 Specifying how EPEs must report imported CEM electricity (chapter 173-441 WAC): The proposed rule amendments would:

| |

| • | Require reporting entities to report electricity from CEMs: |

| |

| o | For the EIM, for 2023-2026, retail providers receiving electricity facilitated through the EIM are the electricity importers. If the market operator identifies deemed market importers that offer energy attributed to Washington before 2026, those are the deemed market importers beginning in the following year. |

| o | Each deemed market importer must separately report electricity assigned, designated, deemed, or attributed to Washington by an originating CEM. |

| o | Each deemed market importer must annually calculate, report, and verify GHG emissions for the electricity they offered that was designated, deemed, or attributed to Washington. |

| |

| • | Add a requirement that for electricity dispatched by a CEM, EPEs must report specified electricity sales attributed to market participants outside Washington or exported from the market to entities outside Washington, for unspecified and specified sources disaggregated by the recipient. |

| • | Add a requirement that retail providers must report net purchases from CEMs based on annual total purchases from each separate market. |

| • | In the baseline specification that reporting includes retail sales from the EIM, replace the EIM with each CEM. |

| • | In the application and maintenance requirements for asset-controlling suppliers, replace first jurisdictional deliverers with deemed market importers. |

This proposed rule amendment would contribute to overall reporting costs, as well as costs associated with designation of importers and attribution of electricity. It would also contribute to benefits of:

| |

| • | Accurate identification of electricity imports from centralized markets and who is importing that power. |

| • | Participation and development of CEMs. |

| • | Data collection supporting the state's statutory goals related to GHG emissions tracking, planning, and reductions. |

Based specifically on proposed rule language related to regulatory timing and transition, Washington energy imbalance market (EIM) importers would not be considered deemed market importers for reporting years 2023-2026. Since only deemed market importers would be required to report emissions associated with specified power CEM imports, this means these reporting costs and benefits would not occur until the 2027 reporting year. Similarly, these costs and benefits would not occur for imports from future CEMs such as extended day ahead market (EDAM) and Markets+ until they launch operations (currently expected in May 2026 and in 2027, respectively). We therefore assume reporting costs and benefits would not occur until reporting year 2027.

2.3.6 Expanding documentation requirements (chapter 173-441 WAC): The proposed rule amendments would add documentation requirements for any other reports provided by the market operator to the EPE documenting electricity attributed to Washington for which that EPE is the deemed market importer.

This proposed rule amendment would result in minor costs of retaining additional documents, as well as benefits of maintaining verifiable records underlying GHG emissions reporting.

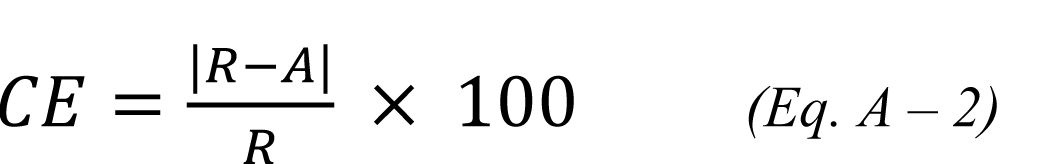

2.3.7 Specifying GHG emissions equations and applicability (chapter 173-441 WAC): The proposed rule amendments would remove reference to WAC 173-444-040(4), and replace it with a numerically equivalent equation in which emissions are the product of the number of MWh, an unspecified emissions factor, and a transmission loss multiplier. The unspecified emissions factor would be 0.428 MT CO2e/MWh, and the transmission loss multiplier would be 1.02. The simplified equation would therefore be MWh multiplied by 0.437, equivalent to the baseline equation.

The proposed rule would also specify that the equation for specified electricity emissions also applies to specified electricity deemed, designated, assigned, or attributed by a CEM.

We do not expect this proposed rule amendment to result in costs or benefits, beyond clarity in which equation must be used facilitating compliance. This is because the newly proposed equation is numerically equivalent to the baseline equation in chapter 173-444 WAC.

2.3.8 Amending requirements for registration of import or export sources (chapter 173-441 WAC): Under the proposed rule amendments, deemed market importers would be included in the types of specified facilities or units required to register their anticipated specified sources, by a registration deadline of February 1st of each year.

The amendments would also add required information to be provided for registration, and specify that EPEs must be able to demonstrate that the market operator designated, assigned, deemed, or attributed the energy from those sources to Washington.

Finally, the amended rule would require EPEs to provide settlement records or other documentation requested by ecology by May 1st of each year.

These proposed rule amendments are likely to result in additional or expanded reporting costs. They would also contribute to benefits of:

| |

| o | Accurate identification of electricity imports from centralized markets and who is importing that power. |

| o | Participation and development of CEMs. |

| o | Data collection supporting the state's statutory goals related to GHG emissions tracking, planning, and reductions. |

2.3.9 Making changes without material impacts (chapter 173-441 WAC): The proposed rule amendments would clarify that point of receipt and point of delivery reports must use an e-tag code only where applicable. They would also delete the requirement to report when unspecified power came from the EIM.

These proposed amendments are not likely to result in costs or benefits as compared to the baseline, beyond clarity. Since e-tag codes are not applicable to all power transactions, the clarification that they must be used only when applicable would reduce confusion for covered entities. Under the collective proposed rule amendments, the requirement to report unspecified power from the EIM would become obsolete, and so its removal would not have material impact given the other proposed amendments would collect necessary information about specified imports from CEMs.

2.3.10 Adding definitions consistent with the GHG reporting rule (chapter 173-446 WAC): This proposed rule amendment would add definitions to the CCA rule, to make it consistent with proposed amendments to the GHG reporting rule. It would define the following by explicit reference to the reporting rule:

| |

| • | CEM. |

| • | Deemed market importer. |

These proposed amendments would facilitate consistency between terms in the CCA rule and GHG reporting rule. Definitions do not, in and of themselves, have impact beyond how the defined terms are used in the rule. Where definitions inform the coverage, scope, or type(s) of impacts under the proposed rule amendments, costs and benefits associated with those sections of the rule below include the relevant baseline and proposed definitions.

2.3.11 Amending covered emissions to reflect electricity imported from CEMs (chapter 173-446 WAC): Compliance obligations: The baseline CCA rule defines emissions that are covered under the cap-and-invest program, beginning with reported emissions under the GHG reporting rule, and modifying those reported emissions to only those that are not exempt and are covered by the program. This includes allotment provisions to avoid double-counting emissions or counting emissions the rule does not apply to.

As part of those provisions, the CCA rule specifically states that it, "provides details on allotment for covered emissions that are potentially attributable to multiple parties and provides direction for allotment when such emissions may be reported by multiple facilities, suppliers, or first jurisdictional deliverers of electricity." It also notes that it only describes the process for determining which covered or opt-in entity is responsible for a given metric ton of covered emissions after exemptions are accounted for, and does not expand the definition of covered emissions itself.

The subsection relevant to this rule making defines the allotment of covered emissions for first jurisdictional deliverers of imported electricity:

| |

| • | Emissions from imported electricity are covered for the first jurisdictional deliverer that is importing electricity. |

| • | If the importer is a federal power marketing administration that is not voluntarily complying with the cap-and-invest program, the importer is the next purchaser-seller on the e-tag. Otherwise, the utility receiving the electricity is the importer. |

| • | If the importer is a federal power marketing administrations that is voluntarily participating in the cap-and-invest program, then the utilities buying from it may provide (by agreement) that the federal power marketing administration is assuming the compliance obligation for emissions from the imported electricity. |

| • | For the first compliance period (2023-2026), the importer for electricity from the EIM is the purchaser in Washington that receives it. If the first jurisdictional deliverer generates and has a compliance obligation for the electricity that is transferred through the EIM, and that electricity is then delivered into Washington, there is no second compliance obligation for it. |

The baseline CCA rule also specifies that ecology may adjust covered emissions based on new reported information, new assigned emissions levels, or to compensate for changes in methodology.

Allocation of no-cost allowances: In section 230, the baseline CCA rule also defines how no-cost allowances are distributed to electric utilities under the cap-and-invest program. Allowances are a form of compliance instrument that can be used to satisfy compliance obligations for GHG emissions. Utilities subject to the Washington Clean Energy Transformation Act (CETA; chapter

19.405 RCW) are eligible to receive no-cost allowances to use for compliance, monetize by consigning them to the allowance market, or bank for future use. By allocating no-cost allowances to electric utilities, the CCA program helps them mitigate the impacts of the following on retail electricity prices and ratepayers:

| |

| • | Utility compliance obligations. |

| • | Increased wholesale electricity prices passed on to utilities by generators, marketers, or importers that have compliance obligations. |

Allocations are based on the "cost burden effect." This effect is calculated by multiplying the electricity load from each type of source by the emissions factor for that source, and then adding up those emissions across all types of sources.

The CCA rule states that initial allocations will be adjusted as necessary to account for the difference between applicable reported emissions for prior years and the number of no-cost allowances allocated. Allocations may also be adjusted based on updated forecasts.

Proposed: The proposed rule amendments include the following changes to the baseline covered emissions discussed above, to allocate covered emissions (and resulting compliance obligations) for electricity imported from CEMs:

| |

| • | Importers are identified using the GHG reporting rule. |

| • | If the importer is a federal power marketing administration, it may voluntarily comply for either all sales into Washington or for attributions to Washington in a CEM for which it is a deemed market importer. In this case, the federal power marketing administration takes on the associated compliance obligation. |

| • | Requirements related to EIM power during the first compliance period are deleted. |

| • | The compliance obligation is only determined once for electricity from an electric generating facility in Washington that is sold into a CEM, and is then assigned, designated, deemed, or attributed back into Washington by that market. |

These proposed amendments, in combination with proposed amendments to the GHG reporting rule, would establish compliance obligations for emissions associated with specified sources of electricity imported through CEMs. Ecology would assign these obligations to those entities identified as CEM importers, distributing compliance obligations in line with actual importing behavior of each EPE. This would result in compliance costs for those entities facing new compliance obligations associated with CEM imports.

Since new information also influences the cost burden effect that ecology uses to allocate no-cost allowances to electric utilities, we also expect these proposed amendments to result in additional allocation of no-cost allowances to match the aggregate increase in compliance obligations. Additional no-cost allowances would be a benefit to those receiving them, as they can choose to:

| |

| • | Use (retire) the allowances to meet compliance obligations. |

| • | Consign the allowances to the allowance market, to receive money for them based on the market's settlement price. This allows utilities to offset compliance costs incurred by importers further up their electricity supply chain. |

| • | Bank the allowances for future use, including potential retirement or consignment in future years. |

Whereas we expect these costs and benefits to be the same in the aggregate over time, it is possible for there to be transitional periods during which they are not. This is because of current uncertainty about the process that will be used to update forecasts and adjust no-cost allowance allocations. Depending on how no-cost allowance adjustments are made and how they occur over time as new information becomes available, there may be periods during which there are differences between the numbers of new compliance obligations and new no-cost allowances. Each of these circumstances has its own net costs and benefits, depending on whether new demand for allowances (from compliance obligations) is less than or greater than new supply (from no-cost allowance allocations).

Based specifically on proposed rule language related to regulatory timing and transition, EIM importers would not be considered deemed market importers for reporting years 2023-2026. Since only deemed market importers would be required to report emissions associated with specified power CEM imports, this means the above costs and benefits associated with new compliance obligations and new no-cost allowance allocations would not occur until the 2027 reporting year. Similarly, these costs and benefits would not occur for imports from future CEMs such as EDAM and Markets+ until after they launch operations (currently expected in May 2026 and in 2027, respectively). We therefore assume these costs and benefits would not occur until reporting year 2027.

COSTS OF COMPLIANCE: EQUIPMENT, SUPPLIES, PROFESSIONAL SERVICES:Compliance with the proposed rule, compared to the baseline, is not likely to impose additional costs of equipment, supplies, or professional services.

COSTS OF COMPLIANCE: LABOR, ADMINISTRATIVE, AND OTHER: 3.2.1.2 Electricity importer compliance: To estimate the costs electricity importers would face under the proposed rule, as compared to the baseline, we considered the number of current and potential future importers. We then applied a range of estimated costs to different types of importers, based on whether they currently report EIM imports, currently report emissions (as they emit more than the reporting threshold of 10,000 MT CO2e), or don't currently report (emit below the threshold).

Total estimated annual costs ranged from $14,124 to $26,786, depending on the number of CEM energy importers reporting in a given year, and whether it is their first year of reporting imports from CEMs. When considering flows of costs over time, ecology calculates the present value of costs. A present value discounts future dollar values into current dollars, accounting for both inflation and the opportunity cost of having funds later instead of now. We estimated the 20-year present value cost of additional reporting effort as approximately $368,000 over 20 years. This is equivalent to an average annual present value cost of $17,527 over the next 20 years.

3.2.2 Costs: New obligations and allocations: To estimate costs associated with new compliance obligations established and assigned under the proposed rule amendments, we considered current imports, potential growth trajectories over time, and potential allowance price profiles.

Multiplying allowance prices by the range of estimated GHG emissions associated with electricity imports from CEMs, we estimated total annual costs (aggregated across all CEM importers) of between $7 million and $119 million. Total costs increase as a larger proportion of GHG emissions is assumed to come from CEM imports, and fall as the decrease in total GHG emissions outweighs CEM import growth.

When considering flows of costs over time, ecology calculates the present value of costs. A present value discounts future dollar values into current dollars, accounting for both inflation and the opportunity cost of having funds later instead of now. We estimated the 20-year present value cost of new compliance obligations as between $497 million and $1.2 billion over 20 years, with the first year of costs occurring in 2027.

COST-SAVINGS:4.2.2 Benefits: New obligations and allocations

CEM import data and associated GHG emissions identified under the proposed rule amendments would impact compliance obligations under the CCA program (see Section 3.2.2) but would also impact the allocation of no-cost allowances to CETA-covered retail utilities. These allocations are intended to mitigate the costs of CCA compliance obligations, whether their costs are incurred directly (by utilities) or indirectly and passed on in wholesale prices (by a generator or marketer that sells to a utility).

New data gathered under the proposed rule amendments would influence the cost burden effect that ecology uses to allocate no-cost allowances. As a result, we expect the proposed amendments to result in additional allocation of no-cost allowances to match the aggregate increase in compliance obligations. Additional no-cost allowances would be a benefit to those receiving them, as they can choose to:

| |

| • | Use (retire) the allowances to meet compliance obligations. |

| • | Consign the allowances to the allowance market, to receive payment for them based on the market's settlement price. This allows utilities to offset compliance costs incurred by importers further up their electricity supply chain. |

| • | Bank the allowances for future use, including potential retirement or consignment in future years. |

4.2.2.1 Value of additional no-cost allowances: Corresponding to our assumptions and estimated new compliance obligations in Section 3.2.2, we estimated annual increases in the allocation of no-cost allowances based on the cost burden effect equation (see Section 2.3.11 for detailed discussion of no-cost allowance allocation). Conceptually, these values are equal, and compliance obligations are offset by no-cost allowance allocations in the aggregate - this way, GHG emissions are accounted for in the CCA program while mitigating potential impacts to electricity ratepayers.

Multiplying allowance prices by the range of estimated new no-cost allowances allocated under the proposed rule, we estimated the total value of this benefit as between $7 million and $119 million in a given year over the next 20 years.

When considering flows of benefits over time, ecology calculates the present value of benefits. A present value discounts future dollar values into current dollars, accounting for both inflation and the opportunity cost of having funds later instead of now. We estimated the 20-year present value benefit of new no-cost allowance allocations as between $497 million and $1.2 billion over 20 years.

4.2.3 Benefits: Centralized electricity market function: It is not clear to what degree or how efficiently CEMs would be able to operate in Washington under the baseline. This is because of complex and uncertain factors such as baseline CCA law's requirements for covered emissions (including those from imported electricity, though ecology is tasked with adopting a rule that specifies the process for their inclusion), the lack of a specified mechanism to identify deemed market importers, and potential difficulties EPEs that participate in CEMs could have in demonstrating compliance with the law. This could create enforcement challenges and undermine the effectiveness of regulatory oversight and ecology's ability ensure the state meets statutory GHG emissions reduction goals.

Market operators may also:

| |

| • | Incur higher transaction costs under the baseline, due to a need for additional risk management measures. These costs could then be passed on to consumers through higher electricity prices, without mitigation such as no-cost allowance allocations to utilities. |

| • | Encounter difficulties ensuring fair competition or preventing electricity market manipulation, due to a lack of clear guidance. This could reduce CEM efficiency and raise costs. |

| • | Be reluctant to invest in infrastructure upgrades or new technologies, which could create gaps in market coverage. Where coverage is possible, it could still be inefficient, and carry risks of grid instability, congestion, or failure due to lacking infrastructure. |

As a result, the proposed specifications of CEM importer identification and compliance obligation responsibility support EPEs and consumers receiving the benefits of CEMs operating in Washington. These include:

| |

| • | Cost-efficiency and cost-savings. For example, CEM participants were estimated to receive various benefits of cost savings: |

| |

| o | During the 4th quarter of 2023, EIM participants attained nearly $400 million in cost-savings. |

| o | 2022 modeling of benefits of the EDAM estimated that the West could save over $500 million per year in operating costs and similar annual savings from avoiding additional capacity investments. Separate 2023 modeling estimated cost savings for five specific participants of nearly $500 million annually. |

| |

| • | Improved availability and integration of renewable resources, and feasibility of efficiently meeting statutory GHG reduction goals. |

| • | Improved grid reliability and matching of generating resources and demand. |

| • | Reduced renewable resource curtailment when supply exceeds local demand. |

| • | Improved allocation of emissions-generating resources that are more efficient. |

COMPARISON OF COMPLIANCE COST FOR SMALL VERSUS LARGE BUSINESSES:We calculated the estimated per-business costs to comply with the proposed rule amendments, based on the costs estimated in Chapter 3 of the Preliminary Regulator Analyses. In this section, we estimate compliance costs per employee.

The average affected small business likely to be covered by the proposed rule amendments employs about 12 people. The largest 10 percent of affected businesses employ an average of 900 people. Many of the entities potentially impacted by the proposed rule are also governments, and are excluded from this analysis. Based on cost estimates in Chapter 3, we estimated compliance costs per employee. As discussed in Chapters 3 and 4, there is uncertainty about how costs and cost-savings will be distributed. In some cases, the businesses that incur costs will also receive cost-savings (e.g., a utility participating in a CEM), but in other cases they may be separate businesses. To capture various possibilities, we estimated the following average compliance costs per business in the first year the proposed rule amendments are likely to result in costs.

Table 1. Costs per business

Cost Estimate Type | Cost | Cost-Savings | Net Cost |

Low estimate | $321,929 | ($320,955) | $974 |

High estimate | $926,079 | ($925,105) | $974 |

Then, based on costs per business and business size (small or large), we calculated costs per employee, as summarized in the tables below.

Table 2. Costs per employee, net costs

Business size | Cost per employee |

Small | $42 |

Largest | $1 |

Table 3. Cost per employee, gross costs

Business size | Low cost per employee | High cost per employee |

Small | $13,779 | $39,638 |

Largest | $358 | $1,029 |

Table 4. Cost per employee, cost-savings

Business size | Low benefit per employee | High benefit per employee |

Small | ($13,737) | ($39,596) |

Largest | ($357) | ($1,028) |

We conclude that the proposed rule amendments are likely to have disproportionate impacts on small businesses, with regard to compliance costs, but may disproportionately benefit small businesses that receive a benefit of cost-savings. As we cannot confidently identify cases in which businesses will see only costs, only cost-savings, or both, ecology has conservatively included elements in the proposed rule amendments to mitigate this disproportion as far as is legal and feasible.

MITIGATION OF DISPROPORTIONATE IMPACT:The RFA (RCW

19.85.030(2)) states that:

"Based upon the extent of disproportionate impact on small business identified in the statement prepared under RCW

19.85.040, the agency shall, where legal and feasible in meeting the stated objectives of the statutes upon which the rule is based, reduce the costs imposed by the rule on small businesses. The agency must consider, without limitation, each of the following methods of reducing the impact of the proposed rule on small businesses:

(a) Reducing, modifying, or eliminating substantive regulatory requirements;

(b) Simplifying, reducing, or eliminating recordkeeping and reporting requirements;

(c) Reducing the frequency of inspections;

(d) Delaying compliance timetables;

(e) Reducing or modifying fine schedules for noncompliance; or

(f) Any other mitigation techniques including those suggested by small businesses or small business advocates."

We considered all of the above options, the goals and objectives of the authorizing statutes (see Chapter 6), and the scope of this rule making. We limited compliance cost-reduction methods to those that:

| |

| • | Are legal and feasible. |

| • | Meet the goals and objectives of the authorizing statute. |

| • | Are within the scope of this rule making. |

Substantive regulatory requirements: The authorizing statutes do not allow ecology to reduce, modify, or eliminate substantive regulatory requirements for any covered entities under the reporting rule or CCA rule. The areas of the rule reflecting these statutory requirements are captured in the scope of the rules, and include program coverage, compliance timetables or support of consistency with potentially linked jurisdictions, and penalties. Ecology does not have discretion in these substantive regulatory requirements.

The baseline rule and proposed amendments also allow for a federal power marketing administration to take on compliance obligations in place of small entities that purchase imported electricity from them.

Recordkeeping and reporting requirements: Recordkeeping and reporting requirements in the baseline rule and in the proposed rule amendments rely largely on maintaining consistency with other programs, using known operations data and information, and using standardized common calculations. Ecology developed the proposed amendments to reporting requirements to provide information necessary for the data's use in the CCA program, and at the same time to be feasible for importers and CEM processes, based on interested party input.

Inspections: This rule making does not address inspections, and inspections are not required under the baseline rules.

Compliance timetables: Compliance deadlines are specified in the authorizing statutes. Ecology cannot use its discretion to change these deadlines. We note also that the proposed amendments would remove some of the phased-in compliance timelines that were included in the baseline rules when they were first adopted but are no longer necessary. As part of the 2022 rule making amending the reporting rule, ecology received information that EPEs (many of which are small) desired later deadlines for the new program. While the statute specifies the reporting deadline, the rule amendments adopted at that time allowed EPEs to submit a provisional report by that deadline, followed by a final report two months later as proposed by interested parties. After gaining experience with the reporting program, reporters are more likely to be able to meet the statutory deadline, and may save costs of developing and submitting separate preliminary reports.

Penalties and noncompliance: The statute specifies many elements related to noncompliance, and could not be changed.

Other reductions of burden: Ecology also considered multiple alternative requirements during development of the proposed rule. These were found to either impose more burden on covered parties, or to not meet the goals and objectives of the authorizing statutes. See Chapter 6 for discussion of these alternatives.

SMALL BUSINESS AND LOCAL GOVERNMENT CONSULTATION: We involved small businesses and local governments in its development of the proposed rule amendments, using the following methods. Recipients and attendees include members of the public, local governments, small businesses, and business associations.

| |

| • | Emails sent to meet requirements one day prior to meetings as a reminder. |

| • | Rule development meeting reminders via GovDelivery to all rule-making subscribers. |

| • | Informational session #1 - July 25, 2023. |

| • | Informational session #2 - August 2, 2023. |

| • | Draft language input review meeting #1 - August 12, 2023. |

| • | Draft language input review meeting #2 - August 16, 2023. |

| • | Listening session - August 18, 2023. |

| • | Individual meetings (by request) with: |

| |

| o | BPA - August 31, 2023. |

| o | Western Power Trading Forum - September 6, 2023. |

| o | Public Generating Pool - September 11, 2023. |

| |

| • | Informational meeting with CAISO - September 12, 2023. |

| • | Informational meeting with Southwest Power Pool - September 28, 2023. |

| • | First informal comment period - July 25 to August 25, 2023. |

| • | Second informal comment period - October 5 to October 30, 2023. |

| • | Third informal comment period - November 8 to November 27, 2023. |

| • | Draft language input review meeting #3 - January 24, 2024. |

| • | Individual meetings (by request) with: |

| |

| o | CARB - March 25, 2024. |

| o | CARB & CAISO - April 10, 2024. |

CARB - May 3, 2024, Attendees variously included local and state government:

| |

| • | City of Issaquah. |

| • | City of Shoreline. |

| • | City of Tacoma. |

| • | Office of the attorney general. |

| • | Puget Sound Clean Air Agency. |

| • | Spokane Regional Clean Air Agency. |

| • | Washington department of commerce. |

| • | Washington department of health. |

| • | Washington public ports association. |

| • | Washington department of transportation. |

| • | Washington parks and recreation commission. |

| • | Washington state parks and recreation commission. |

| • | Washington utilities and transportation commission. |

NAICS CODES OF INDUSTRIES IMPACTED BY THE PROPOSED RULE:The proposed rule amendments likely impact the following industries, with associated NAICS codes. NAICS definitions and industry hierarchies are discussed at https://www.census.gov/naics/.

| |

| • | 221122 Electric power distribution |

| • | 221118 Other electric power generation |

CONSIDERATION OF LOST SALES OR REVENUE, IMPACT ON JOBS:Businesses that would incur costs could experience reduced sales or revenues if the proposed rule amendments significantly affect the prices of the goods they sell. The degree to which this could happen is strongly related to each business's production and pricing model (whether additional lump-sum costs would significantly affect marginal costs), as well as the specific attributes of the markets in which they sell goods, including the degree of influence each firm has on market prices, as well as the relative responsiveness of market demand to price changes. Finally, overall shifts in economic activity in the state, including competition within markets and attributes of the labor market simultaneously adjust in response to changes in compliance costs.

Similarly, employment within directly impacted industries, other industries in Washington, the labor market within and outside of the state, and in the state as a whole will also adjust in response to a change in costs.

We used the REMI E3+ model for Washington state to estimate the impact of the proposed rule amendments on directly affected markets, accounting for dynamic adjustments throughout the economy. The model accounts for variables including but not limited to:

| |

| • | Inter-industry impacts. |

| • | Price changes, including wages. |

| • | Interstate and international trade. |

| • | Population or labor market changes. |

| • | Dynamic adjustment of all economic variables over time. |

Because the REMI model aggregates homogeneous sectors, all estimated costs and cost-savings under the proposed rule amendments would occur within the same industry grouping: Electric power generation, transmission, and distribution. This means the costs of new compliance obligations and the benefits of new no-cost allowance allocations net out to zero impact. This leaves estimated reporting costs as the net inputs into the model.

Estimated additional reporting costs under the proposed rule amendments are relatively small compared to the electricity sector and state economy as a whole. As a result, the model simulations did not identify any impacts to statewide employment or output. They also did not identify any impacts to employment or output at the industry grouping level.

While we did not identify any employment or output impacts of the proposed rule as a whole, there may be distributional impacts within the electricity sector in Washington. As discussed in Chapters 3 and 4, there is considerable uncertainty about how costs and cost-savings (benefits) would be distributed across electricity importers participating in CEMs and electric utilities. Traditionally, competitive businesses with higher net operating costs would face downward pressure on output and their use of labor.

Electricity importers may also face different incentives and limitations (e.g., obligations to meet demand, government or nonprofit structures, limited local competition or geographic monopolies, regulations governing electricity rates, or variable timing of available generating resources). Where ability to respond with changes to employment or output (positive or negative) are limited, impacts may instead manifest as changes to planned infrastructure investments or timing.

A copy of the statement may be obtained by contacting TTY at 877-833-6341, Washington relay service at 711. To request ADA accommodation for disabilities, or printed materials in a format for the visually impaired, call ecology at 360-407-7668 or visit https://ecology.wa.gov/accessibility.

June 27, 2024

Heather R. Bartlett

Deputy Director

OTS-5373.2

AMENDATORY SECTION(Amending WSR 22-05-050, filed 2/9/22, effective 3/12/22)

WAC 173-441-020Definitions.

The definitions in this section apply throughout this chapter unless the context clearly requires otherwise.

(1) Definitions specific to this chapter:

(a) "40 C.F.R. Part 98" or "40 C.F.R. § 98" means the United States Environmental Protection Agency's Mandatory Greenhouse Gas Reporting regulation including any applicable subparts. All references are adopted by reference as if it was copied into this rule. References mentioned in this rule are adopted as they exist on February 9, 2022, or the adoption date in WAC 173-400-025(1), whichever is later.

(b) "Asset controlling supplier" or "ACS" means any entity that owns or operates interconnected electricity generating facilities or serves as an exclusive marketer for these facilities even though it does not own them, and has been designated by the department and received a department-published emissions factor for the wholesale electricity procured from its system. Electricity from an asset controlling supplier is considered a specified source of electricity.

(c) "Biomass" means nonfossilized and biodegradable organic material originating from plants, animals, or microorganisms, including products, by-products, residues and waste from agriculture, forestry, and related industries as well as the nonfossilized and biodegradable organic fractions of industrial and municipal wastes, including gases and liquids recovered from the decomposition of nonfossilized and biodegradable organic material.

(d) "Carbon dioxide equivalent" or "CO2e" means a metric measure used to compare the emissions from various greenhouse gases based upon their global warming potential.

(e) "Director" means the director of the department of ecology.

(f) "Ecology" means the Washington state department of ecology.

(g) "Electric power entity" includes any of the following that supply or transact electric power in Washington: (i) Electricity importers and exporters; (ii) retail providers, including multijurisdictional retail providers; and (iii) the asset controlling suppliers. See WAC 173-441-124 for more detail.

(h) "Facility" unless otherwise specified in WAC 173-441-122, 173-441-124, or any subpart of 40 C.F.R. Part 98 as adopted in WAC 173-441-120, means any physical property, plant, building, structure, source, or stationary equipment located on one or more contiguous or adjacent properties in actual physical contact or separated solely by a public roadway or other public right of way and under common ownership or common control, that emits or may emit any greenhouse gas. Operators of military installations may classify such installations as more than a single facility based on distinct and independent functional groupings within contiguous military properties.

(i) "Fuel products" means petroleum products, biomass-derived fuels, coal-based liquid fuels, natural gas, biogas, and liquid petroleum gas as established in 40 C.F.R. Part 98 Subparts LL through NN. Renewable or biogenic versions of fuel products listed in Tables MM-1 or NN-1 of 40 C.F.R. Part 98 are also considered fuel products. Assume complete combustion or oxidation of fuel products when calculating GHG emissions.

(j) "Fuel supplier" means any of the following suppliers of fuel products: (See WAC 173-441-122 for more detail.)

(i) A supplier of fossil fuel other than natural gas, including:

(A) A supplier of petroleum products;

(B) A supplier of liquid petroleum gas;

(C) A supplier of coal-based liquid fuels.

(ii) A supplier of biomass-derived fuels;

(iii) A supplier of natural gas, including:

(A) Operators of interstate and intrastate pipelines;

(B) Suppliers of liquefied or compressed natural gas;

(C) Natural gas liquid fractionators;

(D) Local distribution companies.

(k) "Greenhouse gas," "greenhouse gases," "GHG," and "GHGs" includes carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, and sulfur hexafluoride. Beginning on January 1, 2012, "greenhouse gas" also includes any other gas or gases designated by ecology by rule in Table A-1 in WAC 173-441-040.

(l) "Operator" means any individual or organization who operates or supervises a facility, supplier, or electric power entity. The operator of an electric power entity may be the electric power entity itself.

(m) "Owner" means any individual or organization who has legal or equitable title to, has a leasehold interest in, or control of a facility, supplier, or electric power entity, except an individual or organization whose legal or equitable title to or leasehold interest in the facility, supplier, or electric power entity arises solely because the person is a limited partner in a partnership that has legal or equitable title to, has a leasehold interest in, or control of the facility, supplier, or electric power entity shall not be considered an "owner" of the facility, supplier, or electric power entity.

(n) "Person" includes the owner or operator of:

(i) A facility;

(ii) A supplier; or

(iii) An electric power entity.

(o) "Product data" means data related to a facility's production that is part of the annual GHG report.

(p) "Reporter" means any of the following subject to this chapter:

(i) A facility;

(ii) A supplier; or

(iii) An electric power entity.

(q) "Supplier" means any person who is a:

(i) Fuel supplier that produces, imports, or delivers, or any combination of producing, importing, or delivering, fuel products in Washington; and

(ii) Supplier of carbon dioxide that produces, imports, or delivers a quantity of carbon dioxide in Washington that, if released, would result in emissions in Washington.

(2) Definitions specific to the Climate Commitment Act program.

For those terms not listed in subsection (1) of this section, WAC 173-441-122(2), or 173-441-124(2), the definitions from chapter

70A.65 RCW, as described in chapters 173-446 and 173-446A WAC apply in this chapter in order of precedence.

(3) Definitions from 40 C.F.R. Part 98. For those terms not listed in subsection (1) or (2) of this section, WAC 173-441-122(2), or 173-441-124(2), the definitions found in 40 C.F.R. § 98.6 or a subpart as adopted in this chapter, apply in this chapter as modified in WAC 173-441-120(2).

AMENDATORY SECTION(Amending WSR 22-05-050, filed 2/9/22, effective 3/12/22)

WAC 173-441-050General monitoring, reporting, recordkeeping and verification requirements.

Persons subject to the requirements of this chapter must submit GHG reports to ecology, as specified in this section. Every metric ton of CO2e emitted by a reporter required to report under this chapter and covered under any applicable source category listed in WAC 173-441-120, 173-441-122, or 173-441-124 must be included in the report.

(1) General. Follow the procedures for emission calculation, monitoring, quality assurance, missing data, recordkeeping, and reporting that are specified in each relevant section of this chapter.

(2) Schedule. The annual GHG report must be submitted as follows:

(a) Report submission due date:

(i) A person required to report or voluntarily reporting GHG emissions under WAC 173-441-030 must submit the report required under this chapter to ecology no later than March 31st of each calendar year for GHG emissions in the previous calendar year. Electric power entities reporting under WAC 173-441-124 must submit a report ((based on best available information by March 31st. Electric power entities reporting under WAC 173-441-124 must submit a final revised report)) by June 1st of each calendar year for GHG emissions in the previous calendar year ((consistent with deadlines for electric power entities in external GHG emissions trading programs)).

(ii) Unless otherwise stated, if the final day of any time period falls on a weekend or a state holiday, the time period shall be extended to the next business day.

(b) Reporting requirements begin:

(i) For an existing reporter that began operation before January 1, 2012, report emissions for calendar year 2012 and each subsequent calendar year.

(ii) For a new reporter that begins operation on or after January 1, 2012, and becomes subject to the rule in the year that it becomes operational, report emissions beginning with the first operating month and ending on December 31st of that year. Each subsequent annual report must cover emissions for the calendar year, beginning on January 1st and ending on December 31st.

(iii) For any reporter that becomes subject to this rule because of a physical or operational change that is made after January 1, 2012, report emissions for the first calendar year in which the change occurs.

(A) Reporters begin reporting with the first month of the change and ending on December 31st of that year. For a reporter that becomes subject to this rule solely because of an increase in hours of operation or level of production, the first month of the change is the month in which the increased hours of operation or level of production, if maintained for the remainder of the year, would cause the reporter to exceed the applicable threshold.

(B) Suppliers and electric power entities begin reporting January 1st and ending on December 31st the year of the change.

(C) For all reporters, each subsequent annual report must cover emissions for the calendar year, beginning on January 1st and ending on December 31st.

(3) Content of the annual report. Each annual GHG report must contain the following information. All reported information is subject to verification by ecology as described in subsection (5) of this section.

(a) Reporter name, reporter ID number, and physical street address of the reporter, including the city, state, and zip code. If the facility does not have a physical street address, then the facility must provide the latitude and longitude representing the geographic centroid or center point of facility operations in decimal degree format. This must be provided in a comma-delimited "latitude, longitude" coordinate pair reported in decimal degrees to at least four digits to the right of the decimal point.

(b) Year and months covered by the report.

(c) Date of submittal.

(d) For facilities, report annual emissions of each GHG (as defined in WAC 173-441-020) and each fluorinated heat transfer fluid, as follows:

(i) Annual emissions (including biogenic CO2) aggregated for all GHGs from all applicable source categories in WAC 173-441-120 and expressed in metric tons of CO2e calculated using Equation A-1 of WAC 173-441-030 (1)(b)(iii).

(ii) Annual emissions of biogenic CO2 aggregated for all applicable source categories in WAC 173-441-120, expressed in metric tons.

(iii) Annual emissions from each applicable source category in WAC 173-441-120, expressed in metric tons of each applicable GHG listed in (d)(iii)(A) through (F) of this subsection.

(A) Biogenic CO2.

(B) CO2 (including biogenic CO2).

(C) CH4.

(D) N2O.

(E) Each fluorinated GHG.

(F) For electronics manufacturing each fluorinated heat transfer fluid that is not also a fluorinated GHG as specified under WAC 173-441-040.

(iv) Emissions and other data for individual units, processes, activities, and operations as specified in the "data reporting requirements" section of each applicable source category referenced in WAC 173-441-120.

(v) Indicate (yes or no) whether reported emissions include emissions from a cogeneration unit located at the facility.

(vi) When applying (d)(i) of this subsection to fluorinated GHGs and fluorinated heat transfer fluids, calculate and report CO2e for only those fluorinated GHGs and fluorinated heat transfer fluids listed in WAC 173-441-040.

(vii) For reporting year 2014 and thereafter, you must enter into verification software specified by the director the data specified in the verification software records provision in each applicable recordkeeping section. For each data element entered into the verification software, if the software produces a warning message for the data value and you elect not to revise the data value, you may provide an explanation in the verification software of why the data value is not being revised. Whenever the use of verification software is required or voluntarily used, the file generated by the verification software must be submitted with the facility's annual GHG report.

(e) For suppliers and electric power entities, report annual emissions of each GHG (as defined in WAC 173-441-020) as follows:

(i) Annual emissions (including biogenic CO2) aggregated for all GHGs from all applicable source categories in WAC 173-441-122 and 173-441-124 and expressed in metric tons of CO2e calculated using Equation A-1 of WAC 173-441-030 (1)(b)(iii).

(ii) Annual emissions of biogenic CO2 aggregated for all applicable source categories in WAC 173-441-122 and 173-441-124, expressed in metric tons.

(iii) Annual emissions from each applicable source category in WAC 173-441-122 and 173-441-124, expressed in metric tons of each applicable GHG listed in subsection (3)(d)(iii)(A) through (E) of this section.

(A) Biogenic CO2.

(B) CO2 (including biogenic CO2).

(C) CH4.

(D) N2O.

(E) Each fluorinated GHG.

(iv) Emissions and other data for individual units, processes, activities, and operations as specified in the "data reporting requirements" section of each applicable source category referenced in WAC 173-441-122 and 173-441-124.

(f) A written explanation, as required under subsection (4) of this section, if you change emission or product data calculation methodologies during the reporting period or since the previous reporting period.

(g) Each data element for which a missing data procedure was used according to the procedures of an applicable subpart referenced in WAC 173-441-120, 173-441-122, or 173-441-124 and the total number of hours in the year that a missing data procedure was used for each data element.

(h) A signed and dated certification statement provided by the designated representative of the owner or operator, according to the requirements of WAC 173-441-060 (5)(a).

(i) NAICS code(s) that apply to the reporter. NAICS codes are subject to approval by ecology.

(i) Primary NAICS code. Report the NAICS code that most accurately describes the reporter's primary product/activity/service. The primary product/activity/service is the principal source of revenue for the reporter. A reporter that has two distinct products/activities/services providing comparable revenue may report a second primary NAICS code.

(ii) Additional NAICS code(s). Report all additional NAICS codes that describe all product(s)/activity(s)/service(s) at the reporter that are not related to the principal source of revenue.

(j) Legal name(s) and physical address(es) of the highest-level United States parent company(s) of the owners (or operators) of the reporter and the percentage of ownership interest for each listed parent company as of December 31st of the year for which data are being reported according to the following instructions.

(i) If the reporter is entirely owned by a single United States company that is not owned by another company, provide that company's legal name and physical address as the United States parent company and report 100 percent ownership.

(ii) If the reporter is entirely owned by a single United States company that is, itself, owned by another company (e.g., it is a division or subsidiary of a higher-level company), provide the legal name and physical address of the highest-level company in the ownership hierarchy as the United States parent company and report 100 percent ownership.

(iii) If the reporter is owned by more than one United States company (e.g., company A owns 40 percent, company B owns 35 percent, and company C owns 25 percent), provide the legal names and physical addresses of all the highest-level companies with an ownership interest as the United States parent companies and report the percent ownership of each company.

(iv) If the reporter is owned by a joint venture or a cooperative, the joint venture or cooperative is its own United States parent company. Provide the legal name and physical address of the joint venture or cooperative as the United States parent company, and report 100 percent ownership by the joint venture or cooperative.

(v) If the reporter is entirely owned by a foreign company, provide the legal name and physical address of the foreign company's highest-level company based in the United States as the United States parent company, and report 100 percent ownership.

(vi) If the reporter is partially owned by a foreign company and partially owned by one or more United States companies, provide the legal name and physical address of the foreign company's highest-level company based in the United States, along with the legal names and physical addresses of the other United States parent companies, and report the percent ownership of each of these companies.

(vii) If the reporter is a federally owned facility, report "U.S. Government" and do not report physical address or percent ownership.

(k) An indication of whether the facility includes one or more plant sites that have been assigned a "plant code" by either the Department of Energy's Energy Information Administration or by the Environmental Protection Agency's (EPA) Clean Air Markets Division.

(l) Facilities must report electricity information including:

(i) Total annual electricity purchased in megawatt hours (MWh), itemized by the supplying utility or, if not obtained from a utility, from the supplying electric power entity for each different source of electricity. Total annual purchases must be reported separately for each supplying utility or electric power entity.

(ii) Self-generated electricity should be itemized separately if a facility includes an electricity generating unit as follows:

(A) Total facility nameplate generating capacity in megawatts (MW).

(B) Generated electricity in MWh provided or sold to each retail provider, electricity marketer, or other reportable end-user that is not a part of the facility, itemized by end-user.

(C) Generated electricity for on-site industrial applications not related to electricity generation in MWh.

(m) Report fuel use or supplied as follows:

(i) Facilities, report each fuel combusted separately by type, quantity, and units of measurement.

(ii) Fuel suppliers, report:

(A) Each fuel supplied separately by type, quantity, and units of measurement; and

(B) Separately report the quantity of each fuel type by purpose if the fuel supplier reports that the fuel is used for one of the purposes described in WAC 173-441-122 (5)(d)(xi).

(n) Facilities, report total annual facility product data, units of production, and specific product based on their first primary NAICS code.

(i) Facilities with a primary NAICS code listed in Table 050-1 of this section must report total annual facility product data as described in Table 050-1. Facilities may additionally report total annual facility product data as described in Table 050-1 for any reported secondary NAICS code. Use six digit NAICS codes when available, otherwise use the shorter NAICS codes listed below substituting the values in the full reported six digit NAICS code for "X".

Table 050-1: Total Annual Facility Product Data Requirements by Primary NAICS Code.

Primary NAICS Code and Sector Definition | Activity | Production Metric |

112112: Cattle Feedlots | Cattle feedlots | Cattle head days |

211130: Natural Gas Extraction | Natural gas extraction | Million standard cubic feet of natural gas extracted |

212399: All Other Nonmetallic Mineral Mining | Freshwater diatomite filter aids manufacturing | Metric tons of mineral product produced |

2211XX: Electric Power Generation, Transmission and Distribution | Electric power generation, transmission and distribution | Net megawatt hours |

221210: Natural Gas Distribution | Natural gas distribution | Million standard cubic feet of natural gas distributed |

221330: Steam and Air-conditioning Supply | Steam supply | Kilograms steam produced |

311213: Malt Manufacturing | Malt manufacturing | Metric tons of malt produced |

3114XX: Fruit and Vegetable Preserving and Specialty Food Manufacturing | Fruit and vegetable preserving and specialty food manufacturing | Metric tons of food product produced |

3115XX: Dairy Product Manufacturing | Dairy product manufacturing | Metric tons of dairy product produced |

311611: Animal (except poultry) Slaughtering | Animal (except poultry) slaughtering | Metric tons of meat product processed |

311613: Rendering and Meat By-product Processing | Rendering and meat by-product processing | Metric tons of meat by-product processed |

311919: Other Snack Food Manufacturing | Other snack food manufacturing | Metric tons of snack food produced |

311920: Coffee and Tea Manufacturing | Coffee and tea manufacturing | Metric tons of coffee and tea produced |

321XXX: Wood Product Manufacturing | Wood product manufacturing | Air dried (10 percent moisture) metric tons of wood product produced |

3221XX: Pulp, Paper, and Paperboard Mills | Pulp, paper, and paperboard mills | Air dried (10 percent moisture) metric tons of produced: • Pulp product; or • Paper; or • Paperboard |

322299: All Other Converted Paper Product Manufacturing | All other converted paper product manufacturing | Air dried (10 percent moisture) metric tons of converted paper product produced |

324110: Petroleum Refineries | Petroleum refineries | Report all of the following: • Facility level Subpart MM report as reported under 40 C.F.R. Part 98; • Barrels of crude oil and intermediate products received from off-site that are processed at the facility; and • Beginning with the first emissions year after a refinery's first turnaround after 2022, the refinery must also submit complexity weighted barrel (CWB) as described in CARB MRR section 95113(l)(3) as adopted by 7/1/2021. CWB supporting data must also be submitted to Ecology as described in CARB MRR section 95113(l)(3). |

324121: Asphalt Paving Mixture and Block Manufacturing | Asphalt paving mixture and block manufacturing | Metric tons of asphalt paving mixture and block produced |

3251XX: Basic Chemical Manufacturing | Basic chemical manufacturing | Metric tons of chemical produced |

325311: Nitrogenous Fertilizer Manufacturing | Nitric acid production | Metric tons of nitric acid produced |

32721X: Glass and Glass Product Manufacturing | Glass and glass product manufacturing | Metric tons of glass produced |

327310: Cement Manufacturing | Cement manufacturing | Metric tons of adjusted clinker and mineral additives produced |

327390: Other Concrete Product Manufacturing | Other concrete product manufacturing | Metric tons of concrete product produced |

327410: Lime Manufacturing | Lime manufacturing | Metric tons of lime produced |

327420: Gypsum Product Manufacturing | Gypsum product manufacturing | Metric tons of gypsum product produced |

331110: Iron and Steel Mills and Ferroalloy Manufacturing | Steel production using an electric arc furnace (EAF) | Metric tons of steel produced |

33131X: Alumina and Aluminum Production and Processing | Alumina and aluminum production and processing | Metric tons of aluminum produced |

331410: Nonferrous Metal (except aluminum) Smelting and Refining | Granular polysilicon production | Metric tons of granular polysilicon produced |

332111: Iron and Steel Forging | Iron forging | Metric tons of iron produced |

334413: Semiconductor and Related Device Manufacturing | Semiconductor and related device manufacturing | Square meters of mask layer produced |

335991: Carbon and Graphite Product Manufacturing | Carbon and graphite product manufacturing | Metric tons of carbon and graphite product produced |

3364XX: Aerospace Product and Parts Manufacturing | Aerospace product and parts manufacturing | • Metric tons of aircraft product and parts produced; or • Square meters of external surface area of aircraft |

486210: Pipeline Transportation of Natural Gas | Pipeline transportation of natural gas | Million standard cubic feet of natural gas transported |

488119: Other Airport Operations | Other airport operations | Passenger kilometers serviced |

562111: Solid Waste Collection | Solid waste collection | Metric tons of total solid waste collected |

562212: Solid Waste Landfill | Solid waste landfill | Metric tons of total waste entered into landfill |

562213: Solid Waste Combustors and Incinerators | Solid waste combustors and incinerators | Net megawatt hours |

611310: Colleges, Universities, and Professional Schools | Colleges, universities, and professional schools | Students serviced |

928110: National Security | Military bases | Troops stationed |

(ii) Facilities without a primary NAICS code listed in Table 050-1 of this section must contact ecology no later than 45 calendar days prior to the emissions report deadline established in subsection (2) of this section and report total annual facility product data as instructed by the department. If ecology does not identify product data for a facility, a facility must use the energy-based calculation method described in Equation 050-1 of this section. Report product data and inputs to the equation. Product data calculated using the energy-based method shall use the following equation:

Product data | = | Sconsumed + Fconsumed - esold | (Eq. 050-1) |

Where: |

| "SConsumed" is the annual amount of steam consumed, measured in MMBtu, at the facility for any process, including heating or cooling applications. This value shall exclude any steam used to produce electricity. This value shall exclude steam produced from an on-site cogeneration unit; |

| "FConsumed" is the annual amount of energy produced due to fuel combustion at the facility, measured in MMBtu. This value shall be calculated based on measured higher heating values or the default higher heating value of the applicable fuel in Table C-1 of 40 C.F.R. Part 98. This value shall include any energy from fuel combusted in an on-site electricity generation or cogeneration unit. This value shall exclude energy to generate the steam accounted for in the "SConsumed" term; |

| "eSold" is the annual amount of electricity sold or provided for off-site use, measured in MWh and converted to MMBtu using the reporting year U.S. Energy Information Administration conversion factor; |

(iii) Facilities with a change in operation that alters either their primary NAICS code, units of production, or product data measurement method must contact ecology no later than 45 calendar days prior to the emissions report deadline established in subsection (2) of this section and report total annual facility product data as instructed by the department. If ecology does not identify product data for a facility, a facility must use the energy-based calculation method described in Equation 050-1 of this section. Report product data and inputs to the equation.