WSR 24-22-091

PROPOSED RULES

DEPARTMENT OF HEALTH

[Filed October 31, 2024, 3:02 p.m.]

Original Notice.

Preproposal statement of inquiry was filed as WSR 23-07-101

Title of Rule and Other Identifying Information: Farmers market nutrition program (FMNP); electronic benefits payments. The department of health (department) is proposing amendments to chapter 246-780 WAC to include requirements for the use of electronic benefit payments.

Hearing Location(s): On December 18, 2024, at 10:00 a.m., at the Department of Health, Town Center 2, Room 166-167, 111 Israel Road S.E., Tumwater, WA 98501; or virtual. Register in advance for this webinar https://us02web.zoom.us/webinar/register/WN_Q9V6Sz3sR1KZ2NYBlr8g6Q. After registering, you will receive a confirmation email containing information about joining the webinar.

Date of Intended Adoption: December 26, 2024.

Submit Written Comments to: Me'Kyel Bailey, P.O. Box 47830, Olympia, WA 98504-7830, https://fortress.wa.gov/doh/policyreview/, email Mekyel.bailey@doh.wa.gov, beginning the date and time of filing, by December 18, 2024, at 11:59 p.m.

Assistance for Persons with Disabilities: Contact Me'Kyel Bailey, phone 360-764-9161, TTY 711, emailmekyel.bailey@doh.wa.gov, by December 4, 2024.

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: The department is proposing amendments to chapter 246-780 WAC to allow the use of electronic benefit payments for MNP which is administered by the department. FMNP allows participants of the special supplemental nutrition program for women, infants, and children (WIC) and the senior FMNP to purchase unprocessed fresh fruits, vegetables, and cut herbs directly from growers in farmers markets using their benefits. FMNP is transitioning to the use of electronic benefit payments (e-FMNP). As part of this change, WIC participants can also use their cash value benefits (CVB) for fresh fruits and vegetables at authorized farmers markets and farm stores, in addition to the seasonal FMNP benefits. The department has updated vendor contracts to reflect the use of e-FMNP. The department is proposing amending chapter 246-780 WAC to align the rules with the contract language and reflect the practice of using e-FMNP.

Reasons Supporting Proposal: The proposal will align the rules with the contract language and reflect the practice of using e-FMNP.

FMNP has transitioned to the use of eFMNP. Electronic benefits means the use of a card or QR code to access fruit, vegetable, and cut herb dollar allotments for redemption at participating farmers markets and farm stands. FMNP transitioned to electronic benefits because banks will no longer cash check FMNP benefits. Electronic benefits can be easier for participants to use at markets. They are not limited purchasing to the amount on individual checks, which were often in four dollar increments, and can access the full benefit amount. Growers and farm stores no longer need to cash checks at banks, which can decrease associated administrative burden, bank and check cashing fees, and lost checks. The farmers markets, growers, and farm stores have participated in two benefit seasons using the electronic redemption method, and we have seen steady numbers of vendors participating.

Rule is necessary because of federal law, 7 C.F.R. Part 248.

Name of Proponent: Department of health, governmental.

Name of Agency Personnel Responsible for Drafting: Karen Mullen, 111 Israel Road S.E., Tumwater, WA 98501, 360-515-8279; Implementation: Katherine Flores, 111 Israel Road S.E., Tumwater, WA 98501, 360-236-3721; and Enforcement: Allen Esparza, 111 Israel Road S.E., Tumwater, WA 98501, 360-236-3619.

A school district fiscal impact statement is not required under RCW

28A.305.135.

A cost-benefit analysis is required under RCW

34.05.328. A preliminary cost-benefit analysis may be obtained by contacting Me'Kyel Bailey, P.O. Box 47830, Olympia, WA 98504-7830, phone 360-764-9161, TTY 711, email

mekyel.bailey@doh.wa.gov.

This rule proposal, or portions of the proposal, is exempt from requirements of the Regulatory Fairness Act because the proposal:

Is exempt under RCW

19.85.025(3) as the rules are adopting or incorporating by reference without material change federal statutes or regulations, Washington state statutes, rules of other Washington state agencies, shoreline master programs other than those programs governing shorelines of statewide significance, or, as referenced by Washington state law, national consensus codes that generally establish industry standards, if the material adopted or incorporated regulates the same subject matter and conduct as the adopting or incorporating rule; and rules only correct typographical errors, make address or name changes, or clarify language of a rule without changing its effect.

Explanation of exemptions: The following proposed rules are exempt under RCW

34.05.310 (4)(d): WAC 246-780-001, 246-780-010, 246-780-020, and 246-780-022. WAC 246-780-030 is exempt under both RCW

34.05.310 (4)(c) and (d).

Scope of exemption for rule proposal:

Is partially exempt:

Explanation of partial exemptions: [See below].

The proposed rule does impose more-than-minor costs on businesses.

Small Business Economic Impact Statement

The following is a brief description of the proposed rule including the current situation/rule, followed by the history of the issue and why the proposed rule is needed. A description of the probable compliance requirements and the kinds of professional services that a small business is likely to need in order to comply with the proposed rule: The department administers the FMNP under the authority of RCW

43.70.700 that allows WIC participants to purchase unprocessed fresh fruits, vegetables, and cut herbs directly from growers in farmers markets using their FMNP benefits. SFMNP, administered by the department of social and health services, and WIC CVB for fruits and vegetables are also included in this proposed rule.

FMNP follows rules set in chapter 246-780 WAC, which includes the process for farmers markets, growers, and farm stores to apply for the program, what products are eligible for benefit redemption, and requirements related to processing benefits. It also explains how the department enforces the rules and how to appeal a department decision.

FMNP has transitioned to the use of eFMNP. Electronic benefits means the use of a card or QR code to access fruit, vegetable, and cut herb dollar allotments for redemption at participating farmers markets and farm stands. FMNP transitioned to electronic benefits because banks will no longer cash check FMNP benefits. Electronic benefits can be easier for participants to use at markets. They are not limited purchasing to the amount on individual checks, which were often in four dollar increments, and can access the full benefit amount. Growers and farm stores no longer need to cash checks at banks, which can decrease associated administrative burden, bank and check cashing fees, and lost checks. The farmers markets, growers, and farm stores have participated in two benefit seasons using the electronic redemption method, and the department has seen steady numbers of vendors participating.

The department has updated vendor contracts to reflect the use of eFMNP. The proposed rules would amend chapter 246-780 WAC to align the rules with the contract language and reflect the practice of using eFMNP. This ensures consistency between the rule language and the grower or market agreements. The proposed rules will update existing rules to reflect current practice and represent the least burdensome means to ensure compliance with FMNP requirements and ensuring that access to fresh fruit and vegetables is expanded.

New costs incurred due to these proposed rule changes are related to the requirement for contracted growers and farm stands to be able to process electronic benefit transactions. The electronic benefit transactions require a smart device and internet connection to process the transactions.

The following is identification and summary of which businesses are required to comply with the proposed rule using the North American Industry Classification System (NAICS):

Table 1. Summary of Businesses Required to

Comply to the Proposed Rule

NAICS Code (4, 5, or 6 Digit) | NAICS Business Description | Number of Businesses in Washington State | Minor Cost Threshold |

1112 | Vegetable and Melon Farming | 104 | $11,448.46 |

1113 | Fruit and Tree Nut Farming | 191 | $4,059.52 |

1114 | Greenhouse, Nursery, and Floriculture Production | 635 | $2,619.02 |

112910 | Apiculture | 97 | $1,445.21 |

445230 | Fruit and Vegetable Retailers | 563 | $2,435.71 |

The following is an analysis of probable costs of businesses in the industry to comply to the proposed rule and includes the cost of equipment, supplies, labor, professional services, and administrative costs. The analysis considers if compliance with the proposed rule will cause businesses in the industry to lose sales or revenue:

WAC 246-780-025 Grower application requirements.

Description: This section describes the actions growers must take and the criteria growers must meet to become authorized participants in the FMNP. If applicant growers are unable to meet the criteria, then they are unable to participate in the program. Criteria includes:

| |

| • | Training on WIC FMNP, WIC CVB, and SFMNP requirements provided by a farmers market manager or the department. The current rule only requires training on FMNP. |

| • | Requires the ability to accept FMNP transactions at the point of sale. The current rule does not require electronic transactions and uses checks instead which do not require a point-of-sale system. |

| • | Clarifies the department can determine which applications to authorize based on community need. The current rule does not say this is up to the department to decide. |

Cost(s): Growers must have the ability to accept an electronic benefits transaction at the point of sale. In practice, this means they must have a smart device with an internet connection. The cost of a smart device with internet connection to process eFMNP benefits is estimated to be $65-$295 per month which accounts for a range of one to five smart devices. Factors which influence this range include the number of lines needed, data usage, and if a device is included in the plan cost or is an additional charge. Some growers may have stands at multiple markets that operate on the same day and they are more likely to need the additional devices and internet lines. The annual cost is estimated with a range of $0-$3,540 for one to five smart devices with data, with $0 assuming the grower is using a device they already own.

Estimates were obtained from two services providers with multiple smart device types (accessed August 2023):

Verizon Wireless:

| |

| • | One line with a free phone and unlimited data: $65-$80/month |

| • | Five lines with free phones and unlimited data: $150-$225/month |

| • | Tablet: Apple IPad Air5th Generation with 5g. $749.49 plus $40/month for unlimited data. Averages to $102.45/month over 12 months |

T-Mobile (Accessed August 2023):

| |

| • | One line with a Samsung Galaxy payment and unlimited data: $98/month |

| • | Five lines with a Samsung Galaxy payment and unlimited data: $295.00/month |

| • | Tablet: Apple iPad Air5th Generation with 5g. $749.99 plus $70.00/month for unlimited data with 20 GB hotspot. Averages to $132.50/month over one year. |

WAC 246-780-026 Farm store application requirements.

Description: This section describes the actions farm stores must take and the criteria farm stores must meet to become authorized participants in the FMNP. If farm stores are unable to meet the criteria, then they are unable to participate in the program. Criteria includes:

| |

| • | Training on WIC FMNP, WIC CVB, and SFMNP requirements provided by a farmers market manager or the department. The current rule only requires training on FMNP. |

| • | Requires the ability to accept FMNP transactions at the point of sale. The current rule does not require electronic transactions and uses checks instead which do not require a point of sale system. |

| • | Clarifies the department can determine which applications to authorize based on community need. The current rule does not say this is up to the department to decide. |

Cost(s): Costs for a smart device are estimated for WAC246-780-025 above and are likely to be within the same range. Some farm stores may have multiple locations that operate on the same day and they are more likely to need the additional devices and internet lines. Some farm stores may need to upgrade their internet or purchase signal boosters depending on the type and speed of internet available in their area.

Estimates for Xfinity internet are $55/month for 400 mbps, $65 for 800mbps and $75/month for 1 GB per second (Accessed August 2023).

A WiFi signal booster is a one-time purchase and costs $40-$100 (Accessed July 2024).

WAC 246-780-028 Authorized grower or authorized farm store—Minimum requirements.

Description: This section includes compliance information for growers and farm stores to participate in FMNP. The changes in this section include:

| |

| • | Removing the current rule requirement that growers accept FMNP checks. Checks are no longer in use for the FMNP program. |

| • | Updates the section to clarify that it applies to WIC FMNP, WIC CVB, and SFMNP. The current rule only references "FMNP." |

| • | Not allowing tokens to be given for WIC FMNP, WIC CVB, and SFMNP benefits. |

| • | Updating terms to reflect current practice. |

| • | Requirements to ensure the business model promotes business integrity. |

The expectations in the proposed rule are updated to reflect WIC FMNP, WIC CVB, and SFMNP rather than only FMNP. The expectations which would apply to WIC FMNP, WIC CVB, and SFMNP are:

| |

| • | Compliance with requirements, terms and conditions of the contract. |

| • | Accept training and technical assistance on requirements. |

| • | Be held accountable for purchases and requirements for all the actions of people working or volunteering with the authorized grower or farm store. |

| • | Only accept benefits for eligible foods. |

| • | Only accept benefits at authorized farmers markets or farm stores at the location in their contract. |

| • | Display the "WIC Farmers Market Benefits Welcome Here" sign. |

| • | Provide participants with the full product for the value of the program transaction. |

| • | Cooperate with department staff in monitoring for compliance with WIC FMNP, WIC CVB, and SFMNP requirements. |

| • | Reimburse the department for mishandled benefits. |

| • | Not collecting sales tax on benefits. |

| • | Allowing the department to investigate the business. integrity of any WIC vendor or applicant. |

Cost(s): The department does not anticipate any costs to growers or farm stores to comply with the changes in this section.

WAC 246-780-040 Noncompliance with FMNP requirements by an authorized farmers market, authorized grower, or authorized farm store.

Description: Updates terms and removes subsections regarding the use of FMNP paper checks. No new compliance rules are in the draft but they are updated to reflect WIC FMNP, WIC CVB, and SFMNP. Authorized farmers markets, growers and farm stores would be considered noncompliant with the following as they relate to WIC FMNP, WIC CVB, and SFMNP:

| |

| • | Not displaying the "WIC Farmers Market Benefits Welcome Here Sign." |

| • | Providing unauthorized food or nonfood items to participants in exchange for benefits. |

| • | Providing change to participants for purchases made with benefits. |

| • | Accepting benefits at unauthorized farmers markets and farm stores. |

| • | Collecting sales tax on purchases made with benefits |

| • | Seeking reimbursement from the participant for benefits not paid by the department. |

The current rule requires the department to notify the farmers markets, growers and farmer stores of noncompliance. The proposed rule updates apply current rule to WIC FMNP, WIC CVB, and SFMNP, including:

| |

| • | Mailing written notice of a pending adverse action at least 15 days in advance. |

| • | Denying payment for mishandling benefits. |

| • | Seeking reimbursement for payments made on ineligible transactions. |

| • | Disqualification for trafficking benefits. |

Cost(s): The department does not anticipate any new costs associated with the changes in this section.

WAC 246-780-060 Appealing a department decision.

Description: This section establishes the right of FMNP authorized farmers markets, authorized growers, authorized farm stores, or applicants to appeal departmental decisions, and the process by which they may appeal. The changes in this sectionupdate terms and remove subsections regarding the use FMNP paper checks.

Cost(s): The Department does not anticipate any new costs associated with the changes in this section.

Table 2. Summary of Section 3 Probable Cost(s)

WAC Section and Title | Probable Cost(s) |

WAC 246-780-001 Purpose of the farmers market nutrition program. | Exempt |

WAC 246-780-010 Definitions. | Exempt |

WAC 246-780-020 Farmers Market Application Requirements. | Exempt |

WAC 246-780-022 Authorized farmers market minimum requirements. | Exempt |

246-780-025 Grower application requirements. | The annual cost is estimated with a range of $0-$3,540 for one to five smart devices with data, with $0 assuming the grower is using a device they already own (data accessed August 2023). |

WAC 246-780-026 Farm store application requirements. | Costs for a smart device are estimated for WAC 246-780-025 above and are likely to be within the same range. Estimates for Xfinity internet are $55/month for 400 mbps, $65 for 800 mbps and $75/month for 1 GB per second (accessed August 2023). A WiFi signal booster is a one-time purchase and costs $40-$100 (accessed July 2024). |

WAC 246-780-028 Authorized grower or authorized farm store—Minimum requirements. | None |

WAC 246-780-030 Farmers market nutrition program eligible foods. | Exempt |

WAC 246-780-040 Noncompliance with FMNP requirements by an authorized farmers market, authorized grower, or authorized farm store. | None |

WAC 246-780-060 Appealing a department decision. | None |

The following is an analysis on if the proposed rule may impose more-than-minor costs for businesses in the industry. Includes a summary of how the costs were calculated:

NAICS Code (4, 5, or 6 Digit) | NAICS Business Description | Minimum Probable Cost to Comply with the Rule | Minor Cost Threshold |

1112 | Vegetable and Melon Farming | $3,540 per year • Up to five phone lines with free phones and unlimited data at $65-98 month (accessed from Verizon and T-Mobile in August 2023) Assumes retailer does not currently have a smart device with internet connection, which would bring the minimum cost to $0. | No, the costs of the proposed rule $3,540 are less than the minor cost threshold of $11,448.46. |

1113 | Fruit and Tree Nut Farming | $3,540 per year • Up to five phone lines with free phones and unlimited data at $65-98 month (accessed from Verizon and T-Mobile in August 2023) Assumes retailer does not currently have a smart device with internet connection, which would bring the minimum cost to $0. | No, the costs of the proposed rule $3,540 are less than the minor cost threshold of $4,059.52. |

1114 | Greenhouse, Nursery, and Floriculture Production | $3,540 per year • Up to five phone lines with free phones and unlimited data at $65-98 month (accessed from Verizon and T-Mobile in August 2023) Assumes retailer does not currently have a smart device with internet connection, which would bring the minimum cost to $0. | Yes, the costs of the proposed rule, $3,540 are greater than the minor cost threshold of $2,619.02. |

112910 | Apiculture | $3,540 per year • Up to five phone lines with free phones and unlimited data at $65-98 month (Accessed from Verizon and T-Mobile in August 2023) Assumes retailer does not currently have a smart device with internet connection, which would bring the minimum cost to $0. | Yes, the costs of the proposed rule, $3,540 are greater than the minor cost threshold of $1,445.20. |

445230 | Fruit and Vegetable Retailers | $3,700 per year • Up to five phone lines with free phones and unlimited data at $65-98 month (Accessed from Verizon and T-Mobile in August 2023) • Internet plan costing $55-$75/month (Accessed from Xfinity in August 2023) • Wifi booster costing $40-$100 (Accessed July 2024) Assumes retailer does not currently have a smart device with internet connection, which would bring the minimum cost to $0. | Yes, the costs of the proposed rule, $3,700 are greater than the minor cost threshold of $2,435.71. |

Summary of how the costs were calculated: The cost of smart devices with a data plan was gathered from Verizon Wireless and T-Mobile's websites in July 2023. Plans included either free or low-cost devices, unlimited data, and between one and five lines and devices. It is anticipated that smaller growers or farm stores will only need one or two devices and larger growers and farm stores will need one to five devices. An estimate for purchasing a tablet with a data plan was also done based on feedback the department heard from interested parties that smartphones are too small for some people to easily use. The department also included an estimate of upgrading the internet and adding signal boosters for farm stores in rural areas. Based on the estimated expense range of $0-$3,700 per year, the proposed rule is expected to impose a more-than-minor cost on some businesses within the industry.

Determination on if the proposed rule may have a disproportionate impact on small businesses as compared to the 10 percent of businesses that are the largest businesses required to comply with the proposed rule: Yes, the department believes the proposed rule may have a disproportionate impact on small businesses as compared to the 10 percent of businesses that are the largest businesses required to comply with the proposed rule.

Explanation of the determination: This requirement may disproportionately impact smaller growers and farm stores who wish to participate in FMNP, SFMNP, and CVB benefits, and need to purchase devices or additional internet capacity, due to economies of scale.1

Many growers and farm stores already use smart devices to process transactions, especially smaller growers and apiculture (honey) vendors. While apiculture has a minor threshold of $322.19, which is below the lower range of probable costs for the proposed rule, the department anticipates that most of them will use an existing device and data plan. This would minimize additional costs for these vendors. Also to note, honey is an allowed item for purchase only with SFMNP benefits and there are about 25 honey-only vendors who participate in SFMNP.

1 | Larger businesses typically experience higher economies of scale as opposed to smaller businesses because investment costs are spread over higher production resulting in lower average costs. |

Greenhouse, Nursery, and Floriculture Production: The minor cost threshold for greenhouse, nursery, and floriculture production is $2,619.02. Estimated costs for this business range from $0-$3,540. The department anticipates, based off feedback received from the 2023 Farmers Market season, that some vendors will bring their own device, which would create an effect cost of $0. Smaller operations may only need one or two devices, which would cost about $780-$1,560 per year. The business, which may have a disproportionate impact, would be those operating stands at multiple farmers markets or those which have multiple employees who each need a smart device. Those may reach the estimated higher end cost of $3,540 per year for five smart devices with internet.

Apiculture: The minor cost threshold for apiculture production is $1,445.20. Estimated costs for this business range from $0-$3,540. The department anticipates, based off feedback received from the 2023 Farmers Market season, that many apiculture vendors will bring their own device, which would create an effect cost of $0. Smaller operations may only need one or two devices, which would cost about $780-$1560 per year. Most of the apiculture vendors are not large operations, and the department anticipates it would be infrequent that they would need five smart devices at the $3,540 per year cost. Also to note, honey is an allowed item for purchase only with SFMNP benefits and there are about 25 honey-only vendors who participate in SFMNP.

Fruit and Vegetable Retailers: The minor cost threshold for fruit and vegetable retailers is $2,435.71. Estimated costs for this business range from $0-$3,700. These businesses may be located in more rural areas without good internet access available. Their costs may reach the higher range of $3,700 if upgraded or fast internet access is needed, and if multiple smart devices are needed.

The following steps have been identified and taken to reduce the costs of the rule on small businesses: The cost of the smart device and internet connection cannot be reduced. These are the minimum necessary to process electronic benefit transactions. The department has taken the following steps to reduce costs elsewhere, or to mitigate device and connectivity costs where possible, including:

| |

| • | Not charging a service or usage fee for the FMNP benefit transaction application. |

| • | Making check deposits weekly into growers and farm stand bank accounts. This reduces the risk of growers and farm stands incurring excessive banking fees related to high volumes of check deposits. Payments from electronic benefits are direct deposited instead and usually incur fewer banking fees. |

| • | A benefit of electronic deposits is they are more likely to have lower associated banks costs and fees. For example, when benefits were on checks, growers reported experiencing rejected check fees of $5-$25 per check. FMNP checks were issued in $4 increments, and so a rejection fee could be more than the value of the check. |

Description of how small businesses were involved in the development of the proposed rule: The FMNP program used feedback from growers and farm stands during prior FMNP seasons to mitigate costs. This feedback was communicated to program staff during routine interactions such as monitoring visits and technical assistance calls. Common issues raised were related to processing of benefit checks such as check deposit fees, rejected check fees being higher than check value, fees for depositing large batches of checks, and issues with incorrectly completed checks. For example, when benefits were on checks, growers reported experiencing rejected check fees of $5-$25 per check. FMNP checks were issued in $4 increments, and so a rejection fee could be more than the value of the check.

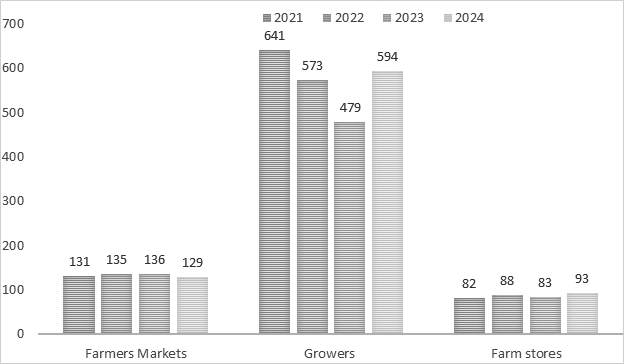

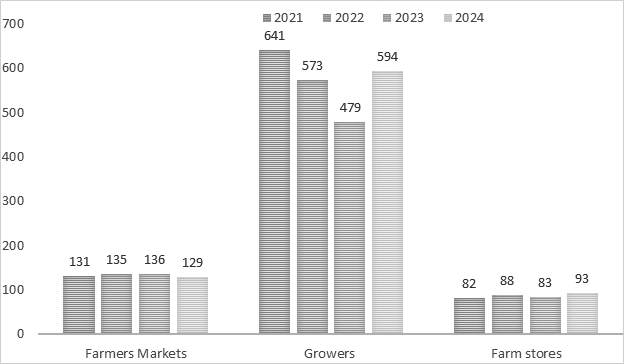

The estimated number of jobs that will be created or lost in result of the compliance with the proposed rule: No job loss is anticipated. The farmers markets, growers, and farm stores have participated in two benefit seasons using the electronic redemption method, and the department has seen steady numbers of vendors participating. In 2023, some markets closed which impacted the number of growers available. However, in 2024 five new markets opened and the growers returned to pre-2023 levels. Two markets that closed in 2023 will reopen in 2025. The trend overall has been that vendor participation looks very similar to 2021 and 2022 levels, which was prior to the shift to electronic benefits.

Many growers also already use electronic payment methods for other benefit programs like the Supplemental Nutrition Assistance Program, and for people who choose to pay with a credit card. This is a change in business operations and could take some time for growers to set up the electronic benefits transactions. The FMNP program will offer technical assistance, training, and frequent communication to support growers, farm stands, and farmers markets.

A copy of the statement may be obtained by contacting Me'Kyel Bailey, P.O. Box 47830, Olympia, WA 98504-7830, phone 360-764-9161, TTY 711, email Mekyel.bailey@doh.wa.gov.

October 31, 2024

Kristin Peterson, JD

Chief of Policy

for Umair A. Shah, MD, MPH

Secretary of Health

OTS-5278.2

Chapter 246-780 WAC

FARMERS((')) MARKET NUTRITION PROGRAM

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-001((What is the purpose of the farmers' market nutrition program?))Purpose of the farmers market nutrition program.

(1) The purpose of the farmers((')) market nutrition program (FMNP) is to:

(a) Provide access to:

(i) Locally grown, fresh, nutritious, unprepared fruits and vegetables, and fresh cut herbs to women, infants over five months of age, and children, who participate in the special supplemental nutrition program for women, infants, and children (WIC); ((and))

(ii) The WIC fruit and vegetable cash value benefit (CVB); and

(iii) The senior farmers market nutrition program (SFMNP) which includes locally grown, fresh, nutritious, unprepared fruits, vegetables, and fresh cut herbs.

(b) Expand the awareness and use of farmers((')) markets where consumers can buy directly from the grower.

(2) The FMNP is administered by the Washington state department of health.

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-010Definitions.

The definitions in this section apply throughout this chapter unless the context clearly implies otherwise.

(1) "Authorized" or "authorization" means an applicant has met the selection criteria and has been issued a signed contract with the department allowing participation in the FMNP.

(2) "Authorized farm store" means a ((store or stand authorized by the department which is located))sale location at the site of agricultural production and is owned, leased, rented, or sharecropped and operated by an authorized grower where the grower sells produce ((is sold)) directly to consumers.

(3) "Authorized farmers((')) market" means a farmers((')) market authorized by the department that has ((a minimum))an assembly of five or more authorized growers ((who assemble)) at a defined location ((for the purpose of selling their))who sell produce directly to consumers.

(4) "Authorized grower" means an individual authorized by the department who grows at least a portion of the produce that they sell at a Washington state authorized farmers((')) market or authorized farm store.

(5) "Benefit" means a negotiable financial instrument issued by the WIC, WIC FMNP, or SFMNP to participants to purchase eligible foods in each of these programs at farmers markets.

(6) "Broker" or "wholesale distributor" means an individual or business who exclusively sells produce grown by others. There is an exception for an individual employed by an authorized grower or nonprofit organization to sell produce on behalf of authorized growers.

(((6) "Check" means a negotiable financial instrument issued by the FMNP to clients to purchase eligible foods.))

(7) "Business and financial documentation" means all documents required to own and operate a business as a grower which may include, but is not limited to, banking and financial records; property sales; accounting; and product sales.

(8) "Civil monetary penalty" means a sum of money imposed by the FMNP program for noncompliance with program requirements for WIC FMNP and SFMNP.

(9) "Contract" or "agreement" means a written legal document binding the contractor and the department to designated terms and conditions.

(((8)))(10) "Cut herbs" means fresh herbs with no medicinal value that are not potted.

(((9)))(11) "WIC CVB" means a monthly cash value benefit which is a WIC food instrument used by a participant to obtain fresh fruits and vegetables.

(12) "Department" means the Washington state department of health.

(((10)))(13) "Disqualification" means terminating the contract or agreement of an authorized farmers((')) market, authorized grower or authorized farm store for noncompliance with ((FMNP))WIC CVB, WIC FMNP, or SFMNP requirements.

(((11)))(14) "Eligible foods" means locally grown, unprocessed (except for washing), fresh, nutritious fruits, vegetables, and cut herbs.

(((12)))(15) "Electronic farmers market nutrition program (e-FMNP)" means the electronic benefits providing access to fresh fruits, vegetables, and cut herbs for WIC and senior participants.

(16) "FMNP" means the farmers((')) market nutrition program.

(((13)))(17) "Food instrument" means an e-WIC card or QR code used to obtain eligible foods.

(18) "Grower" means an individual who grows at least a portion of the produce that they sell at a farmers market or farm store that entered into an agreement with the department.

(19) "Local WIC agency" means the contracted agency or clinic where a ((client))participant receives WIC services and farmers((')) market ((checks))benefits.

(((14)))(20) "Locally grown" means Washington grown or grown in an adjacent county of Idaho or Oregon.

(((15)))(21) "Market manager" means an individual designated by the farmers((')) market management or board ((member)) who is responsible for overseeing the market's participation in the FMNP.

(((16)))(22) "Notice of violation" means a written document given to an authorized grower or market when the department determines the vendor has not complied with program requirements, federal WIC regulations, this chapter, or a contract or agreement.

(23) "Participant" means a senior, woman, infant, or child receiving WIC CVB, WIC FMNP, or SFMNP.

(24) "Point of sale" means the location the transaction occurred between the participant and the grower.

(25) "QR code" means a quick response code used to read a participant's benefits on the senior FMNP card or WIC card, or a sticker added to the e-WIC card for WIC participants, or a quick response code available on a mobile device.

(26) "Selection criteria" means the approved standards the department uses to select growers, markets, and farm stores for WIC FMNP, CVB, and SFMNP authorization.

(27) "SFMNP" means the senior farmers market nutrition program administered by the department of social and health services.

(28) "Suspension" means the immediate stoppage of WIC FMNP, CVB, and SFMNP payments to a grower or market as a result of ongoing compliance activities or lack of federal funding.

(29) "Trafficking" means the buying or exchanging of farmers((')) market ((checks))benefits for cash, drugs, or alcohol.

(((17)))(30) "WIC" ((or "WIC nutrition program")) means the federally funded special supplemental nutrition program for women, infants, and children ((administered in Washington state by the department of health)).

(((18) "Client" means a woman, infant, or child receiving FMNP benefits.))(31) "WIC FMNP" means the WIC farmers market nutrition program administered by the department.

(32) "WIC FMNP & SFMNP benefits" means a negotiable financial instrument issued by the FMNP to participants to purchase eligible foods. Also known as "WIC & SFMNP benefits."

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-020((How does an applicant farmers' market become authorized to participate in the farmer's market nutrition program?))Farmers market application requirements.

(1) To become authorized to participate in the FMNP, an applicant must:

(a) Apply as a farmers((')) market on a form provided by the department;

(b) Meet the selection criteria in subsection (2) of this section;

(c) Complete training on FMNP requirements; and

(d) Receive a contract or agreement from the department signed by both the department and the applicant.

(2) Farmers((')) market selection criteria. The applicant must:

(a) Have a designated market manager on-site during operating hours;

(b) Have been in operation at least one year. The one-year requirement may be waived by the department based on capacity and need;

(c) Be located within ((twenty))20 miles of the local WIC agency;

(d) Have at least five authorized growers participating in the farmers((')) market each year;

(e) ((Agree to))Comply with training sessions and monitor visits; and

(f) ((Agree to))Comply with all terms and conditions specified in the contract.

(3) The department is not required to authorize all applications. Selection is also based on community need.

(4) An authorized farmers((')) market must reapply at the end of the current contract; however, neither the department nor the participant has an obligation to renew a contract.

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-022((What is expected of an authorized farmers' market?))Authorized farmers market minimum requirements.

The authorized farmers' market must:

(1) Comply with the FMNP requirements and the terms and conditions of their contract;

(2) Accept training and technical assistance on FMNP requirements from department staff;

(3) Provide in person training to authorized growers, market employees and volunteers on FMNP requirements including, but not limited to: Eligible foods, ((check))electronic benefits redemption procedures, civil rights requirements, and the complaint process;

(4) Be accountable for the actions of employees and volunteers;

(5) Keep a current list of authorized growers, including the authorized grower's name((,))and business address((, telephone number, and crops to be sold during the farmers' market season. The authorized farmers' market must provide this list to the department on request));

(6) Ensure that WIC FMNP ((checks)), SFMNP benefits, and WIC CVBs are accepted only ((by authorized growers)) for locally grown eligible foods;

(7) ((Report to the department anyone that accepts FMNP checks without authorization from the department;

(8) Refuse to process any FMNP checks taken by unauthorized individuals;

(9) Ensure FMNP checks are stamped with the appropriate market and authorized grower identification numbers;

(10))) Ensure authorized growers have and display the "WIC Farmers((')) Market ((Checks))Benefits Welcome Here" sign each day;

(((11)))(8) Comply with federal and state nondiscrimination laws;

(((12)))(9) Ensure that ((clients))participants receive the same courtesies as other customers;

(((13)))(10) Provide the department, upon request, with any information it has available regarding its participation in the WIC FMNP, WIC CVB, and SFMNP;

(((14)))(11) Keep ((client))participant information confidential;

(((15)))(12) Allow the department to monitor the authorized farmers((')) market for compliance with FMNP requirements;

(((16)))(13) Notify the department immediately if authorized farmers((')) market operations cease; and

(((17)))(14) Notify the department immediately of any authorized farmers((')) market, authorized grower or authorized farm store suspected of noncompliance with WIC FMNP, WIC CVB, and SFMNP requirements.

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-025((How does an applicant grower become authorized to participate in the farmers' market nutrition program?))Grower application requirements.

(1) To become authorized to participate in the WIC FMNP, WIC CVB, and WIC SFMNP an applicant ((must))shall:

(a) Apply as a grower on a form provided by the department;

(b) Meet the grower selection criteria in subsection (2) of this section;

(c) Complete training on WIC FMNP, WIC CVB, and SFMNP requirements provided by either an authorized farmers((')) market manager or the department; and

(d) Receive a contract from the department signed by both the department and the applicant.

(2) Grower selection criteria. The applicant ((must))shall:

(a) Grow a portion of the produce they have for sale;

(b) Have the ability to accept e-FMNP transactions at the point of sale;

(c) Sell locally grown produce at either the authorized farmers((')) market or the authorized farm store, or both as identified on the completed application; and

(((c)))(d) Agree to follow the terms and conditions of the grower contract.

(3) The department is not required to authorize all applications. Selection ((is also))may be based on community need as determined by the department.

(4) An authorized grower ((must))shall reapply at the end of the current contract; however, neither the department nor the participant has an obligation to renew a contract.

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-026((How does an applicant farm store become authorized to participate in the farmers' market nutrition program?))Farm store application requirements.

(1) To become authorized to participate in the WIC FMNP, WIC CVB, and SFMNP an applicant must:

(a) Apply as a farm store on a form provided by the department;

(b) Meet the farm store selection criteria in subsection (2) of this section;

(c) Complete training on WIC FMNP, WIC CVB, and SFMNP requirements provided by either an authorized farmers((')) market manager or the FMNP; and

(d) Receive a contract from the department signed by both the department and the applicant.

(2) Farm store selection criteria. The applicant must:

(a) Be located at the site of agricultural production and grow, at that location, a portion of the produce they have for sale;

(b) Have the ability to accept WIC FMNP, WIC CVB, and SFMNP transactions at the point of sale;

(c) Sell locally grown produce; and

(((c)))(d) Agree to follow the terms and conditions of the contract.

(3) An authorized farm store must reapply at the end of the current contract; however, neither the department nor the participant has an obligation to renew a contract.

(4) The department is not required to authorize all applicants. Priority for authorization will be given to applicants located in areas defined by the department without an authorized farmers((')) market.

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-028((What is expected of an authorized grower or an authorized farm store?))Authorized grower or authorized farm store—Minimum requirements.

The authorized grower or authorized farm store must:

(1) Comply with the WIC FMNP, WIC CVB, and SFMNP requirements and the terms and conditions of the contract;

(2) Accept training and technical assistance on WIC FMNP, WIC CVB, and SFMNP requirements and ensure that all persons working or volunteering with the authorized grower or at the authorized farm store at the location(s) specified in the contract are trained as well. Training may be provided by either a farmers((')) market manager or the department and includes, but is not limited to: Eligible foods, ((check))benefit processing and redemption procedures, civil rights requirements, and the complaint process;

(3) Be held accountable regarding WIC FMNP, WIC CVB, and SFMNP purchases and requirements for the actions of all persons working or volunteering with the authorized grower or at the authorized farm store at the location(s) specified in the contract;

(4) Accept ((FMNP checks))WIC FMNP, WIC CVB, and SFMNP benefits only for eligible foods;

(5) Accept ((FMNP checks))WIC FMNP, WIC CVB, and SFMNP benefits only at authorized farmers((')) markets or at authorized farm stores at the location(s) specified in the contract;

(6) ((Accept FMNP checks within the valid dates of the FMNP and redeem checks by the date imprinted on the check;

(7))) Display the "WIC Farmers((')) Market ((Checks))Benefits Welcome Here" sign when selling eligible foods at authorized farmers((')) markets and authorized farm stores;

(((8)))(7) Provide ((clients))participants with the full amount of product for the value of ((each FMNP check))the program transaction;

(((9)))(8) Charge ((clients))participants the same prices as other customers;

(((10)))(9) Make produce available to ((clients))participants that is the same quality as that offered to other customers;

(((11)))(10) Comply with federal and state nondiscrimination laws;

(((12)))(11) Treat ((clients))participants as courteously as other customers;

(((13)))(12) Cooperate with department staff in monitoring for compliance with WIC FMNP, WIC CVB, and SFMNP requirements and provide information on request;

(((14)))(13) Reimburse the department for mishandled ((FMNP checks))WIC FMNP, WIC CVB, and SFMNP benefits;

(((15)))(14) Not collect sales tax on ((FMNP check))WIC FMNP, WIC CVB, and SFMNP benefit purchases;

(((16) Not seek reimbursement from clients for checks not paid by the department;

(17)))(15) Not give cash back or tokens for purchases ((less than the value of the))with WIC FMNP ((checks)), WIC CVB, and SFMNP benefits; and

(((18)))(16) Not trade, barter, or otherwise use farmers((')) market ((checks))benefits to purchase foods from other growers or pay for market fees or other business costs.

(17) Maintain a business model that promotes business integrity. The department may investigate the business integrity of a WIC vendor or applicant at any time. In its determination of business integrity, the department's considerations will include, but are not limited to, the following:

(a) Providing complete and truthful information in the application, correspondence, and other documents requested by the department.

(b) Cooperating with department requests to complete WIC authorization or compliance activities.

(c) Providing business and financial documentation to the department upon request.

(d) Having no uncorrected violation(s) from a previous contracting period, current disqualification, or outstanding claims owed to the department.

(e) Disclosure of any third party, agent, or broker involved in any part of the application process.

(f) Disclosure of any broker of third parties.

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-030((What kind of foods can clients buy with farmers' market nutrition program checks?))Farmers market nutrition program eligible foods.

(1) ((Clients))Participants can use WIC FMNP ((checks)), WIC CVB, and SFMNP benefits to buy locally grown, unprocessed (except for washing), fresh fruits, vegetables, and cut herbs. SFMNP participants may purchase honey.

(2) Federal regulations do not allow ((clients))participants to buy the following items with WIC FMNP ((checks)), WIC CVB, and SFMNP benefits:

(a) Baked goods;

(b) Cheeses;

(c) Cider;

(d) Crafts;

(e) Dairy products;

(f) Dried fruits;

(g) Dried herbs;

(h) Dried vegetables;

(i) Edible flowers;

(j) Eggs;

(((j)))(k) Flowers((,));

(((k)))(l) Fruit juices;

(((l)))(m) Honey (allowed for SFMNP);

(((m)))(n) Jams;

(((n)))(o) Jellies;

(((o)))(p) Meats;

(((p)))(q) Nuts;

(((q)))(r) Potted herbs;

(((r)))(s) Seafood;

(((s)))(t) Seeds; and

(((t)))(u) Syrups.

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-040((What happens if an authorized farmers' market, authorized grower or authorized farm store does not comply with FMNP requirements?))Noncompliance with FMNP requirements by an authorized farmers market, authorized grower, or authorized farm store.

(1) Authorized farmers((')) markets, authorized growers or authorized farm stores who do not comply with ((FMNP requirements))federal WIC regulations, including those at 7 C.F.R. 248.16, this chapter, or a contract or agreement with the department are subject to sanctions, such as suspensions, civil monetary penalties, or disqualification. Prior to disqualification, the department must consider whether the disqualification would create undue hardships for ((clients))participants.

(2) Noncompliance includes, but is not limited to:

(a) Failing to display the "WIC Farmers((')) Market ((Checks))Benefits Welcome Here" sign each day when selling at authorized farmers((')) markets or authorized farm stores;

(b) Providing unauthorized food or nonfood items to ((clients))participants in exchange for the WIC FMNP ((checks)), WIC CVB, and SFMNP benefits;

(c) Charging the department for foods not received by the ((client))participant;

(d) Providing rain checks or credit to ((clients))participants in ((an))a WIC FMNP, WIC CVB, and SFMNP transaction;

(e) Giving change to ((clients if the purchase is less than the value of the FMNP check))participants for purchases made with WIC FMNP, WIC CVB, and SFMNP benefits;

(f) Accepting WIC FMNP ((checks without having a signed contract with the department;

(g) Accepting FMNP checks)), WIC CVB, and SFMNP benefits at unauthorized farmers((')) markets or unauthorized farm stores;

(((h)))(g) Collecting sales tax on ((FMNP))WIC FMNP, WIC CVB, and SFMNP purchases;

(((i)))(h) Seeking reimbursement after the transaction from ((clients))participants for ((checks))benefits not paid by the department; and

(((j)))(i) Violating the rules of this chapter or the provisions of the contract.

(3) Authorized farmers((')) markets, authorized growers, and authorized farm stores found in noncompliance will be notified by the department in writing.

(4) If an authorized farmers((')) market, authorized grower or authorized farm store is subsequently found in noncompliance for the same or a similar reason, the department may impose sanctions, such as civil monetary penalties or disqualification, without giving the opportunity to correct the problem.

(5) Denials of authorizations and disqualifications are effective upon receipt of the notice of violation. When the department notifies an authorized farmers((')) market, authorized grower or authorized farm store of ((a))any other pending adverse action that affects their authorization status in the ((FMNP))WIC FMNP, WIC CVB, and SFMNP, the department must mail written notice of violation at least ((fifteen))15 days before the effective date of the action. The notice of violation must state what action is being taken, the effective date of the action, and the procedure for requesting an appeal hearing.

(6) The department may deny payment to an authorized grower or an authorized farm store for mishandling ((FMNP checks))WIC FMNP, WIC CVB, and SFMNP benefits.

(7) The department may seek reimbursement from an authorized grower or authorized farm store for payments made on ((mishandled FMNP checks))ineligible transactions.

(8) Civil monetary penalties must be paid to the department within the time period specified in the notice of violation. The department may refer an authorized grower or authorized farm store who fails to pay within the specified time period to a commercial collection agency.

(9) An authorized farmers((')) market, authorized grower or authorized farm store that has been disqualified from the ((FMNP))program may reapply at the end of the disqualification period.

(10) Any trafficking in ((FMNP checks))WIC FMNP, WIC CVB, and SFMNP benefits in any amount must result in disqualification.

(11) An authorized farmers((')) market, authorized grower or authorized farm store who commits fraud or other unlawful activities ((are))is liable for prosecution according to ((FMNP))federal program regulations((. ())at 7 C.F.R. 248.10(k).(()))

(12) The department may sanction growers for violations of WIC CVB, FMNP, and SFMNP requirements in accordance with the sanction table in the grower agreement. A violation occurs when a grower does not comply with WIC CVB, FMNP, and SFMNP requirements during the course of a single transaction involving one or more WIC CVB, FMNP, and SFMNP transactions. Sanctions may include vendor disqualification, civil monetary penalties, or both.

AMENDATORY SECTION(Amending WSR 10-21-068, filed 10/15/10, effective 11/15/10)

WAC 246-780-060((How does an authorized farmers' market, authorized grower, an authorized farm store or an applicant appeal a department decision?))Appealing a department decision.

(1) Proceedings under this chapter shall be in accordance with chapter 246-10 WAC. If a provision of chapter 246-10 WAC conflicts with a provision of 7 C.F.R. 246.18, the federal regulation shall prevail.

(2) An authorized farmers((')) market, authorized grower, authorized farm store or an applicant has a right to appeal denial of payment, denial of an application, civil monetary penalty or disqualification from the ((FMNP. Expiration or nonrenewal of a contract is not subject to appeal))program.

(((2)))(3) If the action being appealed is a disqualification of an authorized farmers((')) market, the authorized farmers((')) market must cease processing farmers((')) market ((checks))benefits for all authorized growers effective the date specified in the ((sanction)) notice of violation.

(((3) If the action being appealed is a disqualification of an authorized grower or authorized farm store, the authorized grower or authorized farm store must cease accepting FMNP checks effective the date specified in the sanction notice. In addition, the authorized farmers' market must cease processing checks for the affected authorized grower. Payments must not be made for any FMNP checks submitted for payment during a period of disqualification.))

(4) The department may, at its discretion, permit the authorized farmers((')) market, authorized grower, or authorized farm store to continue participating in the ((FMNP))program pending the appeal hearing outcome. The ((authorized farmers' market,)) authorized grower or authorized farm store may be required to repay funds for ((FMNP checks))WIC FMNP, WIC CVB, and SFMNP benefits redeemed while waiting for the outcome of the hearing, depending on the hearing outcome.

(5) A request for an appeal hearing must be in writing and must:

(a) State the issue raised;

(b) Contain a summary of the authorized farmers((')) market's, authorized grower's, authorized farm store's or applicant's position on the issue, ((indicating))and indicate whether each charge is admitted, denied, or not contested;

(c) State the name and address of the authorized farmers((')) market, authorized grower, authorized farm store or applicant requesting an appeal hearing;

(d) State the name and address of the attorney representing the authorized farmers((')) market, authorized grower, authorized farm store or applicant if any;

(e) State the need for an interpreter or other special accommodations, if necessary; and

(f) Have a copy of the notice of violation from the department attached.

(6) A request for an appeal must be filed at the Department of Health, Adjudicative Clerk's Office, P.O. Box 47879, Olympia, WA 98504-7879. The request must be made within ((twenty-eight))28 days of the date the authorized farmers((')) market, authorized grower, authorized farm store or applicant received the department's notice of violation.

(7) The decision concerning the appeal must be made within ((sixty))60 days from the date the request for an appeal hearing was received by the adjudicative clerk's office. The time may be extended if all parties agree.

OTS-5697.1

AMENDATORY SECTION(Amending WSR 21-22-092, filed 11/2/21, effective 12/3/21)

WAC 196-09-130Board member limitations—Contract selection.

(1) When a member of the board of registration for professional engineers and land surveyors (board) is beneficially interested, directly or indirectly, in a contract, sale, lease, purchase or grant that may be made by, through, or is under the supervision of the board in whole or in part, or when the member accepts, directly or indirectly, any compensation, gratuity, or reward from any other person beneficially interested in such contract, sale, lease, purchase or grant, the member must:

(a) Exclude ((him or herself))themselves from the board discussion regarding the specific contract, sale, lease, purchase or grant;

(b) Exclude ((him or herself))themselves from the board vote on the specific contract, sale, lease, purchase or grant; and

(c) Refrain from attempting to influence the remaining board members in their discussion and vote regarding the specific contract, sale, lease, purchase or grant.

(2) The prohibition against discussion set forth in sections (a) and (c) may not prohibit the member of the board from using ((his or her))their general expertise to educate and provide general information on the subject area to the other members.

AMENDATORY SECTION(Amending WSR 21-22-092, filed 11/2/21, effective 12/3/21)

WAC 196-09-131Board member limitations—Board actions.

(1) When a member of the board of registration for professional engineers and land surveyors (Board) either owns a beneficial interest in or is an officer, agent, employee or member of an entity or individual, which is subject to a board action, the member must:

(a) Recuse ((him or herself))themselves from the board discussion regarding the specific action;

(b) Recuse ((him or herself))themselves from the board vote on the specific action; and

(c) Refrain from attempting to influence the remaining board members in their discussion and vote regarding the specific action.

(2) The prohibition against discussion and voting set forth in sections (a) and (c) may not prohibit the member of the board from using ((his or her))their general expertise to educate and provide general information on the subject area to the other members.

(3) "Board action" may include any of the following:

(a) An investigation or adjudicative proceeding;

(b) Application or submission;

(c) Request for a ruling or other determination decision, finding, ruling, or order; or

(d) Monetary grant, payment, or award.

AMENDATORY SECTION(Amending WSR 21-22-092, filed 11/2/21, effective 12/3/21)

WAC 196-09-135Reporting of board member recusal.

If exclusion or recusal occurs pursuant to WAC 196-09-130 or 196-09-131, the member of the board should disclose to the public the reasons for ((his or her))their exclusion or recusal from any board action whenever it occurs. The board staff should record each instance of exclusion or recusal and the basis for it in the minutes of the board meetings.

AMENDATORY SECTION(Amending WSR 21-22-092, filed 11/2/21, effective 12/3/21)

WAC 196-09-150Public records.

All public records of the board are available for public inspection and copying pursuant to these rules and applicable state law (chapter

42.56 RCW), as follows:

(1) Inspection of records. Public records are available for inspection and copying during normal business hours of the office of the Washington state board of registration for professional engineers and land surveyors. Records may be inspected at the board's office when the requestor has been notified of the availability of the requested documents and an appointment is made with the public records officer.

(2) Records index. An index of public records, consisting of the retention schedules applicable to those records, is available to members of the public at the board's office.

(3) Organization of records. The board maintains its records in a reasonably organized manner. The board will take reasonable actions to protect records from damage and disorganization. A requestor shall not take original records from the board's office. A variety of records are also available on the board's website at https://brpels.wa.gov/. Requestors are encouraged to view the documents available on the website prior to submitting a public records request.

(4) Making a request for public records.

(a) Any person wishing to inspect or obtain copies of public records should make the request using the board's public records request form available on the board's website or in writing by letter or email addressed to the public records officer. Written request must include the following information:

(i) Date of the request.

(ii) Name of the requestor.

(iii) Address of the requestor and other contact information, including telephone number and any email addresses.

(iv) Clear identification of the public records requested to permit the public records officer or designee to identify and locate the records.

(b) The public records officer may also accept requests for public records by telephone or in person. If the public records officer or designee accepts an oral or telephone request, ((he or she))they will confirm receipt of the request and the details of the records requested, in writing, to the requestor.

(c) If the requests received in (a) or (b) of this subsection are not sufficiently clear to permit the public records officer to identify the specific records requested, the public records officer will request clarification from the requestor in writing.

(d) If the requestor wishes to have copies of the records made instead of simply inspecting them, ((he or she))they should make that preference clear in the request. Copies will be made by the board's public records officer or designee.

(e) When fulfilling public records requests, the board will perform its public records responsibilities in the most expeditious manner consistent with the board's need to fulfill its other essential functions.

(f) By law, certain records and/or specific content of any specific record or document may not be subject to public disclosure. Accordingly, a reasonable time period may occur between the date of the request and the ability of the public records officer to identify, locate, retrieve, remove content not subject to disclosure, prepare a redaction log that includes the specific exemption, a brief explanation of how the exemption applies to the records or portion of the records being withheld, and produce the records for inspection and/or copying. The requestor will be kept informed of the expected delivery timetable.

(g) If the request includes a large number of records, the production of the records for the requestor may occur in installments. The requestor will be informed, in writing, of the board's anticipated installment delivery timetable.

(h) In certain instances, the board may notify affected third parties to whom the record relates. This notice allows the affected third party to seek an injunction within ((fifteen))15 days from the date of the written notice. The notice further provides that release of the records to the requestor will be honored unless timely injunctive relief is obtained by the affected third party on or before the end of the ((fifteen))15-day period.

(i) Requests for lists of credentialed individuals by educational organizations and professional associations: In order to obtain a list of individuals under the provisions of RCW

42.56.070(8), educational organizations and professional associations must provide sufficient information to satisfy the board that the requested list of individuals is primarily for educational and professionally related uses.

Board forms are available on the board's website or upon request.