Suppliers of motor vehicle fuel, special fuel, or aircraft fuel subject to the requirements of this chapter must calculate the CO2 emissions that would result from the complete combustion or oxidation of each fuel that is reported to DOL as sold in Washington state using the methods in this section.

(1) Applicable fuels. Suppliers are responsible for calculating CO2 emissions from the following applicable fossil fuels and biomass derived fuels:

(a) All taxed motor vehicle fuel that the supplier is required to report to DOL as part of the supplier's filed periodic tax reports of motor vehicle fuel sales under chapter 82.38 RCW.

(b) All taxed special fuel that the supplier is required to report to DOL as part of the supplier's filed periodic tax reports of special fuel sales under chapter 82.38 RCW.

(c) All taxed and untaxed aircraft fuel supplied to end users that the supplier is required to report to DOL as part of the supplier's filed periodic tax reports of aircraft fuel under chapter 82.42 RCW.

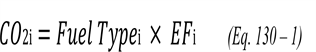

(2) Calculating CO2 emissions separately for each fuel type. CO2 emissions must be calculated separately for each applicable fuel type using Equation 130-1 of this section. Use Equation 130-2 of this section to separate each blended fuel into pure fuel types prior to calculating emissions using Equation 130-1.

|

Where:

CO2i | = | Annual CO2 emissions that would result from the complete combustion or oxidation of each fuel type "i" (metric tons) |

Fuel Typei | = | Annual volume of fuel type "i" supplied by the supplier (gallons). |

EFi | = | Fuel type-specific CO2 emission factor (metric tons CO2 per gallon) found in Table 130-1 of this section. |

|

Where:

Fuel Typei | = | Annual volume of fuel type "i" supplied by the supplier (gallons). |

Fueli | = | Annual volume of blended fuel "i" supplied by the supplier (gallons). |

%Voli | = | Percent volume of product "i" that is fuel typei. |

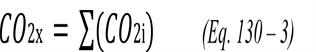

(3) Calculating total CO2 emissions. A supplier must calculate total annual CO2 emissions from all fuels using Equation 130-3 of this section.

|

Where:

CO2x | = | Annual CO2 emissions that would result from the complete combustion or oxidation of all fuels (metric tons). |

CO2i | = | Annual CO2 emissions that would result from the complete combustion or oxidation of each fuel type "i" (gallons). |

(4) Monitoring and QA/QC requirements. Comply with all monitoring and QA/QC requirements under chapters 308-72, 308-77, and 308-78 WAC.

(5) Data recordkeeping requirements. In addition to the annual GHG report required by WAC 173-441-050 (6)(c), the following records must be retained by the supplier in accordance with the requirements established in WAC 173-441-050(6):

(a) For each fuel type listed in Table 130-1 of this section, the annual quantity of applicable fuel in gallons of pure fuel supplied in Washington state.

(b) The CO2 emissions in metric tons that would result from the complete combustion or oxidation of each fuel type for which subsection (5)(a) of this section requires records to be retained, calculated according to subsection (2) of this section.

(c) The sum of biogenic CO2 emissions that would result from the complete combustion oxidation of all supplied fuels, calculated according to subsection (3) of this section.

(d) The sum of nonbiogenic and biogenic CO2 emissions that would result from the complete combustion oxidation of all supplied fuels, calculated according to subsection (3) of this section.

(e) All records required under chapters 308-72, 308-77, and 308-78 WAC in the format required by DOL.

Table 130-1:

Emission Factors for Applicable Motor Vehicle Fuels, Special Fuels, and Aircraft Fuels

Fuel Type (pure fuel) | Emission Factor (metric tons CO2 per gallon) | |

Gasoline | 0.008960 | |

Ethanol (E100) | 0.005767 | |

Diesel | 0.010230 | |

Biodiesel (B100) | 0.009421 | |

Propane | 0.005593 | |

Natural gas | 0.000055* | |

Kerosene | 0.010150 | |

Jet fuel | 0.009750 | |

Aviation gasoline | 0.008310 | |

Contact ecology to obtain an emission factor for any applicable fuel type not listed in this table. |

*In units of metric tons CO2 per scf. When using Equation 130-1 of this section, enter fuel in units of scf. |