WSR 15-15-025

PERMANENT RULES

DEPARTMENT OF REVENUE

[Filed July 7, 2015, 1:20 p.m., effective August 7, 2015]

Effective Date of Rule: Thirty-one days after filing.

Purpose: WAC 458-20-193 (Rule 193) provides guidance on how Washington's B&O tax and retail sales taxes apply to interstate sales of tangible personal property. WAC 458-20-101 (Rule 101) provides, in relevant part, tax reporting and registration requirements for out-of-state businesses.

The department is amending Rules 193 and 101 to provide current and clearer guidance. Included among these changes are the following key updates:

1. Dissociation: Rule 193 currently provides if a taxpayer can prove that its sales in the state are "dissociated" from its local business activity, then those sales are not subject to Washington tax despite the taxpayer's nexus with the state. The department is removing the dissociation concept from the rule. Consistent with this change to Rule 193, the department is removing the dissociation concept found in subsection (5)(a) of Rule 101.

2. Trailing nexus: Rule 193 currently provides that once a taxpayer establishes nexus in Washington, it will continue to have nexus for up to five years even if the taxpayer ceased performing the instate activity which created nexus. Section 102, chapter 23, Laws of 2010 1st sp. sess., changed the trailing nexus for B&O tax to one year following the year the taxpayer ceases having nexus with the state. This legislation did not address the trailing nexus period for other excise taxes. The department is adopting a one year standard for all excise taxes for uniformity purposes.

3. Definition of "receipt": The department is incorporating the current statutory definition of "receipt," which specifically excludes possession by a shipping company. In addition, the department is including the special sourcing provisions for sales of commercial airplane parts in RCW 82.04.627.

4. Drop shipments: The department is providing clearer and more detailed guidance regarding the tax consequences associated with drop shipment sales.

Citation of Existing Rules Affected by this Order: Amending WAC 458-20-101 Tax registration and tax reporting and 458-20-193 Inbound and outbound interstate sales of tangible personal property.

Statutory Authority for Adoption: RCW 82.32.300, 82.01.060(2), 82.24.550(2), 82.26.220(2).

Adopted under notice filed as WSR 15-05-067 on February 17, 2015.

Changes Other than Editing from Proposed to Adopted Version: Rule 101:

- | Changed the term "master application" to "business license application" throughout to reflect legislative and agency change[s] to refer to application as "business license application" rather than "master application." |

- | Added a new sentence to subsection (1) to clarify that for certain ownership structures the secretary of state has its own filing requirements, providing: "Persons with certain ownership structures (e.g., corporations, limited liability companies, limited partnerships, limited liability partnerships, and limited liability limited partnerships) must also register with the office of the secretary of state." |

- | Changed "licensing" to "revenue" in subsection (6)(c) because the department of revenue is now administering the UBI program. |

Rule 193:

- | Changed the order of the references to other rules that may also be helpful (subsection (1)(b)) to put them in numerical order. |

- | Added language to subsection (1)(d) to clarify that the rule does not address "the use tax collection obligation of seller of goods to Washington customers." |

- | Added the phrase "or other information accessible to customers" to subsection (102)(d)(vii)(B). |

- | Changed the definition of "receive" and "receipt" in subsection (202)(a) from "taking possession of tangible personal property" to "the purchaser first either taking physical possession of, or having dominion and control over, tangible personal property." |

- | Removed the following sentence from the "shipping company" definition in subsection (202)(b)(ii): "In the case where a seller or purchaser uses its own transportation equipment for delivery, receipt occurs at the location where the seller or purchaser's own transportation equipment delivers (in the case of the seller) or picks up (in the case of a purchaser) the goods." |

- | Removed the definition of possession in light of changing the definition of "receive" and "receipt" in subsection (203) and renumbered the rest of Part II accordingly. |

- | Added a definition of "purchaser" in subsection (203)(b)(i) as including "the purchaser's agent or designee." |

- | Changed the definition of "purchaser's donee," now in subsection (203)(b)(ii), as follows (underlined language added and struckout language deleted from proposed definition): |

The term "purchaser's donee" means the a person to whom the purchaser directs shipment of the goods in a gratuitous transfer (e.g., a gift recipient). |

- | Added a new Example 11 to subsection (203), providing: |

Company ABC is located in Washington and purchases goods from Company XYZ located in Ohio. Company ABC directs Company XYZ to ship the goods by a for-hire carrier to a commercial storage warehouse in Washington. The goods will be considered as having been received by Company ABC when the goods are delivered at the commercial storage warehouse. Assuming Company XYZ has nexus, Company XYZ is subject to B&O tax and must collect retail sales tax on the sale. |

- | Changed heading of (204)(b) from "Sales of certain itinerant property" to "Sales of motor vehicles, watercraft, airplanes, manufactured homes, etc." |

- | Added the following language to subsection (301): "The place of receipt in a drop shipment transaction is where the property is delivered (i.e., the seller's customer's location)." |

- | Added the following language to the third sentence of (301)(d): "or other approved exemption certificate." |

- | Deleted the following language from subsection (304): "The wholesaler has nexus with Washington, and the customer receives the property in Washington." |

- | Added the following language to the fourth sentence of Example 11: "because Seller does not have nexus with Washington." |

- | Added the following language to the fifth sentence of Example 11: "because Wholesaler has nexus with Washington and Customer receives the parts (i.e., the parts are delivered to Customer) in Washington." |

Number of Sections Adopted in Order to Comply with Federal Statute: New 0, Amended 0, Repealed 0; Federal Rules or Standards: New 0, Amended 0, Repealed 0; or Recently Enacted State Statutes: New 0, Amended 0, Repealed 0.

Number of Sections Adopted at Request of a Nongovernmental Entity: New 0, Amended 0, Repealed 0.

Number of Sections Adopted on the Agency's Own Initiative: New 0, Amended 2, Repealed 0.

Number of Sections Adopted in Order to Clarify, Streamline, or Reform Agency Procedures: New 0, Amended 0, Repealed 0.

Number of Sections Adopted Using Negotiated Rule Making: New 0, Amended 0, Repealed 0; Pilot Rule Making: New 0, Amended 0, Repealed 0; or Other Alternative Rule Making: New 0, Amended 0, Repealed 0.

Date Adopted: July 7, 2015.

Dylan Waits

Rules Coordinator

AMENDATORY SECTION (Amending WSR 14-13-093, filed 6/17/14, effective 7/18/14)

WAC 458-20-101 Tax registration and tax reporting.

(1) Introduction. This ((section)) rule explains tax registration and tax reporting requirements for the Washington state department of revenue as established in RCW 82.32.030 and 82.32.045. This ((section)) rule discusses who is required to be registered, and who must file excise tax returns. This ((section)) rule also discusses changes in ownership requiring a new registration, the administrative closure of taxpayer accounts, and the revocation and reinstatement of a tax reporting account with the department of revenue. Persons required to file tax returns should also refer to WAC 458-20-104 (Small business tax relief based on volume of business). Persons with certain ownership structures (e.g., corporations, limited liability companies, limited partnerships, limited liability partnerships, and limited liability limited partnerships) must also register with the office of the secretary of state.

(2) Persons required to obtain tax registration endorsements. Except as provided in (a) of this subsection, every person who is engaged in any business activity for which the department of revenue is responsible for administering and/or collecting a tax or fee, shall apply for and obtain a tax registration endorsement with the department of revenue. (See RCW 82.32.030.) This endorsement shall be reflected on the face of the business person's registrations and licenses document. The tax registration endorsement is nontransferable, and valid for as long as that person continues in business.

(a) Registration under this ((section)) rule is not required if all of the following conditions are met:

(i) The person's value of products, gross proceeds of sales, or gross income of the business, from all business activities taxable under chapter 82.04 RCW (business and occupation tax), is less than twelve thousand dollars per year;

(ii) A person's gross income from all business activities taxable under chapter 82.16 RCW (public utility tax), is less than twelve thousand dollars per year;

(iii) The person is not required to collect or pay to the department of revenue retail sales tax or any other tax or fee which the department is authorized to administer and/or collect; and

(iv) The person is not otherwise required to obtain a license or registration subject to the ((master)) business license application procedure provided in chapter 19.02 RCW. For the purposes of this ((section)) rule, the term "license or registration" means any agency permit, license, certificate, approval, registration, charter, or any form or permission required by law, including agency rule, to engage in any activity.

(b) The term "tax registration endorsement," as used in this ((section)) rule, has the same meaning as the term "tax registration" or "certificate of registration" used in Title 82 RCW and other ((sections)) rules in chapter 458-20 WAC.

(c) The term "person" has the meaning given in RCW 82.04.030.

(d) The term "tax reporting account number" as used in this ((section)) rule, is the number used to identify persons registered with the department of revenue.

(3) Requirement to file tax returns. Persons registered with the department must file tax returns and remit the appropriate taxes to the department, unless they are placed on an "active nonreporting" status by the department.

(a) The department may relieve any person of the requirement to file returns by placing the person in an active nonreporting status if all of the following conditions are met:

(i) The person's value of products (RCW 82.04.450), gross proceeds of sales (RCW 82.04.070), or gross income of the business (RCW 82.04.080), from all business activities taxable under chapter 82.04 RCW (business and occupation tax), is less than twenty-eight thousand dollars per year;

(ii) The person's gross income (RCW 82.16.010) from all business activities taxable under chapter 82.16 RCW (public utility tax) is less than twenty-four thousand dollars per year; and

(iii) The person is not required to collect or pay to the department retail sales tax or any other tax or fee the department is authorized to collect.

(b) The department will notify those persons it places on an active nonreporting status. (A person may request to be placed on an active nonreporting status if the conditions of (a) of this subsection are met.)

(c) Persons placed on an active nonreporting status by the department are required to timely notify the department if their business activities do not meet any of the conditions explained in (a) of this subsection. These persons will be removed from an active nonreporting status, and must file tax returns and remit appropriate taxes to the department, beginning with the first period in which they do not qualify for an active nonreporting status.

(d) Persons that have not been placed on an active nonreporting status by the department must continue to file tax returns and remit the appropriate taxes.

(4) Examples. The following examples identify a number of facts and then state a conclusion. These examples should be used only as a general guide. The status of each situation must be determined after a review of all facts and circumstances.

(a) Bob Brown is starting a bookkeeping service. The gross income of the business is expected to be less than twelve thousand dollars per year. Due to the nature of the business activities, Bob is not required to pay or collect any other tax which the department is authorized to collect.

Bob Brown is not required to apply for and obtain a tax registration endorsement with the department of revenue. The conditions under which a business person may engage in business activities without obtaining the tax registration endorsement have been met. However, if Bob Brown in some future period has gross income exceeding twelve thousand dollars per year, he will be required to obtain a tax registration endorsement. If Bob's gross income exceeds twenty-eight thousand dollars per year, he will be required to file tax returns and remit the appropriate taxes.

(b) Cindy Smith is opening a business to sell books written for children to local customers at retail. The gross proceeds of sales are expected to be less than twelve thousand dollars per year.

Cindy Smith must apply for and obtain a tax registration endorsement with the department of revenue. While gross income is expected to be less than twelve thousand dollars per year, Cindy Smith is required to collect and remit retail sales tax.

(c) Alice Smith operates a taxicab service with an average gross income of eighteen thousand dollars per year. She also owns a management consulting service with an average gross income of fifteen thousand dollars per year. Assume that Alice is not required to collect or pay to the department any other tax or fee the department is authorized to collect. Alice qualifies for an active nonreporting status because her taxicab income is less than the twenty-four thousand dollar threshold for the public utility tax, and her consulting income is less than the twenty-four thousand dollar threshold for the business and occupation (B&O) tax. If the department of revenue does not first place her on an active nonreporting status, she may request the department to do so.

(5) Out-of-state businesses. The B&O and public utility taxes are imposed on the act or privilege of engaging in business activity within Washington. RCW 82.04.220 and 82.16.020. Out-of-state persons who have established sufficient nexus in Washington to be subject to Washington's B&O or public utility taxes must obtain a tax registration endorsement with this department if they do not satisfy the conditions expressed in subsection (2)(a) of this ((section)) rule. Out-of-state persons required to collect Washington's retail sales or use tax, or who have elected to collect Washington's use tax, even though not statutorily required to do so, must obtain a tax registration endorsement.

(((a) Persons with out-of-state business locations should not include income that is disassociated from their instate activities in their computations for determining whether the gross income thresholds provided in subsection (2)(a)(i) and (ii) of this section are satisfied.

(b))) Out-of-state persons making sales into or doing business within Washington should also refer to the following rules in chapter 458-20 WAC for a discussion of their tax reporting responsibilities:

(((i))) (a) WAC 458-20-103 (Time and place of sale);

(((ii))) (b) WAC 458-20-193 (Inbound and outbound interstate sales of tangible personal property);

(((iii))) (c) WAC 458-20-193D (Transportation, communication, public utility activities, or other services in interstate or foreign commerce);

(((iv))) (d) WAC 458-20-194 (Doing business inside and outside the state); and

(((v))) (e) WAC 458-20-221 (Collection of use tax by retailers and selling agents).

(6) Registration procedure. The state of Washington initiated the unified business identifier (UBI) program to simplify the registration and licensing requirements imposed on the state's business community. Completion of the ((master)) business license application enables a person to register or license with several state agencies, including the department of revenue, using a single form. The person will be assigned one unified business identifier number, which will be used for all state agencies participating in the UBI program. The department may assign the unified business identifier number as the taxpayer's revenue tax reporting account number, or it may assign a different or additional number as the revenue tax reporting account number.

(a) Persons completing the ((master)) business license application will be issued a registrations and licenses document. The face of this document will list the registrations and licenses (endorsements) which have been obtained.

(b) The department of revenue does not charge a registration fee for issuing a tax registration endorsement. Persons required to complete a ((master)) business license application may, however, be subject to other fees.

(c) While the UBI program is administered by the department of ((licensing, master)) revenue, business license applications are available at any participating UBI service provider location. The following agencies of the state of Washington participate in the UBI program (see RCW 19.02.050 for a more complete listing of participating agencies):

(i) The office of the secretary of state;

(ii) The department of licensing;

(iii) The department of employment security;

(iv) The department of labor and industries;

(v) The department of revenue.

(7) Temporary revenue registration certificate. A temporary revenue registration certificate may be issued to any person who operates a business of a temporary nature.

(a) Temporary businesses, for the purposes of registration, are those with:

(i) Definite, predetermined dates of operation for no more than two events each year with each event lasting no longer than one month; or

(ii) Seasonal dates of operation lasting no longer than three months. However, persons engaging in business activities on a seasonal basis every year should refer to subsection (8) of this ((section)) rule.

(b) Each temporary registration certificate is valid for a single event. Persons that subsequently make sales into Washington may incur additional tax liability. Refer to WAC 458-20-193 (Inbound and outbound interstate sales of tangible personal property) for additional information on tax reporting requirements. It may be required that a tax registration endorsement be obtained, in lieu of a temporary registration certificate. See subsection (2) of this ((section)) rule.

(c) Temporary revenue registration certificates may be obtained by making application at any participating UBI agency office, or by completing a seasonal registration form.

(8) Seasonal revenue tax reporting accounts. Persons engaging in seasonal business activities which do not exceed two quarterly reporting periods each calendar year may be eligible for a tax reporting account with a seasonal reporting status. This is a permanent account until closed by the taxpayer. The taxpayer must specify in which quarterly reporting periods he or she will be engaging in taxable business activities. The quarterly reporting periods in which the taxpayer is engaging in taxable business activities may or may not be consecutive, but the same quarterly period or periods must apply each year. The taxpayer is not required to be engaging in taxable business activities during the entire period.

The department will provide and the taxpayer will be required to file tax returns only for the quarterly reporting periods specified by the taxpayer. Examples of persons which may be eligible for the seasonal reporting status include persons operating Christmas tree and/or fireworks stands. Persons engaging in taxable business activities in more than two quarterly reporting periods in a calendar year will not qualify for the seasonal reporting status.

(9) Display of registrations and licenses document. The taxpayer is required to display the registrations and licenses document in a conspicuous place at the business location for which it is issued.

(10) Multiple locations. A registrations and licenses document is required for each place of business at which a taxpayer engages in business activities for which the department of revenue is responsible for administering and/or collecting a tax or fee, and any main office or principal place of business from which excise tax returns are to be filed. This requirement applies to locations both within and without the state of Washington.

(a) For the purposes of this subsection, the term "place of business" means:

(i) Any separate establishment, office, stand, cigarette vending machine, or other fixed location; or

(ii) Any vessel, train, or the like, at any of which the taxpayer solicits or makes sales of tangible personal property, or contracts for or renders services in this state or otherwise transacts business with customers.

(b) A taxpayer wishing to report all tax liability on a single excise tax return may request a separate registrations and licenses document for each location. The original registrations and licenses document shall be retained for the main office or principal place of business from which the returns are to be filed, with additional documents obtained for all branch locations. All registrations and licenses documents will reflect the same tax reporting account number.

(c) A taxpayer desiring to file a separate excise tax return covering a branch location, or a specific construction contract, may apply for and receive a separate revenue tax reporting account number. A registrations and licenses document will be issued for each tax reporting account number and will represent a separate account.

(d) A ((master)) business license application must be completed to obtain a separate registrations and licenses document, or revenue tax reporting account number, for a new location.

(11) Change in ownership. When a change in ownership of a business occurs, the new owner must apply for and obtain a new registrations and licenses document. The original document must be destroyed, and any further use of the tax reporting account number for tax purposes is prohibited.

(a) A "change in ownership," for purposes of registration, occurs upon but is not limited to:

(i) The sale of a business by one individual, firm or corporation to another individual, firm or corporation;

(ii) The dissolution of a partnership;

(iii) The withdrawal, substitution, or addition of one or more partners where the general partnership continues as a business organization and the change in the composition of the partners is equal to or greater than fifty percent;

(iv) Incorporation of a business previously operated as a partnership or sole proprietorship;

(v) Changing from a corporation to a partnership or sole proprietorship; or

(vi) Changing from a corporation, partnership or sole proprietorship to a limited liability company or a limited liability partnership.

(b) For the purposes of registration, a "change in ownership" does not occur upon:

(i) The sale of all or part of the common stock of a corporation;

(ii) The transfer of assets to an assignee for the benefit of creditors or upon the appointment of a receiver or trustee in bankruptcy;

(iii) The death of a sole proprietor where there will be a continuous operation of the business by the executor, administrator, or trustee of the estate or, where the business was owned by a marital community or registered domestic partnership, by the surviving spouse or surviving domestic partner of the deceased owner;

(iv) The withdrawal, substitution, or addition of one or more partners where the general partnership continues as a business organization and the change in the composition of the partners is less than fifty percent; or

(v) A change in the trade name under which the business is conducted.

(c) While changes in a business entity may not result in a "change in ownership," the completion of a new ((master)) business license application may be required to reflect the changes in the registered account.

(12) Change in location. Whenever the place of business is moved to a new location, the taxpayer must notify the department of the change. A new registrations and licenses document will be issued to reflect the change in location.

(13) Lost registrations and licenses documents. If any registrations and licenses document is lost, destroyed or defaced as a result of accident or of natural wear and tear, a new document will be issued upon request.

(14) Administrative closure of taxpayer accounts. The department may, upon written notification to the taxpayer, close the taxpayer's tax reporting account and rescind its tax registration endorsement whenever the taxpayer has reported no gross income and there is no indication of taxable activity for two consecutive years.

The taxpayer may request, within thirty days of notification of closure, that the account remain open. A taxpayer may also request that the account remain open on an "active nonreporting" status if the requirements of subsection (3)(a) of this ((section)) rule are met. The request shall be reviewed by the department and if found to be warranted, the department will immediately reopen the account. The following are acceptable reasons for continuing as an active account:

(a) The taxpayer is engaging in business activities in Washington which may result in tax liability.

(b) The taxpayer is required to collect or pay to the department of revenue a tax or fee which the department is authorized to administer and/or collect.

(c) The taxpayer has in fact been liable for excise taxes during the previous two years.

(15) Reopening of taxpayer accounts. A business person choosing to resume business activities for which the department of revenue is responsible for administering and/or collecting a tax or fee, may request a previously closed account be reopened. The business person must complete a new ((master)) business license application. When an account is reopened a new registrations and licenses document, reflecting a current tax registration endorsement, shall be issued. Persons requesting the reopening of an account which had previously been closed due to a revocation action should refer to subsection (16) of this ((section)) rule.

(16) Revocation and reinstatement of tax registration endorsements. Actions to revoke tax registration endorsements must be conducted by the department pursuant to the provisions of chapter 34.05 RCW, the Administrative Procedure Act, and the taxpayers bill of rights of chapter 82.32A RCW. Persons should refer to WAC 458-20-10001, Adjudicative proceedings—Brief adjudicative proceedings—Wholesale and retail cigarette license revocation/suspension—Certificate of registration (tax registration endorsement) revocation, for an explanation of the procedures and processes pertaining to the revocation of tax registration endorsements.

(a) The department of revenue may, by order, revoke a tax registration endorsement if:

(i) Any tax warrant issued under the provisions of RCW 82.32.210 is not paid within thirty days after it has been filed with the clerk of the superior court; or

(ii) The taxpayer is delinquent, for three consecutive reporting periods, in the transmission to the department of retail sales tax collected by the taxpayer; or

(iii) Either:

(A) The taxpayer was convicted of violating RCW 82.32.290(4) and continues to engage in business without fully complying with RCW 82.32.290 (4)(b)(i) through (iii); or

(B) A person convicted of violating RCW 82.32.290(4) is an owner, officer, director, partner, trustee, member, or manager of the taxpayer, and the person and taxpayer have not fully complied with RCW 82.32.290 (4)(b)(i) through (iii).

For purposes of (a)(iii) of this subsection, the terms "manager," "member," and "officer" mean the same as defined in RCW 82.32.145.

(b) The revocation order will be, if practicable, posted in a conspicuous place at the main entrance to the taxpayer's place of business. The department may also post a copy of the revocation order in any public facility, as may be allowed by the public entity that owns or occupies the facility. The revocation order posted at the taxpayer's place of business must remain posted until the tax registration endorsement has been reinstated or the taxpayer has abandoned the premises. A revoked endorsement will not be reinstated until:

(i) The amount due on the warrant has been paid, or satisfactory arrangements for payment have been approved by the department, and the taxpayer has posted with the department a bond or other security in an amount not exceeding one-half the estimated average annual liability of the taxpayer; or

(ii) The taxpayer and, if applicable, the owner, officer, director, partner, trustee, member, or manager of the taxpayer who was convicted of violating RCW 82.32.290(4) are in full compliance with RCW 82.32.290 (4)(b)(i) through (iii), if the tax registration endorsement was revoked as described in (a)(iii) of this subsection.

(c) It is unlawful for any taxpayer to engage in business after its tax registration endorsement has been revoked.

(17) Penalties for noncompliance. The law provides that any person engaging in any business activity, for which registration with the department of revenue is required, shall obtain a tax registration endorsement.

(a) The failure to obtain a tax registration endorsement prior to engaging in any taxable business activity constitutes a gross misdemeanor.

(b) Engaging in business after a tax registration endorsement has been revoked by the department constitutes a Class C felony.

(c) Any tax found to have been due, but delinquent, and any tax unreported as a result of fraud or misrepresentation, may be subject to penalty as provided in chapter 82.32 RCW, WAC 458-20-228 and 458-20-230.

AMENDATORY SECTION (Amending WSR 10-06-070, filed 2/25/10, effective 3/28/10)

WAC 458-20-193 ((Inbound and outbound)) Interstate sales of tangible personal property.

(1) Introduction. ((This section explains Washington's B&O tax and retail sales tax applications to interstate sales of tangible personal property. It covers the outbound sales of goods originating in this state to persons outside this state and of inbound sales of goods originating outside this state to persons in this state. This section does not include import and export transactions.

(2) Definitions: For purposes of this section the following terms mean:

(a) "State of origin" means the state or place where a shipment of tangible personal property (goods) originates.

(b) "State of destination" means the state or place where the purchaser/consignee or its agent receives a shipment of goods.

(c) "Delivery" means the act of transferring possession of tangible personal property. It includes among others the transfer of goods from consignor to freight forwarder or for-hire carrier, from freight forwarder to for-hire carrier, one for-hire carrier to another, or for-hire carrier to consignee.

(d) "Receipt" or "received" means the purchaser or its agent first either taking physical possession of the goods or having dominion and control over them.

(e) "Agent" means a person authorized to receive goods with the power to inspect and accept or reject them.

(f) "Nexus" means the activity carried on by the seller in Washington which is significantly associated with the seller's ability to establish or maintain a market for its products in Washington.

(3) Outbound sales. Washington state does not assess its taxes on sales of goods which originate in Washington if receipt of the goods occurs outside Washington.

(a) Where tangible personal property is located in Washington at the time of sale and is received by the purchaser or its agent in this state, or the purchaser or its agent exercises ownership over the goods inconsistent with the seller's continued dominion over the goods, the sale is subject to tax under the retailing or wholesaling classification. The tax applies even though the purchaser or its agent intends to and thereafter does transport or send the property out-of-state for use or resale there, or for use in conducting interstate or foreign commerce. It is immaterial that the contract of sale or contract to sell is negotiated and executed outside the state or that the purchaser resides outside the state.

(b) Where the seller delivers the goods to the purchaser who receives them at a point outside Washington neither retailing nor wholesaling business tax is applicable. This exemption applies even in cases where the shipment is arranged through a for-hire carrier or freight consolidator or freight forwarder acting on behalf of either the seller or purchaser. It also applies whether the shipment is arranged on a "freight prepaid" or a "freight collect" basis. The shipment may be made by the seller's own transportation equipment or by a carrier for-hire. For purposes of this section, a for-hire carrier's signature does not constitute receipt upon obtaining the goods for shipment unless the carrier is acting as the purchaser's agent and has express written authority from the purchaser to accept or reject the goods with the right of inspection.

(4) Proof of exempt outbound sales.

(a) If either a for-hire carrier or the seller itself carries the goods for receipt at a point outside Washington, the seller is required to retain in its records documentary proof of the sales and delivery transaction and that the purchaser in fact received the goods outside the state in order to prove the sale is tax exempt. Acceptable proofs, among others, will be:

(i) The contract or agreement of sale, if any, And

(ii) If shipped by a for-hire carrier, a waybill, bill of lading or other contract of carriage indicating the seller has delivered the goods to the for-hire carrier for transport to the purchaser or the purchaser's agent at a point outside the state with the seller shown on the contract of carriage as the consignor (or other designation of the person sending the goods) and the purchaser or its agent as consignee (or other designation of the person to whom the goods are being sent); or

(iii) If sent by the seller's own transportation equipment, a trip-sheet signed by the person making delivery for the seller and showing:

The seller's name and address,

The purchaser's name and address,

The place of delivery, if different from purchaser's address,

The time of delivery to the purchaser together with the signature of the purchaser or its agent acknowledging receipt of the goods at the place designated outside the state of Washington.

(b) Delivery of the goods to a freight consolidator, freight forwarder or for-hire carrier merely utilized to arrange for and/or transport the goods is not receipt of the goods by the purchaser or its agent unless the consolidator, forwarder or for-hire carrier has express written authority to accept or reject the goods for the purchaser with the right of inspection. See also WAC 458-20-174, 458-20-17401, 458-20-175, 458-20-176, 458-20-177, 458-20-238 and 458-20-239 for certain statutory exemptions.

(5) Other B&O taxes - Outbound and inbound sales.

(a) Extracting, manufacturing. Persons engaged in these activities in Washington and who transfer or make delivery of such produced articles for receipt at points outside the state are subject to business tax under the extracting or manufacturing classification and are not subject to tax under the retailing or wholesaling classification. See also WAC 458-20-135 and 458-20-136. The activities taxed occur entirely within the state, are inherently local, and are conducted prior to the commercial journey. The tax is measured by the value of products as determined by the selling price in the case of articles on which the seller performs no further manufacturing after transfer out of Washington. It is immaterial that the value so determined includes an additional increment of value because the sale occurs outside the state. If the seller performs additional manufacturing on the article after transferring the article out-of-state, the value should be measured under the principles contained in WAC 458-20-112.

(b) Extracting or processing for hire, printing and publishing, repair or alteration of property for others. These activities when performed in Washington are also inherently local and the gross income or total charge for work performed is subject to business tax, since the operating incidence of the tax is upon the business activity performed in this state. No deduction is permitted even though the articles produced, imprinted, repaired or altered are delivered to persons outside the state. It is immaterial that the customers are located outside the state, that the work was negotiated or contracted for outside the state, or that the property was shipped in from outside the state for such work.

(c) Construction, repair. Construction or repair of buildings or other structures, public road construction and similar contracts performed in this state are inherently local business activities subject to B&O tax in this state. This is so even though materials involved may have been delivered from outside this state or the contracts may have been negotiated outside this state. It is immaterial that the work may be performed in this state by foreign sellers who performed preliminary services outside this state.

(d) Renting or leasing of tangible personal property. Lessors who rent or lease tangible personal property for use in this state are subject to B&O tax upon their gross proceeds from such rentals for periods of use in this state. Proration of tax liability based on the degree of use in Washington of leased property is required.

It is immaterial that possession of the property leased may have passed to the lessee outside the state or that the lease agreement may have been consummated outside the state. Lessors will not be subject to B&O tax if all of the following conditions are present:

(i) The equipment is not located in Washington at the time the lessee first takes possession of the leased property; and

(ii) The lessor has no reason to know that the equipment will be used by the lessee in Washington; and

(iii) The lease agreement does not require the lessee to notify the lessor of subsequent movement of the property into Washington and the lessor has no reason to know that the equipment may have been moved to Washington.

(6) Retail sales tax - Outbound sales. The retail sales tax generally applies to all retail sales made within this state. The legal incidence of the tax is upon the purchaser, but the seller is obligated to collect and remit the tax to the state. The retail sales tax applies to all sales to consumers of goods located in the state when goods are received in Washington by the purchaser or its agent, irrespective of the fact that the purchaser may use the property elsewhere. However, as indicated in subsection (4)(b), delivery of the goods to a freight consolidator, freight forwarder or for-hire carrier arranged either by the seller or the purchaser, merely utilized to arrange for and/or transport the goods out-of-state is not receipt of the goods by the purchaser or its agent in this state, unless the consolidator, forwarder or for-hire carrier has express written authority to accept or reject the goods for the purchaser with the right of inspection.

(a) The retail sales tax does not apply when the seller delivers the goods to the purchaser who receives them at a point outside the state, or delivers the same to a for-hire carrier consigned to the purchaser outside the state. This exemption applies even in cases where the shipment is arranged through a for-hire carrier or freight consolidator or freight forwarder acting on behalf of either the seller or the purchaser. It also applies regardless of whether the shipment is arranged on a "freight prepaid" or a "freight collect" basis and regardless of who bears the risk of loss. The seller must retain proof of exemption as outlined in subsection (4), above.

(b) RCW 82.08.0273 provides an exemption from the retail sales tax to certain nonresidents of Washington for purchases of tangible personal property for use outside this state when the nonresident purchaser provides proper documentation to the seller. This statutory exemption is available only to residents of states and possessions or Province of Canada other than Washington when the jurisdiction does not impose a retail sales tax of three percent or more. These sales are subject to B&O tax.

(c) A statutory exemption (RCW 82.08.0269) is allowed for sales of goods for use in states, territories and possessions of the United States which are not contiguous to any other state (Alaska, Hawaii, etc.), but only when, as a necessary incident to the contract of sale, the seller delivers the property to the purchaser or its designated agent at the usual receiving terminal of the for-hire carrier selected to transport the goods, under such circumstance that it is reasonably certain that the goods will be transported directly to a destination in such noncontiguous states, territories and possessions. As proof of exemption, the seller must retain the following as part of its sales records:

(i) A certification of the purchaser that the goods will not be used in the state of Washington and are intended for use in the specified noncontiguous state, territory or possession.

(ii) Written instructions signed by the purchaser directing delivery of the goods to a dock, depot, warehouse, airport or other receiving terminal for transportation of the goods to their place of ultimate use. Where the purchaser is also the carrier, delivery may be to a warehouse receiving terminal or other facility maintained by the purchaser when the circumstances are such that it is reasonably certain that the goods will be transported directly to their place of ultimate use.

(iii) A dock receipt, memorandum bill of lading, trip sheet, cargo manifest or other document evidencing actual delivery to such dock, depot, warehouse, freight consolidator or forwarder, or receiving terminal.

(iv) The requirements of (i) and (ii) above may be complied with through the use of a blanket exemption certificate as follows:

Exemption Certificate

We hereby certify that all of the goods which we have purchased and which we will purchase from you will not be used in the State of Washington but are for use in the state, territory or possession of . . . . . . . . . . . .

You are hereby directed to deliver all such goods to the following dock, depot, warehouse, freight consolidator, freight forwarder, transportation agency or other receiving terminal:

. . . . |

|

. . . . |

for the transportation of those goods to their place of ultimate use.

This certificate shall be considered a part of each order that we have given you and which we may hereafter give to you, unless otherwise specified, and shall be valid until revoked by us in writing.

DATED. . . . |

|

. . . . (Purchaser) |

|

By. . . . (Officer or Purchaser's Representative) |

|

Address. . . . |

(v) There is no business and occupation tax deduction of the gross proceeds of sales of goods for use in noncontiguous states unless the goods are received outside Washington.

(d) See WAC 458-20-173 for explanation of sales tax exemption in respect to charges for labor and materials in the repair, cleaning or altering of tangible personal property for nonresidents when the repaired property is delivered to the purchaser at an out-of-state point.

(7) Inbound sales. Washington does not assert B&O tax on sales of goods which originate outside this state unless the goods are received by the purchaser in this state and the seller has nexus. There must be both the receipt of the goods in Washington by the purchaser and the seller must have nexus for the B&O tax to apply to a particular sale. The B&O tax will not apply if one of these elements is missing.

(a) Delivery of the goods to a freight consolidator, freight forwarder or for-hire carrier located outside this state merely utilized to arrange for and/or transport the goods into this state is not receipt of the goods by the purchaser or its agent unless the consolidator, forwarder or for-hire carrier has express written authority to accept or reject the goods for the purchaser with the right of inspection.

(b) When the sales documents indicate the goods are to be shipped to a buyer in Washington, but the seller delivers the goods to the buyer at a location outside this state, the seller may use the proofs of exempt sales contained in subsection 4 to establish the fact of delivery outside Washington.

(c) If a seller carries on significant activity in this state and conducts no other business in the state except the business of making sales, this person has the distinct burden of establishing that the instate activities are not significantly associated in any way with the sales into this state. Once nexus has been established, it will continue throughout the statutory period of RCW 82.32.050 (up to five years), notwithstanding that the instate activity which created the nexus ceased. Persons taxable under the service B&O tax classification should refer to WAC 458-20-194. The following activities are examples of sufficient nexus in Washington for the B&O tax to apply:

(i) The goods are located in Washington at the time of sale and the goods are received by the customer or its agent in this state.

(ii) The seller has a branch office, local outlet or other place of business in this state which is utilized in any way, such as in receiving the order, franchise or credit investigation, or distribution of the goods.

(iii) The order for the goods is solicited in this state by an agent or other representative of the seller.

(iv) The delivery of the goods is made by a local outlet or from a local stock of goods of the seller in this state.

(v) The out-of-state seller, either directly or by an agent or other representative, performs significant services in relation to establishment or maintenance of sales into the state, even though the seller may not have formal sales offices in Washington or the agent or representative may not be formally characterized as a "salesperson."

(vi) The out-of-state seller, either directly or by an agent or other representative in this state, installs its products in this state as a condition of the sale.

(8) Retail sales tax - Inbound sales. Persons engaged in selling activities in this state are required to be registered with the department of revenue. Sellers who are not required to be registered may voluntarily register for the collection and reporting of the use tax. The retail sales tax must be collected and reported in every case where the retailing B&O tax is due as outlined in subsection 7. If the seller is not required to collect retail sales tax on a particular sale because the transaction is disassociated from the instate activity, it must collect the use tax from the buyer.

(9) Use tax - Inbound sales. The following sets forth the conditions under which out-of-state sellers are required to collect and remit the use tax on goods received by customers in this state. A seller is required to pay or collect and remit the tax imposed by chapter 82.12 RCW if within this state it directly or by any agent or other representative:

(a) Has or utilizes any office, distribution house, sales house, warehouse, service enterprise or other place of business; or

(b) Maintains any inventory or stock of goods for sale; or

(c) Regularly solicits orders whether or not such orders are accepted in this state; or

(d) Regularly engages in the delivery of property in this state other than by for-hire carrier or U.S. mail; or

(e) Regularly engages in any activity in connection with the leasing or servicing of property located within this state.

(i) The use tax is imposed upon the use, including storage preparatory to use in this state, of all tangible personal property acquired for any use or consumption in this state unless specifically exempt by statute. The out-of-state seller may have nexus to require the collection of use tax without personal contact with the customer if the seller has an extensive, continuous, and intentional solicitation and exploitation of Washington's consumer market. (See WAC 458-20-221).

(ii) Every person who engages in this state in the business of acting as an independent selling agent for unregistered principals, and who receives compensation by reason of sales of tangible personal property of such principals for use in this state, is required to collect the use tax from purchasers, and remit the same to the department of revenue, in the manner and to the extent set forth in WAC 458-20-221.

(10) Examples - Outbound sales. The following examples show how the provisions of this section relating to interstate sales of tangible personal property will apply when the goods originate in Washington (outbound sales). The examples presume the seller has retained the proper proof documents and that the seller did not manufacture the items being sold.

(a) Company A is located in Washington. It sells machine parts at retail and wholesale. Company B is located in California and it purchases machine parts from Company A. Company A carries the parts to California in its own vehicle to make delivery. It is immaterial whether the goods are received at either the purchaser's out-of-state location or at any other place outside Washington state. The sale is not subject to Washington's B&O tax or its retail sales tax because the buyer did not receive the goods in Washington. Washington treats the transaction as a tax exempt interstate sale. California may impose its taxing jurisdiction on this sale.

(b) Company A, above, ships the parts by a for-hire carrier to Company B in California. Company B has not previously received the parts in Washington directly or through a receiving agent. It is immaterial whether the goods are received at either Company B's out-of-state location or any other place outside Washington state. It is immaterial whether the shipment is freight prepaid or freight collect. Again, Washington treats the transaction as an exempt interstate sale.

(c) Company B, above, has its employees or agents pick up the parts at Company A's Washington plant and transports them out of Washington. The sale is fully taxable under Washington's B&O tax and, if the parts are not purchased for resale by Company B, Washington's retail sales tax also applies.

(d) Company B, above, hires a carrier to transport the parts from Washington. Company B authorizes the carrier, or another agent, to inspect and accept the parts and, if necessary, to hold them temporarily for consolidation with other goods being shipped out of Washington. This sale is taxable under Washington's B&O tax and, if the parts are not purchased for resale by Company B, Washington's retail sales tax also applies.

(e) Washington will not tax the transactions in the above examples (a) and (b) if Company A mails the parts to Company B rather than using its own vehicles or a for-hire carrier for out-of-state receipt. By contrast, Washington will tax the transactions in the above examples (c) and (d) if for some reason Company B or its agent mails the parts to an out-of-state location after receiving them in Washington. The B&O tax applies to the latter two examples and if the parts are not purchased for resale by Company B then retail sales tax will also apply.

(f) Buyer C who is located in Alaska purchases parts for its own use in Alaska from Seller D who is located in Washington. Buyer C specifies to the seller that the parts are to be delivered to the water carrier at a dock in Seattle. The buyer has entered into a written contract for the carrier to inspect the parts at the Seattle dock. The sale is subject to the B&O tax because receipt took place in Washington. The retail sales tax does not apply because of the specific exemption at RCW 82.08.0269. This transaction would have been exempt of the B&O tax if the buyer had taken no action to receive the goods in Washington.

(11) Examples - Inbound sales. The following examples show how the provisions of this section relating to interstate sales of tangible personal property will apply when the goods originate outside Washington (inbound sales). The examples presume the seller has retained the proper proof documents.

(a) Company A is located in California. It sells machine parts at retail and wholesale. Company B is located in Washington and it purchases machine parts for its own use from Company A. Company A uses its own vehicles to deliver the machine parts to its customers in Washington for receipt in this state. The sale is subject to the retail sales and B&O tax if the seller has nexus, or use tax if nexus is not present.

(b) Company A, above, ships the parts by a for-hire carrier to Company B in Washington. The goods are not accepted by Company B until the goods arrive in Washington. The sale is subject to the retail sales or use tax and is also subject to the B&O tax if the seller has nexus in Washington. It is immaterial whether the shipment is freight prepaid or freight collect.

(c) Company B, above, has its employees or agents pick up the parts at Company A's California plant and transports them into Washington. Company A is not required to collect sales or use tax and is not liable for B&O tax on the sale of these parts. Company B is liable for payment of use tax at the time of first use of the parts in Washington.

(d) Company B, above, hires a carrier to transport the parts from California. Company B authorizes the carrier, or an agent, to inspect and accept the parts and, if necessary, to hold them temporarily for consolidation with other goods being shipped to Washington. The seller is not required to collect retail sales or use tax and is not liable for the B&O tax on these sales. Company B is subject to use tax on the first use of the parts in Washington.

(e) Company B, above, instructs Company A to deliver the machine parts to a freight consolidator selected by Company B. The freight consolidator does not have authority to receive the goods as agent for Company B. Receipt will not occur until the parts are received by Company B in Washington. Company A is required to collect retail sales or use tax and is liable for B&O tax if Company A has nexus for this sale. The mere delivery to a consolidator or for-hire carrier who is not acting as the buyer's receiving agent is not receipt by the buyer.

(f) Transactions in examples (11)(a) and (11)(b) will also be taxable if Company A mails the parts to Company B for receipt in Washington, rather than using its own vehicles or a for-hire carrier. The tax will continue to apply even if Company B for some reason sends the parts to a location outside Washington after the parts were accepted in Washington.

(g) Company W with its main office in Ohio has one employee working from the employee's home located in Washington. The taxpayer has no offices, inventory, or other employees in Washington. The employee calls on potential customers to promote the company's products and to solicit sales. On June 30, 1990 the employee is terminated. After this date the company no longer has an employee or agent calling on customers in Washington or carries on any activities in Washington which is significantly associated with the seller's ability to establish or maintain a market for its products in Washington. Washington customers who had previously been contacted by the former employee continue to purchase the products by placing orders by mail or telephone directly with the out-of-state seller. The nexus which was established by the employee's presence in Washington will be presumed to continue through December 31, 1994 and subject to B&O tax. Nexus will cease on December 31, 1994 if the seller has not established any new nexus during this period. Company W may disassociate and exclude from B&O tax sales to new customers who had no contact with the former employee. The burden of proof to disassociate is on the seller.

(h) Company X is located in Ohio and has no office, employees, or other agents located in Washington or any other contact which would create nexus. Company X receives by mail an order from Company Y for parts which are to be shipped to a Washington location. Company X purchases the parts from Company Z who is located in Washington and requests that the parts be drop shipped to Company Y. Since Company X has no nexus in Washington, Company X is not subject to B&O tax or required to collect retail sales tax. Company X has not taken possession or dominion or control over the parts in Washington. Company Z may accept a resale certificate (WAC 458-20-102A) for sales made before January 1, 2010, or a Streamlined Sales and Use Tax Agreement Certificate of Exemption or a Multistate Tax Commission Exemption Certificate (WAC 458-20-102) for sales made on or after January 1, 2010, from Company X which will bear the registration number issued by the state of Ohio. Company Y is required to pay use tax on the value of the parts. Even though resale certificates are no longer used after December 31, 2009, they must be kept on file by Company Z for five years from the date of last use or December 31, 2014.

(i) Company ABC is located in Washington and purchases goods from Company XYZ located in Ohio. Upon receiving the order, Company XYZ ships the goods by a for-hire carrier to a public warehouse in Washington. The goods will be considered as having been received by Company ABC at the time Company ABC is entitled to receive a warehouse receipt for the goods. Company XYZ will be subject to the B&O tax at that time if it had nexus for this sale.

(j) P&S Department Stores has retail stores located in Washington, Oregon, and in several other states. John Doe goes to a P&S store in Portland, Oregon to purchase luggage. John Doe takes physical possession of the luggage at the store and elects to finance the purchase using a credit card issued to him by P&S. John Doe is a Washington resident and the credit card billings are sent to him at his Washington address. P&S does not have any responsibility for collection of retail sales or use tax on this transaction because receipt of the luggage by the customer occurred outside Washington.

(k) JET Company is located in the state of Kansas where it manufactures specialty parts. One of JET's customers is AIR who purchases these parts as components of the product which AIR assembles in Washington. AIR has an employee at the JET manufacturing site who reviews quality control of the product during fabrication. He also inspects the product and gives his approval for shipment to Washington. JET is not subject to B&O tax on the sales to AIR. AIR receives the parts in Kansas irrespective that JET may be shown as the shipper on bills of lading or that some parts eventually may be returned after shipment to Washington because of hidden defects.))

(a) This rule explains the application of the business and occupation (B&O) and retail sales taxes to interstate sales of tangible personal property. In general, Washington imposes its B&O and retail sales taxes on sales of tangible personal property if the seller has nexus with Washington and the sale occurs in Washington.

(b) The following rules may also be helpful:

(i) WAC 458-20-178 Use tax and the use of tangible personal property.

(ii) WAC 458-20-193C Imports and exports—Sales of goods from or to persons in foreign countries.

(iii) WAC 458-20-193D Transportation, communication, public utility activities, or other services in interstate or foreign commerce.

(iv) WAC 458-20-221 Collection of use tax by retailers and selling agents.

(c) Examples included in this rule identify a number of facts and then state a conclusion; they should be used only as a general guide. The tax results of all situations must be determined after a review of all the facts and circumstances.

(d) This rule does not cover sales of intangibles or services and does not address the use tax obligation of a purchaser of goods in Washington (see WAC 458-20-178) or the use tax collection obligation of out-of-state sellers of goods to Washington customers when sellers are not otherwise liable to collect and remit retail sales tax (see WAC 458-20-221).

(e) For purposes of this rule, the term "tangible personal property" means personal property that can be seen, weighed, measured, felt, or touched or that is in any other manner perceptible to the senses, but does not include steam, electricity, or electrical energy. It includes prewritten computer software (as such term is defined in RCW 82.04.215) in tangible form. However, this rule does not address electronically delivered prewritten computer software or remote access software.

(2) Organization of rule. This rule is divided into three parts:

(a) Part I – Nexus standard for sales of tangible personal property;

(b) Part II – Sourcing sales of tangible personal property; and

(c) Part III – Drop shipment sales.

Part I – Nexus Standard for Sales of Tangible Personal Property

(101) Introduction. The nexus standard described here is provided in RCW 82.04.067(6) and is used to determine whether a person who sells tangible personal property has nexus with Washington for B&O and retail sales tax purposes. The economic nexus standard under RCW 82.04.067 (1) through (5) (as further described in WAC 458-20-19401) does not apply to the activity of selling tangible personal property and is, therefore, not addressed in this rule. Further, Public Law 86-272 (15 U.S.C. Sec. 381 et seq.) applies only to taxes on or measured by net income. Washington's B&O tax is measured by gross receipts. Consequently, Public Law 86-272 does not apply.

(102) Nexus. A person who sells tangible personal property is deemed to have nexus with Washington if the person has a physical presence in this state, which need only be demonstrably more than the slightest presence. RCW 82.04.067(6).

(a) Physical presence. A person is physically present in this state if:

(i) The person has property in this state;

(ii) The person has one or more employees in this state; or

(iii) The person, either directly or through an agent or other representative, engages in activities in this state that are significantly associated with the person's ability to establish or maintain a market for its products in Washington.

(b) Property. A person has property in this state if the person owns, leases, or otherwise has a legal or beneficial interest in real or personal property in Washington.

(c) Employees. A person has employees in this state if the person is required to report its employees for Washington unemployment insurance tax purposes, or the facts and circumstances otherwise indicate that the person has employees in the state.

(d) In-state activities. Even if a person does not have property or employees in Washington, the person is physically present in Washington when the person, either directly or through an agent or other representative, engages in activities in this state that are significantly associated with the person's ability to establish or maintain a market for its products in Washington. It is immaterial that the activities that establish nexus are not significantly associated with a particular sale into this state.

For purposes of this rule, the term "agent or other representative" includes an employee, independent contractor, commissioned sales representative, or other person acting either at the direction of or on behalf of another.

A person performing the following nonexclusive list of activities, directly or through an agent or other representative, generally is performing activities that are significantly associated with establishing or maintaining a market for a person's products in this state:

(i) Soliciting sales of goods in Washington;

(ii) Installing, assembling, or repairing goods in Washington;

(iii) Constructing, installing, repairing, or maintaining real property or tangible personal property in Washington;

(iv) Delivering products into Washington other than by mail or common carrier;

(v) Having an exhibit at a trade show to maintain or establish a market for one's products in the state (but not merely attending a trade show);

(vi) An online seller having a brick-and-mortar store in this state accepting returns on its behalf;

(vii) Performing activities designed to establish or maintain customer relationships including, but not limited to:

(A) Meeting with customers in Washington to gather or provide product or marketing information, evaluate customer needs, or generate goodwill; or

(B) Being available to provide services associated with the product sold (such as warranty repairs, installation assistance or guidance, and training on the use of the product), if the availability of such services is referenced by the seller in its marketing materials, communications, or other information accessible to customers.

(103) Effect of having nexus. A person selling tangible personal property that has nexus with Washington is subject to B&O tax on that person's retail and wholesale sales, and is responsible for collecting and remitting retail sales tax on that person's sales of tangible personal property sourced to Washington, unless a specific exemption applies.

(104) Trailing nexus. RCW 82.04.220 provides that for B&O tax purposes a person who stops the business activity that created nexus in Washington continues to have nexus for the remainder of that calendar year, plus one additional calendar year (also known as "trailing nexus"). The department applies the same trailing nexus period for retail sales tax and other taxes reported on the excise tax return.

Part II – Sourcing Sales of Tangible Personal Property

(201) Introduction. RCW 82.32.730 explains how to determine where a sale of tangible personal property occurs based on "sourcing rules" established under the streamlined sales and use tax agreement. Sourcing rules for the lease or rental of tangible personal property are beyond the scope of this rule, as are the sourcing rules for "direct mail," "advertising and promotional direct mail," or "other direct mail" as such terms are defined in RCW 82.32.730. See RCW 82.32.730 for further explanation of the sourcing rules for those particular transactions.

(202) Receive and receipt.

(a) Definition. "Receive" and "receipt" mean the purchaser first either taking physical possession of, or having dominion and control over, tangible personal property.

(b) Receipt by a shipping company.

(i) "Receive" and "receipt" do not include possession by a shipping company on behalf of the purchaser, regardless of whether the shipping company has the authority to accept and inspect the goods on behalf of the purchaser.

(ii) A "shipping company" for purposes of this rule means a separate legal entity that ships, transports, or delivers tangible personal property on behalf of another, such as a common carrier, contract carrier, or private carrier either affiliated (e.g., an entity wholly owned by the seller or purchaser) or unaffiliated (e.g., third-party carrier) with the seller or purchaser. A shipping company is not a division or branch of a seller or purchaser that carries out shipping duties for the seller or purchaser, respectively. Whether an entity is a "shipping company" for purposes of this rule applies only to sourcing sales of tangible personal property and does not apply to whether a "shipping company" can create nexus for a seller.

(203) Sourcing sales of tangible personal property – In general. The following provisions in this subsection apply to sourcing sales of most items of tangible personal property.

(a) Business location. When tangible personal property is received by the purchaser at a business location of the seller, the sale is sourced to that business location.

Example 1. Jane is an Idaho resident who purchases tangible personal property at a retailer's physical store location in Washington. Even though Jane takes the property back to Idaho for her use, the sale is sourced to Washington because Jane received the property at the seller's business location in Washington.

Example 2. Department Store has retail stores located in Washington, Oregon, and in several other states. John, a Washington resident, goes to Department Store's store in Portland, Oregon to purchase luggage. John takes possession of the luggage at the store. Although Department Store has nexus with Washington through its Washington store locations, Department Store is not liable for B&O tax and does not have any responsibility to collect Washington retail sales tax on this transaction because the purchaser, John, took possession of the luggage at the seller's business location outside of Washington.

Example 3. An out-of-state purchaser sends its own trucks to Washington to receive goods at a Washington-based seller and to immediately transport the goods to the purchaser's out-of-state location. The sale occurs in Washington because the purchaser receives the goods in Washington. The sale is subject to B&O and retail sales tax.

Example 4. The same purchaser in Example 3 uses a wholly owned affiliated shipping company (a legal entity separate from the purchaser) to pick up the goods in Washington and deliver them to the purchaser's out-of-state location. Because "receive" and "receipt" do not include possession by the shipping company, the purchaser receives the goods when the goods arrive at the purchaser's out-of-state location and not when the shipping company takes possession of the goods in Washington. The sale is not subject to B&O and retail sales tax.

(b) Place of receipt. If the sourcing rule explained in (a) of this subsection does not apply, the sale is sourced to the location where receipt by the purchaser or purchaser's donee, designated as such by the purchaser, occurs, including the location indicated by instructions for delivery to the purchaser or purchaser's donee, as known to the seller.

(i) The term "purchaser" includes the purchaser's agent or designee.

(ii) The term "purchaser's donee" means a person to whom the purchaser directs shipment of goods in a gratuitous transfer (e.g., a gift recipient).

(iii) Commercial law delivery terms, and the Uniform Commercial Code's provisions defining sale or where risk of loss passes, do not determine where the place of receipt occurs.

(iv) The seller must retain in its records documents used in the ordinary course of the seller's business to show how the seller knows the location of where the purchaser or purchaser's donee received the goods. Acceptable proof includes, but is not limited to, the following documents:

(A) Instructions for delivery to the seller indicating where the purchaser wants the goods delivered, provided on a sales contract, sales invoice, or any other document used in the seller's ordinary course of business showing the instructions for delivery;

(B) If shipped by a shipping company, a waybill, bill of lading or other contract of carriage indicating where delivery occurs; or

(C) If shipped by the seller using the seller's own transportation equipment, a trip-sheet signed by the person making delivery for the seller and showing:

• The seller's name and address;

• The purchaser's name and address;

• The place of delivery, if different from the purchaser's address; and

• The time of delivery to the purchaser together with the signature of the purchaser or its agent acknowledging receipt of the goods at the place designated by the purchaser.

Example 5. John buys luggage from a Department Store that has nexus with Washington (as in Example 2), but has the store ship the luggage to John in Washington. Department Store has nexus with Washington, and receipt of the luggage by John occurred in Washington. Department Store owes Washington retailing B&O tax and must collect Washington retail sales tax on this sale.

Example 6. Parts Store is located in Washington. It sells machine parts at retail and wholesale. Parts Collector is located in California and buys machine parts from Parts Store. Parts Store ships the parts directly to Parts Collector in California, and Parts Collector takes possession of the machine parts in California. The sale is not subject to B&O or retail sales taxes in this state because Parts Collector did not receive the parts in Washington.

Example 7. An out-of-state seller with nexus in Washington uses a third-party shipping company to ship goods to a customer located in Washington. The seller first delivers the goods to the shipping company outside Washington using its own transportation equipment. Even though the shipping company took possession of the goods outside of Washington, possession by the shipping company is not receipt by the purchaser for Washington tax purposes. The sale is subject to B&O and retail sales tax in this state because the purchaser has taken possession of the goods in Washington.

Example 8. A Washington purchaser's affiliated shipping company arranges to pick up goods from an out-of-state seller at its out-of-state location, and deliver those goods to the Washington purchaser's Yakima facility. The affiliated shipping company has the authority to accept and inspect the goods prior to transport on behalf of the buyer. When the affiliated shipping company takes possession of the goods out-of-state, the Washington purchaser has not received the goods out-of-state. Possession by a shipping company on behalf of a purchaser is not receipt for purposes of this rule, regardless of whether the shipping company has the authority to accept and inspect the goods on behalf of the buyer. Receipt occurs when the buyer takes possession of the goods in Washington. The sale is subject to B&O and retail sales tax in this state.

Example 9. An instate seller arranges for shipping its goods to an out-of-state purchaser by first delivering its goods to a Washington-based shipping company at its Washington location for further transport to the out-of-state customer's location. Possession of the goods by the shipping company in Washington is not receipt by the purchaser for Washington tax purposes, and the sale is not subject to B&O and retail sales tax in Washington.

Example 10. An out-of-state manufacturer/seller of a bulk good with nexus in Washington sells the good to a Washington-based purchaser in the business of selling small quantities of the good under its own label in its own packaging. The purchaser directs the seller to deliver the goods to a third-party packaging plant located out-of-state for repackaging of the goods in the purchaser's own packaging. The purchaser then has a third-party shipping company pick up the goods at the packaging plant. The Washington purchaser takes constructive possession of the goods outside of Washington because it has exercised dominion and control over the goods by having them repackaged at an out-of-state packaging facility before shipment to Washington. The sale is not subject to B&O and retail sales tax in this state because the purchaser received the goods outside of Washington.

Example 11. Company ABC is located in Washington and purchases goods from Company XYZ located in Ohio. Company ABC directs Company XYZ to ship the goods by a for-hire carrier to a commercial storage warehouse in Washington. The goods will be considered as having been received by Company ABC when the goods are delivered at the commercial storage warehouse. Assuming Company XYZ has nexus, Company XYZ is subject to B&O tax and must collect retail sales tax on the sale.

(c) Other sourcing rules. There may be unique situations where the sourcing rules provided in (a) and (b) of this subsection do not apply. In those cases, please refer to the provisions of RCW 82.32.730 (1)(c) through (e).

(204) Sourcing sales of certain types of property.

(a) Sales of commercial aircraft parts. As more particularly provided in RCW 82.04.627, the sale of certain parts to the manufacturer of a commercial airplane in Washington is deemed to take place at the site of the final testing or inspection.

(b) Sales of motor vehicles, watercraft, airplanes, manufactured homes, etc. Sales of the following types of property are sourced to the location at or from which the property is delivered in accordance with RCW 82.32.730 (7)(a) through (c): Watercraft; modular, manufactured, or mobile homes; and motor vehicles, trailers, semi-trailers, or aircraft that do not qualify as "transportation equipment" as defined in RCW 82.32.730. See WAC 458-20-145 (2)(b) for further information regarding the sourcing of these sales.

(c) Sales of flowers and related goods by florists. Sales by a "florist" are subject to a special origin sourcing rule. For specific information concerning "florist sales," who qualifies as a "florist," and the related sourcing rules, see RCW 82.32.730 (7)(d) and (9)(e) and WAC 458-20-158.

Part III – Drop Shipments

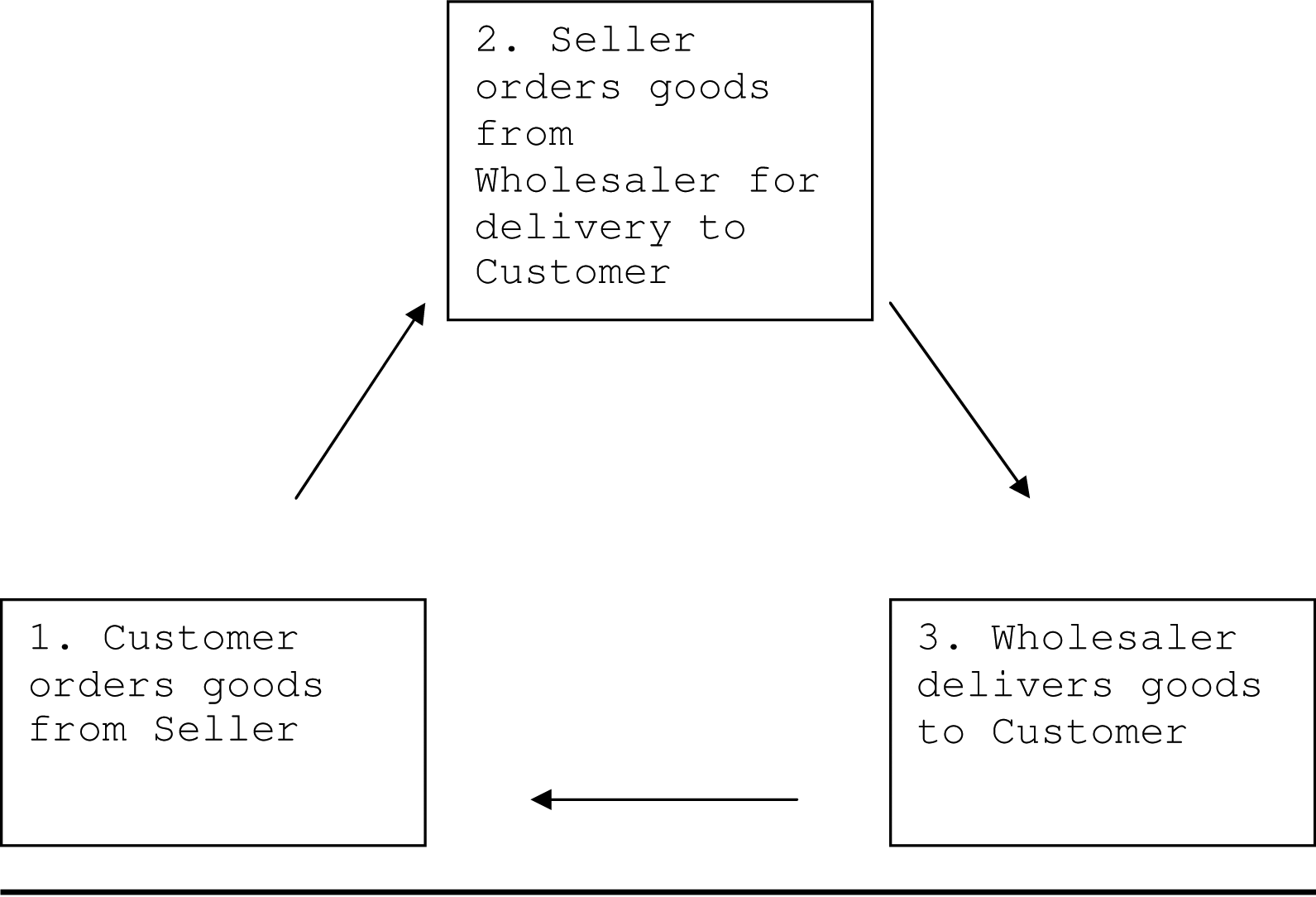

(301) Introduction. A drop shipment generally involves two separate sales. A person (the seller) contracts to sell tangible personal property to a customer. The seller then contracts to purchase that property from a wholesaler and instructs that wholesaler to deliver the property directly to the seller's customer. The place of receipt in a drop shipment transaction is where the property is delivered (i.e., the seller's customer's location). Below is a diagram of a basic drop shipment transaction:

|

The following sections discuss the taxability of drop shipments in Washington when:

(a) The seller and wholesaler do not have nexus;