Effective Date of Rule: Immediately upon filing.

Purpose: WAC 458-20-193 (Rule 193) and 458-20-221 (Rule 221) provide guidance regarding the need for a seller to establish the required nexus for the state to impose a sales or use tax collection obligation on retail sales into Washington. WAC 458-20-19401 (Rule 19401) provides guidance regarding the minimum nexus thresholds for apportionable activities and selling activities in Washington in order to establish a nexus for purposes of the business and occupation (B&O) tax in Washington.

Citation of Rules Affected by this Order: Amending WAC 458-20-193, 458-20-221, and 458-20-19401.

Reasons for this Finding: Taxpayers rely on Rules 193 and 221 to determine whether they are required to collect sales or use tax on taxable retail sales sourced to Washington. Effective October 1, 2018, the department imposed a sales or use tax collection obligation on remote sellers meeting certain thresholds. Taxpayers rely on Rule 19401 to determine whether they meet the minimum nexus thresholds for apportionable activities and selling activities. SSB 5581 (2019) clarified the sales tax collection obligation for remote sellers and when a person is deemed to have established substantial nexus for B&O tax purposes. Because of these changes in the law, Rules 193, 221, and 19401 require substantive updates using the standard rule-making process. Until these rules are amended, the department wants to ensure the public does not use current Rules 193, 221, and 19401 to determine their sales or use tax collection obligations or to determine substantial nexus for apportionable activities and selling activities for periods beginning on or after October 1, 2018.

Number of Sections Adopted in Order to Comply with Federal Statute: New 0, Amended 0, Repealed 0; Federal Rules or Standards: New 0, Amended 0, Repealed 0; or Recently Enacted State Statutes: New 0, Amended 0, Repealed 0.

Number of Sections Adopted at the Request of a Nongovernmental Entity: New 0, Amended 0, Repealed 0.

Number of Sections Adopted on the Agency's own Initiative: New 0, Amended 3, Repealed 0.

Number of Sections Adopted in Order to Clarify, Streamline, or Reform Agency Procedures: New 0, Amended 3, Repealed 0.

Number of Sections Adopted using Negotiated Rule Making: New 0, Amended 0, Repealed 0; Pilot Rule Making: New 0, Amended 0, Repealed 0; or Other Alternative Rule Making: New 0, Amended 0, Repealed 0.

Date Adopted: March 23, 2023.

(1)

Introduction.The U.S. Supreme Court's decision in South Dakota v. Wayfair, 138 S.Ct. 2080 (2018), clarified that Washington may impose a sales and use tax collection obligation on sellers who do not have a physical presence in this state. Effective October 1, 2018, Washington required remote sellers meeting certain thresholds to collect retail sales or use tax on all taxable sales sourced to Washington. Substitute Senate Bill No. 5581 (2019) further clarified the sales tax collection obligation for remote sellers. In accordance with RCW 82.08.052, a seller with a substantial nexus with this state under RCW 82.04.067 is obligated to collect and remit retail sales tax. As a result, this rule may include outdated or incomplete guidance regarding who is required to collect Washington's retail sales or use tax. Please see our website for the most recent information on those requirements.This rule explains the application of the business and occupation (B&O) and retail sales taxes to interstate sales of tangible personal property.

(a) The following rules may also be helpful:

(i) WAC 458-20-178 Use tax and the use of tangible personal property.

(ii) WAC 458-20-193C Imports and exports—Sales of goods from or to persons in foreign countries.

(iii) WAC 458-20-193D Transportation, communication, public utility activities, or other services in interstate or foreign commerce.

(iv) WAC 458-20-19401 Minimum nexus threshold for apportionable receipts.

(b) This rule contains examples that identify a number of facts and then state a conclusion. These examples should be used only as a general guide. The tax results of all situations must be determined after a review of all the facts and circumstances.

(c)

Tangible personal property. For purposes of this rule, the term "tangible personal property" means personal property that can be seen, weighed, measured, felt, or touched or that is in any other manner perceptible to the senses, but does not include steam, electricity, or electrical energy. It includes prewritten computer software (as such term is defined in RCW

82.04.215) in tangible form. However, this rule does not address electronically delivered prewritten computer software or remote access software.

(2) Scope of rule. In general, Washington imposes its B&O and retail sales taxes on sales of tangible personal property if the seller has nexus with Washington and the sale occurs in Washington. This rule explains the applicable nexus and place of sale requirements with respect to sales of tangible personal property. This rule does not cover sales of intangibles or services and does not address the use tax obligation of a purchaser of goods in Washington. For information on payment responsibilities for use tax see WAC 458-20-178.

(3) Organization of rule. This rule is divided into three parts:

(a) Part I – Nexus standards for sales of tangible personal property;

(b) Part II – Sourcing sales of tangible personal property; and

(c) Part III – Drop shipment sales.

Part I – Nexus Standards for Sales of Tangible Personal Property

(101) Introduction. A seller is subject to the state's B&O tax and retail sales tax with respect to sales of tangible personal property, if that seller has nexus. Washington applies specific nexus standards and thresholds that are used to determine whether a seller of tangible personal property has nexus. The nexus standards and thresholds described in this rule pertain only to sellers of tangible personal property. The remainder of Part 1 of this rule describes these nexus standards and thresholds and how they apply in the context of Washington's wholesaling and retailing B&O classifications and the retail sales tax.

(102)

Physical presence nexus standard. A person who sells tangible personal property in a retail sale is deemed to have nexus with Washington if the person has a physical presence in this state, which need only be demonstrably more than the slightest presence. RCW

82.04.067(6). This standard applies to retail sales both in the retail sales tax and retailing B&O tax context.

(a) Physical presence. A person is physically present in this state if:

(i) The person has property in this state;

(ii) The person has one or more employees in this state;

(iii) The person, either directly or through an agent or other representative, engages in activities in this state that are significantly associated with the person's ability to establish or maintain a market for its products in Washington; or

(iv) The person is a remote seller as defined in RCW

82.08.052 and is unable to rebut the substantial nexus presumption for remote sellers set out in RCW

82.04.067 (6)(c)(ii).

(b) Property. A person has property in this state if the person owns, leases, or otherwise has a legal or beneficial interest in real or personal property in Washington.

(c) Employees. A person has employees in this state if the person is required to report its employees for Washington unemployment insurance tax purposes, or the facts and circumstances otherwise indicate that the person has employees in the state.

(d) In-state activities. Even if a person does not have property or employees in Washington, the person is physically present in Washington when the person, either directly or through an agent or other representative, engages in activities in this state that are significantly associated with the person's ability to establish or maintain a market for its products in Washington. It is immaterial that the activities that establish nexus are not significantly associated with a particular sale into this state.

For purposes of this rule, the term "agent or other representative" includes an employee, independent contractor, commissioned sales representative, or other person acting either at the direction of or on behalf of another.

A person performing the following nonexclusive list of activities, directly or through an agent or other representative, generally is performing activities that are significantly associated with establishing or maintaining a market for a person's products in this state:

(i) Soliciting sales of goods in Washington;

(ii) Installing, assembling, or repairing goods in Washington;

(iii) Constructing, installing, repairing, or maintaining real property or tangible personal property in Washington;

(iv) Delivering products into Washington other than by mail or common carrier;

(v) Having an exhibit at a trade show to maintain or establish a market for one's products in the state, except as described in subsection (102)(f) of this rule;

(vi) An online seller having a brick-and-mortar store in this state accepting returns on its behalf;

(vii) Performing activities designed to establish or maintain customer relationships including, but not limited to:

(A) Meeting with customers in Washington to gather or provide product or marketing information, evaluate customer needs, or generate goodwill; or

(B) Being available to provide services associated with the product sold (such as warranty repairs, installation assistance or guidance, and training on the use of the product), if the availability of such services is referenced by the seller in its marketing materials, communications, or other information accessible to customers.

(e)

Remote sellers – Click-through nexus. Effective September 1, 2015, a remote seller as defined in RCW

82.08.052 is presumed to meet the physical presence nexus standard described in this subsection for purposes of the retail sales tax if the remote seller enters into an agreement with a resident of this state under which the resident, for a commission or other consideration, refers potential customers to the remote seller, whether by link on an internet website or otherwise, but only if the cumulative gross receipts from sales by the remote seller to customers in this state who are referred to the remote seller through such agreements exceeds ten thousand dollars during the preceding calendar year. For more information related to the presumption and how to rebut the presumption, see RCW

82.08.052 and

82.04.067 (6)(c)(ii).

(f)

Trade convention exception. For the physical presence nexus standard described in this subsection, the department may not make a determination of nexus based solely on the attendance or participation of one or more representatives of a person at a single trade convention per calendar year in Washington state in determining if such person is physically present in this state for the purposes of establishing substantial nexus with this state. This does not apply to persons making retail sales at a trade convention in this state, including persons taking orders for products or services where receipt will occur at a later time in Washington state. RCW

82.32.531.

Definitions. The following definitions apply only to (f) of this subsection:

(i) "Not marketed to the general public" means that the sponsor of a trade convention limits its marketing efforts for the trade convention to its members and specific invited guests of the sponsoring organization.

(ii) "Physically present in this state" and "substantial nexus with this state" have the same meaning as provided in RCW

82.04.067.

(iii) "Trade convention" means an exhibition for a specific industry or profession, which is not marketed to the general public, for the purposes of:

(A) Exhibiting, demonstrating, and explaining services, products, or equipment to potential customers; or

(B) The exchange of information, ideas, and attitudes in regards to that industry or profession.

(103)

Economic nexus thresholds. RCW

82.04.067 establishes substantial nexus thresholds that apply to persons who sell tangible personal property. For more information on the economic nexus thresholds, see WAC 458-20-19401.

Application to retail sales. Effective July 1, 2017, for B&O tax purposes, a person making retail sales taxable under RCW

82.04.250(1) or

82.04.257(1) is deemed to have substantial nexus with Washington if the person's receipts meet the economic nexus thresholds under RCW

82.04.067 (1)(c)(iii) and (iv). The receipts threshold is met if the person has more than two hundred sixty-seven thousand dollars of receipts (as adjusted by RCW

82.04.067(5)) from this state or at least twenty-five percent of the person's total receipts are in this state. For more information, see WAC 458-20-19401.

(104)

Application of standards and thresholds to wholesale sales. The physical presence nexus standard described in subsection (102) of this rule, applies to wholesale sales for periods prior to September 1, 2015. Effective September 1, 2015, wholesale sales taxable under RCW

82.04.257(1) and

82.04.270 are subject to the RCW

82.04.067 (1) through (5) economic nexus thresholds. Wholesaling activities not taxable under RCW

82.04.257(1) and

82.04.270 remain subject to the physical presence nexus standard. For more information, see WAC 458-20-19401.

(105) Effect of having nexus.

(a)

Retail sales. A person that makes retail sales of tangible personal property and meets either the physical presence nexus standard or whose receipts meet the economic nexus thresholds described in RCW

82.04.067 (1)(c)(iii) or (iv) is subject to B&O tax on that person's retail sales received in the state. In addition, a person that makes retail sales of tangible personal property and meets the physical presence nexus standard, including as described in subsection (102)(e) of this rule, is also responsible for collecting and remitting retail sales tax on that person's sales of tangible personal property sourced to Washington, unless a specific exemption applies.

(b) Wholesale sales. A person that makes wholesale sales of tangible personal property and has nexus with Washington (as described in subsection (104) of this rule) is subject to B&O tax on that person's wholesale sales sourced to Washington.

(106)

Trailing nexus. Effective July 1, 2017, for B&O tax purposes, a person is deemed to have substantial nexus with Washington for the current year if that person meets any of the requirements in RCW

82.04.067 in either the current or immediately preceding calendar year. Thus, a person who stops the business activity that created nexus in Washington continues to have nexus in the calendar year following any calendar year in which the person met any of the requirements in RCW

82.04.067 (also known as "trailing nexus").

Prior to July 1, 2017, RCW

82.04.220 provided that for B&O tax purposes a person who stopped the business activity that created nexus in Washington continued to have nexus for the remainder of that calendar year, plus one additional calendar year.

The department of revenue applies the same trailing nexus period for retail sales tax and other taxes reported on the excise tax return.

(107) Public Law 86-272. Public Law 86-272 (15 U.S.C. Sec. 381 et. seq.) applies only to taxes on or measured by net income. Washington's B&O tax is measured by gross receipts. Consequently, Public Law 86-272 does not apply.

Part II – Sourcing Sales of Tangible Personal Property

(201)

Introduction. RCW

82.32.730 explains how to determine where a sale of tangible personal property occurs based on "sourcing rules" established under the streamlined sales and use tax agreement. Sourcing rules for the lease or rental of tangible personal property are beyond the scope of this rule, as are the sourcing rules for "direct mail," "advertising and promotional direct mail," or "other direct mail" as such terms are defined in RCW

82.32.730. See RCW

82.32.730 for further explanation of the sourcing rules for those particular transactions.

(202) Receive and receipt.

(a) Definition. "Receive" and "receipt" mean the purchaser first either taking physical possession of, or having dominion and control over, tangible personal property.

(b) Receipt by a shipping company.

(i) "Receive" and "receipt" do not include possession by a shipping company on behalf of the purchaser, regardless of whether the shipping company has the authority to accept and inspect the goods on behalf of the purchaser.

(ii) A "shipping company" for purposes of this rule means a separate legal entity that ships, transports, or delivers tangible personal property on behalf of another, such as a common carrier, contract carrier, or private carrier either affiliated (e.g., an entity wholly owned by the seller or purchaser) or unaffiliated (e.g., third-party carrier) with the seller or purchaser. A shipping company is not a division or branch of a seller or purchaser that carries out shipping duties for the seller or purchaser, respectively. Whether an entity is a "shipping company" for purposes of this rule applies only to sourcing sales of tangible personal property and does not apply to whether a "shipping company" can create nexus for a seller.

(203) Sourcing sales of tangible personal property – In general. The following provisions in this subsection apply to sourcing sales of most items of tangible personal property.

(a) Business location. When tangible personal property is received by the purchaser at a business location of the seller, the sale is sourced to that business location.

Example 1. Jane is an Idaho resident who purchases tangible personal property at a retailer's physical store location in Washington. Even though Jane takes the property back to Idaho for her use, the sale is sourced to Washington because Jane received the property at the seller's business location in Washington.

Example 2. Department Store has retail stores located in Washington, Oregon, and in several other states. John, a Washington resident, goes to Department Store's store in Portland, Oregon to purchase luggage. John takes possession of the luggage at the store. Although Department Store has nexus with Washington through its Washington store locations, Department Store is not liable for B&O tax and does not have any responsibility to collect Washington retail sales tax on this transaction because the purchaser, John, took possession of the luggage at the seller's business location outside of Washington.

Example 3. An out-of-state purchaser sends its own trucks to Washington to receive goods at a Washington-based seller and to immediately transport the goods to the purchaser's out-of-state location. The sale occurs in Washington because the purchaser receives the goods in Washington. The sale is subject to B&O and retail sales tax.

Example 4. The same purchaser in Example 3 uses a wholly owned affiliated shipping company (a legal entity separate from the purchaser) to pick up the goods in Washington and deliver them to the purchaser's out-of-state location. Because "receive" and "receipt" do not include possession by the shipping company, the purchaser receives the goods when the goods arrive at the purchaser's out-of-state location and not when the shipping company takes possession of the goods in Washington. The sale is not subject to B&O tax or retail sales tax.

(b) Place of receipt. If the sourcing rule explained in (a) of this subsection does not apply, the sale is sourced to the location where receipt by the purchaser or purchaser's donee, designated as such by the purchaser, occurs, including the location indicated by instructions for delivery to the purchaser or purchaser's donee, as known to the seller.

(i) The term "purchaser" includes the purchaser's agent or designee.

(ii) The term "purchaser's donee" means a person to whom the purchaser directs shipment of goods in a gratuitous transfer (e.g., a gift recipient).

(iii) Commercial law delivery terms, and the Uniform Commercial Code's provisions defining sale or where risk of loss passes, do not determine where the place of receipt occurs.

(iv) The seller must retain in its records documents used in the ordinary course of the seller's business to show how the seller knows the location of where the purchaser or purchaser's donee received the goods. Acceptable proof includes, but is not limited to, the following documents:

(A) Instructions for delivery to the seller indicating where the purchaser wants the goods delivered, provided on a sales contract, sales invoice, or any other document used in the seller's ordinary course of business showing the instructions for delivery;

(B) If shipped by a shipping company, a waybill, bill of lading or other contract of carriage indicating where delivery occurs; or

(C) If shipped by the seller using the seller's own transportation equipment, a trip-sheet signed by the person making delivery for the seller and showing:

• The seller's name and address;

• The purchaser's name and address;

• The place of delivery, if different from the purchaser's address; and

• The time of delivery to the purchaser together with the signature of the purchaser or its agent acknowledging receipt of the goods at the place designated by the purchaser.

Example 5. John buys luggage from a Department Store that has nexus with Washington (as in Example 2), but has the store ship the luggage to John in Washington. Department Store has nexus with Washington, and receipt of the luggage by John occurred in Washington. Department Store owes Washington retailing B&O tax and must collect Washington retail sales tax on this sale.

Example 6. Parts Store is located in Washington. It sells machine parts at retail and wholesale. Parts Collector is located in California and buys machine parts from Parts Store. Parts Store ships the parts directly to Parts Collector in California, and Parts Collector takes possession of the machine parts in California. The sale is not subject to B&O or retail sales taxes in this state because Parts Collector did not receive the parts in Washington.

Example 7. An out-of-state seller with nexus in Washington uses a third-party shipping company to ship goods to a customer located in Washington. The seller first delivers the goods to the shipping company outside Washington using its own transportation equipment. Even though the shipping company took possession of the goods outside of Washington, possession by the shipping company is not receipt by the purchaser for Washington tax purposes. The sale is subject to B&O and retail sales tax in this state because the purchaser has taken possession of the goods in Washington.

Example 8. A Washington purchaser's affiliated shipping company arranges to pick up goods from an out-of-state seller at its out-of-state location, and deliver those goods to the Washington purchaser's Yakima facility. The affiliated shipping company has the authority to accept and inspect the goods prior to transport on behalf of the buyer. When the affiliated shipping company takes possession of the goods out-of-state, the Washington purchaser has not received the goods out-of-state. Possession by a shipping company on behalf of a purchaser is not receipt for purposes of this rule, regardless of whether the shipping company has the authority to accept and inspect the goods on behalf of the buyer. Receipt occurs when the buyer takes possession of the goods in Washington. The sale is subject to B&O and retail sales tax in this state.

Example 9. An instate seller arranges for shipping its goods to an out-of-state purchaser by first delivering its goods to a Washington-based shipping company at its Washington location for further transport to the out-of-state customer's location. Possession of the goods by the shipping company in Washington is not receipt by the purchaser for Washington tax purposes, and the sale is not subject to B&O and retail sales tax in Washington.

Example 10. An out-of-state manufacturer/seller of a bulk good with nexus in Washington sells the good to a Washington-based purchaser in the business of selling small quantities of the good under its own label in its own packaging. The purchaser directs the seller to deliver the goods to a third-party packaging plant located out-of-state for repackaging of the goods in the purchaser's own packaging. The purchaser then has a third-party shipping company pick up the goods at the packaging plant. The Washington purchaser takes constructive possession of the goods outside of Washington because it has exercised dominion and control over the goods by having them repackaged at an out-of-state packaging facility before shipment to Washington. The sale is not subject to B&O and retail sales tax in this state because the purchaser received the goods outside of Washington.

Example 11. Company ABC is located in Washington and purchases goods from Company XYZ located in Ohio. Company ABC directs Company XYZ to ship the goods by a for-hire carrier to a commercial storage warehouse in Washington. The goods will be considered as having been received by Company ABC when the goods are delivered at the commercial storage warehouse. Assuming Company XYZ has nexus, Company XYZ is subject to B&O tax and must collect retail sales tax on the sale.

(c)

Other sourcing rules. There may be unique situations where the sourcing rules provided in (a) and (b) of this subsection do not apply. In those cases, please refer to the provisions of RCW

82.32.730 (1)(c) through (e).

(204) Sourcing sales of certain types of property.

(a)

Sales of commercial aircraft parts. As more particularly provided in RCW

82.04.627, the sale of certain parts to the manufacturer of a commercial airplane in Washington is deemed to take place at the site of the final testing or inspection.

(b)

Sales of motor vehicles, watercraft, airplanes, manufactured homes, etc. Sales of the following types of property are sourced to the location at or from which the property is delivered in accordance with RCW

82.32.730 (7)(a) through (c): Watercraft; modular, manufactured, or mobile homes; and motor vehicles, trailers, semi-trailers, or aircraft that do not qualify as "transportation equipment" as defined in RCW

82.32.730. See WAC 458-20-145 (2)(b) for further information regarding the sourcing of these sales.

(c)

Sales of flowers and related goods by florists. Sales by a "florist" are subject to a special origin sourcing rule. For specific information concerning "florist sales," who qualifies as a "florist," and the related sourcing rules, see RCW

82.32.730 (7)(d) and (9)(e) and WAC 458-20-158.

Part III – Drop Shipments

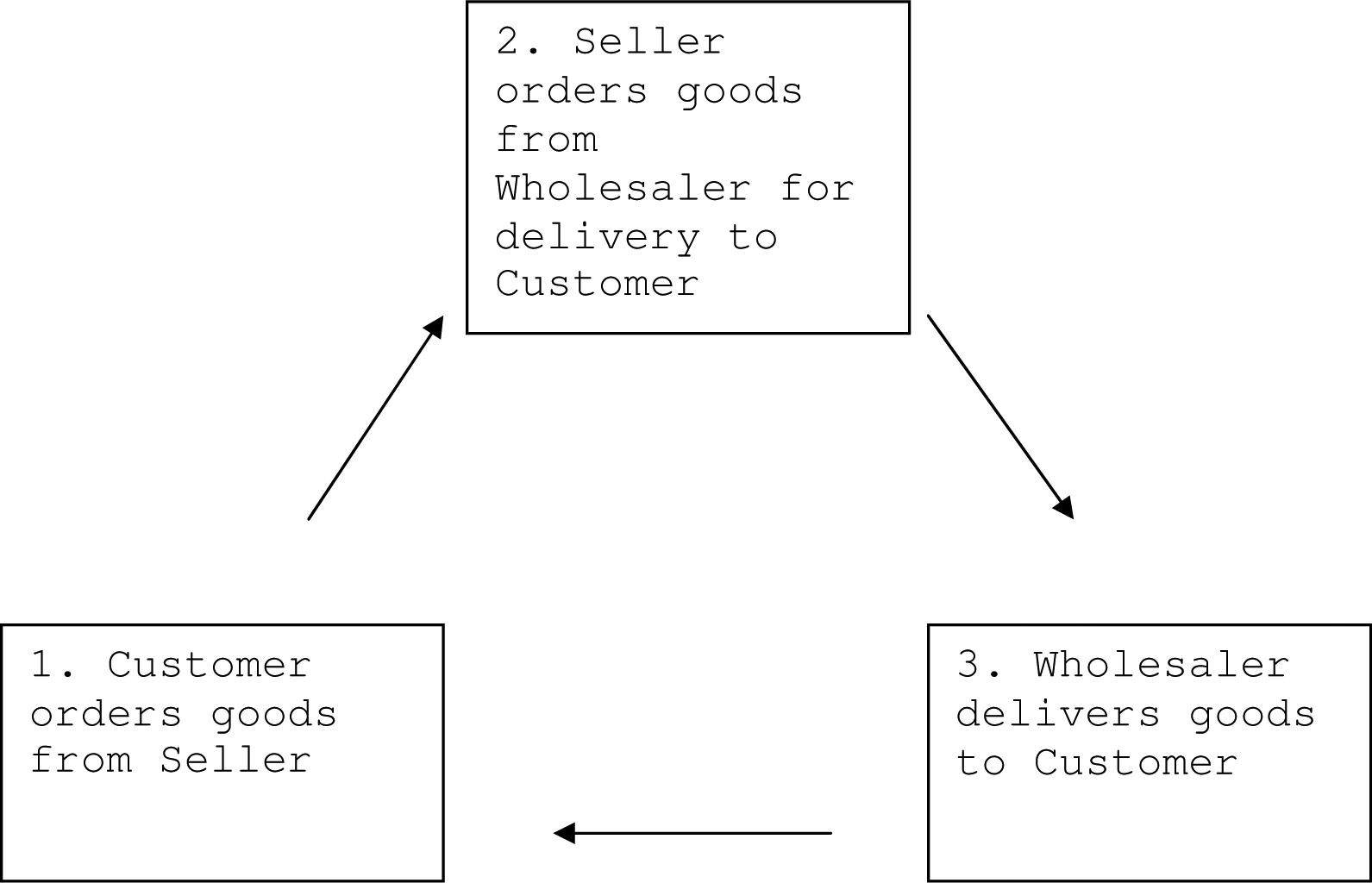

(301) Introduction. A drop shipment generally involves two separate sales. A person (the seller) contracts to sell tangible personal property to a customer. The seller then contracts to purchase that property from a wholesaler and instructs that wholesaler to deliver the property directly to the seller's customer. The place of receipt in a drop shipment transaction is where the property is delivered (i.e., the seller's customer's location). Below is a diagram of a basic drop shipment transaction:

The following subsections discuss the taxability of drop shipments in Washington when:

(a) The seller and wholesaler do not have nexus;

(b) The seller has nexus and the wholesaler does not;

(c) The wholesaler has nexus and the seller does not; and

(d) The seller and wholesaler both have nexus. In each of the following scenarios, the customer receives the property in Washington and the sale is sourced to Washington. Further, in each of the following scenarios, a reseller permit or other approved exemption certificate has been acquired to document any wholesale sales in Washington. For information about reseller permits issued by the department, see WAC 458-20-102.

(302) Seller and wholesaler do not have nexus. Where the seller and the wholesaler do not have nexus with Washington, sales of tangible personal property by the seller to the customer and the wholesaler to the seller are not subject to B&O tax. In addition, neither the seller nor the wholesaler is required to collect retail sales tax on the sale.

(303) Seller has nexus but wholesaler does not. Where the seller has nexus with Washington but the wholesaler does not have nexus with Washington, the wholesaler's sale of tangible personal property to the seller is not subject to B&O tax and the wholesaler is not required to collect retail sales tax on the sale. The sale by the seller to the customer is subject to wholesaling or retailing B&O tax, as the case may be. The seller must collect retail sales tax from the customer unless specifically exempt by law.

(304) Wholesaler has nexus but seller does not. Where the wholesaler has nexus with Washington but the seller does not have nexus with Washington, wholesaling B&O tax applies to the sale of tangible personal property by the wholesaler to the seller for shipment to the seller's customer. The sale from the seller to its Washington customer is not subject to B&O tax, and the seller is not required to collect retail sales tax on the sale.

Example 12. Seller is located in Ohio and does not have nexus with Washington. Seller receives an order from Customer, located in Washington, for parts that are to be shipped to Customer in Washington for its own use as a consumer. Seller buys the parts from Wholesaler, which has nexus with Washington, and requests that the parts be shipped directly to Customer. Seller is not subject to B&O tax and is not required to collect retail sales tax on its sale to Customer because Seller does not have nexus with Washington. The sale by Wholesaler to Seller is subject to wholesaling B&O tax because Wholesaler has nexus with Washington and Customer receives the parts (i.e., the parts are delivered to Customer) in Washington.

(305) Seller and wholesaler have nexus with Washington. Where the seller and wholesaler have nexus with Washington, wholesaling B&O tax applies to the wholesaler's sale of tangible personal property to the seller. The sale from the seller to the customer is subject to wholesaling or retailing B&O tax as the case may be. The seller must collect retail sales tax from the customer unless the sale is specifically exempt by law.

(1)

Introduction.Substitute Senate Bill No. 5581 (2019) clarified the sales tax collection obligation for remote sellers and when a person is deemed to have substantial nexus for business and occupation (B&O) tax purposes. See RCW 82.04.067 and 82.08.052. As a result, this rule may include outdated or incomplete guidance regarding minimum nexus thresholds to determine who has established substantial nexus with Washington. Please see our website for the most recent information on those requirements.(a) The state of Washington imposes business and occupation (B&O) tax on persons that have "substantial nexus" with this state. For apportionable activities and for selling activities taxable under RCW

82.04.250(1),

82.04.257(1) or

82.04.270, substantial nexus does not require a physical presence in this state, as that phrase is described in RCW

82.04.067(6).

(b) This rule only applies to periods after May 31, 2010, and applies as follows:

(i) In 2015, Washington changed the thresholds for substantial nexus described in subsection (3)(a)(iii) of this rule.

(ii) Prior to September 1, 2015, these thresholds only applied to apportionable activities, and did not apply to wholesaling or retailing activity.

(iii) Effective September 1, 2015, Washington expanded the scope of these tests to apply to wholesaling activity.

(iv) Effective July 1, 2017, Washington expanded the scope of some of these tests to apply to retailing activity taxable under RCW

82.04.250(1) or

82.04.257(1).

(c) Effective July 1, 2017, the thresholds are measured based on a person's payroll, property, and receipts in the current or immediately preceding calendar year. For the period from September 1, 2015, to June 30, 2017, the thresholds were measured based on a person's payroll, property, and receipts in the immediately preceding calendar year. See subsection (9) of this rule for additional information. For periods from June 1, 2010, to August 31, 2015, the thresholds were based on the person's payroll, property, and receipts in the current calendar year. See subsection (10) of this rule for additional information.

(d) Other rules that may apply. Readers may also want to refer to other rules for additional information, including those in the following list:

(i) WAC 458-20-193 Interstate sales of tangible personal property. This rule describes the taxation of interstate sales of tangible personal property.

(ii) WAC 458-20-194 Doing business inside and outside the state. This rule describes separate accounting and cost apportionment and applies only to tax liability incurred from January 1, 2006, through May 31, 2010.

(iii) WAC 458-20-19402 Single factor receipts apportionment—Generally. This rule describes the general application of single factor receipts apportionment and applies only to tax liability incurred after May 31, 2010.

(iv) WAC 458-20-19403 Apportionable royalty receipts attribution. This rule describes the application of single factor receipts apportionment to gross income from royalties and applies only to tax liability incurred after May 31, 2010.

(v) WAC 458-20-19404 Financial institutions—Income apportionment. This rule describes the application of single factor receipts apportionment to certain income of financial institutions and applies only to tax liability incurred after December 31, 2015.

(vi) WAC 458-20-19404A Financial institutions—Income apportionment. This rule describes the application of single factor receipts apportionment to certain income of financial institutions and applies only to tax liability incurred between June 1, 2010, and December 31, 2015.

(e) Examples included in this rule identify a number of facts and then state a conclusion; they should be used only as a general guide. The tax results of all situations must be determined after a review of all the facts and circumstances. For the examples in this rule, gross income received by the taxpayer is from engaging in apportionable activities or from making wholesale or retail sales. Also, unless otherwise stated, the years in the examples are time periods that occur after June 30, 2017.

The minimum nexus thresholds described in this rule and used in examples are unadjusted for consumer price index changes applicable for years after 2017.

(2) Definitions. Unless the context clearly requires otherwise, the definitions in this subsection apply throughout this rule.

(a) "Apportionable activities" includes only those activities subject to B&O tax under the following classifications:

(i) Service and other activities;

(ii) Royalties;

(iii) Travel agents and tour operators;

(iv) International steamship agent, international customs house broker, international freight forwarder, vessel and/or cargo charter broker in foreign commerce, and/or international air cargo agent;

(v) Stevedoring and associated activities;

(vi) Disposing of low-level waste;

(vii) Insurance producers, title insurance agents, or surplus line brokers;

(viii) Public or nonprofit hospitals;

(ix) Real estate brokers;

(x) Research and development performed by nonprofit corporations or associations;

(xi) Inspecting, testing, labeling, and storing canned salmon owned by another person;

(xii) Representing and performing services for fire or casualty insurance companies as an independent resident managing general agent licensed under the provisions of chapter

48.17 RCW;

(xiii) Contests of chance;

(xiv) Horse races;

(xv) International investment management services;

(xvi) Room and domiciliary care to residents of a boarding home;

(xvii) Aerospace product development;

(xviii) Printing or publishing a newspaper (but only with respect to advertising income);

(xix) Printing materials other than newspapers and publishing periodicals or magazines (but only with respect to advertising income); and

(xx) Cleaning up radioactive waste and other by-products of weapons production and nuclear research and development, but only with respect to activities that would be taxable as an "apportionable activity" under any of the tax classifications listed in (a)(i) through (xix) of this subsection if this special tax classification did not exist.

(b) "Credit card" means a card or device existing for the purpose of obtaining money, property, labor, or services on credit.

(c) "Gross income of the business" means the value proceeding or accruing by reason of the transaction of the business engaged in and includes gross proceeds of sales, compensation for the rendition of services, gains realized from trading in stocks, bonds, or other evidences of indebtedness, interest, discount, rents, royalties, fees, commissions, dividends, and other emoluments however designated, all without any deduction on account of the cost of tangible property sold, the cost of materials used, labor costs, interest, discount, delivery costs, taxes, or any other expense whatsoever paid or accrued and without any deduction on account of losses. The term gross receipts means gross income from apportionable activities.

(d) "Loan" means any extension of credit resulting from direct negotiations between the taxpayer and its customer, and/or the purchase, in whole or in part, of such extension of credit from another. Loan includes participations, syndications, and leases treated as loans for federal income tax purposes. Loan does not include: Futures or forward contracts; options; notional principal contracts such as swaps; credit card receivables, including purchased credit card relationships; noninterest bearing balances due from depository institutions; cash items in the process of collection; federal funds sold; securities purchased under agreements to resell; assets held in a trading account; securities; interests in a real estate mortgage investment conduit (REMIC) or other mortgage-backed or asset-backed security; and other similar items.

(e) "Net annual rental rate" means the annual rental rate paid by the taxpayer less any annual rental rate received by the taxpayer from subrentals.

(f) The terms "nexus" and "substantial nexus" are used interchangeably in this rule.

(g)

"Property" means tangible, intangible, and real property owned or rented and used in this state during the calendar year, except property does not include ownership of or rights in computer software, including computer software used in providing a digital automated service; master copies of software; and digital goods or digital codes residing on servers located in this state. Refer to RCW

82.04.192 and

82.04.215 for definitions of the terms computer software, digital automated services, digital goods, digital codes, and master copies.

(h) "Securities" includes any intangible property defined as a security under section 2 (a)(1) of the Securities Act of 1933 including, but not limited to, negotiable certificates of deposit and municipal bonds.

(i) "State" means a state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, any territory or possession of the United States, or any foreign country or political subdivision of a foreign country.

(j)

"Wholesale sales" means wholesale sales taxable under RCW

82.04.257(1) or

82.04.270 and

"wholesaling" means the activity of making such sales. For substantial nexus standards applicable to wholesale sales taxable under another classification, see WAC 458-20-193.

(3) Substantial nexus.

(a) With respect to taxes on persons engaged in apportionable activities as defined in RCW

82.04.460 or making wholesale sales taxable under RCW

82.04.257(1) or

82.04.270, substantial nexus exists where, in the current or immediately preceding calendar year, a person is:

(i) An individual and is a resident or domiciliary of this state;

(ii) A business entity and is organized or commercially domiciled in this state; or

(iii) A nonresident individual or a business entity that is organized and commercially domiciled outside this state, and the person had:

(A) More than fifty-three thousand dollars of property in this state;

(B) More than fifty-three thousand dollars of payroll in this state;

(C) More than two hundred sixty-seven thousand dollars of receipts from this state from apportionable activities, from selling activities, or from a combination of both; or

(D) At least twenty-five percent of the person's total property, total payroll, or total receipts in this state.

(b) With respect to taxes on a person making sales at retail taxable under RCW

82.04.250(1) or

82.04.257(1), substantial nexus exists if, in the current or immediately preceding calendar year:

(i) The person has a physical presence in this state as that phrase is described in RCW

82.04.067(6); or

(ii) The person's receipts exceed the receipts threshold described in (a)(iii)(C) or (D) of this subsection.

(c) A person who has a substantial nexus with this state in the current calendar year based solely on exceeding property, payroll, or receipts thresholds during the current calendar year, but did not exceed the thresholds in the immediately preceding year, is subject to B&O tax on business activity occurring on and after the date that the person established a substantial nexus with this state in the current calendar year. RCW

82.04.220(2). If the person exceeded any of the thresholds in the immediately preceding year, the person is subject to B&O tax on its business activity occurring throughout the current year.

Example 1. Company C is commercially domiciled in Washington and has one employee in Washington who earns $30,000 per year. Company C has substantial nexus with Washington because it is commercially domiciled in Washington. The minimum nexus thresholds for property, payroll, and receipts do not apply to a business entity commercially domiciled in this state.

(d) The department will adjust the amounts listed in (a) of this subsection based on changes in the consumer price index as required by RCW

82.04.067. (These adjustments are published in ETA 3195 "Economic Nexus Minimum Thresholds.")

(e) The minimum nexus thresholds are applied on a calendar year basis.

Example 2. Assume Corporation N, which is not commercially domiciled or organized in Washington, earns receipts attributable to Washington in 2017 that exceed the minimum nexus receipts threshold for determining substantial nexus. If Corporation N's 2018 and later payroll, property, and receipts do not exceed any of the minimum nexus thresholds for determining substantial nexus, its B&O tax reporting obligation for any gross receipts attributable to Washington continues through the calendar year 2018.

Example 3. Company Q is organized and domiciled outside of Washington. Company Q maintains an office in Washington which housed a single employee in the immediately preceding calendar year. In 2016, Company Q had $40,000 in property located in Washington, paid $45,000 in compensation to the Washington employee, and had $200,000 in apportionable receipts attributed to Washington and $0 wholesaling or retailing receipts sourced to Washington. In 2016, Company Q's total property everywhere was valued at $200,000, total payroll was $400,000, and total apportionable and wholesaling or retailing receipts were $5,000,000. In 2017, Company Q had $45,000 in property located in Washington, paid $48,000 in compensation to the Washington employee, and had $200,000 in apportionable receipts attributed to Washington and $0 wholesaling or retailing receipts sourced to Washington. In 2017, Company Q's total property everywhere was valued at $225,000, total payroll was $420,000, and total apportionable and wholesaling or retailing receipts were $6,000,000. Although Company Q has physical presence in Washington, as described in RCW

82.04.067(6), it is not treated as having substantial nexus with Washington with respect to its apportionable and wholesaling activities because (a) it is not organized or domiciled in Washington and (b) it did not have sufficient property, payroll, or receipts in the current or immediately preceding calendar year to exceed the minimum nexus thresholds identified in subsection (3)(a)(iii) of this rule.

(4) Property threshold.

(a) Location of property.

(i) Real property - Real property owned or rented is in this state if the real property is located in this state.

(ii) Tangible personal property - Tangible personal property is in this state if it is physically located in this state.

(iii) Intangible property - Intangible property is in this state based on the following:

A loan is located in this state if:

(A) More than fifty percent of the fair market value of the real and/or personal property securing the loan is in this state. An automobile loan is in this state if the vehicle is properly registered in this state. Other than for property that is subject to registered ownership, the determination of whether the real or personal property securing a loan is in this state must be made as of the time the original agreement was made, and any and all subsequent substitutions of collateral must be disregarded; or

(B) If (a)(iii)(A) of this subsection does not apply and the borrower is located in this state.

(iv) A borrower is located in this state if:

(A) The borrower is engaged in business and the borrower's commercial domicile is located in this state; or

(B) The borrower is not engaged in business and the borrower's billing address is located in this state.

(v) A credit card receivable is in this state if the billing address of the card holder is located in this state.

(vi) A nonnegotiable certificate of deposit is property in this state if the issuing bank is in this state.

(vii) Securities:

(A) A negotiable certificate of deposit is property in this state if the owner is located in this state.

(B) A municipal bond is property in this state if the owner is located in this state.

(b) Value of property.

(i) Property the taxpayer owns and uses in this state, other than loans and credit card receivables, is valued at its original cost basis.

Examples 4 and 5 assume the businesses depicted are not engaged in retailing activity. Therefore, the businesses' mere physical presence in Washington is not used as the basis for determining whether they have nexus with Washington.

Example 4. In January 2013, ABC Corp. bought Machinery for $65,000 for use in State X. On March 1, 2018, ABC Corp. brought that Machinery into Washington for the remainder of the year. ABC Corp. has nexus with Washington beginning on March 1, 2018, based on Machinery's original cost basis value of $65,000. The value is $65,000 even though the property has depreciated prior to entering the state.

(ii) Property the taxpayer rents and uses in this state is valued at eight times the net annual rental rate.

Example 5. In 2018, out-of-state Business X rented office space in Washington for $6,000 and had $7,000 of office furniture and equipment in Washington. Business X has nexus with Washington in 2018 because the value of the rented office space ($6,000 multiplied by eight, which is $48,000) plus the value of office furniture and equipment exceeds the $53,000 property threshold.

(iii) Loans and credit card receivables owned by the taxpayer are valued at their outstanding principal balance, without regard to any reserve for bad debts. However, if a loan or credit card receivable is actually charged off as a bad debt in whole or in part for federal income tax purposes (see 26 U.S.C. 166), the portion of the loan or credit card receivable charged off is deducted from the outstanding principal balance.

(c) Calculating property value. To determine whether the $53,000 property threshold has been exceeded, average the value of property in this state on the first and last day of the calendar year. The department may require the averaging of monthly values during the calendar year if reasonably required to properly reflect the average value of the taxpayer's property in this state throughout the taxable period. Examples 6 through 9 assume the businesses depicted are not engaged in retailing activity. Therefore, the businesses' mere physical presence in Washington is not used as the basis for determining whether they have nexus with Washington.

Example 6. Company Y has property in Washington valued at $90,000 on January 1st and $20,000 on December 31st. The value of property in Washington is $55,000 ((90,000 + 20,000)/2). Company Y exceeds the property threshold in this calendar year because it exceeds the $53,000 property threshold.

Example 7. Company A had no property located in Washington on January 1st or on December 31st. However, it brought $100,000 in property into Washington on January 15th and removed it from Washington on November 15th of that calendar year. In this situation, the department may compute the value of Company A's property over the period of time it was in the state during the calendar year in order to properly reflect its average value ($100,000 multiplied by ten (months) divided by 12 (months), which is $83,333). Company A exceeds the $53,000 property threshold in this calendar year.

Example 8. Company B had no property located in Washington on January 1st or on December 31st of 2018. However, it brought $100,000 in property into Washington on January 15th and removed it from Washington on February 15th of that calendar year. In this situation, the department may compute the value of Company B's property over the period of time it was in the state during the calendar year to properly reflect its average value, $8,333. ($100,000 multiplied by one (month) divided by 12 (months).) Company B also had no property located in Washington on January 1st or on December 31st of 2019. However, it brought $100,000 in property into Washington on January 15th and removed it from Washington on October 15th of that calendar year. For 2019, the average value of Company A's property is $75,000 ($100,000 multiplied by nine (months) divided by 12 (months)). Company B exceeds the property threshold in 2019 based on the average value of its property in Washington during 2019, but it did not exceed the property threshold based on the average value of its property in Washington during 2018.

Example 9. IT Co. is commercially domiciled in State X with Employee located in Washington who works from a home office. In 2018, IT Co. provided to Employee $5,000 of office supplies and $50,000 of equipment owned by IT Co. In 2019, the employee returned an unneeded portion of the equipment and IT Co. provided no other equipment to the employee. The cost of returned equipment was $25,000 of the total $50,000 of equipment. IT Co. is treated as having substantial nexus with Washington in both 2018 and 2019 based on the $53,000 property threshold because the value of its property in this state in 2018 ($55,000) exceeded $53,000. For 2018, IT Co. exceeded the threshold for the current year, and in 2019, IT Co. exceeded the threshold for the immediately preceding calendar year. If IT Co. does not exceed the property threshold in 2020, beginning in 2020 it will no longer have substantial nexus unless it exceeds another threshold.

(5) Payroll threshold. "Payroll" is the total compensation defined as gross income under 26 U.S.C. Sec. 61 (section 61 of the Internal Revenue Code of 1986), as of June 1, 2010, paid during the calendar year to employees and to third-party representatives who represent the taxpayer in interactions with the taxpayer's clients and includes sales commissions.

(a) Payroll compensation is received in this state if it is properly reportable in this state for unemployment compensation tax purposes, regardless of whether it was actually reported to this state.

Examples 10 and 11 assume the businesses depicted are not engaged in retailing activity. Therefore, the businesses' physical presence in Washington is not relevant in determining whether they have nexus with Washington.

Example 10. Company D is commercially domiciled in State X and has a single Employee whose pay of $80,000 2018 and 2019 was properly reportable in Washington for unemployment compensation purposes. Company D has substantial nexus with Washington during 2018 and 2019 because the compensation paid to Employee during the current or immediately preceding calendar year exceeds the $53,000 payroll threshold in both years. Company D will also have substantial nexus in 2020 because the payroll in the immediately preceding year (2019) exceeded the $53,000 payroll threshold.

Example 11. Assume the same facts as Example 9 except only 50% of Employee's pay for 2018 and 2019 was properly reportable in Washington for unemployment compensation purposes. Employee's Washington compensation of $40,000 does not exceed the $53,000 payroll threshold to establish substantial nexus with Washington during the current or immediately preceding calendar year, unless this amount exceeds 25% of total payroll compensation in the current or immediately preceding calendar year.

(b) Third-party representatives receive payroll compensation in this state if the service(s) performed occurs entirely or primarily within this state.

(6) Receipts threshold. The receipts threshold is exceeded if a taxpayer's receipts from apportionable and selling activities attributed and sourced, respectively, to Washington totaled more than $267,000 in the current or immediately preceding calendar year.

(a) All receipts from all apportionable and selling activities are accumulated to determine if the receipts threshold is satisfied. Receipts from activities other than apportionable and selling activities (e.g., extracting) are not used to determine if the receipts threshold has been satisfied.

(b) Apportionable receipts are attributed to Washington per WAC 458-20-19402 (general attribution), WAC 458-20-19403 (royalties), WAC 458-20-19404 (financial institutions, after 2015), and WAC 458-20-19404A (financial institutions, before 2016). Receipts from wholesale and retail sales are sourced to Washington in accordance with RCW

82.32.730.

Example 12. Company E is organized and commercially domiciled in State X. In a calendar year it had $50,000 in receipts from wholesale sales sourced to Washington in accordance with RCW

82.32.730, $50,000 in receipts from retail sales sourced to Washington in accordance with RCW

82.32.730, $50,000 in royalty receipts attributed to Washington per WAC 458-20-19403, and $150,000 in gross receipts from other apportionable activities attributed to Washington per WAC 458-20-19402. Company E has substantial nexus with Washington in the calendar year because its total of $300,000 in receipts from apportionable activities attributed to Washington and retail and wholesale sales sourced to Washington in a calendar year exceeded the $267,000 receipts threshold. It does not matter that a portion of the receipts were from apportionable activities that are subject to tax under different B&O tax classifications or that the receipts from apportionable activities or wholesaling or retailing activities did not separately exceed the receipts threshold. The receipts threshold is determined by the totality of the taxpayer's apportionable and selling activities in Washington.

(7) Application of 25% threshold.

(a) If, in the current or immediately preceding year, at least twenty-five percent of an out-of-state taxpayer's property, payroll, or receipts from apportionable and selling activities consisted of Washington property, Washington payroll, or Washington receipts, then the taxpayer has substantial nexus with Washington with respect to its apportionable and wholesaling activities.

(b) If, in the current or immediately preceding year, at least twenty-five percent of an out-of-state taxpayer's receipts from apportionable and selling activities consisted of Washington receipts, then the taxpayer also has substantial nexus with Washington with respect to its retailing activities.

(c) The twenty-five percent threshold is determined by dividing:

(i) The value of property located in Washington by the total value of taxpayer's property;

(ii) Payroll located in Washington by taxpayer's total payroll; or

(iii) Apportionable, wholesaling and retailing receipts attributed and sourced to Washington by total apportionable, wholesaling and retailing receipts.

Example 13. Company G is organized and commercially domiciled in State X. In 2018 it had $45,000 in property, $45,000 in payroll, and $240,000 in gross receipts attributed to Washington. In 2018, its total property was valued at $200,000; its worldwide payroll was $150,000; and its gross receipts, all from apportionable activities, totaled $2,000,000. Company G had twenty-two and a half percent of its property, thirty percent of its payroll, and twelve percent of its receipts attributed to Washington. With respect to its apportionable activities, Company G has substantial nexus with Washington in 2018 because at least twenty-five percent of its payroll in 2018 was located in Washington. Based on its payroll in 2018, Company G will also have substantial nexus in 2019.

(8) Application to local gross receipts business and occupations taxes. This rule does not apply to the nexus requirements for local gross receipts business and occupation taxes.

(9) Periods from September 1, 2015, through June 30, 2017.

(a) Apportionable and wholesaling activities. From September 1, 2015, through June 30, 2017, substantial nexus with Washington of a nonresident individual or a business entity organized and commercially domiciled outside this state was established with respect to that person's apportionable activities and wholesaling activities taxable under RCW

82.04.257 or

82.04.270 in a particular calendar year by measuring the person's payroll, property, and receipts only in the immediately preceding calendar year. Pursuant to RCW

82.04.220, in effect during this period, once established, substantial nexus continued through the following calendar year. See WAC 458-20-193 regarding the continuing application of the physical presence substantial nexus standard on wholesaling activity not subject to the economic nexus thresholds discussed in this rule.

(b) Retailing activities. Prior to July 1, 2017, a nonresident individual or a business entity organized and commercially domiciled outside of Washington was deemed to have substantial nexus with this state with respect to its retailing activity taxable under RCW

82.04.250(1) in a calendar year only if it had a physical presence in Washington in the calendar year. See WAC 458-20-193 regarding the continuing application of the physical presence substantial nexus standard on retailing activities.

(10) Periods from June 1, 2010, through August 31, 2015.

(a) Apportionable activities. From June 1, 2010, through August 31, 2015, substantial nexus with Washington of a nonresident individual or a business entity organized and commercially domiciled outside this state was established with respect to that person's apportionable activities in a particular calendar year by measuring the person's payroll, property, and receipts in that calendar year rather than by measuring the person's payroll, property, and receipts in the immediately preceding calendar year. Pursuant to RCW

82.04.220, in effect during this period, once established, substantial nexus continued through the following calendar year.

Example 14. Company E was organized and commercially domiciled in State X. In 2013 it had $275,000 in gross receipts from apportionable activities attributed to Washington per WAC 458-20-19402. Company E had substantial nexus with Washington in 2013 because its total receipts from apportionable activities attributed to Washington in that calendar year, $275,000, exceeded the receipts threshold. Therefore, Company E was subject to B&O taxes for the entire 2013 calendar year and its substantial nexus continued through at least the 2014 calendar year.

(b) Wholesaling activity. Prior to September 1, 2015, other than as a result of continuing substantial nexus pursuant to RCW

82.04.220, a nonresident individual or a business entity organized and commercially domiciled outside of Washington was deemed to have substantial nexus with this state with respect to its wholesaling activity in a calendar year only if it had a physical presence in Washington in the calendar year. See WAC 458-20-193 regarding the continuing application of the physical presence substantial nexus standard on wholesaling activity not subject to the economic nexus thresholds discussed in this rule.