WSR 24-21-143

PROPOSED RULES

POLLUTION LIABILITY

INSURANCE AGENCY

[Filed October 22, 2024, 1:34 p.m.]

Original Notice.

Preproposal statement of inquiry was filed as WSR 17-16-145.

Title of Rule and Other Identifying Information: Chapter 374-90 WAC, Underground storage tank (UST) revolving loan and grant program (program).

Hearing Location(s): On November 25, 2024, at 1:00 - 2:30 p.m., virtual Zoom session; on December 2, 2024, at 6:00 - 7:30 p.m., virtual Zoom session; and on December 4, 2024, at 11:00 a.m. - 12:30 p.m., virtual Zoom session. Please submit written comments to rules@plia.wa.gov. See https://plia.wa.gov/public for more details and links to the Zoom sessions.

Date of Intended Adoption: December 20, 2024.

Submit Written Comments to: Phi V. Ly, P.O. Box 40930, Olympia, WA 98504-0930, email rules@plia.wa.gov, 800-822-3905, beginning November 6, 2024, 8:00 a.m., by December 13, 2024, 5:00 p.m.

Assistance for Persons with Disabilities: Contact Xyzlinda VanEvery, phone 360-407-0515, TTY 711 or 800-833-6388, email rules@plia.wa.gov, by December 13, 2024.

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: This chapter establishes the UST program pursuant to chapter

70A.345 RCW and outlines the program requirements and processes. The purpose of the program is to assist owners or operators of petroleum UST systems to: Remediate past releases; upgrade, replace, or remove petroleum UST systems to prevent future releases; or install new infrastructure or retrofit existing infrastructure for dispensing or using renewable or alternative energy. The program also assists owners and operators of heating oil tanks to remediate past releases or prevent future releases by upgrading, replacing, decommissioning, or removing heating oil tank systems.

Reasons Supporting Proposal: The program will provide owners of petroleum USTs and of properties with petroleum releases or heating oil tanks with the financial means to clean up contamination and replace older fueling and heating infrastructure. The program will help ensure that petroleum releases that are harmful for human health and the environment are cleaned up to state cleanup standards and will allow the property to be safely used or upgraded.

Statute Being Implemented: Chapter

70A.345 RCW, Underground storage tank revolving loan and grant program.

Rule is not necessitated by federal law, federal or state court decision.

Name of Agency Personnel Responsible for Drafting, Implementation, and Enforcement: Phi V. Ly, 500 Columbia Street N.W., #103, Olympia, WA 98501, 360-407-0520.

A school district fiscal impact statement is not required under RCW

28A.305.135.

A cost-benefit analysis is not required under RCW

34.05.328. The proposed rule does not meet the conditions of RCW

34.05.328 (5)(a) that mandate a cost-benefit analysis, and the pollution liability insurance agency (PLIA) is not choosing to voluntarily subject the rule to a cost-benefit analysis.

The proposed rule does impose more-than-minor costs on businesses.

Small Business Economic Impact Statement (SBEIS)

Executive Summary: As of April 2024, there were more than 8,000 operational petroleum USTs across more than 3,000 sites within the state of Washington. While the use of these tanks varies across several different industries, a significant number of them are owned and operated by small businesses, primarily small gas stations which keep their fuel stores in one or more UST. With the proposed implementation of a revolving loan and grant program for UST owners and operators, PLIA needs to determine how these policy changes may impact small businesses.

The authorization for the UST program was signed by the governor in April of 2016. PLIA has been operating the program since then under guidance documents. The program was created to serve the state's aging UST infrastructure. The vast majority of the state's operating USTs are between 20 and 40 years of age, which means they are approaching or at the end of their operational lifespan. As the tanks age, the risk of leakage increases, posing a potential environmental threat. Removing and replacing a UST is expensive, as is spill cleanup. The program provides UST owners and operators with financial aid that can be used to address these issues. Though the program has already been operating for years under interpretive guidance, the proposed rule will formally adopt this program, and provide a framework for both the UST and heating oil tank programs.

To analyze the potential impacts of this proposed rule for an SBEIS, Greene Economics performed an analysis using a database provided by the department of ecology (DOE). The database contains information on all of the USTs in the state, both active and inactive, and dates back to the early 20th century. In addition, the team used data collected by PLIA over the initial years of the program. These data include all loans and grants distributed to both UST and heating oil owners and operators since the program's inception.

The projected compliance cost of this new program was determined to be zero because the program is entirely voluntary. In addition, there are no significant costs associated with the program application process. In fact, the program provides businesses with grant money and loans offered at prime rates that they would not be able to secure elsewhere. PLIA also has a priority ranking scheme that favors small business applicants. Therefore, there are no anticipated disproportionate impacts expected for small businesses under this new rule.

Section 1: Introduction: PLIA proposes a new rule to administer a State UST and heating oil tank program, providing owners and operators of USTs and heating oil tanks financial assistance to remediate past releases; upgrade, replace, or remove petroleum UST systems to prevent future releases; or install new infrastructure or retrofit existing infrastructure for dispensing or using renewable or alternative energy. The proposed rule defines criteria and procedures for a state-run program that was first established as a pilot in 2016 for UST owners and expanded to include heating oil tank owners in 2020. Since the proposed rule has the potential to impose more than minor costs on businesses, an SBEIS is required by law (RCW

19.85.030). This study has been developed to analyze the compliance costs of the proposed rule to small and large businesses to determine whether small businesses will bear a disproportionate share of these costs or experience any economic impacts from participating in the UST program.

Objective of the SBEIS: The objective of the SBEIS, as established in RCW

19.85.040, is to identify and evaluate the various requirements and costs that the rule might impose on businesses. In particular, the purpose is to determine whether a disproportionate impact of the compliance costs is borne by small businesses in the state. The legislative purpose of the Regulatory Fairness Act (chapter

19.85 RCW) is set out in RCW

19.85.011:

"The legislature finds that administrative rules adopted by state agencies can have a disproportionate impact on the state's small businesses because of the size of those businesses. This disproportionate impact reduces competition, innovation, employment, and new employment opportunities, and threatens the very existence of some small businesses. The legislature therefore enacts the Regulatory Fairness Act with the intent of reducing the disproportionate impact of state administrative rules on small business."

The specific purpose of the SBEIS is identified in RCW

19.85.040:

"A small business economic impact statement must include [1] a brief description of the reporting, recordkeeping, and other compliance requirements of the proposed rule, and [2] the kinds of professional services that a small business is likely to need in order to comply with such requirements. [3] It shall analyze the costs of compliance for businesses required to comply with the proposed rule adopted pursuant to RCW 34.05.320, including costs of equipment, supplies, labor, and increased administrative costs. [4] It shall consider, based on input received, whether compliance with the rule will cause businesses to lose sales or revenue. [5] To determine whether the proposed rule will have a disproportionate impact on small businesses, the impact statement must compare the cost of compliance for small business with the cost of compliance for the ten percent of businesses that are the largest businesses required to comply with the proposed rules using one or more of the following as a basis for comparing costs: (a) Cost per employee;

(b) Cost per hour of labor; or

(c) Cost per one hundred dollars of sales.

(2) A small business economic impact statement must also include:

(a) [6] A statement of the steps taken by the agency to reduce the costs of the rule on small businesses as required by RCW 19.85.030(3), or reasonable justification for not doing so, addressing the options listed in RCW 19.85.030(3); (b) [7] A description of how the agency will involve small businesses in the development of the rule;

(c) [8] A list of industries that will be required to comply with the rule. However, this subsection (2)(c) shall not be construed to preclude application of the rule to any business or industry to which it would otherwise apply and;

(d) An estimate of the number of jobs that will be created or lost as the result of compliance with the proposed rule."

For purposes of the SBEIS, the terms "business," "small business," and "industry" are defined by RCW

19.85.020:

(1) "Small business" means any business entity, including a sole proprietorship, corporation, partnership, or other legal entity, that is owned and operated independently from all other businesses, and that has fifty or fewer employees.

(2) "Small business economic impact statement" means a statement meeting the requirements of RCW 19.85.040 prepared by a state agency pursuant to RCW 19.85.030. (3) "Industry" means all of the businesses in this state in any one four-digit standard industrial classification as published by the United States department of commerce, or the North American industry classification system as published by the executive office of the president and the office of management and budget. However, if the use of a four-digit standard industrial classification or North American industry classification system would result in the release of data that would violate state confidentiality laws, "industry" means all businesses in a three-digit standard industrial classification or the North American industry classification system.

Summary of Proposed Rule: PLIA was authorized by the Washington state legislature to establish a UST program in 2016 (chapter

70A.345 RCW). With the state's aging UST infrastructure, this program is meant to provide owners and operators of USTs with financial assistance to remediate contamination, enhance UST systems to prevent future releases, and install new infrastructure for dispensing renewable or alternative energy. Though authorized to establish this program in 2016, PLIA was permitted to implement the UST program through interpretive guidance pending adoption of rules to prevent the delay of critical loan and grant awards (RCW

70A.345.100).

With this memorandum of agreement in place, PLIA has been administering the UST program under interpretive guidance since 2016, with the addition of the heating oil tank loan and grant program in 2020. This new proposed rule will replace the interpretive guidance and allow for the running of this program under an officially adopted rule. The proposed rule mirrors the existing interpretive guidance with a few minor changes.

"PLIA partners with the Washington State Department of Health (DOH) for administration of the financial lending portion of the program. The DOH has existing underwriting capabilities and experience administering loan and grant programs, while PLIA has the technical expertise and project management experience to efficiently and effectively guide cleanups and infrastructure upgrades to prevent future contamination."1

Under the existing guidance and proposed rule, PLIA offers financial assistance for remediating past releases, upgrading, replacing, or removing petroleum UST systems to prevent future releases, and installing new infrastructure or retrofitting existing infrastructure for dispensing renewable or alternative energy. The program also provides financial assistance to heating oil tank owners and operators that need funding to remediate past releases or prevent future releases through upgrades, replacements, and decommissioning; the removal of heating oil tank systems; or the installation of new infrastructure to replace heating oil with another source for heating purposes.

To be eligible for this program, UST owners and operators must maintain compliance with UST requirements at the state or federal level and be registered with DOE or the federal equivalent if seeking financial assistance for an operational UST. For nonoperational UST systems, the site must not be under an agreed order or consent decree. Both UST and heating oil tank owners and operators must also be applying for funds to address issues as listed above to be considered eligible for assistance. A personal credit history report may be required for applicants applying for loan funding.

Application for these programs occurs on a yearly cycle, with dates and applications available on PLIA's website. The application cycle may be suspended if the program receives a large applicant pool that exceeds PLIA's resources. The UST program was so popular in its first few years that PLIA closed the application cycle in 2020 to address the backlog of current program participants from 2017 through 2020.

In most instances, accepted applicants require a preliminary planning assessment (PPA) to determine the magnitude and cost of the proposed project. PLIA provides a PPA grant to cover these costs. It should be noted that the award of this grant does not guarantee further program funding. The grant pays up to $150,000 for the PPA and reduces an applicant's total funding award amount. PLIA's agency-contracted consultants conduct these assessments.

PLIA uses program ranking criteria to determine which projects are prioritized for funding. Projects that involve remediation are of high priority, especially those with significant contamination and that pose an immediate threat to public and environmental health. Other considerations include the age of the tank or tanks in question, insurance and financial need, and environmental justice2 concerns. The heating oil tank loan and grant funding similarly prioritizes applicants seeking remediation for oil spills. The ranking for these projects also considers whether the location of the project is in an area identified as a vulnerable population or overburdened community.

UST program funding is awarded via loan, grant, agency-led remediation, or some combination of these mechanisms with the total not exceeding $2 million (which includes the PPA grant funding).

| |

| • | For a loan, the participant is charged interest (prime rate for the year the applicant applied) for a 30-year term on the outstanding balance applied to project work. |

| • | Agency-led remediation funding can only go towards costs associated with remediation work and is subject to cost recovery. PLIA directly pays the prime consultant from the funding award upon review and approval of invoices. Funds are not dispersed to the participant except in very limited circumstances. |

| • | Grant funding for the entirety of the project is very limited by the program and is only considered when there are exceptional civic benefits by remediating contamination. Such a project site must also be highly ranked and scored based on the criteria outlined in the program guidance. |

Heating oil tank program funding is awarded via loan or grant and cannot exceed $75,000. The grant and loan funds have the same stipulations as those awarded via the UST program.

The new rule includes specific eligible and ineligible costs for the UST and heating oil tank programs. These eligibility requirements are the same as those listed in the current program guidance. The rule also lists scenarios through which PLIA may terminate a project. These scenarios include times when a participant fails to comply with program funding rules, there is a mutual agreement to suspend or terminate the project, funding becomes limited, the participant enters a Model Toxics Control Act "agree order" or "consent decree," or termination is necessary to protect the interests of the state.

History of Revolving Loan and Grant Program: The programs for both USTs and heating oil tanks have already provided financial aid to several entities over the past few years. Though the heating oil tank program was not initiated until 2020, PLIA has conducted PPAs for 25 applicants and has distributed loans to three entities.

The UST program has administered since 2016. In the first four years of its existence, PLIA received 89 applications.3 Due to the large volume of applicants, PLIA has not reopened its application cycle since the 2019-2020 award cycle and has been working on providing financial aid to the backlog of applicants. As highlighted in Table 2 below, PLIA has provided its applicants with over $7 million in PPA grants, $700 thousand in additional grant funding, over $360 thousand in remedial action funding, and over $2 million in loan funding.

Table 1: UST Loan and Grant Funding Totals by Year:

Year | Invoice Total by Fund Source |

| PPA Fund | Grant Fund | Loan Fund | Remedial Action fund |

2017 | $2,513 | | | |

2018 | $3,539,918 | | | |

2019 | $1,092,328 | $30,610 | | |

2020 | $510,181 | $128,943 | $547,171 | |

2021 | $2,005,897 | $89,282 | $868,852 | $162,063 |

2022 | $635,892 | $318,466 | $49,905 | |

2023 | $168,848 | $97,012 | $24,661 | |

2024 | $9,915 | $61,302 | $673,451 | $200,154 |

TOTAL | $7,965,492 | $725,615 | $2,164,040 | $362,217 |

Since the inception of the UST program, PLIA has completed 86 PPAs and distributed program funding to the eight entities listed in Table 3. The grants and loans have ranged from $150 thousand to over $1 million.

| |

| • | The funds granted to the Port of Illahee funded the removal of USTs and cleanup of contamination at a gasoline station and convenience market that historically served the local community. With this grant, the Port of Illahee was able to purchase this property and remodel the building as a community-meeting space. |

| • | Quick Stop#4 applied for a loan to remove and replace five aging USTs (55 years old). Quick Stop#4 is a family owned and operated convenience store and gas station that serves the community of Longview. The loan supported the removal and replacement of the tanks, remedial cleanup efforts, and the installation of EV charging stations. |

| • | Seaview Mobil had a similar story. The gas station and convenience store are family run and have been serving the small community of Seaview since 1980. The loan paid for cleanup and the removal and replacement of their three aging USTs.4 |

Table 2: UST Funding Details:

Entity | Funding Total (excluding PPA) | Years of Project Work |

Bill's Garage | $400,000 | 2021-2023 |

Port of Illahee | $539,500 | 2023-2024 |

Port of Skagit | $165,181 | 2019-2021 |

Quick Stop#4 | $1,377,022 | 2020-2023 |

Seaview Mobil | $727,944 | 2021-2023 |

Smitty's Conoco #190 | $567,645 | 2021 |

Vashon Athletic Club | $1,009,469 | 2020-2024 |

Nordic Properties, Inc. | $159,084 | 2023-2024 |

Industries Required to Comply with New Rule: UST owners and operators can be found in several different industries throughout Washington. The following analysis of Washington state UST operational sites by site type was conducted using an extensive database5 which contains all regulated tanks installed and documented in the state since 1900 and was made available through DOE's website.6 The database includes important information regarding the sites, tanks, and tank compartments. For example, the database lists each site name, region of the state, county, the number of tanks, date of installment, the material stored in each tank, and the material used to construct each tank. The database does not include information about tank conditions, nor the type of business using the tanks.

It should be noted that no industries must comply with this new rule. The program is completely voluntary for UST and heating oil tank owners and operators. Table 6 below is a summation of industries that may participate in the program.

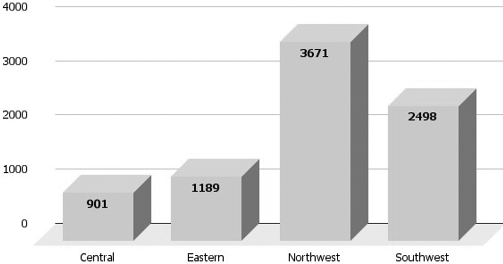

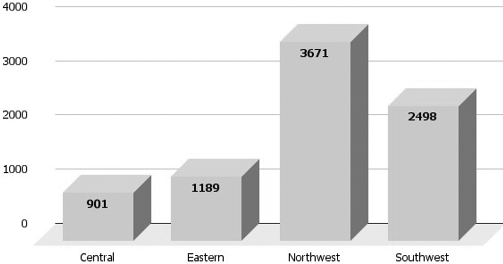

The DOE UST database tells an interesting story about the USTs in the state. For instance, there are more operational tanks in western Washington compared to the eastern and central parts of the state. The northwest region is comprised of only seven counties, but these counties contain over 3,600 USTs. The central region also contains seven counties but houses less than 1,000 USTs. The southwest region (12 counties) and eastern region (13 counties) also contain a similar number of counties, but the southwest region has double the number of USTs. As seen in the graphic below, the northwestern region has the greatest number of USTs with triple the number of operational tanks compared to the central region and the eastern region (see Figure 1).

Figure 1: Total Number of Operational UST by Region in the State

As of April 2024, there are 3,235 sites with at least one tank listed as "Operational." Tanks are given various different statuses, such as "Removed," "Closed In Place," "Closure In Progress," "Temporarily Closed," "Red Tag," and more. As seen in the table below, of the 15,078 total UST systems in the DOE UST database, 8,251 are labeled operational (see Table 4). There is an average of 2.6 operational tanks per site.

Table 3: UST by Status:

UST Status | Number of UST |

Operational | 8,251 |

Change in Service | 14 |

Closed in Place | 427 |

Closure in Process | 73 |

Exempt | 326 |

Red Tag | 26 |

Removed | 5,609 |

Temporarily Closed | 331 |

Unknown | 16 |

Unregister 30-day Notice | 5 |

Of the operational tanks, the vast majority are between 25 and 40 years of age, nearing or at the end of their viable lifespan. The table below highlights this trend (see Table 5).

Table 4: Age Breakdown of Operational UST:

Age in Years | 0-9 | 10-14 | 15-19 | 20-24 | 25-29 | 30-24 | 35-40 | 40-44 | 45+ |

# of Operational Tanks | 505 | 292 | 364 | 446 | 1,590 | 2,128 | 1,586 | 648 | 687 |

Small gas stations made up the largest portion of operational sites. A series of informed data refinements were employed to estimate the number of sites that qualify as small gas stations (including those with a convenience store attached), and the share of all operational tanks represented by this group. The first step in this process involved isolating the group of tanks with contents labeled under both "Motor Fuel for Vehicles" and "Unleaded Gasoline," as those are the classifications that at least one tank at every small gas station would adhere to. Following this, the hypermarkets of Costco, Safeway, Walmart, and Fred Meyer were filtered out, and a word search was employed to remove sites with naming conventions not likely to be used by small gas stations. For example, this method eliminated all police departments, fire departments, hospitals, Washington department of transportation fueling stations, and sites with "port of" or "city of" in their name. This analysis resulted in a final list of 2,360 sites, or approximately 73 percent of all operational sites.

Emergency generator tanks are the next most common type of UST held by a broad variety of business types. These represent just over nine percent, followed by large gas stations (hypermarkets such as Costco and Safeway) at 5.4 percent. The table below contains around 90 percent of the total 3,235 operational sites. The remaining 10 percent belong to a diverse array of groups from large automobile fleet owning companies like Microsoft to small businesses with niche UST needs. While the larger organizations might also apply to the proposed financial assurance program, identifying the specific type of business was not possible with the available data. However, the table below provides a general overview of the UST owners and operators potentially affected by the proposed financial assurance program (see Table 6).

Table 5: Statewide Breakdown of UST Sites:

Site Type | Percentage of Operational Sites | Number of Operational Sites |

Small Gas Stations | 73.0% | 2,360 |

Large Gas Stations (Hypermarkets) | 5.4% | 176 |

Emergency Generator Tanks | 9.2% | 298 |

Aviation Fuel Supply Tanks | 1.4% | 45 |

Heating Fuel Supply Tanks | 0.8% | 26 |

Hospitals | 1.0% | 31 |

Truck Stops | 0.5% | 16 |

Total | 91.3% | 2,952 |

In addition to these listed UST groups, it is also important to consider the owners and operators of heating oil tanks. Heating oil tanks are used almost exclusively to heat buildings, mainly households. Approximately 1.3 percent (40,000 homes) of all Washington households use fuel oil to heat their homes.7

Based on the information available from the DOE UST database, the following table lists the industrial codes (NAICS) for the sectors that will potentially be impacted by this new rule (see Table 7). UST owners and operators fall under a wide variety of industries, which makes it challenging to compile a complete NAICS list of industries potentially impacted by the new financial assurance program. Some of the potentially affected entities are in such broad industries that only the two-digit NAICS code is provided.

Table 6: NAICS for Industries Potentially Impacted by Proposed Program:

Type of Business | NAICS Code/s |

Petroleum Refineries | 324110 |

Gas Stations/Truck Stops | 447190 |

Convenience Stores (w/gas station) | 447110 |

Heating Oil Distributors | 454310 |

Hospitals | 622110 | 622310 | 622210 |

Airports | 488119 |

Fleets | 532112 |

Agriculture | 11 |

Government | 92 |

Methods of Analysis: This analysis compares the cost of compliance per one $100 of sales between large and small businesses that own USTs, in order to determine whether small businesses will bear a disproportionate share of these costs. Based on sales, the hypermarkets, or large gas stations, are considered the largest businesses in this analysis. Small businesses, most of which are smaller, independently-owned gas stations, are aggregated, and the total per $100 of sales cost is compared with that of the largest businesses to assess whether or not a disproportionate impact is expected for small businesses.

Section 2: Compliance Costs for Washington Businesses: As noted above, the UST and heating oil tank program is completely voluntary. Its purpose is to provide UST and heating oil tank owners and operators with a source of funding, in the form of financial assistance. Since the program is voluntary and actively provides UST and heating oil businesses with financial aid, there are no compliance costs associated with this proposed rule.

While there are no compliance costs, there are several eligibility considerations mentioned in the rule summary section above. These requirements include meeting UST requirements under chapter 173-360A WAC, being registered with DOE or an equivalent federal agency, and that the applicant must be seeking financial assistance for remediation and/or infrastructure upgrades. Nonoperational tank owners and operators must not be under an enforcement order or consent decree.

Heating oil tank owners and operators must be seeking financial assistance to pay for remediation, a heating oil tank upgrade/removal, or an upgrade or installation of new infrastructure to replace the heating oil tank. UST and heating oil tank owners and operators should already meet these eligibility requirements as they are required by other rules, and if not, the cost to meet these requirements is negligible. Again, due to the voluntary nature of this program, there are no true compliance costs. Those applying for this program should expect a range from no cost to negligible cost to meet eligibility standards.

The application for the revolving loan program is available on PLIA's website along with important application cycle dates and deadlines. Alternative formats, such as language-translated applications, will also be offered if requested. Applications must include financial documents, business documents, and UST information. There are no major anticipated costs associated with the application.

Applicants that are offered a loan can expect the interest rate on their loan to match the prime rate that was in effect in March of the year they applied. This rate will likely be lower than what they could expect via a traditional loan through a bank. PLIA also works with recipients to identify and make use of all existing funding sources (insurance policies and other mechanisms) to maximize these private funding sources before expending loan and grant funds. In summation, this proposed program is voluntary, so there are no required compliance costs. For those who do choose to participate in the program, the application process imposes no to negligible cost to applicants, and for those who are offered a loan, the interest rate on said loan is at a low rate that reduces the financial burden for participatory Washington businesses.

Section 3: Analysis of Impact on Small Businesses: To determine if the proposed program will have a disproportionate impact on small businesses relative to large businesses, both small and large businesses were identified. As mentioned in Section 1, the top 10 percent of businesses are considered large businesses. For this analysis, hypermarkets, or large gas station corporations are considered large businesses. Additionally, hospitals and aviation fuel supply tanks are also considered large businesses. Though they make up just under eight percent of the DOE UST database, this is the only group of affected businesses that consistently fall in the top 10 percent of annual sales and have more than 50 employees, which is the demarcation for small businesses. The vast majority of USTs belong to small businesses, almost all of which are independently owned gas stations. The remaining small businesses with USTs come from other industries (e.g., construction, nonretail facilities) and are harder to identify. Therefore, small, independently owned gas stations represent small businesses for this analysis, while hypermarkets, hospitals, and airports represent large businesses (see Table 8).

Table 7: Breakdown of Small and Large Businesses Potentially Impacted by Proposed Financial Assurance Program:

Sector Class | Description of Sector Class | Average Annual Sales | Number of Businesses |

Large | Hyper markets (Costco, Safeway, Fred Meyers), hospitals and airports | | ~254 |

Small | Small independently owned gas stations | $9.8 million8 | ~2,360 |

As noted in Section 2, there are no anticipated costs associated with the proposed program. Therefore, there are no anticipated disproportionate impacts on small businesses. In fact, the site ranking criteria that determines which applicants are prioritized for funding favors small businesses. As highlighted in Table 9, applicants with high financial need, with insurance need, located in environmental justice communities, and/or providing community benefits are prioritized for funding. Small businesses are more likely to serve environmental justice communities and isolated communities than larger businesses. They may also struggle to secure finances and insurance compared to larger companies that have stronger financial support. So not only will small business program participants incur little to no cost to apply to this proposed program, but their projects will also have higher priority than that of a similar project requesting funding by a larger company, ensuring that small businesses are more likely to access grant and low interest rate loans than large businesses.

Table 8: Site Ranking for Revolving Loan and Grant Program9:

Criteria | Explanation | Points |

Age of tank(s) | Scoring is based on tank age (>25 years). Older tanks are more likely to fail/have failed. | 25 |

Public health threat to water | Contamination with potential to impact surface and groundwater. | 15 |

Extent of historical contamination | Immediate free-product removal required, and impacted groundwater present. | 15 |

Insurance need | Inability to obtain insurance through PLIA reinsurance or financial assurance program, insurance policy has been cancelled, or there has been a significant premium increase. | 13 |

Financial need | Owner/operator has documentation of financing denial. | 10 |

Current insurance policy exceeded | Owner/operator exceeded their current insurance policy limit before completing cleanup. | 8 |

Environmental justice (EJ) | Meeting the needs of a highly impacted EJ community. Revitalizing the community that surrounds the property by transforming the project into drivers of community revival. | 8 |

Community need and benefit | Isolated communities depend on the station as their source of motor vehicle fuel for essential emergency, medical, fire and police services. | 6 |

Section 4: Small Business Involvement in Rule Making and Impact Reduction Efforts:

Involvement of Small Business in the Development of the Proposed Rule: As part of the rule-making process, PLIA held public, informational listening sessions on proposed loan and grant program rules. These sessions were held in May 2023 where several attendees provided comments and questions for the agency to consider in finalizing rule language.

Due to PLIA's 2023 legislative activities that included the establishment of a new agency program and appropriations request to add additional staffing and resources, the loan and grant rule making was pended until early 2024. The additional time allowed the agency to refine program processes, properly staff the program with dedicated staffing, and update program documents.

PLIA intends to conduct additional informational listening sessions in fall 2024 prior to adoption of the rule.

Actions Taken to Reduce the Impact of the Rule on Small Businesses: In general, the proposed program does not impact small businesses, particularly because the program is voluntary. For small businesses that do apply for financial aid, the applicant ranking scheme described in Section 3 includes several considerations that favor small businesses, improving their chances of receiving grant and loan funding.

1 | Ly, Phi. 2024. Underground Storage Tank Revolving Loan and Grant Program 2021-2023 Biennium Report to the Legislature. September: Report here. |

2 | Based on the Washington Department of Health Disparities Map: https://fortress.wa.gov/doh/wtnibl/WTNIBL/. |

3 | PLIA. 2024. Underground Storage Tank Revolving Loan and Grant Program Report to the Legislature 2021-2023 Biennium. September. Available here. |

4 | PLIA. 2022. Underground Storage Tank Revolving Loan and Grant Program Report to the Legislature 2019-2021 Biennium. September. Available here. |

5 | Department of Ecology. Regulated Underground Storage Tanks (USTs). Available here. |

6 | It should be noted that the percentages presented in the table below should be viewed as estimations. While a thorough examination of the database was conducted, some site types were harder to identify than others based on naming practice among other challenges. |

7 | United State Census Bureau. 2022. American Community Survey House Heating Fuel 1-Year Estimate. Available here. |

8 | From IMPLAN, 2022. Unites States (US Totals) Region. Available at: https://implan.com. |

9 | PLIA. Revised 2020. Underground Storage Tank Loan and Grant Program Guidance. September. Available here. |

A copy of the statement may be obtained by contacting Phi V. Ly, P.O. Box 40930, Olympia, WA 98504-0930, phone 360-407-0520.

October 22, 2024

Phi V. Ly

Legislative and Policy Manager

OTS-5919.1

Chapter 374-90 WAC

UNDERGROUND STORAGE TANK REVOLVING LOAN AND GRANT PROGRAM

NEW SECTION

WAC 374-90-010Authority and purpose.

This chapter establishes the underground storage tank revolving loan and grant program pursuant to chapter

70A.345 RCW and outlines the program requirements and processes. The purpose of the program is to assist owners or operators of petroleum underground storage tank systems to: Remediate past releases; upgrade, replace, or remove petroleum underground storage tank systems to prevent future releases; or install new infrastructure or retrofit existing infrastructure for dispensing or using renewable or alternative energy. The program also assists owners and operators of heating oil tanks to remediate past releases or prevent future releases by upgrading, replacing, decommissioning, or removing heating oil tank systems.

NEW SECTION

WAC 374-90-020Definitions.

Unless the context requires otherwise, the definitions in this section apply throughout this chapter.

(1) "Agency" or "PLIA" means the pollution liability insurance agency, as used throughout this chapter. For purposes of chapter

70A.345 RCW, agency or PLIA shall mean staff or employees of the pollution liability insurance agency.

(2) "Applicant" means the owner or operator of a petroleum underground storage tank or heating oil tank who has applied to the program.

(3) "Ecology" means the Washington state department of ecology.

(4) "Facility" or "petroleum underground storage tank facility" means the property where the enrolled tank is located, including any tank-related infrastructure within that property. The term encompasses all real property under common ownership associated with the operation of the petroleum underground storage tank. For purposes of this program, facility does not have the same meaning as WAC 173-340-200.

(5) "Grant" means a financial award to a program participant that is not repaid by the grantee.

(6) "Heating oil" means any petroleum product used for space heating in oil-fired furnaces, heaters, and boilers, including stove oil, diesel fuel, or kerosene. "Heating oil" does not include petroleum products used as fuels in motor vehicles, marine vessels, trains, buses, aircraft, or any off-highway equipment not used for space heating, or for industrial processing or the generation of electrical energy.

(7) "Heating oil tank" means the same as RCW

70A.345.020(2). Heating oil tank does not include a tank used solely for industrial process heating purposes or generation of electrical energy. This term does not include any:

(a) Tank owned by the federal government or located on a federal military installation or federal military base.

(b) Tank located within the Hanford site.

(8) "Location" means the physical area or site where the assessment, cleanup, or infrastructure replacement, upgrade, or installation will occur.

(9) "Model Toxics Control Act" or "MTCA" means the Model Toxics Control Act, chapter

70A.305 RCW, and chapter 173-340 WAC.

(10) "Online community" means the cloud-based application and data system used by the agency and the applicant or participant to submit documentation and to report, process, and look up project information.

(11) "Operator" means the entity in control of, or having a responsibility for, the daily operation of a petroleum underground storage tank or heating oil tank.

(12) "Owner" means a person who owns a petroleum underground storage tank or heating oil tank.

(13) "Participant" means a petroleum underground storage tank owner or operator accepted into the program who receives and accepts a financial award offer, other than a preliminary planning assessment grant, and signs a participant agreement.

(14) "Petroleum" has the same meaning as defined in WAC 173-360A-0150(48).

(15) "Petroleum underground storage tank" means an underground storage tank regulated under chapter

70A.355 RCW or subtitle I of the Solid Waste Disposal Act (42 U.S.C. chapter 82, subchapter IX) that is used for storing petroleum. This includes tanks owned or operated on property under the direct jurisdiction of either the federal government or tribal governments other nonstate regulating agency. This term does not include any:

(a) Septic tank;

(b) Pipeline facility (including gathering lines):

(i) Which is regulated under 49 U.S.C. chapter 601; or

(ii) Which is an intrastate pipeline facility regulated under state laws as provided in 49 U.S.C. chapter 601, and which is determined by the Secretary of Transportation to be connected to a pipeline, or to be operated or intended to be capable of operating at pipeline pressure or as an integral part of a pipeline;

(c) Surface impoundment, pit, pond, or lagoon;

(d) Storm water or wastewater collection system;

(e) Flow-through process tank;

(f) Liquid trap or associated gathering lines directly related to oil or gas production and gathering operations; or storage tank situated in an underground area (such as a basement, cellar, mineworking, drift, shaft, or tunnel) if the storage tank is situated upon or above the surface of the floor;

(g) Tank owned by the federal government or located on a federal military installation or federal military base; and

(h) Tank located within the Hanford site.

(16) "Petroleum underground storage tank system" or "tank system" means a petroleum underground storage tank and connected underground piping, underground ancillary equipment, and containment system, if any.

(17) "Preliminary planning assessment" means an identification report, to the agency, of any existing contamination at the facility, the necessary actions to address such contamination, and the cost estimate for cleanup and any desired infrastructure upgrades.

(18) "Prime consultant" means an environmental consultant or business contracted by PLIA to perform the preliminary planning assessment or remediation under the program.

(19) "Program" means the underground storage tank revolving loan and grant program established by chapter

70A.345 RCW.

(20) "Release" has the same meaning as defined in RCW

70A.305.020.

(21) "Remedy" or "remedial action" means any action or expenditure consistent with the purposes of chapter

70A.305 RCW to identify, eliminate, or minimize any threat posed by hazardous substances to human health or the environment including any investigative and monitoring activities with respect to any release or threatened release of a hazardous substance and any health assessments or health effects studies conducted in order to determine the risk or potential risk to human health.

(22) "Site" has the same meaning as "facility" in RCW

70A.305.020. The phrase "facility" as used in this program is defined above.

(23) "Technical assistance program" means the program administered by the agency under the requirements of chapter 374-80 WAC.

NEW SECTION

WAC 374-90-030Eligibility—Underground storage tank owner or operator.

To be eligible for the program, an owner or operator of a petroleum underground storage tank must meet the following requirements.

(1) For an operational petroleum underground storage tank:

(a) Maintain compliance with the petroleum underground storage tank requirements of chapter 173-360A WAC, or equivalent federal regulating agency; and

(b) Be registered with the department of ecology or equivalent federal regulating agency.

(c) The petroleum underground storage tank cannot be within the site boundary currently under a Model Toxics Control Act order or decree.

(2) For a nonoperational petroleum underground storage tank, or if the tank has been removed, then the tank must not be within the site boundary of a Model Toxics Control Act order or decree. If the tank has been removed, the applicant must show by clear, cogent, and convincing evidence that the release occurred from a petroleum underground storage tank.

(3) The owner or operator is seeking financial assistance to pay for costs associated with at least one of the following actions:

(a) Remediation of a release or prevention of a threatened release of petroleum from a petroleum underground storage tank or its system;

(b) Upgrade, replacement, or removal of a petroleum underground storage tank system unless closure in place is necessary; or

(c) Upgrade, replacement, or retrofit of existing infrastructure, or the installation of new infrastructure to dispense renewable or alternative energy for motor vehicles, including recharging stations for electric vehicles or alternate fuels.

NEW SECTION

WAC 374-90-040Eligibility—Heating oil tank owner or operator.

(1) To be eligible for the program, a heating oil tank owner or operator must have a heating oil tank or a historic heating oil release, and be seeking financial assistance to pay for costs associated with at least one of the following actions:

(a) Remediation of a release or prevention of a threatened release of petroleum from a heating oil tank or its system;

(b) Upgrade, replacement, or removal of a heating oil tank or its system unless a determination is made that closure in place is necessary; or

(c) Upgrade or installation of new infrastructure to replace the heating oil tank with another source for heating purposes.

(2) For a heating oil tank (operational or nonoperational), or if the tank has been removed, then the tank must not be located within the site boundary of a Model Toxics Control Act order or decree. If the heating oil tank has been removed, then the applicant must show by clear, cogent, and convincing evidence that the release occurred from a heating oil tank.

NEW SECTION

WAC 374-90-050Application.

(1) The application cycle and acceptance dates for the program will be posted on the agency's website.

(2) The director may suspend an application cycle when program funding is limited or if the agency must address a large number of applicants from an application cycle.

(3) Applicants will submit applications through the agency's online community. Alternative formats will be provided if requested from the agency.

(4) Applications must be complete with all required information and must be submitted by the application deadline.

(5) PLIA will require an applicant's personal credit history report if the applicant seeks loan funding. This information will be used to assess the applicant's financial condition.

(6) The agency will review all completed applications in the application cycle and will issue written notice about program acceptance to applicants.

(a) For accepted applicants, the notice letter will indicate whether a preliminary planning assessment is required.

(b) The agency may determine that a preliminary planning assessment is not required if an applicant provides evidence of an equivalent and technically sufficient assessment. Such an assessment should be provided in an applicant's application. If PLIA accepts the assessment, the notice letter will confirm that the assessment is accepted and that a preliminary planning assessment is not required.

(c) If an application is denied, the notice letter will list the reasons for program denial. Denied applicants may apply to the program in another application cycle if they address the reasons for denial.

NEW SECTION

WAC 374-90-070Preliminary planning assessment grant.

(1) The agency may award grant funding for a preliminary planning assessment if there has been a release or threatened release of a hazardous substance to the environment.

(2) The amount awarded through a preliminary planning assessment grant reduces an applicant's total funding award amount. Preliminary planning assessment grant amounts are listed in the program guidance.

(3) If PLIA determines that a preliminary planning assessment is required, the agency will designate a prime consultant to perform the preliminary planning assessment at the location of the release or threatened release.

(4) An award of a preliminary planning assessment grant does not guarantee that the applicant will receive further program funding.

NEW SECTION

WAC 374-90-080Project prioritization—Underground storage tank owner or operators.

(1) The agency may rank each application to establish funding and project prioritization.

(2) To ensure that program funds are used to address contamination from petroleum underground storage tanks, the agency may prioritize funding for project locations that require remediation.

(3) The agency will review information from the preliminary planning assessment, the application, and the following factors and any other factors PLIA deems relevant to establish ranking:

(a) Whether or not a release from a petroleum underground storage tank has occurred, and the nature and extent of contamination from that release.

(b) An assessment of whether the petroleum contamination poses a threat to public health and the environment.

(c) An evaluation of the location with preestablished criteria including, but not limited to, proximity to drinking water, provided in the program guidance.

(d) An assignment of a numeric score to each applicant project location and a ranking of each applicant within an application cycle.

(4) The agency may adjust project rankings if the extent of petroleum contamination is later identified as posing an immediate threat to human health or the environment. The agency may also rerank projects within an application award cycle due to emergent conditions or new information.

(5) Applicants may not appeal the agency's project rankings.

NEW SECTION

WAC 374-90-090Project prioritization—Heating oil tank owners or operators.

(1) The agency may rank each application to establish funding and project prioritization, which will determine timing on when project remediation work may occur and may limit funding offered based on the factors in subsection (3) of this section.

(2) To ensure that program funds are used to address contamination from heating oil tank releases, the agency may prioritize funding and timing of when project remediation may occur for projects that require immediate remediation and where it is known that the release is impacting surface water, groundwater used for drinking water, or a stormwater system.

(3) The agency will prioritize participants based on the time the application was submitted, general location information, and the following factors and any other factors PLIA deems relevant:

(a) Determine if the project location has contamination from a heating oil tank release and only requires remediation funding.

(b) The project location has contamination from a heating oil tank release and requires funding for remediation and infrastructure upgrade. Program funding is allocated to the cleanup of contamination from the heating oil tank release before allocation for infrastructure upgrades.

(c) The project location requires funding for only infrastructure upgrades.

(d) The project location includes a vulnerable population as defined in RCW

70A.02.010(14), or an overburdened community as identified in RCW

70A.02.010(11).

(4) The agency may adjust project rankings when the extent of contamination from the heating oil tank release is later identified as posing a threat to human health or the environment.

(5) The program may re-rank or reassess applications due to emergent conditions or availability of new information. Affected applicants will be notified in writing.

(6) Applicants may not appeal the agency's project rankings.

NEW SECTION

WAC 374-90-100Funding awards—Underground storage tank owners or operators.

(1) The agency may award funding for any amount up to, but not exceeding, the maximum amounts established in RCW

70A.345.030(2) for each applicant for a single petroleum underground storage facility.

(2) Program funding is awarded by loan, grant, agency-led remediation, or a combination of these. The total funding amount cannot exceed the maximum amount established in RCW

70A.345.030(2).

(3) An applicant is considered for the following award types.

(a) Loan.

(i) A loan award is for the amount that the participant is borrowing from the program. The participant will be charged with interest on the outstanding balance of moneys applied to project work. Financing and repayment terms will be described in the participant loan agreement.

(ii) The loan amount is reduced by any grant amount paid towards the preliminary planning assessment and the technical assistance program fee, if applicable.

(iii) Loan awards must be applied to remedial action prior to infrastructure upgrade costs.

(iv) Program participants may select their own consultant to perform remediation and infrastructure upgrades.

(b) Grant.

(i) A grant award is the amount that the program will pay towards the project work identified in the preliminary planning assessment.

(ii) All work may be performed by a prime consultant.

(iii) If applicants or participants are not able to secure access to the location for remediation work, the agency may rescind the award offer or terminate the participant agreement.

(c) Government grant.

(i) A government grant may only be awarded to a state agency, local government, or a tribal government who is the owner or operator of a petroleum underground storage tank.

(ii) A grant award is the amount that the program will pay towards the project work identified in the preliminary planning assessment.

(iii) All work may be performed by a prime consultant.

(iv) If applicants or participants are not able to secure access to the location for remediation work, the agency may rescind the award offer or terminate the participant agreement.

(d) Agency-led remediation.

(i) Agency-led remediation funding is limited to costs associated with remedial action and is subject to cost recovery as provided in RCW

70A.345.070.

(ii) If applicants or participants are not able to secure access to the location for remediation work, the agency may rescind the award.

(iii) All remediation work will be conducted by a prime consultant.

(4) Program funding awards are made after:

(a) The department of health conducts a review of the applicant's financial circumstances and provides a recommendation (as applicable); and

(b) The agency reviews a completed preliminary planning assessment or a technically sufficient assessment that was submitted with the application.

(5) If selected for funding, any applicant with funding needs for remediation will enroll in the agency's technical assistance program with the enrollment fee paid from the funding awarded under this chapter.

(6) When PLIA issues an applicant a written program funding award, the agency may require a meeting to review the terms and conditions of the award. Applicants have 30 calendar days to either accept or decline the program funding award and, if accepting the award, must sign a participant agreement. If the applicant does not accept the program funding award after 30 calendar days, the award terminates.

(7) Funds are not dispersed directly to the participant except with the director's approval.

(8) The agency will directly pay the prime consultant or participant-selected contractor direct costs from the program funding award after review and approval of invoices.

(9) PLIA may terminate a program funding award or may adjust a ranking of an application if information about the project significantly differs from the preliminary planning assessment. If a program funding award is terminated or a ranking is adjusted, the agency will provide written notice to the applicant with an explanation.

NEW SECTION

WAC 374-90-110Funding awards—Heating oil tank owners or operators.

(1) The agency may award funding in total of any amount up to, but not exceeding, the maximum amounts established in RCW

70A.345.030(2) for each applicant for a single heating oil tank.

(a) Program funding offered by grant is an amount up to, but not exceeding, $60,000.

(b) Where program funding is only a loan the amount is up to, but not exceeding, the maximum amounts established in RCW

70A.345.030(2) for each applicant for a single heating oil tank.

(c) Where a project is awarded a grant and loan, the program funding combined may not exceed the maximum amounts established in RCW

70A.345.030(2) for each applicant for a single heating oil tank.

(2) Program funding may be offered by loan, grant, or combination of both.

(3) A program funding award is determined after the agency reviews the preliminary planning assessment or technically sufficient assessment, and the department of health conducts an applicant financial review (as applicable). Applicants not seeking loan funding do not need a department of health review.

(4) If the program funding award is applied to remediation, then the applicant must enroll in the agency's technical assistance program. The enrollment fee will then be paid from the total funding award.

(5) The application will be considered for the following program funding award types.

(a) Loan.

(i) A loan award amount is reduced by the amount used for the preliminary planning assessment and the technical assistance program enrollment fee, if applicable.

(ii) Loan funding will be applied to remediation prior to infrastructure upgrades.

(iii) Program participants may select their own consultant to perform remediation and infrastructure upgrades.

(b) Grant.

(i) A grant award is the amount that the program will pay towards the project work identified in the preliminary planning assessment.

(ii) All work may be performed by a prime consultant.

(iii) If applicants or participants are not able to provide access to the location for remediation work, the agency may rescind the award offer or terminate the participant agreement.

(6) If applicants receive a written program funding award, the agency may require a meeting to review the terms and conditions of the award. Applicants have 30 calendar days to either accept or decline the program funding award and, if accepting the award, sign a participant agreement. If the applicant does not accept the program funding award after 30 calendar days, the award terminates.

(7) Funds are not dispersed directly to the participant except with the director's approval.

(8) The agency will directly pay the prime consultant or participant-selected contractor direct costs from the program funding award after review and approval of invoices.

(9) If required, applicants receiving a program funding award may have their award terminated or ranking adjusted when, in PLIA's discretion, information about the project significantly differs from the preliminary planning assessment. In that event, the agency will provide written notice to the applicant with an explanation.

NEW SECTION

WAC 374-90-120Eligible and ineligible costs—Underground storage tank program funding awards.

(1) Program funding awards used for an asset (e.g., infrastructure), then that asset must have a useful life of at least 13 years.

(2) Loan funding. Eligible costs include, but are not limited to, the following:

(a) Remedial action, including excavation, treatment, and/or removal and proper disposal of any soil or water contaminated by the petroleum release and proper disposal of petroleum underground storage tanks.

(b) Testing and assessments to determine the nature and extent of a release of petroleum and whether cleanup standards have been met.

(c) Replacement of some surface features, including surface asphalt and concrete, curbs or lanes, and stormwater drainage as required by municipal law.

(d) Replacement costs for a new petroleum underground storage tank and certain equipment related to the operation of the affected tank.

(e) Some infrastructure upgrades, including alternative energy fueling facilities.

(3) Grant funding. Eligible grant costs include, but are not limited to, the following:

(a) Remedial action, including excavation, treatment, and/or removal and proper disposal of any soil or water contaminated by the petroleum release and proper disposal of petroleum underground storage tanks.

(b) Testing and assessments to determine the extent and severity of a release of petroleum and whether cleanup standards have been met.

(c) Replacement of some surface features, including surface asphalt and concrete, curbs or lanes, and stormwater drainage as required by municipal law.

(4) Ineligible costs for any program funding award. The program will not pay for ineligible costs incurred by the program participant. PLIA has discretion to determine whether costs are ineligible.

(5) Ineligible costs include, but are not limited to, the following:

(a) Costs covered by other valid insurance or warranties.

(b) Remedial action that exceeds cleanup levels required by the agency or MTCA.

(c) Remedial action to address a release of petroleum from or damage to a petroleum underground storage tank, or its system, or surrounding property caused by the owner or operator, an owner/operator's contractor, or the prime consultant.

(d) Replacement of tanks that were decommissioned or nonoperational at the time of a release.

(e) Any legal costs.

(f) Costs not included in an agency-approved scope of work.

(g) Costs incurred by the participant after the date the participant received a termination letter.

(h) Business related expenses, including:

(i) Costs related to development of the application package.

(ii) Costs for a business to remain operational during remedial activities.

(iii) Costs for lost revenue, including lost business income resulting from closures related to the release or remediation.

(iv) Retroactive costs.

NEW SECTION

WAC 374-90-130Eligible and ineligible costs—Heating oil tanks.

(1) Program funding award must be used for improvements (e.g., heating oil tank) that have a useful life of at least 13 years.

(2) Loan funding. Eligible loan costs include, but are not limited to, the following:

(a) Remedial actions, including excavation, treatment, and/or removal and proper disposal of any soil or water contaminated by the petroleum release and proper disposal of heating oil tanks.

(b) Testing and assessments, including:

(i) Costs necessary to determine the nature and extent of the petroleum release.

(ii) Soil sampling, water sampling, soil vapor sampling, and testing to determine if cleanup standards are met.

(c) Replacement of some surface features, including surface asphalt and concrete, curbs or lanes, and stormwater drainage required by municipal law.

(d) Infrastructure upgrades, including:

(i) Replacement costs for a new heating oil tank that meets the current standards for such tanks, as specified in guidance policy.

(ii) Replacement of certain equipment related to the operation of the affected tank.

(e) Replacement of the heating oil tank and infrastructure with heating infrastructure including:

(i) Alternative energy heating systems.

(ii) Upgrades to existing home heating oil systems.

(f) Other costs included within an agency-approved scope of work.

(3) Grant funding. Eligible grant costs include, but are not limited to, the following:

(a) Remedial actions, including excavation, treatment, and/or removal and proper disposal of any soil or water contaminated by the petroleum release and proper disposal of heating oil tanks.

(b) Testing and assessments, including:

(i) Costs necessary to determine the nature and extent of the petroleum release.

(ii) Soil sampling, water sampling, soil vapor sampling, and testing to determine if cleanup standards are met.

(c) Replacement of some surface features, including surface asphalt and concrete, curbs or lanes, and stormwater drainage as required by municipal law.

(d) Other costs included within an agency-approved scope of work.

(4) Loan or grant funding. Ineligible costs will not be paid with program funds. The program is not responsible for paying any ineligible costs incurred by the participant. Ineligible costs include, but are not limited to, the following:

(a) Costs covered by other valid insurance or warranties.

(b) Remedial action that exceeds cleanup levels required by the agency or MTCA.

(c) Remedial action to address a release or damage to a heating oil tank or its system or surrounding property caused by the owner or operator, the owner/operator's contractor, or the prime consultant.

(d) Replacement of tanks that were decommissioned, temporarily out of service, or abandoned at the time of a release of petroleum.

(e) Any legal costs, including the costs of legal representation, expert fees, and related costs and expenses incurred in defending against claims or actions.

(f) Costs not included in an agency-approved scope of work.

(g) Costs incurred by the participant after the date the participant received a termination letter.

(h) Temporary heat restoration.

(i) Business related expenses, including:

(i) Costs needed to develop the application package.

(ii) Costs for a business to remain operational during remedial activities.

(iii) Costs for lost revenue.

(iv) Retroactive costs.

NEW SECTION

WAC 374-90-140Participant program termination.

(1) The agency may terminate the program funding award, in whole or in part, for any of the following situations.

(a) The participant fails to comply with the program funding award terms and conditions.

(b) The participant and agency mutually agree to the suspension or termination of the program funding award.

(c) A participant's facility enters into a Model Toxics Control Act enforcement order, agreed order, or consent decree.

(2) The agency may immediately terminate a loan or grant without notice when necessary to protect the interests of the state.

(3) The participant will be notified in writing if the agency terminates the program funding award. A cost calculation, record keeping, and program summarization process will begin no later than one week after written notice of the termination has been mailed to the participant. The notice will describe the procedures necessary to close out participation in the program. The participant will repay the remainder of the loan according to the established loan terms.

NEW SECTION

WAC 374-90-150Overpayments.

(1) The agency may require an owner or operator or prime consultant to return any overpayment made by the program. Overpayments may occur if:

(a) Another party, such as an insurer, has paid costs prior to payments from the program; or

(b) The agency discovers an accidental overpayment has been made to an owner, operator, or prime consultant for any reason.

(2) If an overpayment is not paid upon demand, the agency may pursue one of the following actions:

(a) Collections. The agency may request cost recovery with a debt collection agency.

(b) Lien filing. The agency may seek cost recovery of remedial action costs from any liable person by filing a lien on the petroleum underground storage tank facility as authorized under RCW

70A.345.070.

(c) Civil action. The agency may request the attorney general's office to commence a civil action against the owner or operator in superior court to recover costs and the agency's administrative and legal expenses to pursue recovery.

NEW SECTION

WAC 374-90-160Fraud and material omissions.

(1) The agency may seek return of payments made if:

(a) Any party misrepresents or omits material facts relevant to the agency's determination of coverage; or

(b) Any party, with intent to defraud, initiates a loan or grant request or issues or approves an invoice or request for payment, with knowledge that the information submitted is false in whole or in part.

(2) If the agency determines that any party has committed program fraud or omitted material information, the agency may request the attorney general's office to:

(a) Commence a civil action against the person in superior court; or

(b) Recover the overpayment and other expenses as determined by a court.

(3) If the agency determines that the owner or operator of an enrolled petroleum underground storage tank omitted material facts or intentionally defrauded the program, it will terminate program enrollment, and any person or party determined to have committed program fraud may be prohibited from applying for future funding. The agency will report instances of fraud to the appropriate authorities including criminal referral for prosecution.

(4) Any party participating in the program must agree to allow the agency to conduct financial audits related to the receipt of payments intended for remedial actions.