(1) Introduction. This rule explains the application of the business and occupation (B&O) and retail sales taxes to interstate sales of tangible personal property.

(a) The following rules may also be helpful:

(i) WAC 458-20-178 Use tax and the use of tangible personal property.

(ii) WAC 458-20-193C Imports and exports—Sales of goods from or to persons in foreign countries.

(iii) WAC 458-20-193D Transportation, communication, public utility activities, or other services in interstate or foreign commerce.

(iv) WAC 458-20-19401 Minimum nexus threshold for apportionable receipts.

(b) This rule contains examples that identify a number of facts and then state a conclusion. These examples should be used only as a general guide. The tax results of all situations must be determined after a review of all the facts and circumstances.

(c) Tangible personal property. For purposes of this rule, the term "tangible personal property" means personal property that can be seen, weighed, measured, felt, or touched or that is in any other manner perceptible to the senses, but does not include steam, electricity, or electrical energy. It includes prewritten computer software (as such term is defined in RCW 82.04.215) in tangible form. However, this rule does not address electronically delivered prewritten computer software or remote access software.

(2) Scope of rule. In general, Washington imposes its B&O and retail sales taxes on sales of tangible personal property if the seller has nexus with Washington and the sale occurs in Washington. This rule explains the applicable nexus and place of sale requirements with respect to sales of tangible personal property. This rule does not cover sales of intangibles or services and does not address the use tax obligation of a purchaser of goods in Washington. For information on payment responsibilities for use tax see WAC 458-20-178.

(3) Organization of rule. This rule is divided into three parts:

(a) Part I – Nexus standards for sales of tangible personal property;

(b) Part II – Sourcing sales of tangible personal property; and

(c) Part III – Drop shipment sales.

Part I – Nexus Standards for Sales of Tangible Personal Property

(101) Introduction. A seller is subject to the state's B&O tax and retail sales tax with respect to sales of tangible personal property, if that seller has nexus. Washington applies specific nexus standards and thresholds that are used to determine whether a seller of tangible personal property has nexus. The nexus standards and thresholds described in this rule pertain only to sellers of tangible personal property. The remainder of Part 1 of this rule describes these nexus standards and thresholds and how they apply in the context of Washington's wholesaling and retailing B&O classifications and the retail sales tax.

(102) Physical presence nexus standard. A person who sells tangible personal property in a retail sale is deemed to have nexus with Washington if the person has a physical presence in this state, which need only be demonstrably more than the slightest presence. RCW 82.04.067(6). This standard applies to retail sales both in the retail sales tax and retailing B&O tax context.

(a) Physical presence. A person is physically present in this state if:

(i) The person has property in this state;

(ii) The person has one or more employees in this state;

(iii) The person, either directly or through an agent or other representative, engages in activities in this state that are significantly associated with the person's ability to establish or maintain a market for its products in Washington; or

(iv) The person is a remote seller as defined in RCW 82.08.052 and is unable to rebut the substantial nexus presumption for remote sellers set out in RCW 82.04.067 (6)(c)(ii).

(b) Property. A person has property in this state if the person owns, leases, or otherwise has a legal or beneficial interest in real or personal property in Washington.

(c) Employees. A person has employees in this state if the person is required to report its employees for Washington unemployment insurance tax purposes, or the facts and circumstances otherwise indicate that the person has employees in the state.

(d) In-state activities. Even if a person does not have property or employees in Washington, the person is physically present in Washington when the person, either directly or through an agent or other representative, engages in activities in this state that are significantly associated with the person's ability to establish or maintain a market for its products in Washington. It is immaterial that the activities that establish nexus are not significantly associated with a particular sale into this state.

For purposes of this rule, the term "agent or other representative" includes an employee, independent contractor, commissioned sales representative, or other person acting either at the direction of or on behalf of another.

A person performing the following nonexclusive list of activities, directly or through an agent or other representative, generally is performing activities that are significantly associated with establishing or maintaining a market for a person's products in this state:

(i) Soliciting sales of goods in Washington;

(ii) Installing, assembling, or repairing goods in Washington;

(iii) Constructing, installing, repairing, or maintaining real property or tangible personal property in Washington;

(iv) Delivering products into Washington other than by mail or common carrier;

(v) Having an exhibit at a trade show to maintain or establish a market for one's products in the state, except as described in subsection (102)(f) of this rule;

(vi) An online seller having a brick-and-mortar store in this state accepting returns on its behalf;

(vii) Performing activities designed to establish or maintain customer relationships including, but not limited to:

(A) Meeting with customers in Washington to gather or provide product or marketing information, evaluate customer needs, or generate goodwill; or

(B) Being available to provide services associated with the product sold (such as warranty repairs, installation assistance or guidance, and training on the use of the product), if the availability of such services is referenced by the seller in its marketing materials, communications, or other information accessible to customers.

(e) Remote sellers – Click-through nexus. Effective September 1, 2015, a remote seller as defined in RCW 82.08.052 is presumed to meet the physical presence nexus standard described in this subsection for purposes of the retail sales tax if the remote seller enters into an agreement with a resident of this state under which the resident, for a commission or other consideration, refers potential customers to the remote seller, whether by link on an internet website or otherwise, but only if the cumulative gross receipts from sales by the remote seller to customers in this state who are referred to the remote seller through such agreements exceeds ten thousand dollars during the preceding calendar year. For more information related to the presumption and how to rebut the presumption, see RCW 82.08.052 and 82.04.067 (6)(c)(ii).

(f) Trade convention exception. For the physical presence nexus standard described in this subsection, the department may not make a determination of nexus based solely on the attendance or participation of one or more representatives of a person at a single trade convention per calendar year in Washington state in determining if such person is physically present in this state for the purposes of establishing substantial nexus with this state. This does not apply to persons making retail sales at a trade convention in this state, including persons taking orders for products or services where receipt will occur at a later time in Washington state. RCW 82.32.531.

Definitions. The following definitions apply only to (f) of this subsection:

(i) "Not marketed to the general public" means that the sponsor of a trade convention limits its marketing efforts for the trade convention to its members and specific invited guests of the sponsoring organization.

(ii) "Physically present in this state" and "substantial nexus with this state" have the same meaning as provided in RCW 82.04.067.

(iii) "Trade convention" means an exhibition for a specific industry or profession, which is not marketed to the general public, for the purposes of:

(A) Exhibiting, demonstrating, and explaining services, products, or equipment to potential customers; or

(B) The exchange of information, ideas, and attitudes in regards to that industry or profession.

(103) Economic nexus thresholds. RCW 82.04.067 establishes substantial nexus thresholds that apply to persons who sell tangible personal property. For more information on the economic nexus thresholds, see WAC 458-20-19401.

Application to retail sales. Effective July 1, 2017, for B&O tax purposes, a person making retail sales taxable under RCW 82.04.250(1) or 82.04.257(1) is deemed to have substantial nexus with Washington if the person's receipts meet the economic nexus thresholds under RCW 82.04.067 (1)(c)(iii) and (iv). The receipts threshold is met if the person has more than two hundred sixty-seven thousand dollars of receipts (as adjusted by RCW 82.04.067(5)) from this state or at least twenty-five percent of the person's total receipts are in this state. For more information, see WAC 458-20-19401.

(104) Application of standards and thresholds to wholesale sales. The physical presence nexus standard described in subsection (102) of this rule, applies to wholesale sales for periods prior to September 1, 2015. Effective September 1, 2015, wholesale sales taxable under RCW 82.04.257(1) and 82.04.270 are subject to the RCW 82.04.067 (1) through (5) economic nexus thresholds. Wholesaling activities not taxable under RCW 82.04.257(1) and 82.04.270 remain subject to the physical presence nexus standard. For more information, see WAC 458-20-19401.

(105) Effect of having nexus.

(a) Retail sales. A person that makes retail sales of tangible personal property and meets either the physical presence nexus standard or whose receipts meet the economic nexus thresholds described in RCW 82.04.067 (1)(c)(iii) or (iv) is subject to B&O tax on that person's retail sales received in the state. In addition, a person that makes retail sales of tangible personal property and meets the physical presence nexus standard, including as described in subsection (102)(e) of this rule, is also responsible for collecting and remitting retail sales tax on that person's sales of tangible personal property sourced to Washington, unless a specific exemption applies.

(b) Wholesale sales. A person that makes wholesale sales of tangible personal property and has nexus with Washington (as described in subsection (104) of this rule) is subject to B&O tax on that person's wholesale sales sourced to Washington.

(106) Trailing nexus. Effective July 1, 2017, for B&O tax purposes, a person is deemed to have substantial nexus with Washington for the current year if that person meets any of the requirements in RCW 82.04.067 in either the current or immediately preceding calendar year. Thus, a person who stops the business activity that created nexus in Washington continues to have nexus in the calendar year following any calendar year in which the person met any of the requirements in RCW 82.04.067 (also known as "trailing nexus").

Prior to July 1, 2017, RCW 82.04.220 provided that for B&O tax purposes a person who stopped the business activity that created nexus in Washington continued to have nexus for the remainder of that calendar year, plus one additional calendar year.

The department of revenue applies the same trailing nexus period for retail sales tax and other taxes reported on the excise tax return.

(107) Public Law 86-272. Public Law 86-272 (15 U.S.C. Sec. 381 et. seq.) applies only to taxes on or measured by net income. Washington's B&O tax is measured by gross receipts. Consequently, Public Law 86-272 does not apply.

Part II – Sourcing Sales of Tangible Personal Property

(201) Introduction. RCW 82.32.730 explains how to determine where a sale of tangible personal property occurs based on "sourcing rules" established under the streamlined sales and use tax agreement. Sourcing rules for the lease or rental of tangible personal property are beyond the scope of this rule, as are the sourcing rules for "direct mail," "advertising and promotional direct mail," or "other direct mail" as such terms are defined in RCW 82.32.730. See RCW 82.32.730 for further explanation of the sourcing rules for those particular transactions.

(202) Receive and receipt.

(a) Definition. "Receive" and "receipt" mean the purchaser first either taking physical possession of, or having dominion and control over, tangible personal property.

(b) Receipt by a shipping company.

(i) "Receive" and "receipt" do not include possession by a shipping company on behalf of the purchaser, regardless of whether the shipping company has the authority to accept and inspect the goods on behalf of the purchaser.

(ii) A "shipping company" for purposes of this rule means a separate legal entity that ships, transports, or delivers tangible personal property on behalf of another, such as a common carrier, contract carrier, or private carrier either affiliated (e.g., an entity wholly owned by the seller or purchaser) or unaffiliated (e.g., third-party carrier) with the seller or purchaser. A shipping company is not a division or branch of a seller or purchaser that carries out shipping duties for the seller or purchaser, respectively. Whether an entity is a "shipping company" for purposes of this rule applies only to sourcing sales of tangible personal property and does not apply to whether a "shipping company" can create nexus for a seller.

(203) Sourcing sales of tangible personal property – In general. The following provisions in this subsection apply to sourcing sales of most items of tangible personal property.

(a) Business location. When tangible personal property is received by the purchaser at a business location of the seller, the sale is sourced to that business location.

Example 1. Jane is an Idaho resident who purchases tangible personal property at a retailer's physical store location in Washington. Even though Jane takes the property back to Idaho for her use, the sale is sourced to Washington because Jane received the property at the seller's business location in Washington.

Example 2. Department Store has retail stores located in Washington, Oregon, and in several other states. John, a Washington resident, goes to Department Store's store in Portland, Oregon to purchase luggage. John takes possession of the luggage at the store. Although Department Store has nexus with Washington through its Washington store locations, Department Store is not liable for B&O tax and does not have any responsibility to collect Washington retail sales tax on this transaction because the purchaser, John, took possession of the luggage at the seller's business location outside of Washington.

Example 3. An out-of-state purchaser sends its own trucks to Washington to receive goods at a Washington-based seller and to immediately transport the goods to the purchaser's out-of-state location. The sale occurs in Washington because the purchaser receives the goods in Washington. The sale is subject to B&O and retail sales tax.

Example 4. The same purchaser in Example 3 uses a wholly owned affiliated shipping company (a legal entity separate from the purchaser) to pick up the goods in Washington and deliver them to the purchaser's out-of-state location. Because "receive" and "receipt" do not include possession by the shipping company, the purchaser receives the goods when the goods arrive at the purchaser's out-of-state location and not when the shipping company takes possession of the goods in Washington. The sale is not subject to B&O tax or retail sales tax.

(b) Place of receipt. If the sourcing rule explained in (a) of this subsection does not apply, the sale is sourced to the location where receipt by the purchaser or purchaser's donee, designated as such by the purchaser, occurs, including the location indicated by instructions for delivery to the purchaser or purchaser's donee, as known to the seller.

(i) The term "purchaser" includes the purchaser's agent or designee.

(ii) The term "purchaser's donee" means a person to whom the purchaser directs shipment of goods in a gratuitous transfer (e.g., a gift recipient).

(iii) Commercial law delivery terms, and the Uniform Commercial Code's provisions defining sale or where risk of loss passes, do not determine where the place of receipt occurs.

(iv) The seller must retain in its records documents used in the ordinary course of the seller's business to show how the seller knows the location of where the purchaser or purchaser's donee received the goods. Acceptable proof includes, but is not limited to, the following documents:

(A) Instructions for delivery to the seller indicating where the purchaser wants the goods delivered, provided on a sales contract, sales invoice, or any other document used in the seller's ordinary course of business showing the instructions for delivery;

(B) If shipped by a shipping company, a waybill, bill of lading or other contract of carriage indicating where delivery occurs; or

(C) If shipped by the seller using the seller's own transportation equipment, a trip-sheet signed by the person making delivery for the seller and showing:

• The seller's name and address;

• The purchaser's name and address;

• The place of delivery, if different from the purchaser's address; and

• The time of delivery to the purchaser together with the signature of the purchaser or its agent acknowledging receipt of the goods at the place designated by the purchaser.

Example 5. John buys luggage from a Department Store that has nexus with Washington (as in Example 2), but has the store ship the luggage to John in Washington. Department Store has nexus with Washington, and receipt of the luggage by John occurred in Washington. Department Store owes Washington retailing B&O tax and must collect Washington retail sales tax on this sale.

Example 6. Parts Store is located in Washington. It sells machine parts at retail and wholesale. Parts Collector is located in California and buys machine parts from Parts Store. Parts Store ships the parts directly to Parts Collector in California, and Parts Collector takes possession of the machine parts in California. The sale is not subject to B&O or retail sales taxes in this state because Parts Collector did not receive the parts in Washington.

Example 7. An out-of-state seller with nexus in Washington uses a third-party shipping company to ship goods to a customer located in Washington. The seller first delivers the goods to the shipping company outside Washington using its own transportation equipment. Even though the shipping company took possession of the goods outside of Washington, possession by the shipping company is not receipt by the purchaser for Washington tax purposes. The sale is subject to B&O and retail sales tax in this state because the purchaser has taken possession of the goods in Washington.

Example 8. A Washington purchaser's affiliated shipping company arranges to pick up goods from an out-of-state seller at its out-of-state location, and deliver those goods to the Washington purchaser's Yakima facility. The affiliated shipping company has the authority to accept and inspect the goods prior to transport on behalf of the buyer. When the affiliated shipping company takes possession of the goods out-of-state, the Washington purchaser has not received the goods out-of-state. Possession by a shipping company on behalf of a purchaser is not receipt for purposes of this rule, regardless of whether the shipping company has the authority to accept and inspect the goods on behalf of the buyer. Receipt occurs when the buyer takes possession of the goods in Washington. The sale is subject to B&O and retail sales tax in this state.

Example 9. An instate seller arranges for shipping its goods to an out-of-state purchaser by first delivering its goods to a Washington-based shipping company at its Washington location for further transport to the out-of-state customer's location. Possession of the goods by the shipping company in Washington is not receipt by the purchaser for Washington tax purposes, and the sale is not subject to B&O and retail sales tax in Washington.

Example 10. An out-of-state manufacturer/seller of a bulk good with nexus in Washington sells the good to a Washington-based purchaser in the business of selling small quantities of the good under its own label in its own packaging. The purchaser directs the seller to deliver the goods to a third-party packaging plant located out-of-state for repackaging of the goods in the purchaser's own packaging. The purchaser then has a third-party shipping company pick up the goods at the packaging plant. The Washington purchaser takes constructive possession of the goods outside of Washington because it has exercised dominion and control over the goods by having them repackaged at an out-of-state packaging facility before shipment to Washington. The sale is not subject to B&O and retail sales tax in this state because the purchaser received the goods outside of Washington.

Example 11. Company ABC is located in Washington and purchases goods from Company XYZ located in Ohio. Company ABC directs Company XYZ to ship the goods by a for-hire carrier to a commercial storage warehouse in Washington. The goods will be considered as having been received by Company ABC when the goods are delivered at the commercial storage warehouse. Assuming Company XYZ has nexus, Company XYZ is subject to B&O tax and must collect retail sales tax on the sale.

(c) Other sourcing rules. There may be unique situations where the sourcing rules provided in (a) and (b) of this subsection do not apply. In those cases, please refer to the provisions of RCW 82.32.730 (1)(c) through (e).

(204) Sourcing sales of certain types of property.

(a) Sales of commercial aircraft parts. As more particularly provided in RCW 82.04.627, the sale of certain parts to the manufacturer of a commercial airplane in Washington is deemed to take place at the site of the final testing or inspection.

(b) Sales of motor vehicles, watercraft, airplanes, manufactured homes, etc. Sales of the following types of property are sourced to the location at or from which the property is delivered in accordance with RCW 82.32.730 (7)(a) through (c): Watercraft; modular, manufactured, or mobile homes; and motor vehicles, trailers, semi-trailers, or aircraft that do not qualify as "transportation equipment" as defined in RCW 82.32.730. See WAC 458-20-145 (2)(b) for further information regarding the sourcing of these sales.

(c) Sales of flowers and related goods by florists. Sales by a "florist" are subject to a special origin sourcing rule. For specific information concerning "florist sales," who qualifies as a "florist," and the related sourcing rules, see RCW 82.32.730 (7)(d) and (9)(e) and WAC 458-20-158.

Part III – Drop Shipments

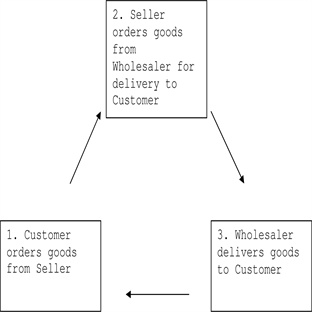

(301) Introduction. A drop shipment generally involves two separate sales. A person (the seller) contracts to sell tangible personal property to a customer. The seller then contracts to purchase that property from a wholesaler and instructs that wholesaler to deliver the property directly to the seller's customer. The place of receipt in a drop shipment transaction is where the property is delivered (i.e., the seller's customer's location). Below is a diagram of a basic drop shipment transaction:

|

The following subsections discuss the taxability of drop shipments in Washington when:

(a) The seller and wholesaler do not have nexus;

(b) The seller has nexus and the wholesaler does not;

(c) The wholesaler has nexus and the seller does not; and

(d) The seller and wholesaler both have nexus. In each of the following scenarios, the customer receives the property in Washington and the sale is sourced to Washington. Further, in each of the following scenarios, a reseller permit or other approved exemption certificate has been acquired to document any wholesale sales in Washington. For information about reseller permits issued by the department, see WAC 458-20-102.

(302) Seller and wholesaler do not have nexus. Where the seller and the wholesaler do not have nexus with Washington, sales of tangible personal property by the seller to the customer and the wholesaler to the seller are not subject to B&O tax. In addition, neither the seller nor the wholesaler is required to collect retail sales tax on the sale.

(303) Seller has nexus but wholesaler does not. Where the seller has nexus with Washington but the wholesaler does not have nexus with Washington, the wholesaler's sale of tangible personal property to the seller is not subject to B&O tax and the wholesaler is not required to collect retail sales tax on the sale. The sale by the seller to the customer is subject to wholesaling or retailing B&O tax, as the case may be. The seller must collect retail sales tax from the customer unless specifically exempt by law.

(304) Wholesaler has nexus but seller does not. Where the wholesaler has nexus with Washington but the seller does not have nexus with Washington, wholesaling B&O tax applies to the sale of tangible personal property by the wholesaler to the seller for shipment to the seller's customer. The sale from the seller to its Washington customer is not subject to B&O tax, and the seller is not required to collect retail sales tax on the sale.

Example 12. Seller is located in Ohio and does not have nexus with Washington. Seller receives an order from Customer, located in Washington, for parts that are to be shipped to Customer in Washington for its own use as a consumer. Seller buys the parts from Wholesaler, which has nexus with Washington, and requests that the parts be shipped directly to Customer. Seller is not subject to B&O tax and is not required to collect retail sales tax on its sale to Customer because Seller does not have nexus with Washington. The sale by Wholesaler to Seller is subject to wholesaling B&O tax because Wholesaler has nexus with Washington and Customer receives the parts (i.e., the parts are delivered to Customer) in Washington.

(305) Seller and wholesaler have nexus with Washington. Where the seller and wholesaler have nexus with Washington, wholesaling B&O tax applies to the wholesaler's sale of tangible personal property to the seller. The sale from the seller to the customer is subject to wholesaling or retailing B&O tax as the case may be. The seller must collect retail sales tax from the customer unless the sale is specifically exempt by law.