(1) Introduction. Chapter 82.59 RCW establishes a limited sales and use tax deferral program. The purpose of the program is to encourage the conversion of underutilized commercial property to multifamily housing units in targeted urban areas to increase affordable housing.

(a) Deferral program. This deferral program allows the legislative authorities of cities under chapter 82.59 RCW to authorize a sales and use tax deferral for an investment project within the city if that legislative authority finds that there are significant areas of underutilized commercial property and a lack of affordable housing within that city.

(b) Administration. This rule provides guidance regarding how the department will determine whether and to what extent an applicant qualifies for a state and local sales and use tax deferral under chapters 82.08, 82.12, 82.14, and 81.104 RCW on each eligible investment project. The department may not accept applications for deferral after June 30, 2034.

(c) Examples. Examples found in this rule identify a number of facts and then state a conclusion. These examples should be used only as a general guide. The tax results of other situations must be determined after a review of all facts and circumstances.

(2) Definitions. For the purposes of this rule, the following definitions will apply:

(a) "Affordable housing" means:

(i) Homeownership housing intended for owner occupancy to low-income households whose monthly housing costs, including utilities other than telephone, do not exceed 30 percent of the household's monthly income;

(ii) "Rental housing" for low-income households whose monthly housing costs, including utilities other than telephone, do not exceed 30 percent of the household's monthly income.

(b) "Applicant" means an owner of commercial property.

(c) "City" means any city or town, including a code city.

(d) "Conditional recipient" means an owner of commercial property granted a conditional certificate of program approval under chapter 82.59 RCW, which includes any successor owner of the property.

(e)(i) "Eligible investment project" means an investment project that is located in a city and receiving a conditional certificate of program approval from the legislative authority of that city.

(ii) To qualify as an "eligible investment project" under this program, the property in question must be an "underutilized commercial property" that will be converted to primarily multifamily housing units, with at least 10 percent of the units rented or sold as affordable housing to low-income households.

(iii) In a mixed-use project, only the ground floor of a building may be used for commercial purposes with the remainder dedicated to multifamily housing units.

(iv) Chapter 82.59 RCW contemplates only investment projects that convert existing underutilized commercial properties into multifamily housing to be eligible for deferral. The demolition of an existing structure to be replaced by a new building for multifamily housing does not qualify for the deferral.

(f) "Governing authority" means the local legislative authority of a city having jurisdiction over the property for which a deferral may be granted under chapter 82.59 RCW. The governing authority implements the sales and use tax deferral program for its city.

(g) "Household" means a single person, family, or unrelated persons living together.

(h)(i) "Initiation of construction" means the date that a building permit is issued under the building code adopted under RCW 19.27.031 for construction of the qualified building if the underlying ownership of the building vests exclusively with the person receiving the economic benefit of the deferral.

(ii) "Initiation of construction" does not include soil testing, site clearing and grading, site preparation, or any other related activities that are initiated before the issuance of a building permit for the construction of the foundation of the building.

(iii) If the investment project is a phased project, "initiation of construction" applies separately to each phase.

(i)(i) "Investment project" means an investment in multifamily housing, including labor, services, and materials incorporated in the planning, installation, and construction of the project. "Investment project" includes investment in related facilities such as playgrounds and sidewalks as well as facilities used for business use for mixed-use development.

(ii) Related facilities of investment projects may also include, but are not limited to, the following:

• Driveways, parking lots, covered parking structures;

• Fitness facilities for residents (e.g., gyms, pools, recreational courts, bicycle storage areas);

• Laundry areas;

• Landscaping (does not include activities initiated prior to issuance of a building permit);

• Dining facilities for residents;

• Cooking facilities for residents;

• Event spaces for use by residents;

• Lobbies and/or elevators to access residences and commercial spaces;

• Conference rooms and other business facilities (e.g., leasing office, communal office space for use by residents);

• Dog runs/parks;

• Residential storage areas;

• Electric vehicle charging stations for residents;

• Permanent security fencing and/or gates for the project;

• Mailbox stations;

• Spaces used to manage and maintain the project (e.g., tool shed);

• Facilities used for business use in mixed-use development; or

• Other facilities approved by the department on a case-by-case basis.

(j) "Low-income household" means a single person, family, or unrelated persons living together whose adjusted income is at or below 80 percent of the median family income adjusted for family size, for the county, city, or metropolitan statistical area, where the project is located, as reported by the United States Department of Housing and Urban Development.

(k) "Multifamily housing" means a building or group of buildings having four or more dwelling units not designed or used as transient accommodations and not including hotels and motels. Multifamily units may result from the rehabilitation or conversion of vacant, underutilized, or substandard buildings to multifamily housing. To be eligible for deferral under chapter 82.59 RCW, multifamily housing units must be part of an "eligible investment project" per subsection (2)(e) of this rule.

(l) "Owner" means the property owner of record.

(m)(i) "Underutilized commercial property" means an entire property, or portion thereof, currently used or intended to be used by a business for retailing or office-related or administrative activities. If the property is used partly for a qualifying use and partly for other purposes, the applicable tax deferral must be determined by apportionment of the costs of construction under this rule.

(ii) Areas of the property that are outside of the building or structure defined as an "underutilized commercial property" may qualify only if they are used for retailing, office-related, or administrative activities.

(iii) The department will generally presume that vacant land does not qualify. To rebut this presumption, the applicant must provide adequate, material substantiation to show that the property was used or was intended to be used for a qualifying use.

(3) What types of property may be classified as "underutilized commercial property" eligible for the sales and use tax deferral program?

(a) An "underutilized commercial property" must currently be used or "intended to be used" for one or more of the following "qualifying uses": Retailing activities, office-related activities, or administrative activities.

(i) "Qualifying use" means the use or intended use of property, or portions thereof, for retailing, office-related, and administrative activities, collectively referred to in this rule as "qualifying activities."

(ii) "Qualifying activities" include selling goods and services to customers for their consumption, and professional, clerical, or administrative activities such as human resources, accounting, legal, sales and marketing, or executive management activities.

(A) Examples of qualifying activities that are eligible for deferral include, but are not limited to: The use of copy rooms, employee offices, reception areas, office libraries, storage rooms, conference rooms, call centers, and/or sales activities.

(B) The following nonexclusive list of activities are not considered to be qualifying activities and are, therefore, not eligible for deferral: Manufacturing, wholesaling, warehousing, and similar activities.

(b)(i) "Intended to be used" means that the underutilized commercial property is expected to be used for "qualifying uses" (i.e., retailing, office-related and administrative activities), at the time of application to the city for conditional approval. For an applicant to establish that a property is intended to be used for a "qualifying use," the applicant must include adequate substantiation with their application to the department that shows this intent. Adequate substantiation may include, but is not necessarily limited to, the following: Blueprints or site plans, current or historical zoning, building permits, marketing materials, leasing agreements, sales agreements, promotional materials, or similar documents showing the intended use of the property is for a "qualifying use." Some documents may be insufficient by themselves to show intent, but in combination with other documentation may be sufficient to adequately substantiate intent.

(ii) For property with existing structures and property already under commercial development, the department will review the substantiation provided to determine if it adequately shows intent to use the property for a qualifying purpose.

Example 1: Underutilized commercial property currently used for qualifying activities.

Facts: Applicant currently leases commercial property to a tenant that uses the entire property for their restaurant business. The property has a kitchen, dining area, and an office area used for accounting and other managerial activities of the restaurant. The applicant's lease with the tenant establishes that the property will be used for this purpose.

Result: Presuming all other requirements of the statute are met, applicant's property qualifies as underutilized commercial property as the applicant has provided adequate substantiation that the entire property is being used for a qualifying use. Restaurant activities are qualifying activities as they involve the sale of services to an ultimate consumer. The tenant uses the remaining areas of the property to conduct or manage its restaurant business, so these other areas also qualify because the space is being used for eligible qualifying activities.

Example 2: Underutilized commercial property intended to be used for qualifying activities.

Facts: Applicant has a commercial building that is currently vacant, but applicant has previously leased the entire property to other businesses for use as office space. Applicant's marketing materials for the property promote the building as containing numerous offices, meeting areas, storage rooms, and a call center.

Result: Presuming all other requirements of the statute are met, applicant's building qualifies as underutilized commercial property as the applicant has provided adequate substantiation that the entire property is intended to be used for eligible qualifying activities.

Example 3: Underutilized commercial property under construction to be used for qualifying activities.

Facts: Applicant is in the process of constructing a commercial property. While construction is not complete, original blueprints and marketing materials used for promotion purposes demonstrate that the property is entirely comprised of meeting rooms, space for cubicles and offices, a mail room, and a reception area.

Result: Presuming all other requirements of the statute are met, applicant's property qualifies as underutilized commercial property as the applicant has provided adequate substantiation that the entire property is intended to be used for eligible qualifying activities.

Example 4: Vacant land marketed as being usable for qualifying activities.

Facts: Applicant owns a vacant lot and plans to sell the entire property to a developer. The marketing and promotional materials for the vacant lot provide that the site may be used for qualifying activities.

Result: Applicant's property does not qualify as underutilized commercial property because it is a vacant lot. The marketing and promotional materials do not adequately substantiate the intent that the property will be used for one or more eligible "qualifying activities."

(4) Application to the department is required. After receiving a conditional certificate from the local jurisdiction, but before the initiation of the construction of the investment project, recipients of a conditional certificate must submit an initial application to the department.

(a) How does a conditional recipient obtain an application? Application forms may be obtained from the department's website at dor.wa.gov, or by contacting the department at 360-534-1443. Applications approved by the department under chapter 82.59 RCW are not confidential and are subject to disclosure.

(b) What information does an application to the department need to include? Applicants must include the following information and materials with their application to the department:

(i) The property owner's information;

(ii) The contact person for the investment project;

(iii) The location of the investment project (including the address and parcel number);

(iv) A detailed description of the property as it currently exists and the square footage of the property that is currently used, or intended to be used, for a "qualifying use" prior to conversion to multifamily housing. The description should include the building or buildings to be remodeled, other structures, parking, and other related facilities. The department may request a schematic of the site, including square footage, and may tour the property;

(v) A detailed description of the planned investment project (which must be multifamily housing and affordable housing), including estimated square footage;

(vi) A copy of the conditional certificate of approval issued by the local jurisdiction;

(vii) Substantiation that the applicant has a current active business license for both the city and the state (as applicable);

(viii) Estimated investment project construction costs (both qualifying and nonqualifying);

(ix) Estimated time schedules for initiation of construction, completion, and operation;

(x) Waiver of the four-year limitation under RCW 82.32.100 by the conditional recipient; and

(xi) Any additional information requested by the department.

(c) What if the project involves multiple qualified buildings? For an investment project that involves multiple buildings, a conditional recipient must submit a separate application before the initiation of construction for each building.

(d) When will a conditional recipient receive a response from the department? The department has 60 days to approve or deny a complete application that has been submitted to the department for approval.

(e) What happens if the conditional recipient's application is approved? If approved, the department will issue a tax deferral certificate for each eligible investment project and notify the conditional recipient of the documentation that the conditional recipient must retain to substantiate the amount of sales and use tax actually deferred. Such documentation may include, but is not limited to: Purchase invoices such as accounts payable and receipts, the sales and use tax deferral certificate(s), other supporting documentation such as building permits and construction contracts, and any other documentation the department may advise the conditional recipient to retain.

(f) What happens if the conditional recipient's application is denied? If denied, a conditional recipient may request a review of the department's denial of their tax deferral application through the department's informal administrative review process within 30 days of the date of the denial notice. See WAC 458-20-100. The review of a denied deferral application under WAC 458-20-100 is not appealable to the board of tax appeals under RCW 82.03.190.

Example 5: Application requirements prior to initiation of construction.

Facts: Applicant owns a three-story building where the ground floor is being used as a coffee shop and the second and third floors are being used as office space. Applicant plans to convert the second and third floors of the building into multifamily housing, but intends to renovate the coffee shop on the ground floor. Applicant has divided the project into phases with the first being the renovation work on the coffee shop. The applicant requests guidance from the department as to whether they may apply for building permits for the coffee shop renovation before submitting their deferral application to convert the second and third floors into multifamily housing units.

Result: Applicant's renovation of the coffee shop does not qualify for deferral under chapter 82.59 RCW as applicant is not converting the existing retail space into multifamily housing units. However, presuming all other requirements of the statute are met, converting the second and third floors to multifamily housing units may be eligible for deferral as this space is currently being used for "qualifying activities."

To maintain eligibility for the potentially qualifying portions of the project, applicant cannot initiate construction on any eligible portion of the project (including what may be considered related facilities) until the applicant has submitted their application to the department. However, because "initiation of construction" applies to each phase of a project separately, the applicant may initiate construction for the coffee shop renovation phase of the project before submitting their application to the department without invalidating the potentially qualifying portions of the project that will occur in a separate phase of construction.

(5) What happens after the department approves the conditional recipient's application? The department will issue a sales and use tax deferral certificate for state and local sales and use taxes due under chapters 82.08, 82.12, 82.14, and 81.104 RCW for each eligible investment project. The department will state on the certificate the estimated amount of qualifying taxable purchases eligible for deferral and the time period for which the certificate is valid.

(6) How should a tax deferral certificate be used? A tax deferral certificate issued under this program is only valid during active construction of a qualified investment project and expires the day the local jurisdiction issues a certificate of occupancy for the investment project for which a deferral certificate was issued. A conditional recipient may only use the deferral certificate to defer sales and use taxes due on eligible investment projects.

(7) When is apportionment of underutilized commercial properties appropriate? A deferral of sales or use tax under this program is only allowable for underutilized commercial properties that are currently used or are intended to be used for a "qualifying use." If a portion of an applicant's property is not used, or intended to be used, for a qualifying use at the time of application to the governing authority for conditional approval, that portion does not qualify for tax deferral treatment and the underutilized commercial property must be apportioned.

(a) How does the department apportion qualifying and nonqualifying underutilized commercial property? The apportionment method used depends on the status of the eligible investment project.

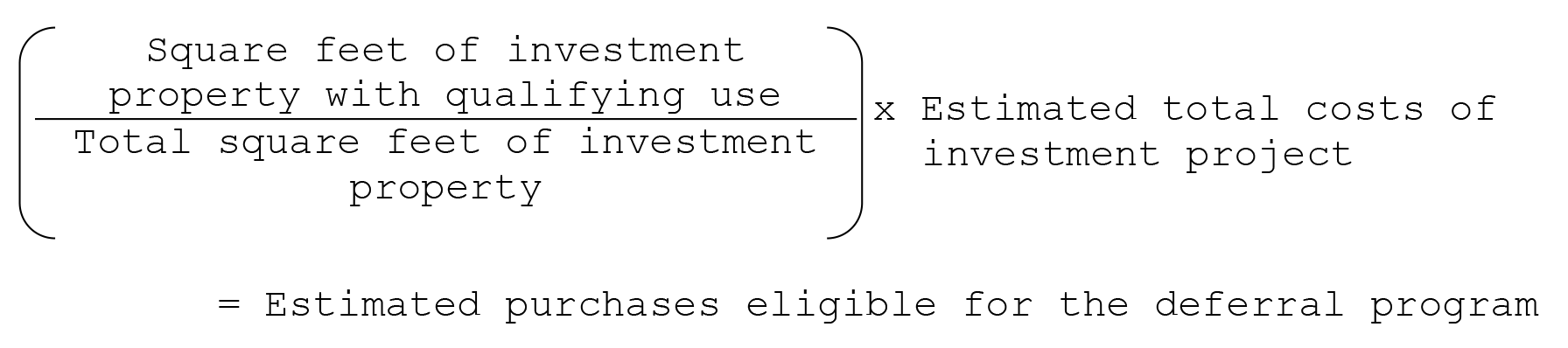

(i) Deferral estimate (required before issuance of deferral certificate): The department will use the estimated figures in the conditional recipient's application to the department to provide a preliminary estimate of the amount of costs for which taxes may be deferred. The department will use the following ratio to apportion an eligible investment property:

|

(ii) Final deferred tax amount (required after investment project is operationally complete): The department will calculate the final deferred tax amount using the conditional recipient's actual construction costs for eligible purposes (multifamily housing) in the investment project. The department will determine the actual costs eligible for deferral by touring the operationally complete investment project and auditing the conditional recipient's records. The final deferral figure will supersede the department's preliminary deferral estimate.

Example 6: Apportionment of qualifying and nonqualifying activities.

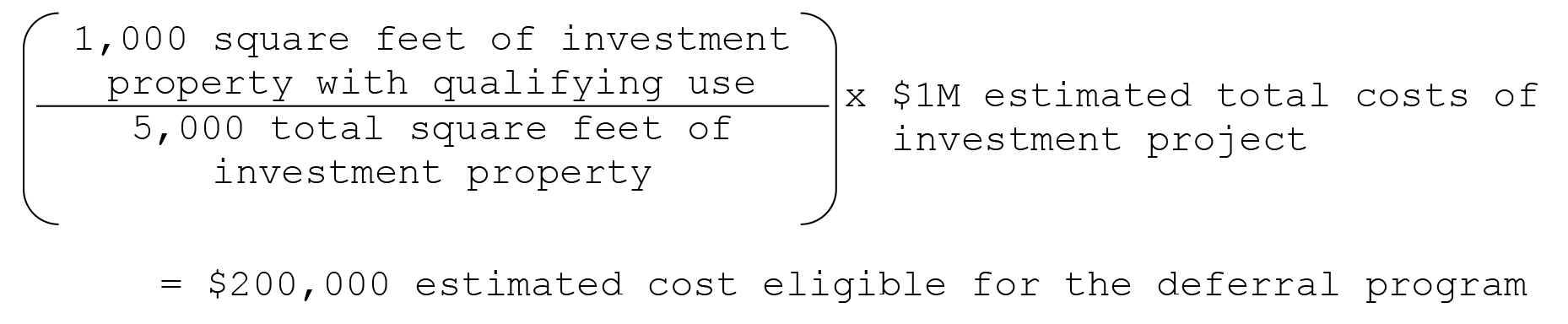

Facts: An applicant seeks a deferral to convert a church into multifamily housing. Of the total 5,000 square feet of space in the church, a 4,000 square foot area is used for religious activities and a 1,000 square foot area is used by staff for administrative activities, such as accounting, organizing community events, and other administrative activities. The applicant estimates that the project will cost about $1,000,000. The combined sales/use tax rate at this location is 9%.

Result: Presuming all other requirements of the statute are met, the 1,000 square feet of space used for "qualifying activities" is eligible for deferral, but the remaining 4,000 square feet are not because space used for religious services is not an eligible qualifying use. In approving the application, the department will estimate the costs that may be deferred as follows:

|

1,000 square feet of the investment property with a qualifying use is divided by the 5,000 total square footage of the property (which equals 20%). 20% is multiplied against the estimated cost of $1,000,000 to equal $200,000. When the department issues the deferral certificate to the applicant, the certificate will state an estimated amount of $200,000 for qualifying purchases. Although it will not appear on the deferral certificate, the estimated tax eligible for the deferral will be $18,000 (9% tax rate multiplied by $200,000 of estimated costs).

(b) When will the department certify the final amount of sales and use taxes that qualify for deferral? Within 30 days after the local jurisdiction issues the conditional recipient with a certificate of occupancy for the eligible investment project, the conditional recipient must notify the department in writing that the eligible investment project is operationally complete. The project is operationally complete once it can be used for its intended purpose as described in the application (primarily multifamily housing with at least 10 percent affordable housing). Upon receiving such notification, the department will certify the project and determine the final amount of sales and use taxes that qualify for deferral. As a part of the certification process, the department will independently verify the areas of the property that qualify for deferral and qualifying purchases. The governing authority of the city is not required to notify the department that the investment project is operationally complete, but this communication is encouraged to facilitate timely administration.

(c) What happens if the department determines that purchases are not eligible for deferral? If the department determines that purchases are not eligible for deferral, the conditional recipient is required to pay the sales and use tax on purchases made for the project and the department is required to assess interest, but not penalties, on ineligible purchases. Conditional recipients who are denied the tax deferral may pursue an informal administrative review of the department's decision, as provided in WAC 458-20-100.

(8) What types of projects are eligible for deferral?

(a) Certain mixed-use projects may be eligible for deferral. Local jurisdictions may approve certain mixed-use projects (i.e., projects that have both a commercial and residential component). However, commercial activity must be restricted to the ground floor of the building and the remainder of the building must be used for multifamily housing units. "Ground floor" means the building floor that is level with the street. Points of access to both the commercial and residential components of a mixed-use project that are not on the ground floor may qualify as "related facilities" to an eligible investment project. Applicants are encouraged to request a letter ruling from the department prior to submitting their application to determine if the facilities in their investment project may qualify for deferral.

Example 7: Related facilities in mixed-use development projects.

Facts: Applicant applies for a conditional certificate of program approval for an existing mixed-use building. The ground floor of the building currently has several shops and a day care facility while the remainder of the building is used entirely for office-related activities. The day care facility has a fenced outdoor playground for the children. The applicant plans to convert the ground floor to a restaurant and renovate the outdoor playground to be used by the multifamily housing residents. The applicant reaches out to the department to clarify whether purchases for the outdoor playground qualify for deferral.

Result: Presuming all other requirements of the statute are met, purchases for the outdoor playground qualify for tax deferral. This is because the term "investment project" also includes investment in related facilities. In this case, the fenced outdoor playground would be related to the multifamily housing as it is for the use of the residents, and any renovation costs for the outdoor playground would be deferrable.

(b) Are additions eligible for deferral? The eligibility of an addition will depend on the facts and circumstances at issue. All areas of an investment project must qualify for the deferral, including any addition. Otherwise, areas that do not qualify for the deferral will be apportioned out under subsection (7) of this rule. If an applicant is unsure whether their project qualifies for the deferral, they may contact the department at 360-534-1443, or email at DORdeferrals@dor.wa.gov.

Example 8: Addition to previously renovated commercial building.

Facts: Applicant applies for a conditional certificate of program approval for a renovated commercial building that previously qualified for tax deferral under this program. The building, previously used for office-related activities, is now fully comprised of several multifamily housing units. However, the applicant would like to expand the current building to add additional units. Applicant reaches out to the department to clarify whether purchases for an addition to this property may qualify for deferral.

Results: Purchases for an addition to this property do not qualify for deferral. This is because the property is no longer used or intended to be used for a "qualifying use" as it has already been fully converted to multifamily housing units. As such, this building no longer qualifies as an underutilized commercial property for the purposes of tax deferral under this program.

(9) What should a conditional recipient do if its investment project reaches the estimated costs but the project is not yet operationally complete? An applicant must provide the department with the estimated cost of the investment project at the time the application is made. The conditional recipient must notify the department, in writing, when the value of the investment project reaches the estimated cost as stated on their tax deferral certificate. If, at that time, the project is not operationally complete, the conditional recipient may request from the department an amended certificate stating a revised estimated cost, along with an explanation for the estimated cost increase. Requests must be mailed or emailed to the department at DORdeferrals@dor.wa.gov.

(10) What should a conditional recipient do if their investment project reaches the completion date but the project is not yet operationally complete? If an investment project has reached the completion date and the project is not operationally complete, the conditional recipient may request from the city an amended conditional certificate of program approval stating a revised completion date along with an explanation for the new completion date. City approved extensions must be mailed or emailed by the city to the department prior to the expiration date on the conditional recipient's sales and use tax deferral certificate. The conditional recipient must then request from the department an amended sales and use tax deferral certificate stating the revised completion date. Requests must be mailed or emailed to the department at DORdeferrals@dor.wa.gov.

(11) What should a certificate holder do when its investment project is operationally complete? Within 30 days after the local jurisdiction issues the conditional recipient with a certificate of occupancy for the eligible investment project, the conditional recipient must notify the department in writing that the eligible investment project is operationally complete. The project is operationally complete once it can be used for its intended purpose as described in the application. The department will certify the qualifying areas and costs and the date when the project became operationally complete. It is important to remember that annual tax performance report reporting requirements begin the year following the operationally complete date, even though the audit certification may not be complete. If a conditional recipient maintains the property for qualifying purposes for at least 10 years after issuance of a certificate of occupancy, the conditional recipient is not required to repay the deferred sales and use taxes.

(12) Is a recipient of a tax deferral required to submit an annual tax performance report? RCW 82.32.534 requires each recipient of a tax deferral to complete an annual tax performance report by May 31st following the year in which the project is operationally complete, and each year thereafter for 10 years, regardless of whether the department has audited the project. For example, if the certificate of occupancy is issued July 31, 2024, then the first annual tax performance report is due May 31, 2025. The reports need to be submitted for tax years 2024-2034. For more information on the requirements to file annual tax performance reports refer to WAC 458-20-267.

(13) What happens if the conditional recipient is no longer in compliance with the requirements of this program? If a conditional recipient voluntarily opts to discontinue compliance with the requirements of chapter 82.59 RCW, the conditional recipient must notify the city and the department within 60 days of the change in use or intended discontinuance. After the department has issued a deferral certificate, and the conditional recipient has been issued a certificate of occupancy by the city, if the city finds that the conditional recipient is no longer in compliance with program requirements, the city must notify the department and all deferred sales and use taxes are immediately due and payable. Interest will be assessed retroactively to the date of deferral. Note that within 30 days after the issuance of the certificate of occupancy, the conditional recipient must file with the city statements and information attesting to the qualification of the project as described in RCW 82.59.070(1). Within 30 days of the city's receipt of these statements from the conditional recipient, the city must determine and notify the conditional recipient as to whether the work completed and the affordable housing to be offered are consistent with the application and the contract approved by the city and may be eligible for tax deferral under chapter 82.59 RCW. If at any point the city finds that the investment project no longer qualifies for tax deferral, the city must notify the department of the noncompliance in writing and all deferred sales and use taxes are immediately due and payable. The department is required to assess interest, but not penalties, retroactively to the deferral date on the conditional recipient's tax certificate. Conditional recipients who are denied the tax deferral may pursue an informal administrative review of the department's decision, as provided in WAC 458-20-100.

(14) How long must a conditional recipient stay in compliance to avoid repayment of deferred taxes? If a conditional recipient maintains the property for qualifying purposes for at least 10 years after issuance of the certificate of occupancy, the conditional recipient is not required to repay the deferred sales and use taxes.

(15) Is debt extinguishable because of insolvency or sale? Insolvency or other failure of the conditional recipient does not extinguish the debt for deferred taxes nor will the sale, exchange, or other disposition of the conditional recipient's business extinguish the debt for deferred taxes.

(16) Does transfer of ownership terminate the tax deferral? Transfer of ownership does not terminate the deferral. The deferral is transferable, subject to the successor meeting the eligibility requirements of chapter 82.59 RCW. The transferor of an eligible property must promptly notify the department of the transfer and must provide all information necessary for the department to transfer the deferral. If the transferor fails to notify the department, then all deferred sales and use taxes are immediately due and payable with interest, which will be calculated retroactively back to the date of the deferral. Any person who becomes a successor to such investment project is liable for the full amount of any unpaid, deferred taxes under the same terms and conditions as the original recipient of the deferral. For additional information on successorship or quitting business refer to WAC 458-20-216.

(17) Can a conditional applicant also apply for other tax exemptions for multifamily housing? Yes. The owner of an underutilized commercial property may also apply for the multiple-unit housing property tax exemption program under chapter 84.14 RCW. Applicants who are receiving a property tax exemption under chapter 84.14 RCW should note that the amount of affordable housing units required for eligibility under this program is in addition to the affordability conditions in chapter 84.14 RCW.