WSR 14-21-165

PROPOSED RULES

DEPARTMENT OF AGRICULTURE

[Filed October 22, 2014, 8:06 a.m.]

Original Notice.

Preproposal statement of inquiry was filed as WSR 14-17-030.

Title of Rule and Other Identifying Information: Chapter 16-29 WAC, Animal disease traceability.

Hearing Location(s): Natural Resources Building, 1111 Washington Street S.E., First Floor, Conference Room 175, Olympia, WA 98504, on December 8, 2014, at 12:30 p.m.; and at Central Washington University, 400 East University Way, Sue Lombard Hall, Ellensburg, WA 98926, on December 9, 2014, at 11:00 a.m.

Date of Intended Adoption: December 30, 2014.

Submit Written Comments to: Teresa Norman, P.O. Box 42560, Olympia, WA 98504-2560, e-mail WSDARulesComments@agr.wa.gov, fax (360) 902-2092, by 5:00 p.m., December 9, 2014.

Assistance for Persons with Disabilities: Contact Washington state department of agriculture (WSDA) receptionist by December 1, 2014, TTY (800) 833-6388, or 711.

Purpose of the Proposal and Its Anticipated Effects, Including Any Changes in Existing Rules: The department proposes to add new chapter 16-29 WAC, Animal disease traceability. The 2011 legislative session passed SHB 1538 which directed the department to adopt by rule a fee per head on cattle sold or slaughtered in the state or transported out of the state to administer animal disease traceability activities for cattle. The proposed new WAC will establish per head fees on cattle sold or slaughtered in the state or transported out of state, establish a process to assess and collect the fees, and establish a penalty matrix for failing to pay the fees.

Reasons Supporting Proposal: If Washington state is unable to trace cattle, the United States Department of Agriculture has the authority to put movement restrictions on the entire state. This new WAC is necessary for the department to trace cattle that may be infected or have been exposed to infectious and communicable diseases. In order for the department to trace cattle, the department must obtain health and movement information to determine where cattle originated from, where the cattle moved to, and what cattle were exposed.

Statute Being Implemented: Chapter 16.36 RCW.

Rule is not necessitated by federal law, federal or state court decision.

Name of Proponent: WSDA, governmental.

Name of Agency Personnel Responsible for Drafting and Implementation: David Hecimovich, Olympia, (360) 725-5493; and Enforcement: David Bangart, Olympia, (360) 902-1946.

A small business economic impact statement has been prepared under chapter 19.85 RCW.

Small Business Economic Impact Statement

SUMMARY OF PROPOSED RULES: During the 2011 legislative session, the cattle industry approached the legislature for WSDA to adopt rules that will prevent the introduction or spreading of infectious livestock diseases into the state. One component of this request is the ability to carry out animal disease traceability activities for cattle funded through fees. The legislation was passed (SHB 1538) and a new section was added to chapter 16.36 RCW allowing the director to administer animal disease traceability activities for cattle by adopting by rule a fee per head on cattle sold or slaughtered in the state, or transported out of the state. The fee would not exceed forty cents per head of cattle.

WSDA is proposing to establish chapter 16-29 WAC, Animal disease traceability within Title 16 WAC, Department of agriculture. The purpose of this chapter is to establish animal disease traceability activities for cattle.

SMALL BUSINESS ECONOMIC IMPACT STATEMENT (SBEIS): Chapter 19.85 RCW, the Regulatory Fairness Act, requires an analysis of the economic impact proposed rules will have on regulated small businesses. Preparation of an SBEIS is required when proposed rules will impose more than minor costs for compliance or have the potential of placing an economic impact on small businesses that is disproportionate to the impact on large businesses. "Minor cost" means a cost that is less than three-tenths of one percent of annual revenue or income, or one hundred dollars, whichever is greater, or one percent of annual payroll. "Small business" means any business entity that is owned and operated independently from all other businesses and has fifty or fewer employees.

INDUSTRY ANALYSIS: The animal disease traceability program will be responsible for administering animal disease tracebacks for livestock within the state of Washington. The program has determined it regulates six thousand four hundred twenty existing businesses that fall under the North American Industry Classification System codes corresponding to the regulated industry: 31161, Animal Slaughtering (except poultry); 112120, Dairy Cattle and Milk Production; 112111, Beef Cattle Ranching & Farming; and 112112, Cattle Feedlots.

INVOLVEMENT OF SMALL BUSINESSES: A small business economic impact assessment survey was mailed to six thousand four hundred twenty producers and businesses (six thousand sixty-three registered brand holders and three hundred fifty-seven businesses associated with cattle who were not registered brand holders) to analyze the economic impact of proposed rules on small businesses.

WSDA analyzed how the fee per head to administer animal disease traceability activities for cattle would be collected on cattle at change of ownership, transported out of the state, or slaughtered in the state.

COST OF COMPLIANCE: RCW 19.85.040 directs agencies to analyze the costs of compliance for businesses required to comply with the proposed rule, including costs of equipment, supplies, labor, professional services, and increased administrative costs. Agencies must also consider whether compliance with the rule will result in loss of sales or revenue. RCW 19.85.040 directs agencies to determine whether the proposed rule will have a disproportionate cost impact on small businesses by comparing the cost of compliance for small business with the cost of compliance for the ten percent of the largest businesses required to comply with the proposed rules. Agencies are to use one or more of the following as a basis for comparing costs:

• | Cost per employee; |

• | Cost per hour of labor; or |

• | Cost per one hundred dollars of sales. |

The program has opted to look at cost per one hundred dollars of sales as a basis for comparing costs.

Analysis of Cost of Compliance: The program has analyzed the cost of compliance anticipated by regulated small businesses. Four hundred and eight small businesses and five large businesses returned the small business economic impact survey. Thirty-seven percent of small businesses and sixty percent of the large businesses surveyed indicated fees would have an impact.

The following questions were asked and then charted to business that may have an impact from SHB 1538:

• | Will the business incur costs to comply? If yes, cost per $100 of sales? |

• | What kinds of resources will the business likely need i.e., equipment, supplies, labor, increased administrative costs or professional services? |

• | Will the business lose sales or revenue? If yes, how much revenue will be lost? |

• | Will jobs be created or eliminated? If yes, how many jobs? |

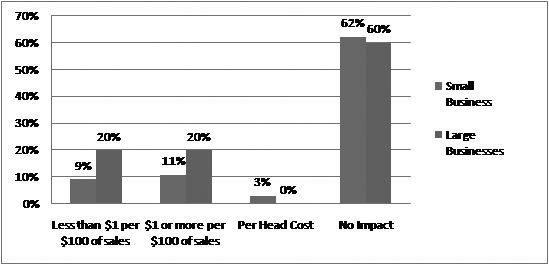

Question: Will the business incur costs to comply? If yes, cost per $100 of sales?

Costs listed as less than $1 per $100 of sales, $1 or more per $100 of sales, per head cost and no impact. |

|

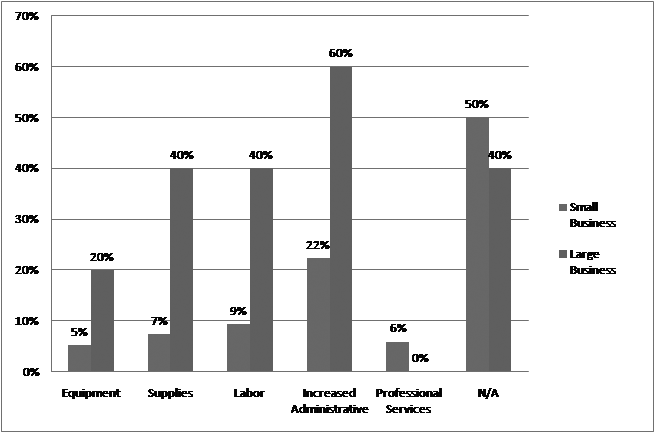

Question: What kinds of resources will the business likely need i.e., equipment, supplies, labor, increased administrative costs or professional services?

50% of small business and 60% of the large business would require resources. |

|

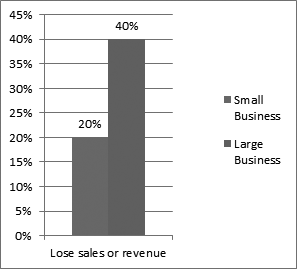

Question: Will the business lose sales or revenue? If yes, how much revenue will be lost?

20% of small business and 40% of large business would lose sales or revenue Note: The 20% total of small business was from the sum of 13% of small business would lose sales or revenue plus 8% of small business reporting sales or revenue lost on a per head basis. Large business only reported loss of sale or revenue. |

|

Analysis of Disproportionate Economic Impact: When costs associated with proposed rules are more than minor, the Regulatory Fairness Act requires a comparison of the costs to small businesses with those of ten percent of the largest businesses in the regulated industry. An analysis has shown that the costs small businesses will incur to comply with the proposed rules are not more than minor and are not disproportionate to costs incurred by large business entities.

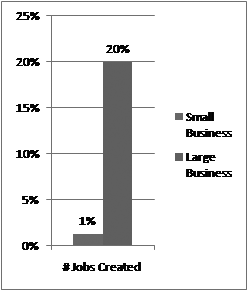

JOBS CREATED OR LOST: Under RCW 19.85.040, agencies must provide an estimate of the number of jobs that will be created or lost as the result of compliance with the proposed rules.

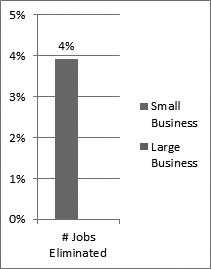

Question: Will jobs be created or eliminated? If yes, how many jobs?

1% of small business and 20% of large business responded 1 or 2 jobs would be created. 4% of small business responded 1 or 2 jobs would be eliminated. No large business reported an impact. |

|

|

CONCLUSION: To comply with chapter 19.85 RCW, the Regulatory Fairness Act, WSDA has analyzed the economic impact of the proposed rules on small businesses and has concluded that the costs are not more than minor and there is no disproportionate impact between small and large businesses.

Please contact David Hecimovich if you have any questions at (360) 725-5493, or by e-mail dhecimovich@agr.wa.gov.

A copy of the statement may be obtained by contacting David Hecimovich, WSDA, P.O. Box 42560, Olympia, WA 98504-2560, phone (360) 725-5493, fax (360) 902-2087, e-mail dhecimovich@agr.wa.gov.

A cost-benefit analysis is not required under RCW 34.05.328. WSDA is not a listed agency in RCW 34.05.328 (5)(a)(i).

October 22, 2014

Lynn M. Briscoe

Assistant Director

Chapter 16-29 WAC

ANIMAL DISEASE TRACEABILITY

NEW SECTION

WAC 16-29-005 Purpose.

The purpose of this chapter is to administer animal disease traceability activities by assessing a per head fee on cattle sold or slaughtered in the state or transported out of the state.

NEW SECTION

WAC 16-29-010 Definitions.

In addition to the definitions found in RCW 16.36.005, 16.57.010, 16.58.020 and chapter 16-610 WAC the following definitions apply to this chapter:

"Custom slaughtering" means slaughtering performed by a person licensed under chapter 16.49 RCW to slaughter meat food animals for the owner of the animal.

"Entry permit" means prior written permission issued by the director to admit or import animals or animal reproductive products into Washington state.

"Immediate slaughter cattle" means out-of-state cattle processed within twenty-four hours of entry to a federally inspected slaughter facility.

"Slaughter facility" means an establishment operated for the purpose of slaughtering meat food animals for sale or use as human food in compliance with the federal Meat Inspection Act.

NEW SECTION

WAC 16-29-015 Levy and collection of assessment.

(1) An assessment of $0.23 per head is levied on all cattle sold or slaughtered in the state or transported out of the state except for:

(a) An assessment of $0.05 per head is levied on all immediate slaughter cattle.

(b) No assessment is paid on cattle slaughtered and retained by the owner for personal consumption.

(2) Collection of assessments will be collected in the same manner as the livestock inspection fees under RCW 16.57.223 and 16.65.090 except for subsection (1)(a) of this section. For immediate slaughter cattle or cattle originating from a certified feedlot, the assessments will be collected by the slaughter facility and remitted to the department by the fifteenth day of the month following the month the transaction occurred.

In addition to the assessment collected by the slaughter facility, the slaughter facility shall furnish the department a list of all cattle slaughtered during any given month.

(3) Assessments owed from private individual sales, trades, gifting, barter, or any other action that constitutes a change of ownership of livestock per WAC 16-610-020(3), not occurring at a public livestock market or special sale licensed under chapters 16.65 RCW and 16-610 WAC or a slaughter facility, will be collected:

(a) When a change of ownership livestock inspection is conducted or when the transaction is reported through an electronic livestock movement reporting system per chapter 16-610 WAC.

(b) When utilizing the "green tag" as provided in RCW 16.57.160(3). The assessment will be added to the purchase price of each tag.

(4) Assessments are collected at a federally inspected slaughter facility when:

(a) Cattle are sold and slaughtered concurrently. This is considered a one assessment event and one fee shall be collected per head from the seller.

(b) Cattle originate from a certified feedlot licensed under chapter 16.58 RCW. The assessments will be collected by the slaughter facility and remitted to the department by the fifteenth day of the month following the month the transaction occurred.

(c) Cattle are slaughtered and no change of ownership has occurred, the per head fee shall be collected from the owner of the animal.

(5) Collection of assessments for custom slaughtering occurs when utilizing custom slaughter beef tags per WAC 16-610-100. The assessment will be added to the purchase price of each tag.

(6) Collection of assessments at public livestock markets and special sales licensed under chapter 16.65 RCW will be considered one assessment event, charged to the seller, when:

(a) Cattle are purchased and destined to an out-of-state location by the buyer.

(b) Cattle are purchased and destined for slaughter to an in-state federally inspected slaughter facility.

(7) When Washington origin cattle are transported for sale to an out-of-state market where the director conducts inspections of Washington origin cattle by agreement with the host state, it shall be considered one assessment event and one fee shall be collected per head from the Washington seller.

(8) Collection of assessments for out-of-state movement occurs when:

(a) Cattle are purchased and destined to an out-of-state location by the buyer. This is considered a one assessment event and one fee shall be collected per head from the seller.

(b) Cattle are moving out-of-state with no change of ownership.

NEW SECTION

WAC 16-29-020 Inspection of records.

The slaughter facility must keep accurate records for six years for all cattle entering a federally inspected slaughter facility. Records must be open for review by authorized department of agriculture personnel during normal business hours, and must be provided to the department upon the director's request.

NEW SECTION

WAC 16-29-025 Penalty outline and schedule.

(1) If any person fails to comply with the requirements of RCW 16.36.150 and this chapter, the director may issue that person a notice of infraction and may assess a penalty.

(2) Each violation is a separate and distinct offense. Penalties may be assessed per violation or per head.

(3) The following is the base penalty, not including statutory assessments.

Violation |

Base Penalty |

|

RCW 16.36.150 |

Failing to pay the traceability fee |

|

First offense |

$50.00 |

|

Second offense within three years |

$125.00 |

|

Third and subsequent offenses within three years |

$250.00 |

|