(1) Introduction. RCW 82.16.020 levies a public utility tax upon persons engaging in the business of sewerage collection. This rule provides guidance on the assessment of the public utility tax upon sewerage collection businesses, including the distinction between sewerage collection and other related business activities. It also describes how to determine the taxable gross receipts of a sewerage collection business that also engages in other related business activities. Additionally, the rule addresses a sewerage collection business's business and occupation (B&O), retail sales, and use tax reporting responsibilities. Municipalities and other governmental entities engaging in sewerage collection business activities should also refer to WAC 458-20-189 for guidance on the taxation of public service businesses and enterprise activities.

(2) What is a sewerage collection business? A sewerage collection business is the activity of accepting sewage to be deposited into and carried off by a system of lateral sewers, drains, and pipes to a common point, or points, for transfer to treatment or disposal, but does not include the actual transfer, treatment, or disposal of sewage. A sewerage collection business includes only that portion of a sewer system where "collection" occurs. Sewerage collection ends when the sewage exits the lateral sewers in a sewer system. Collection does not include the further transfer of sewage through a system of intercepting sewers or the final treatment or disposal of sewage.

(a) What is the difference between sewage and sewerage? Sewage is the waste matter carried off by sewer drains and pipes. Sewerage refers to the physical facilities (e.g., pipes, lift stations, and treatment and disposal facilities) through which sewage flows.

(b) What is the difference between lateral and intercepting sewers?

(i) A lateral sewer is a branch sewer running laterally down a street, alley, or easement that collects sewage directly from abutting properties and delivers it into an intercepting sewer.

(A) The sewage from abutting properties is collected through sewer pipes running from the abutting properties to the lateral sewer in the street, alley, or easement. If a sewerage collection business is responsible for maintaining any portion of such a sewer pipe, that portion is considered to be part of the lateral sewer.

(B) A lateral sewer may include force mains or lift stations if such equipment is installed as part of a lateral sewer line.

(ii) An intercepting sewer is a main sewer that receives flow from laterals and delivers the sewage to another main sewer or to a point for treatment or disposal.

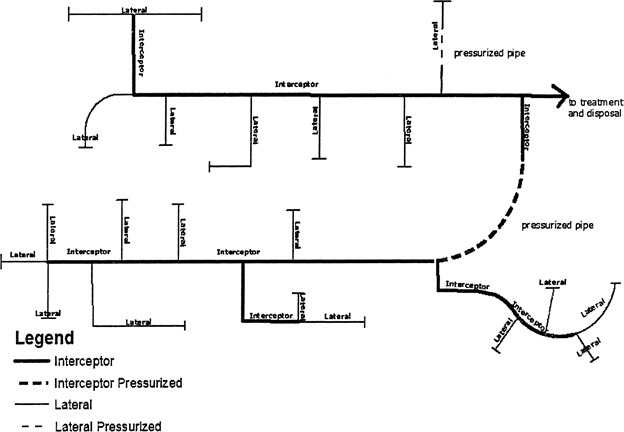

The following diagram illustrates how sewer pipes in a sewerage system are categorized as lateral or intercepting sewers. The diagram does not attempt to represent any publicly maintained portions of sewer pipes that run from abutting properties to the lateral sewer in the street, alley, or easement.

|

(c) How are drainage utility charges accounted for? Certain real estate development projects (due to paving and other factors) may adversely affect rainwater runoff within areas served by a stormwater sewer system. Often, the stormwater system is administered by the same entity that operates a sewerage collection business. In this circumstance, some sewerage utilities impose a drainage utility charge on the development to reflect the impact on the utility's stormwater sewer system caused by the increased runoff. Other sewerage utilities charge all sewerage customers an additional drainage utility charge to reflect stormwater runoff. Although the same entity may be providing both stormwater and sanitary sewer collection services to the customer and many of the same facilities may be used, a drainage utility charge is not related to the collection of sewage for treatment and disposal. Therefore, a sewerage collection business does not include this activity. Utility drainage charges are, however, subject to B&O taxation under the service and other activities classification, as discussed in subsection (4) below.

(3) How is the public utility tax determined? Persons engaged in the sewerage collection business are subject to the public utility tax under the sewer collection classification measured by the gross receipts of the collection business. (See RCW 82.16.020.) Gross receipts of the sewerage collection business include only that portion of income from customer billings that is allocable to the collection of sewage by a sewerage collection business. Gross receipts do not include any charges of any kind attributable to sewerage services other than collection.

There are two methods to determine the gross receipts of the collection business.

(a) Itemization of customer billings. If customer billings are itemized to show the actual charge for sewage collection, income realized from those billings is the gross receipts tax measure. If the itemized charges for sewage collection are less than the actual cost of providing the collection service, however, the sewerage collection business must use the cost-of-doing-business formula in subsection (3)(b) below.

(b) Cost-of-doing-business formula. If collection services are provided jointly with other related sewer services provided by the sewerage collection business or any other person, and the actual charge for sewerage collection is not itemized separately on customer billings or is less than the actual cost of providing the collection service, a simple cost-of-doing-business formula is used to derive the gross receipts public utility tax measure.

(i) Formula. The costs of providing sewerage collection services are divided by all business costs incurred in rendering all sewer services, including sewerage collection. The resulting percentage is multiplied by gross income from customer billings (all sewerage related charges). The result is the gross receipts public utility tax measure from engaging in the sewerage collection business. The standard cost accounting records of the sewerage collection business must be used for this purpose.

The formula is:

Sewerage collection costs (Annualized) | = | % x gross billing income | = | Public Utility Tax Measure | |

Total sewer service costs (Annualized) |

In determining sewage collection costs for a sewerage collection business that also engages in related business activities involving the interception, transfer, storage, treatment, and/or disposal of sewage, only lateral sewers are considered collection sewers. Intercepting sewers are not collection sewers and may not be allocated to collection activities. All costs of operation of the sewer services business must be included in the denominator, including, but not limited to, direct operating costs and direct and indirect overhead costs. When circumstances warrant, the department may allow certain equipment—such as force mains or pump stations—to be converted into an equivalent length of pipe for purposes of allocating costs accurately.

(ii) Annual year-end adjustment. For the purpose of annualizing its costs, the sewerage collection business may use the previous calendar year costs or its budget allocations for the current tax year. In either case, however, it must make an end-of-year adjustment to its reporting based upon actual costs incurred during the current year.

(c) Late charges/penalties excluded. Revenue from late charges or other penalties for untimely payment by sewerage collection customers must be excluded when calculating gross receipts under subsection (3)(a) and (b) above. Receipts from these sources are subject to B&O taxation under the service and other activities classification as provided in subsection (4) below. (See WAC 458-20-179, Public utility tax, for further explanation of the taxation of late charge penalties.)

(d) Preutility service activities excluded. Services provided to a customer prior to receipt of sewerage collection services are subject to B&O taxation under the service and other activities classification as provided in subsection (4) below. For example, many sewerage collection businesses assess connection charges to a new customer before providing sewerage collection services to that customer. Such a connection charge may be variable (calculated as a charge per linear foot of road frontage for example) or a flat fee. A sewerage collection business may assess other charges for specific services provided to new customers, such as installing or inspecting the installation of service connections. In each case, the revenue from such fees is taxable under the service and other activities classification as long as the service for which the fee is assessed is performed before the sewerage collection business provides collection services to that customer. (See WAC 458-20-179, Public utility tax, for further explanation of the taxation of preutility service activities.)

(e) Treatment or disposal costs deduction. RCW 82.16.050(11) provides that in computing the public utility tax, a sewerage collection business may deduct from its reported gross income amounts paid by the business to a person taxable under chapter 82.04 RCW for the treatment or disposal of sewage. The deduction provided by RCW 82.16.050(11) may be taken on the combined excise tax return only when the receipts related to treatment or disposal are included in the gross amounts reported under the sewer collection classification.

(4) How are related business activities taxed? Persons engaged in the sewerage collection business may also be engaged in related business activities involving the interception, transfer, storage, treatment, and/or disposal of sewage. These activities are generally subject to the service and other activities B&O tax. The measure of tax is the gross income or gross proceeds derived from those other services. The measure of tax does not include any amount subject to the sewerage collection public utility tax classification. The amount of gross income or gross proceeds subject to the service and other activities B&O tax must be determined consistent with the method used to determine the gross receipts subject to the sewage collection public utility tax (see subsection (3) above).

(5) What if a governmental sewerage collection business pays a separate governmental entity for sewage interception, treatment or disposal? RCW 82.04.432 provides a deduction from the B&O tax measure for amounts paid by municipal sewerage utilities and other public corporations to any other municipal corporation or governmental agency for sewage interception, treatment, or disposal. Thus, in such cases the service and other activities B&O tax on sewer services does not have a pyramiding effect. In addition, RCW 82.04.4291 provides a B&O tax deduction for amounts derived by a political subdivision of the state of Washington from another political subdivision of the state of Washington as compensation for services subject to the service and other activities B&O tax. Income received from the state of Washington or its agencies and departments, however, is not deductible under RCW 82.04.4291. Thus, the local government entity that receives compensation from another local government entity for providing sewage interception, treatment, or disposal for that other government entity may also deduct the income from its own measure of service and other activities B&O tax, provided this amount has been included in the gross amount reported on the combined excise tax return. In such a case, neither entity pays tax on the amounts represented by the payments made for sewage interception, treatment, or disposal.

For example, Washington Municipality A operates a sewerage collection business. Rather than invest in its own treatment facilities, it contracts with Washington Municipality B to provide sewage transfer, treatment, and disposal services to Municipality A. When determining its tax liability, Municipality A must break down its sewage service charges (as provided in subsection (3) above) into a sewerage collection portion and that portion representing other sewage services (interception, transfer, treatment, and disposal). Municipality A pays public utility tax on its gross receipts from the sewerage collection business. Municipality A also pays service and other activities B&O tax on income derived from that portion of sewage transfer that it undertakes to move the waste to Municipality B for further transfer, treatment, and disposal by Municipality B. However, Municipality A may deduct from its gross income subject to service and other activities B&O tax the amount of any payments made to Municipality B for sewage transfer, treatment, or disposal services provided by Municipality B. In addition, pursuant to RCW 82.04.4291, Municipality B may deduct from its gross income subject to service and other activities B&O tax the amount of the payments received from Municipality A.

(6) Local improvement district assessments. Local improvement district (LID) and utility local improvement district (ULID) assessments, including interest and penalties on assessments, are not considered part of taxable income for either public utility tax or B&O tax purposes because they are exercises of the jurisdiction's taxing authority. These assessments may be composed of a share of the costs of capital facilities, installation labor, connection fees, and other expenses. A deduction may be taken for these amounts if they are included in the LID or ULID assessments.

(7) Property purchased and used by a sewerage collection business. Persons engaged in the sewerage collection business and/or engaged in providing other related sewer services are themselves the consumers of all tangible personal property purchased for their own use in conducting those activities. Retail sales tax (commonly referred to as "deferred sales tax") or use tax must be remitted directly to the department upon all tangible personal property used by a sewerage collection business or sewer service provider as a consumer, if the retail sales tax has not been collected by the seller. (See RCW 82.12.020.)

(8) Sale of sludge. With proper treatment, it is possible for the sludge remaining after the initial treatment of raw sewage to be used as fertilizer. If a sewerage collection business sells sludge, manufacturing B&O tax is due on the value of the products and retailing or wholesaling B&O tax is due on the gross proceeds of the sale. A multiple activities tax credit (MATC) applies as provided in RCW 82.04.440 and WAC 458-20-19301. If the sludge is sold to a consumer, retail sales tax is due on the proceeds of that sale, unless otherwise exempt by law.

If the necessary requirements are met, the business may claim a manufacturing machinery and equipment (M&E) exemption for machinery and equipment used directly in manufacturing the sludge (rendering it suitable for use as a fertilizer). This exemption is not available for machinery or equipment used merely to treat sewage for disposal.